Professional Documents

Culture Documents

International Monetary System: Prof Mahesh Kumar Amity Business School

International Monetary System: Prof Mahesh Kumar Amity Business School

Uploaded by

asifanis100%(1)100% found this document useful (1 vote)

452 views33 pagesThe document provides an overview of the international monetary system. It discusses the key problems it addresses like liquidity, adjustment, and stability. It outlines the evolution of the system from the gold exchange standard to Bretton Woods. The Bretton Woods system established the IMF and a system of fixed exchange rates linked to gold. It discusses the IMF's role in providing temporary financing and its surveillance of members' exchange rate policies. It also briefly discusses the IBRD/World Bank and its role in providing long-term financing.

Original Description:

Original Title

International Monetary System

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides an overview of the international monetary system. It discusses the key problems it addresses like liquidity, adjustment, and stability. It outlines the evolution of the system from the gold exchange standard to Bretton Woods. The Bretton Woods system established the IMF and a system of fixed exchange rates linked to gold. It discusses the IMF's role in providing temporary financing and its surveillance of members' exchange rate policies. It also briefly discusses the IBRD/World Bank and its role in providing long-term financing.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

100%(1)100% found this document useful (1 vote)

452 views33 pagesInternational Monetary System: Prof Mahesh Kumar Amity Business School

International Monetary System: Prof Mahesh Kumar Amity Business School

Uploaded by

asifanisThe document provides an overview of the international monetary system. It discusses the key problems it addresses like liquidity, adjustment, and stability. It outlines the evolution of the system from the gold exchange standard to Bretton Woods. The Bretton Woods system established the IMF and a system of fixed exchange rates linked to gold. It discusses the IMF's role in providing temporary financing and its surveillance of members' exchange rate policies. It also briefly discusses the IBRD/World Bank and its role in providing long-term financing.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 33

International Monetary System

Prof Mahesh Kumar

Amity Business School

profmaheshkumar@rediffmail.com

Introduction

Problems of international trade relate to:

1. Liquidity

2. Adjustment

3. Stability

Liquidity is necessary to finance transactions

that are done on cash basis.

Adjustment is needed to bridge the gap that

emanates because of imbalance between

demand and supply at existing exchange rates.

Stability is necessary with intent to limit the

degree of uncertainty in international business

decisions.

Introduction

International Monetary System addresses itself

to provide mechanisms where all interacting

nations agree to certain modus operandi to find

solutions to common problems.

Evolution of International Monetary System

IMS has grown over a period of time and has

successfully tackled periods of stresses and

strains.

It has passed a period of transition from the

system of fixed exchange rates to the system of

floating rates.

Evolution of International Monetary System

Gold Exchange Standard

Gold Exchange Standard was first major step

towards establishment of IMS in 1850.

The participants were UK, France, Germany and

USA.

In this system each currency was linked to a

weight of gold.

The system was institutionalized at the

Conference of Genes in 1922.

Since gold was convertible into currencies of the

major developed countries, Central Banks of

different countries either held gold or currency

of these developed countries.

Evolution of International Monetary System

Gold Exchange Standard

This system failed after the Conference of Genes in

1922 due to

a) Tremendous speculative activity accompanied by

economic crisis in 1929.

b) High inflation in Germany.

c) Protectionism following the crisis of 1929.

d) Competitive devaluations for providing impetus to

exports. (Beggar-Thy-Neighbor Devaluations: A

devaluation that is designed to cheapen a nation’s

currency and thereby increase its exports at other

countries expense and reduce imports . Such

devaluations often lead to trade wars.)

e) Finally the Second World War.

The System of Bretton Woods (1944-71)

A conference was held at Bretton Woods in the

USA in July 1944 to put in place a new IMS.

The major objectives of Bretton Woods were:

1. To review the existing rules.

2. To devise a system to encourage international

monetary co-operation.

3. To establish an international institution to

ensure good functioning of the system.

The System of Bretton Woods (1944-71)

Main characteristics of IMS developed at Bretton

Woods were:

1. Fixed rates in terms of gold (i.e. a system of

gold standard), but only the USD was

convertible into gold as the USA ensured the

convertibility of dollars into gold at international

level.

2. A procedure for mutual international credits.

The System of Bretton Woods (1944-71)

3. Creation of International Monetary Fund (IMF) to

supervise and ensure smooth functioning of the system.

Countries were expected to pursue economic and

monetary policies in a manner so that fluctuations of

currency remained within a permitted margin of + 1

percent. In other words, the central bank of every country

had to intervene to buy or sell foreign exchange

depending on the need.

4. Devaluations or Revaluations of more than 5% had to be

done with the permission of the IMF. This measure was

necessary to avoid chain devaluations like the one which

occurred before the Second World War.

International Monetary Fund (IMF)

IMF had 44 countries as its members in 1946.

Currently almost all the countries (181) are

members of IMF. The only exception is Cuba.

The main functions of IMF are:

1. To help member countries in stabilizing their

currency.

2. To supervise the evolution of exchange rates

and to provide guidance to countries on their

exchange rate policies.

3. To accord temporary financing to tide over BoP

difficulties.

International Monetary Fund (IMF):

Resources

The capital of the IMF is constituted by the totality of the

subscriptions of the member states known as quotas.

These quotas are determined as per the economic

importance of each country reflected/measured in terms

of national income, exports etc.

Since 1970, a new instrument of reserve has been

created, namely SDR (Special Drawing Right).

The value of SDR represents a weighted average of 5

currencies, that is, the US Dollar (40 percent), German

Deutschmark (21 percent), UK Pound Sterling (11

percent), French Franc (11 percent) and Japanese Yen

(17 percent). These weights reflect the relative strength

of economies of these countries.

International Monetary Fund (IMF):

Resources

The quotas of different currency are paid to the IMF

in ratio of 25% as SDRs and 75% in national

currency.

IMF also has recourse to loans from member states

to augment its resources. These loans are drawn in

SDRs.

Also, under the General Agreement to Borrow (GAB)

signed by the Group of Ten (also known as Paris

Club consist of 10 industrialized countries: Belgium,

Canada, France, Germany, Italy, Japan, the

Netherlands, Sweden, the UK and the USA), the IMF

can borrow in order to have supplementary

resources in convertible currencies.

International Monetary Fund (IMF):

Activities

Pre requisites of good functioning of IMF

requires:

a) Appropriate adjustment mechanism.

b) An attentive surveillance policies adopted by

member states relating to the exchange rate.

International Monetary Fund (IMF):

Activities

Member countries have an absolute claim on the

IMF up to the amount of gold subscriptions they

have made. In operational terms, they can draw

this amount (equal to 25% of their quota) from

IMF anytime. This is called reserve tranche (or

gold tranche) and is treated as the reserve of

the country concerned. This amount is to be

reimbursed to IMF within a specified period

varying between 3 months to 5 years.

International Monetary Fund (IMF):

Activities

Beyond 25%, a country can draw upon its credit tranche:

the additional credit the IMF can grant. The credit tranche

consists of amount of drawings beyond the reserve or gold

tranche that would raise the Fund’s total holding of that

country to 200 percent of the quota (raised to 400 percent

in special cases). Approval from IMF is necessary for a

country to draw on its credit tranche. The approval comes

with restrictions which become increasingly tight as the

credit amount increases. This is in consonance with the

general principles of finance where the lender (IMF) will

like to be assured of security and repayment of sum so

lent along with interest (if charged)

The temporary credit is used more often to finance

temporary disequilibrium in balance of payments than to

provide temporary liquidity.

International Monetary Fund (IMF):

Activities

Besides the reserve (or gold) and credit tranche; the IMF

has three permanent credit facilities:

i. The compensatory financing facility (established in 1963

and liberalized in 1975)

ii. The buffer stock financing facility (established in 1969)

iii. The extended facility (established in 1974 & expanded in

1983)

There are other temporal facilities created in response to

specific needs such as oil price increases, and the Special

Emergency Fund created by General Agreement to Borrow

(GAB)

International Monetary Fund (IMF):

Activities

Apart from the credits advanced by the IMF, it gives

technical aid as well to its member countries.

The IMF exercises a firm surveillance on the exchange rate

policy of the member states and adopt specific principles to

guide them.

In order that the system of exchange rate be effective, the

Fund recommends adoption of an anti-inflationary policy.

Over the past years, in many countries, the budget deficit

had become very high which resulted in a heavy external

debt. Serious problems of adjustment were a natural

consequence of such a situation. The Fund had to incite the

countries to put in place exchange rate policies compatible

with an overall medium strategy of adjustment.

International Monetary Fund (IMF):

Activities

The member states have adopted an exchange

rate policy, varying from free floating to pegging

to a single major currency.

There is no, or very little, government

intervention to maintain an exchange rate in the

case of completely floating currencies.

Ex: the USA, Canada and EMS as a group, are

the examples where currency floats without any

intervention. Among the currencies participating

in the EMS, a system of fixed rate exists,

fluctuation being possible within a permitted

range.

The International Bank for Reconstruction

and Development (The World Bank)

Created at the time of creation of IMF.

Initially its principal role was to facilitate the

reconstruction of countries affected by the

Second World War and to aid these countries

develop their economies.

IBRD has two other associated institutions:

1. International Finance Corporation (IFC) est. in

1956.

2. International Development Association (IDA)

est. in 1960.

The Role of the IBRD

It provides long term debt financing for periods

up to 15-20 years.

Financing is done for

1. The development of infrastructure such roads,

rail, telecommunication.

2. The development of energy resources,

electricity, gas and petrol.

3. The regional development programs, irrigation

projects, agriculture development, education

and the projects to promote investments in

small and medium enterprises.

The Resources of the IBRD

Every member country subscribes to the fixed capital of

the Bank. Member’s share is payable in two parts:

a) The first corresponds to a deposit of 10 percent- 1

percent payable in gold or US dollars and 9 percent in

national currency.

b) The second corresponds to a deferred deposit of 90

percent. This represents a commitment to respond to the

eventual needs of the Bank.

The bank can also issue bonds on principal financial

markets. Bonds are issued either in US dollars or in

currency of some other countries. Duration of these bonds

varies from 6 to 35 years.

Affiliated Institutions: IFC ( International

Finance Corporation

Role to engage private sector in developing

countries.

It lends without government guarantees and

may participate in the capital creation of certain

institutions.

Loan period may vary from 5 to 15 years.

Interest rates conform to that of the market.

Affiliated Institutions: IDA (International

Development Association)

Lends to the poorest countries, with conditions

that do not weight heavily on the balance of

payments.

Loans mostly are for a period of 50 years.

Rate of interest is very low or nil.

Loans are refused in the currency of the

borrowing country.

Credits of the IDA are accorded only to the

government.

The IMS since 1971

Difficulties for the system of Bretton Woods started from

1958 when the trade balance of the USA became highly

negative and a very large amount of US dollars was held

outside the USA; it was more than the total gold holdings

of the USA. Anticipating a devaluation of the US dollars,

speculator bought gold while other governments

demanded conversion of US dollars into gold.

To solve the problem, a ‘gold pool’ was established with

the co-operation of the UK , France, Germany, Italy,

Belgium, the Netherlands & Switzerland. The gold pool

was used to sell gold to maintain its price at $35 per

ounce. In return, the USA was expected to improve its

external trade.

The IMS since 1971

Since the US could not reduce its trade deficits, some of

the European countries started demanding again for

conversion of their dollar holdings into gold. Finally the

‘gold pool’ arrangement broke down. Eventually a series

of devaluations & speculations led to the breaking down of

the fixed rate system of Bretton Woods.

On 15th August 1971, President Nixon of USA suspended

the system of convertibility of gold and dollar.

For sometime, the system of fixed rates with an

adjustment margin of + 2.5% was tried but did not work.

Finally the fixed rate system was abandoned and floating

rate system came into effect.

The IMS since 1971

In December 1971, the Smithsonian Agreement

was signed at Washington; its major features

were:

1. Devaluation of the dollar and revaluation of other

currencies; gold passed from $35 per ounce to

$38.

2. New fluctuations margins: changing from +1% to

+2.5%.

3. Non convertibility of dollar.

In 1973, another devaluation of the dollar took

place. Petrol shock added to the international

monetary crisis. Exchange rates became volatile.

The IMS since 1971

In 1976, Jamaica Agreements were signed

focusing on the:

1. Legalization of the floating exchange rate.

2. Demonetization of gold as the currency of

reserves.

Thus, the part of quota which was hitherto

required to be deposited in gold could be

deposited in foreign exchange. At the same

time, IMF sold one third of its gold reserves.

The IMS since 1971

In 1977 & 1978, in the wake of inflation in the USA, the

dollar further depreciated. The Federal Reserve practiced

a strict monetary policy. Between 1980 and 1985, the

dollar appreciated but at the same time American BoP

situation deterioted.

The changes that took place in East Europe at the end of

1980s led to the creation of several new currencies.

Besides, adoption of the system of market economy by a

large majority of countries the world over had important

repercussions on the international financial scene.

Now the member of G-7 (Canada, France, Germany, Italy,

Japan, the UK and the USA) meet from time to time to co-

ordinate the policies so that the exchange rate stability

can be maintained. Their meeting has an effect of

avoiding protectionist tendencies on the part of any one

or more of them.

Different Exchange Rate Regimes

The IMF classifies exchange rate regimes in

four categories:

1. Regime of fixed exchange rates

2. Regime of free floating exchange rates.

3. Regime of managed floating rates.

4. Regime of limited flexibility.

Regime of Fixed Exchange Rates

In this system, a currency is pegged to a foreign currency

with fixed parity.

The rates are maintained constant or they may fluctuate

within a narrow range.

When a currency tends crossing over the limits,

governments intervene to keep it within the band.

A country pegs its currency to the currency of the country

in which the major foreign transactions are carried out.

Some countries peg their currencies to SDR.

The currencies to which many other currencies are

pegged are:

1. USD (24 currencies)

2. French Franc (14 currencies)

3. SDR (4 currencies)

Advantages and Disadvantages of the

Fixed Rate System

It provides stability to international trade.

Commercial transactions take place without any

worry about exchange rate risk.

The disadvantage of the system is speculation

e.g. A speculator anticipating devaluation of the

pound sterling will buy USD at forward so as to

sell them when devaluation of pound takes place

on future date.

Regime of Floating Exchange Rates

In the regime of floating exchange rates, adjustment

takes place on the market as a function of free play of

demand and supply.

Sometimes central banks do intervene to avoid high

volatility of exchange rates.

Different variants of this regime are:

• Regime of freely floating rates.

• Regime of managed flexibility.

• Regime of flexibility, adjusted according to a series of

indicators.

• Regime of limited flexibility according to certain

agreement (e.g. European Union Exchange Mechanism)

Advantages and Disadvantages of the

Floating Rate System

Advantages:

Possibility of speculation is reduced because the central

bank is not responsible to ensure as to what future rate

should be. A speculator is exposed to greater risk, and

therefore, will indulge in it less often.

Central Bank of the country is not required to maintain

large reserves to defend the currency.

Disadvantage:

Since one is not in a position to anticipate with any

degree of accuracy as to what is going to happen in

future, a trader is continuously exposed to foreign

exchange risk. As a result, one has to take recourse to

different techniques of exchange rate risk management.

You might also like

- Chetan Bhagat - Three Mistakes of My LifeDocument144 pagesChetan Bhagat - Three Mistakes of My LifeGayathri ParthasarathyNo ratings yet

- Computer Architecture and Assembly LanguageDocument2 pagesComputer Architecture and Assembly LanguageasifanisNo ratings yet

- Simple 200 EMA StrategyDocument3 pagesSimple 200 EMA StrategyActive88No ratings yet

- Itl Unit IDocument4 pagesItl Unit IShrabani KarNo ratings yet

- International InsititutionDocument23 pagesInternational InsititutionNelsonMoseMNo ratings yet

- The Current Relationship Between Imf N World BankDocument13 pagesThe Current Relationship Between Imf N World Bankmishrasneha76439No ratings yet

- Notes On International Business Finance Portion - 2 Example On Balance of Payment (BOP) : Example 1Document9 pagesNotes On International Business Finance Portion - 2 Example On Balance of Payment (BOP) : Example 1Md Tabish RazaNo ratings yet

- International Financial InstitutionsDocument9 pagesInternational Financial InstitutionsgzalyNo ratings yet

- IMF and WTODocument28 pagesIMF and WTOFahmiatul JannatNo ratings yet

- ImfDocument11 pagesImfHarsh KothariNo ratings yet

- Role of ImfDocument41 pagesRole of ImfAasthaNo ratings yet

- About The IMF: Bretton Woods System and ImfDocument8 pagesAbout The IMF: Bretton Woods System and ImfNilesh BhosaleNo ratings yet

- Key IMF ActivitiesDocument4 pagesKey IMF ActivitiesDwani SangviNo ratings yet

- Contribution of IMF in Global TradeDocument48 pagesContribution of IMF in Global TradeNainaNo ratings yet

- FinanceDocument3 pagesFinanceLovelie Peth VerzosaNo ratings yet

- International Finance Management Assignment: Topic-International Monetary FundDocument19 pagesInternational Finance Management Assignment: Topic-International Monetary Fundniks1190No ratings yet

- Introduction of Imf: 1.1 MeaningDocument58 pagesIntroduction of Imf: 1.1 MeaningRiSHI KeSH GawaINo ratings yet

- Report:The International Monetary Fund (IMF) : Tatarlî Anastasia, 102RIDocument6 pagesReport:The International Monetary Fund (IMF) : Tatarlî Anastasia, 102RIAnastasia TatarlîNo ratings yet

- European Monetary SystemDocument19 pagesEuropean Monetary Systemhakheemvp4809100% (3)

- Imf ProjectDocument7 pagesImf ProjectDeepali MestryNo ratings yet

- United States Court of Appeals, Third Circuit.: in No. 88-3395. Nos. 88-3385, 88-3389, 88-3393, 88-3394 and 88-3395Document18 pagesUnited States Court of Appeals, Third Circuit.: in No. 88-3395. Nos. 88-3385, 88-3389, 88-3393, 88-3394 and 88-3395Scribd Government DocsNo ratings yet

- The International Monetary System: How Does World Financial System Work ?Document38 pagesThe International Monetary System: How Does World Financial System Work ?lovejkbs100% (1)

- Different Contracts in Legal Aspect of BankingDocument7 pagesDifferent Contracts in Legal Aspect of Bankingdrishya3No ratings yet

- ImfDocument24 pagesImfKethavath Poolsing100% (2)

- International Monetary Fund in Globalization: International Organization Bretton Woods ConferenceDocument43 pagesInternational Monetary Fund in Globalization: International Organization Bretton Woods ConferenceYogita BathijaNo ratings yet

- What Does International Monetary FundDocument4 pagesWhat Does International Monetary FundSanthosh T KarthickNo ratings yet

- CreditcardsDocument22 pagesCreditcardsSandeep AroraNo ratings yet

- Adverse Selection & Moral HazardDocument4 pagesAdverse Selection & Moral HazardAJAY KUMAR SAHUNo ratings yet

- Fms AssignmentDocument6 pagesFms AssignmentGloir StoriesNo ratings yet

- University Lecture ASSET FINANCEDocument100 pagesUniversity Lecture ASSET FINANCESteven TylerNo ratings yet

- Define and Explain Thoroughly What Is CREDITDocument4 pagesDefine and Explain Thoroughly What Is CREDITAngelika SinguranNo ratings yet

- Swiss Bank ProjectDocument37 pagesSwiss Bank ProjectDhwani RajyaguruNo ratings yet

- International Banking SystemDocument24 pagesInternational Banking SystemSukumar Nandi100% (9)

- Written Report in Entreprenuerial MindDocument21 pagesWritten Report in Entreprenuerial MindAndrea OrbisoNo ratings yet

- Detecting Ponzi Finance: An Evolutionary Approach To The Measure of Financial FragilityDocument15 pagesDetecting Ponzi Finance: An Evolutionary Approach To The Measure of Financial FragilitytymoigneeNo ratings yet

- Classification of CreditDocument25 pagesClassification of CreditJohn Nikko LlaneraNo ratings yet

- Types of Financial Instruments of Money MarketDocument2 pagesTypes of Financial Instruments of Money MarketMian Abdul HaseebNo ratings yet

- IMF and INDIa FileDocument23 pagesIMF and INDIa FilehocordinatoreNo ratings yet

- Certificate in COmmodity DeriviatvesDocument4 pagesCertificate in COmmodity DeriviatvesFreeman JacksonNo ratings yet

- Debentures and BondsDocument3 pagesDebentures and Bondsremruata rascalralteNo ratings yet

- Lecture 9 International Credit Market enDocument42 pagesLecture 9 International Credit Market enElla Marie WicoNo ratings yet

- Business Laws and Company LawsDocument82 pagesBusiness Laws and Company LawsNITISH KUMARNo ratings yet

- International BankingDocument9 pagesInternational Bankingbharathi.sunagar5389No ratings yet

- International Monetary FundDocument12 pagesInternational Monetary FundPia SottoNo ratings yet

- Wolfsberg Private Banking Prinicples May 2012Document8 pagesWolfsberg Private Banking Prinicples May 2012SundayNo ratings yet

- CH 1 - Scope of International FinanceDocument7 pagesCH 1 - Scope of International Financepritesh_baidya269100% (3)

- The Fundamentals of Money Market Instruments in IndiaDocument53 pagesThe Fundamentals of Money Market Instruments in Indiathemeditator100% (4)

- STUDENT Capital and Bond Market UNITDocument24 pagesSTUDENT Capital and Bond Market UNITTetiana VozniukNo ratings yet

- Consolidate Debt Credit UnionsDocument3 pagesConsolidate Debt Credit UnionsSK Sabbir AhmedNo ratings yet

- IMF and World Bank AssignmentDocument5 pagesIMF and World Bank AssignmentAmazing worldNo ratings yet

- Corporate Finance - BondsDocument54 pagesCorporate Finance - BondsAnna LinNo ratings yet

- Debenture Trust Deed1Document95 pagesDebenture Trust Deed1Sancho SanchezNo ratings yet

- UN-DESA in English 22 2 2017Document1 pageUN-DESA in English 22 2 2017WORLD MEDIA & COMMUNICATIONSNo ratings yet

- Definition of MoneyDocument5 pagesDefinition of MoneyM .U.KNo ratings yet

- International BankingDocument25 pagesInternational Bankingvikas nabikNo ratings yet

- Mutual Fund WikipediaDocument12 pagesMutual Fund WikipediaDave ThreeTearsNo ratings yet

- Term Sheet For Series A Round of FinancingDocument5 pagesTerm Sheet For Series A Round of FinancingKnownUnknowns-XNo ratings yet

- Trust ReceiptDocument5 pagesTrust ReceiptMyna Zosette MesiasNo ratings yet

- Money LaunderingDocument27 pagesMoney LaunderingPratik ShahNo ratings yet

- Treasury Operations In Turkey and Contemporary Sovereign Treasury ManagementFrom EverandTreasury Operations In Turkey and Contemporary Sovereign Treasury ManagementNo ratings yet

- Leonardo Da Vinci - Lost NotebooksDocument130 pagesLeonardo Da Vinci - Lost NotebooksTuyenOnline100% (14)

- Exim Policy of India 2004Document8 pagesExim Policy of India 2004Jas777100% (3)

- Textile HistoryDocument23 pagesTextile Historyajabrao75% (4)

- Indian Export Import GuideDocument101 pagesIndian Export Import GuideMEGHANALOKSHA100% (1)

- Registration FormDocument1 pageRegistration FormasifanisNo ratings yet

- Final Export ImportDocument9 pagesFinal Export Importronak sNo ratings yet

- DBT STCDocument2 pagesDBT STCasifanisNo ratings yet

- Exim Policy of India 2004Document8 pagesExim Policy of India 2004Jas777100% (3)

- Chapter 5Document24 pagesChapter 5asifanisNo ratings yet

- Chapter 7Document27 pagesChapter 7asifanisNo ratings yet

- Prices and Monetary ManagementDocument26 pagesPrices and Monetary ManagementasifanisNo ratings yet

- Amended Foreign Trade Policy of India (2004-2009) : ObjectiveDocument1 pageAmended Foreign Trade Policy of India (2004-2009) : ObjectiveasifanisNo ratings yet

- Chapter 3Document28 pagesChapter 3asifanisNo ratings yet

- Chap 110Document2 pagesChap 110asifanisNo ratings yet

- AOL Time Warner Final Paper-Marena BronsonDocument26 pagesAOL Time Warner Final Paper-Marena BronsonasifanisNo ratings yet

- Chapter 2Document13 pagesChapter 2asifanisNo ratings yet

- Chap 12Document1 pageChap 12asifanisNo ratings yet

- Chapter 1Document18 pagesChapter 1asifanisNo ratings yet

- Applied Chemistry Lab - Ii: Course Code: BTF 221 Credit Units: 01 Course ContentsDocument1 pageApplied Chemistry Lab - Ii: Course Code: BTF 221 Credit Units: 01 Course ContentsasifanisNo ratings yet

- Mohd Asif Anis: Uttar Prades HDocument2 pagesMohd Asif Anis: Uttar Prades HasifanisNo ratings yet

- List of Currency in World by CountryDocument12 pagesList of Currency in World by CountryLAMOUCHI RIMNo ratings yet

- Macroeconomics - Chapter 12Document19 pagesMacroeconomics - Chapter 12tomshave28No ratings yet

- Tutorial 4 Exercises IFMDocument5 pagesTutorial 4 Exercises IFMNguyễn Gia Phương Anh100% (1)

- N.L.S I.U: Rbi As The Custodian of Foreign ExchangeDocument13 pagesN.L.S I.U: Rbi As The Custodian of Foreign Exchangevishnu TiwariNo ratings yet

- DSA Rates May2019Document54 pagesDSA Rates May2019Francesca Santos100% (1)

- 01A Forex SummaryDocument44 pages01A Forex Summarymonurai4uNo ratings yet

- Chapter 5Document12 pagesChapter 5tai nguyen100% (1)

- Usd To Myr - Google SearchDocument1 pageUsd To Myr - Google SearchKuhendran RavandranNo ratings yet

- Exchange Rate: Rate at Which One Currency Is Exchanged With Another CurrencyDocument4 pagesExchange Rate: Rate at Which One Currency Is Exchanged With Another CurrencyDulni WedageNo ratings yet

- Forex All 5 Tests With SolutionsDocument60 pagesForex All 5 Tests With Solutionsantim routNo ratings yet

- Lampiran I Entitas Ilegal NovemberDocument5 pagesLampiran I Entitas Ilegal NovemberCoba KillNo ratings yet

- The Reserve Bank of IndiaDocument15 pagesThe Reserve Bank of IndiaDivya JainNo ratings yet

- Foreign CurrencyDocument6 pagesForeign CurrencyLJ AggabaoNo ratings yet

- International Flow of Funds1Document82 pagesInternational Flow of Funds1Rammohanreddy RajidiNo ratings yet

- AD312 Sample Final Exam 2020 (With Answers)Document2 pagesAD312 Sample Final Exam 2020 (With Answers)Ekin MadenNo ratings yet

- Test 2 557 Answer-2Document3 pagesTest 2 557 Answer-2minah_sengalNo ratings yet

- 2022-01-01 - 2022-12-31 - Transaction (1) 1Document16 pages2022-01-01 - 2022-12-31 - Transaction (1) 1Chidinma NnoliNo ratings yet

- Foreign Exchange ReservesDocument2 pagesForeign Exchange ReservesOzair Ali KhanNo ratings yet

- Ninjatrader Futures Contract DetailsDocument3 pagesNinjatrader Futures Contract DetailsmatusalemcassimNo ratings yet

- How Far From Fair Value Is Your Currency?: Country Big Mac Price in Local Currency in US Dollars 1 2Document2 pagesHow Far From Fair Value Is Your Currency?: Country Big Mac Price in Local Currency in US Dollars 1 2Vadim PosticaNo ratings yet

- Ch2-Study Guide 16-17Document2 pagesCh2-Study Guide 16-17api-307744300No ratings yet

- Csec Pob June 2015 p2Document17 pagesCsec Pob June 2015 p2econlabttNo ratings yet

- ENGLISHDocument45 pagesENGLISHmanurunggeorge25No ratings yet

- Bangko Sentral NG Pilipinas Statistics - Exchange RateDocument1 pageBangko Sentral NG Pilipinas Statistics - Exchange RateDOJ maagermanNo ratings yet

- Forex TradingDocument1 pageForex TradingGirish NairNo ratings yet

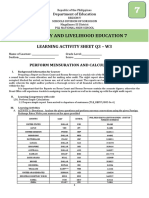

- Technology and Livelihood Education 7: Learning Activity Sheet Q3 - W3Document4 pagesTechnology and Livelihood Education 7: Learning Activity Sheet Q3 - W3Sandy Lagata100% (1)

- MONEYDocument5 pagesMONEYShazia SadhikaliNo ratings yet

- Devaluation of The Pakistani RupeeDocument45 pagesDevaluation of The Pakistani Rupeehameed.mba05533692% (12)

- Forex Risk Management FinalDocument83 pagesForex Risk Management FinalMohd. Farhan AnsariNo ratings yet