Professional Documents

Culture Documents

Mishkin CH 06

Mishkin CH 06

Uploaded by

Mohamed MedCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 15 U.S. Code 1635 - Right of Rescission As To Certain TransactionsDocument7 pages15 U.S. Code 1635 - Right of Rescission As To Certain TransactionsHelpin Hand100% (6)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Chapter 16: Time-Series ForecastingDocument48 pagesChapter 16: Time-Series ForecastingMohamed MedNo ratings yet

- Aia Bop Slides Eng Ver2.2Document51 pagesAia Bop Slides Eng Ver2.2Raja Periasamy100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Case 2.4 Asher Farms IncDocument3 pagesCase 2.4 Asher Farms IncMohamed MedNo ratings yet

- Lesson Plan - Basic Documents and Transactions Related To Bank DepositsDocument5 pagesLesson Plan - Basic Documents and Transactions Related To Bank DepositsBrenda Sebandal100% (4)

- The Delhi Apartment Ownership ActDocument12 pagesThe Delhi Apartment Ownership ActRahul TomarNo ratings yet

- %nitems 3Document1 page%nitems 3Mohamed MedNo ratings yet

- Positional Parameters: & &Document1 pagePositional Parameters: & &Mohamed MedNo ratings yet

- WhileDocument1 pageWhileMohamed MedNo ratings yet

- Conditional AssemblyDocument1 pageConditional AssemblyMohamed MedNo ratings yet

- init &char &dev: Macro Expansion of of PUTC (First Version)Document1 pageinit &char &dev: Macro Expansion of of PUTC (First Version)Mohamed MedNo ratings yet

- Source Code: Macro DefinitionDocument1 pageSource Code: Macro DefinitionMohamed MedNo ratings yet

- Problems With The Second Version of PUTC: Duplicated SymbolDocument1 pageProblems With The Second Version of PUTC: Duplicated SymbolMohamed MedNo ratings yet

- Macro Calls Within A Macro: Saves The System StateDocument1 pageMacro Calls Within A Macro: Saves The System StateMohamed MedNo ratings yet

- Macro Expansion of Second Version of PUTCDocument1 pageMacro Expansion of Second Version of PUTCMohamed MedNo ratings yet

- GCNT SET 0: Revised PUTC Using SET VariablesDocument1 pageGCNT SET 0: Revised PUTC Using SET VariablesMohamed MedNo ratings yet

- A First Example: PUTCDocument1 pageA First Example: PUTCMohamed MedNo ratings yet

- $ab MSG $ab $ab $ab X'05' $ab X'05' $abDocument1 page$ab MSG $ab $ab $ab X'05' $ab X'05' $abMohamed MedNo ratings yet

- Can Be Concatenated Together: Concatenation of SymbolsDocument1 pageCan Be Concatenated Together: Concatenation of SymbolsMohamed MedNo ratings yet

- A Final Version of PUTC Using System QualifiersDocument1 pageA Final Version of PUTC Using System QualifiersMohamed MedNo ratings yet

- Putmsg: Example Macro Expansion of PUTMSGDocument1 pagePutmsg: Example Macro Expansion of PUTMSGMohamed MedNo ratings yet

- Header Macro Prototype Statement & & Body of Macro - . - (To Replace Prototype) End Statement MendDocument1 pageHeader Macro Prototype Statement & & Body of Macro - . - (To Replace Prototype) End Statement MendMohamed MedNo ratings yet

- Putcsave Putcloop: Problems With The First Version of PUTCDocument1 pagePutcsave Putcloop: Problems With The First Version of PUTCMohamed MedNo ratings yet

- COM2301 ProfessionalCom Agnaou Spring 2013 TentatiDocument7 pagesCOM2301 ProfessionalCom Agnaou Spring 2013 TentatiMohamed MedNo ratings yet

- Assembly Language MacrosDocument1 pageAssembly Language MacrosMohamed MedNo ratings yet

- Lab5.2 Inheritance Exceptions-2Document4 pagesLab5.2 Inheritance Exceptions-2Mohamed MedNo ratings yet

- Al Akhawayn University School of Sciences & Engineering CSC2303 Collections Lab ManualDocument1 pageAl Akhawayn University School of Sciences & Engineering CSC2303 Collections Lab ManualMohamed MedNo ratings yet

- Online Marketing ChallengeDocument8 pagesOnline Marketing ChallengeMohamed MedNo ratings yet

- Amandalovestoaudit: Amanda'S LecturesDocument2 pagesAmandalovestoaudit: Amanda'S LecturesMohamed MedNo ratings yet

- Metrobank Vs BA Finance CorpDocument11 pagesMetrobank Vs BA Finance CorpWalter FernandezNo ratings yet

- Resume Template1Document1 pageResume Template1anjani5230No ratings yet

- "Assets: Masalah-Masalah Khusus": Teori Dan Praktik Akuntansi KeuanganDocument18 pages"Assets: Masalah-Masalah Khusus": Teori Dan Praktik Akuntansi KeuanganrajaNo ratings yet

- Study of Equipment Prices in The Power SectorDocument121 pagesStudy of Equipment Prices in The Power Sector이주성100% (1)

- Year DividendDocument2 pagesYear DividendHimanshu SharmaNo ratings yet

- Bharti Axa Life Insurance ProjectDocument80 pagesBharti Axa Life Insurance ProjectTripti Srivastava100% (1)

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument3 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledRush YuviencoNo ratings yet

- Hi Telling PersonDocument12 pagesHi Telling PersonyashNo ratings yet

- Name - KEYDocument30 pagesName - KEYjhouvanNo ratings yet

- Chapter 12 - AsisDocument8 pagesChapter 12 - AsisArs MoriendiNo ratings yet

- US Internal Revenue Service: Irb04-47Document28 pagesUS Internal Revenue Service: Irb04-47IRSNo ratings yet

- Public DebtDocument2 pagesPublic DebtRonnie TambalNo ratings yet

- Cfi Accounting EbookDocument66 pagesCfi Accounting EbookAmjid MalNo ratings yet

- 15-10458 - Solid Foundation Rev Memo PDFDocument2 pages15-10458 - Solid Foundation Rev Memo PDFRecordTrac - City of OaklandNo ratings yet

- Maharashtra Act No. XLV of 1963Document20 pagesMaharashtra Act No. XLV of 1963BalrajNo ratings yet

- BSP RediscountingDocument17 pagesBSP Rediscountingjessel m. decenaNo ratings yet

- IA IFRS 2nd PDFDocument50 pagesIA IFRS 2nd PDFKatie NovriantiNo ratings yet

- Managing Personal FinanceDocument40 pagesManaging Personal FinanceDylan AdrianNo ratings yet

- HPFP Profile and Assessment by Prof - SwillingDocument22 pagesHPFP Profile and Assessment by Prof - SwillingStewart Paul TorreNo ratings yet

- CHAPTER 3, SEC. 1 (Arts. 1179-1192)Document5 pagesCHAPTER 3, SEC. 1 (Arts. 1179-1192)Lyan David Marty Juanico100% (3)

- Sample Notice of Lis PendensDocument2 pagesSample Notice of Lis PendensOrlando PaylipNo ratings yet

- 28784Document40 pages28784alicewilliams83nNo ratings yet

- Capital Structure Theory NotesDocument4 pagesCapital Structure Theory NotesAurangzeb ChaudharyNo ratings yet

- BudgetingDocument11 pagesBudgetingWinnie Ann Daquil LomosadNo ratings yet

- Income Tax Act As Amended by The Finance Act, 2008: SupplementDocument13 pagesIncome Tax Act As Amended by The Finance Act, 2008: SupplementbhavaniNo ratings yet

- Tiu Vs Philippine Bank CommunicationDocument14 pagesTiu Vs Philippine Bank CommunicationmarlouierespicioNo ratings yet

Mishkin CH 06

Mishkin CH 06

Uploaded by

Mohamed MedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mishkin CH 06

Mishkin CH 06

Uploaded by

Mohamed MedCopyright:

Available Formats

Chapter 6

The Risk and

Term Structure

of Interest Rates

Risk Structure of Interest Rates

Default riskoccurs when the issuer of the

bond is unable or unwilling to make interest

payments or pay off the face value

U.S. T-bonds are considered default free

Risk premiumthe spread between the interest

rates on bonds with default risk and the interest

rates on T-bonds

Liquiditythe ease with which an asset can be

converted into cash

Income tax considerations

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-2

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-3

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-4

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-5

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-6

Term Structure of Interest Rates

Bonds with identical risk, liquidity, and tax

characteristics may have different interest rates

because the time remaining to maturity is different

Yield curvea plot of the yield on bonds with differing

terms to maturity but the same risk, liquidity and tax

considerations

Upward-sloping long-term rates are above

short-term rates

Flat short- and long-term rates are the same

Inverted long-term rates are below short-term rates

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-7

Facts Theory of the Term Structure

of Interest Rates Must Explain

1. Interest rates on bonds of different

maturities move together over time

2. When short-term interest rates are low,

yield curves are more likely to have an

upward slope; when short-term rates

are high, yield curves are more likely to

slope downward and be inverted

3. Yield curves almost always

slope upward

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-8

Three Theories

to Explain the Three Facts

1. Expectations theory explains the first

two facts but not the third

2. Segmented markets theory explains

fact three but not the first two

3. Liquidity premium theory combines the

two theories to explain all three facts

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-9

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-10

Expectations Theory

The interest rate on a long-term bond will equal

an average of the short-term interest rates that

people expect to occur over the life of the long-

term bond

Buyers of bonds do not prefer bonds of one

maturity over another; they will not hold

any quantity of a bond if its expected return

is less than that of another bond with a different

maturity

Bonds like these are said to be perfect

substitutes

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-11

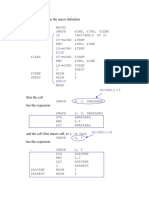

Expectations TheoryExample

Let the current rate on one-year bond be 6%.

You expect the interest rate on a one-year

bond to be 8% next year.

Then the expected return for buying two one-

year bonds averages (6% + 8%)/2 = 7%.

The interest rate on a two-year bond must be

7% for you to be willing to purchase it.

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-12

Expectations TheoryIn General

For an investment of $1

it = today's interest rate on a one-period bond

ite1 = interest rate on a one-period bond expected for next period

i2t = today's interest rate on the two-period bond

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-13

Expectations TheoryIn General

(contd)

Expected return over the two periods from investing $1 in the

two-period bond and holding it for the two periods

(1 + i2t )(1 + i2t ) 1

1 2i2t (i2t ) 2 1

2i2t (i2t ) 2

Since (i2t ) 2 is very small

the expected return for holding the two-period bond for two periods is

2i2t

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-14

Expectations TheoryIn General

(contd)

If two one-period bonds are bought with the $1 investment

(1 it )(1 ite1 ) 1

1 it ite1 it (ite1 ) 1

it ite1 it (ite1 )

it (ite1 ) is extremely small

Simplifying we get

it ite1

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-15

Expectations TheoryIn General

(contd)

Both bonds will be held only if the expected returns are equal

2i2t it ite1

it ite1

i2t

2

The two-period rate must equal the average of the two one-period rates

For bonds with longer maturities

it ite1 ite 2 ... ite ( n 1)

int

n

The n-period interest rate equals the average of the one-period

interest rates expected to occur over the n-period life of the bond

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-16

Expectations Theory

Explains why the term structure of interest

rates changes at different times

Explains why interest rates on bonds with

different maturities move together over time

(fact 1)

Explains why yield curves tend to slope up

when short-term rates are low and slope down

when short-term rates are high (fact 2)

Cannot explain why yield curves usually slope

upward (fact 3)

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-17

Segmented Markets Theory

Bonds of different maturities are not substitutes at all

The interest rate for each bond with a different

maturity is determined by the demand for and supply

of that bond

Investors have preferences for bonds of one maturity

over another

If investors have short desired holding periods and

generally prefer bonds with shorter maturities that

have less interest-rate risk, then this explains why

yield curves usually slope upward (fact 3)

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-18

Liquidity Premium &

Preferred Habitat Theories

The interest rate on a long-term bond

will equal an average of short-term

interest rates expected to occur over the

life of the long-term bond plus a liquidity

premium that responds to supply and

demand conditions for that bond

Bonds of different maturities are

substitutes but not perfect substitutes

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-19

Liquidity Premium Theory

it it1

e

it2

e

... it(

e

int n1)

lnt

n

where lnt is the liquidity premium for the n-period bond at time t

lnt is always positive

Rises with the term to maturity

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-20

Preferred Habitat Theory

Investors have a preference for bonds of

one maturity over another

They will be willing to buy bonds of

different maturities only if they earn a

somewhat higher expected return

Investors are likely to prefer short-term

bonds over longer-term bonds

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-21

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-22

Liquidity Premium and Preferred Habitat

Theories, Explanation of the Facts

Interest rates on different maturity bonds move

together over time; explained by the first term in

the equation

Yield curves tend to slope upward when short-term

rates are low and to be inverted when short-term rates

are high; explained by the liquidity premium term in the

first case and by a low expected average in the second

case

Yield curves typically slope upward; explained

by a larger liquidity premium as the term to

maturity lengthens

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-23

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-24

Copyright 2007 Pearson Addison-Wesley. All rights reserved. 6-25

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 15 U.S. Code 1635 - Right of Rescission As To Certain TransactionsDocument7 pages15 U.S. Code 1635 - Right of Rescission As To Certain TransactionsHelpin Hand100% (6)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Chapter 16: Time-Series ForecastingDocument48 pagesChapter 16: Time-Series ForecastingMohamed MedNo ratings yet

- Aia Bop Slides Eng Ver2.2Document51 pagesAia Bop Slides Eng Ver2.2Raja Periasamy100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Case 2.4 Asher Farms IncDocument3 pagesCase 2.4 Asher Farms IncMohamed MedNo ratings yet

- Lesson Plan - Basic Documents and Transactions Related To Bank DepositsDocument5 pagesLesson Plan - Basic Documents and Transactions Related To Bank DepositsBrenda Sebandal100% (4)

- The Delhi Apartment Ownership ActDocument12 pagesThe Delhi Apartment Ownership ActRahul TomarNo ratings yet

- %nitems 3Document1 page%nitems 3Mohamed MedNo ratings yet

- Positional Parameters: & &Document1 pagePositional Parameters: & &Mohamed MedNo ratings yet

- WhileDocument1 pageWhileMohamed MedNo ratings yet

- Conditional AssemblyDocument1 pageConditional AssemblyMohamed MedNo ratings yet

- init &char &dev: Macro Expansion of of PUTC (First Version)Document1 pageinit &char &dev: Macro Expansion of of PUTC (First Version)Mohamed MedNo ratings yet

- Source Code: Macro DefinitionDocument1 pageSource Code: Macro DefinitionMohamed MedNo ratings yet

- Problems With The Second Version of PUTC: Duplicated SymbolDocument1 pageProblems With The Second Version of PUTC: Duplicated SymbolMohamed MedNo ratings yet

- Macro Calls Within A Macro: Saves The System StateDocument1 pageMacro Calls Within A Macro: Saves The System StateMohamed MedNo ratings yet

- Macro Expansion of Second Version of PUTCDocument1 pageMacro Expansion of Second Version of PUTCMohamed MedNo ratings yet

- GCNT SET 0: Revised PUTC Using SET VariablesDocument1 pageGCNT SET 0: Revised PUTC Using SET VariablesMohamed MedNo ratings yet

- A First Example: PUTCDocument1 pageA First Example: PUTCMohamed MedNo ratings yet

- $ab MSG $ab $ab $ab X'05' $ab X'05' $abDocument1 page$ab MSG $ab $ab $ab X'05' $ab X'05' $abMohamed MedNo ratings yet

- Can Be Concatenated Together: Concatenation of SymbolsDocument1 pageCan Be Concatenated Together: Concatenation of SymbolsMohamed MedNo ratings yet

- A Final Version of PUTC Using System QualifiersDocument1 pageA Final Version of PUTC Using System QualifiersMohamed MedNo ratings yet

- Putmsg: Example Macro Expansion of PUTMSGDocument1 pagePutmsg: Example Macro Expansion of PUTMSGMohamed MedNo ratings yet

- Header Macro Prototype Statement & & Body of Macro - . - (To Replace Prototype) End Statement MendDocument1 pageHeader Macro Prototype Statement & & Body of Macro - . - (To Replace Prototype) End Statement MendMohamed MedNo ratings yet

- Putcsave Putcloop: Problems With The First Version of PUTCDocument1 pagePutcsave Putcloop: Problems With The First Version of PUTCMohamed MedNo ratings yet

- COM2301 ProfessionalCom Agnaou Spring 2013 TentatiDocument7 pagesCOM2301 ProfessionalCom Agnaou Spring 2013 TentatiMohamed MedNo ratings yet

- Assembly Language MacrosDocument1 pageAssembly Language MacrosMohamed MedNo ratings yet

- Lab5.2 Inheritance Exceptions-2Document4 pagesLab5.2 Inheritance Exceptions-2Mohamed MedNo ratings yet

- Al Akhawayn University School of Sciences & Engineering CSC2303 Collections Lab ManualDocument1 pageAl Akhawayn University School of Sciences & Engineering CSC2303 Collections Lab ManualMohamed MedNo ratings yet

- Online Marketing ChallengeDocument8 pagesOnline Marketing ChallengeMohamed MedNo ratings yet

- Amandalovestoaudit: Amanda'S LecturesDocument2 pagesAmandalovestoaudit: Amanda'S LecturesMohamed MedNo ratings yet

- Metrobank Vs BA Finance CorpDocument11 pagesMetrobank Vs BA Finance CorpWalter FernandezNo ratings yet

- Resume Template1Document1 pageResume Template1anjani5230No ratings yet

- "Assets: Masalah-Masalah Khusus": Teori Dan Praktik Akuntansi KeuanganDocument18 pages"Assets: Masalah-Masalah Khusus": Teori Dan Praktik Akuntansi KeuanganrajaNo ratings yet

- Study of Equipment Prices in The Power SectorDocument121 pagesStudy of Equipment Prices in The Power Sector이주성100% (1)

- Year DividendDocument2 pagesYear DividendHimanshu SharmaNo ratings yet

- Bharti Axa Life Insurance ProjectDocument80 pagesBharti Axa Life Insurance ProjectTripti Srivastava100% (1)

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument3 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledRush YuviencoNo ratings yet

- Hi Telling PersonDocument12 pagesHi Telling PersonyashNo ratings yet

- Name - KEYDocument30 pagesName - KEYjhouvanNo ratings yet

- Chapter 12 - AsisDocument8 pagesChapter 12 - AsisArs MoriendiNo ratings yet

- US Internal Revenue Service: Irb04-47Document28 pagesUS Internal Revenue Service: Irb04-47IRSNo ratings yet

- Public DebtDocument2 pagesPublic DebtRonnie TambalNo ratings yet

- Cfi Accounting EbookDocument66 pagesCfi Accounting EbookAmjid MalNo ratings yet

- 15-10458 - Solid Foundation Rev Memo PDFDocument2 pages15-10458 - Solid Foundation Rev Memo PDFRecordTrac - City of OaklandNo ratings yet

- Maharashtra Act No. XLV of 1963Document20 pagesMaharashtra Act No. XLV of 1963BalrajNo ratings yet

- BSP RediscountingDocument17 pagesBSP Rediscountingjessel m. decenaNo ratings yet

- IA IFRS 2nd PDFDocument50 pagesIA IFRS 2nd PDFKatie NovriantiNo ratings yet

- Managing Personal FinanceDocument40 pagesManaging Personal FinanceDylan AdrianNo ratings yet

- HPFP Profile and Assessment by Prof - SwillingDocument22 pagesHPFP Profile and Assessment by Prof - SwillingStewart Paul TorreNo ratings yet

- CHAPTER 3, SEC. 1 (Arts. 1179-1192)Document5 pagesCHAPTER 3, SEC. 1 (Arts. 1179-1192)Lyan David Marty Juanico100% (3)

- Sample Notice of Lis PendensDocument2 pagesSample Notice of Lis PendensOrlando PaylipNo ratings yet

- 28784Document40 pages28784alicewilliams83nNo ratings yet

- Capital Structure Theory NotesDocument4 pagesCapital Structure Theory NotesAurangzeb ChaudharyNo ratings yet

- BudgetingDocument11 pagesBudgetingWinnie Ann Daquil LomosadNo ratings yet

- Income Tax Act As Amended by The Finance Act, 2008: SupplementDocument13 pagesIncome Tax Act As Amended by The Finance Act, 2008: SupplementbhavaniNo ratings yet

- Tiu Vs Philippine Bank CommunicationDocument14 pagesTiu Vs Philippine Bank CommunicationmarlouierespicioNo ratings yet