Professional Documents

Culture Documents

100%(2)100% found this document useful (2 votes)

175 viewsVenture Capital: Prof. Sarbesh Mishra, Finance Area

Venture Capital: Prof. Sarbesh Mishra, Finance Area

Uploaded by

Dr Sarbesh MishraVenture capital involves financing provided by specialized institutions to entrepreneurs for start-up or developing businesses that involve a high degree of risk. The venture capitalist typically takes an active role in the business and seeks an eventual return through sale or IPO of the company. Venture capital investing occurs in stages from early seed funding through expansion financing, and involves high risks but also the potential for high returns if companies succeed. In India, venture capital funds are regulated by SEBI and must meet restrictions on where and how much they can invest.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You might also like

- DLP-COT-festival DanceDocument2 pagesDLP-COT-festival DanceJelly Mae Getalla70% (10)

- Structure and Framework of Venture Capital Financing in IndiaDocument11 pagesStructure and Framework of Venture Capital Financing in Indiabrackishsea88% (8)

- Inventory ManagementDocument5 pagesInventory ManagementDr Sarbesh Mishra90% (10)

- Venture CapitalDocument24 pagesVenture Capitalsuseelasenthilkumar10No ratings yet

- Features - Venture CapitalDocument19 pagesFeatures - Venture CapitalnavinpoddarNo ratings yet

- SEBI (Venture Capital Funds) RegulationsDocument23 pagesSEBI (Venture Capital Funds) RegulationsDickench Das50% (2)

- Chapter 2Document49 pagesChapter 2Naveen gupiNo ratings yet

- Unit 6 Venture CapitalDocument39 pagesUnit 6 Venture CapitalNtinginya Iddi rajabuNo ratings yet

- Venture Capital: Submitted byDocument26 pagesVenture Capital: Submitted bySatish KumarNo ratings yet

- Fijas King Cincila Heena Lakshya Jeyaraj JituparnaDocument30 pagesFijas King Cincila Heena Lakshya Jeyaraj JituparnaClarence PSNo ratings yet

- VC 131209235045 Phpapp02Document45 pagesVC 131209235045 Phpapp02rachealllNo ratings yet

- Venture Capital FundingDocument20 pagesVenture Capital FundingSanchit TaksaliNo ratings yet

- FMR AssignmentDocument8 pagesFMR AssignmentSiddharth PandeyNo ratings yet

- Venture CapitalDocument7 pagesVenture CapitalRag LakNo ratings yet

- BY Amarnath PoornimaDocument30 pagesBY Amarnath PoornimaexistsasnitinNo ratings yet

- Venture CapitalDocument38 pagesVenture CapitalPardeep PardeepNo ratings yet

- Mutual FundsDocument24 pagesMutual FundsAnurag VermaNo ratings yet

- Enture Financing: BY: M.Shamrin Sofia 18COAE049Document21 pagesEnture Financing: BY: M.Shamrin Sofia 18COAE049Sofia ShamrinNo ratings yet

- IFM Class 10 CH 7 NotesDocument4 pagesIFM Class 10 CH 7 NotesVidhit VermaNo ratings yet

- Presentation On: Venture Capital & SebiDocument14 pagesPresentation On: Venture Capital & Sebivineeta4604No ratings yet

- Venture Capital PresentationDocument20 pagesVenture Capital PresentationAcousticParesh Patel100% (1)

- Public International LawDocument40 pagesPublic International Lawabhiramishaji45No ratings yet

- Venture Capital: Rahul Shah Roll:135 MFM3-BDocument53 pagesVenture Capital: Rahul Shah Roll:135 MFM3-BParth MakwanaNo ratings yet

- Mutual Funds: PRENTENED BY:-Sher Singh Pradeep KumarDocument18 pagesMutual Funds: PRENTENED BY:-Sher Singh Pradeep Kumarsherrysingh44No ratings yet

- Venture CapitalDocument10 pagesVenture CapitalsadathnooriNo ratings yet

- Private Equity StructureDocument14 pagesPrivate Equity Structurewww.pubg3.co.inNo ratings yet

- Venture CapitalDocument60 pagesVenture CapitalAdii AdityaNo ratings yet

- Sample Institutional IPSDocument5 pagesSample Institutional IPSWilliam RomeroNo ratings yet

- Mutual Fund ProspectusDocument2 pagesMutual Fund ProspectusJitiNo ratings yet

- Venture Capital Fund ProjectDocument29 pagesVenture Capital Fund ProjectAdii AdityaNo ratings yet

- Venture CapitalDocument45 pagesVenture CapitalGaurav BhawsarNo ratings yet

- Venture Capital FinancingDocument2 pagesVenture Capital FinancingCharu ModiNo ratings yet

- The Capital Protected Fund Is Classed As A Cautious InvestmentDocument6 pagesThe Capital Protected Fund Is Classed As A Cautious InvestmentMuhammad Fahad SaleemNo ratings yet

- Venture CapitalDocument23 pagesVenture CapitalpecmbaNo ratings yet

- Alternative Investments AssignmentDocument8 pagesAlternative Investments AssignmentYashwanth YashasNo ratings yet

- What Is A Mutual Fund?Document8 pagesWhat Is A Mutual Fund?Pratikshya HuiNo ratings yet

- Welcome To Venture Capital PresentationDocument24 pagesWelcome To Venture Capital PresentationrachealllNo ratings yet

- Venture CapitalDocument32 pagesVenture CapitalVarnika BajajNo ratings yet

- Nism Va Mutual Fund Distributor ExaminationDocument130 pagesNism Va Mutual Fund Distributor ExaminationKrishna JhaNo ratings yet

- Venture Capital FinancingDocument19 pagesVenture Capital FinancingRaghav GuptaNo ratings yet

- Standard Chartered Bank Pakistan: HistoryDocument8 pagesStandard Chartered Bank Pakistan: HistoryUzair ShaikhNo ratings yet

- Venture CapitalDocument28 pagesVenture CapitalAdii AdityaNo ratings yet

- Foreign Institutional InvestmentDocument61 pagesForeign Institutional InvestmentPrashantChauhanNo ratings yet

- Venture Capital Industry in BangladeshDocument8 pagesVenture Capital Industry in BangladeshUzzal AhmedNo ratings yet

- Mutual Fund: BY-Group EDocument17 pagesMutual Fund: BY-Group EVilasagarapu ChaitanyaNo ratings yet

- FIMIS Funds ManagementDocument50 pagesFIMIS Funds ManagementHitesh JawaleNo ratings yet

- Venture Capital: Debt Finance Term LoanDocument4 pagesVenture Capital: Debt Finance Term LoanmansionerNo ratings yet

- Growth of Venture CapitalDocument24 pagesGrowth of Venture CapitalAshish MahendraNo ratings yet

- About Mutual FundsDocument34 pagesAbout Mutual FundsAbhijeet PatilNo ratings yet

- Shri Chinai College of Commerce and Economics Andheri (E) ,: Submitted By: Group 9Document21 pagesShri Chinai College of Commerce and Economics Andheri (E) ,: Submitted By: Group 9Mohit ZaveriNo ratings yet

- Definition of 'Venture Capital'Document3 pagesDefinition of 'Venture Capital'Adarsh UttarkarNo ratings yet

- Venture Capital: by M.M. Upendra Vasanth PGDM171972050Document19 pagesVenture Capital: by M.M. Upendra Vasanth PGDM171972050Satish Reddy Karri (PGDM 17-19chn)No ratings yet

- Foreign Instituitional InvestorsDocument8 pagesForeign Instituitional InvestorsJayneel JadejaNo ratings yet

- A Mutual Fund is a Common Pool of Money in to Which Investors With Common Investment Objective Place Their Contributions That Are to Be Invested in Accordance With the Stated Investment Objective of the SchemeDocument6 pagesA Mutual Fund is a Common Pool of Money in to Which Investors With Common Investment Objective Place Their Contributions That Are to Be Invested in Accordance With the Stated Investment Objective of the SchemeKumaran MohanNo ratings yet

- Asset/Fund Based Financial Services & Fee-Based /advisory Services (Unit-4: FIM&S)Document5 pagesAsset/Fund Based Financial Services & Fee-Based /advisory Services (Unit-4: FIM&S)Sweeti GuptaNo ratings yet

- Mutual Funds in India: T.Sita Ramaiah Center Head INC - GunturDocument36 pagesMutual Funds in India: T.Sita Ramaiah Center Head INC - GunturPUTTU GURU PRASAD SENGUNTHA MUDALIAR100% (2)

- الاستثمار الجرئ-2ENDocument22 pagesالاستثمار الجرئ-2ENAbdulmohsn AlmuhaidbNo ratings yet

- Venturecapital 121214000438 Phpapp02Document39 pagesVenturecapital 121214000438 Phpapp02pradeepbandiNo ratings yet

- Investing Made Easy: Finding the Right Opportunities for YouFrom EverandInvesting Made Easy: Finding the Right Opportunities for YouNo ratings yet

- Australian Managed Funds for Beginners: A Basic Guide for BeginnersFrom EverandAustralian Managed Funds for Beginners: A Basic Guide for BeginnersNo ratings yet

- Corporate Governance: Sarbesh MishraDocument11 pagesCorporate Governance: Sarbesh MishraDr Sarbesh MishraNo ratings yet

- Corporate GovernanceDocument26 pagesCorporate GovernanceDr Sarbesh MishraNo ratings yet

- Introduction to Net Zero ConstructionsDocument18 pagesIntroduction to Net Zero ConstructionsDr Sarbesh MishraNo ratings yet

- Factoring: Dr. Sarbesh MishraDocument10 pagesFactoring: Dr. Sarbesh MishraDr Sarbesh MishraNo ratings yet

- Business OrganizationsDocument22 pagesBusiness OrganizationsArvind HoodaNo ratings yet

- IRDA Guidelines On OutsourcingDocument30 pagesIRDA Guidelines On OutsourcingDr Sarbesh MishraNo ratings yet

- InfrastructureDocument32 pagesInfrastructureDr Sarbesh Mishra100% (2)

- Measuring Corporate Performance - An EVA Approach: DR Sarbesh MishraDocument20 pagesMeasuring Corporate Performance - An EVA Approach: DR Sarbesh MishraDr Sarbesh Mishra100% (1)

- Cost Control and Waste ManagementDocument21 pagesCost Control and Waste ManagementbasithalNo ratings yet

- DepreciationDocument17 pagesDepreciationDr Sarbesh Mishra100% (1)

- Building Economics and Value ManagementDocument28 pagesBuilding Economics and Value ManagementDr Sarbesh MishraNo ratings yet

- Capital and RevenueDocument20 pagesCapital and RevenueDr Sarbesh Mishra100% (1)

- Preparation of Final AccountsDocument13 pagesPreparation of Final AccountsDr Sarbesh MishraNo ratings yet

- Goal Congruence Approach Under Advnced Strategic PlanningDocument4 pagesGoal Congruence Approach Under Advnced Strategic PlanningDr Sarbesh MishraNo ratings yet

- Power Sector Reforms - Orissa PerspectiveDocument294 pagesPower Sector Reforms - Orissa PerspectiveDr Sarbesh Mishra100% (4)

- Capital & RevenueDocument7 pagesCapital & RevenueDr Sarbesh Mishra50% (2)

- New Financial Products and ServicesDocument16 pagesNew Financial Products and ServicesDr Sarbesh Mishra86% (7)

- Core Concepts of Financial ManagementDocument10 pagesCore Concepts of Financial ManagementDr Sarbesh Mishra100% (15)

- Modern Risk ManagementDocument15 pagesModern Risk ManagementDr Sarbesh Mishra100% (2)

- Building Economics and Cost ControlDocument25 pagesBuilding Economics and Cost ControlDr Sarbesh Mishra100% (1)

- Building Economics and Value ManagementDocument23 pagesBuilding Economics and Value ManagementDr Sarbesh Mishra100% (1)

- LeasingDocument17 pagesLeasingDr Sarbesh Mishra100% (10)

- Evaluation of Financial FeasibilityDocument25 pagesEvaluation of Financial FeasibilityDr Sarbesh Mishra86% (7)

- Bills DiscountingDocument9 pagesBills DiscountingDr Sarbesh Mishra83% (6)

- Scientific Method Test Study Guide2Document4 pagesScientific Method Test Study Guide2Gabriel TaylorNo ratings yet

- 01 Diabetes Mellitus Type2Document39 pages01 Diabetes Mellitus Type2Che HaniffNo ratings yet

- 65.000 KH CA Nhan AcbDocument2,048 pages65.000 KH CA Nhan Acbhu hila0% (1)

- My Classroom Management PlanDocument6 pagesMy Classroom Management Plannanie1986No ratings yet

- APS ThinsulatorsDocument3 pagesAPS ThinsulatorsBobbie RuckNo ratings yet

- Screenshot 2023-01-03 at 6.11.33 PM PDFDocument4 pagesScreenshot 2023-01-03 at 6.11.33 PM PDFtamanna groverNo ratings yet

- Waterfront Boundaries For Grants of Public Crown Lands - MNR - E000074 - 2001Document3 pagesWaterfront Boundaries For Grants of Public Crown Lands - MNR - E000074 - 2001Sen HuNo ratings yet

- Ionic Equilibrium: Acid-Base Equilibrium Salt Hydrolysis Buffer SystemDocument55 pagesIonic Equilibrium: Acid-Base Equilibrium Salt Hydrolysis Buffer SystemMuhammad Muaz MahmudNo ratings yet

- Section 2 Structure and Written Expression Time: 25 Minutes (Including Reading The Direction)Document2 pagesSection 2 Structure and Written Expression Time: 25 Minutes (Including Reading The Direction)Lailatul Badriyah0% (1)

- Uae Essential Network List July 2016Document75 pagesUae Essential Network List July 2016ubyisismayilNo ratings yet

- Automation Testing 2 Years Exp 2Document3 pagesAutomation Testing 2 Years Exp 2Swapnil FulariNo ratings yet

- Reminiscences of Madame Sidney PrattenDocument121 pagesReminiscences of Madame Sidney PrattenjavisatrianiNo ratings yet

- Partnership Law Atty. Macmod: Multiple ChoiceDocument10 pagesPartnership Law Atty. Macmod: Multiple ChoiceJomarNo ratings yet

- Ophtha Quiz - Ocular Manifestations of SystemicDocument3 pagesOphtha Quiz - Ocular Manifestations of SystemicAsif MohammedNo ratings yet

- Pengaruh Pemberian Tempe Kacang Hijau Sebagai Polen Pengganti Terhadap Penampilan Larva Lebah Pekerja Apis MelliferaDocument8 pagesPengaruh Pemberian Tempe Kacang Hijau Sebagai Polen Pengganti Terhadap Penampilan Larva Lebah Pekerja Apis MelliferaResti Amelia SusantiNo ratings yet

- Gastech2008 Macdonald MaguireDocument6 pagesGastech2008 Macdonald Maguire463990305No ratings yet

- Joslyn C Smith Resume 2018Document1 pageJoslyn C Smith Resume 2018api-361867506No ratings yet

- Families Caring For An Aging AmericaDocument366 pagesFamilies Caring For An Aging AmericaVladimirNo ratings yet

- IronbutterplyDocument3 pagesIronbutterplyCiliaNo ratings yet

- The Food Industry in Nigeria Development and QualiDocument6 pagesThe Food Industry in Nigeria Development and Qualimercy luwaNo ratings yet

- Siva Stuti SanskritDocument374 pagesSiva Stuti SanskritDurgavenkat LakshmiNo ratings yet

- Legal Metrology Act: Analysis: Dhruv Sharma, 01319103516 BBALLB 9Document4 pagesLegal Metrology Act: Analysis: Dhruv Sharma, 01319103516 BBALLB 9dhruv sharmaNo ratings yet

- Bombastic Words For SPM EssayDocument11 pagesBombastic Words For SPM EssayAmirul Zaki100% (3)

- Greg Crowfoot - Understanding The Galdrabok Part 2Document14 pagesGreg Crowfoot - Understanding The Galdrabok Part 2michael ellisNo ratings yet

- Ga Hong Mei's DiaryDocument5 pagesGa Hong Mei's DiaryZefroudeille MartiniNo ratings yet

- COCA COCA AssigmentDocument16 pagesCOCA COCA AssigmentSamridhi ShreyaNo ratings yet

- BAED Bens Short Quiz 1Document5 pagesBAED Bens Short Quiz 1Luisa RadaNo ratings yet

- Compounding Self AssessmentDocument15 pagesCompounding Self AssessmentLara LaiNo ratings yet

- Valley Winery Case StudyDocument15 pagesValley Winery Case Studysarakhan0622No ratings yet

Venture Capital: Prof. Sarbesh Mishra, Finance Area

Venture Capital: Prof. Sarbesh Mishra, Finance Area

Uploaded by

Dr Sarbesh Mishra100%(2)100% found this document useful (2 votes)

175 views12 pagesVenture capital involves financing provided by specialized institutions to entrepreneurs for start-up or developing businesses that involve a high degree of risk. The venture capitalist typically takes an active role in the business and seeks an eventual return through sale or IPO of the company. Venture capital investing occurs in stages from early seed funding through expansion financing, and involves high risks but also the potential for high returns if companies succeed. In India, venture capital funds are regulated by SEBI and must meet restrictions on where and how much they can invest.

Original Description:

An Indian Perspective of Venture Capital Arrangement

Original Title

VENTURE CAPITAL

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentVenture capital involves financing provided by specialized institutions to entrepreneurs for start-up or developing businesses that involve a high degree of risk. The venture capitalist typically takes an active role in the business and seeks an eventual return through sale or IPO of the company. Venture capital investing occurs in stages from early seed funding through expansion financing, and involves high risks but also the potential for high returns if companies succeed. In India, venture capital funds are regulated by SEBI and must meet restrictions on where and how much they can invest.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

100%(2)100% found this document useful (2 votes)

175 views12 pagesVenture Capital: Prof. Sarbesh Mishra, Finance Area

Venture Capital: Prof. Sarbesh Mishra, Finance Area

Uploaded by

Dr Sarbesh MishraVenture capital involves financing provided by specialized institutions to entrepreneurs for start-up or developing businesses that involve a high degree of risk. The venture capitalist typically takes an active role in the business and seeks an eventual return through sale or IPO of the company. Venture capital investing occurs in stages from early seed funding through expansion financing, and involves high risks but also the potential for high returns if companies succeed. In India, venture capital funds are regulated by SEBI and must meet restrictions on where and how much they can invest.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 12

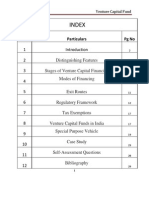

VENTURE CAPITAL

Prof. Sarbesh Mishra,

Finance Area.

VENTURE CAPITAL: THE CONCEPT

Finance provided by a specialized

institution to an entrepreneur.

Start-up or developing business, where

a fairly high degree of risk is involved.

Venture capitalist usually has a

continuing involvement in the business

of the customer after making an

investment.

Contd….

Venturecapitalist seek to protect and

enhance his investment by keeping

close to the entrepreneur and his

team in an active supportive role.

A venture capital investment is illiquid

i.e. not subject to repayment on

demand as with an overdraft or

following a loan repayment schedule.

Contd….

Investment is realised only when the

company is sold or achieves a stock

market listing.

In the event of liquidation the

investment is lost.

VentureCapital is risk financing at its

extreme.

ORIGIN

The concept of venture capital

originated in USA during 19th. and early

20th. Century.

European investors alongwith

American natives were involved in

backing construction and other new

industries viz. Rail, Road, Steel, Oil,

Gas and Glass.

VC SPECIALISATION

The state of development of investee

company decided the financing stage as

perceived by the venture capitalist.

The funds investments size range i.e.

minimum/maximum equity percentages

also vary from fund to fund.

VC funds includes many financing

instruments i.e. Shares, Preferred Shares,

deferred shares, convertible loan stock.

Contd….

Venture capitalist specialize in specific

technology and their portfolio include a

significant proportion of business in the

areas of advanced technology.

Time scale to realisation i.e. early stage

financing are inevitably taking a medium to

long-term (5-7 years) and later stage

financing will have a 3-5 years time scale.

Geographical Limitations i.e. funds say also

specialize regionally.

STAGES OF INVESTMENT

Early stage investment Time Scale Risk

Equity Share

c. Seed Capital and R&D Projects (7-10yrs.) Extreme

d. Start Ups (5-10yrs.) Very

High

e. Second Round Finance (3-7yrs.) High

6. Later Stage Investment

VII. Expansion Finance (1-3yrs.) Medium

VIII. Replacement Capital (1-3yrs.)

Low

IX. Turnarounds (3-5yrs.) Medium

X. Buy Outs (3-5yrs.) Low

VENTURE CAPITAL FUNDS

Finance Act, 2000 has made SEBI the single

point nodal agency for registration and

regulation of both domestic and overseas

venture capital funds (VCFs)

No approval of VCFs by Tax authorities is

required.

There will be no tax on distributed or

undistributed income of such funds.

The income distributed by these funds will

only be taxed in the hands of investors.

INVESTMENT RESTRICTION

VCFs has to disclose the investment

strategy at the time of application for

registration.

A VCF cannot invest more than 25%

corpus of the funds in one venture capital

undertaking (VCU).

At least 75% of the investible funds has to

be invested in unlisted equity shares or

equity linked instruments.

Contd….

2. Not more than 25% of the investible funds

may be invested by way of subscription to

IPO of VCU with a lock-in period of one

year.

VCF cannot invest in the associated

companies

REGULATION OF VCFs BY SEBI

VCF is a fund established in the form of a

trust / a company including a body

corporate and registered with SEBI.

Minimum investment in a VCF from any

investor would not be less than 5 lakh.

The VCF will be eligible to participate in the

IPO through book building route as QIB.

VCF is to provide venture capital activity for

every quarter starting from Dec. 31, 2000.

You might also like

- DLP-COT-festival DanceDocument2 pagesDLP-COT-festival DanceJelly Mae Getalla70% (10)

- Structure and Framework of Venture Capital Financing in IndiaDocument11 pagesStructure and Framework of Venture Capital Financing in Indiabrackishsea88% (8)

- Inventory ManagementDocument5 pagesInventory ManagementDr Sarbesh Mishra90% (10)

- Venture CapitalDocument24 pagesVenture Capitalsuseelasenthilkumar10No ratings yet

- Features - Venture CapitalDocument19 pagesFeatures - Venture CapitalnavinpoddarNo ratings yet

- SEBI (Venture Capital Funds) RegulationsDocument23 pagesSEBI (Venture Capital Funds) RegulationsDickench Das50% (2)

- Chapter 2Document49 pagesChapter 2Naveen gupiNo ratings yet

- Unit 6 Venture CapitalDocument39 pagesUnit 6 Venture CapitalNtinginya Iddi rajabuNo ratings yet

- Venture Capital: Submitted byDocument26 pagesVenture Capital: Submitted bySatish KumarNo ratings yet

- Fijas King Cincila Heena Lakshya Jeyaraj JituparnaDocument30 pagesFijas King Cincila Heena Lakshya Jeyaraj JituparnaClarence PSNo ratings yet

- VC 131209235045 Phpapp02Document45 pagesVC 131209235045 Phpapp02rachealllNo ratings yet

- Venture Capital FundingDocument20 pagesVenture Capital FundingSanchit TaksaliNo ratings yet

- FMR AssignmentDocument8 pagesFMR AssignmentSiddharth PandeyNo ratings yet

- Venture CapitalDocument7 pagesVenture CapitalRag LakNo ratings yet

- BY Amarnath PoornimaDocument30 pagesBY Amarnath PoornimaexistsasnitinNo ratings yet

- Venture CapitalDocument38 pagesVenture CapitalPardeep PardeepNo ratings yet

- Mutual FundsDocument24 pagesMutual FundsAnurag VermaNo ratings yet

- Enture Financing: BY: M.Shamrin Sofia 18COAE049Document21 pagesEnture Financing: BY: M.Shamrin Sofia 18COAE049Sofia ShamrinNo ratings yet

- IFM Class 10 CH 7 NotesDocument4 pagesIFM Class 10 CH 7 NotesVidhit VermaNo ratings yet

- Presentation On: Venture Capital & SebiDocument14 pagesPresentation On: Venture Capital & Sebivineeta4604No ratings yet

- Venture Capital PresentationDocument20 pagesVenture Capital PresentationAcousticParesh Patel100% (1)

- Public International LawDocument40 pagesPublic International Lawabhiramishaji45No ratings yet

- Venture Capital: Rahul Shah Roll:135 MFM3-BDocument53 pagesVenture Capital: Rahul Shah Roll:135 MFM3-BParth MakwanaNo ratings yet

- Mutual Funds: PRENTENED BY:-Sher Singh Pradeep KumarDocument18 pagesMutual Funds: PRENTENED BY:-Sher Singh Pradeep Kumarsherrysingh44No ratings yet

- Venture CapitalDocument10 pagesVenture CapitalsadathnooriNo ratings yet

- Private Equity StructureDocument14 pagesPrivate Equity Structurewww.pubg3.co.inNo ratings yet

- Venture CapitalDocument60 pagesVenture CapitalAdii AdityaNo ratings yet

- Sample Institutional IPSDocument5 pagesSample Institutional IPSWilliam RomeroNo ratings yet

- Mutual Fund ProspectusDocument2 pagesMutual Fund ProspectusJitiNo ratings yet

- Venture Capital Fund ProjectDocument29 pagesVenture Capital Fund ProjectAdii AdityaNo ratings yet

- Venture CapitalDocument45 pagesVenture CapitalGaurav BhawsarNo ratings yet

- Venture Capital FinancingDocument2 pagesVenture Capital FinancingCharu ModiNo ratings yet

- The Capital Protected Fund Is Classed As A Cautious InvestmentDocument6 pagesThe Capital Protected Fund Is Classed As A Cautious InvestmentMuhammad Fahad SaleemNo ratings yet

- Venture CapitalDocument23 pagesVenture CapitalpecmbaNo ratings yet

- Alternative Investments AssignmentDocument8 pagesAlternative Investments AssignmentYashwanth YashasNo ratings yet

- What Is A Mutual Fund?Document8 pagesWhat Is A Mutual Fund?Pratikshya HuiNo ratings yet

- Welcome To Venture Capital PresentationDocument24 pagesWelcome To Venture Capital PresentationrachealllNo ratings yet

- Venture CapitalDocument32 pagesVenture CapitalVarnika BajajNo ratings yet

- Nism Va Mutual Fund Distributor ExaminationDocument130 pagesNism Va Mutual Fund Distributor ExaminationKrishna JhaNo ratings yet

- Venture Capital FinancingDocument19 pagesVenture Capital FinancingRaghav GuptaNo ratings yet

- Standard Chartered Bank Pakistan: HistoryDocument8 pagesStandard Chartered Bank Pakistan: HistoryUzair ShaikhNo ratings yet

- Venture CapitalDocument28 pagesVenture CapitalAdii AdityaNo ratings yet

- Foreign Institutional InvestmentDocument61 pagesForeign Institutional InvestmentPrashantChauhanNo ratings yet

- Venture Capital Industry in BangladeshDocument8 pagesVenture Capital Industry in BangladeshUzzal AhmedNo ratings yet

- Mutual Fund: BY-Group EDocument17 pagesMutual Fund: BY-Group EVilasagarapu ChaitanyaNo ratings yet

- FIMIS Funds ManagementDocument50 pagesFIMIS Funds ManagementHitesh JawaleNo ratings yet

- Venture Capital: Debt Finance Term LoanDocument4 pagesVenture Capital: Debt Finance Term LoanmansionerNo ratings yet

- Growth of Venture CapitalDocument24 pagesGrowth of Venture CapitalAshish MahendraNo ratings yet

- About Mutual FundsDocument34 pagesAbout Mutual FundsAbhijeet PatilNo ratings yet

- Shri Chinai College of Commerce and Economics Andheri (E) ,: Submitted By: Group 9Document21 pagesShri Chinai College of Commerce and Economics Andheri (E) ,: Submitted By: Group 9Mohit ZaveriNo ratings yet

- Definition of 'Venture Capital'Document3 pagesDefinition of 'Venture Capital'Adarsh UttarkarNo ratings yet

- Venture Capital: by M.M. Upendra Vasanth PGDM171972050Document19 pagesVenture Capital: by M.M. Upendra Vasanth PGDM171972050Satish Reddy Karri (PGDM 17-19chn)No ratings yet

- Foreign Instituitional InvestorsDocument8 pagesForeign Instituitional InvestorsJayneel JadejaNo ratings yet

- A Mutual Fund is a Common Pool of Money in to Which Investors With Common Investment Objective Place Their Contributions That Are to Be Invested in Accordance With the Stated Investment Objective of the SchemeDocument6 pagesA Mutual Fund is a Common Pool of Money in to Which Investors With Common Investment Objective Place Their Contributions That Are to Be Invested in Accordance With the Stated Investment Objective of the SchemeKumaran MohanNo ratings yet

- Asset/Fund Based Financial Services & Fee-Based /advisory Services (Unit-4: FIM&S)Document5 pagesAsset/Fund Based Financial Services & Fee-Based /advisory Services (Unit-4: FIM&S)Sweeti GuptaNo ratings yet

- Mutual Funds in India: T.Sita Ramaiah Center Head INC - GunturDocument36 pagesMutual Funds in India: T.Sita Ramaiah Center Head INC - GunturPUTTU GURU PRASAD SENGUNTHA MUDALIAR100% (2)

- الاستثمار الجرئ-2ENDocument22 pagesالاستثمار الجرئ-2ENAbdulmohsn AlmuhaidbNo ratings yet

- Venturecapital 121214000438 Phpapp02Document39 pagesVenturecapital 121214000438 Phpapp02pradeepbandiNo ratings yet

- Investing Made Easy: Finding the Right Opportunities for YouFrom EverandInvesting Made Easy: Finding the Right Opportunities for YouNo ratings yet

- Australian Managed Funds for Beginners: A Basic Guide for BeginnersFrom EverandAustralian Managed Funds for Beginners: A Basic Guide for BeginnersNo ratings yet

- Corporate Governance: Sarbesh MishraDocument11 pagesCorporate Governance: Sarbesh MishraDr Sarbesh MishraNo ratings yet

- Corporate GovernanceDocument26 pagesCorporate GovernanceDr Sarbesh MishraNo ratings yet

- Introduction to Net Zero ConstructionsDocument18 pagesIntroduction to Net Zero ConstructionsDr Sarbesh MishraNo ratings yet

- Factoring: Dr. Sarbesh MishraDocument10 pagesFactoring: Dr. Sarbesh MishraDr Sarbesh MishraNo ratings yet

- Business OrganizationsDocument22 pagesBusiness OrganizationsArvind HoodaNo ratings yet

- IRDA Guidelines On OutsourcingDocument30 pagesIRDA Guidelines On OutsourcingDr Sarbesh MishraNo ratings yet

- InfrastructureDocument32 pagesInfrastructureDr Sarbesh Mishra100% (2)

- Measuring Corporate Performance - An EVA Approach: DR Sarbesh MishraDocument20 pagesMeasuring Corporate Performance - An EVA Approach: DR Sarbesh MishraDr Sarbesh Mishra100% (1)

- Cost Control and Waste ManagementDocument21 pagesCost Control and Waste ManagementbasithalNo ratings yet

- DepreciationDocument17 pagesDepreciationDr Sarbesh Mishra100% (1)

- Building Economics and Value ManagementDocument28 pagesBuilding Economics and Value ManagementDr Sarbesh MishraNo ratings yet

- Capital and RevenueDocument20 pagesCapital and RevenueDr Sarbesh Mishra100% (1)

- Preparation of Final AccountsDocument13 pagesPreparation of Final AccountsDr Sarbesh MishraNo ratings yet

- Goal Congruence Approach Under Advnced Strategic PlanningDocument4 pagesGoal Congruence Approach Under Advnced Strategic PlanningDr Sarbesh MishraNo ratings yet

- Power Sector Reforms - Orissa PerspectiveDocument294 pagesPower Sector Reforms - Orissa PerspectiveDr Sarbesh Mishra100% (4)

- Capital & RevenueDocument7 pagesCapital & RevenueDr Sarbesh Mishra50% (2)

- New Financial Products and ServicesDocument16 pagesNew Financial Products and ServicesDr Sarbesh Mishra86% (7)

- Core Concepts of Financial ManagementDocument10 pagesCore Concepts of Financial ManagementDr Sarbesh Mishra100% (15)

- Modern Risk ManagementDocument15 pagesModern Risk ManagementDr Sarbesh Mishra100% (2)

- Building Economics and Cost ControlDocument25 pagesBuilding Economics and Cost ControlDr Sarbesh Mishra100% (1)

- Building Economics and Value ManagementDocument23 pagesBuilding Economics and Value ManagementDr Sarbesh Mishra100% (1)

- LeasingDocument17 pagesLeasingDr Sarbesh Mishra100% (10)

- Evaluation of Financial FeasibilityDocument25 pagesEvaluation of Financial FeasibilityDr Sarbesh Mishra86% (7)

- Bills DiscountingDocument9 pagesBills DiscountingDr Sarbesh Mishra83% (6)

- Scientific Method Test Study Guide2Document4 pagesScientific Method Test Study Guide2Gabriel TaylorNo ratings yet

- 01 Diabetes Mellitus Type2Document39 pages01 Diabetes Mellitus Type2Che HaniffNo ratings yet

- 65.000 KH CA Nhan AcbDocument2,048 pages65.000 KH CA Nhan Acbhu hila0% (1)

- My Classroom Management PlanDocument6 pagesMy Classroom Management Plannanie1986No ratings yet

- APS ThinsulatorsDocument3 pagesAPS ThinsulatorsBobbie RuckNo ratings yet

- Screenshot 2023-01-03 at 6.11.33 PM PDFDocument4 pagesScreenshot 2023-01-03 at 6.11.33 PM PDFtamanna groverNo ratings yet

- Waterfront Boundaries For Grants of Public Crown Lands - MNR - E000074 - 2001Document3 pagesWaterfront Boundaries For Grants of Public Crown Lands - MNR - E000074 - 2001Sen HuNo ratings yet

- Ionic Equilibrium: Acid-Base Equilibrium Salt Hydrolysis Buffer SystemDocument55 pagesIonic Equilibrium: Acid-Base Equilibrium Salt Hydrolysis Buffer SystemMuhammad Muaz MahmudNo ratings yet

- Section 2 Structure and Written Expression Time: 25 Minutes (Including Reading The Direction)Document2 pagesSection 2 Structure and Written Expression Time: 25 Minutes (Including Reading The Direction)Lailatul Badriyah0% (1)

- Uae Essential Network List July 2016Document75 pagesUae Essential Network List July 2016ubyisismayilNo ratings yet

- Automation Testing 2 Years Exp 2Document3 pagesAutomation Testing 2 Years Exp 2Swapnil FulariNo ratings yet

- Reminiscences of Madame Sidney PrattenDocument121 pagesReminiscences of Madame Sidney PrattenjavisatrianiNo ratings yet

- Partnership Law Atty. Macmod: Multiple ChoiceDocument10 pagesPartnership Law Atty. Macmod: Multiple ChoiceJomarNo ratings yet

- Ophtha Quiz - Ocular Manifestations of SystemicDocument3 pagesOphtha Quiz - Ocular Manifestations of SystemicAsif MohammedNo ratings yet

- Pengaruh Pemberian Tempe Kacang Hijau Sebagai Polen Pengganti Terhadap Penampilan Larva Lebah Pekerja Apis MelliferaDocument8 pagesPengaruh Pemberian Tempe Kacang Hijau Sebagai Polen Pengganti Terhadap Penampilan Larva Lebah Pekerja Apis MelliferaResti Amelia SusantiNo ratings yet

- Gastech2008 Macdonald MaguireDocument6 pagesGastech2008 Macdonald Maguire463990305No ratings yet

- Joslyn C Smith Resume 2018Document1 pageJoslyn C Smith Resume 2018api-361867506No ratings yet

- Families Caring For An Aging AmericaDocument366 pagesFamilies Caring For An Aging AmericaVladimirNo ratings yet

- IronbutterplyDocument3 pagesIronbutterplyCiliaNo ratings yet

- The Food Industry in Nigeria Development and QualiDocument6 pagesThe Food Industry in Nigeria Development and Qualimercy luwaNo ratings yet

- Siva Stuti SanskritDocument374 pagesSiva Stuti SanskritDurgavenkat LakshmiNo ratings yet

- Legal Metrology Act: Analysis: Dhruv Sharma, 01319103516 BBALLB 9Document4 pagesLegal Metrology Act: Analysis: Dhruv Sharma, 01319103516 BBALLB 9dhruv sharmaNo ratings yet

- Bombastic Words For SPM EssayDocument11 pagesBombastic Words For SPM EssayAmirul Zaki100% (3)

- Greg Crowfoot - Understanding The Galdrabok Part 2Document14 pagesGreg Crowfoot - Understanding The Galdrabok Part 2michael ellisNo ratings yet

- Ga Hong Mei's DiaryDocument5 pagesGa Hong Mei's DiaryZefroudeille MartiniNo ratings yet

- COCA COCA AssigmentDocument16 pagesCOCA COCA AssigmentSamridhi ShreyaNo ratings yet

- BAED Bens Short Quiz 1Document5 pagesBAED Bens Short Quiz 1Luisa RadaNo ratings yet

- Compounding Self AssessmentDocument15 pagesCompounding Self AssessmentLara LaiNo ratings yet

- Valley Winery Case StudyDocument15 pagesValley Winery Case Studysarakhan0622No ratings yet