Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

62 viewsName 10 Things Your Taxes Pay For

Name 10 Things Your Taxes Pay For

Uploaded by

PualeilehuaTaxes pay for many government services and programs. The federal government levies income taxes on individuals, corporations, trusts and estates. Some state and local governments also impose income taxes. Key taxes include the Federal Insurance Contributions Act (FICA) tax that funds Social Security and disability insurance. Medicare taxes fund health insurance for those over 65 and others. The Internal Revenue Service (IRS) collects taxes and enforces tax laws. W-2 forms provide details on taxes withheld from employee paychecks and are used to file annual tax returns.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You might also like

- Comments On Term SheetDocument19 pagesComments On Term SheettriapthishuchitaNo ratings yet

- Case Study Fast FashionDocument2 pagesCase Study Fast Fashionanon_80601113780% (10)

- 1 Economic Influences 2021Document69 pages1 Economic Influences 2021akshatNo ratings yet

- Rent ReceiptDocument1 pageRent ReceiptSwapnil BangareNo ratings yet

- General Payroll, Employment and DeductionsDocument6 pagesGeneral Payroll, Employment and DeductionsJosh LeBlancNo ratings yet

- Individuals Part 2Document157 pagesIndividuals Part 2Henish N JainNo ratings yet

- Financial Markets in 2013Document56 pagesFinancial Markets in 2013Sean SpositoNo ratings yet

- ACC 111 Chapter 7 Lecture NotesDocument5 pagesACC 111 Chapter 7 Lecture NotesLoriNo ratings yet

- What Is Taxable Income?: Key TakeawaysDocument4 pagesWhat Is Taxable Income?: Key TakeawaysBella AyabNo ratings yet

- Usitt 2Document122 pagesUsitt 2Sachin D SalankeyNo ratings yet

- Student Worker W2 InformationDocument1 pageStudent Worker W2 InformationAxel SotoNo ratings yet

- Employee and Employer Taxes ExplanationDocument1 pageEmployee and Employer Taxes ExplanationKim KimNo ratings yet

- What Are TaxesDocument7 pagesWhat Are TaxesNasir AliNo ratings yet

- Paying For National Health Insurance-And Not Getting ItDocument11 pagesPaying For National Health Insurance-And Not Getting Itcaneman85No ratings yet

- The Sections of A Tax ReturnDocument2 pagesThe Sections of A Tax ReturnLJBernardoNo ratings yet

- Unemployment Insurance Trust FundDocument34 pagesUnemployment Insurance Trust FundLuke ParsnowNo ratings yet

- Esspat Pro1 Ani 4x500Document3 pagesEsspat Pro1 Ani 4x500Anisa ChNo ratings yet

- 941 2008-1Document47 pages941 2008-1lionkingae100% (1)

- US and Canada Tax ChangesDocument11 pagesUS and Canada Tax ChangesGANYA JOKERNo ratings yet

- Fiscal Cliff Comments From Andy FriedmanDocument19 pagesFiscal Cliff Comments From Andy FriedmancdietzrNo ratings yet

- 2013 Instructions For Schedule SE (Form 1040) : Self-Employment TaxDocument6 pages2013 Instructions For Schedule SE (Form 1040) : Self-Employment TaxJames D. SassNo ratings yet

- Taxessalarygrowthchoices2015201628129jeslin FinishDocument4 pagesTaxessalarygrowthchoices2015201628129jeslin Finishapi-318368416No ratings yet

- Introduction To Income TaxDocument6 pagesIntroduction To Income TaxReena AgrawalNo ratings yet

- Tax HandbookDocument37 pagesTax HandbookChouchir SohelNo ratings yet

- Us W-2 2015 PDFDocument7 pagesUs W-2 2015 PDFkevsNo ratings yet

- Employee BenefitsDocument20 pagesEmployee BenefitsSophieNo ratings yet

- X 70 15 PDFDocument32 pagesX 70 15 PDFkunalwarwickNo ratings yet

- Federal Tax System 2015Document32 pagesFederal Tax System 2015Matt GillNo ratings yet

- CareerDocument2 pagesCareerapi-302638588No ratings yet

- IRS Glossary: SETC Tax Credit Terms You Should Be Aware of - WikiSauceDocument4 pagesIRS Glossary: SETC Tax Credit Terms You Should Be Aware of - WikiSaucePanel Rank (panelrank.com)No ratings yet

- TaxesDocument30 pagesTaxesapi-3256211040% (1)

- Income Tax NotesDocument17 pagesIncome Tax Notesrushdarais7No ratings yet

- Income Taxes: Key ConceptsDocument10 pagesIncome Taxes: Key ConceptsErika BNo ratings yet

- Taxes Salary Growth Choices 20152016 1Document3 pagesTaxes Salary Growth Choices 20152016 1api-318875381No ratings yet

- Us Taxation UpdatedDocument8 pagesUs Taxation Updatedjainmayankmj1999No ratings yet

- Income Tax Law and Practice - 1Document39 pagesIncome Tax Law and Practice - 1Ayush ManjunathNo ratings yet

- Module 2 Slides - Employment TaxesDocument30 pagesModule 2 Slides - Employment Taxesjciy4No ratings yet

- Taxation of An IndividualDocument15 pagesTaxation of An IndividualsahilNo ratings yet

- 2011 Instructions For Schedule SE (Form 1040) Self-Employment TaxDocument5 pages2011 Instructions For Schedule SE (Form 1040) Self-Employment Tax5sfsfdNo ratings yet

- Chapter 5 - Tax PayableDocument36 pagesChapter 5 - Tax PayableRyan YangNo ratings yet

- TaxesdocumentDocument2 pagesTaxesdocumentapi-301940147No ratings yet

- Full Payroll Accounting 2019 5Th Edition Landin Solutions Manual Online PDF All ChapterDocument40 pagesFull Payroll Accounting 2019 5Th Edition Landin Solutions Manual Online PDF All Chapterkadinkaspadial538100% (6)

- Nursing Home Residents and Stimulus ChecksDocument2 pagesNursing Home Residents and Stimulus ChecksDavid BlevingsNo ratings yet

- Chapter 1 TaxDocument17 pagesChapter 1 TaxSiddharth VaswaniNo ratings yet

- Tax Benefit Rule - Recovery of Previous Deduction Could Be Non-TaxableDocument1 pageTax Benefit Rule - Recovery of Previous Deduction Could Be Non-TaxableJacen BondsNo ratings yet

- Income TaxationDocument12 pagesIncome TaxationMonica Jarabelo RamintasNo ratings yet

- State Tax FormDocument2 pagesState Tax FormRon SchingsNo ratings yet

- Filling For Claim For RefundDocument8 pagesFilling For Claim For RefundsheldonNo ratings yet

- Chapter Four Brief Lecture Note For AAU Stu ExtDocument50 pagesChapter Four Brief Lecture Note For AAU Stu Extaddis adugenet100% (6)

- Homework 3Document15 pagesHomework 3Marie StéphanNo ratings yet

- Fringe Benefit GuideDocument91 pagesFringe Benefit GuideJeff MartinsonNo ratings yet

- Law AssessmentDocument8 pagesLaw AssessmentHina MubarakNo ratings yet

- Occupation GuidelinesDocument160 pagesOccupation Guidelinesjo lamosNo ratings yet

- Chapter 1 of Introduction With Margin 1111-1-2Document33 pagesChapter 1 of Introduction With Margin 1111-1-2YogiNo ratings yet

- Income Taxation Written Report TOPIC #17: Members Banawa, Cherry May F. Delos Santos, Erika G. Velasquez, EricksonDocument6 pagesIncome Taxation Written Report TOPIC #17: Members Banawa, Cherry May F. Delos Santos, Erika G. Velasquez, EricksonChira Rose Fejedero NeriNo ratings yet

- (Download PDF) Payroll Accounting 2019 5th Edition Landin Solutions Manual Full ChapterDocument40 pages(Download PDF) Payroll Accounting 2019 5th Edition Landin Solutions Manual Full Chapterpinguewerush100% (6)

- Tax Impact of Job LossDocument7 pagesTax Impact of Job LossbullyrayNo ratings yet

- Tax Guide For U.S. Citizens and Resident Aliens Abroad: Publication 54Document38 pagesTax Guide For U.S. Citizens and Resident Aliens Abroad: Publication 54Muzammil HanifNo ratings yet

- Income Tax in AustraliaDocument5 pagesIncome Tax in AustraliaRiva BhattaraiNo ratings yet

- Income and Business Taxation Fabm 2Document32 pagesIncome and Business Taxation Fabm 2Daniela Mariz CepresNo ratings yet

- Cimage College Patna: Abhijit PrasadDocument31 pagesCimage College Patna: Abhijit Prasadabhijit prasadNo ratings yet

- US Internal Revenue Service: p4128Document6 pagesUS Internal Revenue Service: p4128IRSNo ratings yet

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryFrom EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo ratings yet

- Daily Quiz - Ionic CompoundsDocument1 pageDaily Quiz - Ionic CompoundsPualeilehuaNo ratings yet

- Homework: Bond Character, Electron Dot Structures and Formal ChargesDocument3 pagesHomework: Bond Character, Electron Dot Structures and Formal ChargesPualeilehuaNo ratings yet

- Covalent BondsDocument32 pagesCovalent BondsPualeilehuaNo ratings yet

- Unit 2B.6 Mining and RefiningDocument20 pagesUnit 2B.6 Mining and RefiningPualeilehuaNo ratings yet

- Unit 2B.1Document16 pagesUnit 2B.1PualeilehuaNo ratings yet

- Unit 2B.3 and 2B.5Document17 pagesUnit 2B.3 and 2B.5PualeilehuaNo ratings yet

- Lab NotebookDocument3 pagesLab NotebookPualeilehuaNo ratings yet

- Bell Ringer: What Are Cells?Document19 pagesBell Ringer: What Are Cells?Pualeilehua100% (1)

- Bell Ringer: List An Example of A Physical Change AND A Chemical Change Your Body Undergoes Each DayDocument20 pagesBell Ringer: List An Example of A Physical Change AND A Chemical Change Your Body Undergoes Each DayPualeilehuaNo ratings yet

- Quantum Chemistry (REAL)Document122 pagesQuantum Chemistry (REAL)Pualeilehua100% (6)

- Quantum Chemistry (REAL)Document122 pagesQuantum Chemistry (REAL)Pualeilehua100% (6)

- Quantum Chemistry (REAL)Document122 pagesQuantum Chemistry (REAL)Pualeilehua100% (6)

- Sept 24Document16 pagesSept 24PualeilehuaNo ratings yet

- Homework Sheet 6 - Naming AlkanesDocument4 pagesHomework Sheet 6 - Naming AlkanesPualeilehua100% (4)

- Bell Ringer: - What Does Being "Saturated" Mean?Document9 pagesBell Ringer: - What Does Being "Saturated" Mean?PualeilehuaNo ratings yet

- Sept 4Document12 pagesSept 4PualeilehuaNo ratings yet

- Sept 7Document18 pagesSept 7PualeilehuaNo ratings yet

- Examples of How To Draw Alkanes in WordDocument1 pageExamples of How To Draw Alkanes in WordPualeilehuaNo ratings yet

- The Metric System: "I'm Ten Times Better Than The Standard System of Measurement!"Document58 pagesThe Metric System: "I'm Ten Times Better Than The Standard System of Measurement!"PualeilehuaNo ratings yet

- MetricsDocument16 pagesMetricsPualeilehua100% (3)

- Chemisty Intensive Assinments Schedule Semester 1Document1 pageChemisty Intensive Assinments Schedule Semester 1PualeilehuaNo ratings yet

- Aug 10Document10 pagesAug 10PualeilehuaNo ratings yet

- Chemisty Intensive-Semester 1Document2 pagesChemisty Intensive-Semester 1PualeilehuaNo ratings yet

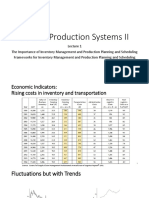

- Chapter 1 Importance of Inventory Management and Production SystemsDocument39 pagesChapter 1 Importance of Inventory Management and Production Systemsjane chahineNo ratings yet

- Audit CaseDocument16 pagesAudit CaseChristine Joy Pama100% (1)

- Economics of Poultry Broiler Farming: Techno Economic ParametersDocument2 pagesEconomics of Poultry Broiler Farming: Techno Economic ParametersBrijesh SrivastavaNo ratings yet

- Visa USA Interchange Reimbursement FeesDocument26 pagesVisa USA Interchange Reimbursement FeesMark Jasper DabuNo ratings yet

- Module 2 - Online ExerciseDocument3 pagesModule 2 - Online ExerciseSoumya JainNo ratings yet

- Unit 1: Resources in An EconomyDocument62 pagesUnit 1: Resources in An EconomySalmanyousafbandeshaNo ratings yet

- Ch13 - Supply Chain Resilience in The Fourth Industrial RevolutionDocument15 pagesCh13 - Supply Chain Resilience in The Fourth Industrial Revolutiontrangntm919396No ratings yet

- RRC Sample: Contractor ManagementDocument8 pagesRRC Sample: Contractor Managementleah nyamasveNo ratings yet

- This Content Downloaded From 13.232.140.242 On Thu, 29 Oct 2020 05:31:30 UTCDocument34 pagesThis Content Downloaded From 13.232.140.242 On Thu, 29 Oct 2020 05:31:30 UTCShreyanshuOjhaNo ratings yet

- The Million Dollar ProjectDocument2 pagesThe Million Dollar Projectapi-299101048No ratings yet

- Fundamentals of Energy ManagementDocument50 pagesFundamentals of Energy ManagementJeffcaster ComelNo ratings yet

- Interim Report - Final Draft123Document6 pagesInterim Report - Final Draft123Rupesh SharmaNo ratings yet

- India's IT Infrastructure ServicesDocument27 pagesIndia's IT Infrastructure Servicesmartand86No ratings yet

- 1.3. Nikes's Triple Double StrategyDocument1 page1.3. Nikes's Triple Double StrategySanthosh Kumar RaoNo ratings yet

- Group Assignment Cover Sheet: Student DetailsDocument5 pagesGroup Assignment Cover Sheet: Student DetailsBao Ngoc NguyenNo ratings yet

- Balance Sheet ITCDocument2 pagesBalance Sheet ITCProsenjit RoyNo ratings yet

- Classical and Modern Approaches To Public Administration: ArticlesDocument8 pagesClassical and Modern Approaches To Public Administration: ArticlesJm LanuzaNo ratings yet

- IKea PresentationDocument18 pagesIKea PresentationHassanNo ratings yet

- Unit 4 Accounting For LabourDocument18 pagesUnit 4 Accounting For LabourAayushi KothariNo ratings yet

- AS SBM - Strategic ChoiceDocument38 pagesAS SBM - Strategic ChoicesajedulNo ratings yet

- MorningStar StockInvestor Apr 09Document32 pagesMorningStar StockInvestor Apr 09Daniel MillerNo ratings yet

- Bir Form 1601E - Schedule I Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of March, 2018Document10 pagesBir Form 1601E - Schedule I Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of March, 2018MaricrisNo ratings yet

- M Advertising 3rd Edition Arens Schaefer Weigold Solution ManualDocument74 pagesM Advertising 3rd Edition Arens Schaefer Weigold Solution Manualronald100% (32)

- State Bank of IndiaDocument1 pageState Bank of IndiaAnjusha NairNo ratings yet

- Nobs Empresa Verde HistoriaDocument3 pagesNobs Empresa Verde HistoriaHumberto RomeroNo ratings yet

- KhiyarsDocument3 pagesKhiyarsnadeemuzairNo ratings yet

Name 10 Things Your Taxes Pay For

Name 10 Things Your Taxes Pay For

Uploaded by

Pualeilehua0 ratings0% found this document useful (0 votes)

62 views15 pagesTaxes pay for many government services and programs. The federal government levies income taxes on individuals, corporations, trusts and estates. Some state and local governments also impose income taxes. Key taxes include the Federal Insurance Contributions Act (FICA) tax that funds Social Security and disability insurance. Medicare taxes fund health insurance for those over 65 and others. The Internal Revenue Service (IRS) collects taxes and enforces tax laws. W-2 forms provide details on taxes withheld from employee paychecks and are used to file annual tax returns.

Original Description:

Original Title

Taxes[1]

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTaxes pay for many government services and programs. The federal government levies income taxes on individuals, corporations, trusts and estates. Some state and local governments also impose income taxes. Key taxes include the Federal Insurance Contributions Act (FICA) tax that funds Social Security and disability insurance. Medicare taxes fund health insurance for those over 65 and others. The Internal Revenue Service (IRS) collects taxes and enforces tax laws. W-2 forms provide details on taxes withheld from employee paychecks and are used to file annual tax returns.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

62 views15 pagesName 10 Things Your Taxes Pay For

Name 10 Things Your Taxes Pay For

Uploaded by

PualeilehuaTaxes pay for many government services and programs. The federal government levies income taxes on individuals, corporations, trusts and estates. Some state and local governments also impose income taxes. Key taxes include the Federal Insurance Contributions Act (FICA) tax that funds Social Security and disability insurance. Medicare taxes fund health insurance for those over 65 and others. The Internal Revenue Service (IRS) collects taxes and enforces tax laws. W-2 forms provide details on taxes withheld from employee paychecks and are used to file annual tax returns.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 15

Name 10 things your

taxes pay for

The federal government of the United States imposes a

progressive tax on the taxable income of individuals,

corporations, trusts, and estates,

Some state and municipal governments also impose

income taxes.

The first Federal income tax was imposed during the

Civil War

•under Article I, section 8, clause 1 of the U.S. Constitution

•In the 1890s

•Sixteenth Amendment was ratified in 1913.

FICA is the acronym for the Federal Insurance Contributions Act.

This act mandates that an employer withhold a set percentage of an

employee’s salary each pay period. FICA also requires that the

employer match the employee’s amount and contribute the money to

a government account known as the Social Security Trust Fund.

This fund provides retirement income, as well as disability

insurance, Medicare, and benefits for survivors

6.2% of gross compensation up to a limit of $97,500 of

compensation

The employer is also liable for separate 6.2%

Self-employed people are responsible for the entire FICA

percentage of 12.4%.

Medicare is the name given to a health insurance

program administered by the United States

government, covering people who are either age

65 and over, or who meet other special criteria.

1.45% withheld from the worker and a matching

1.45% paid by the employer

In the case of self-employed individuals, the tax is

2.9% of net earnings from self-employment

The Internal Revenue Service (IRS) is the

United States federal government agency that

collects taxes and enforces the internal revenue

laws

In 1862, during the Civil War, President Lincoln

and Congress created the office of Commissioner

of Internal Revenue and enacted an income tax to

pay war expenses . The position of Commissioner

exists today as the head of the Internal Revenue

Service

Some of your wages are exempt from taxation

Tax exemptions

Allowances for dependants

Deductions

Standard or itemized

Has anyone has ever seen a W-2?

When do we receive a W-2 form?

after the year ends, usually in January

What is the purpose of the W-2 form?

it tells the employee how much money was earned,

and how much money was withheld for taxes.

Box 1- Wages, tips, other

compensation: This is the

amount that will be entered on

the wages line of your tax

return.

Box 2 - Federal income tax

withheld by your employer.

Box 3 = Social security tax

withheld

Box 6 - Medicate tax withheld.

Box 17 - State income tax.

Other information on the W-2:

Box 8 - Allocated tips.

Box 10 - Dependent care

benefits. Total dependent care

benefits that were paid to you

by your employer or incurred

on your behalf.

Complete the following :

Earning Statement (answer questions)

W-4 (complete the form)

W-2 (answer questions)

1040EZ (complete the form)

You might also like

- Comments On Term SheetDocument19 pagesComments On Term SheettriapthishuchitaNo ratings yet

- Case Study Fast FashionDocument2 pagesCase Study Fast Fashionanon_80601113780% (10)

- 1 Economic Influences 2021Document69 pages1 Economic Influences 2021akshatNo ratings yet

- Rent ReceiptDocument1 pageRent ReceiptSwapnil BangareNo ratings yet

- General Payroll, Employment and DeductionsDocument6 pagesGeneral Payroll, Employment and DeductionsJosh LeBlancNo ratings yet

- Individuals Part 2Document157 pagesIndividuals Part 2Henish N JainNo ratings yet

- Financial Markets in 2013Document56 pagesFinancial Markets in 2013Sean SpositoNo ratings yet

- ACC 111 Chapter 7 Lecture NotesDocument5 pagesACC 111 Chapter 7 Lecture NotesLoriNo ratings yet

- What Is Taxable Income?: Key TakeawaysDocument4 pagesWhat Is Taxable Income?: Key TakeawaysBella AyabNo ratings yet

- Usitt 2Document122 pagesUsitt 2Sachin D SalankeyNo ratings yet

- Student Worker W2 InformationDocument1 pageStudent Worker W2 InformationAxel SotoNo ratings yet

- Employee and Employer Taxes ExplanationDocument1 pageEmployee and Employer Taxes ExplanationKim KimNo ratings yet

- What Are TaxesDocument7 pagesWhat Are TaxesNasir AliNo ratings yet

- Paying For National Health Insurance-And Not Getting ItDocument11 pagesPaying For National Health Insurance-And Not Getting Itcaneman85No ratings yet

- The Sections of A Tax ReturnDocument2 pagesThe Sections of A Tax ReturnLJBernardoNo ratings yet

- Unemployment Insurance Trust FundDocument34 pagesUnemployment Insurance Trust FundLuke ParsnowNo ratings yet

- Esspat Pro1 Ani 4x500Document3 pagesEsspat Pro1 Ani 4x500Anisa ChNo ratings yet

- 941 2008-1Document47 pages941 2008-1lionkingae100% (1)

- US and Canada Tax ChangesDocument11 pagesUS and Canada Tax ChangesGANYA JOKERNo ratings yet

- Fiscal Cliff Comments From Andy FriedmanDocument19 pagesFiscal Cliff Comments From Andy FriedmancdietzrNo ratings yet

- 2013 Instructions For Schedule SE (Form 1040) : Self-Employment TaxDocument6 pages2013 Instructions For Schedule SE (Form 1040) : Self-Employment TaxJames D. SassNo ratings yet

- Taxessalarygrowthchoices2015201628129jeslin FinishDocument4 pagesTaxessalarygrowthchoices2015201628129jeslin Finishapi-318368416No ratings yet

- Introduction To Income TaxDocument6 pagesIntroduction To Income TaxReena AgrawalNo ratings yet

- Tax HandbookDocument37 pagesTax HandbookChouchir SohelNo ratings yet

- Us W-2 2015 PDFDocument7 pagesUs W-2 2015 PDFkevsNo ratings yet

- Employee BenefitsDocument20 pagesEmployee BenefitsSophieNo ratings yet

- X 70 15 PDFDocument32 pagesX 70 15 PDFkunalwarwickNo ratings yet

- Federal Tax System 2015Document32 pagesFederal Tax System 2015Matt GillNo ratings yet

- CareerDocument2 pagesCareerapi-302638588No ratings yet

- IRS Glossary: SETC Tax Credit Terms You Should Be Aware of - WikiSauceDocument4 pagesIRS Glossary: SETC Tax Credit Terms You Should Be Aware of - WikiSaucePanel Rank (panelrank.com)No ratings yet

- TaxesDocument30 pagesTaxesapi-3256211040% (1)

- Income Tax NotesDocument17 pagesIncome Tax Notesrushdarais7No ratings yet

- Income Taxes: Key ConceptsDocument10 pagesIncome Taxes: Key ConceptsErika BNo ratings yet

- Taxes Salary Growth Choices 20152016 1Document3 pagesTaxes Salary Growth Choices 20152016 1api-318875381No ratings yet

- Us Taxation UpdatedDocument8 pagesUs Taxation Updatedjainmayankmj1999No ratings yet

- Income Tax Law and Practice - 1Document39 pagesIncome Tax Law and Practice - 1Ayush ManjunathNo ratings yet

- Module 2 Slides - Employment TaxesDocument30 pagesModule 2 Slides - Employment Taxesjciy4No ratings yet

- Taxation of An IndividualDocument15 pagesTaxation of An IndividualsahilNo ratings yet

- 2011 Instructions For Schedule SE (Form 1040) Self-Employment TaxDocument5 pages2011 Instructions For Schedule SE (Form 1040) Self-Employment Tax5sfsfdNo ratings yet

- Chapter 5 - Tax PayableDocument36 pagesChapter 5 - Tax PayableRyan YangNo ratings yet

- TaxesdocumentDocument2 pagesTaxesdocumentapi-301940147No ratings yet

- Full Payroll Accounting 2019 5Th Edition Landin Solutions Manual Online PDF All ChapterDocument40 pagesFull Payroll Accounting 2019 5Th Edition Landin Solutions Manual Online PDF All Chapterkadinkaspadial538100% (6)

- Nursing Home Residents and Stimulus ChecksDocument2 pagesNursing Home Residents and Stimulus ChecksDavid BlevingsNo ratings yet

- Chapter 1 TaxDocument17 pagesChapter 1 TaxSiddharth VaswaniNo ratings yet

- Tax Benefit Rule - Recovery of Previous Deduction Could Be Non-TaxableDocument1 pageTax Benefit Rule - Recovery of Previous Deduction Could Be Non-TaxableJacen BondsNo ratings yet

- Income TaxationDocument12 pagesIncome TaxationMonica Jarabelo RamintasNo ratings yet

- State Tax FormDocument2 pagesState Tax FormRon SchingsNo ratings yet

- Filling For Claim For RefundDocument8 pagesFilling For Claim For RefundsheldonNo ratings yet

- Chapter Four Brief Lecture Note For AAU Stu ExtDocument50 pagesChapter Four Brief Lecture Note For AAU Stu Extaddis adugenet100% (6)

- Homework 3Document15 pagesHomework 3Marie StéphanNo ratings yet

- Fringe Benefit GuideDocument91 pagesFringe Benefit GuideJeff MartinsonNo ratings yet

- Law AssessmentDocument8 pagesLaw AssessmentHina MubarakNo ratings yet

- Occupation GuidelinesDocument160 pagesOccupation Guidelinesjo lamosNo ratings yet

- Chapter 1 of Introduction With Margin 1111-1-2Document33 pagesChapter 1 of Introduction With Margin 1111-1-2YogiNo ratings yet

- Income Taxation Written Report TOPIC #17: Members Banawa, Cherry May F. Delos Santos, Erika G. Velasquez, EricksonDocument6 pagesIncome Taxation Written Report TOPIC #17: Members Banawa, Cherry May F. Delos Santos, Erika G. Velasquez, EricksonChira Rose Fejedero NeriNo ratings yet

- (Download PDF) Payroll Accounting 2019 5th Edition Landin Solutions Manual Full ChapterDocument40 pages(Download PDF) Payroll Accounting 2019 5th Edition Landin Solutions Manual Full Chapterpinguewerush100% (6)

- Tax Impact of Job LossDocument7 pagesTax Impact of Job LossbullyrayNo ratings yet

- Tax Guide For U.S. Citizens and Resident Aliens Abroad: Publication 54Document38 pagesTax Guide For U.S. Citizens and Resident Aliens Abroad: Publication 54Muzammil HanifNo ratings yet

- Income Tax in AustraliaDocument5 pagesIncome Tax in AustraliaRiva BhattaraiNo ratings yet

- Income and Business Taxation Fabm 2Document32 pagesIncome and Business Taxation Fabm 2Daniela Mariz CepresNo ratings yet

- Cimage College Patna: Abhijit PrasadDocument31 pagesCimage College Patna: Abhijit Prasadabhijit prasadNo ratings yet

- US Internal Revenue Service: p4128Document6 pagesUS Internal Revenue Service: p4128IRSNo ratings yet

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryFrom EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo ratings yet

- Daily Quiz - Ionic CompoundsDocument1 pageDaily Quiz - Ionic CompoundsPualeilehuaNo ratings yet

- Homework: Bond Character, Electron Dot Structures and Formal ChargesDocument3 pagesHomework: Bond Character, Electron Dot Structures and Formal ChargesPualeilehuaNo ratings yet

- Covalent BondsDocument32 pagesCovalent BondsPualeilehuaNo ratings yet

- Unit 2B.6 Mining and RefiningDocument20 pagesUnit 2B.6 Mining and RefiningPualeilehuaNo ratings yet

- Unit 2B.1Document16 pagesUnit 2B.1PualeilehuaNo ratings yet

- Unit 2B.3 and 2B.5Document17 pagesUnit 2B.3 and 2B.5PualeilehuaNo ratings yet

- Lab NotebookDocument3 pagesLab NotebookPualeilehuaNo ratings yet

- Bell Ringer: What Are Cells?Document19 pagesBell Ringer: What Are Cells?Pualeilehua100% (1)

- Bell Ringer: List An Example of A Physical Change AND A Chemical Change Your Body Undergoes Each DayDocument20 pagesBell Ringer: List An Example of A Physical Change AND A Chemical Change Your Body Undergoes Each DayPualeilehuaNo ratings yet

- Quantum Chemistry (REAL)Document122 pagesQuantum Chemistry (REAL)Pualeilehua100% (6)

- Quantum Chemistry (REAL)Document122 pagesQuantum Chemistry (REAL)Pualeilehua100% (6)

- Quantum Chemistry (REAL)Document122 pagesQuantum Chemistry (REAL)Pualeilehua100% (6)

- Sept 24Document16 pagesSept 24PualeilehuaNo ratings yet

- Homework Sheet 6 - Naming AlkanesDocument4 pagesHomework Sheet 6 - Naming AlkanesPualeilehua100% (4)

- Bell Ringer: - What Does Being "Saturated" Mean?Document9 pagesBell Ringer: - What Does Being "Saturated" Mean?PualeilehuaNo ratings yet

- Sept 4Document12 pagesSept 4PualeilehuaNo ratings yet

- Sept 7Document18 pagesSept 7PualeilehuaNo ratings yet

- Examples of How To Draw Alkanes in WordDocument1 pageExamples of How To Draw Alkanes in WordPualeilehuaNo ratings yet

- The Metric System: "I'm Ten Times Better Than The Standard System of Measurement!"Document58 pagesThe Metric System: "I'm Ten Times Better Than The Standard System of Measurement!"PualeilehuaNo ratings yet

- MetricsDocument16 pagesMetricsPualeilehua100% (3)

- Chemisty Intensive Assinments Schedule Semester 1Document1 pageChemisty Intensive Assinments Schedule Semester 1PualeilehuaNo ratings yet

- Aug 10Document10 pagesAug 10PualeilehuaNo ratings yet

- Chemisty Intensive-Semester 1Document2 pagesChemisty Intensive-Semester 1PualeilehuaNo ratings yet

- Chapter 1 Importance of Inventory Management and Production SystemsDocument39 pagesChapter 1 Importance of Inventory Management and Production Systemsjane chahineNo ratings yet

- Audit CaseDocument16 pagesAudit CaseChristine Joy Pama100% (1)

- Economics of Poultry Broiler Farming: Techno Economic ParametersDocument2 pagesEconomics of Poultry Broiler Farming: Techno Economic ParametersBrijesh SrivastavaNo ratings yet

- Visa USA Interchange Reimbursement FeesDocument26 pagesVisa USA Interchange Reimbursement FeesMark Jasper DabuNo ratings yet

- Module 2 - Online ExerciseDocument3 pagesModule 2 - Online ExerciseSoumya JainNo ratings yet

- Unit 1: Resources in An EconomyDocument62 pagesUnit 1: Resources in An EconomySalmanyousafbandeshaNo ratings yet

- Ch13 - Supply Chain Resilience in The Fourth Industrial RevolutionDocument15 pagesCh13 - Supply Chain Resilience in The Fourth Industrial Revolutiontrangntm919396No ratings yet

- RRC Sample: Contractor ManagementDocument8 pagesRRC Sample: Contractor Managementleah nyamasveNo ratings yet

- This Content Downloaded From 13.232.140.242 On Thu, 29 Oct 2020 05:31:30 UTCDocument34 pagesThis Content Downloaded From 13.232.140.242 On Thu, 29 Oct 2020 05:31:30 UTCShreyanshuOjhaNo ratings yet

- The Million Dollar ProjectDocument2 pagesThe Million Dollar Projectapi-299101048No ratings yet

- Fundamentals of Energy ManagementDocument50 pagesFundamentals of Energy ManagementJeffcaster ComelNo ratings yet

- Interim Report - Final Draft123Document6 pagesInterim Report - Final Draft123Rupesh SharmaNo ratings yet

- India's IT Infrastructure ServicesDocument27 pagesIndia's IT Infrastructure Servicesmartand86No ratings yet

- 1.3. Nikes's Triple Double StrategyDocument1 page1.3. Nikes's Triple Double StrategySanthosh Kumar RaoNo ratings yet

- Group Assignment Cover Sheet: Student DetailsDocument5 pagesGroup Assignment Cover Sheet: Student DetailsBao Ngoc NguyenNo ratings yet

- Balance Sheet ITCDocument2 pagesBalance Sheet ITCProsenjit RoyNo ratings yet

- Classical and Modern Approaches To Public Administration: ArticlesDocument8 pagesClassical and Modern Approaches To Public Administration: ArticlesJm LanuzaNo ratings yet

- IKea PresentationDocument18 pagesIKea PresentationHassanNo ratings yet

- Unit 4 Accounting For LabourDocument18 pagesUnit 4 Accounting For LabourAayushi KothariNo ratings yet

- AS SBM - Strategic ChoiceDocument38 pagesAS SBM - Strategic ChoicesajedulNo ratings yet

- MorningStar StockInvestor Apr 09Document32 pagesMorningStar StockInvestor Apr 09Daniel MillerNo ratings yet

- Bir Form 1601E - Schedule I Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of March, 2018Document10 pagesBir Form 1601E - Schedule I Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of March, 2018MaricrisNo ratings yet

- M Advertising 3rd Edition Arens Schaefer Weigold Solution ManualDocument74 pagesM Advertising 3rd Edition Arens Schaefer Weigold Solution Manualronald100% (32)

- State Bank of IndiaDocument1 pageState Bank of IndiaAnjusha NairNo ratings yet

- Nobs Empresa Verde HistoriaDocument3 pagesNobs Empresa Verde HistoriaHumberto RomeroNo ratings yet

- KhiyarsDocument3 pagesKhiyarsnadeemuzairNo ratings yet