Professional Documents

Culture Documents

MM CH05

MM CH05

Uploaded by

Isam BoukattayaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MM CH05

MM CH05

Uploaded by

Isam BoukattayaCopyright:

Available Formats

Chapter 5

Banking Procedures

Copyright 2007 Thomson South-Western

Introduction to Checking Accounts

A check is a written order to pay a stated

amount to a person or business

Checking account

Is a demand deposit in a bank or other financial

institution

Provides a safe place to keep money

Provides easy access to the money

The FDIC insures accounts for up to

$100,000 per depositor per bank

5-1 Checking Accounts Slide 2

Opening an Account

To open an account, you will need to

Provide personal data and identification

Complete a signature card

Deposit money

Some banks charge

monthly fees or a fee

for each check written

5-1 Checking Accounts Slide 3

Keeping a Checkbook Register

Checks and a checkbook register are

received when you open an account

A checkbook register

Can be used to track checking account

transactions

Can provide a record of payments made for

bills or purchases

Shows how much money is in the account

5-1 Checking Accounts Slide 4

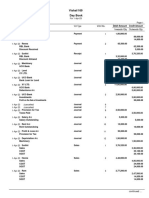

Sample Checkbook Register

5-1 Checking Accounts Slide 5

Writing Checks

Use ink to write the data on checks

The current date

The name of the payee

The amount in numbers and words

Your signature

A note on the Memo line

If you make a mistake

Write VOID on the check and in the register

Begin a new check

5-1 Checking Accounts Slide 6

Sample Check

5-1 Checking Accounts Slide 7

Using Debit and ATM Cards

Debit card

Allows the account holder to withdraw cash

at an ATM

Can be used to make purchases

The withdrawal is made electronically

ATM card

Allows the account holder to withdraw cash

or make deposits at an ATM

5-1 Checking Accounts Slide 8

Protecting Account Data

Crimes can be committed using account

and personal data

Check fraud and forgery

Identity theft

To help prevent crime

Keep cards and account

information in a safe place

Protect your PIN or

password when using cards

5-1 Checking Accounts Slide 9

Making Deposits

Endorse checks to be deposited

5-1 Checking Accounts Slide 10

Making Deposits

Complete a deposit slip, including

Current date

Amount of cash (bills and coins)

Check numbers and amounts

Total amount of cash and checks

Cash amount received, if any, and your

signature

Net deposit amount

Record the deposit in the check register

5-1 Checking Accounts Slide 11

Reconciling a Bank Statement

Bank statements

Come in paper or electronic form

Show the checks, other withdrawals, and

deposits made to an account

Purpose of a bank reconciliation

To review the bank statement

To update the checkbook register

To bring the statement and register balances

into agreement

5-1 Checking Accounts Slide 12

Focus on...

Check Cashing Services

Are businesses that charge a fee to cash a

check

Charge fees that vary by state and by the

type of check being cashed

May also make payday loans

5-1 Checking Accounts Slide 13

The Purpose of Savings

Saving means accumulating money to

use for future needs

A savings account

Is a demand deposit in a bank or other

financial institution

Is a safe way to set aside money

Typically pays interest

May have some restrictions on how quickly or

easily the money can be withdrawn

5-2 Savings Accounts Slide 14

Computing Interest

Money deposited in a savings account

typically earns a set rate of interest

Simple interest

SIMPLE INTEREST

Interest (I) = Principal (P) x Rate (R) x Time (T)

Interest = $1,000 x 6% annual rate x 6 months

$30 = $1,000 x 0.06 x 0.5

5-2 Savings Accounts Slide 15

Computing Interest

Compound interest

QUARTERLY COMPOUNDING

Annual Interest Rate 6%

Quarterly Interest

Beginning Ending

Year Balance Rate 1 2 3 4 Balance

1 $100.00 0.015 $1.50 $1.52 $1.55 $1.57 $106.14

2 $106.14 0.015 $1.59 $1.62 $1.64 $1.66 $112.65

3 $112.65 0.015 $1.69 $1.72 $1.74 $1.77 $119.57

5-2 Savings Accounts Slide 16

Savings Options

Certificates of deposit

Money market accounts

Individual retirement arrangements (IRAs)

U.S. savings

bonds

The TreasuryDirect Web

site provides information

on savings bonds.

Source: TreasuryDirect, http://www.treasurydirect.gov

(accessed April 27, 2006).

5-2 Savings Accounts Slide 17

Meeting Financial Goals

When choosing a savings option, consider

The amount to save

The length of time you will save

The interest you can earn

Use the Rule of 72 to estimate how long it

will take the money to double at a certain

interest rate

5-2 Savings Accounts Slide 18

Bank Services

Safe deposit box

Overdraft protection

Cashiers checks and money orders

Stop payment

Bank cards

Bank loans

Banks offer home mortgages

and other types of loans.

5-2 Savings Accounts Slide 19

Success Skills

Negotiating

Means working to reach an agreement

that benefits you

Understand your position (what you want)

Understand the other partys position

Create a proposed solution

Be willing to compromise when appropriate

5-2 Savings Accounts Slide 20

Ethics

Writing Bad Checks

A bad check is one you write but do not

have money in the account to pay

Monitor your account carefully to avoid

writing a bad check by mistake

Show ethical behavior by not writing a

bad check intentionally

5-2 Savings Accounts Slide 21

Technology Corner

Internet Banking

Involves banking using phone or Internet access

to bank accounts

Offers various services

Electronic payment of bills

Transfer of money between accounts

Checking that deposits are posted

Seeing which checks have been processed

Seeing interest or fees that have been posted

5-2 Savings Accounts Slide 22

Federal Reserve System

Is the central bank of the United States

Seeks to provide the nation with safe, flexible,

and stable monetary and financial systems

Source: The Federal Reserve Board, http://www.federalreserve.gov/consumers.htm

(accessed October 20, 2006).

5-3 The Federal Reserve System Slide 23

Monetary Policy

Key interest rates are controlled by the Fed

Discount rate

Federal funds rate

Prime rate

The Fed sells and buys U.S. government

securities in open-market transactions

Government bills (Treasury bills)

Treasury notes

Treasury bonds

5-3 The Federal Reserve System Slide 24

Monetary Policy

The Fed plays a major role in operating the

countrys payment systems

Reserve banks act as a clearinghouse for checks

Checks may be deducted from your account in a

single business day

The Fed regulates the banking industry

All interstate banks must be Fed members

Intrastate banks are also subject to Fed rules

5-3 The Federal Reserve System Slide 25

Building Communications Skills

Reading Comprehension

Is the ability to understand what is read

Can be improved with practice

Read slowly and think about the material

Note the paragraph structure and topic sentences

Underline key points

Read the material a second time, focusing on

vocabulary and details

5-3 The Federal Reserve System Slide 26

You might also like

- Direct Deposit Info PDFDocument1 pageDirect Deposit Info PDFJustin hill100% (1)

- Deposit Function PDFDocument75 pagesDeposit Function PDFrojon pharmacyNo ratings yet

- Eco 101 Midterm ExamDocument2 pagesEco 101 Midterm ExamIsam Boukattaya0% (1)

- Beowulf Timed WritingDocument2 pagesBeowulf Timed WritingIsam BoukattayaNo ratings yet

- John Jay Immunization FormDocument3 pagesJohn Jay Immunization FormIsam BoukattayaNo ratings yet

- Tax Test Bank TheoryDocument6 pagesTax Test Bank TheoryXtian de Vera100% (1)

- BlackDocument2 pagesBlacksaxvdx100% (1)

- Chap 017Document44 pagesChap 017coukslyneNo ratings yet

- Money Management Skills: - Must Be Coordinated With Needs, Goals, and Personal SituationDocument24 pagesMoney Management Skills: - Must Be Coordinated With Needs, Goals, and Personal SituationDan KellyNo ratings yet

- AFN 221 W04 Savings vF2021Document19 pagesAFN 221 W04 Savings vF2021Dina SboulNo ratings yet

- 1 Money, Banking, and Finance - 231226 - 101619Document143 pages1 Money, Banking, and Finance - 231226 - 101619Arjun RunaiyaNo ratings yet

- BusinessDocument34 pagesBusinessMaryem YaakoubiNo ratings yet

- 05 Accounting For CashDocument37 pages05 Accounting For CashTahir DestaNo ratings yet

- Types of Investment and The Related Risk: Business FinanceDocument22 pagesTypes of Investment and The Related Risk: Business FinanceRovic NacionNo ratings yet

- Fundamentals of Accountancy, Business and Management 2Document22 pagesFundamentals of Accountancy, Business and Management 2wendell john medianaNo ratings yet

- NHUNG - C 2 - Part 1-Personal Financial Services - SVDocument8 pagesNHUNG - C 2 - Part 1-Personal Financial Services - SVHoàng NhiNo ratings yet

- ACC201 PPTs - 2T2019 - Workshop 06 - Week 07Document23 pagesACC201 PPTs - 2T2019 - Workshop 06 - Week 07Luu MinhNo ratings yet

- Topic 7: Traditional Banking ProductsDocument26 pagesTopic 7: Traditional Banking ProductsPremah BalasundramNo ratings yet

- Cash and Liquidity ManagementDocument35 pagesCash and Liquidity ManagementWALTER SHAMAIRAINo ratings yet

- PERSONAL FINANCIAL STATEMENTS (Money Management Strategy, Financial Statements and Budgeting) - Amended 19102023Document39 pagesPERSONAL FINANCIAL STATEMENTS (Money Management Strategy, Financial Statements and Budgeting) - Amended 19102023khairighulamNo ratings yet

- FABM2-MODULE 8 - With ActivitiesDocument7 pagesFABM2-MODULE 8 - With ActivitiesROWENA MARAMBANo ratings yet

- Managing Your Cash and SavingsDocument48 pagesManaging Your Cash and SavingsAbigail ConstantinoNo ratings yet

- Group 3 - Cash and Marketable SecuritiesDocument71 pagesGroup 3 - Cash and Marketable SecuritiesNaia SNo ratings yet

- Ch.4 - Cash and Receivables - MHDocument75 pagesCh.4 - Cash and Receivables - MHSamZhaoNo ratings yet

- Cash ManagementDocument27 pagesCash ManagementAnonymous jGew8BNo ratings yet

- SLG FABM2 Q1 WK 8Document5 pagesSLG FABM2 Q1 WK 8Maybellyn RoqueNo ratings yet

- CH 7Document32 pagesCH 7Савелий СмирновNo ratings yet

- ECON Chapter 6Document6 pagesECON Chapter 6Mushaisano MudauNo ratings yet

- Fundamentals of Accountancy, Business, and Management 2Document11 pagesFundamentals of Accountancy, Business, and Management 2Honey ShenNo ratings yet

- Chap017 2Document29 pagesChap017 2coukslyneNo ratings yet

- Banking Basics: by Prasanthi VDocument29 pagesBanking Basics: by Prasanthi VSrikanth ReddyNo ratings yet

- Checking Savings InvestmentsDocument25 pagesChecking Savings InvestmentsAlyssa SophiaNo ratings yet

- Bank Financial Analysis PresentationDocument24 pagesBank Financial Analysis PresentationlevuthiNo ratings yet

- WCMDocument12 pagesWCMShariful IslamNo ratings yet

- Chapter - 20 Cash and Liquidity ManagementDocument17 pagesChapter - 20 Cash and Liquidity ManagementBayem BusukNo ratings yet

- Cash and Liquidity Management: Mcgraw-Hill/IrwinDocument19 pagesCash and Liquidity Management: Mcgraw-Hill/Irwinjoshua soebrotoNo ratings yet

- Module 2Document57 pagesModule 2Tejaswini TejuNo ratings yet

- BankingDocument32 pagesBankingapi-173610472No ratings yet

- Fabm2 Q1 - W7 M10Document17 pagesFabm2 Q1 - W7 M10Ashianna Kim FernandezNo ratings yet

- FABM 2 Module 4Document14 pagesFABM 2 Module 4Gotenk JujuNo ratings yet

- Cash and Marketable Securities Management: Group 8Document14 pagesCash and Marketable Securities Management: Group 8Ruhani KimpaNo ratings yet

- Accounting 2 - 4rd ModuleDocument4 pagesAccounting 2 - 4rd ModuleJessalyn Sarmiento TancioNo ratings yet

- Fabm2 Final M2Document8 pagesFabm2 Final M2BryanNo ratings yet

- Fundamentals of Accountancy Business and Management 2Document20 pagesFundamentals of Accountancy Business and Management 2MOST SUBSCRIBER WITHOUT A VIDEO43% (7)

- Chapter 9 (Banking Products and Services)Document48 pagesChapter 9 (Banking Products and Services)2023436742No ratings yet

- Lecture 5 and 6Document43 pagesLecture 5 and 6Wei WeiNo ratings yet

- Unit-3 Commercial Banking & Retail BanksDocument97 pagesUnit-3 Commercial Banking & Retail BanksAbhikaam SharmaNo ratings yet

- Notes: MARCH 18, 2021Document4 pagesNotes: MARCH 18, 2021Joris YapNo ratings yet

- Abm Basic DocumentsDocument6 pagesAbm Basic DocumentsAmimah Balt GuroNo ratings yet

- Bank Risk AssessmentDocument52 pagesBank Risk AssessmentWessam IbrahemNo ratings yet

- Do You Have A: SavingsDocument34 pagesDo You Have A: SavingsLee TeukNo ratings yet

- FINA2209 Lecture2Document35 pagesFINA2209 Lecture2Dylan AdrianNo ratings yet

- ACCY111 Spring 2019 Week 3 Lecture Powerpoint PresentationDocument29 pagesACCY111 Spring 2019 Week 3 Lecture Powerpoint PresentationStephanie BuiNo ratings yet

- Cash Management Varun 10808154 Project OnDocument24 pagesCash Management Varun 10808154 Project Ondont_forgetme2004No ratings yet

- Branch Banking in PakistanDocument42 pagesBranch Banking in PakistanZaid Bin SafdarNo ratings yet

- Accounting Prefinals ReviewerDocument9 pagesAccounting Prefinals ReviewerMaxine RodriguezNo ratings yet

- Cash Handling Procedures "Don't Lose The Lettuce": Pepperdine University Cashier's Office Tac 2 Floor, Malibu x4107Document23 pagesCash Handling Procedures "Don't Lose The Lettuce": Pepperdine University Cashier's Office Tac 2 Floor, Malibu x4107TinsuNo ratings yet

- Cash Handling BasicsDocument49 pagesCash Handling BasicsHassan MphandeNo ratings yet

- Content No. 06 Basic Documents and Transactions Related To Bank DepositsDocument3 pagesContent No. 06 Basic Documents and Transactions Related To Bank DepositsAway To PonderNo ratings yet

- Accounting For and Presentation of Current AssetsDocument54 pagesAccounting For and Presentation of Current AssetsdanterozaNo ratings yet

- Techniques To Analyze Financial StatementDocument2 pagesTechniques To Analyze Financial StatementrizaNo ratings yet

- Lesson Plan Basic Banking TransactionDocument7 pagesLesson Plan Basic Banking TransactionJennifer Dela Rosa100% (1)

- Training, Teaching and Learning Materials (TTLM)Document16 pagesTraining, Teaching and Learning Materials (TTLM)birhanu sintayehuNo ratings yet

- Insider Information: What Wall Street Doesn't Want Your Street to KnowFrom EverandInsider Information: What Wall Street Doesn't Want Your Street to KnowNo ratings yet

- Napkin Finance: Build Your Wealth in 30 Seconds or LessFrom EverandNapkin Finance: Build Your Wealth in 30 Seconds or LessRating: 3 out of 5 stars3/5 (3)

- The Rhetoric of Argument 2Document30 pagesThe Rhetoric of Argument 2Isam BoukattayaNo ratings yet

- Canterbury Tales Creative ProjectDocument2 pagesCanterbury Tales Creative ProjectIsam BoukattayaNo ratings yet

- Stages of DeathDocument25 pagesStages of DeathIsam BoukattayaNo ratings yet

- Beowulf OverviewDocument4 pagesBeowulf OverviewIsam BoukattayaNo ratings yet

- International Tax AvoidanceDocument27 pagesInternational Tax Avoidanceflordeliz12No ratings yet

- Business and Transfer Taxation Test BankDocument186 pagesBusiness and Transfer Taxation Test Bankprettyboiy19No ratings yet

- PDS DEBIT CARD I ENGLISH VERSION Debit Generic - 02032022Document8 pagesPDS DEBIT CARD I ENGLISH VERSION Debit Generic - 02032022Muhammad TaqiyuddinNo ratings yet

- Important Changes Introduced by The Finance Act, 2022 - ACNABINDocument40 pagesImportant Changes Introduced by The Finance Act, 2022 - ACNABINZamanNo ratings yet

- BZ Payroll Slip OKT 2023-UnlockedDocument1 pageBZ Payroll Slip OKT 2023-UnlockedWidha AgustriaNo ratings yet

- VAT 12 Fort Bonifacio Dev. Corp. Vs CIRDocument2 pagesVAT 12 Fort Bonifacio Dev. Corp. Vs CIRMarivic EspiaNo ratings yet

- Canada Carbon Rebate Notice 2024 03 23 17 13 55 140705Document3 pagesCanada Carbon Rebate Notice 2024 03 23 17 13 55 140705Meet AhalparaNo ratings yet

- Receipt: Customer Details: INVOICE NUMBER: C11067 / 2021 / 247Document1 pageReceipt: Customer Details: INVOICE NUMBER: C11067 / 2021 / 247Mirella DánielNo ratings yet

- PAY SLIP For The Month July/2019 (From 01/07/2018 To 31/07/2019)Document2 pagesPAY SLIP For The Month July/2019 (From 01/07/2018 To 31/07/2019)rahul rahulNo ratings yet

- Petron Corp - 110034539 - DP Evaluation-Rosario WarehouseDocument1 pagePetron Corp - 110034539 - DP Evaluation-Rosario WarehouseAngel Bhert S. BravoNo ratings yet

- Fund Raising BalkansDocument2 pagesFund Raising BalkansRebekah HaleNo ratings yet

- References: Philippine Tax Code CREATE Law TRAIN Law Income Taxation, Banggawan RR8-2018 RR14-2001Document13 pagesReferences: Philippine Tax Code CREATE Law TRAIN Law Income Taxation, Banggawan RR8-2018 RR14-2001Mark Lawrence YusiNo ratings yet

- Noise Colorfit Caliber Smartwatch: Grand Total 1799.00Document1 pageNoise Colorfit Caliber Smartwatch: Grand Total 1799.00VINEET TIWARINo ratings yet

- CIR v. BOAC G.R. No. L-65773, April 30, 1987Document1 pageCIR v. BOAC G.R. No. L-65773, April 30, 1987Rizchelle Sampang-ManaogNo ratings yet

- MANORANJANDocument9 pagesMANORANJANmanasjkkumNo ratings yet

- Tax Invoice: Gstin PAN Drug Licence NoDocument1 pageTax Invoice: Gstin PAN Drug Licence Nobanubanu0101No ratings yet

- Central Board of Direct Taxes, E-Filing Project: ITR 1 - Validation Rules For AY 2021-22Document15 pagesCentral Board of Direct Taxes, E-Filing Project: ITR 1 - Validation Rules For AY 2021-22MOHAMMED LayeeqNo ratings yet

- Electricity BillDocument1 pageElectricity Bill[КИЛЛ] Кот Играет Левой Лапой [КИЛЛ]No ratings yet

- Tat ATO 2022Document3 pagesTat ATO 2022Tate chanNo ratings yet

- SURVEY QUESTIONNAIRE - Online BankingDocument4 pagesSURVEY QUESTIONNAIRE - Online BankingEstrada, Jemuel A.No ratings yet

- Steps To Take After Receiving Offer LetterDocument5 pagesSteps To Take After Receiving Offer LetterNal ChowdhuryNo ratings yet

- Account Statement As of 21-03-2020 11:43:46 GMT +0530Document2 pagesAccount Statement As of 21-03-2020 11:43:46 GMT +0530Sourabh MeenaNo ratings yet

- Case 3-1 PDFDocument3 pagesCase 3-1 PDFZereen Gail Nievera100% (2)

- Vishal 0169Document5 pagesVishal 0169169 Vishal DabiNo ratings yet

- إيصال العملية (PDF) Document1 pageإيصال العملية (PDF) meshalml7m2008No ratings yet

- Maitry Research TybafDocument40 pagesMaitry Research TybafMaitry VasaNo ratings yet

- On October 1 2008 Kristy Gomez Established An Interior DecoratDocument2 pagesOn October 1 2008 Kristy Gomez Established An Interior DecoratAmit PandeyNo ratings yet