Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

45 viewsCommodity Business: An: Rahul Singh, India

Commodity Business: An: Rahul Singh, India

Uploaded by

surjitxinghaThe document provides an overview of commodity markets and trading. It discusses that commodities are bulk goods that are traded on exchanges in standardized contracts. There are various types of commodities grouped into categories like precious metals, agricultural products, energies and more. The commodity market in India has grown significantly in recent years with turnover increasing over 300% and daily trading volumes around Rs. 14,000-16,000 crore. However, the market is still dominated by a few commodities and lacks depth. The top traded futures contracts globally include agricultural products like mung beans, coffee, corn and sugars.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You might also like

- Health Insurance Off The GridDocument163 pagesHealth Insurance Off The GridDaryl Kulak100% (4)

- US and International Media DirectoryDocument342 pagesUS and International Media DirectoryGurnaamSingh40% (5)

- The Fair Trade Scandal: Marketing Poverty to Benefit the RichFrom EverandThe Fair Trade Scandal: Marketing Poverty to Benefit the RichNo ratings yet

- Motorola Communication StructureDocument25 pagesMotorola Communication Structureyo5208No ratings yet

- NCDEX - National Commodity and Derivatives ExchangeDocument29 pagesNCDEX - National Commodity and Derivatives ExchangeEsha ShahNo ratings yet

- CommDocument26 pagesCommapi-3797997No ratings yet

- MR Narendra Gupta, CBO, NCDEX MR Narendra Gupta, CBO, NCDEX: August 10, 2005Document18 pagesMR Narendra Gupta, CBO, NCDEX MR Narendra Gupta, CBO, NCDEX: August 10, 2005mayankkrazyNo ratings yet

- Presentation 2Document30 pagesPresentation 2Rishabh RankaNo ratings yet

- Doing Business in India: Market OpportunitiesDocument5 pagesDoing Business in India: Market OpportunitiesMarisol LeiraNo ratings yet

- Project Report On Commodity MarketsDocument65 pagesProject Report On Commodity Marketskrittika03No ratings yet

- Project Report, Satpal Singh, B-26, 10906078Document11 pagesProject Report, Satpal Singh, B-26, 10906078satpalsinghsasan1989No ratings yet

- CommodityDocument14 pagesCommodityChamp DsouzaNo ratings yet

- Final ProjectDocument90 pagesFinal Projectaryanabhi123No ratings yet

- FM PPT - Commodities MKTDocument18 pagesFM PPT - Commodities MKTrichabhagat2906No ratings yet

- Indian Commodity Market - GroundnutDocument42 pagesIndian Commodity Market - GroundnutAnjali PanchalNo ratings yet

- Executive Summary: Commodities Market in IndiaDocument67 pagesExecutive Summary: Commodities Market in IndiaSushil RajguruNo ratings yet

- Performance Analysis of Indian Commodity Market: March 2020Document16 pagesPerformance Analysis of Indian Commodity Market: March 2020Suraj O V 1820368No ratings yet

- Commodity TradingDocument0 pagesCommodity TradingNIKNISHNo ratings yet

- Performance Evaluation of Selected CommoditiesDocument73 pagesPerformance Evaluation of Selected CommoditiesMessiNo ratings yet

- Indian Commodity MarketDocument9 pagesIndian Commodity MarketSweta SinghNo ratings yet

- Commodity Markets Group7Document4 pagesCommodity Markets Group7abhrajeetNo ratings yet

- Mba 1Document89 pagesMba 1Hariharan KuppusamyNo ratings yet

- Relationship Between Inflation and Price of CommodityDocument41 pagesRelationship Between Inflation and Price of CommoditydhruvgujaratiNo ratings yet

- Growth and Challenges of Commodity Derivative Market in IndiaDocument14 pagesGrowth and Challenges of Commodity Derivative Market in IndiaPradyumn PaliwalNo ratings yet

- What Is Commodity Trading?: MBA Education & CareersDocument0 pagesWhat Is Commodity Trading?: MBA Education & CareersprajuprathuNo ratings yet

- A Project On Commodity TradingDocument80 pagesA Project On Commodity Tradingswami808100% (9)

- Introduction To Commodity ExchangeDocument26 pagesIntroduction To Commodity ExchangeVinay ArtwaniNo ratings yet

- Commodity MarketDocument21 pagesCommodity Markethaseeb_tankiwalaNo ratings yet

- Faq Booklet EnglishDocument30 pagesFaq Booklet EnglishSameer MishraNo ratings yet

- Icex FinalDocument33 pagesIcex FinalAmi Parekh MehtaNo ratings yet

- What Is CommodityDocument2 pagesWhat Is CommodityyoogeeshhNo ratings yet

- An Anyalysis of The Indian Commodity Market Exchange and Commodity MarketDocument10 pagesAn Anyalysis of The Indian Commodity Market Exchange and Commodity MarketAswin RNo ratings yet

- ProjectDocument61 pagesProjectmeetNo ratings yet

- A Project Report ON Investors Percepton of Future Commodity: Submitted byDocument29 pagesA Project Report ON Investors Percepton of Future Commodity: Submitted byManish ChauhanNo ratings yet

- What Is Commodity TradingDocument2 pagesWhat Is Commodity TradingYash JainNo ratings yet

- A Case Study On Commodities Trading-Investment and SpeculationDocument95 pagesA Case Study On Commodities Trading-Investment and SpeculationNishant Sharma100% (1)

- PROJECT REPORT On Retail Sector in India by Satishpgoyal PDFDocument77 pagesPROJECT REPORT On Retail Sector in India by Satishpgoyal PDFNiro ThakurNo ratings yet

- Commodity Basics - The Financial DoctorsDocument30 pagesCommodity Basics - The Financial DoctorsAnsumanNathNo ratings yet

- Definition of CommoditiesDocument16 pagesDefinition of CommoditiesDeepika MahnaNo ratings yet

- Chapter - IDocument34 pagesChapter - ITriveni ItnalNo ratings yet

- Commodity Market ReportDocument10 pagesCommodity Market ReportsaturunNo ratings yet

- Commodities MarketDocument6 pagesCommodities MarketyatindraNo ratings yet

- GuptaRavi PDFDocument8 pagesGuptaRavi PDFJames WagnerNo ratings yet

- Commodity MarketDocument7 pagesCommodity MarketSid JainNo ratings yet

- Commodity Market ReportDocument38 pagesCommodity Market Reportpankajku2020100% (6)

- Organised Commodity Markets SLBoadoDocument41 pagesOrganised Commodity Markets SLBoadoKumar JayawardhaneNo ratings yet

- Price Discovery, Return and Market Conditions: Evidence From Commodity Futures MarketsDocument22 pagesPrice Discovery, Return and Market Conditions: Evidence From Commodity Futures MarketssravanakumarNo ratings yet

- CommoditiesDocument18 pagesCommoditiesVicky BajajNo ratings yet

- S AshfaqDocument45 pagesS AshfaqCMA-1013 V.NAVEENNo ratings yet

- A Study On Future Scenario of Bullion MarketDocument86 pagesA Study On Future Scenario of Bullion Marketjonathan-vaz-622867% (6)

- A Research ReportDocument57 pagesA Research ReportShridhar BhatNo ratings yet

- Commodity Futures Market in India DeveloDocument17 pagesCommodity Futures Market in India DeveloPDJ PU II computer scienceNo ratings yet

- Synopsis On Commodity MarketDocument8 pagesSynopsis On Commodity MarketsonaliasudaniNo ratings yet

- Commodity Guide PDFDocument108 pagesCommodity Guide PDFgaurav dixitNo ratings yet

- 14 - Presentation On Commodity TradingDocument15 pages14 - Presentation On Commodity TradingvijayxkumarNo ratings yet

- What Is Commodity MarketDocument12 pagesWhat Is Commodity MarketVivek GittuwalaNo ratings yet

- Commodity MarketsDocument30 pagesCommodity MarketsSourabh SinghNo ratings yet

- Diamond Derivatives: Lessons From Indian Markets: June 2007Document19 pagesDiamond Derivatives: Lessons From Indian Markets: June 2007Satendra KumarNo ratings yet

- India's Store Wars: Retail Revolution and the Battle for the Next 500 Million ShoppersFrom EverandIndia's Store Wars: Retail Revolution and the Battle for the Next 500 Million ShoppersNo ratings yet

- Sources of FinancingDocument33 pagesSources of FinancingWilmark J. RamosNo ratings yet

- Developmental Counseling Form: The Leader's Facts and Observations Prior To The Counseling.)Document3 pagesDevelopmental Counseling Form: The Leader's Facts and Observations Prior To The Counseling.)Anonymous EpKfz0LNo ratings yet

- Tenggara Backgrounder 2023 Jun 09 1 sPNFol6RDocument20 pagesTenggara Backgrounder 2023 Jun 09 1 sPNFol6RAlisa Syakila MaharaniNo ratings yet

- CH 02 SolsDocument2 pagesCH 02 SolsHạng VũNo ratings yet

- Lesson 1 FRANCHISING Introduction Converted 1Document32 pagesLesson 1 FRANCHISING Introduction Converted 1arzeljoyvillanueva3No ratings yet

- App I Section 03050 Fill CreteDocument2 pagesApp I Section 03050 Fill CreteAnonymous M4BGwOkIpNo ratings yet

- Info - Iec61000 4 33 (Ed1.0) enDocument8 pagesInfo - Iec61000 4 33 (Ed1.0) enUntung Yudho PrakosoNo ratings yet

- Law On Treaties Group 4Document51 pagesLaw On Treaties Group 4Seyre Eser ArymNo ratings yet

- Laravel Security ChecklistDocument18 pagesLaravel Security ChecklistfokavomoNo ratings yet

- Estimate For Scrubber Tank FoundationDocument3 pagesEstimate For Scrubber Tank Foundationuche ekeNo ratings yet

- History of Perodua Analysis PDFDocument13 pagesHistory of Perodua Analysis PDFaishahrodziNo ratings yet

- Module 1A - People - ReligionDocument59 pagesModule 1A - People - ReligionVrankovich.EllieNo ratings yet

- Republic v. Far East EnterprisesDocument3 pagesRepublic v. Far East EnterprisesJustineNo ratings yet

- Sample Front Desk Receptionist ResumeDocument5 pagesSample Front Desk Receptionist ResumeReyvie FabroNo ratings yet

- SYH Industria Ethernet Networking Manual 76Document607 pagesSYH Industria Ethernet Networking Manual 76fabianbritez8489100% (2)

- Classification of MSME in IndiaDocument7 pagesClassification of MSME in Indiaaishu patilNo ratings yet

- Bank Soal MJK PDFDocument47 pagesBank Soal MJK PDFNabila Aulia RamadhaniNo ratings yet

- This Article Is About Plant LayoutDocument6 pagesThis Article Is About Plant Layoutsushant_jhawerNo ratings yet

- Sebial Vs SebialDocument4 pagesSebial Vs SebialNC BergoniaNo ratings yet

- Wa0007Document3 pagesWa0007SharuNo ratings yet

- Lepsl 530 Module 6 21st Century Surveillanec Technology AcademicDocument6 pagesLepsl 530 Module 6 21st Century Surveillanec Technology Academicapi-6159526430% (1)

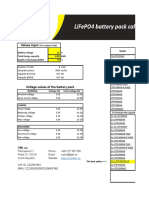

- The Best Suitable Lifepo4 Cells Values Input: (Fill in Yellow Fields)Document2 pagesThe Best Suitable Lifepo4 Cells Values Input: (Fill in Yellow Fields)HirenNo ratings yet

- AHR 2016previewDocument29 pagesAHR 2016previewAnonymous XhkjXCxxsTNo ratings yet

- M.aitchison PublicationsDocument2 pagesM.aitchison PublicationsRuxandra VasileNo ratings yet

- Leakage Power Optimization Using Gate Length Biasing and Multiple VTDocument13 pagesLeakage Power Optimization Using Gate Length Biasing and Multiple VTSanupKumarSinghNo ratings yet

- Gujarat Technological University: W.E.F. AY 2018-19Document3 pagesGujarat Technological University: W.E.F. AY 2018-19Bhavesh PatelNo ratings yet

- Dell Precision M4800 ParametryDocument2 pagesDell Precision M4800 ParametryWilsonLópezNo ratings yet

Commodity Business: An: Rahul Singh, India

Commodity Business: An: Rahul Singh, India

Uploaded by

surjitxingha0 ratings0% found this document useful (0 votes)

45 views15 pagesThe document provides an overview of commodity markets and trading. It discusses that commodities are bulk goods that are traded on exchanges in standardized contracts. There are various types of commodities grouped into categories like precious metals, agricultural products, energies and more. The commodity market in India has grown significantly in recent years with turnover increasing over 300% and daily trading volumes around Rs. 14,000-16,000 crore. However, the market is still dominated by a few commodities and lacks depth. The top traded futures contracts globally include agricultural products like mung beans, coffee, corn and sugars.

Original Description:

Original Title

Commodity Business

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides an overview of commodity markets and trading. It discusses that commodities are bulk goods that are traded on exchanges in standardized contracts. There are various types of commodities grouped into categories like precious metals, agricultural products, energies and more. The commodity market in India has grown significantly in recent years with turnover increasing over 300% and daily trading volumes around Rs. 14,000-16,000 crore. However, the market is still dominated by a few commodities and lacks depth. The top traded futures contracts globally include agricultural products like mung beans, coffee, corn and sugars.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

45 views15 pagesCommodity Business: An: Rahul Singh, India

Commodity Business: An: Rahul Singh, India

Uploaded by

surjitxinghaThe document provides an overview of commodity markets and trading. It discusses that commodities are bulk goods that are traded on exchanges in standardized contracts. There are various types of commodities grouped into categories like precious metals, agricultural products, energies and more. The commodity market in India has grown significantly in recent years with turnover increasing over 300% and daily trading volumes around Rs. 14,000-16,000 crore. However, the market is still dominated by a few commodities and lacks depth. The top traded futures contracts globally include agricultural products like mung beans, coffee, corn and sugars.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 15

Commodity Business: An

Introduction

Rahul Singh, India

Introduction

A bulk good such as an agricultural product, food, natural

resource or metal that is traded on an exchange in bulk

quantities.

A commodity is any homogenous item which may be

freely bought and sold. The term typically refers to

products such as coffee, cocoa and soyabeans (soft

commodities) or gold, aluminium and platinum (hard

commodities). Commodities typically are bought and sold

in futures markets where producers combine with

manufacturers and speculators to create a smoothly

functioning market.

Commodity Market

Commodity market is a place where trading in

commodities takes place. These are the markets where raw

and primary products are exchanged.

These raw commodities are traded on regulated

commodity exchanges, in which they are bought and sold

in standardised contracts. It is similar to an equity market,

but instead of buying or selling shares one buys or sells

commodities.

The commodities markets are one of the oldest prevailing

markets in the human history. In fact, derivatives trading

started off in commodities with the earliest records being

traced back to the 17th century when rice futures were

traded in Japan.

Global Classification

Precious Metals: Gold, Silver, Platinum, etc.

Other Metals: Nickel, Aluminum, Copper, Zinc, etc.

Agro-Based Commodities: Wheat, Rice, Corn, Cotton,

Oils, Oilseeds, etc.

Soft Commodities: Coffee, Cocoa, Sugar, etc.

Petrochemicals: High Density Polyethylene,

Polypropylene.

Live-Stock: Live Cattle, Pork Bellies, etc.

Energy: Crude Oil, Natural Gas, Gasoline, etc.

How is Indian Market Moving?

Turnover in agriculture grew 375 per cent over the past two years.

There are 18 commodity exchanges in India.

Multi Commodity Exchange of India Ltd (MCX), located at Mumbai.

National Commodity and Derivatives Exchange Ltd (NCDEX), located at

Mumbai.

National Board of Trade (NBOT), located at Indore.

National Multi Commodity Exchange (NMCE), located at Ahmedabad.

Trading in country’s commodity exchanges totalled $460 billion in

the financial year ended 2005, a four-fold jump from the year

before.

Currently, the commodity market in India clocks a daily average

turnover of Rs 14,000-16,000 crore.

Only 4 commodities out of the 94 allowed for trading account for

over 70 per cent of the total turnover. This does not speak highly

about the commodity futures market in terms of its width and depth.

How is Indian Market Moving?

The Survey has admitted that gold and crude oil account

for the major part of the total transactions in the futures

market at present.

During 2005-06, the total value of commodity futures

trade was Rs. 21.34 lakh crore as compared to Rs. 5.71

lakh crore during 2004-05 showing an increase of 274%.

The volume of trade has also gone up to 6685 lakh tonnes

during 2005-06 as compared to 1942 lakh tonnes during

2004-05. The trade volume has also gone up by 244%

during 2005-2006.

Mega Trends in Commodity

Reduction of government intervention

Globalisation (competition vs. market

opportunities)

Technology revolution: information and

bio-sciences

The consumer as queen

New “corporate” business models

Indian Market

64% of pop. Works in agriculture=35 % GNI.

It now accounts for approx. 23 % of GDP compared to 50

% in 1947.

Economy potentially very strong, large industrial output,

technological knowledge and extensive reservoir of

skilled manpower.

Exports: cotton goods, iron, jute products, coffee,

electrical goods, leather, handicrafts, diamonds,

chemicals, auto and software.

Imports are machinery, petroleum, chemicals, cereals,

copper, and zinc.

Fraction of Agriculture in National GDP

Market Structure: Spot

Minimum Support Price (MSP)

Mandis

Product – primary and non-primary, Participants,

Trading, Clearance, Settlement, Governance

Problems:

Pricedissemination

Lack of standards

Market Structure: Spot

Price discovery

Contract design, trading system, clearing system,

settlement, participants, regulations and

governance

Problems:

Lack of price transparency

Lack of contract size

Lack of regulatory compliances

Some Recent Facts

There are 18 existing commodity exchanges in

India offering domestic contracts in 8 commodities

and 2 exchanges that have permission to conduct

trading in international (USD denominated)

contracts.

There are around 1,700 brokerages in India today,

many of which are single proprietary concerns.

Trade Concessions

Country # Products Depth of

concessions

Bangladesh 572 10% -15%

Bhutan 266 10-20%

India 2402 10-100%

Maldives 390 5-15%

Nepal 425 10-15%

Pakistan 685 10-30%

Sri Lanka 211` 10-75%

TOTAL 4951

Top Traded Futures Contracts

PRODUCTS EXCHANGES VOLUMES

Mungbean Zhengzhou

Commodity Exchange People

Republic of China 47,422,496

Coffee China Commodity Futures Exchange of

Hainan 20,590,058

Corn CBOT 16,984,951

Tokyo Grain Exchange 13,840,721

Green Bean Beijing Commodity Exchange 15,152,960

Ruber China Commodity Futures Exchange 14,587,546

TOCOM 4,758,390

Red Bean Tainjin United Futures Exchange 11,234,681

American Soyabean TGF 9,966,257

Soyabean Meal CBOT 6,424,945

Sugar Coffee, Sugar, Cocoa Exchange, US 5,284,971

Plywood Shanghai Commodity Exchange 2,897,746

Cotton New York Cotton Exchange 2,837,280

You might also like

- Health Insurance Off The GridDocument163 pagesHealth Insurance Off The GridDaryl Kulak100% (4)

- US and International Media DirectoryDocument342 pagesUS and International Media DirectoryGurnaamSingh40% (5)

- The Fair Trade Scandal: Marketing Poverty to Benefit the RichFrom EverandThe Fair Trade Scandal: Marketing Poverty to Benefit the RichNo ratings yet

- Motorola Communication StructureDocument25 pagesMotorola Communication Structureyo5208No ratings yet

- NCDEX - National Commodity and Derivatives ExchangeDocument29 pagesNCDEX - National Commodity and Derivatives ExchangeEsha ShahNo ratings yet

- CommDocument26 pagesCommapi-3797997No ratings yet

- MR Narendra Gupta, CBO, NCDEX MR Narendra Gupta, CBO, NCDEX: August 10, 2005Document18 pagesMR Narendra Gupta, CBO, NCDEX MR Narendra Gupta, CBO, NCDEX: August 10, 2005mayankkrazyNo ratings yet

- Presentation 2Document30 pagesPresentation 2Rishabh RankaNo ratings yet

- Doing Business in India: Market OpportunitiesDocument5 pagesDoing Business in India: Market OpportunitiesMarisol LeiraNo ratings yet

- Project Report On Commodity MarketsDocument65 pagesProject Report On Commodity Marketskrittika03No ratings yet

- Project Report, Satpal Singh, B-26, 10906078Document11 pagesProject Report, Satpal Singh, B-26, 10906078satpalsinghsasan1989No ratings yet

- CommodityDocument14 pagesCommodityChamp DsouzaNo ratings yet

- Final ProjectDocument90 pagesFinal Projectaryanabhi123No ratings yet

- FM PPT - Commodities MKTDocument18 pagesFM PPT - Commodities MKTrichabhagat2906No ratings yet

- Indian Commodity Market - GroundnutDocument42 pagesIndian Commodity Market - GroundnutAnjali PanchalNo ratings yet

- Executive Summary: Commodities Market in IndiaDocument67 pagesExecutive Summary: Commodities Market in IndiaSushil RajguruNo ratings yet

- Performance Analysis of Indian Commodity Market: March 2020Document16 pagesPerformance Analysis of Indian Commodity Market: March 2020Suraj O V 1820368No ratings yet

- Commodity TradingDocument0 pagesCommodity TradingNIKNISHNo ratings yet

- Performance Evaluation of Selected CommoditiesDocument73 pagesPerformance Evaluation of Selected CommoditiesMessiNo ratings yet

- Indian Commodity MarketDocument9 pagesIndian Commodity MarketSweta SinghNo ratings yet

- Commodity Markets Group7Document4 pagesCommodity Markets Group7abhrajeetNo ratings yet

- Mba 1Document89 pagesMba 1Hariharan KuppusamyNo ratings yet

- Relationship Between Inflation and Price of CommodityDocument41 pagesRelationship Between Inflation and Price of CommoditydhruvgujaratiNo ratings yet

- Growth and Challenges of Commodity Derivative Market in IndiaDocument14 pagesGrowth and Challenges of Commodity Derivative Market in IndiaPradyumn PaliwalNo ratings yet

- What Is Commodity Trading?: MBA Education & CareersDocument0 pagesWhat Is Commodity Trading?: MBA Education & CareersprajuprathuNo ratings yet

- A Project On Commodity TradingDocument80 pagesA Project On Commodity Tradingswami808100% (9)

- Introduction To Commodity ExchangeDocument26 pagesIntroduction To Commodity ExchangeVinay ArtwaniNo ratings yet

- Commodity MarketDocument21 pagesCommodity Markethaseeb_tankiwalaNo ratings yet

- Faq Booklet EnglishDocument30 pagesFaq Booklet EnglishSameer MishraNo ratings yet

- Icex FinalDocument33 pagesIcex FinalAmi Parekh MehtaNo ratings yet

- What Is CommodityDocument2 pagesWhat Is CommodityyoogeeshhNo ratings yet

- An Anyalysis of The Indian Commodity Market Exchange and Commodity MarketDocument10 pagesAn Anyalysis of The Indian Commodity Market Exchange and Commodity MarketAswin RNo ratings yet

- ProjectDocument61 pagesProjectmeetNo ratings yet

- A Project Report ON Investors Percepton of Future Commodity: Submitted byDocument29 pagesA Project Report ON Investors Percepton of Future Commodity: Submitted byManish ChauhanNo ratings yet

- What Is Commodity TradingDocument2 pagesWhat Is Commodity TradingYash JainNo ratings yet

- A Case Study On Commodities Trading-Investment and SpeculationDocument95 pagesA Case Study On Commodities Trading-Investment and SpeculationNishant Sharma100% (1)

- PROJECT REPORT On Retail Sector in India by Satishpgoyal PDFDocument77 pagesPROJECT REPORT On Retail Sector in India by Satishpgoyal PDFNiro ThakurNo ratings yet

- Commodity Basics - The Financial DoctorsDocument30 pagesCommodity Basics - The Financial DoctorsAnsumanNathNo ratings yet

- Definition of CommoditiesDocument16 pagesDefinition of CommoditiesDeepika MahnaNo ratings yet

- Chapter - IDocument34 pagesChapter - ITriveni ItnalNo ratings yet

- Commodity Market ReportDocument10 pagesCommodity Market ReportsaturunNo ratings yet

- Commodities MarketDocument6 pagesCommodities MarketyatindraNo ratings yet

- GuptaRavi PDFDocument8 pagesGuptaRavi PDFJames WagnerNo ratings yet

- Commodity MarketDocument7 pagesCommodity MarketSid JainNo ratings yet

- Commodity Market ReportDocument38 pagesCommodity Market Reportpankajku2020100% (6)

- Organised Commodity Markets SLBoadoDocument41 pagesOrganised Commodity Markets SLBoadoKumar JayawardhaneNo ratings yet

- Price Discovery, Return and Market Conditions: Evidence From Commodity Futures MarketsDocument22 pagesPrice Discovery, Return and Market Conditions: Evidence From Commodity Futures MarketssravanakumarNo ratings yet

- CommoditiesDocument18 pagesCommoditiesVicky BajajNo ratings yet

- S AshfaqDocument45 pagesS AshfaqCMA-1013 V.NAVEENNo ratings yet

- A Study On Future Scenario of Bullion MarketDocument86 pagesA Study On Future Scenario of Bullion Marketjonathan-vaz-622867% (6)

- A Research ReportDocument57 pagesA Research ReportShridhar BhatNo ratings yet

- Commodity Futures Market in India DeveloDocument17 pagesCommodity Futures Market in India DeveloPDJ PU II computer scienceNo ratings yet

- Synopsis On Commodity MarketDocument8 pagesSynopsis On Commodity MarketsonaliasudaniNo ratings yet

- Commodity Guide PDFDocument108 pagesCommodity Guide PDFgaurav dixitNo ratings yet

- 14 - Presentation On Commodity TradingDocument15 pages14 - Presentation On Commodity TradingvijayxkumarNo ratings yet

- What Is Commodity MarketDocument12 pagesWhat Is Commodity MarketVivek GittuwalaNo ratings yet

- Commodity MarketsDocument30 pagesCommodity MarketsSourabh SinghNo ratings yet

- Diamond Derivatives: Lessons From Indian Markets: June 2007Document19 pagesDiamond Derivatives: Lessons From Indian Markets: June 2007Satendra KumarNo ratings yet

- India's Store Wars: Retail Revolution and the Battle for the Next 500 Million ShoppersFrom EverandIndia's Store Wars: Retail Revolution and the Battle for the Next 500 Million ShoppersNo ratings yet

- Sources of FinancingDocument33 pagesSources of FinancingWilmark J. RamosNo ratings yet

- Developmental Counseling Form: The Leader's Facts and Observations Prior To The Counseling.)Document3 pagesDevelopmental Counseling Form: The Leader's Facts and Observations Prior To The Counseling.)Anonymous EpKfz0LNo ratings yet

- Tenggara Backgrounder 2023 Jun 09 1 sPNFol6RDocument20 pagesTenggara Backgrounder 2023 Jun 09 1 sPNFol6RAlisa Syakila MaharaniNo ratings yet

- CH 02 SolsDocument2 pagesCH 02 SolsHạng VũNo ratings yet

- Lesson 1 FRANCHISING Introduction Converted 1Document32 pagesLesson 1 FRANCHISING Introduction Converted 1arzeljoyvillanueva3No ratings yet

- App I Section 03050 Fill CreteDocument2 pagesApp I Section 03050 Fill CreteAnonymous M4BGwOkIpNo ratings yet

- Info - Iec61000 4 33 (Ed1.0) enDocument8 pagesInfo - Iec61000 4 33 (Ed1.0) enUntung Yudho PrakosoNo ratings yet

- Law On Treaties Group 4Document51 pagesLaw On Treaties Group 4Seyre Eser ArymNo ratings yet

- Laravel Security ChecklistDocument18 pagesLaravel Security ChecklistfokavomoNo ratings yet

- Estimate For Scrubber Tank FoundationDocument3 pagesEstimate For Scrubber Tank Foundationuche ekeNo ratings yet

- History of Perodua Analysis PDFDocument13 pagesHistory of Perodua Analysis PDFaishahrodziNo ratings yet

- Module 1A - People - ReligionDocument59 pagesModule 1A - People - ReligionVrankovich.EllieNo ratings yet

- Republic v. Far East EnterprisesDocument3 pagesRepublic v. Far East EnterprisesJustineNo ratings yet

- Sample Front Desk Receptionist ResumeDocument5 pagesSample Front Desk Receptionist ResumeReyvie FabroNo ratings yet

- SYH Industria Ethernet Networking Manual 76Document607 pagesSYH Industria Ethernet Networking Manual 76fabianbritez8489100% (2)

- Classification of MSME in IndiaDocument7 pagesClassification of MSME in Indiaaishu patilNo ratings yet

- Bank Soal MJK PDFDocument47 pagesBank Soal MJK PDFNabila Aulia RamadhaniNo ratings yet

- This Article Is About Plant LayoutDocument6 pagesThis Article Is About Plant Layoutsushant_jhawerNo ratings yet

- Sebial Vs SebialDocument4 pagesSebial Vs SebialNC BergoniaNo ratings yet

- Wa0007Document3 pagesWa0007SharuNo ratings yet

- Lepsl 530 Module 6 21st Century Surveillanec Technology AcademicDocument6 pagesLepsl 530 Module 6 21st Century Surveillanec Technology Academicapi-6159526430% (1)

- The Best Suitable Lifepo4 Cells Values Input: (Fill in Yellow Fields)Document2 pagesThe Best Suitable Lifepo4 Cells Values Input: (Fill in Yellow Fields)HirenNo ratings yet

- AHR 2016previewDocument29 pagesAHR 2016previewAnonymous XhkjXCxxsTNo ratings yet

- M.aitchison PublicationsDocument2 pagesM.aitchison PublicationsRuxandra VasileNo ratings yet

- Leakage Power Optimization Using Gate Length Biasing and Multiple VTDocument13 pagesLeakage Power Optimization Using Gate Length Biasing and Multiple VTSanupKumarSinghNo ratings yet

- Gujarat Technological University: W.E.F. AY 2018-19Document3 pagesGujarat Technological University: W.E.F. AY 2018-19Bhavesh PatelNo ratings yet

- Dell Precision M4800 ParametryDocument2 pagesDell Precision M4800 ParametryWilsonLópezNo ratings yet