Professional Documents

Culture Documents

Call Money Market & T Bills 1

Call Money Market & T Bills 1

Uploaded by

Nishant Mishra0 ratings0% found this document useful (0 votes)

87 views37 pagesThe document discusses India's call money market. It defines call money as very short term funds with maturities of 1-14 days. Major participants include public and private sector banks. The size of the market is Rs. 60,000-70,000 crores. Borrowing levels fluctuate seasonally and with changes in bank reserve requirements. Treasury bills are also discussed as short term government debt instruments used to finance budgetary needs.

Original Description:

Original Title

Call money market & T bills~1.PPT

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses India's call money market. It defines call money as very short term funds with maturities of 1-14 days. Major participants include public and private sector banks. The size of the market is Rs. 60,000-70,000 crores. Borrowing levels fluctuate seasonally and with changes in bank reserve requirements. Treasury bills are also discussed as short term government debt instruments used to finance budgetary needs.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

87 views37 pagesCall Money Market & T Bills 1

Call Money Market & T Bills 1

Uploaded by

Nishant MishraThe document discusses India's call money market. It defines call money as very short term funds with maturities of 1-14 days. Major participants include public and private sector banks. The size of the market is Rs. 60,000-70,000 crores. Borrowing levels fluctuate seasonally and with changes in bank reserve requirements. Treasury bills are also discussed as short term government debt instruments used to finance budgetary needs.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 37

Call money market is a market for very

short term funds repayable on demand

with maturity period varying between one

day to a fortnight.

Until march 1978,transaction in the call

money market were usually effected

through brokers.

RBI has prohibited banks paying brokerage

on operations in the call money market.

The seasonal nature of the call money

market would be reflected in two indicators:

1. A decline in money at call and short

notice should be greater in the slack

season than in the busy season of the

given year.

2. An increase in money at call and short

notice should be greater in busy season

than the slack season.

The need for call money borrowings is the

highest around march every year1.withdrawals of deposits in march to

meet year end tax payments.

2.withdrwal of funds by financial

institutions to meet their statutory

obligations.

Call money borrowings tend to increase

when there is an increase in CRR.

Call Money" means deals in overnight funds

"Notice Money" means deals in funds for 2 - 14

days

"Fortnight" shall be on a reporting Friday basis

and

mean the period from Saturday to the second

following Friday, both days inclusive

"Bank or banking company" means a banking

company or a "corresponding new bank",

"State Bank of India" or "subsidiary bank and

includes a "co-operative bank"

Scheduled bank means a bank included in the

Second Schedule of the Reserve Bank of India

Act, 1934

"Primary Dealer" means a financial institution

which holds a valid letter of authorization as a

Primary Dealer issued by the Reserve Bank, in

terms of the "Guidelines for Primary Dealers in

Government Securities Market

"Capital Funds" means the sum of the Tier I and

Tier II capital as disclosed in the latest audited

balance sheet of the entity

As per RBI definitions A market for short

terms financial assets that are close

substitute for money, facilitates the

exchange of money in primary and

secondary market.

The money market is a mechanism that

deals with the lending and borrowing of

short term funds (less than one year).

A segment of the financial market in which

financial instruments with high liquidity and

very short maturities are traded.

Commercial banks and co operative

banks are the participants

LIC, GIC, UTI direct participants.

Indirect participants -IDBI,IFC,ICICI.

Located in big industrial and commercial

centers like Mumbai, Chennai, Calcutta,

Delhi etc

Market has expanded small banks and

nonscheduled banks also participate in

this market.

Participation of foreign banks as borrower

has increased to meet CRR requirements.

After 1970 SBI has been regularly

participating in this market, a major

lender but a small borrower.

As per latest RBI policy LIC,UTI,GIC,IDBI,

and NABARAD are allowed to participate

as lenders and not as borrowers.

In APRIL 1991 RBI announced that

lenders should provide evidence to RBI

about-bulk lend able resources and no

outstanding borrowings from banks.

They will be required to observe a

minimum size of operations of Rs 20 Cr

per transactions.

Participate with prior permission of RBI

and only through DFHI.

RBI has permitted four primary dealers to

participate as both lenders and

borrowers.

Mutual funds as lenders.

Located in big industrial and commercial

centers like Mumbai, Chennai, Calcutta,

Delhi etc

There are large number of local call

markets developed and operated by

indigenous local bankers.

Market for very short term funds, known as

money on call

The rate at which funds are borrowed in

this market is called `Call Money rate'

The size of the market for these funds in

India is between Rs 60,000 million to Rs

70,000 million

Of which public sector banks account for

80% of borrowings

Foreign banks/private sector banks

account for the balance 20%

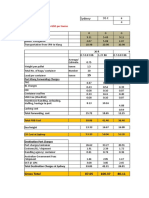

Total call loans in India increased from Rs 9.3 Cr

in 1955-56 to Rs 7,147 Cr in 1995-96 and to Rs

36093 Cr in 2003.

Total turnover (borrowings) in the following

years: years

Rs. (in Billion)

1991-92

16,450

1993-94

22,510

1994-95

17,030

1995-96

20,980

1996-97

15,450

The daily average borrowings by all banks

and PDs were Rs 9,465 Cr in 1996 and Rs

10,203 Cr in 1997.

Foreign banks daily average Borrowings

were Rs 2,531 Cr in 1996 and Rs 3,807 in

1997.

The cumulative turnover (borrowings and

landings) was Rs 1,499 billion in 1995-96

and Rs 2,743 billion in 1996-97

Large borrowings by banks to meet CRR

requirements.

Credit operations of certain banks tend to

be much higher than their resources.

Occasional factors in the market.

Withdrawal of funds by corporate for

business needs and payment of advance

tax.

Liquidity crisis and illiquidity of money.

In US there are two markets which can be

said to form the call money markets:

Federal funds market: Transactions between

banks involving borrowing or lending of

banks deposits at federal reserve banks for

one day at a specified rate of interest.

Call money market proper: The call loans

represent short term loans by banks to

security brokers and dealers for the purpose

of financing their customers to purchase

common stock.

In UK the call money market consist of

three parts:

Clearing banks loans to discount houses

Inter bank loans

Mobilization of surplus money by discount

houses among themselves before they

approach the bank of England for financial

accommodation.

(Existence of an intermediary in the form of

discount houses in between Bank of

England and commercial banks is a

peculiar feature of British money market)

The size of call market in India has been

much smaller than that of the US and UK

because of some factors:

- The bill market in India is

underdeveloped.

- Unlike in the UK, discounting facilities

available to banks in India.

- Loans to security lenders can not be large.

- Indian commercial banks hold fairly large

cash reserves.

Borrowers and lenders contact each other over

telephone.

The borrowers and lenders arrive at a deal

specifying the amount of loan and the rate of

interest.

After the deal is over, the lender issues FBL

cheque in favour of the borrower.

The borrower in turn issues call money

borrowing receipt.

When the loan is repaid with interest, the lender

returns the duly discharged receipt

The deal can be directly negotiated by routing it through the

Discount and Finance House of India (DFHI).

The borrowers and lenders inform the DFHI about their fund

requirement and availability at a specified rate of interest.

Once the deal is confirmed, the Deal Settlement Advice is

exchanged.

In case the DFHI borrows, it issues a call deposit receipt to

the lender and receives RBI cheque for the money borrowed.

The reverse takes place in the case of lendings by the DFHI.

The duly discharged call deposit receipt is surrendered at

the time of settlement.

Call loans can be renewed upto a maximum period of 14

days only and such renewals are recorded on the back of the

deposit receipt by the borrower

Treasury Bills are money market instruments

to finance the short term requirements of the

Government of India.

These are discounted securities and thus are

issued at a discount to face value.

The return to the investor is the difference

between the maturity value and issue price.

Types of Treasury bills based on the maturity

period and utility of the issuance like, ad-hoc

Treasury bills, 3 months, 12months Treasury

bills etc. In India, at present, the Treasury

Bills are the 91-days 182 days and 364-days

Treasury bills.

T-bills are sold through an auction process

announced by the RBI at a discount to its face

value. RBI issues a calendar of T-bill auctions

It also announces the exact dates of auction,

the amount to be auctioned and payment

dates. T-bills are available for a minimum

amount of Rs. 25,000 and in multiples of Rs.

25,000.

Banks and PDs are major bidders in the T-bill

market.

Both discriminatory and uniform price auction

methods are used in issuance of T-bills.

Currently, the auctions of all T-bills are

multiple/discriminatory price auctions, where the successful

bidders have to pay the prices they have actually bid for.

Non-competitive bids, where bidders need not quote the

rate of yield at which they desire to buy these T-bills, are

also allowed from provident funds and other investors.

RBI allots bids to the non-competitive bidders at the

weighted average yield arrived at on the basis of the yields

quoted by accepted competitive bids at the auction.

Allocations to non-competitive bidders are outside the

amount notified for sale. Noncompetitive bidders therefore

do not face any uncertainty in purchasing the desired

amount of T-bills from the auctions.

No tax deducted at source

Zero default risk being sovereign paper

Highly liquid money market instrument

Better returns especially in the short term

Transparency

Simplified settlement

High degree of tradability and active secondary

market facilitates meeting unplanned fund

requirements.

Market related yields

Ideal matching for funds management

particularly for short term tenors of less than

15 days.

Transparency in operations as the

transactions would be put through Reserve

Bank of Indias SGL (subsidiary general

ledger) or Clients Gilt account only

Two way quotes offered by primary dealers

for purchase and sale of treasury bills.

Certainty in terms of availability, entry & exit

The auction of treasury bills is done only at Reserve Bank

of India, Mumbai.

Bids are to be submitted on NDS (Negotiable Dealing

System) by 2:30 PM on Wednesday. If Wednesday

happens to be a holiday then bids are to submitted on

Tuesday.

Bids are submitted in terms of price per Rs 100. For

example, a bid for 91-day Treasury bill auction could be

for Rs 97.50.

Auction committee of Reserve Bank of India decides the

cut-off price and results are announced on the same day.

Bids above the cut-off price receive full allotment; bids

at cut-off price may receive full or partial allotment and

bids below the cut-off price are rejected.

Multiple Price Based or French Auction

Uniform Price Based or Dutch auction

Scheduled banks,

Financial Institutions,

Primary dealers,

Mutual funds,

Insurance companies and

Corporate treasuries

T-bills are issued at a discount and are

redeemed at par. The implicit yield in the Tbill is the rate at which the issue price

(which is the cut-off price in the auction)

has to be compounded, for the number of

days to maturity, to equal the maturity

value.

Yield, given price, is computed using the

formula:

= ((100-Price)*365)/ (Price * No of days to

maturity)

Similarly, price can be computed, given

yield, using the formula:

= 100/(1+(yield% * (No of days to

maturity/365))

A treasury bill maturing on 28-Jun2002 is trading in the market on 3Jul-2001 at a price of Rs. 92.8918.

What is the discount rate inherent

in this price?

2. What is the price at which a

treasury bill maturing on 23rd

March 2002 would be valued on July

13, 2001 at a yield of 6.8204%?

You might also like

- Home Replication StrategyDocument5 pagesHome Replication StrategyChau Hoang100% (19)

- Burlington Northern Railroad CompanyDocument13 pagesBurlington Northern Railroad CompanysdNo ratings yet

- Unit 3 Call Money MarketDocument14 pagesUnit 3 Call Money MarketsadathnooriNo ratings yet

- FmisDocument49 pagesFmisIqra AfsarNo ratings yet

- Money Market InstrumentsDocument76 pagesMoney Market InstrumentsMansi Latawa AgrawalNo ratings yet

- Money MarketsDocument30 pagesMoney MarketsAshwin JacobNo ratings yet

- Biitm-IFSS-Notes Module 2 - SBMDocument33 pagesBiitm-IFSS-Notes Module 2 - SBMshubham kumarNo ratings yet

- Money MarketDocument36 pagesMoney MarketPramod PatjoshiNo ratings yet

- Understanding - Money MarketDocument39 pagesUnderstanding - Money MarketaartipujariNo ratings yet

- Money Market InstrumentDocument30 pagesMoney Market Instrumentdont_forgetme2004No ratings yet

- Money MarketDocument37 pagesMoney MarketharshNo ratings yet

- Money MarketDocument10 pagesMoney Marketswe1234No ratings yet

- Money MarketDocument34 pagesMoney MarketAshish TagadeNo ratings yet

- Money Market's InstrumentsDocument20 pagesMoney Market's InstrumentsManmohan Prasad RauniyarNo ratings yet

- Money MarketDocument22 pagesMoney Marketkunaldaga78No ratings yet

- Money MarketDocument16 pagesMoney MarketBelikovNo ratings yet

- Instruments in Treasury MarketDocument34 pagesInstruments in Treasury MarketsupriyabhadoriyaNo ratings yet

- Money Market and Types of Money Market InstrumentsDocument6 pagesMoney Market and Types of Money Market InstrumentsWasimAkramNo ratings yet

- Money Market Means Market Where Money or Its: Equivalent Can Be TradedDocument62 pagesMoney Market Means Market Where Money or Its: Equivalent Can Be Tradedtrupti_viradiyaNo ratings yet

- Definition of Money MarketDocument17 pagesDefinition of Money MarketSmurti Rekha JamesNo ratings yet

- Money MarketDocument37 pagesMoney Marketmohamedsafwan0480No ratings yet

- Call Money Market in IndiaDocument37 pagesCall Money Market in IndiaDivya71% (7)

- Call Money MarketDocument24 pagesCall Money MarketiyervsrNo ratings yet

- T-Bills in India: Treasury Bills, 2. 182 Days Treasury Bills, and 3. 364 Days Treasury BillsDocument5 pagesT-Bills in India: Treasury Bills, 2. 182 Days Treasury Bills, and 3. 364 Days Treasury Billsbb2No ratings yet

- Financial Markets: Money MarketDocument11 pagesFinancial Markets: Money Marketramesh2490No ratings yet

- Money Market & InstrumentsDocument40 pagesMoney Market & InstrumentssujithchandrasekharaNo ratings yet

- Money Learning Outcomes: Meaning of Money Market. A Money Market Is A Market For Short-Term LoansDocument17 pagesMoney Learning Outcomes: Meaning of Money Market. A Money Market Is A Market For Short-Term LoanspraneixNo ratings yet

- MF0016 B1814 SLM Unit 02 PDFDocument18 pagesMF0016 B1814 SLM Unit 02 PDFBinnatPatelNo ratings yet

- Money MarketDocument12 pagesMoney MarketNeha RathoreNo ratings yet

- Unit-3 Financial MarketsDocument30 pagesUnit-3 Financial MarketsPiyu VyasNo ratings yet

- Call Money Market: Made By:-Akriti Agrawal Anjali Aggarwal Preety Dixit Anirudh ShrivastavDocument11 pagesCall Money Market: Made By:-Akriti Agrawal Anjali Aggarwal Preety Dixit Anirudh ShrivastavAnirudh ShrivastavNo ratings yet

- Money MarketDocument42 pagesMoney Marketharry1213No ratings yet

- Bills MarketDocument40 pagesBills MarketShipra ChaudharyNo ratings yet

- Money Market InstrumentsDocument8 pagesMoney Market InstrumentsGudikandula RavinderNo ratings yet

- Chapter 5 Indian Money MarketDocument5 pagesChapter 5 Indian Money Marketrajan2778No ratings yet

- Call MoneyDocument23 pagesCall MoneyGaurav BhattacharyaNo ratings yet

- Money Market PPTZZZZDocument18 pagesMoney Market PPTZZZZKrinal ShahNo ratings yet

- The Indian Money Market: Prime AcademyDocument5 pagesThe Indian Money Market: Prime AcademyHardik KharaNo ratings yet

- Name of School: AMITY LAW SCHOOL, Gurgaon: Money MarketDocument16 pagesName of School: AMITY LAW SCHOOL, Gurgaon: Money Marketankita singhNo ratings yet

- JAIIB (Module A) : Indian Financial SystemDocument40 pagesJAIIB (Module A) : Indian Financial SystemSwaraj PurohitNo ratings yet

- CH - 3Document11 pagesCH - 3Jap KhambholiyaNo ratings yet

- Indian Financial SystemDocument40 pagesIndian Financial SystemArun SarkarNo ratings yet

- Money MarketDocument21 pagesMoney MarketPratik ShethNo ratings yet

- Money Market Numerical ExamplesDocument14 pagesMoney Market Numerical ExamplesgauravNo ratings yet

- Money MarketDocument37 pagesMoney MarketShaishav BhesaniaNo ratings yet

- Money MarketDocument10 pagesMoney MarketVizz 30No ratings yet

- Money InstrumentsDocument14 pagesMoney InstrumentsSherin BabuNo ratings yet

- Money Market Instruments: Submitted To Submitted byDocument24 pagesMoney Market Instruments: Submitted To Submitted bySukant MakhijaNo ratings yet

- 3 - Script - Money Market in India200324060603035050Document15 pages3 - Script - Money Market in India200324060603035050DWITI RavariyaNo ratings yet

- 08 - Chapter 3 PDFDocument39 pages08 - Chapter 3 PDFvidushi sahuNo ratings yet

- 5.or.a Call Money MarketsDocument2 pages5.or.a Call Money MarketsmaladeepNo ratings yet

- Money MarketDocument17 pagesMoney MarketsujithchandrasekharaNo ratings yet

- Money MarketDocument20 pagesMoney Marketmanisha guptaNo ratings yet

- Presentation On Money Market BangladeshDocument25 pagesPresentation On Money Market BangladeshAminul Haque100% (1)

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingFrom EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingNo ratings yet

- A Practical Approach to the Study of Indian Capital MarketsFrom EverandA Practical Approach to the Study of Indian Capital MarketsNo ratings yet

- Equity Investment for CFA level 1: CFA level 1, #2From EverandEquity Investment for CFA level 1: CFA level 1, #2Rating: 5 out of 5 stars5/5 (1)

- Summary of Philip J. Romero & Tucker Balch's What Hedge Funds Really DoFrom EverandSummary of Philip J. Romero & Tucker Balch's What Hedge Funds Really DoNo ratings yet

- Bank Fundamentals: An Introduction to the World of Finance and BankingFrom EverandBank Fundamentals: An Introduction to the World of Finance and BankingRating: 4.5 out of 5 stars4.5/5 (4)

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2From EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2No ratings yet

- 28905cpt Fa SM Cp8 Part3Document46 pages28905cpt Fa SM Cp8 Part3Nishant MishraNo ratings yet

- Initial Public Offer (IPO) : Presented By: Gaurav Kumar Mishra Deep Chatterjee Amit Kumar Kunal Vohra Manish ShuklaDocument21 pagesInitial Public Offer (IPO) : Presented By: Gaurav Kumar Mishra Deep Chatterjee Amit Kumar Kunal Vohra Manish ShuklaNishant Mishra100% (1)

- Partnership Accounts: Chapter - 8Document23 pagesPartnership Accounts: Chapter - 8Nishant MishraNo ratings yet

- 28903cpt Fa SM Cp8 Part1Document43 pages28903cpt Fa SM Cp8 Part1Nishant MishraNo ratings yet

- IPO of Shares Through Book Building': Corporate Secretarial Study Circle, Sewree, July 4, 2007Document61 pagesIPO of Shares Through Book Building': Corporate Secretarial Study Circle, Sewree, July 4, 2007Nishant MishraNo ratings yet

- Kowledge Paper PlasticDocument185 pagesKowledge Paper PlasticNishant MishraNo ratings yet

- Knowledge Paper PsDocument140 pagesKnowledge Paper PsNishant MishraNo ratings yet

- Kowledge Paper Plastic 2Document62 pagesKowledge Paper Plastic 2Nishant MishraNo ratings yet

- Summer Internship Report Mahindra and MahindraDocument65 pagesSummer Internship Report Mahindra and MahindraNishant Mishra33% (3)

- Developing and Driving Effective Sales Promotional Strategy For Tapping Potential Market For Mahindra BusesDocument9 pagesDeveloping and Driving Effective Sales Promotional Strategy For Tapping Potential Market For Mahindra BusesNishant MishraNo ratings yet

- Free Trade or Protection - A Literature Review On Trade Barriers PDFDocument9 pagesFree Trade or Protection - A Literature Review On Trade Barriers PDFNishant Mishra100% (1)

- Case Analysis Hand OutDocument6 pagesCase Analysis Hand OutNishant MishraNo ratings yet

- Nishant Cipla PDFDocument164 pagesNishant Cipla PDFNishant MishraNo ratings yet

- Sydney 96 T: All Cost Numbers Are in USD Per TonneDocument5 pagesSydney 96 T: All Cost Numbers Are in USD Per Tonnesoumyarm942No ratings yet

- Procurement IR35 Presentation For CompaniesDocument26 pagesProcurement IR35 Presentation For CompaniesMark CoulsonNo ratings yet

- Angie Saunders Resume 10Document2 pagesAngie Saunders Resume 10api-248028750No ratings yet

- Entrepreneurship: Quarter 4 - Module SixDocument8 pagesEntrepreneurship: Quarter 4 - Module SixAlexa ValdezNo ratings yet

- Conjoint AnalysisDocument12 pagesConjoint AnalysisvamsibuNo ratings yet

- Product Distribution The BasicsDocument8 pagesProduct Distribution The BasicsNicol Katherine Sierra RodríguezNo ratings yet

- Defining Performance DimensionsDocument4 pagesDefining Performance DimensionsJaneNo ratings yet

- Block22 AnswersDocument5 pagesBlock22 AnswersSophia GarnerNo ratings yet

- Money Quiz: Starting U PDocument6 pagesMoney Quiz: Starting U PSfar Khouloud Ca100% (1)

- Intensive SBR (INT) 4 WeekDocument9 pagesIntensive SBR (INT) 4 WeekBellaNo ratings yet

- Elemica Creating Efficiencies in Procurement EbookDocument59 pagesElemica Creating Efficiencies in Procurement EbookKyaw WannaNo ratings yet

- Practice Test Paper & Mock Test For NISM SeriesDocument2 pagesPractice Test Paper & Mock Test For NISM SeriesIntelivisto Consulting India Private LimitedNo ratings yet

- SM - Distinctive CompetenciesDocument2 pagesSM - Distinctive CompetenciesVivek PimpleNo ratings yet

- Solution Proposed For Salary Ranges Customisation and AutomationDocument6 pagesSolution Proposed For Salary Ranges Customisation and Automationrahul patelNo ratings yet

- 3 DERIVATIVES AND HEDGING ACTIVITIES FinalDocument2 pages3 DERIVATIVES AND HEDGING ACTIVITIES FinalCha ChieNo ratings yet

- Mid Term 2022 Company LawDocument4 pagesMid Term 2022 Company Lawpradeep ranaNo ratings yet

- Port LogisticsDocument8 pagesPort LogisticsAnuradha Wasalamudali100% (1)

- Problems GeneralDocument9 pagesProblems GeneralAmal BharaliNo ratings yet

- The Inbound Marketing Sales Playbookv5-1Document51 pagesThe Inbound Marketing Sales Playbookv5-1rahulartiNo ratings yet

- Zhouying Soft TechnologyDocument24 pagesZhouying Soft TechnologyErnesto TreviñoNo ratings yet

- Trainee'S Record Book: Technical Education and Skills Development AuthorityDocument10 pagesTrainee'S Record Book: Technical Education and Skills Development AuthorityVirgil Keith Juan PicoNo ratings yet

- Essentials of Corporate Finance 9Th Edition Ross Solutions Manual Full Chapter PDFDocument36 pagesEssentials of Corporate Finance 9Th Edition Ross Solutions Manual Full Chapter PDFroberto.mcdaniel967100% (10)

- Infolink College: Instructor: Ashenafi NDocument186 pagesInfolink College: Instructor: Ashenafi NBeka AsraNo ratings yet

- Infosys JobsDocument3 pagesInfosys JobsChandan upadhyayNo ratings yet

- Caan Report 2014-FDocument53 pagesCaan Report 2014-Fpkrsuresh2013No ratings yet

- Marketing Debate Ch17Document3 pagesMarketing Debate Ch17Mariska Putri Adelia67% (3)

- Arun Kumar Shukla: Notable Attainments at HDB Financial Services LimitedDocument2 pagesArun Kumar Shukla: Notable Attainments at HDB Financial Services Limitedsaurabh kumar1No ratings yet

- Doing Deals in PEDocument139 pagesDoing Deals in PEHarjot SinghNo ratings yet