Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

25 views1.2 The Seven-Step Model-Building Process

1.2 The Seven-Step Model-Building Process

Uploaded by

tanvis1Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- Erp Implementation at Cadbury'sDocument19 pagesErp Implementation at Cadbury'samishaa1375% (16)

- Office Systems and ProceduresDocument4 pagesOffice Systems and ProceduresPauline Bogador Mayordomo75% (4)

- Mis Pepsico Project ReportDocument63 pagesMis Pepsico Project ReportSheenam BhallaNo ratings yet

- Chapter 6 Momentum & Collisions Nice Check ItDocument67 pagesChapter 6 Momentum & Collisions Nice Check Itvenkateshyadav2116100% (1)

- KIT Volume XX No 2 September 2008Document14 pagesKIT Volume XX No 2 September 2008KITexBruderhofCCINo ratings yet

- UntitledDocument3 pagesUntitledismail ElansariNo ratings yet

- Joju Johny - ADSCM - SPL Case StudyDocument15 pagesJoju Johny - ADSCM - SPL Case StudyJoju JohnyNo ratings yet

- OM End SemDocument16 pagesOM End Semdivya.marathe23No ratings yet

- Introduction To Operations Research: N Onur BakırDocument9 pagesIntroduction To Operations Research: N Onur Bakırmhmd2222No ratings yet

- Application of Six-Sigma in FinanceDocument12 pagesApplication of Six-Sigma in Financeani198609No ratings yet

- Production Planning & ControlDocument43 pagesProduction Planning & ControlkunjammuNo ratings yet

- Aggregate Planning and MRPDocument67 pagesAggregate Planning and MRPnandhini rNo ratings yet

- OM Term Paper PresentationDocument8 pagesOM Term Paper PresentationWasim Akram TalukderNo ratings yet

- Course Pack - Operations ManagementDocument34 pagesCourse Pack - Operations ManagementSARBIKPAUL CHOWDHURYNo ratings yet

- Aggregate Planning and MRPDocument66 pagesAggregate Planning and MRPSindhuja KumarNo ratings yet

- Aggregate Planning and MRPDocument68 pagesAggregate Planning and MRPJanarthanan Siva KumarNo ratings yet

- Strategic Capacity Planning For Products and Services: Overview: Learning ObjectivesDocument4 pagesStrategic Capacity Planning For Products and Services: Overview: Learning ObjectivesCharice Anne VillamarinNo ratings yet

- Revision Final ExamDocument8 pagesRevision Final ExambarcodeNo ratings yet

- Inception of Six SigmaDocument3 pagesInception of Six SigmaRohan SmithNo ratings yet

- Productivity Reporting SystemDocument15 pagesProductivity Reporting SystemDeep DaveNo ratings yet

- TOPIC 11-Decision Making ProcessDocument19 pagesTOPIC 11-Decision Making ProcessKevin RiveraNo ratings yet

- Basel II Accord: Presentation To Information Systems Audit and Control AssociationDocument30 pagesBasel II Accord: Presentation To Information Systems Audit and Control AssociationprjiviNo ratings yet

- Finals BOMDocument22 pagesFinals BOMtolentino FamilyNo ratings yet

- Kik Dev PresentationDocument22 pagesKik Dev Presentationjustin29600No ratings yet

- AIS Ch-5Document10 pagesAIS Ch-5Rabbumaa KabbadaaNo ratings yet

- Operation Management NotesDocument30 pagesOperation Management NotesRenato WilsonNo ratings yet

- Production Planning and ControlDocument28 pagesProduction Planning and ControlSAMRUDA SADANANDNo ratings yet

- Demand Forecasting LectureDocument68 pagesDemand Forecasting LectureAbhishek Fanse100% (1)

- Cost Amd WDocument7 pagesCost Amd WMOHIT JINo ratings yet

- Total Productive Maintenance and Reliability Notes 3Document3 pagesTotal Productive Maintenance and Reliability Notes 3carr carrNo ratings yet

- ForecastingDocument61 pagesForecastingHya Althea DiamanteNo ratings yet

- Module 5 MarketingDocument11 pagesModule 5 MarketingMaricar Tan ArtuzNo ratings yet

- Principle 3 - Early TestingDocument6 pagesPrinciple 3 - Early TestingKarthik.KNo ratings yet

- Global Bike IncDocument39 pagesGlobal Bike IncSameet DoshiNo ratings yet

- Forecasting: Basic Input in The Decision ProcessesDocument50 pagesForecasting: Basic Input in The Decision ProcessesNITIN NAUTIYALNo ratings yet

- CHL v4 - U1 Task 2 Opportunities For Improvement (CT9) - AnswersDocument3 pagesCHL v4 - U1 Task 2 Opportunities For Improvement (CT9) - AnswersSara KhalilNo ratings yet

- Introduction To Supply Chain Process-Main Issues: Compiled by A Srinivasa Rao NIFT, HyderabadDocument34 pagesIntroduction To Supply Chain Process-Main Issues: Compiled by A Srinivasa Rao NIFT, Hyderabadsapna maheshwariNo ratings yet

- Chapter 13 (Managing TheDocument14 pagesChapter 13 (Managing TheGizelle AlviarNo ratings yet

- World Class ManufacturingDocument8 pagesWorld Class ManufacturingParamesh PalanichamyNo ratings yet

- Total Quality Management Short NoteDocument4 pagesTotal Quality Management Short NoteHazim IzzatNo ratings yet

- BCG Using Advanced Analytics To Make Better Operational Decisions Dec 2016 Tcm80 217732Document6 pagesBCG Using Advanced Analytics To Make Better Operational Decisions Dec 2016 Tcm80 217732sarveshrathiNo ratings yet

- 04 Capacity PlanningDocument10 pages04 Capacity PlanningGwyneth BundaNo ratings yet

- 6 SigmaDocument7 pages6 Sigmaalfianitap95No ratings yet

- MGT613 Short Answers QuestionsDocument12 pagesMGT613 Short Answers QuestionsHilew TSegayeNo ratings yet

- Methodology To Implement BPR: Ramkumar.K 12MBA036Document26 pagesMethodology To Implement BPR: Ramkumar.K 12MBA036Ram KumarNo ratings yet

- Or Notes Unit 1Document14 pagesOr Notes Unit 1kotreshisnNo ratings yet

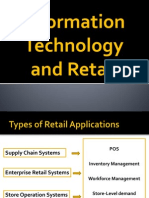

- It and RetailDocument49 pagesIt and RetailchetnachhabraNo ratings yet

- Material Requirement PlanningDocument23 pagesMaterial Requirement Planningsangaleabhi100% (1)

- Spe 191598Document14 pagesSpe 191598Efendi DhanaNo ratings yet

- UNIT II Need For PPC-Objectives-Functions-Information Required For PPC-ProductionDocument30 pagesUNIT II Need For PPC-Objectives-Functions-Information Required For PPC-Productionmohanmech2006886No ratings yet

- MB 0044 - Production and Operation Management: Q1. State The Important Considerations For Locating An Automobile PlantDocument9 pagesMB 0044 - Production and Operation Management: Q1. State The Important Considerations For Locating An Automobile PlantSaju AugustineNo ratings yet

- Amm PDFDocument13 pagesAmm PDFShruti AirenNo ratings yet

- Lean Manufacturing 1,2,5Document37 pagesLean Manufacturing 1,2,5senthamil2525No ratings yet

- Business Process Reengineering - Dina Rizkia Rachmah (29120431)Document8 pagesBusiness Process Reengineering - Dina Rizkia Rachmah (29120431)Dina Rizkia RachmahNo ratings yet

- Chapter 11 Ten Steps To Operational Efficiency: Monitoring EquipmentDocument2 pagesChapter 11 Ten Steps To Operational Efficiency: Monitoring EquipmentcartarNo ratings yet

- Assignment 6Document4 pagesAssignment 6api-309373770No ratings yet

- Level-I Fit Allign Resources With RequirementsDocument75 pagesLevel-I Fit Allign Resources With RequirementsRahul MahantNo ratings yet

- Practical Guide To Production Planning & Control [Revised Edition]From EverandPractical Guide To Production Planning & Control [Revised Edition]Rating: 1 out of 5 stars1/5 (1)

- Critical Chain Project Management: A Concept Used By The Great Military and Aerospace Companies of The World.From EverandCritical Chain Project Management: A Concept Used By The Great Military and Aerospace Companies of The World.No ratings yet

- Process Improvement & Performance Management Made Simple: The Fasttrack Approach to Getting Results QuicklyFrom EverandProcess Improvement & Performance Management Made Simple: The Fasttrack Approach to Getting Results QuicklyNo ratings yet

- CLASS X CHEMISTRY Solution-988039Document5 pagesCLASS X CHEMISTRY Solution-988039abiniveshofficial4708No ratings yet

- DidiDocument12 pagesDidiAndreea DamianNo ratings yet

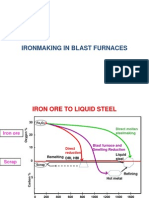

- Blast Furnace IronmakingDocument83 pagesBlast Furnace IronmakingKumar Varun100% (1)

- I Survive The Blizzard ofDocument2 pagesI Survive The Blizzard ofRyle DyNo ratings yet

- Disciplines and Ideas in The Social SciencesDocument18 pagesDisciplines and Ideas in The Social SciencesArjane Grace SullanoNo ratings yet

- HL7807ADocument6 pagesHL7807AluismdmjNo ratings yet

- Ar6017 Urban Housing by A Sivaraman 01 - NoDocument156 pagesAr6017 Urban Housing by A Sivaraman 01 - Nosiva ramanNo ratings yet

- Supported Platforms For aspenONE V9 PDFDocument6 pagesSupported Platforms For aspenONE V9 PDFJose Luis MoltoNo ratings yet

- Model: AGB2518ZKZ (TAG2522Z) : Technical Data SheetDocument1 pageModel: AGB2518ZKZ (TAG2522Z) : Technical Data SheetZikko Firmansyah100% (2)

- HYDROPOWER MCQsDocument9 pagesHYDROPOWER MCQsAlexis MUHIRWANo ratings yet

- A Grid Tie Inverter For Solar SystemsDocument5 pagesA Grid Tie Inverter For Solar SystemsR-MarufNo ratings yet

- Subiect - III - 2019Document4 pagesSubiect - III - 2019Valeriu CondreaNo ratings yet

- Amphibians: Class AmphibiaDocument33 pagesAmphibians: Class Amphibiaisfi farihaNo ratings yet

- Social Anxiety DisorderDocument12 pagesSocial Anxiety DisorderhafiznaveedNo ratings yet

- IELTS Writing Task 1Document3 pagesIELTS Writing Task 1Kamala LamichhaneNo ratings yet

- Topic 2Document9 pagesTopic 2Ria AccadNo ratings yet

- Magallona Vs ErmitaDocument13 pagesMagallona Vs ErmitaERNIL L BAWA100% (1)

- Artificial LiftDocument2 pagesArtificial LiftScott LongmireNo ratings yet

- Poliquin Ed 3Document198 pagesPoliquin Ed 3Louis Trần100% (1)

- Saa 11Document184 pagesSaa 11jcch1969No ratings yet

- 03-1 XPAND IP System Configuration 2010-08-10-R1ADocument31 pages03-1 XPAND IP System Configuration 2010-08-10-R1AArdo SitumeankNo ratings yet

- 3254 IEC ACCC Spec Sheets HelsinkiDocument1 page3254 IEC ACCC Spec Sheets HelsinkiRicardo Hernandez MoralesNo ratings yet

- Uberlingen Map PDFDocument3 pagesUberlingen Map PDFamsouyioltzisNo ratings yet

- The Digestive System Final 1Document34 pagesThe Digestive System Final 1Jam DabalosNo ratings yet

- Cutting Tool Material PDFDocument43 pagesCutting Tool Material PDFsandeepNo ratings yet

- Sharp Productivity: Information Technology Reference GuideDocument71 pagesSharp Productivity: Information Technology Reference GuideIticien HitechingNo ratings yet

- Pyramid ListDocument6 pagesPyramid Listmukul sharmaNo ratings yet

- Who Uses The Drug? What Is Powdered Cocaine?Document2 pagesWho Uses The Drug? What Is Powdered Cocaine?api-607022055No ratings yet

1.2 The Seven-Step Model-Building Process

1.2 The Seven-Step Model-Building Process

Uploaded by

tanvis10 ratings0% found this document useful (0 votes)

25 views23 pagesOriginal Title

Q1.2

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

25 views23 pages1.2 The Seven-Step Model-Building Process

1.2 The Seven-Step Model-Building Process

Uploaded by

tanvis1Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 23

1.

2 The Seven-Step Model-Building Process

1.Formulate the Problem

– Define the problem.

– Specify objectives.

– Determine parts of the organization to be studied.

2.Observe the System

– Determine parameters affecting the problem.

– Collect data to estimate values of the parameters.

3.Formulate a Mathematical Model of the

Problem

4.Verify the Model and Use the Model for

Prediction

– Does the model yield results for values of decision

variables not used to develop the model?

– What eventualities might cause the model to

become invalid?

5.Select a Suitable Alternative

– Given a model and a set of alternative solutions,

determine which solution best meets the

organizations objectives.

6.Present the Results and Conclusion(s) of the

Study to the Organization

– Present the results to the decision maker(s)

• If necessary, prepare several alternative solutions and

permit the organization to choose the one that best

meets their needs.

– Any non-approval of the study’s recommendations

may have stemmed from an incorrect problem

definition or failure to involve the decision

maker(s) from the start of the project.

• In such a case, return to step 1, 2, or 3.

7.Implement and Evaluate Recommendations

Assist in implementing the recommendations.

Monitor and dynamically update the system as the

environment and parameters change to ensure

that recommendations enable the organization to

meet its goals.

1.3 CITGO Petroleum

• Klingman et. Al. (1987) applied a variety of

management-science techniques to CITGO

Petroleum. Their work saved the company an

estimated $70 million per year.

• Focus on two aspects of the CITGO’s team’s

work:

1.A mathematical model to optimize the operation

of CITGO’s refineries.

2.A mathematical model – supply, distribution and

marketing (SDM) system – used to develop an 11-

week supply, distribution and marketing plan for

• Optimizing Refinery Operations

Step 1 (Formulate the Problem) Klingman et. Al.

wanted to minimize the cost of CITGO’s refineries.

Step 2 (Observe the System) The Lake Charles,

Louisiana, refinery was closely observed in an

attempt to estimate key relationships such as:

1.How the cost of producing each of CITGO’s products

(motor fuel, no. 2 fuel oil, turbine fuel, naphtha, and

several blended motor fuels) depends upon the inputs

used to produce each product.

2.The amount of energy needed to produce each product

(requiring the installation of a new metering system).

3.The yield associated with each input – output

combination. For example, if 1 gallon of crude oil

would yield 0.52 gallons of motor fuel, then the yield

would be 52%.

4.To reduce maintenance costs, data was collected on

parts inventories and equipment breakdowns.

Obtaining accurate data required the installation of a

new data based - management system and integrated

maintenance information system. Additionally, a

process control system was also installed to accurately

monitor the inputs and resources used to manufacture

each product.

Step 3 (Formulate a Mathematical Model of the

Problem) Using linear programming (LP), a model

was developed to optimize refinery operations.

• The model:

– Determines the cost-minimizing method for mixing or

blending together inputs to obtain desired results.

– Contains constraints that ensure that inputs are blended to

produce desired results.

– Includes constraints that ensure inputs are blended so that

each output is of the desired quality.

– Ensures that plant capacities are not exceeded and allow for

inventory for each end product.

Step 4 (Verify the Model and Use the Model for

Prediction) To validate the model, inputs and

outputs from the refinery were collected for one

month.

• Given actual inputs used at the refinery during that

month, actual outputs were compared to those

predicted by the model.

• After extensive changes, the model’s predicted

outputs were close to actual outputs.

Step 5 (Select Suitable Alternative Solutions)

Running the LP yielded a daily strategy for

running the refinery.

Step 6 (Present the Results and Conclusions) and

Step 7 (Implement and Evaluate

Recommendations) Once the data base and

process control were in place, the model was used

to guide day-to-day operations.

• CITGO estimated that the overall benefits of the

refinery system exceeded $50 million annually.

• The Supply Distribution Marketing (SDM)

System

Step 1 (Formulate the Problem) CITGO wanted a

mathematical model that could be used to make

supply, distribution, and marketing decisions such

as:

• Where should the crude oil be purchased?

• Where should products be sold?

• What price should be charged for products?

• How much of each product should be held in

inventory?

Step 2 (Observe the System) A database that kept

track of sales, inventory, trades, and exchanges of

all refined goods was installed. Also regression

analysis was used to develop forecasts of for

wholesale prices and wholesale demand for each

CITGO product.

Step 3 (Formulate a Mathematical Model of the

Problem) and Step 5 (Select Suitable Alterative

Solutions) A minimum-cost network flow model

(MCNFM) is used a determine an 11-week supply,

marketing, and distribution strategy.

• The model makes all decisions discussed in Step 1.

Step 4 (Verify the Model and Use the Model for

Prediction)

• The forecasting models are continuously evaluated to

ensure that they continue to give accurate forecasts.

Step 6 (Present the Results and Conclusions) and

Step 7 (Implement and Evaluate

Recommendations) Implementing the SDM

required several organizational changes.

• A new vice-president was appointed to coordinate the

operation of the SDM and refinery LP model.

• The product supply and product scheduling

departments were combined to improve

1.4 San Francisco Police Department Scheduling

• Taylor and Huxley (1989) developed a police

patrol scheduling system (PPSS).

– All San Francisco (SF) police precincts use the PPSS

to schedule their officers.

– It is estimated that the PSS saves the SF police

more than $5 million annually.

– Other cities have also adopted PPSS.

• Following the seven-step model here is a

description of PPSS.

• Step 1 The SFPD wanted a method to schedule

patrol officers in each precinct that would:

– Quickly produce a schedule and graphically display

it.

– Minimize the sum of hourly shortages and

surpluses

– Would allow precinct captains to easily fine-tune

to produce the optimal schedule.

• Step 2 The SPFD had a sophisticated

computer-aided dispatch (CAD) system to

keep track of calls for police help, police travel

• Step 3 An LP model was formulated

– Primary objective was to minimize the sum of

hourly shortages and surpluses.

– The constraints in the PPSS model reflected the

limited number of officers available and the

relationship of the number of officers working

each hour to the shortages and surpluses for that

hour.

– PPSS would produce a schedule that would tell the

precinct captains how many officers should start

work at each possible shift time.

• Step 4 Before implementing PPSS, the SFPD

tested the PPSS schedule against manually

created schedules.

– It produced approximately a 50% reduction in

both shortages and surpluses.

• Step 5 PPSS can be used to minimize the

shortages and surpluses as well as being used

to experiment with shift times and work rules.

– Officers had wanted to switch to a 4/10 schedule

versus a 5/8 schedule for years but were not

permitted to because city felt it would reduce

productivity.

• Step 6 and Step 7

– Estimated that PPSS created an extra 170,000

productive hours per year, thereby saving the city

of San Francisco $5.2 million dollars per year.

– 96% of workers preferred PPSS generated

schedules

– PPSS enabled SFPD tot make strategic changes

which made officers happier and increased

productivity.

– Response times to calls improved 20% after PPSS

was adopted.

1.5 GE Capital

• GE Capital provides credit card service to 50

million accounts with an average outstanding

balance of $12 billion.

• GE Capital led by Makuch et al. (1989)

developed the PAYMENT system to reduce

delinquent accounts and the cost of collecting

from delinquent accounts.

• Step 1 The company’s goal was to reduce the

delinquent accounts and the cost of

processing them.

– To do this, GE capital needed to come up with a

• Step 2 The key to modeling delinquent

accounts is the concept of a delinquency

movement matrix (DMM).

– The DMM determines how the probability of the

payment on a delinquent account during the

current month depends on the following factors:

• size of unpaid balance

• action taken

• performance score

• Step 3 GE developed a linear optimization

model.

– The objective function for the PAYMENT model

was to maximize the expected delinquent

accounts collected during the next six months.

– The decision variables represented the fraction of

each type of delinquent account.

– The constraints in the PAYMENT model ensure

that available resources are not overused.

– Constraints also relate the number of each type of

delinquent account present in, say, January to the

number of delinquent accounts for each type

• Step 4 PAYMENT was piloted on a $62 million

portfolio for a single department store.

– GE Capital managers came up with their own

strategies for allocating resources (called

CHAMPION).

– Store’s accounts were randomly assigned to the

CHAMPION and PAYMENT strategies.

– PAYMENT used more live calls and “no action”.

PAYMENT showed a 5-7% improvement over

CHAMPION.

• Step 5 For each type of account PAYMENT tells

the credit managers the fraction that should

• Steps 6 and 7 PAYMENT was next applied to

the 18 million accounts of the $4.6 billion

Montgomery Ward store portfolio.

– Comparing accounts to the previous year,

PAYMENT increased collections by $1.6 million per

month.

– Overall, GE Capital estimated PAYMENT increased

collections by $37 million per year and used fewer

resources than previous strategies.

You might also like

- Erp Implementation at Cadbury'sDocument19 pagesErp Implementation at Cadbury'samishaa1375% (16)

- Office Systems and ProceduresDocument4 pagesOffice Systems and ProceduresPauline Bogador Mayordomo75% (4)

- Mis Pepsico Project ReportDocument63 pagesMis Pepsico Project ReportSheenam BhallaNo ratings yet

- Chapter 6 Momentum & Collisions Nice Check ItDocument67 pagesChapter 6 Momentum & Collisions Nice Check Itvenkateshyadav2116100% (1)

- KIT Volume XX No 2 September 2008Document14 pagesKIT Volume XX No 2 September 2008KITexBruderhofCCINo ratings yet

- UntitledDocument3 pagesUntitledismail ElansariNo ratings yet

- Joju Johny - ADSCM - SPL Case StudyDocument15 pagesJoju Johny - ADSCM - SPL Case StudyJoju JohnyNo ratings yet

- OM End SemDocument16 pagesOM End Semdivya.marathe23No ratings yet

- Introduction To Operations Research: N Onur BakırDocument9 pagesIntroduction To Operations Research: N Onur Bakırmhmd2222No ratings yet

- Application of Six-Sigma in FinanceDocument12 pagesApplication of Six-Sigma in Financeani198609No ratings yet

- Production Planning & ControlDocument43 pagesProduction Planning & ControlkunjammuNo ratings yet

- Aggregate Planning and MRPDocument67 pagesAggregate Planning and MRPnandhini rNo ratings yet

- OM Term Paper PresentationDocument8 pagesOM Term Paper PresentationWasim Akram TalukderNo ratings yet

- Course Pack - Operations ManagementDocument34 pagesCourse Pack - Operations ManagementSARBIKPAUL CHOWDHURYNo ratings yet

- Aggregate Planning and MRPDocument66 pagesAggregate Planning and MRPSindhuja KumarNo ratings yet

- Aggregate Planning and MRPDocument68 pagesAggregate Planning and MRPJanarthanan Siva KumarNo ratings yet

- Strategic Capacity Planning For Products and Services: Overview: Learning ObjectivesDocument4 pagesStrategic Capacity Planning For Products and Services: Overview: Learning ObjectivesCharice Anne VillamarinNo ratings yet

- Revision Final ExamDocument8 pagesRevision Final ExambarcodeNo ratings yet

- Inception of Six SigmaDocument3 pagesInception of Six SigmaRohan SmithNo ratings yet

- Productivity Reporting SystemDocument15 pagesProductivity Reporting SystemDeep DaveNo ratings yet

- TOPIC 11-Decision Making ProcessDocument19 pagesTOPIC 11-Decision Making ProcessKevin RiveraNo ratings yet

- Basel II Accord: Presentation To Information Systems Audit and Control AssociationDocument30 pagesBasel II Accord: Presentation To Information Systems Audit and Control AssociationprjiviNo ratings yet

- Finals BOMDocument22 pagesFinals BOMtolentino FamilyNo ratings yet

- Kik Dev PresentationDocument22 pagesKik Dev Presentationjustin29600No ratings yet

- AIS Ch-5Document10 pagesAIS Ch-5Rabbumaa KabbadaaNo ratings yet

- Operation Management NotesDocument30 pagesOperation Management NotesRenato WilsonNo ratings yet

- Production Planning and ControlDocument28 pagesProduction Planning and ControlSAMRUDA SADANANDNo ratings yet

- Demand Forecasting LectureDocument68 pagesDemand Forecasting LectureAbhishek Fanse100% (1)

- Cost Amd WDocument7 pagesCost Amd WMOHIT JINo ratings yet

- Total Productive Maintenance and Reliability Notes 3Document3 pagesTotal Productive Maintenance and Reliability Notes 3carr carrNo ratings yet

- ForecastingDocument61 pagesForecastingHya Althea DiamanteNo ratings yet

- Module 5 MarketingDocument11 pagesModule 5 MarketingMaricar Tan ArtuzNo ratings yet

- Principle 3 - Early TestingDocument6 pagesPrinciple 3 - Early TestingKarthik.KNo ratings yet

- Global Bike IncDocument39 pagesGlobal Bike IncSameet DoshiNo ratings yet

- Forecasting: Basic Input in The Decision ProcessesDocument50 pagesForecasting: Basic Input in The Decision ProcessesNITIN NAUTIYALNo ratings yet

- CHL v4 - U1 Task 2 Opportunities For Improvement (CT9) - AnswersDocument3 pagesCHL v4 - U1 Task 2 Opportunities For Improvement (CT9) - AnswersSara KhalilNo ratings yet

- Introduction To Supply Chain Process-Main Issues: Compiled by A Srinivasa Rao NIFT, HyderabadDocument34 pagesIntroduction To Supply Chain Process-Main Issues: Compiled by A Srinivasa Rao NIFT, Hyderabadsapna maheshwariNo ratings yet

- Chapter 13 (Managing TheDocument14 pagesChapter 13 (Managing TheGizelle AlviarNo ratings yet

- World Class ManufacturingDocument8 pagesWorld Class ManufacturingParamesh PalanichamyNo ratings yet

- Total Quality Management Short NoteDocument4 pagesTotal Quality Management Short NoteHazim IzzatNo ratings yet

- BCG Using Advanced Analytics To Make Better Operational Decisions Dec 2016 Tcm80 217732Document6 pagesBCG Using Advanced Analytics To Make Better Operational Decisions Dec 2016 Tcm80 217732sarveshrathiNo ratings yet

- 04 Capacity PlanningDocument10 pages04 Capacity PlanningGwyneth BundaNo ratings yet

- 6 SigmaDocument7 pages6 Sigmaalfianitap95No ratings yet

- MGT613 Short Answers QuestionsDocument12 pagesMGT613 Short Answers QuestionsHilew TSegayeNo ratings yet

- Methodology To Implement BPR: Ramkumar.K 12MBA036Document26 pagesMethodology To Implement BPR: Ramkumar.K 12MBA036Ram KumarNo ratings yet

- Or Notes Unit 1Document14 pagesOr Notes Unit 1kotreshisnNo ratings yet

- It and RetailDocument49 pagesIt and RetailchetnachhabraNo ratings yet

- Material Requirement PlanningDocument23 pagesMaterial Requirement Planningsangaleabhi100% (1)

- Spe 191598Document14 pagesSpe 191598Efendi DhanaNo ratings yet

- UNIT II Need For PPC-Objectives-Functions-Information Required For PPC-ProductionDocument30 pagesUNIT II Need For PPC-Objectives-Functions-Information Required For PPC-Productionmohanmech2006886No ratings yet

- MB 0044 - Production and Operation Management: Q1. State The Important Considerations For Locating An Automobile PlantDocument9 pagesMB 0044 - Production and Operation Management: Q1. State The Important Considerations For Locating An Automobile PlantSaju AugustineNo ratings yet

- Amm PDFDocument13 pagesAmm PDFShruti AirenNo ratings yet

- Lean Manufacturing 1,2,5Document37 pagesLean Manufacturing 1,2,5senthamil2525No ratings yet

- Business Process Reengineering - Dina Rizkia Rachmah (29120431)Document8 pagesBusiness Process Reengineering - Dina Rizkia Rachmah (29120431)Dina Rizkia RachmahNo ratings yet

- Chapter 11 Ten Steps To Operational Efficiency: Monitoring EquipmentDocument2 pagesChapter 11 Ten Steps To Operational Efficiency: Monitoring EquipmentcartarNo ratings yet

- Assignment 6Document4 pagesAssignment 6api-309373770No ratings yet

- Level-I Fit Allign Resources With RequirementsDocument75 pagesLevel-I Fit Allign Resources With RequirementsRahul MahantNo ratings yet

- Practical Guide To Production Planning & Control [Revised Edition]From EverandPractical Guide To Production Planning & Control [Revised Edition]Rating: 1 out of 5 stars1/5 (1)

- Critical Chain Project Management: A Concept Used By The Great Military and Aerospace Companies of The World.From EverandCritical Chain Project Management: A Concept Used By The Great Military and Aerospace Companies of The World.No ratings yet

- Process Improvement & Performance Management Made Simple: The Fasttrack Approach to Getting Results QuicklyFrom EverandProcess Improvement & Performance Management Made Simple: The Fasttrack Approach to Getting Results QuicklyNo ratings yet

- CLASS X CHEMISTRY Solution-988039Document5 pagesCLASS X CHEMISTRY Solution-988039abiniveshofficial4708No ratings yet

- DidiDocument12 pagesDidiAndreea DamianNo ratings yet

- Blast Furnace IronmakingDocument83 pagesBlast Furnace IronmakingKumar Varun100% (1)

- I Survive The Blizzard ofDocument2 pagesI Survive The Blizzard ofRyle DyNo ratings yet

- Disciplines and Ideas in The Social SciencesDocument18 pagesDisciplines and Ideas in The Social SciencesArjane Grace SullanoNo ratings yet

- HL7807ADocument6 pagesHL7807AluismdmjNo ratings yet

- Ar6017 Urban Housing by A Sivaraman 01 - NoDocument156 pagesAr6017 Urban Housing by A Sivaraman 01 - Nosiva ramanNo ratings yet

- Supported Platforms For aspenONE V9 PDFDocument6 pagesSupported Platforms For aspenONE V9 PDFJose Luis MoltoNo ratings yet

- Model: AGB2518ZKZ (TAG2522Z) : Technical Data SheetDocument1 pageModel: AGB2518ZKZ (TAG2522Z) : Technical Data SheetZikko Firmansyah100% (2)

- HYDROPOWER MCQsDocument9 pagesHYDROPOWER MCQsAlexis MUHIRWANo ratings yet

- A Grid Tie Inverter For Solar SystemsDocument5 pagesA Grid Tie Inverter For Solar SystemsR-MarufNo ratings yet

- Subiect - III - 2019Document4 pagesSubiect - III - 2019Valeriu CondreaNo ratings yet

- Amphibians: Class AmphibiaDocument33 pagesAmphibians: Class Amphibiaisfi farihaNo ratings yet

- Social Anxiety DisorderDocument12 pagesSocial Anxiety DisorderhafiznaveedNo ratings yet

- IELTS Writing Task 1Document3 pagesIELTS Writing Task 1Kamala LamichhaneNo ratings yet

- Topic 2Document9 pagesTopic 2Ria AccadNo ratings yet

- Magallona Vs ErmitaDocument13 pagesMagallona Vs ErmitaERNIL L BAWA100% (1)

- Artificial LiftDocument2 pagesArtificial LiftScott LongmireNo ratings yet

- Poliquin Ed 3Document198 pagesPoliquin Ed 3Louis Trần100% (1)

- Saa 11Document184 pagesSaa 11jcch1969No ratings yet

- 03-1 XPAND IP System Configuration 2010-08-10-R1ADocument31 pages03-1 XPAND IP System Configuration 2010-08-10-R1AArdo SitumeankNo ratings yet

- 3254 IEC ACCC Spec Sheets HelsinkiDocument1 page3254 IEC ACCC Spec Sheets HelsinkiRicardo Hernandez MoralesNo ratings yet

- Uberlingen Map PDFDocument3 pagesUberlingen Map PDFamsouyioltzisNo ratings yet

- The Digestive System Final 1Document34 pagesThe Digestive System Final 1Jam DabalosNo ratings yet

- Cutting Tool Material PDFDocument43 pagesCutting Tool Material PDFsandeepNo ratings yet

- Sharp Productivity: Information Technology Reference GuideDocument71 pagesSharp Productivity: Information Technology Reference GuideIticien HitechingNo ratings yet

- Pyramid ListDocument6 pagesPyramid Listmukul sharmaNo ratings yet

- Who Uses The Drug? What Is Powdered Cocaine?Document2 pagesWho Uses The Drug? What Is Powdered Cocaine?api-607022055No ratings yet

![Practical Guide To Production Planning & Control [Revised Edition]](https://imgv2-2-f.scribdassets.com/img/word_document/235162742/149x198/2a816df8c8/1709920378?v=1)