Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

36 viewsGrowth Through M&A

Growth Through M&A

Uploaded by

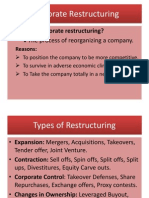

RohanA merger occurs when two or more companies combine to form one new company or when one company absorbs another. There are two main types of mergers - absorption and consolidation. An acquisition differs in that control is gained over another company but both entities remain legally separate. Mergers and acquisitions are driven by factors like competition and globalization and allow companies to gain scale, synergies, market power and tax benefits. The managerial processes involved careful strategy formulation, due diligence and negotiation of acquisition terms.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You might also like

- Auditing Problems 2Document8 pagesAuditing Problems 2Luzviminda Maruzzo100% (2)

- 3Document7 pages3Guillemr Cherry JedlynNo ratings yet

- Mergers & AquisitionsDocument36 pagesMergers & AquisitionsJay KishanNo ratings yet

- Job Order Costing: Illustrative ProblemsDocument30 pagesJob Order Costing: Illustrative ProblemsPatrick LanceNo ratings yet

- Types of Mergers and Acq PDFDocument16 pagesTypes of Mergers and Acq PDFNaman Jain0% (1)

- Marketing Performance of Garlic Vendors in Major Public Markets of Davao CityDocument72 pagesMarketing Performance of Garlic Vendors in Major Public Markets of Davao CityRubeline BangunanNo ratings yet

- Intel Case StudyDocument6 pagesIntel Case StudyhazryleNo ratings yet

- Consolidated Financial Statements - Notes PDFDocument2 pagesConsolidated Financial Statements - Notes PDFKeanna Denise GonzalesNo ratings yet

- Body ShopDocument29 pagesBody ShopUzma Malik67% (3)

- Corporate RestructuringDocument27 pagesCorporate RestructuringAkash Bafna100% (1)

- What Is Corporate RestructuringDocument45 pagesWhat Is Corporate RestructuringPuneet GroverNo ratings yet

- Merger & ConsolidationDocument21 pagesMerger & Consolidationgilberthufana446877No ratings yet

- Mergers & Acquisitions KSLUDocument51 pagesMergers & Acquisitions KSLUHans TalawarNo ratings yet

- Mergers and AcquisitionDocument32 pagesMergers and AcquisitionjffhNo ratings yet

- Mergers and AcquisitionDocument95 pagesMergers and AcquisitionjffhNo ratings yet

- Corporate ResDocument22 pagesCorporate Res20bal216No ratings yet

- Merger Acquisition & Corporate RestructuringDocument23 pagesMerger Acquisition & Corporate RestructuringHarsha GuptaNo ratings yet

- Mergers AcquisitionDocument11 pagesMergers AcquisitionAamir NabiNo ratings yet

- Mergers & AmalgamationsDocument9 pagesMergers & AmalgamationsPriya GopiNo ratings yet

- Types of Mergers & AcquisitionsDocument16 pagesTypes of Mergers & Acquisitionschandran0567No ratings yet

- Topic 6.0 - Corporate Restructuring - M ADocument54 pagesTopic 6.0 - Corporate Restructuring - M ANannet WakariNo ratings yet

- Mergers Acquisitions KSLUDocument51 pagesMergers Acquisitions KSLUsalman parvezNo ratings yet

- Acquisition Merger & ConsolidationDocument32 pagesAcquisition Merger & Consolidationgilberthufana446877No ratings yet

- Chapter-4 Business Acquisition & FranchaisingDocument35 pagesChapter-4 Business Acquisition & FranchaisingLowzil Rayan AranhaNo ratings yet

- Mergers and AcquisitionDocument93 pagesMergers and Acquisitionapi-3712392100% (7)

- Cor - Res M1Document107 pagesCor - Res M1Sobhan PradhanNo ratings yet

- What Is Grand Strategy ?Document48 pagesWhat Is Grand Strategy ?Vishwajeet ChavanNo ratings yet

- Grand Strategy Unit 6Document48 pagesGrand Strategy Unit 6ReenaAswaneyNo ratings yet

- Law of Mergers and Governance-3Document73 pagesLaw of Mergers and Governance-3Mohit PrasadNo ratings yet

- Intro To Mergers and AcquisitionDocument54 pagesIntro To Mergers and AcquisitionAmeesha MunjalNo ratings yet

- An andDocument17 pagesAn andastrivediNo ratings yet

- Mergers and AcquisitionsDocument17 pagesMergers and AcquisitionsTahseenKhanNo ratings yet

- M&a 3Document25 pagesM&a 3Xavier Francis S. LutaloNo ratings yet

- Merger & AcquisitionDocument16 pagesMerger & Acquisitionvarsha_kuchara01No ratings yet

- Mergers & AcquisitionDocument54 pagesMergers & AcquisitionMegha Bhatt JoshiNo ratings yet

- Mergers and Acquisitions: Term 6Document17 pagesMergers and Acquisitions: Term 6Jithu JoseNo ratings yet

- Growth Strategies For SMEsDocument82 pagesGrowth Strategies For SMEsLong BunNo ratings yet

- Theory of MergersDocument37 pagesTheory of MergersJoyal JosephNo ratings yet

- Introduction To Corporate RestructuringDocument94 pagesIntroduction To Corporate RestructuringDevansh GoenkaNo ratings yet

- Corporate Restructuring: Prof Ashish K MitraDocument18 pagesCorporate Restructuring: Prof Ashish K MitraSanchit GuptaNo ratings yet

- Unit 1 About MergerDocument6 pagesUnit 1 About MergerJhumri TalaiyaNo ratings yet

- Mergers and AcquisitionsDocument123 pagesMergers and AcquisitionsAshi RohraNo ratings yet

- Introduction To M & ADocument35 pagesIntroduction To M & AShefali PawarNo ratings yet

- Chapter-2 Mergers and AcquisitionsDocument33 pagesChapter-2 Mergers and AcquisitionsMihir KeniaNo ratings yet

- Submitted To Course InstructorDocument15 pagesSubmitted To Course InstructorAmitesh TejaswiNo ratings yet

- Businesscombination Copy Imp Topic 3Document29 pagesBusinesscombination Copy Imp Topic 3Gul khanNo ratings yet

- Corporate RestructuringDocument18 pagesCorporate Restructuringbhavya_bajaj968No ratings yet

- Strategic Financial ManagementDocument14 pagesStrategic Financial ManagementDeepak ParidaNo ratings yet

- Mergers and AcquisitionDocument38 pagesMergers and AcquisitionRajesh WariseNo ratings yet

- Corporate RestructuringDocument10 pagesCorporate RestructuringSamarth PathakNo ratings yet

- Ify Growth of FirmsDocument15 pagesIfy Growth of Firmsdestinyebeku01No ratings yet

- Merger & AcquisitionDocument43 pagesMerger & AcquisitionVinod100% (1)

- Mergers and Acquisitions: Abhishek AgarwalDocument34 pagesMergers and Acquisitions: Abhishek AgarwalchandancogniNo ratings yet

- MergersDocument23 pagesMergersarvind singhalNo ratings yet

- Business Mergers and Amalgamations, Takeover and Corporate-2Document24 pagesBusiness Mergers and Amalgamations, Takeover and Corporate-2Sukruth SNo ratings yet

- Mergers and Acquisitions: Close (X)Document6 pagesMergers and Acquisitions: Close (X)Sunil PatelNo ratings yet

- Introduction To Mergers and AcquisitionsDocument38 pagesIntroduction To Mergers and AcquisitionsSwati TiwariNo ratings yet

- Day 2 - Discussion On M&A TransactionsDocument31 pagesDay 2 - Discussion On M&A TransactionsMAHANTESH GNo ratings yet

- Mergers and Acquisitions TheoryDocument5 pagesMergers and Acquisitions TheoryRathi54No ratings yet

- Meaning of Mergers & AcquistionsDocument9 pagesMeaning of Mergers & Acquistions20bal216No ratings yet

- MergerDocument21 pagesMergerPrince SinghNo ratings yet

- Breakthrough (Review and Analysis of Davidson's Book)From EverandBreakthrough (Review and Analysis of Davidson's Book)No ratings yet

- LLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCFrom EverandLLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCNo ratings yet

- Questions To Be Asked On External InfluencesDocument4 pagesQuestions To Be Asked On External InfluencesRohanNo ratings yet

- ESC Rennes Fact Sheet 2017-2018Document5 pagesESC Rennes Fact Sheet 2017-2018RohanNo ratings yet

- Coca Cola Belgian Crisis: 1999Document2 pagesCoca Cola Belgian Crisis: 1999RohanNo ratings yet

- Promoters (TCS) : Total Shares Held Shares Pledged or Otherwise EncumberedDocument1 pagePromoters (TCS) : Total Shares Held Shares Pledged or Otherwise EncumberedRohanNo ratings yet

- Macroeconomics: PGDM: 2016 - 18 Term 2 (September - December, 2016) (Lecture 05)Document48 pagesMacroeconomics: PGDM: 2016 - 18 Term 2 (September - December, 2016) (Lecture 05)RohanNo ratings yet

- Competitive Advantage in Mature Industries: OutlineDocument9 pagesCompetitive Advantage in Mature Industries: OutlineRohanNo ratings yet

- GSK GroupDocument15 pagesGSK GroupRohanNo ratings yet

- Managerial Communication Questionnaire (1) LIF CRYDocument3 pagesManagerial Communication Questionnaire (1) LIF CRYRohanNo ratings yet

- MBA Basics ModuleDocument68 pagesMBA Basics ModuleRohanNo ratings yet

- Survey MoviesDocument2 pagesSurvey MoviesRohanNo ratings yet

- Matlab Simulation of A Connecting RodDocument5 pagesMatlab Simulation of A Connecting RodRohanNo ratings yet

- Solution Manual Chapter 9Document16 pagesSolution Manual Chapter 9Shealalyn1100% (2)

- IHRMDocument17 pagesIHRMShaily Agarwal100% (1)

- HPG Finance Statement 1Document25 pagesHPG Finance Statement 1Hoàng Ngọc OanhNo ratings yet

- AXA Rosenberg Equity Alpha Trust September Interim 2017Document257 pagesAXA Rosenberg Equity Alpha Trust September Interim 2017Saluka KulathungaNo ratings yet

- PROBLEM EXERCISES IN TAXATION (Series 2019 - Part II) Prepared by Dr. Jeannie P. LimDocument16 pagesPROBLEM EXERCISES IN TAXATION (Series 2019 - Part II) Prepared by Dr. Jeannie P. LimXerjiah YuagaNo ratings yet

- AB Limited Provides You The Following DataDocument2 pagesAB Limited Provides You The Following DataRajarshi DaharwalNo ratings yet

- EDHEC M1 BM Financial Statement Analysis Year 2017Document8 pagesEDHEC M1 BM Financial Statement Analysis Year 2017Dinhkhanh NguyenNo ratings yet

- SAP GL ConfigurationDocument164 pagesSAP GL ConfigurationTharaka Hettiarachchi100% (1)

- NCERT Solutions For Class 11 Economics Chapter 2Document8 pagesNCERT Solutions For Class 11 Economics Chapter 2raghu8215No ratings yet

- IBREL Annual Report2019Document276 pagesIBREL Annual Report2019Anonymous 0BpXe7RMNo ratings yet

- Circular Flow of Economic ActivityDocument8 pagesCircular Flow of Economic ActivityUma BalasubramanianNo ratings yet

- E-Payment Request Form: Payment Details Payment InstructionsDocument1 pageE-Payment Request Form: Payment Details Payment InstructionsSiva ReddyNo ratings yet

- Profit and Loss Practice QuestionsDocument4 pagesProfit and Loss Practice QuestionsAkanksha SinghNo ratings yet

- A Member of AMA Education System: Aclc College of CalapanDocument25 pagesA Member of AMA Education System: Aclc College of CalapanJohnVhal Magboo GarayNo ratings yet

- Bapp 01Document20 pagesBapp 01MaybellineTorresNo ratings yet

- Bank Accounting PolicyDocument29 pagesBank Accounting Policykotha123No ratings yet

- Topper 2 101 504 549 Accountancy Question Up201801231745 1516709744 8573Document15 pagesTopper 2 101 504 549 Accountancy Question Up201801231745 1516709744 8573gauravNo ratings yet

- Fund Mobilization of Commercial BanksDocument3 pagesFund Mobilization of Commercial BanksSidra SidNo ratings yet

- Depreciation KeysDocument54 pagesDepreciation KeysVinod NairNo ratings yet

- Simple InterestDocument7 pagesSimple InterestAbrar AhmedNo ratings yet

- Engineering Economics Final QSDocument6 pagesEngineering Economics Final QSAyugma Acharya0% (1)

- BudgetDocument269 pagesBudgetRavi CharanNo ratings yet

- Intelligent Village - Vibrant India: Building Foundations For Rural EntrepreneurshipDocument32 pagesIntelligent Village - Vibrant India: Building Foundations For Rural EntrepreneurshipjnaguNo ratings yet

Growth Through M&A

Growth Through M&A

Uploaded by

Rohan0 ratings0% found this document useful (0 votes)

36 views14 pagesA merger occurs when two or more companies combine to form one new company or when one company absorbs another. There are two main types of mergers - absorption and consolidation. An acquisition differs in that control is gained over another company but both entities remain legally separate. Mergers and acquisitions are driven by factors like competition and globalization and allow companies to gain scale, synergies, market power and tax benefits. The managerial processes involved careful strategy formulation, due diligence and negotiation of acquisition terms.

Original Description:

m and A

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentA merger occurs when two or more companies combine to form one new company or when one company absorbs another. There are two main types of mergers - absorption and consolidation. An acquisition differs in that control is gained over another company but both entities remain legally separate. Mergers and acquisitions are driven by factors like competition and globalization and allow companies to gain scale, synergies, market power and tax benefits. The managerial processes involved careful strategy formulation, due diligence and negotiation of acquisition terms.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

36 views14 pagesGrowth Through M&A

Growth Through M&A

Uploaded by

RohanA merger occurs when two or more companies combine to form one new company or when one company absorbs another. There are two main types of mergers - absorption and consolidation. An acquisition differs in that control is gained over another company but both entities remain legally separate. Mergers and acquisitions are driven by factors like competition and globalization and allow companies to gain scale, synergies, market power and tax benefits. The managerial processes involved careful strategy formulation, due diligence and negotiation of acquisition terms.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 14

Mergers And Acquisitions

Definition

A merger is said to occur when

two or more companies combine into one company

an existing company or

entirely a new company.

Laws in India use the term amalgamation for merger.

For example, the Income Tax Act, 1961 defines

amalgamation as the merger of one or more companies

with another company or the merger of two or more

companies (called amalgamating company or companies)to

form a new company(called amalgamated company)

Merger or amalgamation may take two

forms:

Merger through absorption.

Merger through consolidation

Merger through absorption

An absorption is a combination of two or more

companies into an existing company.

All companies except one lose their identity in a

merger through absorption.

example : Reliance Petroleum by Reliance industries.

Merger through consolidation

A consolidation is a combination of two or more

companies into a new company.

In a narrow sense, the terms, amalgamation and

consolidation are sometimes used interchangeably.

An example of consolidation is the merger or

amalgamation of Hindustan Computers Ltd., Hindustan

Instruments Ltd. and Indian Reprographics Ltd.

Acquisition

An acquisition may be defined as an act of acquiring

effective control by one company over assets or

management of another company without any

combination of companies.

Thus, in an acquisition two or more companies may

remain independent, separate legal entity, but there

may be change in control of companies.

Horizontal Merger

This is a combination of two or more firms in similar

type of production, distribution or area of business.

Example,

India cement acquired Raasi Cement as well as Vishnu

Cement.

Grasims acquisition of Digvijay Cement and Dharani

Cement.

Vertical Merger

This is a combination of two or more firms involved

in different stages of production or distribution. For

example,

TV manufacturing company and a TV marketing

company.

Merger of Reliance Petroleum Ltd with Reliance

Industries Ltd.

Economic forces leading to mergers and

acquisitions

Enhanced competition,

Free flow of capital across countries and globalisation

of business etc,

Limit competition

Utilise under-utilised market power.

Overcome the problem of slow growth and

profitability in ones own industry.

Gain economies of scale and increase income with

proportionately less investment.

True motives and advantages

Maintaining or accelerating a companys growth,

particularly when the internal growth is constrained

due to paucity of resources.

Enhancing profitability, through cost reduction

resulting from

economies of scale,

operating efficiency and

synergy.

Reducing tax liability because of the provision of

setting-off accumulated losses and unabsorbed

depreciation of one company against the profits of

another.

Limiting the severity of competition by increasing the

companys market power.

Managerial processes in mergers and

acquisitions

Formulation of the strategies for acquisition.

Due diligence.

Merger negotiations to decide the terms of

acquisitions/mergers.

Increased Market Power

A merger can increase the market share of the

merged firm. For example,

Universal Luggage was acquired by Blow Plast for

limiting competition for increasing market power.

Acquisition of Cement Business of L&T by Grasim.

Strategic objectives: (Types of M&A)

Overcapacity M&A:

Eliminate capacity, gain market share

More efficient operation

Geographic roll-up M&A:

Expand geographically, operating units remain local

Product or Market extension M&A

Extends a companies product line.

M&A as R&D

in lieu of in-house R&D to build a market position quickly.

Industry convergence M&A

New industry emerging, positioning for being a part of the new

industry

You might also like

- Auditing Problems 2Document8 pagesAuditing Problems 2Luzviminda Maruzzo100% (2)

- 3Document7 pages3Guillemr Cherry JedlynNo ratings yet

- Mergers & AquisitionsDocument36 pagesMergers & AquisitionsJay KishanNo ratings yet

- Job Order Costing: Illustrative ProblemsDocument30 pagesJob Order Costing: Illustrative ProblemsPatrick LanceNo ratings yet

- Types of Mergers and Acq PDFDocument16 pagesTypes of Mergers and Acq PDFNaman Jain0% (1)

- Marketing Performance of Garlic Vendors in Major Public Markets of Davao CityDocument72 pagesMarketing Performance of Garlic Vendors in Major Public Markets of Davao CityRubeline BangunanNo ratings yet

- Intel Case StudyDocument6 pagesIntel Case StudyhazryleNo ratings yet

- Consolidated Financial Statements - Notes PDFDocument2 pagesConsolidated Financial Statements - Notes PDFKeanna Denise GonzalesNo ratings yet

- Body ShopDocument29 pagesBody ShopUzma Malik67% (3)

- Corporate RestructuringDocument27 pagesCorporate RestructuringAkash Bafna100% (1)

- What Is Corporate RestructuringDocument45 pagesWhat Is Corporate RestructuringPuneet GroverNo ratings yet

- Merger & ConsolidationDocument21 pagesMerger & Consolidationgilberthufana446877No ratings yet

- Mergers & Acquisitions KSLUDocument51 pagesMergers & Acquisitions KSLUHans TalawarNo ratings yet

- Mergers and AcquisitionDocument32 pagesMergers and AcquisitionjffhNo ratings yet

- Mergers and AcquisitionDocument95 pagesMergers and AcquisitionjffhNo ratings yet

- Corporate ResDocument22 pagesCorporate Res20bal216No ratings yet

- Merger Acquisition & Corporate RestructuringDocument23 pagesMerger Acquisition & Corporate RestructuringHarsha GuptaNo ratings yet

- Mergers AcquisitionDocument11 pagesMergers AcquisitionAamir NabiNo ratings yet

- Mergers & AmalgamationsDocument9 pagesMergers & AmalgamationsPriya GopiNo ratings yet

- Types of Mergers & AcquisitionsDocument16 pagesTypes of Mergers & Acquisitionschandran0567No ratings yet

- Topic 6.0 - Corporate Restructuring - M ADocument54 pagesTopic 6.0 - Corporate Restructuring - M ANannet WakariNo ratings yet

- Mergers Acquisitions KSLUDocument51 pagesMergers Acquisitions KSLUsalman parvezNo ratings yet

- Acquisition Merger & ConsolidationDocument32 pagesAcquisition Merger & Consolidationgilberthufana446877No ratings yet

- Chapter-4 Business Acquisition & FranchaisingDocument35 pagesChapter-4 Business Acquisition & FranchaisingLowzil Rayan AranhaNo ratings yet

- Mergers and AcquisitionDocument93 pagesMergers and Acquisitionapi-3712392100% (7)

- Cor - Res M1Document107 pagesCor - Res M1Sobhan PradhanNo ratings yet

- What Is Grand Strategy ?Document48 pagesWhat Is Grand Strategy ?Vishwajeet ChavanNo ratings yet

- Grand Strategy Unit 6Document48 pagesGrand Strategy Unit 6ReenaAswaneyNo ratings yet

- Law of Mergers and Governance-3Document73 pagesLaw of Mergers and Governance-3Mohit PrasadNo ratings yet

- Intro To Mergers and AcquisitionDocument54 pagesIntro To Mergers and AcquisitionAmeesha MunjalNo ratings yet

- An andDocument17 pagesAn andastrivediNo ratings yet

- Mergers and AcquisitionsDocument17 pagesMergers and AcquisitionsTahseenKhanNo ratings yet

- M&a 3Document25 pagesM&a 3Xavier Francis S. LutaloNo ratings yet

- Merger & AcquisitionDocument16 pagesMerger & Acquisitionvarsha_kuchara01No ratings yet

- Mergers & AcquisitionDocument54 pagesMergers & AcquisitionMegha Bhatt JoshiNo ratings yet

- Mergers and Acquisitions: Term 6Document17 pagesMergers and Acquisitions: Term 6Jithu JoseNo ratings yet

- Growth Strategies For SMEsDocument82 pagesGrowth Strategies For SMEsLong BunNo ratings yet

- Theory of MergersDocument37 pagesTheory of MergersJoyal JosephNo ratings yet

- Introduction To Corporate RestructuringDocument94 pagesIntroduction To Corporate RestructuringDevansh GoenkaNo ratings yet

- Corporate Restructuring: Prof Ashish K MitraDocument18 pagesCorporate Restructuring: Prof Ashish K MitraSanchit GuptaNo ratings yet

- Unit 1 About MergerDocument6 pagesUnit 1 About MergerJhumri TalaiyaNo ratings yet

- Mergers and AcquisitionsDocument123 pagesMergers and AcquisitionsAshi RohraNo ratings yet

- Introduction To M & ADocument35 pagesIntroduction To M & AShefali PawarNo ratings yet

- Chapter-2 Mergers and AcquisitionsDocument33 pagesChapter-2 Mergers and AcquisitionsMihir KeniaNo ratings yet

- Submitted To Course InstructorDocument15 pagesSubmitted To Course InstructorAmitesh TejaswiNo ratings yet

- Businesscombination Copy Imp Topic 3Document29 pagesBusinesscombination Copy Imp Topic 3Gul khanNo ratings yet

- Corporate RestructuringDocument18 pagesCorporate Restructuringbhavya_bajaj968No ratings yet

- Strategic Financial ManagementDocument14 pagesStrategic Financial ManagementDeepak ParidaNo ratings yet

- Mergers and AcquisitionDocument38 pagesMergers and AcquisitionRajesh WariseNo ratings yet

- Corporate RestructuringDocument10 pagesCorporate RestructuringSamarth PathakNo ratings yet

- Ify Growth of FirmsDocument15 pagesIfy Growth of Firmsdestinyebeku01No ratings yet

- Merger & AcquisitionDocument43 pagesMerger & AcquisitionVinod100% (1)

- Mergers and Acquisitions: Abhishek AgarwalDocument34 pagesMergers and Acquisitions: Abhishek AgarwalchandancogniNo ratings yet

- MergersDocument23 pagesMergersarvind singhalNo ratings yet

- Business Mergers and Amalgamations, Takeover and Corporate-2Document24 pagesBusiness Mergers and Amalgamations, Takeover and Corporate-2Sukruth SNo ratings yet

- Mergers and Acquisitions: Close (X)Document6 pagesMergers and Acquisitions: Close (X)Sunil PatelNo ratings yet

- Introduction To Mergers and AcquisitionsDocument38 pagesIntroduction To Mergers and AcquisitionsSwati TiwariNo ratings yet

- Day 2 - Discussion On M&A TransactionsDocument31 pagesDay 2 - Discussion On M&A TransactionsMAHANTESH GNo ratings yet

- Mergers and Acquisitions TheoryDocument5 pagesMergers and Acquisitions TheoryRathi54No ratings yet

- Meaning of Mergers & AcquistionsDocument9 pagesMeaning of Mergers & Acquistions20bal216No ratings yet

- MergerDocument21 pagesMergerPrince SinghNo ratings yet

- Breakthrough (Review and Analysis of Davidson's Book)From EverandBreakthrough (Review and Analysis of Davidson's Book)No ratings yet

- LLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCFrom EverandLLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCNo ratings yet

- Questions To Be Asked On External InfluencesDocument4 pagesQuestions To Be Asked On External InfluencesRohanNo ratings yet

- ESC Rennes Fact Sheet 2017-2018Document5 pagesESC Rennes Fact Sheet 2017-2018RohanNo ratings yet

- Coca Cola Belgian Crisis: 1999Document2 pagesCoca Cola Belgian Crisis: 1999RohanNo ratings yet

- Promoters (TCS) : Total Shares Held Shares Pledged or Otherwise EncumberedDocument1 pagePromoters (TCS) : Total Shares Held Shares Pledged or Otherwise EncumberedRohanNo ratings yet

- Macroeconomics: PGDM: 2016 - 18 Term 2 (September - December, 2016) (Lecture 05)Document48 pagesMacroeconomics: PGDM: 2016 - 18 Term 2 (September - December, 2016) (Lecture 05)RohanNo ratings yet

- Competitive Advantage in Mature Industries: OutlineDocument9 pagesCompetitive Advantage in Mature Industries: OutlineRohanNo ratings yet

- GSK GroupDocument15 pagesGSK GroupRohanNo ratings yet

- Managerial Communication Questionnaire (1) LIF CRYDocument3 pagesManagerial Communication Questionnaire (1) LIF CRYRohanNo ratings yet

- MBA Basics ModuleDocument68 pagesMBA Basics ModuleRohanNo ratings yet

- Survey MoviesDocument2 pagesSurvey MoviesRohanNo ratings yet

- Matlab Simulation of A Connecting RodDocument5 pagesMatlab Simulation of A Connecting RodRohanNo ratings yet

- Solution Manual Chapter 9Document16 pagesSolution Manual Chapter 9Shealalyn1100% (2)

- IHRMDocument17 pagesIHRMShaily Agarwal100% (1)

- HPG Finance Statement 1Document25 pagesHPG Finance Statement 1Hoàng Ngọc OanhNo ratings yet

- AXA Rosenberg Equity Alpha Trust September Interim 2017Document257 pagesAXA Rosenberg Equity Alpha Trust September Interim 2017Saluka KulathungaNo ratings yet

- PROBLEM EXERCISES IN TAXATION (Series 2019 - Part II) Prepared by Dr. Jeannie P. LimDocument16 pagesPROBLEM EXERCISES IN TAXATION (Series 2019 - Part II) Prepared by Dr. Jeannie P. LimXerjiah YuagaNo ratings yet

- AB Limited Provides You The Following DataDocument2 pagesAB Limited Provides You The Following DataRajarshi DaharwalNo ratings yet

- EDHEC M1 BM Financial Statement Analysis Year 2017Document8 pagesEDHEC M1 BM Financial Statement Analysis Year 2017Dinhkhanh NguyenNo ratings yet

- SAP GL ConfigurationDocument164 pagesSAP GL ConfigurationTharaka Hettiarachchi100% (1)

- NCERT Solutions For Class 11 Economics Chapter 2Document8 pagesNCERT Solutions For Class 11 Economics Chapter 2raghu8215No ratings yet

- IBREL Annual Report2019Document276 pagesIBREL Annual Report2019Anonymous 0BpXe7RMNo ratings yet

- Circular Flow of Economic ActivityDocument8 pagesCircular Flow of Economic ActivityUma BalasubramanianNo ratings yet

- E-Payment Request Form: Payment Details Payment InstructionsDocument1 pageE-Payment Request Form: Payment Details Payment InstructionsSiva ReddyNo ratings yet

- Profit and Loss Practice QuestionsDocument4 pagesProfit and Loss Practice QuestionsAkanksha SinghNo ratings yet

- A Member of AMA Education System: Aclc College of CalapanDocument25 pagesA Member of AMA Education System: Aclc College of CalapanJohnVhal Magboo GarayNo ratings yet

- Bapp 01Document20 pagesBapp 01MaybellineTorresNo ratings yet

- Bank Accounting PolicyDocument29 pagesBank Accounting Policykotha123No ratings yet

- Topper 2 101 504 549 Accountancy Question Up201801231745 1516709744 8573Document15 pagesTopper 2 101 504 549 Accountancy Question Up201801231745 1516709744 8573gauravNo ratings yet

- Fund Mobilization of Commercial BanksDocument3 pagesFund Mobilization of Commercial BanksSidra SidNo ratings yet

- Depreciation KeysDocument54 pagesDepreciation KeysVinod NairNo ratings yet

- Simple InterestDocument7 pagesSimple InterestAbrar AhmedNo ratings yet

- Engineering Economics Final QSDocument6 pagesEngineering Economics Final QSAyugma Acharya0% (1)

- BudgetDocument269 pagesBudgetRavi CharanNo ratings yet

- Intelligent Village - Vibrant India: Building Foundations For Rural EntrepreneurshipDocument32 pagesIntelligent Village - Vibrant India: Building Foundations For Rural EntrepreneurshipjnaguNo ratings yet