Professional Documents

Culture Documents

Credit Appraisal: Abhishek Patawari 57

Credit Appraisal: Abhishek Patawari 57

Uploaded by

minhaal reemaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit Appraisal: Abhishek Patawari 57

Credit Appraisal: Abhishek Patawari 57

Uploaded by

minhaal reemaCopyright:

Available Formats

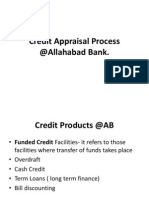

CREDIT APPRAISAL

Abhishek Patawari

57

WHAT IS CREDIT APPRAISAL?

Credit

appraisal

means

an

investigation/assessment done by the bank

prior providing any loans & advances/project

finance & also checks the commercial, financial

& technical viability of the project proposed.

Proper evaluation of the customer is preferred

which measures the financial condition & ability

to repay back the loan in future

Credit appraisal is the process of appraising

the credit worthiness of the loan applicant

WHAT IS CREDIT APPRAISAL? (CONTD)

Factors like:-

Age

Income

Number of dependents

Nature of employment

Continuity of employment

Repayment capacity

Previous loans, etc. are taken into

account while appraising the credit worthiness

of a person.

3 C of credit are must be kept in mind for

lending : Character

Capacity

Collateral

CREDIT APPRAISAL PROCESS

Receipt of application from applicant

|

Receipt of documents

(Balance sheet, KYC papers, Different govt. registration no.,

MOA, AOA, and Properties documents)

|

Pre-sanction visit by bank officers

|

Check for RBI defaulters list, willful defaulters list, CIBIL data,

ECGC caution list, etc.

|

Title clearance reports of the properties to be obtained from

empanelled advocates

|

Valuation reports of the properties to be obtained from

empanelled valuer/engineers

CREDIT APPRAISAL PROCESS

(CONTD)

Preparation of financial data

|

Proposal preparation

|

Assessment of proposal

|

Sanction/approval of proposal by appropriate sanctioning authority

|

Documentations, agreements, mortgages

|

Disbursement of loan

|

Post sanction activities such as receiving stock statements, review

of accounts, renew of accounts, etc

TECHNIQUE FOR CREDIT APPRAISAL

LOAN ADMINISTRATION PRE SANCTION PROCESS

Preliminary appraisal:

Sound credit appraisal involves analysis of the viability

of operations of a business and the capacity of the

promoters to run it profitably and repay the bank the

dues

The companys Memorandum and Articles of Association

should be scrutinized carefully to ensure that there are

no clauses prejudicial to the Banks interests

TECHNIQUE FOR CREDIT APPRAISAL

Towards this end the preliminary appraisal will

examine the following aspects of a proposal. Banks

lending policy and other relevant guidelines/RBI

guidelines:

Industry related risk factors

Credit risk rating

Profile of the promoters/senior management personnel of the

project

List of defaulters

Caution lists

Government regulations impacting on the industry

Financial status whether it is acceptable

TECHNIQUE FOR CREDIT APPRAISAL

Whether the project cost acceptable or not

Debt/ Equity ratio whether acceptable

Organizational set up with a list of Board of Directors & indicating

the qualifications & experience in the industry

Demand and supply projections based on the overall market

prospects together with a copy of the market survey report

Estimates of sales, cost of production and profitability

Projected profit and loss account and balance sheet for the

operating year

Audited profit loss account and balance sheet for the past three

years

TECHNIQUE FOR CREDIT

APPRAISAL

LOAN ADMINISTRATION POST SANCTION PROCESS

The post-sanction credit process can be broadly

classified into three stages:

Follow-up

Supervision

Monitoring

which together facilitate efficient and effective

credit management and maintaining high level of

standard assets

Thank You..

You might also like

- Credit Appraisal Process of BanksDocument25 pagesCredit Appraisal Process of Banksbhavikashetty75% (4)

- SBI - Credit AppraisalDocument31 pagesSBI - Credit AppraisalSuvra Ghosh25% (4)

- Credit Appraisal ProcessDocument19 pagesCredit Appraisal ProcessVaishnavi khot100% (2)

- Credit Appraisal in Banking Sector PPT at Bec DomsDocument31 pagesCredit Appraisal in Banking Sector PPT at Bec DomsBabasab Patil (Karrisatte)100% (2)

- Credit Apprisal Method-FDocument16 pagesCredit Apprisal Method-FRishabh JainNo ratings yet

- Credit Appraisal Process GRP 10Document18 pagesCredit Appraisal Process GRP 10Priya JagtapNo ratings yet

- Pre-Sanction Credit ProcessDocument14 pagesPre-Sanction Credit ProcessSumit Kumar Sharma100% (2)

- Credit AppraisalDocument49 pagesCredit AppraisalRam Vishrojwar50% (2)

- CREDIT Service TRAINING SLIDESDocument92 pagesCREDIT Service TRAINING SLIDESsiinqeecreditNo ratings yet

- Credit Appraisal System of PUNJAB NATIONAL BANKDocument36 pagesCredit Appraisal System of PUNJAB NATIONAL BANKManish Kanwar78% (9)

- Term Loans: Assets and WC MarginsDocument11 pagesTerm Loans: Assets and WC MarginsSrinidhi RangarajanNo ratings yet

- Components of Credit Appraisal ProcessDocument1 pageComponents of Credit Appraisal Processminushastri33No ratings yet

- Case Study: Presented by Neha.G - 31 Neha .M - 32Document10 pagesCase Study: Presented by Neha.G - 31 Neha .M - 32cuteneha_1989No ratings yet

- Credit Appraisal Means An InvestigationDocument3 pagesCredit Appraisal Means An InvestigationSoumava Paul100% (1)

- Credit AppraialDocument6 pagesCredit AppraialRishi OjhaNo ratings yet

- Final Coverage PageDocument5 pagesFinal Coverage Pageanilmourya5No ratings yet

- Credit Mgt. - WEBILT - DeckDocument287 pagesCredit Mgt. - WEBILT - Decksimran kaur100% (1)

- Presentation On Credit Appraisal in Banking SectorDocument31 pagesPresentation On Credit Appraisal in Banking Sectorchintan05ecNo ratings yet

- Credit Process and Credit Appraisal of A CommercialDocument26 pagesCredit Process and Credit Appraisal of A CommercialLiza Ahmed100% (2)

- Credit AppraisalDocument14 pagesCredit AppraisalRishabh Jain0% (1)

- Credit Monitoring: R.KanchanamalaDocument53 pagesCredit Monitoring: R.Kanchanamalamithilesh tabhaneNo ratings yet

- Objectives of Credit Management (Four)Document33 pagesObjectives of Credit Management (Four)arshita sharmaNo ratings yet

- Credit RatingDocument28 pagesCredit Ratingak5775No ratings yet

- Credit Administration and Documentation StandardsDocument7 pagesCredit Administration and Documentation StandardsEINSTEIN2DNo ratings yet

- Credit ApprisalDocument74 pagesCredit Apprisalpiupush100% (1)

- Interim Report ModifiedDocument37 pagesInterim Report ModifiedsrikanthkgNo ratings yet

- Credit Appraisal Process of Sbi: A Case Study of Branch of Sbi in HisarDocument1 pageCredit Appraisal Process of Sbi: A Case Study of Branch of Sbi in Hisarnbtamana4No ratings yet

- Credit Rating: - Kanika KhuranaDocument40 pagesCredit Rating: - Kanika KhuranaAnunay AroraNo ratings yet

- Verification of AdvancesDocument12 pagesVerification of AdvancesAvinash SinyalNo ratings yet

- Appraisal of Term LoanDocument13 pagesAppraisal of Term LoanAabhash ShrivastavNo ratings yet

- Bank of IndiaDocument15 pagesBank of Indiashreyaasharmaa100% (1)

- Due Diligence Assessment Slide FinalDocument17 pagesDue Diligence Assessment Slide FinalMwalimu Hachalu FayeNo ratings yet

- UNIT3Document37 pagesUNIT3lokesh palNo ratings yet

- 1 Bank LendingDocument56 pages1 Bank Lendingparthasarathi_inNo ratings yet

- Credit-Management ReviewerDocument34 pagesCredit-Management ReviewerJhay Zem OrtizNo ratings yet

- Credit Appraisal Process Followed in Allahabad BankDocument42 pagesCredit Appraisal Process Followed in Allahabad BankParthapratim DebnathNo ratings yet

- JAIIB PAPER 1 IE IFS Module D UNIT 12 CREDIT RATING AND CREDIT SCORING Ambitious Baba 1Document13 pagesJAIIB PAPER 1 IE IFS Module D UNIT 12 CREDIT RATING AND CREDIT SCORING Ambitious Baba 1Amit KanojiaNo ratings yet

- How To Prevent Fraud in MSMEDocument16 pagesHow To Prevent Fraud in MSMEsidh0987No ratings yet

- Assignment of Management of Working Capital: TopicDocument13 pagesAssignment of Management of Working Capital: TopicDavinder Singh Banss0% (1)

- Assignment of Management of Working Capital: TopicDocument13 pagesAssignment of Management of Working Capital: TopicDavinder Singh BanssNo ratings yet

- Summer Intership Presentation ON State Bank of India: Presented By: Supreet Gupta PGFB1354Document14 pagesSummer Intership Presentation ON State Bank of India: Presented By: Supreet Gupta PGFB1354Supreet GuptaNo ratings yet

- Credit RatingDocument56 pagesCredit RatingRaman Gupta100% (1)

- Ethodology OF Credit Rating AgenciesDocument8 pagesEthodology OF Credit Rating Agenciesnagusajjan08No ratings yet

- PNBDocument20 pagesPNBShuchita BhutaniNo ratings yet

- Capital: Owner About Their Stake Hence More Safeguard Will Be The Borrowed FundsDocument28 pagesCapital: Owner About Their Stake Hence More Safeguard Will Be The Borrowed FundsMdramjanaliNo ratings yet

- Credit Rating: Prof. Rahul MailcontractorDocument49 pagesCredit Rating: Prof. Rahul MailcontractorDivyesh GandhiNo ratings yet

- Synopsis On: Corporate Debt Ratings: An Analysis of Methodologies and Practices by Select Credit Rating Agencies in IndiaDocument39 pagesSynopsis On: Corporate Debt Ratings: An Analysis of Methodologies and Practices by Select Credit Rating Agencies in IndiaNihit SrivastavaNo ratings yet

- Credit Rating Is The Opinion of The Rating Agency On The Relative Ability and Willingness of The Issuer of A Debt Instrument To Meet The Debt Service Obligations As and When They AriseDocument5 pagesCredit Rating Is The Opinion of The Rating Agency On The Relative Ability and Willingness of The Issuer of A Debt Instrument To Meet The Debt Service Obligations As and When They ArisePrince VargheseNo ratings yet

- Lending and Credit Procedure of Dutch Bangla Bank LimitedDocument9 pagesLending and Credit Procedure of Dutch Bangla Bank LimitedSiddanth SidNo ratings yet

- Lesson 3 - Credit ProcessDocument6 pagesLesson 3 - Credit ProcessRachel Ann RazonableNo ratings yet

- Factoring - BangladeshDocument58 pagesFactoring - Bangladeshrajin_rammstein100% (1)

- BankingDocument110 pagesBankingNarcity UzumakiNo ratings yet

- Remuneration:: Internship Report On Bank of KhyberDocument1 pageRemuneration:: Internship Report On Bank of KhyberFaisal Khan JadoonNo ratings yet

- CARE's Issuer Rating: 1. ScopeDocument7 pagesCARE's Issuer Rating: 1. ScopeSuryaNo ratings yet

- Retail Lending PrinciplesDocument22 pagesRetail Lending PrinciplesViji Ranga25% (4)

- 14 Credit PolicyDocument48 pages14 Credit Policynallafirdos786No ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18From EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18No ratings yet

- Loan Application Form 1. Applicant'S Personal InformationDocument2 pagesLoan Application Form 1. Applicant'S Personal InformationWingadianLeviOsa100% (5)

- CMBS Extension Risk: Timing Is Everything: Merganser Investment MemorandumDocument2 pagesCMBS Extension Risk: Timing Is Everything: Merganser Investment MemorandumJay KabNo ratings yet

- BS GroupingsDocument438 pagesBS GroupingsShivakumar RaoNo ratings yet

- CFPB Loan EstimateDocument3 pagesCFPB Loan EstimateRichard VetsteinNo ratings yet

- Personal Financial Literacy: Madura Casey RobertsDocument337 pagesPersonal Financial Literacy: Madura Casey RobertsGrantt ChristianNo ratings yet

- Module 1-Project Feasibility Study-IntroDocument22 pagesModule 1-Project Feasibility Study-IntroJoshua BarracaNo ratings yet

- Financing Tools For Urban Redevelopment: November 2014Document33 pagesFinancing Tools For Urban Redevelopment: November 2014Andrea GiavoniNo ratings yet

- Fin02 Case PDFDocument2 pagesFin02 Case PDFRahil JainNo ratings yet

- Causes of Financial CrisisDocument10 pagesCauses of Financial CrisisBun Seng KongNo ratings yet

- Accountants TodayDocument6 pagesAccountants TodayAkmal RosliNo ratings yet

- Module 04 - Financial InstrumentsDocument19 pagesModule 04 - Financial Instrumentsapostol ignacioNo ratings yet

- MB 6023Document16 pagesMB 6023LIU HAO PASCANo ratings yet

- AU 2 I COMPARE Select A Financial Account or ProductDocument5 pagesAU 2 I COMPARE Select A Financial Account or ProductMaria SalinasNo ratings yet

- Temo Letlotlo Guidelines - Final Setswana Version KgaodiDocument22 pagesTemo Letlotlo Guidelines - Final Setswana Version Kgaodikmathumo3No ratings yet

- CV Loan AgreementDocument17 pagesCV Loan AgreementankitNo ratings yet

- 50 Business Words, Meaning and SentencesDocument8 pages50 Business Words, Meaning and Sentencesvener magpayoNo ratings yet

- Assignment #2Document2 pagesAssignment #2Angela AngelesNo ratings yet

- CB MCQDocument11 pagesCB MCQVaishnavi khotNo ratings yet

- Started OnDocument6 pagesStarted OnGrace LagasiNo ratings yet

- Financial Strategies Adopted by Indian RailwaysDocument109 pagesFinancial Strategies Adopted by Indian RailwaysDarvesh SinghNo ratings yet

- Ifrs 9 Financial Instruments SummaryDocument17 pagesIfrs 9 Financial Instruments SummaryrasfazzzataNo ratings yet

- Receivable ManagementDocument40 pagesReceivable ManagementrenudhingraNo ratings yet

- Module 3.2 Ordinary and Exact InterestsDocument20 pagesModule 3.2 Ordinary and Exact InterestsvanNo ratings yet

- Rating Methodology For Project Bond: Salyadi Saputra - Ceo of PT PefindoDocument7 pagesRating Methodology For Project Bond: Salyadi Saputra - Ceo of PT PefindoRuth TheresiaNo ratings yet

- CMS Base II - Plan Master and Monetary Transaction ControlDocument56 pagesCMS Base II - Plan Master and Monetary Transaction ControlKrishna KingNo ratings yet

- NCERT Solutions Class 10 Social Science Economics Chapter 3 Money and CreditDocument4 pagesNCERT Solutions Class 10 Social Science Economics Chapter 3 Money and CreditTaksh MehrotraNo ratings yet

- Bank Secrecy Law and Truth in Lending ActDocument23 pagesBank Secrecy Law and Truth in Lending ActArjay MolinaNo ratings yet

- Desha Management and ConsultancyDocument45 pagesDesha Management and Consultancysumanavathi02No ratings yet

- Unit 6: Risk For Financial Institutions and Their ManagementDocument65 pagesUnit 6: Risk For Financial Institutions and Their ManagementDeepak PokhrelNo ratings yet

- Sales Kza7ihj 1657241262009Document17 pagesSales Kza7ihj 1657241262009MARCELO TAVARESNo ratings yet