Professional Documents

Culture Documents

Idle Capacity and Management: BE Presentation

Idle Capacity and Management: BE Presentation

Uploaded by

Bhawna GosainCopyright:

Available Formats

You might also like

- ACC3600 Past Year Exam Questions and AnswersDocument9 pagesACC3600 Past Year Exam Questions and AnswersKirsten Paton100% (1)

- Supply Chain Strategy and Financial MetricsDocument27 pagesSupply Chain Strategy and Financial Metricshappiest1No ratings yet

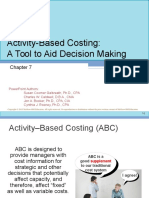

- Activity Based Costing-A Tool To Aid Decision MakingDocument54 pagesActivity Based Costing-A Tool To Aid Decision MakingSederiku KabaruzaNo ratings yet

- Activity Based Costing:: A Tool To Aid Decision MakingDocument36 pagesActivity Based Costing:: A Tool To Aid Decision MakingParikshit SethiNo ratings yet

- ZCMA6022 Activity Based CostingDocument56 pagesZCMA6022 Activity Based CostingIlanchelian ChandranNo ratings yet

- Yustika Adiningsih-F0319141-Mindmap SPM A Chapter 6 Dan 7Document2 pagesYustika Adiningsih-F0319141-Mindmap SPM A Chapter 6 Dan 7yes iNo ratings yet

- Activity Based Costing:: A Tool To Aid Decision MakingDocument28 pagesActivity Based Costing:: A Tool To Aid Decision MakingAlbana QemaliNo ratings yet

- Activity Based CostingDocument20 pagesActivity Based CostingCJ MacasioNo ratings yet

- White Paper Consumption Based ABCMDocument8 pagesWhite Paper Consumption Based ABCMMaribet RodríguezNo ratings yet

- PC205 InstructorSlides Power PointDocument76 pagesPC205 InstructorSlides Power PointJoaNiniaNo ratings yet

- Product Cost Controlling - v1Document37 pagesProduct Cost Controlling - v1Uday Bhaskar GurralaNo ratings yet

- 4-Business Level StrategyDocument13 pages4-Business Level StrategyIKLIMA PILA SOPIANo ratings yet

- Software License and Maintenance Pricing Principles - Best Practices and Case StudiesDocument35 pagesSoftware License and Maintenance Pricing Principles - Best Practices and Case StudiesasthapriyamvadaNo ratings yet

- 11 Edition: Mcgraw-Hill/IrwinDocument48 pages11 Edition: Mcgraw-Hill/IrwinArlene Magalang NatividadNo ratings yet

- MS08 - Activity-Based Costing (Abc) - Total Quality Management (TQM)Document5 pagesMS08 - Activity-Based Costing (Abc) - Total Quality Management (TQM)Elsie GenovaNo ratings yet

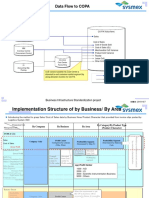

- Data Flow To COPA: Business Infrastructure Standardization ProjectDocument3 pagesData Flow To COPA: Business Infrastructure Standardization ProjectT SAIKIRANNo ratings yet

- F5 BPP Revision SlidesDocument142 pagesF5 BPP Revision SlidesUjjal ShiwakotiNo ratings yet

- Quinle - Oscm Supply 2022Document1 pageQuinle - Oscm Supply 2022gabes shivoloNo ratings yet

- Absorption and MarginalDocument7 pagesAbsorption and MarginalshafinasimanNo ratings yet

- Cost AccountingDocument2 pagesCost Accountingjumper200No ratings yet

- Ms04 Cost Behavior and Cost ClassificationDocument7 pagesMs04 Cost Behavior and Cost ClassificationAshley BrevaNo ratings yet

- Module 2 Cost Estimation Costing StatementDocument33 pagesModule 2 Cost Estimation Costing StatementTaaraniyaal Thirumurugu ArivanandanNo ratings yet

- Activity Based Costing OmairDocument26 pagesActivity Based Costing OmairblablaNo ratings yet

- Agil DiscussionDocument8 pagesAgil DiscussionreachlaxmiNo ratings yet

- XLRI ClockspeedDocument15 pagesXLRI ClockspeedSneha KhaitanNo ratings yet

- Activity Based Costing/Management: Mgr. Andrea Gažová, PHDDocument23 pagesActivity Based Costing/Management: Mgr. Andrea Gažová, PHDRoberto SanchezNo ratings yet

- Oracle Applications User Group Discrete MFG SIG - Cost Group April 27 2010Document50 pagesOracle Applications User Group Discrete MFG SIG - Cost Group April 27 2010Conrad RodricksNo ratings yet

- Major Tables and Relationships For Costing April 2010Document50 pagesMajor Tables and Relationships For Costing April 2010sastrylanka1980No ratings yet

- Major Tables and Relationships For Costing April 2010Document50 pagesMajor Tables and Relationships For Costing April 2010karthik rNo ratings yet

- Monitoring Report For Faculty Online Classes Bachelor of Science in AccountancyDocument8 pagesMonitoring Report For Faculty Online Classes Bachelor of Science in AccountancyJay AnnNo ratings yet

- Cost Accounting - HandoutsDocument3 pagesCost Accounting - Handoutsronniel tiglaoNo ratings yet

- MANBI-Implementation of Activity-Based Costing and ManagementDocument2 pagesMANBI-Implementation of Activity-Based Costing and ManagementFirman HotwheelsNo ratings yet

- Strategy MappingDocument6 pagesStrategy MappingLuis Carlos RodriguezNo ratings yet

- Prepared By: Jessy ChongDocument7 pagesPrepared By: Jessy ChongDaleNo ratings yet

- Chapter 2 - Cost and Cost ClassificationDocument12 pagesChapter 2 - Cost and Cost ClassificationVuong PhamNo ratings yet

- Absorption and Allocation CostingDocument21 pagesAbsorption and Allocation Costingashishmission2020No ratings yet

- Activity-Based Costing: A Tool To Aid Decision Making: Chapter EightDocument75 pagesActivity-Based Costing: A Tool To Aid Decision Making: Chapter EightRand Nasa'aNo ratings yet

- The Costing Cheat Sheet - Oana Labes, MBA, CPADocument1 pageThe Costing Cheat Sheet - Oana Labes, MBA, CPAYen HoangNo ratings yet

- Activity-Based Costing: A Tool To Aid Decision MakingDocument29 pagesActivity-Based Costing: A Tool To Aid Decision MakingAce RividiNo ratings yet

- Managerial Accounting and Cost ConceptsDocument18 pagesManagerial Accounting and Cost Conceptsginish12No ratings yet

- Activity-Based CostingDocument49 pagesActivity-Based CostingJene LmNo ratings yet

- P2 MA Cheet Sheet PDFDocument2 pagesP2 MA Cheet Sheet PDFbooks_sumiNo ratings yet

- Om FinanceDocument26 pagesOm Financeshahrachit91No ratings yet

- Variable Costing: A Tool For ManagementDocument37 pagesVariable Costing: A Tool For ManagementumakantanayakNo ratings yet

- Chapter 1Document11 pagesChapter 1kimberlyann ongNo ratings yet

- Week Four: Costing SystemsDocument4 pagesWeek Four: Costing SystemsNizam JewelNo ratings yet

- Optimizing Manufacturing Operations Using Big Data and AnalyticsDocument39 pagesOptimizing Manufacturing Operations Using Big Data and AnalyticsWisnu AjiNo ratings yet

- Bab 2 - Perilaku BiayaDocument40 pagesBab 2 - Perilaku BiayaAndy ReynaldyyNo ratings yet

- Bab 2 - Perilaku BiayaDocument40 pagesBab 2 - Perilaku BiayaAndy ReynaldyyNo ratings yet

- Garrison Lecture Chapter 7Document64 pagesGarrison Lecture Chapter 7jeanette100% (1)

- (16 Cost Accounting Systems)Document71 pages(16 Cost Accounting Systems)St Dalfour CebuNo ratings yet

- Framework Profitability Smarthveer Sidana 1Document1 pageFramework Profitability Smarthveer Sidana 1adityaNo ratings yet

- Arginal OstingDocument69 pagesArginal Ostingmoses jcNo ratings yet

- Lecture No. 19: Production Strategy: Takahiro Fujimoto Department of Economics, University of TokyoDocument25 pagesLecture No. 19: Production Strategy: Takahiro Fujimoto Department of Economics, University of Tokyoprafulla_mahantaNo ratings yet

- ms04 Cost Behavior and Cost ClassificationDocument8 pagesms04 Cost Behavior and Cost ClassificationdigididoghakdogNo ratings yet

- Activity Based CostingDocument17 pagesActivity Based CostingPoonamNo ratings yet

- Inventory Costing: Chapter NineDocument39 pagesInventory Costing: Chapter NineDio VinosaNo ratings yet

- Product CostingDocument2 pagesProduct CostingSudharsanRenganathanNo ratings yet

- Hms 05Document28 pagesHms 05JavierNo ratings yet

- Lecture-9.1 Variable & Absorption Costing PDFDocument24 pagesLecture-9.1 Variable & Absorption Costing PDFNazmul-Hassan Sumon100% (1)

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Important Questions With Star Ratings - TQM 16 Marks Unit 1Document1 pageImportant Questions With Star Ratings - TQM 16 Marks Unit 1Prakash ThalaNo ratings yet

- Floro Cement Corp V GorospeDocument1 pageFloro Cement Corp V GorospeiciamadarangNo ratings yet

- 2) Instructions For Playing The GameDocument7 pages2) Instructions For Playing The GameAna MariaNo ratings yet

- O Uco Bank: Rnictj/Date: 19.08.2019Document3 pagesO Uco Bank: Rnictj/Date: 19.08.2019Satya KarNo ratings yet

- Smart 30-01Document75 pagesSmart 30-01humbleNo ratings yet

- Consumers in 2030: Forecasts and Projections For Life in 2030Document15 pagesConsumers in 2030: Forecasts and Projections For Life in 2030Adriano AraujoNo ratings yet

- Chapter 02Document56 pagesChapter 02MD Hafizul Islam HafizNo ratings yet

- Mock - Econ - Exercise 4Document2 pagesMock - Econ - Exercise 4najib casanNo ratings yet

- Labour BA0130026 - JerinDocument16 pagesLabour BA0130026 - JerinAnirudhaRudhraNo ratings yet

- Survey of Accounting: A Further Look at The Balance SheetDocument28 pagesSurvey of Accounting: A Further Look at The Balance SheetTiaraNo ratings yet

- Work Study and Ergonomics SIRAJ PDFDocument4 pagesWork Study and Ergonomics SIRAJ PDFsirajudeen INo ratings yet

- Job Description: Elovi Vietnam Joint Stock Company (Morinaga Milk Group)Document2 pagesJob Description: Elovi Vietnam Joint Stock Company (Morinaga Milk Group)Minh AnhNo ratings yet

- Invoice 7218740Document2 pagesInvoice 7218740Johanny SantosNo ratings yet

- CV-Jabir Ali Revised 2010Document7 pagesCV-Jabir Ali Revised 2010Jabir Ali100% (1)

- Subsidiary Ledger: Department of Public Works and HighwaysDocument629 pagesSubsidiary Ledger: Department of Public Works and HighwaysKenneth Cyrus OlivarNo ratings yet

- Hsslive-XII-economics - Macro - EconomicsDocument3 pagesHsslive-XII-economics - Macro - Economicscsc kalluniraNo ratings yet

- Chapter 1 - Buyback Additional QuestionsDocument9 pagesChapter 1 - Buyback Additional QuestionsMohammad ArifNo ratings yet

- Unit 08 - Financial Statement AnalysisDocument31 pagesUnit 08 - Financial Statement Analysisqwertyytrewq12No ratings yet

- Sapm Eic AnalysisDocument21 pagesSapm Eic AnalysisSai SrikarNo ratings yet

- Entrepreneurship Business Plan DR John ProductDocument11 pagesEntrepreneurship Business Plan DR John ProductsuccessseakerNo ratings yet

- Synergy Basic Trading MethodDocument16 pagesSynergy Basic Trading Methodkazabian kazabian50% (2)

- Bulletin 200658 2023-02-21.zeendoc PDFDocument1 pageBulletin 200658 2023-02-21.zeendoc PDFComboulNo ratings yet

- Uts Act206 Seksi D 201801020230 Roberta AndrianiDocument7 pagesUts Act206 Seksi D 201801020230 Roberta AndrianiIgnatius MaryantoNo ratings yet

- Assignment 1Document2 pagesAssignment 1Umar GondalNo ratings yet

- Quiz 1 AnswersDocument3 pagesQuiz 1 AnswersAlia MazouzNo ratings yet

- Solutions To Assigned ProblemsDocument85 pagesSolutions To Assigned ProblemsJasmine NicodemusNo ratings yet

- Project On Online Trading at Sharekhan LTDDocument134 pagesProject On Online Trading at Sharekhan LTDMithun Kumar Patnaik73% (26)

- Analisis Harga Pokok Produksi Dengan Metode Activity Based Costing Untuk Mengambil Keputusan Manajemen Pada Industri Garmen CV. Surya SurabayaDocument12 pagesAnalisis Harga Pokok Produksi Dengan Metode Activity Based Costing Untuk Mengambil Keputusan Manajemen Pada Industri Garmen CV. Surya SurabayaNur Syafi'ahNo ratings yet

Idle Capacity and Management: BE Presentation

Idle Capacity and Management: BE Presentation

Uploaded by

Bhawna GosainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Idle Capacity and Management: BE Presentation

Idle Capacity and Management: BE Presentation

Uploaded by

Bhawna GosainCopyright:

Available Formats

Idle Capacity and Management

BE Presentation

by

Bhawna Gosain(16) Dhiksha Purohit

Dhiman Ray(21) Chetanya Vali(18)

Kapil Dhar(33) Mayank Agarwal(43)

Kumar Sain Goyal(37) Mukesh Kumar(46)

For internal use only

1 © Nokia Siemens Networks Presentation / Author / Date

Idle Capacity in Non-Production and Service

Industry

Market

Demand

People Used Capacity

Fixed Cost Services Services

in short run Unused Capacity

Infrastructure

Capacity

Planning Management Function

Mechanism to create Market Demands to subside the Unused Capacity

cost

- Discounts during off peak ( season/day of time)

- Various schemes – Advertisements

- Dynamic pricing ( hotel, airlines and now in telecom)

For IIFT MBA 2010 - 2013 Presentation / Author / Date

Idle Capacity in Production

Market Production

Demand Flexibility

Cost

Variable

cost in Labor

Used Capacity

short run Raw material Production

Function

Fixed Cost Idle Capacity

Machine

in short run

Capacity

Planning

Management Function

In which scenario Idle capacity help companies to compete in the Market

How Idle capacity help in creating market demand for its products

Idle capability can lead to non competitiveness of company

Various ways to calculate idle costs and look for process oriented cost

measures and checks

For IIFT MBA 2010 - 2013 Presentation / Author / Date

Various Mechanism of Cost

Calculations/Allocation

Traditional

• Only Manufacturing cost assigned to products

• Non manufacturing activities were treated as period cost and

were not added to the final product cost

Activity Based Costing (ABC) system

products are assigned all of the costs-manufacturing as

well as non-manufacturing-that they can reasonably be

supposed to have caused.

Thus the entire cost of the product is determined rather than

just its manufacturing cost.

For IIFT MBA 2010 - 2013 Presentation / Author / Date

How Costs are Treated Under Activity-Based

Costing

Activity

Activity Based

Based

Costing

Costing

Departmental

Departmental

Overhead

Overhead

i ty

Rates

Rates l ex

p

o m

Plantwide

Plantwide f C

l o

Overhead

Overhead v e

Rate

Rate Le

Overhead Allocation

For IIFT MBA 2010 - 2013 Presentation / Author / Date

Activity Based Costing (ABC)

ABC is designed to ABC is a

good supplement

provide managers to our traditional

with cost information cost system

for strategic and I agree!

other decisions that

potentially affect

capacity and

therefore “fixed”

costs.

For IIFT MBA 2010 - 2013 Presentation / Author / Date

Cost of Idle Capacity

Traditional

Traditional Cost

Cost Activity

Activity Based

Based

Accounting

Accounting Costing

Costing

The

The predetermined

predetermined Products

Products are

are charged

charged

overhead

overhead rate

rate is

is based

based for

for the

the costs

costs of

of capacity

capacity

on

on budgeted

budgeted activity.

activity. they

they use

use –– not

not for

for the

the

costs

costs of

of capacity

capacity they

they

don’t

don’t use.

use.

This

This results

results in

in applying

applying Idle

Idle capacity

capacity is

is charged

charged

overhead

overhead costs

costs of

of as

as aa period

period Cost

Cost thus

thus

unused,

unused, or

or idle,

idle, capacity.

capacity. not

not charged

charged toto products.

products.

For IIFT MBA 2010 - 2013 Presentation / Author / Date

Linear Programming - Idle Capacity

Step 1:Define linear profit Function. The Function maximised

the profit

Step 2: Define the Constraint representing the limited activity

capacities like b1 …b3 for individual activities x1,x2.. xn

Eliminate those products that consume

a high and over-proportional part of the

overhead departments’ capacities.

For IIFT MBA 2010 - 2013 Presentation / Author / Date

In Business | Traditional Costing Accounting

Labor

M/C

+ Overhead cost

Material

Direct Labor Cost

For IIFT MBA 2010 - 2013 Presentation / Author / Date

In Business | Activity Based Costing (ABC)

Changes the Focus

Other Activities

Labor

Product

Development

M/C

+ Product

Launch

10 %

Material

Marketing

Direct Labor Cost

Sales

System = 9%

The new information produced by the ABC study also helped Euclid in its relations with

customers. The detailed breakdown of the costs of design and engineering activities

helped customers to make trade-offs, with the result that they would often ask that

certain activities whose costs exceeded their benefits be skipped.

For IIFT MBA 2010 - 2013 Presentation / Author / Date

How to Calculate Cost of Idle Capacity by ABC ?

Z Mobile company makes two phone of two different model :

•Model A

•Model B

Step:1 Identify the main activities in the organization

1. Machine Maintenance 400

2. Quality Control 600

Total Overhead of the firm = 1,000

Step 2 Identify factors which determine cost (Cost drivers)

Model A Model B Total

Number of Machine Hour 6 4 10

Number of Inspections 3 7 10

For IIFT MBA 2010 - 2013 Presentation / Author / Date

Step 3 : Collect the cost of each activity (Cost Pools)

A+B

Overhead of Machine Maintenace 400

Number of Machine Hour 10

Rate per unit machine hour 40

A+B

Overhead of Quality control 600

Number of Inspections 10

Rate per unit Inspection 60

Step 4: Charge support overheads to product on the basis of their usage of the

activity

Model A Model B

Number of Machine Hours 6 4

Rate per unit Machine 40 40

Overhead per product 240 160

For IIFT MBA 2010 - 2013 Presentation / Author / Date

Model A Model B

Number of Inspections 3 7

Overhead of Quality control 60 60

Overhead per product 180 420

Final Result

Overhead Model A Model B

Linked to Maintenace activity 240 160

Linked to Quality control 180 420

Total Overhead Rs 420 580

For IIFT MBA 2010 - 2013 Presentation / Author / Date

Management Functions – Idle Capacity

- Product Portfolio Management

- Handing Seasonal nature of Products and rising cost in fixed Capacity

- Eliminate products consuming high and overhead costs

- Managing Demand Flexibility

- Product Costing – Overhead optimization

- Informed Decision making

- Optimizing the overheads

For IIFT MBA 2010 - 2013 Presentation / Author / Date

For IIFT MBA 2010 - 2013 Presentation / Author / Date

You might also like

- ACC3600 Past Year Exam Questions and AnswersDocument9 pagesACC3600 Past Year Exam Questions and AnswersKirsten Paton100% (1)

- Supply Chain Strategy and Financial MetricsDocument27 pagesSupply Chain Strategy and Financial Metricshappiest1No ratings yet

- Activity Based Costing-A Tool To Aid Decision MakingDocument54 pagesActivity Based Costing-A Tool To Aid Decision MakingSederiku KabaruzaNo ratings yet

- Activity Based Costing:: A Tool To Aid Decision MakingDocument36 pagesActivity Based Costing:: A Tool To Aid Decision MakingParikshit SethiNo ratings yet

- ZCMA6022 Activity Based CostingDocument56 pagesZCMA6022 Activity Based CostingIlanchelian ChandranNo ratings yet

- Yustika Adiningsih-F0319141-Mindmap SPM A Chapter 6 Dan 7Document2 pagesYustika Adiningsih-F0319141-Mindmap SPM A Chapter 6 Dan 7yes iNo ratings yet

- Activity Based Costing:: A Tool To Aid Decision MakingDocument28 pagesActivity Based Costing:: A Tool To Aid Decision MakingAlbana QemaliNo ratings yet

- Activity Based CostingDocument20 pagesActivity Based CostingCJ MacasioNo ratings yet

- White Paper Consumption Based ABCMDocument8 pagesWhite Paper Consumption Based ABCMMaribet RodríguezNo ratings yet

- PC205 InstructorSlides Power PointDocument76 pagesPC205 InstructorSlides Power PointJoaNiniaNo ratings yet

- Product Cost Controlling - v1Document37 pagesProduct Cost Controlling - v1Uday Bhaskar GurralaNo ratings yet

- 4-Business Level StrategyDocument13 pages4-Business Level StrategyIKLIMA PILA SOPIANo ratings yet

- Software License and Maintenance Pricing Principles - Best Practices and Case StudiesDocument35 pagesSoftware License and Maintenance Pricing Principles - Best Practices and Case StudiesasthapriyamvadaNo ratings yet

- 11 Edition: Mcgraw-Hill/IrwinDocument48 pages11 Edition: Mcgraw-Hill/IrwinArlene Magalang NatividadNo ratings yet

- MS08 - Activity-Based Costing (Abc) - Total Quality Management (TQM)Document5 pagesMS08 - Activity-Based Costing (Abc) - Total Quality Management (TQM)Elsie GenovaNo ratings yet

- Data Flow To COPA: Business Infrastructure Standardization ProjectDocument3 pagesData Flow To COPA: Business Infrastructure Standardization ProjectT SAIKIRANNo ratings yet

- F5 BPP Revision SlidesDocument142 pagesF5 BPP Revision SlidesUjjal ShiwakotiNo ratings yet

- Quinle - Oscm Supply 2022Document1 pageQuinle - Oscm Supply 2022gabes shivoloNo ratings yet

- Absorption and MarginalDocument7 pagesAbsorption and MarginalshafinasimanNo ratings yet

- Cost AccountingDocument2 pagesCost Accountingjumper200No ratings yet

- Ms04 Cost Behavior and Cost ClassificationDocument7 pagesMs04 Cost Behavior and Cost ClassificationAshley BrevaNo ratings yet

- Module 2 Cost Estimation Costing StatementDocument33 pagesModule 2 Cost Estimation Costing StatementTaaraniyaal Thirumurugu ArivanandanNo ratings yet

- Activity Based Costing OmairDocument26 pagesActivity Based Costing OmairblablaNo ratings yet

- Agil DiscussionDocument8 pagesAgil DiscussionreachlaxmiNo ratings yet

- XLRI ClockspeedDocument15 pagesXLRI ClockspeedSneha KhaitanNo ratings yet

- Activity Based Costing/Management: Mgr. Andrea Gažová, PHDDocument23 pagesActivity Based Costing/Management: Mgr. Andrea Gažová, PHDRoberto SanchezNo ratings yet

- Oracle Applications User Group Discrete MFG SIG - Cost Group April 27 2010Document50 pagesOracle Applications User Group Discrete MFG SIG - Cost Group April 27 2010Conrad RodricksNo ratings yet

- Major Tables and Relationships For Costing April 2010Document50 pagesMajor Tables and Relationships For Costing April 2010sastrylanka1980No ratings yet

- Major Tables and Relationships For Costing April 2010Document50 pagesMajor Tables and Relationships For Costing April 2010karthik rNo ratings yet

- Monitoring Report For Faculty Online Classes Bachelor of Science in AccountancyDocument8 pagesMonitoring Report For Faculty Online Classes Bachelor of Science in AccountancyJay AnnNo ratings yet

- Cost Accounting - HandoutsDocument3 pagesCost Accounting - Handoutsronniel tiglaoNo ratings yet

- MANBI-Implementation of Activity-Based Costing and ManagementDocument2 pagesMANBI-Implementation of Activity-Based Costing and ManagementFirman HotwheelsNo ratings yet

- Strategy MappingDocument6 pagesStrategy MappingLuis Carlos RodriguezNo ratings yet

- Prepared By: Jessy ChongDocument7 pagesPrepared By: Jessy ChongDaleNo ratings yet

- Chapter 2 - Cost and Cost ClassificationDocument12 pagesChapter 2 - Cost and Cost ClassificationVuong PhamNo ratings yet

- Absorption and Allocation CostingDocument21 pagesAbsorption and Allocation Costingashishmission2020No ratings yet

- Activity-Based Costing: A Tool To Aid Decision Making: Chapter EightDocument75 pagesActivity-Based Costing: A Tool To Aid Decision Making: Chapter EightRand Nasa'aNo ratings yet

- The Costing Cheat Sheet - Oana Labes, MBA, CPADocument1 pageThe Costing Cheat Sheet - Oana Labes, MBA, CPAYen HoangNo ratings yet

- Activity-Based Costing: A Tool To Aid Decision MakingDocument29 pagesActivity-Based Costing: A Tool To Aid Decision MakingAce RividiNo ratings yet

- Managerial Accounting and Cost ConceptsDocument18 pagesManagerial Accounting and Cost Conceptsginish12No ratings yet

- Activity-Based CostingDocument49 pagesActivity-Based CostingJene LmNo ratings yet

- P2 MA Cheet Sheet PDFDocument2 pagesP2 MA Cheet Sheet PDFbooks_sumiNo ratings yet

- Om FinanceDocument26 pagesOm Financeshahrachit91No ratings yet

- Variable Costing: A Tool For ManagementDocument37 pagesVariable Costing: A Tool For ManagementumakantanayakNo ratings yet

- Chapter 1Document11 pagesChapter 1kimberlyann ongNo ratings yet

- Week Four: Costing SystemsDocument4 pagesWeek Four: Costing SystemsNizam JewelNo ratings yet

- Optimizing Manufacturing Operations Using Big Data and AnalyticsDocument39 pagesOptimizing Manufacturing Operations Using Big Data and AnalyticsWisnu AjiNo ratings yet

- Bab 2 - Perilaku BiayaDocument40 pagesBab 2 - Perilaku BiayaAndy ReynaldyyNo ratings yet

- Bab 2 - Perilaku BiayaDocument40 pagesBab 2 - Perilaku BiayaAndy ReynaldyyNo ratings yet

- Garrison Lecture Chapter 7Document64 pagesGarrison Lecture Chapter 7jeanette100% (1)

- (16 Cost Accounting Systems)Document71 pages(16 Cost Accounting Systems)St Dalfour CebuNo ratings yet

- Framework Profitability Smarthveer Sidana 1Document1 pageFramework Profitability Smarthveer Sidana 1adityaNo ratings yet

- Arginal OstingDocument69 pagesArginal Ostingmoses jcNo ratings yet

- Lecture No. 19: Production Strategy: Takahiro Fujimoto Department of Economics, University of TokyoDocument25 pagesLecture No. 19: Production Strategy: Takahiro Fujimoto Department of Economics, University of Tokyoprafulla_mahantaNo ratings yet

- ms04 Cost Behavior and Cost ClassificationDocument8 pagesms04 Cost Behavior and Cost ClassificationdigididoghakdogNo ratings yet

- Activity Based CostingDocument17 pagesActivity Based CostingPoonamNo ratings yet

- Inventory Costing: Chapter NineDocument39 pagesInventory Costing: Chapter NineDio VinosaNo ratings yet

- Product CostingDocument2 pagesProduct CostingSudharsanRenganathanNo ratings yet

- Hms 05Document28 pagesHms 05JavierNo ratings yet

- Lecture-9.1 Variable & Absorption Costing PDFDocument24 pagesLecture-9.1 Variable & Absorption Costing PDFNazmul-Hassan Sumon100% (1)

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Important Questions With Star Ratings - TQM 16 Marks Unit 1Document1 pageImportant Questions With Star Ratings - TQM 16 Marks Unit 1Prakash ThalaNo ratings yet

- Floro Cement Corp V GorospeDocument1 pageFloro Cement Corp V GorospeiciamadarangNo ratings yet

- 2) Instructions For Playing The GameDocument7 pages2) Instructions For Playing The GameAna MariaNo ratings yet

- O Uco Bank: Rnictj/Date: 19.08.2019Document3 pagesO Uco Bank: Rnictj/Date: 19.08.2019Satya KarNo ratings yet

- Smart 30-01Document75 pagesSmart 30-01humbleNo ratings yet

- Consumers in 2030: Forecasts and Projections For Life in 2030Document15 pagesConsumers in 2030: Forecasts and Projections For Life in 2030Adriano AraujoNo ratings yet

- Chapter 02Document56 pagesChapter 02MD Hafizul Islam HafizNo ratings yet

- Mock - Econ - Exercise 4Document2 pagesMock - Econ - Exercise 4najib casanNo ratings yet

- Labour BA0130026 - JerinDocument16 pagesLabour BA0130026 - JerinAnirudhaRudhraNo ratings yet

- Survey of Accounting: A Further Look at The Balance SheetDocument28 pagesSurvey of Accounting: A Further Look at The Balance SheetTiaraNo ratings yet

- Work Study and Ergonomics SIRAJ PDFDocument4 pagesWork Study and Ergonomics SIRAJ PDFsirajudeen INo ratings yet

- Job Description: Elovi Vietnam Joint Stock Company (Morinaga Milk Group)Document2 pagesJob Description: Elovi Vietnam Joint Stock Company (Morinaga Milk Group)Minh AnhNo ratings yet

- Invoice 7218740Document2 pagesInvoice 7218740Johanny SantosNo ratings yet

- CV-Jabir Ali Revised 2010Document7 pagesCV-Jabir Ali Revised 2010Jabir Ali100% (1)

- Subsidiary Ledger: Department of Public Works and HighwaysDocument629 pagesSubsidiary Ledger: Department of Public Works and HighwaysKenneth Cyrus OlivarNo ratings yet

- Hsslive-XII-economics - Macro - EconomicsDocument3 pagesHsslive-XII-economics - Macro - Economicscsc kalluniraNo ratings yet

- Chapter 1 - Buyback Additional QuestionsDocument9 pagesChapter 1 - Buyback Additional QuestionsMohammad ArifNo ratings yet

- Unit 08 - Financial Statement AnalysisDocument31 pagesUnit 08 - Financial Statement Analysisqwertyytrewq12No ratings yet

- Sapm Eic AnalysisDocument21 pagesSapm Eic AnalysisSai SrikarNo ratings yet

- Entrepreneurship Business Plan DR John ProductDocument11 pagesEntrepreneurship Business Plan DR John ProductsuccessseakerNo ratings yet

- Synergy Basic Trading MethodDocument16 pagesSynergy Basic Trading Methodkazabian kazabian50% (2)

- Bulletin 200658 2023-02-21.zeendoc PDFDocument1 pageBulletin 200658 2023-02-21.zeendoc PDFComboulNo ratings yet

- Uts Act206 Seksi D 201801020230 Roberta AndrianiDocument7 pagesUts Act206 Seksi D 201801020230 Roberta AndrianiIgnatius MaryantoNo ratings yet

- Assignment 1Document2 pagesAssignment 1Umar GondalNo ratings yet

- Quiz 1 AnswersDocument3 pagesQuiz 1 AnswersAlia MazouzNo ratings yet

- Solutions To Assigned ProblemsDocument85 pagesSolutions To Assigned ProblemsJasmine NicodemusNo ratings yet

- Project On Online Trading at Sharekhan LTDDocument134 pagesProject On Online Trading at Sharekhan LTDMithun Kumar Patnaik73% (26)

- Analisis Harga Pokok Produksi Dengan Metode Activity Based Costing Untuk Mengambil Keputusan Manajemen Pada Industri Garmen CV. Surya SurabayaDocument12 pagesAnalisis Harga Pokok Produksi Dengan Metode Activity Based Costing Untuk Mengambil Keputusan Manajemen Pada Industri Garmen CV. Surya SurabayaNur Syafi'ahNo ratings yet