Professional Documents

Culture Documents

Institute of Management and Information Techonology

Institute of Management and Information Techonology

Uploaded by

Prakash Acharya0 ratings0% found this document useful (0 votes)

192 views18 pagesThe document analyzes the financial position of OSCB Ltd. over several years through ratio analysis of annual reports and financial statements. It calculates liquidity, leverage, profitability, and other ratios to evaluate the bank's ability to meet current obligations, manage debt levels, and generate returns. While some ratios like current ratio, ROCE, and EPS show improving financial strength over time, other ratios relating to solvency, debt, and assets remain high and not satisfactory. Overall, ratio analysis provides an understanding of the bank's financial position but also indicates areas needing further improvement.

Original Description:

ratio analyis of oscb

submitted to bput

Original Title

Ratio Analysis

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document analyzes the financial position of OSCB Ltd. over several years through ratio analysis of annual reports and financial statements. It calculates liquidity, leverage, profitability, and other ratios to evaluate the bank's ability to meet current obligations, manage debt levels, and generate returns. While some ratios like current ratio, ROCE, and EPS show improving financial strength over time, other ratios relating to solvency, debt, and assets remain high and not satisfactory. Overall, ratio analysis provides an understanding of the bank's financial position but also indicates areas needing further improvement.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

192 views18 pagesInstitute of Management and Information Techonology

Institute of Management and Information Techonology

Uploaded by

Prakash AcharyaThe document analyzes the financial position of OSCB Ltd. over several years through ratio analysis of annual reports and financial statements. It calculates liquidity, leverage, profitability, and other ratios to evaluate the bank's ability to meet current obligations, manage debt levels, and generate returns. While some ratios like current ratio, ROCE, and EPS show improving financial strength over time, other ratios relating to solvency, debt, and assets remain high and not satisfactory. Overall, ratio analysis provides an understanding of the bank's financial position but also indicates areas needing further improvement.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

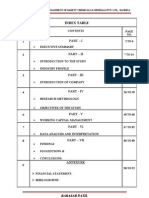

You are on page 1of 18

INSTITUTE OF MANAGEMENT AND INFORMATION TECHONOLOGY

INSTITUTE OF MANAGEMENT AND INFORMATION TECHONOLOGY

To know the financial position of the OSCB Ltd.

To know strength of bank to fulfill its current

obligation or not .

Find out strength and weakness of the OSCB Ltd.

To know the overall profitability of O.S.C.B. Ltd.

Know the liquidity position of OSCB Ltd.

Know the long term solvency of OSCB Ltd.

INSTITUTE OF MANAGEMENT AND INFORMATION TECHONOLOGY

Time factor plays a vital role. The study was

conducted with in 8 weeks.

Due to heavy burden of work getting information

from staff was not possible.

The bank may or may not show true financial

result in annual report.

The data provided by the organization was not up

to date.

Despite of certain limitations, efforts has

been taken to make the project report scientific

and reliable one as far as possible.

INSTITUTE OF MANAGEMENT AND INFORMATION TECHONOLOGY

The whole of my study is based on secondary data of

OSCB Ltd. I have not taken any primary data for my

study because it is not suitable for our study. I have

taken the following secondary data –

Annual report of OSCB Ltd.

Balance sheet of OSCB Ltd.

Profit & Loss account of OSCB Ltd.

Annual audit report of OSCB Ltd.

Development action plan of OSCB Ltd.

INSTITUTE OF MANAGEMENT AND INFORMATION TECHONOLOGY

Liquidity Ratio:

• Current ratio

• Absolute Liquid Ratio

Leverage Ratio:

• Debt-equity Ratio.

• Solvency Ratio.

• Debt Assets Ratio.

• Fixed Asset to Current Asset Ratio

Profitability Ratio:

• Return on capital employed.

• Return on equity capital

• Earning per share.

INSTITUTE OF MANAGEMENT AND INFORMATION TECHONOLOGY

In the convention of current ratio, the minimum of 2:1 is referred as good to a

rule of Thumb. So current ratio of OSCB in the year 2002-03, 03-04, 04-05 is

not satisfactory and 2005-06, 06-07, 07-08 is satisfactory. Which mean

current financial position is satisfactory.

INSTITUTE OF MANAGEMENT AND INFORMATION TECHONOLOGY

The standard norm of absolute liquate ratio is 0.5:1 .In case of OSCB in

the year 2002-03, 03-04, 04-05, 05-06,06-07 is not satisfactory and 2007-

08 is satisfactory. Which mean it fulfill it’s current obligation.

INSTITUTE OF MANAGEMENT AND INFORMATION TECHONOLOGY

In OSCB the outsider fund has increased from 2002-2006 which states that the claim of

outsider is greater than those of own but in the year 2006-2008 the owners fund

increased than outsider’s fund.

INSTITUTE OF MANAGEMENT AND INFORMATION TECHONOLOGY

It indicates the relationship between the total liability to total asset of the firm.

Generally the low solvency ratio is more satisfactory .

But in OSCB it is high over the years. So solvency ratio is not satisfactory.

INSTITUTE OF MANAGEMENT AND INFORMATION TECHONOLOGY

The debt asset ratio of OSCB is very higher over the year which

means the debt is very high than Total asset so it is not good to raise

additional lone.

INSTITUTE OF MANAGEMENT AND INFORMATION TECHONOLOGY

The fixed asset of OSCB is lower than current asset over the years,

which means there is no scope of idle of asset. It is also shows that the

working capital of the bank is very high. It is good. From2002-08 the

current asset is increasing over fixed asset.

INSTITUTE OF MANAGEMENT AND INFORMATION TECHONOLOGY

The return on capital employed of OSCB is increasing from 2002-06 .But in 2006-

07 it is decreased and now it is increasing which is a good sign for bank. Which

mean the overall profitability is increasing.

INSTITUTE OF MANAGEMENT AND INFORMATION TECHONOLOGY

The return on equity share of OSCB shows that it provides a high rate

of dividend to its equity share holders.

INSTITUTE OF MANAGEMENT AND INFORMATION TECHONOLOGY

The EPS of OSCB is gradually increases except in 2006-07,

which is satisfactory to shareholders.

INSTITUTE OF MANAGEMENT AND INFORMATION TECHONOLOGY

The bank should focus more on advancing loans and

money from depositors.

It should recover its money from defaulters in a limited

time.

It should ready for the coming competitive as all banks are

going to be privatize.

It should diversify its business and should give loans to

non-agricultural sector.

It should invest in long term, so that it should increase the

liquidity position of the firm.

Asset should be properly utilized to get a sound return.

INSTITUTE OF MANAGEMENT AND INFORMATION TECHONOLOGY

Ratio analysis is an important financial tools to

measure financial position of a firm. It is with

the help of ratio analysis the financial

statement can be analyzed more clearly and

decisions made from such analysis.

From above analysis it may conclude that the

financial position of the Bank is satisfactory .

And bank should take step to improve it’s

position.

INSTITUTE OF MANAGEMENT AND INFORMATION TECHONOLOGY

INSTITUTE OF MANAGEMENT AND INFORMATION TECHONOLOGY

You might also like

- A Complete Swimming Pool Construction Business Plan: A Key Part Of How To Start A Pool Installation BusinessFrom EverandA Complete Swimming Pool Construction Business Plan: A Key Part Of How To Start A Pool Installation BusinessRating: 5 out of 5 stars5/5 (5)

- Working Capital Management PROJECT REPORT MBADocument90 pagesWorking Capital Management PROJECT REPORT MBABabasab Patil (Karrisatte)93% (15)

- Tutorial Cash Book & Petty CashDocument7 pagesTutorial Cash Book & Petty CashClovey CsyNo ratings yet

- Major FindingsDocument12 pagesMajor FindingsKhem Raj GhimireNo ratings yet

- Objectives of The StudyDocument9 pagesObjectives of The Studysarvesh.bhartiNo ratings yet

- Conclusion of EblDocument4 pagesConclusion of Eblrk shahNo ratings yet

- A Study On Financial Performance of Esaf Microfinance & Investments (P) LTDDocument23 pagesA Study On Financial Performance of Esaf Microfinance & Investments (P) LTDneenuwilsonNo ratings yet

- Eastern Bank AnalysisDocument44 pagesEastern Bank AnalysisSamiul AhsanNo ratings yet

- A Study On Financial Performance of Sbi BankDocument3 pagesA Study On Financial Performance of Sbi Bankjivak 21100% (1)

- Financial Statement Analysis - PPT (25!06!2013)Document18 pagesFinancial Statement Analysis - PPT (25!06!2013)servicenagarjunaNo ratings yet

- An Analysis of Financial Performance of BRAC Bank LTD - Al SukranDocument31 pagesAn Analysis of Financial Performance of BRAC Bank LTD - Al SukranAl SukranNo ratings yet

- Project Work FinalDocument7 pagesProject Work Finalshushilpoudel1No ratings yet

- Performance Evaluation of Eastern Bank LTDDocument15 pagesPerformance Evaluation of Eastern Bank LTDMehedi HasanNo ratings yet

- Second File WipDocument46 pagesSecond File WipDilip PrajapatiNo ratings yet

- Financial Calculation of EBLDocument38 pagesFinancial Calculation of EBLAbdullah Al-RafiNo ratings yet

- "AS N S M ": Tudy ON ON Performing Assets IN Tate Bank OF YsoreDocument15 pages"AS N S M ": Tudy ON ON Performing Assets IN Tate Bank OF YsoreKrishna Prasad GaddeNo ratings yet

- Non-Performing Assets: A Comparative Study of SBI & ICICI Bank From (2014-2017)Document32 pagesNon-Performing Assets: A Comparative Study of SBI & ICICI Bank From (2014-2017)Alok NayakNo ratings yet

- PNB Analysis 2012Document14 pagesPNB Analysis 2012Niraj SharmaNo ratings yet

- ACI Limited Submitted To:: ULAB School of Business Bachelor of Business Administration (B.B.A.) Term Paper OnDocument13 pagesACI Limited Submitted To:: ULAB School of Business Bachelor of Business Administration (B.B.A.) Term Paper OnashikNo ratings yet

- DESARTETION Project 2022 EIILMDocument27 pagesDESARTETION Project 2022 EIILMDebajit DasNo ratings yet

- A Study of Financial Statement Analysis of Chassis Brakes International CompanyDocument19 pagesA Study of Financial Statement Analysis of Chassis Brakes International CompanySanjay TalegaonkarNo ratings yet

- Diajukan OlehDocument23 pagesDiajukan OlehdheaNo ratings yet

- NiblDocument14 pagesNiblBikash ChaudharyNo ratings yet

- CBE Annual Report 06 - 07Document60 pagesCBE Annual Report 06 - 07Addis AlemayehuNo ratings yet

- A Study On Capital Structure AND Performance Analysis of Everest Bank LimitedDocument14 pagesA Study On Capital Structure AND Performance Analysis of Everest Bank LimitedReshma MaliNo ratings yet

- Performance of Eastern Bank Limited ORIGINIALDocument78 pagesPerformance of Eastern Bank Limited ORIGINIALPushpa Barua100% (2)

- FinanceDocument67 pagesFinancericha panwarNo ratings yet

- Synopsis of WORKING CAPITAL ANALYSIS of Bajaj Allianz Life InsuranceDocument3 pagesSynopsis of WORKING CAPITAL ANALYSIS of Bajaj Allianz Life InsuranceHemchandra KhoisnamNo ratings yet

- Working Capital ManagementDocument92 pagesWorking Capital Managementletter2lalNo ratings yet

- Peresentation On Study of Non-Performing Assets Management By: Shaikh Abdul HadiDocument13 pagesPeresentation On Study of Non-Performing Assets Management By: Shaikh Abdul HadiCma Abdul HadiNo ratings yet

- Applying The CAMELS Performance Evaluation Approach For Emirates NBD BankDocument20 pagesApplying The CAMELS Performance Evaluation Approach For Emirates NBD BankAnirudha PaulNo ratings yet

- Revised)Document31 pagesRevised)Farhad SyedNo ratings yet

- Financial Performance Analysis of First Security Islami Bank LimitedDocument21 pagesFinancial Performance Analysis of First Security Islami Bank LimitedSabrinaIra50% (2)

- Amrutha ValliDocument14 pagesAmrutha ValliSai KishoreNo ratings yet

- Non Performing Assets - Challenges To Public Sector Bank-1Document96 pagesNon Performing Assets - Challenges To Public Sector Bank-1nimittpathak1989No ratings yet

- Finance Project ReportDocument72 pagesFinance Project ReportRavinder GargNo ratings yet

- Impact of Liquidity On Profitability of Nepalese Commercial BanksDocument8 pagesImpact of Liquidity On Profitability of Nepalese Commercial BanksWelcome BgNo ratings yet

- Alok Industries Final Report 2010-11.Document117 pagesAlok Industries Final Report 2010-11.Ashish Navagamiya0% (1)

- A Study On Financial Performance of State Bank of India For Past Five Financial Years Starting From 2016 2017Document5 pagesA Study On Financial Performance of State Bank of India For Past Five Financial Years Starting From 2016 2017danny kanniNo ratings yet

- A Project Work Report AnupaDocument11 pagesA Project Work Report AnupaAmrit SapkotaNo ratings yet

- Non-Performing Assets: A Comparative Study Ofsbi&Icici Bank From 2014-2017Document22 pagesNon-Performing Assets: A Comparative Study Ofsbi&Icici Bank From 2014-2017Alok NayakNo ratings yet

- Research Project (18.9.20)Document25 pagesResearch Project (18.9.20)Custom CafeNo ratings yet

- Final Report - AkshatDocument6 pagesFinal Report - AkshatAkshat SoniNo ratings yet

- 414pm - 27.EPRA JOURNALS 13284Document3 pages414pm - 27.EPRA JOURNALS 13284beemagani9No ratings yet

- Analysis On Activities of Key DepartmentsDocument11 pagesAnalysis On Activities of Key DepartmentsKhadiza Akter MoniNo ratings yet

- Internship Report On Nib Bank: Provided by Nishat Academy IslamabadDocument16 pagesInternship Report On Nib Bank: Provided by Nishat Academy Islamabadk_starsunNo ratings yet

- Profitability Analysis: A Synopsis Report ON AT Ulteratech Cements LTDDocument10 pagesProfitability Analysis: A Synopsis Report ON AT Ulteratech Cements LTDMOHAMMED KHAYYUMNo ratings yet

- A Study On Assets and Liability Management Towards Indian Overseas BankDocument14 pagesA Study On Assets and Liability Management Towards Indian Overseas BankmussifalaceNo ratings yet

- Banking System Analysis of IFIC Bank LimitedDocument28 pagesBanking System Analysis of IFIC Bank LimitedMd Omar FaruqNo ratings yet

- Financial Performance of Icici BankDocument15 pagesFinancial Performance of Icici BankcityNo ratings yet

- Project On Bajaj Allianz Life InsuranceDocument57 pagesProject On Bajaj Allianz Life InsurancePrashantSachinSharma100% (1)

- Himel Paul FINALDocument13 pagesHimel Paul FINALHimel paulNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Implementing Beyond Budgeting: Unlocking the Performance PotentialFrom EverandImplementing Beyond Budgeting: Unlocking the Performance PotentialRating: 5 out of 5 stars5/5 (1)

- Effective Project Financing Essential Principles And Tactics: An Introduction To Finance, Cash Flows, And Project EvaluationFrom EverandEffective Project Financing Essential Principles And Tactics: An Introduction To Finance, Cash Flows, And Project EvaluationNo ratings yet

- Strengthening Partnerships: Accountability Mechanism Annual Report 2014From EverandStrengthening Partnerships: Accountability Mechanism Annual Report 2014No ratings yet

- ACC311 Chapter 7 Review Notes and Practice Problems SODocument7 pagesACC311 Chapter 7 Review Notes and Practice Problems SOfatimalghaisNo ratings yet

- ATM CARD ApplicationDocument2 pagesATM CARD Applicationboggy XaiomiNo ratings yet

- A B C D of E-BankingDocument75 pagesA B C D of E-Bankinglove tannaNo ratings yet

- StatementDocument22 pagesStatementsergio andres gutierrez leonNo ratings yet

- Frequently Asked Questions: Your Guide To Money Matters Some BasicsDocument18 pagesFrequently Asked Questions: Your Guide To Money Matters Some BasicsKRVAMSI_432No ratings yet

- Perusahaan Service Mobil Anugerah Jalan Bumi I Liliba-Kupang Neraca Lajur Per 30 Nopember 2011Document1 pagePerusahaan Service Mobil Anugerah Jalan Bumi I Liliba-Kupang Neraca Lajur Per 30 Nopember 2011Glorya Alexandra LenengNo ratings yet

- Account Statement 011119 290320Document8 pagesAccount Statement 011119 290320Ankit SupareNo ratings yet

- Indian Banking Industry: Challenges and Opportuniti EsDocument24 pagesIndian Banking Industry: Challenges and Opportuniti EsdelmaNo ratings yet

- Admission Deposit Slip-2019.PfDocument2 pagesAdmission Deposit Slip-2019.PfRizwan KhanNo ratings yet

- Cug Qop TV Aeb Cs 35 eDocument4 pagesCug Qop TV Aeb Cs 35 eMainam Rameshwar Singh100% (1)

- KASB - Case Solve Sidra 62615Document4 pagesKASB - Case Solve Sidra 62615Asad MemonNo ratings yet

- Merger and Acquisition in Banking IndustryDocument6 pagesMerger and Acquisition in Banking IndustryGauravsNo ratings yet

- CSIS Circular-IIDocument2 pagesCSIS Circular-IItarun panwarNo ratings yet

- Central Bank of India (Eco Project)Document2 pagesCentral Bank of India (Eco Project)Shivam TanejaNo ratings yet

- Law Is Law 2Document2 pagesLaw Is Law 2jamesNo ratings yet

- T3TLC - Letters of Credit - R10.2Document320 pagesT3TLC - Letters of Credit - R10.2Wagdy TawfikNo ratings yet

- Session 3 - World Bank Presentation Crypto AssetsDocument15 pagesSession 3 - World Bank Presentation Crypto AssetsCr CryptoNo ratings yet

- Sharekhan DocumentDocument2 pagesSharekhan DocumentsprtkmitraNo ratings yet

- Uniform Residential Loan ApplicationDocument4 pagesUniform Residential Loan Applicationapi-26011493No ratings yet

- HDFC Bank Limited: "Melioration in Asset Quality Marginal Compression in NIM Initiating Coverage With HOLD"Document18 pagesHDFC Bank Limited: "Melioration in Asset Quality Marginal Compression in NIM Initiating Coverage With HOLD"janu_ballav9913No ratings yet

- Dlocal Industry Report 2018 PDFDocument56 pagesDlocal Industry Report 2018 PDFdesperadodick82No ratings yet

- Module 1 IntroductionDocument14 pagesModule 1 IntroductionJannine Cabrera PanganNo ratings yet

- Loan Classification NotesDocument33 pagesLoan Classification NotesAtia IbnatNo ratings yet

- Module 2.11 ForfaitingDocument33 pagesModule 2.11 ForfaitingdiviprabhuNo ratings yet

- Narra Egg Layer Production Resolution-FINAL1Document2 pagesNarra Egg Layer Production Resolution-FINAL1Nichol AlcazarNo ratings yet

- College of Management: Capiz State UniversityDocument4 pagesCollege of Management: Capiz State UniversityDave IsoyNo ratings yet

- Merc Rev - NegoDocument185 pagesMerc Rev - NegoAlfarah Alonto Adiong100% (1)

- Project On HDFC BANKDocument70 pagesProject On HDFC BANKAshutosh MishraNo ratings yet

- HSBC - Assesment 1Document16 pagesHSBC - Assesment 1aliNo ratings yet