Professional Documents

Culture Documents

Money Supply and Money Demand: Macroeconomics

Money Supply and Money Demand: Macroeconomics

Uploaded by

Hay JirenyaaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Money Supply and Money Demand: Macroeconomics

Money Supply and Money Demand: Macroeconomics

Uploaded by

Hay JirenyaaCopyright:

Available Formats

CHAPTER EIGHTEEN

macro Money Supply

and Money Demand

macroeconomics

fifth edition

N. Gregory Mankiw

PowerPoint Slides

by Ron Cronovich

2002 Worth Publishers, all rights reserved

Chapter objectives

Money supply

how the banking system creates

money

three ways the Fed can control the

money supply

why the Fed cant control it precisely

Theories of money demand

a portfolio theory

a transactions theory: the Baumol-

Tobin model

CHAPTER 18 Money Supply and Money Demand

slide 2

Banks role in the money supply

The money supply equals currency plus

demand (checking account) deposits:

M = C + D

Since the money supply includes

demand deposits, the banking system

plays an important role.

CHAPTER 18 Money Supply and Money Demand

slide 3

A few preliminaries

Reserves (R ): the portion of deposits that

banks have not lent.

To a bank, liabilities include deposits,

assets include reserves and outstanding

loans

100-percent-reserve banking: a system

in which banks hold all deposits as reserves.

Fractional-reserve banking:

a system in which banks hold a fraction of

their deposits as reserves.

CHAPTER 18 Money Supply and Money Demand

slide 4

SCENARIO 1: No Banks

With no banks,

D = 0 and M = C = $1000.

CHAPTER 18 Money Supply and Money Demand

slide 5

SCENARIO 2: 100 Percent Reserve Banking

Initially C = $1000, D = $0, M = $1000.

Now suppose households deposit the $1000

at Firstbank.

After the deposit,

FIRSTBANKS C = $0,

balance sheet D = $1000,

Assets Liabilities M = $1000.

reserves $1000 deposits $1000 100% Reserve

Banking has no

impact on size of

money supply.

CHAPTER 18 Money Supply and Money Demand

slide 6

SCENARIO 3: Fractional-Reserve Banking

Suppose banks hold 20% of deposits in

reserve, making loans with the rest.

Firstbank will make $800 in loans.

The money supply

FIRSTBANKS now equals $1800:

balance sheet The depositor still

Assets Liabilities has $1000 in

$1000 deposits $1000

reserves $200 demand deposits,

loans $800 but now the

borrower holds

$800 in currency.

CHAPTER 18 Money Supply and Money Demand

slide 7

SCENARIO 3: Fractional-Reserve Banking

Thus, in a fractional-reserve

banking system, banks create money.

The money supply

FIRSTBANKS now equals $1800:

balance sheet The depositor still

Assets Liabilities has $1000 in

reserves $200 deposits $1000 demand deposits,

loans $800 but now the

borrower holds

$800 in currency.

CHAPTER 18 Money Supply and Money Demand

slide 8

SCENARIO 3: Fractional-Reserve Banking

Suppose the borrower deposits the $800 in

Secondbank.

Initially, Secondbanks balance sheet is:

SECONDBANKS But then

Secondbank will

balance sheet

loan 80% of this

Assets Liabilities deposit

$800 deposits $800

reserves $160 and its balance

loans $0

$640 sheet will look like

this:

CHAPTER 18 Money Supply and Money Demand

slide 9

SCENARIO 3: Fractional-Reserve Banking

If this $640 is eventually deposited in Thirdbank,

then Thirdbank will keep 20% of it in reserve,

and loan the rest out:

THIRDBANKS

balance sheet

Assets Liabilities

$640 deposits $640

reserves $128

loans $0

$512

CHAPTER 18 Money Supply and Money Demand

slide 10

Finding the total amount of money:

Original deposit = $1000

+ Firstbank lending = $ 800

+ Secondbank lending = $ 640

+ Thirdbank lending = $ 512

+ other lending

Total money supply = (1/rr ) $1000

where rr = ratio of reserves to deposits

In our example, rr = 0.2, so M = $5000

CHAPTER 18 Money Supply and Money Demand

slide 11

Money creation in the banking system

A fractional reserve banking system

creates money,

but it doesnt create wealth:

bank loans give borrowers

some new money

and an equal amount of new debt.

CHAPTER 18 Money Supply and Money Demand

slide 12

A model of the money supply

exogenous variables

the monetary base, B = C + R

controlled by the central bank

the reserve-deposit ratio, rr = R/D

depends on regulations & bank

policies

the currency-deposit ratio, cr = C/D

depends on households preferences

CHAPTER 18 Money Supply and Money Demand

slide 13

Solving for the money supply:

C D

M C D B m B

B

wher

e C D

m

B

C D

C D D D

cr 1

C R C D R D cr rr

CHAPTER 18 Money Supply and Money Demand

slide 14

The money multiplier

cr 1

M m B, where m

cr rr

If rr < 1, then m > 1

If monetary base changes by B,

then M = m B

m is called the money multiplier.

CHAPTER 18 Money Supply and Money Demand

slide 15

Exercise

cr 1

M m B, wher m

e cr rr

Suppose households decide to hold more

of their money as currency and less in

the form of demand deposits.

1. Determine impact on money

supply.

2. Explain the intuition for your result.

CHAPTER 18 Money Supply and Money Demand

slide 16

Solution to exercise

Impact of an increase in the currency-deposit ratio

cr > 0.

1. An increase in cr increases the denominator

of m proportionally more than the

numerator. So m falls, causing M to fall too.

2. If households deposit less of their money,

then banks cant make as many loans,

so the banking system wont be able to

create as much money.

CHAPTER 18 Money Supply and Money Demand

slide 17

Three instruments of monetary policy

1. Open

1. Openmarket

market

operations

operations

2. Reserve

2. Reserverequirements

requirements

3. The

3. Thediscount

discountrate

rate

CHAPTER 18 Money Supply and Money Demand

slide 18

Open market operations

definition:

The purchase or sale of government

bonds by the Federal Reserve.

how it works:

If Fed buys bonds from the public,

it pays with new dollars, increasing B and

therefore M.

CHAPTER 18 Money Supply and Money Demand

slide 19

Reserve requirements

definition:

Fed regulations that require banks to hold

a minimum reserve-deposit ratio.

how it works:

Reserve requirements affect rr and m:

If Fed reduces reserve requirements, then

banks can make more loans and create

more money from each deposit.

CHAPTER 18 Money Supply and Money Demand

slide 20

The discount rate

definition:

The interest rate that the Fed charges on

loans it makes to banks.

how it works:

When banks borrow from the Fed, their

reserves increase, allowing them to make

more loans and create more money.

The Fed can increase B by lowering the

discount rate to induce banks to borrow

more reserves from the Fed.

CHAPTER 18 Money Supply and Money Demand

slide 21

Which instrument is used most often?

Open market operations:

Most frequently used.

Changes in reserve requirements:

Least frequently used.

Changes in the discount rate:

Largely symbolic;

the Fed is a lender of last resort,

does not usually make loans to banks

on demand.

CHAPTER 18 Money Supply and Money Demand

slide 22

Why the Fed cant precisely control M

cr 1

M m B , wher m

e cr rr

Households can change cr,

causing m and M to change.

Banks often hold excess reserves

(reserves above the reserve

requirement).

If banks change their excess reserves,

then rr, m and M change.

CHAPTER 18 Money Supply and Money Demand

slide 23

Money Demand

Two types of theories:

Portfolio theories

emphasize store of value function

relevant for M2, M3

not relevant for M1. (As a store of value,

M1 is dominated by other assets.)

Transactions theories

emphasize medium of exchange function

also relevant for M1

CHAPTER 18 Money Supply and Money Demand

slide 29

A simple portfolio theory

(M / P )d = L(rs , rb , e ,W ),

where

rs = expected real return on stock

rb = expected real return on bonds

e = expected inflation rate

W = real wealth

CHAPTER 18 Money Supply and Money Demand

slide 30

The Baumol-Tobin Model

A transactions theory of money demand.

Notation:

Y = total spending, done gradually over the

year

i = interest rate on savings account

N= number of trips consumer makes to

the bank to withdraw money from savings

account

F = cost of a trip to the bank

(e.g., if a trip takes 15 minutes and

consumers wage = $12/hour, then F =

$3)

CHAPTER 18 Money Supply and Money Demand

slide 31

Money holdings over the year

Money

N=1

holding

s Y

Average

= Y/ 2

1 Tim

e

CHAPTER 18 Money Supply and Money Demand

slide 32

Money holdings over the year

Money

N=2

holding

s Y

Y/ 2 Average

= Y/ 4

1/2 1 Tim

e

CHAPTER 18 Money Supply and Money Demand

slide 33

Money holdings over the year

Money

N=3

holding

s Y

Average

Y/ 3 = Y/ 6

1/3 2/3 1 Tim

e

CHAPTER 18 Money Supply and Money Demand

slide 34

The cost of holding money

In general, average money holdings = Y/2N

Foregone interest = i (Y/2N )

Cost of N trips to bank = F N

Thus,

Given Y, i, and F,

consumer chooses N to minimize total cost

CHAPTER 18 Money Supply and Money Demand

slide 35

Finding the cost-minimizing N

Cost

Foregone

interest =

iY/2N

Cost of trips

= FN

Total cost

N* N

CHAPTER 18 Money Supply and Money Demand

slide 36

The money demand function

The cost-minimizing value of N :

To obtain the money demand function,

plug N* into the expression for

average money holdings:

Money demand depends positively on Y

and F, and negatively on i .

CHAPTER 18 Money Supply and Money Demand

slide 38

The money demand function

The Baumol-Tobin money demand function:

How the B-T money demand func. differs from

the money demand func. from previous chapters:

B-T shows how F affects money demand

B-T implies that the

income elasticity of money demand = 0.5,

interest rate elasticity of money demand = 0.5

CHAPTER 18 Money Supply and Money Demand

slide 39

Financial Innovation, Near Money, and

the Demise of the Monetary Aggregates

Examples of financial innovation:

many checking accounts now pay interest

very easy to buy and sell assets

mutual funds are baskets of stocks that

are easy to redeem - just write a check

Non-monetary assets having some of the

liquidity of money are called near money.

Money & near money are close substitutes,

and switching from one to the other is easy.

CHAPTER 18 Money Supply and Money Demand

slide 41

Financial Innovation, Near Money, and

the Demise of the Monetary Aggregates

The rise of near money makes money

demand less stable and complicates

monetary policy.

1993: the Fed switched from targeting

monetary aggregates to targeting the

Federal Funds rate.

This change may help explain why the

U.S. economy was so stable during the

rest of the 1990s.

CHAPTER 18 Money Supply and Money Demand

slide 42

Chapter summary

1. Fractional reserve banking creates money

because each dollar of reserves generates

many dollars of demand deposits.

2. The money supply depends on the

monetary base

currency-deposit ratio

reserve ratio

3. The Fed can control the money supply with

open market operations

the reserve requirement

the discount rate

CHAPTER 18 Money Supply and Money Demand

slide 43

Chapter summary

4. Portfolio theories of money demand

stress the store of value function

posit that money demand depends on

risk/return of money & alternative assets

5. The Baumol-Tobin model

is an example of the transactions

theories of money demand, stresses

medium of exchange function

money demand depends positively on

spending, negatively on the interest rate,

and positively on the cost of converting

non-monetary assets to money

CHAPTER 18 Money Supply and Money Demand

slide 44

You might also like

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 95 Worksheet Calculus For EconomistsDocument5 pages95 Worksheet Calculus For EconomistsBereket DesalegnNo ratings yet

- Intermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesDocument20 pagesIntermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesMckenzieNo ratings yet

- Economics 5 MCQ C14Document14 pagesEconomics 5 MCQ C14Lindelwe Nene100% (1)

- Mock Exam Economics Mid Term 2021Document13 pagesMock Exam Economics Mid Term 2021FrancinalanfermanNo ratings yet

- Acma Assignment MaterialDocument12 pagesAcma Assignment MaterialHay Jirenyaa100% (8)

- Accounting For Merchandising Business PDFDocument38 pagesAccounting For Merchandising Business PDFHay Jirenyaa100% (1)

- Chapter 6 - Hedging Foreign Exchange RiskDocument66 pagesChapter 6 - Hedging Foreign Exchange RiskHay JirenyaaNo ratings yet

- MCQ FimDocument13 pagesMCQ FimVIVEK SHARMA100% (3)

- Group AssignmentDocument2 pagesGroup AssignmentibsaashekaNo ratings yet

- Agricultural Project Chapter 4Document73 pagesAgricultural Project Chapter 4Milkessa SeyoumNo ratings yet

- Course Title: DISSERTATION Course Code: MSDS600 Credit Units: Seven Level: PGDocument11 pagesCourse Title: DISSERTATION Course Code: MSDS600 Credit Units: Seven Level: PGAnil Kumar SinghNo ratings yet

- International Economics II Chapter 2Document29 pagesInternational Economics II Chapter 2Härêm ÔdNo ratings yet

- Chapter 05 Test Bank - StaticDocument14 pagesChapter 05 Test Bank - StaticCaioGamaNo ratings yet

- Risk and Return-With Solve-23 PDFDocument26 pagesRisk and Return-With Solve-23 PDFReaz Ahmed Roni100% (1)

- Chapter 3 - Current Liabilities and Ethiopian Payroll SystemDocument42 pagesChapter 3 - Current Liabilities and Ethiopian Payroll SystemMeseret mollaNo ratings yet

- Chapter 3Document100 pagesChapter 3HayamnotNo ratings yet

- Mathematics For Finance To Acfn StudentsDocument46 pagesMathematics For Finance To Acfn Studentsaddiaddisu532No ratings yet

- CH 6 Cost Volume Profit Revised Mar 18Document84 pagesCH 6 Cost Volume Profit Revised Mar 18beccafabbriNo ratings yet

- Mathematics of Finance Exercise and SolutionDocument14 pagesMathematics of Finance Exercise and Solutionfarid rosliNo ratings yet

- Micro Perfect and MonopolyDocument57 pagesMicro Perfect and Monopolytegegn mogessieNo ratings yet

- Topic: Application of Linear and Quadratic FunctionsDocument15 pagesTopic: Application of Linear and Quadratic Functionselizabeth lizNo ratings yet

- EconometricsDocument25 pagesEconometricsLynda Mega SaputryNo ratings yet

- Fa I MidDocument7 pagesFa I MidFãhâd Õró ÂhmédNo ratings yet

- Exam History of Economic ThoughtDocument3 pagesExam History of Economic ThoughtLeonardo VidaNo ratings yet

- FIN203 Tutorial 1 QDocument4 pagesFIN203 Tutorial 1 Q黄于绮100% (1)

- Time: 2 Hours Total Marks: 70Document3 pagesTime: 2 Hours Total Marks: 70Vinod yadavNo ratings yet

- Chapter - 5 Long Term FinancingDocument6 pagesChapter - 5 Long Term FinancingmuzgunniNo ratings yet

- Chapter 5 Inflation TEST BANK 1Document20 pagesChapter 5 Inflation TEST BANK 1Marouani RouaNo ratings yet

- Chapter 3 - Tutorial - With Solutions 2023Document34 pagesChapter 3 - Tutorial - With Solutions 2023Jared Herber100% (1)

- Quiz Money and BankingDocument10 pagesQuiz Money and Bankingibrahim gendiiNo ratings yet

- TVM Practice Questions With AnswersDocument4 pagesTVM Practice Questions With AnswersAhmed NomanNo ratings yet

- Chapter-3: Balance of PaymentsDocument34 pagesChapter-3: Balance of Paymentschanchal22No ratings yet

- Financial Management Mcqs With AnswersDocument53 pagesFinancial Management Mcqs With Answersviveksharma51No ratings yet

- Bond Valuation SolutionsDocument7 pagesBond Valuation SolutionsShubham AggarwalNo ratings yet

- Exercise - Income ApproachDocument1 pageExercise - Income ApproachThùy Linh Vũ NguyễnNo ratings yet

- Chapter 4 Historic Growth and Contemporary Development (Edited)Document11 pagesChapter 4 Historic Growth and Contemporary Development (Edited)kasu50% (2)

- Untitled 6Document17 pagesUntitled 6Ersin TukenmezNo ratings yet

- Macroeconomics Money Market MCQsDocument3 pagesMacroeconomics Money Market MCQsTan NguyenNo ratings yet

- Meyad DiribaDocument86 pagesMeyad Diribatech storeNo ratings yet

- Chapter 4 - Time Value of MoneyDocument5 pagesChapter 4 - Time Value of MoneyLayla MainNo ratings yet

- Worksheet For Mathematics For ManagementDocument3 pagesWorksheet For Mathematics For Managementabel shimeles100% (1)

- Chapter Two: Banking SystemDocument45 pagesChapter Two: Banking Systemዝምታ ተሻለNo ratings yet

- Application QuestionsDocument8 pagesApplication QuestionsAbdelnasir HaiderNo ratings yet

- TB 18Document30 pagesTB 18mzh1992No ratings yet

- Chapter 13 Saving, Investment, and The Financial SystemDocument3 pagesChapter 13 Saving, Investment, and The Financial SystemPhuong Vy PhamNo ratings yet

- Unemployment (Multiple Choice Questions)Document16 pagesUnemployment (Multiple Choice Questions)NickNo ratings yet

- International Trade Assignment # 01Document4 pagesInternational Trade Assignment # 01ArifaNo ratings yet

- E SRKRPORTALuploadsSyllabus ModelPapersModel R17 B.tech MECH 69Document33 pagesE SRKRPORTALuploadsSyllabus ModelPapersModel R17 B.tech MECH 69prasadNo ratings yet

- Liquidity Trap - Handout To StudentsDocument3 pagesLiquidity Trap - Handout To StudentsHau89No ratings yet

- Reserve Requirement/Deposit Expansion AND BANK BALANCE SHEET PRACTICE Questions - Show Your Work and Answer in The Space ProvidedDocument6 pagesReserve Requirement/Deposit Expansion AND BANK BALANCE SHEET PRACTICE Questions - Show Your Work and Answer in The Space ProvidedRingle JobNo ratings yet

- Finance 16UCF519-FINANCIAL-MANAGEMENTDocument23 pagesFinance 16UCF519-FINANCIAL-MANAGEMENTHuzaifa Aman AzizNo ratings yet

- AdmasDocument170 pagesAdmasHMichael AbeNo ratings yet

- International Economics II - Chapter 3Document75 pagesInternational Economics II - Chapter 3seid sufiyanNo ratings yet

- Range For The Coefficients of Basic Decision VariablesDocument5 pagesRange For The Coefficients of Basic Decision Variablessami damtew0% (1)

- Chapter 3-Evaluation of Financial Performance: Multiple ChoiceDocument23 pagesChapter 3-Evaluation of Financial Performance: Multiple ChoiceKyla Ramos DiamsayNo ratings yet

- Management Accounting Group Assignmemt (Group 2) Msc. Accounting and Finance Sunyani Study CenyerDocument5 pagesManagement Accounting Group Assignmemt (Group 2) Msc. Accounting and Finance Sunyani Study CenyerBrow SimonNo ratings yet

- Chapter 1 and 2 Mcqs EconometricsDocument10 pagesChapter 1 and 2 Mcqs EconometricsMujahid AliNo ratings yet

- Chapter 11: The International Monetary System: True / False QuestionsDocument45 pagesChapter 11: The International Monetary System: True / False QuestionsQuốc PhúNo ratings yet

- Money Supply and Money Demand: AcroeconomicsDocument42 pagesMoney Supply and Money Demand: AcroeconomicsAda Nama 'Mawardy'No ratings yet

- Money Supply Money Demand, and Inflation: Textbook: Mankiw Chapter 4Document43 pagesMoney Supply Money Demand, and Inflation: Textbook: Mankiw Chapter 4PriyankaNo ratings yet

- Chapter 19 - Money Supply, Money Demand, and The Banking SystemDocument47 pagesChapter 19 - Money Supply, Money Demand, and The Banking SystemClaudioModoloNo ratings yet

- Money and Money Demand: in This Chapter, You Will LearnDocument24 pagesMoney and Money Demand: in This Chapter, You Will LearnK.m.khizir AhmedNo ratings yet

- Chapter 3 - Money Supply and Money DemandDocument37 pagesChapter 3 - Money Supply and Money DemandJamalNo ratings yet

- Commercial BanksDocument35 pagesCommercial Banksmohitvyas972No ratings yet

- Bank Instruments & Accounts Management: Detecting & Preventing Fraud: With Case Law, Tutorial Notes, Questions & AnswersFrom EverandBank Instruments & Accounts Management: Detecting & Preventing Fraud: With Case Law, Tutorial Notes, Questions & AnswersNo ratings yet

- Determinants of Tax Revenue Efforts in Developing Countries: Abhijit Sen GuptaDocument41 pagesDeterminants of Tax Revenue Efforts in Developing Countries: Abhijit Sen GuptaHay JirenyaaNo ratings yet

- Principle MaterialDocument35 pagesPrinciple MaterialHay JirenyaaNo ratings yet

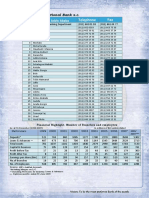

- No Telephone Fax: Branches in Addis AbabaDocument35 pagesNo Telephone Fax: Branches in Addis AbabaHay Jirenyaa100% (1)

- 2016 2017 PDFDocument44 pages2016 2017 PDFHay Jirenyaa100% (1)

- Ahmaric Annual ReportDocument23 pagesAhmaric Annual ReportHay JirenyaaNo ratings yet

- Comm - Ica Asa510 App1ill1Document3 pagesComm - Ica Asa510 App1ill1Hay JirenyaaNo ratings yet

- 2016 2017 PDFDocument44 pages2016 2017 PDFHay Jirenyaa100% (1)

- Auditors Report: Financial Result 2005-2006Document11 pagesAuditors Report: Financial Result 2005-2006Hay JirenyaaNo ratings yet

- Auditors Report: Financial Result 2005-2006Document11 pagesAuditors Report: Financial Result 2005-2006Hay JirenyaaNo ratings yet

- Chapter 4 SlidesDocument66 pagesChapter 4 SlidesHay Jirenyaa100% (1)

- Article ReviewDocument2 pagesArticle ReviewHay Jirenyaa86% (37)

- Chapter FourDocument88 pagesChapter FourHay Jirenyaa100% (3)

- Accounting Information Systems: AnDocument333 pagesAccounting Information Systems: AnHay JirenyaaNo ratings yet

- MD 2CDocument34 pagesMD 2CIbraheem KhressNo ratings yet

- Example of An Engagement LetterDocument3 pagesExample of An Engagement LettermaryxtelNo ratings yet

- Chapter 3 SlidesDocument43 pagesChapter 3 SlidesHay JirenyaaNo ratings yet

- Overview of Business ProcessesDocument68 pagesOverview of Business ProcessesHay JirenyaaNo ratings yet

- AIS Best Teaching MaterialDocument121 pagesAIS Best Teaching MaterialHay Jirenyaa100% (1)

- Chapter 5 - Foriegn Exchange MarketDocument67 pagesChapter 5 - Foriegn Exchange MarketHay Jirenyaa100% (1)

- Continuous Auditing in Internal Audit PDFDocument15 pagesContinuous Auditing in Internal Audit PDFHay Jirenyaa0% (1)

- Chapter 7 SlidesDocument31 pagesChapter 7 SlidesHay JirenyaaNo ratings yet

- Chapter 4 - Foriegn Direct Investment and Balance of PaymentDocument48 pagesChapter 4 - Foriegn Direct Investment and Balance of PaymentHay JirenyaaNo ratings yet

- Chapter 1-IBF IntroductionDocument61 pagesChapter 1-IBF IntroductionHay JirenyaaNo ratings yet

- Chapter 1-IBF IntroductionDocument61 pagesChapter 1-IBF IntroductionHay JirenyaaNo ratings yet

- Chapter 2-The International Monetary SystemDocument52 pagesChapter 2-The International Monetary SystemHay Jirenyaa100% (1)

- Chapter 3 - International TradeDocument70 pagesChapter 3 - International TradeHay JirenyaaNo ratings yet

- Tax Digest Part3Document6 pagesTax Digest Part3bcarNo ratings yet

- Vasavi Urban OldDocument13 pagesVasavi Urban OldSagar WayakoleNo ratings yet

- Income Tax Ordinance, 2001Document21 pagesIncome Tax Ordinance, 2001Shah ShaikhNo ratings yet

- Global Equities - Balancing Home Bias and DiversificationDocument4 pagesGlobal Equities - Balancing Home Bias and DiversificationjennaNo ratings yet

- 2023-08-17 St. Mary's County TimesDocument32 pages2023-08-17 St. Mary's County TimesSouthern Maryland OnlineNo ratings yet

- Stoploss Brochure enDocument1 pageStoploss Brochure envolvoproNo ratings yet

- Accountancy & Financial ManagementDocument12 pagesAccountancy & Financial ManagementNitin FardeNo ratings yet

- Accounting Theory Project 1 - MayaDocument18 pagesAccounting Theory Project 1 - MayaDima AbdulhayNo ratings yet

- Designation of Beneficiary: ImportantDocument3 pagesDesignation of Beneficiary: ImportantJeremy KissellNo ratings yet

- Grayscale Investor Deck Nov21 RevDocument36 pagesGrayscale Investor Deck Nov21 RevcrescenawanNo ratings yet

- Importance of Annual BudgetDocument10 pagesImportance of Annual BudgetNwigwe Promise ChukwuebukaNo ratings yet

- Financial Loan Application Form: Organization Name DNT PowerDocument5 pagesFinancial Loan Application Form: Organization Name DNT PowersanjayNo ratings yet

- TIP Letter To ParentsDocument3 pagesTIP Letter To ParentsncossNo ratings yet

- Afar Hedging Ja With AnswersDocument3 pagesAfar Hedging Ja With AnswersShigure KousakaNo ratings yet

- Dps 103 Basic Financial Accounting PDFDocument129 pagesDps 103 Basic Financial Accounting PDFlizzy mandenda100% (1)

- Metrobank V Judge DigestDocument1 pageMetrobank V Judge DigestMara Corteza San PedroNo ratings yet

- Implementing Ifrs For Smes Challenges For DevelopingDocument21 pagesImplementing Ifrs For Smes Challenges For DevelopingHanna Maria Scriftura SinagaNo ratings yet

- ADV2 Chapter12 QADocument4 pagesADV2 Chapter12 QAMa Alyssa DelmiguezNo ratings yet

- Plaintiffs' Amended Complaint-Martin SchuermannDocument25 pagesPlaintiffs' Amended Complaint-Martin SchuermannSYCR ServiceNo ratings yet

- AC3102 Jan2018 Seminar 2 Two Acquisition Method FRS103 LKW 11january2018Document30 pagesAC3102 Jan2018 Seminar 2 Two Acquisition Method FRS103 LKW 11january2018Shawn TayNo ratings yet

- Implementing Strategies: Marketing, Finance/Accounting, R&D, and MIS IssuesDocument44 pagesImplementing Strategies: Marketing, Finance/Accounting, R&D, and MIS IssuesairwanNo ratings yet

- Garrett Motion Chapter 11 Statement of Fees and Out-Of-pocket Expenses of Perella Weinberg Partners LPDocument39 pagesGarrett Motion Chapter 11 Statement of Fees and Out-Of-pocket Expenses of Perella Weinberg Partners LPKirk HartleyNo ratings yet

- FAR1 ASN02 Financial Transaction WorksheetDocument2 pagesFAR1 ASN02 Financial Transaction WorksheetPatricia Camille AustriaNo ratings yet

- Financial Management I Ch3Document8 pagesFinancial Management I Ch3bikilahussenNo ratings yet

- Roles and Functions of A Provincial Board MemberDocument4 pagesRoles and Functions of A Provincial Board MemberKay AvilesNo ratings yet

- Group 1 (Corpo)Document8 pagesGroup 1 (Corpo)MaanNo ratings yet

- Scaling Up Community-DrivenDocument43 pagesScaling Up Community-DrivenJonah R. MeranoNo ratings yet

- FX Risk MGT PDFDocument29 pagesFX Risk MGT PDFkuttan1000No ratings yet