Professional Documents

Culture Documents

Directors

Directors

Uploaded by

shekharmvm0 ratings0% found this document useful (0 votes)

253 views17 pagesThe document discusses the definition, appointment, powers, duties and removal of company directors under Indian law. It provides details on:

- Directors must be individuals and every company must have a minimum number of directors based on its type.

- Directors can be appointed by shareholders, to fill casual vacancies, as additional directors temporarily, or nominated by third parties like debenture holders.

- Powers of the board include general powers, powers exercised through board resolutions like borrowing, and powers requiring shareholder approval like selling major assets.

- Duties of directors include fiduciary duties to act in good faith and in the company's best interests. Directors can be removed by shareholders or the central government under certain

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the definition, appointment, powers, duties and removal of company directors under Indian law. It provides details on:

- Directors must be individuals and every company must have a minimum number of directors based on its type.

- Directors can be appointed by shareholders, to fill casual vacancies, as additional directors temporarily, or nominated by third parties like debenture holders.

- Powers of the board include general powers, powers exercised through board resolutions like borrowing, and powers requiring shareholder approval like selling major assets.

- Duties of directors include fiduciary duties to act in good faith and in the company's best interests. Directors can be removed by shareholders or the central government under certain

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

253 views17 pagesDirectors

Directors

Uploaded by

shekharmvmThe document discusses the definition, appointment, powers, duties and removal of company directors under Indian law. It provides details on:

- Directors must be individuals and every company must have a minimum number of directors based on its type.

- Directors can be appointed by shareholders, to fill casual vacancies, as additional directors temporarily, or nominated by third parties like debenture holders.

- Powers of the board include general powers, powers exercised through board resolutions like borrowing, and powers requiring shareholder approval like selling major assets.

- Duties of directors include fiduciary duties to act in good faith and in the company's best interests. Directors can be removed by shareholders or the central government under certain

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 17

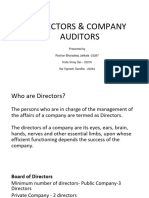

Directors

‘Director’ includes any person occupying the position

of director,

A person having control over the direction, conduct,

management of the affairs of a company. Any person

in accordance with whose directions or instructions,

the Board of a company is accustomed to act, is

deemed to be a director of the company.

Only individuals can be directors

Number of directors

Every public company have at least 3 directors

Every other company have at least 2 directors.

A public company having-

(a) A paid-up capital of Rs. 5 crore or more;

(b) One thousand or more small shareholders;

shall have at least one director elected by such small

shareholders

Sanction by the central government. Where the

increase in number does not make the total number

of directors more than 12, no approval of the central

government is Needed.

APPOINTMENT OF DIRECTORS

1. First directors.

(a) The articles of a company usually name the first

directors by their respective names or prescribe the

method of appointing them.

(b) If the first directors are not named shall be

determined in writing by the subscribers of the

memorandum.

(c) If the first directors are not appointed in the above

manner, the subscribers become directors of the

company.

2. Appointment of directors by the company

Directors must be appointed by shareholders in

general meeting. In the case of a public company or

a subsidiary of a public company, at least 1/3rds of

the total number of directors shall be liable to retire

by rotation.

Ascertainment of directors retiring by rotation and filling

of vacancies

(1) At the annual general meeting of a public company

or 1/3rd (or the number nearest to 1/3rd) of the

rotational directors shall retire from office.

(2) The directors to retire by rotation at every annual

general meeting shall be those who have been

longest in the office since their last appointment.

(3) At the annual general meeting the company may fill

up the vacancy by appointing the retiring director or

some other person.

(4) If at the meeting the place of retiring director is not

filled up, nor is there a resolution not to fill the

vacancy, the retiring director shall be deemed to

have been re-appointed at the adjourned meeting.

3. Appointment of directors by directors.

The directors of a company may appoint directors-

(1) As additional directors. Any additional directors

appointed by the directors shall hold office only up

to the date of the next annual general meeting of the

company.

(2) In a casual vacancy.

If the office of any director appointed by the

company in general meeting is vacated before his

term of office expires in the normal course, the

resulting casual vacancy may be filled by the Board

of directors at a meeting of the Board.

(3) As alternate director.

An alternate director can be appointed by the board

if it is so authorised by

(i) The articles of the company, or

(ii) A resolution passed by the company in the general

meeting.

He shall act for a director, called ‘the original

director’ during his absence for a period of at least 3

months from the state in which Board meetings are

ordinarily held.

4. Appointment of directors by third parties.

The debenture-holders or other, creditors, e.g., a

banking company or financial corporation, who

have advanced loans to the company to appoint

their nominees to the Board.

The number of directors so appointed shall not

exceed 1/3rd of the total number of directors, and

they are not liable to retire by rotation.

5. Appointment by proportional representation.

6. Appointment of directors by the central

government. The purpose of the appointment is to

prevent the affairs of the company from being

conducted either in the manner-

(a) Which is oppressive to any members of the company

; or

(b) Which is prejudicial to the interests of the company

or to public interest.

The tribunal may pass the above order on a

reference made to it by the central Government or

on the application-

(i) Of not less than 100 members of the company, or

(ii) Of members of the company holding not less than

1/10th of the total voting power.

POSITION OF DIRECTORS

(1) Directors as agents.

A company, as an artifical person, acts through

directors who are elected representatives of the

shareholders.

They are, in the eyes of the law, agents of the

company for which they act,

(2) Directors as employees.

(3) Directors as officers. The directors are treated as

officers of the company. As such they are liable to

certain penalties if the provisions of the companies

act are not strictly complied with.

(4) Directors as trustees. Directors are treated as

trustees-

• Of the company’s money and property ; and

• Of the powers entrusted to them.

Removal of directors

Directors may be removed by-

1. Shareholders : The shareholders may remove a

director before the expiry of his period of office by

passing an ordinary resolution. This does not

(a) Apply to the case of a director appointed by the

Central Government

(b) authorise, in the case of a private company, removal

of a director holding office for life on April 1, 1952

(c) Apply to the case of a company which has adopted

the system of electing 2/3rds of its directors by the

principle of proportional representation.

2. Central Government. The central government may,

in certain circumstances, remove managerial

personnel from office on the recommendation of the

tribunal.

(a) Any person concerned has been guilty of fraud,

persistent negligence or default in carrying out his

obligations and functions under the law, or breach

of trust ; or

(b) The business of the company has not been

conducted and managed by such person in

accordance with sound business principles

(c) The company is or has been conducted and

managed by the person concerned in a manner

which is likely to cause, or has caused, serious

injury or damage to the interest of the trade,

(d) The business of the company is or has been

conducted and managed by the person concerned

with intent to defraud its creditors, members or

any other person

The person against whom a case is presented shall be

joined as a respondent to the application.

3. Removal by tribunal. where, on an application to

the tribunal for prevention of oppression or

mismanagement the tribunal finds that the relief

ought to be granted, it may terminate, set aside or

modify any agreement between the company and the

managing director or any other director or the

manager.

POWERS OF DIRECTORS

I. General powers to the Board

(1) The Board shall not do any act which is to be done

by the company in general meeting.

(2) The board shall exercise its powers subject to the

provisions , contained in the Companies Act, or in

the Memorandum or the Articles of the company in

general meeting.

II. Powers to be exercised at Board meetings

Directors of a company shall exercise the following

powers by means of resolutions passed at the

meetings of the Board, the power to-

(a) Make calls on shareholders in respect of money

unpaid on their shares:

(b) Issue debentures ;

(c) Borrow moneys otherwise than on debentures (say

through public deposits) ;

(b) Invest the funds of the company ; and

(c) Make loans.

III. Powers to be exercised with the approval of

company in general meeting

The board of directors shall exercise the following

powers only with the consent of the company in

general meeting :

(a) To sell, lease or otherwise dispose of (say under

amalgamation scheme the whole, or substantially

the whole, of the undertaking of the company.)

(b) To remit or give time for repayment of any debt

due to the company by a director except in the

case of renewal or continuance of an advance made

by a banking company to its director in the ordinary

course of business.

(c) To invest (excluding trust securities) the amount

of compensation received by the company in

respect of the compulsory acquisition of any

undertaking or property of the company.

(d) To borrow moneys where the moneys to be

borrowed are more than the paid-up capital of

the company and its free reserves

(e) To contribute to charitable and other funds not

directly relating to the business of the company or

the welfare of its employees, amounts exceeding in

any financial year Rs. 50,000 or 5 per cent of the

average net profits of the three preceding financial

years, whichever is greater.

IV. Political contributions. Sec. 293-a allows

companies to make contributions to political

purposes to any person, directly or indirectly out of

their profits.

Sec. 293-a however prohibits political

contributions

(a) Government companies and

(b) Companies which have been in existence for less

than 3 financial years.

Any other company may contribute any amount or

amounts, directly or indirectly,

(a) To any political party, or

(b) For any political purpose to any person. This is

however subject to the following conditions :

1. The amount shall not exceed 5 per cent of its

average net profits during the three immediately

preceding financial years.

2. The company shall disclose in its profit and loss

account the amount or amounts giving

(a) Particulars of the total amount contributed, and

(b) The name of the party or person to which or to

whom such amount has been contributed.

DUTIES OF DIRECTORS

1. Fiduciary duties, and

The directors must-

(a) Exercise their powers honestly and bona fide for the

benefit of the company as a whole ;and

(b) Not place themselves in a position in which there is

a conflict between their duties to the company and

their personal interests. They must not make any

secret profit out of their position.

2. Duties of care, skill and diligence.

Directors should carry out their duties with

reasonable care and exercise such degree of skill

and diligence as is reasonably expected of persons of

their knowledge and status.

Standard of care. There are various standards of the care

depending upon :

(a) The type and nature of work ;

(b) Division of powers between directors and other

officers ;

(c) General usages and customs in that of business ;

and

(d) Whether directors work gratutiously or

remuneratively.

Other duties of directors.

(1) To attend Board meetings.

(2) Not to delegate his functions except to the extent

authorised by the Act or the constitution of the

company, and

(3) To disclose his interest.

You might also like

- FSP 150cc-Ge11x r6.1 Cli Reference GuideDocument1,578 pagesFSP 150cc-Ge11x r6.1 Cli Reference GuideWill Beach100% (4)

- Deed of Agreement SampleDocument3 pagesDeed of Agreement SampleMonzurul HaqueNo ratings yet

- Board CharterDocument9 pagesBoard CharterPriya Sharma100% (1)

- Module - 4 Company Management and AdministrationDocument59 pagesModule - 4 Company Management and Administrationkavitagothe100% (1)

- 01 Delsan Transport Lines, Inc. vs. C& A Construction (Tan)Document3 pages01 Delsan Transport Lines, Inc. vs. C& A Construction (Tan)Rudejane Tan100% (1)

- Antonio V Desierto (Lee)Document2 pagesAntonio V Desierto (Lee)Karina GarciaNo ratings yet

- Draft Share Pledge AgreementDocument10 pagesDraft Share Pledge AgreementMuneeb Ahmed ShiekhNo ratings yet

- Corporate Law DirectorsDocument19 pagesCorporate Law DirectorsAdityakondawar575No ratings yet

- Directors Company LawDocument8 pagesDirectors Company LawChicIshuNo ratings yet

- CG05 - Role of Directors and The BoardDocument51 pagesCG05 - Role of Directors and The BoardSandeep KumarNo ratings yet

- APPOINTMENT & REMOVAL OF DIRECTIORS (L.a.b.)Document9 pagesAPPOINTMENT & REMOVAL OF DIRECTIORS (L.a.b.)Piyu SolNo ratings yet

- Managerial PersonnelDocument31 pagesManagerial PersonnelpoonamNo ratings yet

- Chapter 2 - Directors: Company LawDocument27 pagesChapter 2 - Directors: Company LawKhyati SethNo ratings yet

- Company Law-IV Members, Directors, Meetings, &winding UpDocument9 pagesCompany Law-IV Members, Directors, Meetings, &winding UpJoel FdezNo ratings yet

- Unit 3&4Document11 pagesUnit 3&4chethanraaz_66574068No ratings yet

- Appointment and Qualifications of DirectorsDocument44 pagesAppointment and Qualifications of DirectorsDrRupali GuptaNo ratings yet

- On Directors Rights and Duties or LiabilitiesDocument19 pagesOn Directors Rights and Duties or LiabilitiesSachin Saxena89% (9)

- Law PPT (Director Companies Act)Document24 pagesLaw PPT (Director Companies Act)rohit vermaNo ratings yet

- Powers and Duties of The BoardDocument3 pagesPowers and Duties of The BoardSakshiNo ratings yet

- Powers, Duties & Liabilities of Board of Directors of A Company in IndiaDocument18 pagesPowers, Duties & Liabilities of Board of Directors of A Company in IndiaTanweer Ashraf50% (2)

- 1Document9 pages1MANISH KUMARNo ratings yet

- Director Mod 4Document5 pagesDirector Mod 4Sakshi SinghNo ratings yet

- Powers: Powers, Duties & Liabilities of Board of Directors of A Company in IndiaDocument7 pagesPowers: Powers, Duties & Liabilities of Board of Directors of A Company in IndiaVinay SinghNo ratings yet

- Management of CompanyDocument21 pagesManagement of CompanyRaoneRajaNo ratings yet

- DirectorsDocument7 pagesDirectorsSamkitNo ratings yet

- Part V The Companies Act, 2013: Management, Meetings and Winding Up of CompanyDocument37 pagesPart V The Companies Act, 2013: Management, Meetings and Winding Up of CompanyAbhishekNo ratings yet

- The Companies (Amendment) Act, 1956: Definition of A CompanyDocument6 pagesThe Companies (Amendment) Act, 1956: Definition of A CompanyAnamika JosephNo ratings yet

- Paper3 25236Document19 pagesPaper3 25236naytik jainNo ratings yet

- Doctrine of Indoor ManagementDocument7 pagesDoctrine of Indoor ManagementSahil SharmaNo ratings yet

- Board of Directors - A Powerful Instrument in GovernanceDocument27 pagesBoard of Directors - A Powerful Instrument in GovernancesweetrozzNo ratings yet

- AAL Nomination and Remuneration PolicyDocument10 pagesAAL Nomination and Remuneration PolicyTeja MopideviNo ratings yet

- Lecture 6 Companies Act 2017 PDFDocument10 pagesLecture 6 Companies Act 2017 PDFAnonymous 6Ft0y15tNo ratings yet

- Unit 3-Corporate Law & AdministrationDocument85 pagesUnit 3-Corporate Law & AdministrationRachana AyyappaNo ratings yet

- Board of Directors Officer and Rights of The CorporationDocument10 pagesBoard of Directors Officer and Rights of The CorporationAce LimpinNo ratings yet

- Law NotesDocument22 pagesLaw NotesRatnadeep KarNo ratings yet

- Directors, Meetings, Winding Up, Statutory Bodies, CSR, ReconstructionDocument42 pagesDirectors, Meetings, Winding Up, Statutory Bodies, CSR, ReconstructionHELI SHAHNo ratings yet

- Power of BoardDocument14 pagesPower of BoardShivam saketNo ratings yet

- Mod 2 CGDocument16 pagesMod 2 CGNeha MakeoversNo ratings yet

- Board of Directors: A Powerful Instrument in GovernanceDocument27 pagesBoard of Directors: A Powerful Instrument in GovernanceAbdul wahabNo ratings yet

- Unit III Company ManagementDocument9 pagesUnit III Company ManagementE01212501-PRAKASH KUMAR T DEPT OF PURE COMMERCENo ratings yet

- Republic Act No. 3591 Philippine Deposit Insurance CorporationDocument42 pagesRepublic Act No. 3591 Philippine Deposit Insurance CorporationJomer FernandezNo ratings yet

- Buslaw 2Document5 pagesBuslaw 2Rose Jean Raniel OropaNo ratings yet

- Board of Directors - A Powerful Instrument in GovernanceDocument71 pagesBoard of Directors - A Powerful Instrument in GovernanceMadiha Riaz Bhatti100% (1)

- Company ManagementDocument68 pagesCompany ManagementLatha Dona VenkatesanNo ratings yet

- Unit 4Document18 pagesUnit 4kush mandaliaNo ratings yet

- Unit IvDocument5 pagesUnit IvJ.SreenivasanNo ratings yet

- Notification: The Conditions: 1. Board of Directors: 1.1 Board's SizeDocument17 pagesNotification: The Conditions: 1. Board of Directors: 1.1 Board's SizeMegh AhmedNo ratings yet

- Directors and Key Managerial Personnel: DR Anil KumarDocument26 pagesDirectors and Key Managerial Personnel: DR Anil KumarrajneeshkarloopiaNo ratings yet

- Company Law NotesDocument6 pagesCompany Law NotesPriyatham GuntupalliNo ratings yet

- Board of Directors: Minimum/Maximum Number of Directors in A Company (Section 149 (1) )Document7 pagesBoard of Directors: Minimum/Maximum Number of Directors in A Company (Section 149 (1) )androos achayanNo ratings yet

- Duties of Directors and Winding UpDocument22 pagesDuties of Directors and Winding UpKanishk GuptaNo ratings yet

- Directors:: Appointment, Roles and RemunerationDocument49 pagesDirectors:: Appointment, Roles and RemunerationParthapratim DebnathNo ratings yet

- Project NehaDocument8 pagesProject NehaDivya SamotaNo ratings yet

- Directors of A CompanyDocument29 pagesDirectors of A CompanyGagan Sai Chandra Bose0% (1)

- DirectorsDocument70 pagesDirectorsRoshan BharadwajNo ratings yet

- The Powers of BoardDocument28 pagesThe Powers of BoardMuhammad AbdullahNo ratings yet

- RFBT 2 Corporations Module 1 Lesson 3Document6 pagesRFBT 2 Corporations Module 1 Lesson 3Gabriel Trinidad SonielNo ratings yet

- Company LawDocument4 pagesCompany LawSakibul Islam SifatNo ratings yet

- Unit 3 CLCGDocument13 pagesUnit 3 CLCGaryan manjunathaNo ratings yet

- Auditing&Assurance LL (Lesson2)Document13 pagesAuditing&Assurance LL (Lesson2)BRIAN KORIRNo ratings yet

- Company Unit-2Document6 pagesCompany Unit-2thehackerdude09No ratings yet

- LLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCFrom EverandLLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCNo ratings yet

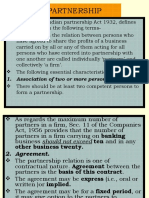

- Partnership: 1. Association of Two or More PersonsDocument4 pagesPartnership: 1. Association of Two or More PersonsshekharmvmNo ratings yet

- Delivery." Which A Right Is Created in Favour of Some Person."Document5 pagesDelivery." Which A Right Is Created in Favour of Some Person."shekharmvmNo ratings yet

- Incoming and Outgoing PartnersDocument4 pagesIncoming and Outgoing PartnersshekharmvmNo ratings yet

- Conditions and WarrantiesDocument13 pagesConditions and WarrantiesshekharmvmNo ratings yet

- Doctrine of Caveat EmptorDocument3 pagesDoctrine of Caveat Emptorshekharmvm80% (5)

- Dissolution of Partnership FirmDocument5 pagesDissolution of Partnership Firmshekharmvm100% (2)

- Cheque: Two Additional Qualifications, Viz.Document15 pagesCheque: Two Additional Qualifications, Viz.shekharmvmNo ratings yet

- Bill of ExchangeDocument2 pagesBill of Exchangeshekharmvm100% (1)

- Supreme Transliner, Inc. vs. BPI Family Savings Bank, Inc.Document19 pagesSupreme Transliner, Inc. vs. BPI Family Savings Bank, Inc.gryffindorkNo ratings yet

- LOKIN, JR. vs. COMMISSION ON ELECTIONSDocument2 pagesLOKIN, JR. vs. COMMISSION ON ELECTIONSAreeNo ratings yet

- Unit 2, Section 2: Residential Block & Estate Management © ARLA, ARHM, ARMA, ASSET SKILLS, CIH, NAEA, RICSDocument11 pagesUnit 2, Section 2: Residential Block & Estate Management © ARLA, ARHM, ARMA, ASSET SKILLS, CIH, NAEA, RICSFranciska HeystekNo ratings yet

- Web Development AgreementDocument3 pagesWeb Development AgreementRocketLawyer100% (2)

- CPC CaseDocument4 pagesCPC CaseNidhi RaiNo ratings yet

- GSIS-vs.-CADocument4 pagesGSIS-vs.-CAhoney samaniego100% (1)

- Shinryo Vs RNN Inc.Document5 pagesShinryo Vs RNN Inc.Lemuel Lagasca Razalan IVNo ratings yet

- Taylor v. ThomasDocument21 pagesTaylor v. ThomaspropertyintangibleNo ratings yet

- Claridades v. MercaderDocument3 pagesClaridades v. MercaderClement del RosarioNo ratings yet

- Asia Brewery, Inc Vs CA and SMCDocument17 pagesAsia Brewery, Inc Vs CA and SMCNeNe Dela LLanaNo ratings yet

- De Barretto vs. Villanueva 1 Scra 289Document15 pagesDe Barretto vs. Villanueva 1 Scra 289Quennie Jane SaplagioNo ratings yet

- Cy Prés Comme Possible and The University Museum: Dana Elizabeth RowlandDocument18 pagesCy Prés Comme Possible and The University Museum: Dana Elizabeth RowlandderowlandNo ratings yet

- 195Document3 pages195EngrBhaiNo ratings yet

- Heirs of Sandueta v. RoblesDocument3 pagesHeirs of Sandueta v. RoblesPaul Joshua SubaNo ratings yet

- Rule 112-Preliminary InvestigationDocument17 pagesRule 112-Preliminary InvestigationNEWBIENo ratings yet

- People v. CayatDocument2 pagesPeople v. CayatRon AceNo ratings yet

- Chapter 18 Fraud ExaminationDocument3 pagesChapter 18 Fraud ExaminationDiana Mindru StrenerNo ratings yet

- 1 Obligations and Contracts PDFDocument112 pages1 Obligations and Contracts PDFaaaNo ratings yet

- Practical - PRINTDocument21 pagesPractical - PRINTJam Yap PagsuyoinNo ratings yet

- Chua V TorresDocument4 pagesChua V TorresDhin CaragNo ratings yet

- LABREL Recit Notes 1Document39 pagesLABREL Recit Notes 1Hazel SantosNo ratings yet

- Persons - M112 Silva V CADocument1 pagePersons - M112 Silva V CAYu BabylanNo ratings yet

- Rana v. Gonzales, 10th Cir. (2006)Document18 pagesRana v. Gonzales, 10th Cir. (2006)Scribd Government DocsNo ratings yet

- Indian Contract Act 1872 Important Case Laws EnglishDocument10 pagesIndian Contract Act 1872 Important Case Laws Englishsudharsana kumarNo ratings yet

- Agreement To Sell With ComponentsDocument2 pagesAgreement To Sell With ComponentsraiyhaNo ratings yet