Professional Documents

Culture Documents

Corporate Governance

Corporate Governance

Uploaded by

Piyush Khare0 ratings0% found this document useful (0 votes)

28 views25 pagesThe document discusses the nature of the agency problem in corporate governance where managers' interests may not be aligned with shareholders' interests. It defines corporate governance as the mechanisms used by shareholders to induce managers to act in shareholders' interests. It also outlines some key principles of corporate governance such as shareholders' rights, transparency, board roles and responsibilities, and ethical decision making.

Original Description:

Original Title

CG

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the nature of the agency problem in corporate governance where managers' interests may not be aligned with shareholders' interests. It defines corporate governance as the mechanisms used by shareholders to induce managers to act in shareholders' interests. It also outlines some key principles of corporate governance such as shareholders' rights, transparency, board roles and responsibilities, and ethical decision making.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

28 views25 pagesCorporate Governance

Corporate Governance

Uploaded by

Piyush KhareThe document discusses the nature of the agency problem in corporate governance where managers' interests may not be aligned with shareholders' interests. It defines corporate governance as the mechanisms used by shareholders to induce managers to act in shareholders' interests. It also outlines some key principles of corporate governance such as shareholders' rights, transparency, board roles and responsibilities, and ethical decision making.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 25

CORPORATE GOVERNANCE

NATURE OF AGENCY PROBLEM

Adam Smith had identified, very perceptively, the

agency problem in his classic work The Wealth of

Nations:

"Like the stewards of a rich man, they (managers) are

apt to consider attention to small matters as not for

their master's honour, and very easily give themselves

a dispensation from having it. Negligence and

profusion, therefore, must always prevail, more or less,

in the management of the affairs of such a company."

Managers are the agents of shareholders. There is

often a lack of congruence in the objectives of the

shareholders (principals) and managers (agents). This

leads to agency costs which represent a loss in the

value of the firm.

WHAT IS CORPORATE GOVERNANCE

Corporate governance is concerned basically

with the agency problem that arises from the

separation of finance and management (or, in

popular terms, ownership and control).

It refers to the mechanisms and arrangements

employed by financiers (shareholders and

lenders) to induce managers, who tend to acquire

considerable residual control rights in practice,

to care for their interest.

ASSETS CONTROLLED BY

VARIOUS INDIAN COMPANIES

Total Assets

No of Controlled % of Aggregated Assets

Types of Companies Companies (Rs. Crores) Controlled

Indian Business Groups 2959 893454.61 38%

Top 50 Indian Business Groups 1151 452590.35 19%

Government Controlled Companies 462 1121816.48 48%

Foreign Companies 593 153373.82 7%

Other Companies 5689 171307.64 7%

Total 9703 2339952.55 100%

SHAREHOLDING PATTERN OF

INDIAN COMPANIES

Indian Business

Groups Controlled Government Controlled

Shareholders Companies(%) Companies (%) Foreign Companies (%)

Promoters 51.86 64.71 63.01

Mutual Funds 2.40 1.95 2.37

Banks and Insurance Companies 5.18 8.24 2.92

FIIs 3.64 6.06 2.95

Public 23.85 13.18 19.68

Others 13.07 5.86 9.06

Total 100 100 100

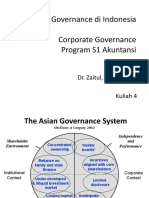

ASIAN OWNERSHIP

The ownership of firms in Asia is held

by a small number of very wealthy

families.

Number of Percent of Assets

Firms in Widely controlled by top

Smaple Family State Held 10 families

Hong Kong 330 66.7 1.4 7 32.1

Indonesia 178 71.5 8.2 5.1 57.7

Japan 1240 9.7 0.8 79.8 2.4

Korea 345 48.4 1.6 43.2 36.8

Malaysia 238 67.2 13.4 10.3 24.8

Philippines 120 44.6 2.1 19.2 52.5

Singapore 221 55.4 23.5 5.4 26.6

Taiwan 141 48.2 2.8 26.2 18.4

Thailand 167 61.6 8 6.6 46.2

The whole issue of corporate governance became a

matter of concern especially because of the process of

globalization and particularly the investment by the

foreign financial institutions in the emerging markets

The investors had to ensure that the companies in

which they invested were not only managed properly

but also had proper corporate governance.

Management involves the optimum use of the

resources available for an enterprise like human,

physical & financial resources as well as time.

Corporate governance relates to the issue of the

framework of values under which an enterprise

performs

the issue of corporate governance is an issue of

agency function namely how to ensure that the

interests of the investors are taken care of.

This is not only in terms of return on investment by

effective management but also ensuring that the

enterprises do not indulge in corrupt practices or acts

which are unethical and which may have greater

consequences.

corporate governance is going to depend on two factors.

The first is the internal factor of the philosophy, values, mission etc. adopted by the

top management of the company.

So far as the internal factors are concerned, the thinking as a result of the various

processes in different countries on the issue of corporate governance appears to be

veering to the option of having supervisory board.

This board will look into the corporate governance aspect and executive board,

which looks into the management aspect. This is the pattern in Germany.

Malaysia had made it mandatory for every corporate directors to undergo annual

reorientation training programmes, so that they would be able to cope with the

changing dynamics of globalization.

Also, it was mandatory that the corporates must appoint independent directors to

one-third of their boards and that they must get themselves rated for corporate

governance annually, besides doing quarterly reporting their corporate performance

PARTIES TO C G

Parties involved in corporate governance include the

regulatory body (e.g. the CHIEF EXECUTIVE OFFICER,

the BOARD OF DIRECTORS, MANAGEMENT and

SHAREHOLDERS).

Other stakeholders who take part include suppliers,

employees, creditors, customers and the community at

large.

In corporations, the shareholder delegates decision rights to

the manager to act in the principal's best interests.

This separation of ownership from control implies a loss of

effective control by shareholders over managerial decisions.

Partly as a result of this separation between the two parties,

a system of CORPORATE GOVERNANCE controls is

implemented to assist in aligning the incentives of

managers with those of shareholders.

With the significant increase in equity holdings of

investors, there has been an opportunity for a

reversal of the separation of ownership and control

problems because ownership is not so diffuse.

A board of directors often plays a key role in

corporate governance. It is their responsibility to

endorse the organisation's strategy, develop

directional policy, appoint, supervise and remunerate

senior executives and to ensure accountability of the

organisation to its owners and authorities

The COMPANY SECRETARY is a high ranking professional

who is trained to uphold the highest standards of corporate

governance, effective operations, compliance and administration.

All parties to corporate governance have an interest, whether

direct or indirect, in the effective performance of the organisation.

Directors, workers and management receive salaries, benefits and

reputation, while shareholders receive capital return.

Customers receive goods and services; suppliers receive

compensation for their goods or services. In return these

individuals provide value in the form of natural, human, social

and other forms of capital.

A key factor is an individual's decision to participate in an

organisation e.g. through providing financial capital and trust that

they will receive a fair share of the organisational returns.

If some parties are receiving more than their fair return then

participants may choose to not continue participating leading to

organizational collapse.

PRINCIPLES

Commonly accepted principles of corporate governance

include:

Rights and equitable treatment of shareholders:

Organizations should respect the rights of shareholders and

help shareholders to exercise those rights.

Interests of other stakeholders: Organizations should

recognize that they have legal and other obligations to all

legitimate stakeholders.

Role and responsibilities of the board:

The board needs a range of skills and understanding to be able

to deal with various business issues and have the ability to

review and challenge management performance. It needs to be

of sufficient size and have an appropriate level of commitment

to fulfill its responsibilities and duties.

Integrity and ethical behaviour: Ethical and responsible decision

making is not only important for public relations, but it is also a

necessary element in risk management and avoiding lawsuits.

Organizations should develop a code of conduct for their directors

and executives that promotes ethical and responsible decision

making.

Disclosure and transparency: Organizations should clarify and

make publicly known the roles and responsibilities of board and

management to provide shareholders with a level of accountability.

They should also implement procedures to independently verify and

safeguard the integrity of the company's financial reporting.

Disclosure of material matters concerning the organization should be

timely and balanced to ensure that all investors have access to clear,

factual information.

GOVERNANCE PRINCIPLES

INCLUDE:

internal controls and internal auditors

the independence of the entity's external auditors and the

quality of their audits

oversight and management of risk

oversight of the preparation of the entity's financial

statements

review of the compensation arrangements for the chief

executive officer and other senior executives

the resources made available to directors in carrying out

their duties

the way in which individuals are nominated for positions

on the board

DIVIDEND policy

Integrity and ethical behaviour: Ethical and responsible decision

making is not only important for public relations, but it is also a

necessary element in risk management and avoiding lawsuits.

Organizations should develop a code of conduct for their directors and

executives that promotes ethical and responsible decision making. It is

important to understand, though, that reliance by a company on the

integrity and ethics of individuals is bound to eventual failure. Because

of this, many organizations establish Compliance and Ethics Programs

to minimize the risk that the firm steps outside of ethical and legal

boundaries.

Disclosure and transparency: Organizations should clarify and make

publicly known the roles and responsibilities of board and management

to provide shareholders with a level of accountability. They should also

implement procedures to independently verify and safeguard the

integrity of the company's financial reporting. Disclosure of material

matters concerning the organization should be timely and balanced to

ensure that all investors have access to clear, factual information.

In India the Bajaj Committee has

recommended that we need not go in for two

tier system for running of enterprise and

governance of the corporations are concerned.

This brings the other alternative of having

external part time directors for companies who

in turn would play the role of a watchdog to the

board not only for protecting the interests of

the stakeholders but also from the point of view

of corporate governance.

The formation of an ethics committee and a

finance committee seems to be the pattern.

CORPORATE GOVERNANCE IN

INDIA : PRIVATE SECTOR

Historically, promoters, financial institutions, and

individual investors, on average, were more or less equal

shareholders.

In recent years, promoters and financial institutions have

gained at the expense of individual investors.

For electing the directors, the majority rule voting system

is typically followed.

Company boards comprise of three types of directors :

promoter directors, professional directors, and

institutionally nominated directors.

In general, institutional investors have been supportive of

promoters.

Individual shareholders have, by and large, been benign,

tolerant, and ignorant.

CORPORATE GOVERNANCE IN INDIA :

PUBLIC SECTOR

Boards comprise of functional directors,

government directors, and outside directors.

There can be a good deal of political and

bureaucratic influence over the management of

PSUs.

PSUs are constrained by various regulations and

administrative guidelines.

The short tenure of CEOs may induce myopia.

In general, performance standards are soft,

compensation levels low, incentives for

performance poor, and ‘real’ accountability

weak.

THE COMPANIES

ACT

The key legal provisions with respect to

corporate boards are as follows:

Strength A public limited company must have at

least three directors

Meetings The board of directors must meet at least

once in a quarter

Composition There is no fixed number of non-

executive directors.

No person can be a director of more than twenty

companies.

Powers The board of directors has the

powers to (a) borrow, lend, and invest funds,

(b) recommend dividends, and (c) appoint

the managing director.

Remuneration The total remuneration of

the directors is subject to a ceiling of 11

percent of net profits.

In addition, board members can be paid a

sitting fees upto Rs.20000 per meeting.

Duties The board has the duty to present

the annual report to the members.

Liabilities The board is punishable for

breach of trust, dishonesty, and fraud.

CONFLICT OF INTEREST

According to Lambert and Larcker, there are

three principal sources of conflict between the

interest of managers (agents) and the interest of

shareholders (principals).

Excessive perquisites

Differential risk attitudes

Varying time horizons

Theexecutive compensation system can be an

important means of reconciling the conflicts.

DESIGNING AN INCENTIVE COMPENSATION PLAN

Integrate the incentive plan into the total compensation

architecture

Choose the appropriate level of risk posture and time

focus

Use objective criteria

Select the right set of performance measures

Reward relative performance

Discourage parochial behaviour

Abandon attempts to measure what executives control

Lengthen the decision making horizon of the executives

Employ stock options judiciously

Ensure tax efficiency

EMPLOYEE STOCK OPTION PLAN

In India, stock options which were virtually

unheard of till the late 1990s are gaining

popularity and a lot of attention, particularly in

knowledge-intensive sectors like information

technology, entertainment, and health care.

This trend is expected to gather momentum

because it is generally believed that stock options

align closely the interest of managers with those

of shareholders.

After all, the value of a stock option depends

mainly on the share price which is the dominant

component of shareholders' total return.

SHAREHOLDER VALUE CREATION NETWORK

Creating shareholder

Corporate objective Shareholder return

value

• Dividends

• Capital gains

Valuation

components Cash flow from operations Discount rate Debt

Value • Value growth • Cost of

drivers duration • Sales growth • Working capital capital

• Operating profit investment

margin • Fixed capital

• Income tax rate investment

Management decisions Operating Investment Financing

Source : Alfred Rappaport, Creating Shareholder Value : A Guide for Managers and Investors.

You might also like

- Developers BudgetDocument5 pagesDevelopers BudgetDilanthaDeSilva50% (2)

- Corporete Governance Final ExamDocument7 pagesCorporete Governance Final Examcn comNo ratings yet

- 2019 TaxreturnDocument6 pages2019 TaxreturnMARC ANDREWS WOLFFNo ratings yet

- Corporate Governance and EthicsDocument285 pagesCorporate Governance and EthicsSURYA100% (10)

- Evaluation of Spin Off of Indian CompaniesDocument33 pagesEvaluation of Spin Off of Indian Companiesparthsarthi_705No ratings yet

- Mid-Rise Economics, Proforma Analysis: Total Costs PSF GLADocument1 pageMid-Rise Economics, Proforma Analysis: Total Costs PSF GLAMeek MillNo ratings yet

- WILP - CGEC - Reading Material PDFDocument273 pagesWILP - CGEC - Reading Material PDFMALAVIKA SNo ratings yet

- Assignment On Corporate GovernanceDocument22 pagesAssignment On Corporate GovernanceRakib TusharNo ratings yet

- Corporate GovernanceDocument33 pagesCorporate GovernanceAmol Shelar50% (2)

- What Are The Principles Underlying Corporate Governance?Document3 pagesWhat Are The Principles Underlying Corporate Governance?wannaplayNo ratings yet

- Gobierno Corporativo INDIRADocument12 pagesGobierno Corporativo INDIRAIndira Judith Castro CarbajalNo ratings yet

- Becg m-5Document16 pagesBecg m-5CH ANIL VARMANo ratings yet

- Tutorial 6 Company LawDocument3 pagesTutorial 6 Company Lawdanish0127No ratings yet

- Corporate Governance in IndiaDocument9 pagesCorporate Governance in IndiaRama KrishnanNo ratings yet

- Unite 6 (Leadership)Document7 pagesUnite 6 (Leadership)टलक जंग सरकारNo ratings yet

- CH 1 Conceptual Frameworkof CGDocument30 pagesCH 1 Conceptual Frameworkof CGKhushali OzaNo ratings yet

- Modules 4,7,8,9,10Document32 pagesModules 4,7,8,9,10Pranav KadamNo ratings yet

- Profitability and Welfare 2Document11 pagesProfitability and Welfare 2Shailesh KumarNo ratings yet

- Corp Notes 1Document23 pagesCorp Notes 1ishutiwari56789No ratings yet

- Corporate Governance in Indian Perspective: A Case of Grasim IndustriesDocument11 pagesCorporate Governance in Indian Perspective: A Case of Grasim IndustriesInternational Journal in Management Research and Social ScienceNo ratings yet

- Group 4Document28 pagesGroup 4Kriti SinghNo ratings yet

- Business Ethics (Unit 3)Document6 pagesBusiness Ethics (Unit 3)prabhav1822001No ratings yet

- Issues and Challenges of Corporate Governance in IndiaDocument16 pagesIssues and Challenges of Corporate Governance in IndiaArya SenNo ratings yet

- Diversification Strategy. (Don Not Put All Your Eggs in One Basket)Document3 pagesDiversification Strategy. (Don Not Put All Your Eggs in One Basket)Watcher PegasusNo ratings yet

- Corporate Governance - Presentation-12Document53 pagesCorporate Governance - Presentation-12Puneet MittalNo ratings yet

- Zahid Riaz Corporate GovernanceDocument10 pagesZahid Riaz Corporate GovernanceZahidRiazHaansNo ratings yet

- Corporate Governance Aim, Importance and Problems in IndiaDocument7 pagesCorporate Governance Aim, Importance and Problems in IndiaManas DudhaniNo ratings yet

- Assignment ECGDocument13 pagesAssignment ECGsaitteyNo ratings yet

- Group 4 - FSAFADocument5 pagesGroup 4 - FSAFAAbhishek GautamNo ratings yet

- Pradeep Kumar Gupta22020091612606Document12 pagesPradeep Kumar Gupta22020091612606Madhav ZoadNo ratings yet

- unit-4CG ChallengesDocument7 pagesunit-4CG Challengeskush mandaliaNo ratings yet

- Corporate Governance ProjectDocument13 pagesCorporate Governance ProjectPratik BanerjeeNo ratings yet

- Corporate GovernanceDocument11 pagesCorporate GovernanceHeenu GillNo ratings yet

- Enterprise: Gundo Masindi CA (SA)Document20 pagesEnterprise: Gundo Masindi CA (SA)chaukeeuginiaNo ratings yet

- Corporate GovernanceDocument23 pagesCorporate Governancejoshant012No ratings yet

- Corporate Governance: Constitution of CommitteeDocument26 pagesCorporate Governance: Constitution of CommitteeRajeev KambleNo ratings yet

- Unit 17 Investors Relations: ObjectivesDocument41 pagesUnit 17 Investors Relations: ObjectivesHolly SmithNo ratings yet

- Chapter 1Document26 pagesChapter 1Baby KhorNo ratings yet

- BUSS 426 Governance and Ethics NotesDocument43 pagesBUSS 426 Governance and Ethics NotesFabio NyagemiNo ratings yet

- Kumar Mangalam Committe ReportDocument26 pagesKumar Mangalam Committe Reportrahul_singh128854436No ratings yet

- Corporate Governance: An OverviewDocument24 pagesCorporate Governance: An OverviewAmmara NawazNo ratings yet

- LM02 Introduction To Corporate Governance and Other ESG ConsiderationsDocument21 pagesLM02 Introduction To Corporate Governance and Other ESG ConsiderationsSYED HAIDER ABBAS KAZMINo ratings yet

- 3 - Corporate Governance PPT - 03, Lecture - 5, 6, 7 & 8Document35 pages3 - Corporate Governance PPT - 03, Lecture - 5, 6, 7 & 8PRAKHAR GUPTA100% (1)

- Lecture 4Document22 pagesLecture 4zaitul ubhNo ratings yet

- Governing OrganizationgDocument13 pagesGoverning OrganizationgNINIO B. MANIALAGNo ratings yet

- Corporate GovernanaceDocument48 pagesCorporate GovernanaceTinoManhangaNo ratings yet

- What Is Corporate GovernanceDocument5 pagesWhat Is Corporate GovernanceAkif AlamNo ratings yet

- Q1. The Following Information of A Company Is Given To YouDocument5 pagesQ1. The Following Information of A Company Is Given To YouAman RastogiNo ratings yet

- Need & Scope of Corporate Governance in IndiaDocument8 pagesNeed & Scope of Corporate Governance in IndiaVaishnavi VenkatesanNo ratings yet

- Corporate Governance: Q.1) What Are The Factors Affecting Corporate Governance? (400 Words, 10 Marks)Document12 pagesCorporate Governance: Q.1) What Are The Factors Affecting Corporate Governance? (400 Words, 10 Marks)Tanay Kumar DasNo ratings yet

- Module 3Document6 pagesModule 3Marjalino Laicell CrisoloNo ratings yet

- Agency Theory, Kaplan UkDocument4 pagesAgency Theory, Kaplan UkTRÂN PHẠM NGỌC BẢONo ratings yet

- CG - Lecturer Week 3Document23 pagesCG - Lecturer Week 3chong jia xinNo ratings yet

- Business Ethics: Assignment OnDocument9 pagesBusiness Ethics: Assignment OnSomesh KumarNo ratings yet

- Overview of Governance Governance in GeneralDocument5 pagesOverview of Governance Governance in GeneralJohn Michael GeneralNo ratings yet

- Core Concept of Corporate Governance: Professor Niki Lukviarman (Governance Research Program-Andalas University)Document26 pagesCore Concept of Corporate Governance: Professor Niki Lukviarman (Governance Research Program-Andalas University)Inney SildalatifaNo ratings yet

- Pradeep Kumar Gupta22020091612606Document12 pagesPradeep Kumar Gupta22020091612606log10No ratings yet

- Corporate Governance ThesisDocument76 pagesCorporate Governance ThesisAtul KumarNo ratings yet

- Yes Bank Corp Govn.Document24 pagesYes Bank Corp Govn.choco_pie_952No ratings yet

- Business Ethics - Part 2 - Chapter 5Document26 pagesBusiness Ethics - Part 2 - Chapter 5Sarah Jarrar100% (1)

- Total ProjectDocument78 pagesTotal ProjectChandra Sekhar JujjuvarapuNo ratings yet

- ZERO TO MASTERY IN CORPORATE GOVERNANCE: Become Zero To Hero In Corporate Governance, This Book Covers A-Z Corporate Governance Concepts, 2022 Latest EditionFrom EverandZERO TO MASTERY IN CORPORATE GOVERNANCE: Become Zero To Hero In Corporate Governance, This Book Covers A-Z Corporate Governance Concepts, 2022 Latest EditionNo ratings yet

- Review Problem: Budget Schedules: RequiredDocument8 pagesReview Problem: Budget Schedules: RequiredShafa AlyaNo ratings yet

- Annualrpt2018 PDFDocument270 pagesAnnualrpt2018 PDFHelenNo ratings yet

- National Income Formula and NumericalsDocument17 pagesNational Income Formula and Numericalsbhaskarvishal100% (9)

- 1 Modul - Accounting IntermediateDocument30 pages1 Modul - Accounting IntermediatepastadishéNo ratings yet

- MCQ FRMDocument40 pagesMCQ FRMAmine IzamNo ratings yet

- FM Final ReviewerDocument42 pagesFM Final ReviewerMaryJaneNo ratings yet

- Cost Accounting BBA MCQsDocument19 pagesCost Accounting BBA MCQsPhanikumar Katuri100% (2)

- Name: Date: Management Advisory Services: P1,500 of Fixed Costs. Calculate The Variable Cost Per UnitDocument3 pagesName: Date: Management Advisory Services: P1,500 of Fixed Costs. Calculate The Variable Cost Per UnitLeizzamar BayadogNo ratings yet

- 07 - Mock Paper 1Document6 pages07 - Mock Paper 1monster gamerNo ratings yet

- Chapter 3 Adjusting The Accounts PDFDocument56 pagesChapter 3 Adjusting The Accounts PDFJed Riel BalatanNo ratings yet

- Final Tax ReviewerDocument35 pagesFinal Tax Revieweryza100% (1)

- Ch07 Audit Planning Assessment of Control Risk1Document26 pagesCh07 Audit Planning Assessment of Control Risk1Mary GarciaNo ratings yet

- Camposol Holding PLC: Fourth Quarter and Preliminary Full Year 2018 ReportDocument24 pagesCamposol Holding PLC: Fourth Quarter and Preliminary Full Year 2018 Reportkaren ramosNo ratings yet

- Valuation Gordon Growth ModelDocument25 pagesValuation Gordon Growth ModelwaldyraeNo ratings yet

- FS AmardexDocument104 pagesFS AmardexGideon SalvadorNo ratings yet

- L13LLB183031Document29 pagesL13LLB183031Debasis MisraNo ratings yet

- Lecture 8 - Share CapitalDocument15 pagesLecture 8 - Share CapitalJason LuximonNo ratings yet

- Accountancy XII Trial Pakshikha 2021Document15 pagesAccountancy XII Trial Pakshikha 2021Kuenga Geltshen100% (1)

- Acrysil 20211130 Ary in CD EquisearchDocument16 pagesAcrysil 20211130 Ary in CD EquisearchsourabhNo ratings yet

- f8 QuestionsDocument66 pagesf8 QuestionsReem JavedNo ratings yet

- Valuation of SharesDocument15 pagesValuation of Sharesbharatipaul42No ratings yet

- Ind As 11Document37 pagesInd As 11CA Keshav MadaanNo ratings yet

- Kunezle & StreiffDocument3 pagesKunezle & StreiffJanna Robles SantosNo ratings yet

- Tally PDFDocument1 pageTally PDFVipin Kumar ChandelNo ratings yet

- Finance MBADocument528 pagesFinance MBASantosh Athani100% (1)

- Fa S23 Introduction To Consolidated Financial StatementsDocument9 pagesFa S23 Introduction To Consolidated Financial StatementsCharisma CharlesNo ratings yet

- Intermediate Accounting All Summaries and Classifications 1Document2 pagesIntermediate Accounting All Summaries and Classifications 1Imthe OneNo ratings yet