Professional Documents

Culture Documents

Taxation: Wealth Tax and Gift Tax

Taxation: Wealth Tax and Gift Tax

Uploaded by

harshita0 ratings0% found this document useful (0 votes)

7 views10 pagesThe document discusses India's wealth tax and gift tax policies. Wealth tax was abolished in 2016-17 and replaced with a 2% additional surcharge on incomes over 1 crore. Gift tax applies to gifts over Rs. 50,000, except for gifts from relatives or received during occasions like marriage. Real estate gifts are taxed if the stamp duty value exceeds Rs. 50,000 and are received without consideration.

Original Description:

tax

Original Title

GIFT tax

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses India's wealth tax and gift tax policies. Wealth tax was abolished in 2016-17 and replaced with a 2% additional surcharge on incomes over 1 crore. Gift tax applies to gifts over Rs. 50,000, except for gifts from relatives or received during occasions like marriage. Real estate gifts are taxed if the stamp duty value exceeds Rs. 50,000 and are received without consideration.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views10 pagesTaxation: Wealth Tax and Gift Tax

Taxation: Wealth Tax and Gift Tax

Uploaded by

harshitaThe document discusses India's wealth tax and gift tax policies. Wealth tax was abolished in 2016-17 and replaced with a 2% additional surcharge on incomes over 1 crore. Gift tax applies to gifts over Rs. 50,000, except for gifts from relatives or received during occasions like marriage. Real estate gifts are taxed if the stamp duty value exceeds Rs. 50,000 and are received without consideration.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 10

Taxation

Wealth Tax and Gift Tax

Wealth Tax

Objective: To penalize unproductive use of assets

PRIOR TO 2016-17: Wealth above Rs. 30 lakh is subject to WT

Tax rate 1% on the value above Rs. 30 lakh

Financial assets are not subject to wealth tax

Jewellery, bullion, Gold/ silver utensils, House, luxury cars, watches, yachts and

aircraft, and cash over Rs. 50,000.

Real Estate:

Second house is subject to WT

Exempted if rented for at least 300 days in a year

Commercial complex is not subject to WT

Penalty: 1% interest for each month of delay. Penalty for evasion 100-500% of the

amount due.

WEALTH TAX NOW STANDS ABOLISHED FROM THE FINANCIAL YEAR 2016-

17. INSTEAD ADDITIONAL SURCHARGE OF 2% FOR INCOME ABOVE ONE

CRORE.

2 NMiMS - PGDM02 –WM12 Feb 4, 2013

Gift Tax

No gift tax since 1998, but brought in again in 2004 by

including provisions in the IT Act and tightened in 2009.

Receiver has to pay tax

On any gift worth more than Rs. 50,000

Gifts received by children clubbed with parents’ income

Real estate transaction below govt. fixed price

Exempt:

Gifts from relatives: spouse, siblings, uncles, lineal

ascendants or descendants (or spouse of these relatives)

Gifts received on the occasion of marriage

Gifts from parents, grandparents, gifts through will and

inheritance

3 NMiMS - PGDM02 –WM12 Feb 4, 2013

As per the provisions of section 56(2) of the Income Tax

Act, 1961, any gifts (in cash or kind) received by an

individual or HUF (Hindu Undivided Family) in excess of

Rs. 50,000/- in a year would be taxable.

4 NMiMS - PGDM02 –WM12 Feb 4, 2013

Who is liable to pay gift Tax?

Person receiving gifts will be liable to pay gift tax. Such

income would be taxable in the year in which received and

taxable under the head “Income from other sources”.

5 NMiMS - PGDM02 –WM12 Feb 4, 2013

What does Gift means in Income Tax Act?

“Gift” means the transfer by one person to another of

any existing movable or immovable property made

voluntarily and without consideration in money or money’s

worth.

Thus, income tax authority considers:

Monetary gifts given in cash/cheque/demand draft,

Moveable property such as jewellery, gold bars, paintings,

drawings or sculptures,

Immovable property such as land or building or both, as

gifts.

6 NMiMS - PGDM02 –WM12 Feb 4, 2013

Are gifts of immovable property received by an

individual or HUF charged to tax?

Gift of immovable property received by an individual or

HUF will be charged to tax, if:

Immovable property (land or building or both) is received by

an individual/HUF,

received without consideration (i.e., received as a gift)

Stamp duty value of such immovable property

received exceeds Rs. 50,000

7 NMiMS - PGDM02 –WM12 Feb 4, 2013

Exemptions from levy of Income

Tax on Gifts

Received from relatives** (See below).

Received by a HUF from its members.

Received on the occasion of the marriage

Received under will/ by way of inheritance.

Received in contemplation of death of the payer or donor.

Received from a local authority

Received from any fund/foundation/university/other educational

institution/hospital or other medical institution, any trust or institution

referred to in Section 10(23C).

Money received from a trust or institution registered under section 12AA.

8 NMiMS - PGDM02 –WM12 Feb 4, 2013

Relatives Meaning for Gift taxability

Relatives for this purpose means:

(a) Spouse of the individual;

(b) Siblings (Brother or sister) and their spouses of the individual;

(c) Siblings of the spouse of the individual;

(d) Siblings of the parents of the individual;

(e) Any lineal ascendant or descendant of the individual;

(f) Any lineal ascendant or descendant of the spouse of the

individual;

9 NMiMS - PGDM02 –WM12 Feb 4, 2013

Key Points / Highlights – Income

Tax on Gift Received

any gift (cash or kind) in excess of Rs.50000, received without consideration by

an individual or HUF from any person* is chargeable to tax,

Gift include any gift, “cash or kind” or “movable or immovable property,

Chargeable to tax under head “income from other sources”,

Chargeable to tax in the hand of recipient

Gift of immovable property received without consideration by an individual or

HUF will be charged to tax, if, Stamp duty value of such immovable

property exceeds Rs. 50,000

Gift received on the occasion of the marriage is exempt from tax

Gift received from relatives exempt from tax

10 NMiMS - PGDM02 –WM12 Feb 4, 2013

You might also like

- Prenuptial AgreementDocument2 pagesPrenuptial Agreementyurets92991% (11)

- Donor's Tax ReviewerDocument6 pagesDonor's Tax ReviewerMaria Victoria75% (4)

- Donors Tax NotesDocument3 pagesDonors Tax NotesRey PerosaNo ratings yet

- Natural Family Planning InstructionsDocument5 pagesNatural Family Planning Instructionsjackie_meNo ratings yet

- Recent Trends in Divorce and Custody Litigation - Richard GardnerDocument9 pagesRecent Trends in Divorce and Custody Litigation - Richard GardnerBeatriz PomelliNo ratings yet

- Tax Treatment of GiftsDocument17 pagesTax Treatment of Giftssreyans banthiaNo ratings yet

- Tax Treatment of GiftsDocument18 pagesTax Treatment of GiftsM H MullaNo ratings yet

- Tax Treatment of Gift Received by An Individual or Hindu Undivided Family (Huf)Document9 pagesTax Treatment of Gift Received by An Individual or Hindu Undivided Family (Huf)chiragkeshariya274No ratings yet

- Tax Treatment of GiftsDocument19 pagesTax Treatment of GiftsVaibhavNo ratings yet

- Tax Would Be Levied On Such Gifts. The Persons Who Constitute Relatives For ThisDocument2 pagesTax Would Be Levied On Such Gifts. The Persons Who Constitute Relatives For ThisSavoir PenNo ratings yet

- Tax Treatment of GiftsDocument16 pagesTax Treatment of GiftsGokul NairNo ratings yet

- CHAPTER 6 - Donor's Tax ReportDocument58 pagesCHAPTER 6 - Donor's Tax ReportheyheyNo ratings yet

- Vivos Based On Pure Act of Liberality Without Any or Less Than Adequate Consideration and Without AnyDocument5 pagesVivos Based On Pure Act of Liberality Without Any or Less Than Adequate Consideration and Without AnyJunivenReyUmadhayNo ratings yet

- Condonation or Cancellation of IndebtednessDocument4 pagesCondonation or Cancellation of IndebtednessArceño, Advrelyn Frances C.No ratings yet

- Transfer TaxDocument63 pagesTransfer TaxZiad DnetNo ratings yet

- Taxability of GiftDocument9 pagesTaxability of GiftGaurav BeniwalNo ratings yet

- Donor's TaxDocument25 pagesDonor's TaxMark Erick Acojido RetonelNo ratings yet

- In-House Cpa Review Taxation Donor'S Tax - Notes: E.A.Dg - MateoDocument2 pagesIn-House Cpa Review Taxation Donor'S Tax - Notes: E.A.Dg - MateoMina ValenciaNo ratings yet

- Receive A Gift From RelatiDocument2 pagesReceive A Gift From Relatinagaraj.winNo ratings yet

- The Tax Treatment of Sum of Money Received As Gift Under Section 56Document4 pagesThe Tax Treatment of Sum of Money Received As Gift Under Section 56Anshu kumarNo ratings yet

- 2donor's Tax LectureDocument23 pages2donor's Tax LectureJohn Paulo CalubNo ratings yet

- Donor's Tax HandoutDocument14 pagesDonor's Tax HandoutJamesiversonNo ratings yet

- Incomefromothersource Bose 130128051842 Phpapp01Document3 pagesIncomefromothersource Bose 130128051842 Phpapp01Prâtèék ShâhNo ratings yet

- Module 1 Lesson 5Document6 pagesModule 1 Lesson 5Rich Ann Redondo VillanuevaNo ratings yet

- Transfer Taxes: Atty. Kim M. Aranas Faculty, USC-SOLGDocument61 pagesTransfer Taxes: Atty. Kim M. Aranas Faculty, USC-SOLGethel hyugaNo ratings yet

- Chapter 2 - Donor's Tax (Notes)Document8 pagesChapter 2 - Donor's Tax (Notes)Angela Denisse FranciscoNo ratings yet

- Tax 2 Reviewer LectureDocument13 pagesTax 2 Reviewer LectureShiela May Agustin MacarayanNo ratings yet

- Understanding The Provisions of Section 56 (2) (X)Document5 pagesUnderstanding The Provisions of Section 56 (2) (X)kavi priyaNo ratings yet

- Gift - Def of RelativeDocument1 pageGift - Def of RelativeAshish JainNo ratings yet

- Estate TaxDocument26 pagesEstate Taxkitayroselyn4No ratings yet

- Donors TaxDocument19 pagesDonors TaxIo AyaNo ratings yet

- Transfer Taxes (Donor'S Tax) : Jhoniel Sells To Ruzby His Land For An Amount of P5,000,000 (Current FMV) Which He Bought atDocument8 pagesTransfer Taxes (Donor'S Tax) : Jhoniel Sells To Ruzby His Land For An Amount of P5,000,000 (Current FMV) Which He Bought atKristina Casandra FernandezNo ratings yet

- Concepts of Donation and DonorDocument7 pagesConcepts of Donation and DonorbeverlyrtanNo ratings yet

- Govern The Imposition of The Donor's TaxDocument5 pagesGovern The Imposition of The Donor's TaxjuliNo ratings yet

- Govt Client Taxes Settlement DiscussionDocument21 pagesGovt Client Taxes Settlement DiscussionadrianvincentopinionNo ratings yet

- Pointers To Review BUSINESS TAXATIONDocument4 pagesPointers To Review BUSINESS TAXATIONFaizal MutiaNo ratings yet

- Basic Concept of Donation and Donor's TaxDocument20 pagesBasic Concept of Donation and Donor's TaxKarl BasaNo ratings yet

- Filing of Return and Payment of Gift TaxDocument8 pagesFiling of Return and Payment of Gift Taxmariyha PalangganaNo ratings yet

- To Supplement The Estate Taxes by Preventing Their Avoidance Through The Taxation of Gifts Inter VivosDocument1 pageTo Supplement The Estate Taxes by Preventing Their Avoidance Through The Taxation of Gifts Inter VivosJayson RHNo ratings yet

- Atty. Israel Lay-At by Edwin SiyDocument58 pagesAtty. Israel Lay-At by Edwin SiyRyan de LeonNo ratings yet

- Effective January 1, 2018 and Onwards (Republic Act (RA) No. 10963/TRAIN)Document3 pagesEffective January 1, 2018 and Onwards (Republic Act (RA) No. 10963/TRAIN)Deneb DoydoraNo ratings yet

- Lecture Donors TaxDocument9 pagesLecture Donors TaxOtis MelbournNo ratings yet

- Tax Free in Case of Other SourcesDocument4 pagesTax Free in Case of Other SourcesAnshul TyagiNo ratings yet

- Donor's Tax - BirDocument7 pagesDonor's Tax - BirHannah Brynne UrreraNo ratings yet

- M U S: Ift and Estate: OD LE Taxe GDocument2 pagesM U S: Ift and Estate: OD LE Taxe GEl-Sayed MohammedNo ratings yet

- CAclubindia News - Gifts - Taxable or Non TaxableDocument2 pagesCAclubindia News - Gifts - Taxable or Non TaxableAppurva ShahNo ratings yet

- Donor's Tax & Estate TaxDocument28 pagesDonor's Tax & Estate TaxMae Manoelle LeonaNo ratings yet

- Donor's TaxDocument10 pagesDonor's TaxRov BiadnesNo ratings yet

- DonationDocument31 pagesDonationJust JhexNo ratings yet

- Donors TaxDocument4 pagesDonors TaxkjabbugaoNo ratings yet

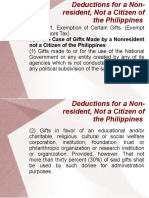

- B) in The Case of Gifts Made by A Nonresident Not A Citizen of The PhilippinesDocument23 pagesB) in The Case of Gifts Made by A Nonresident Not A Citizen of The PhilippinesNissi JonnaNo ratings yet

- Accept Gift and Pay TaxDocument2 pagesAccept Gift and Pay TaxSantosh ParasharNo ratings yet

- Module 1 Lesson 4Document4 pagesModule 1 Lesson 4Rich Ann Redondo VillanuevaNo ratings yet

- GiftDocument8 pagesGiftsagar kukrejaNo ratings yet

- Bsa2105-Fs2021-Donor'staxtax-Da010 - 1Document3 pagesBsa2105-Fs2021-Donor'staxtax-Da010 - 1ela kikayNo ratings yet

- Donor's TXDocument5 pagesDonor's TXdorie shane sta. mariaNo ratings yet

- Donors Tax in The Philippines Under TRAINDocument4 pagesDonors Tax in The Philippines Under TRAINAnna Dominique VillanuevaNo ratings yet

- Section 56 - Decoding Section 56 of The Income-Tax Act, 1961 (ITDocument5 pagesSection 56 - Decoding Section 56 of The Income-Tax Act, 1961 (ITNavyaNo ratings yet

- TAXATIONDocument6 pagesTAXATIONWenah Eliab ArtajoNo ratings yet

- PART 2 Donors TaxDocument6 pagesPART 2 Donors TaxrhieelaaNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Petition To Determine HeirshipDocument4 pagesPetition To Determine Heirshipjnylaw20020% (1)

- Bach G Minor Arr. Luo NiDocument5 pagesBach G Minor Arr. Luo NiwayaNo ratings yet

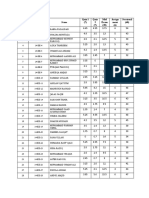

- SR - No Reg - No Name: Quiz 1 (7) Quiz 2 (7) Mid Exam (20) Assign Ment (6) SessionalDocument8 pagesSR - No Reg - No Name: Quiz 1 (7) Quiz 2 (7) Mid Exam (20) Assign Ment (6) SessionalFarhanBaqiNo ratings yet

- Caste and WomenDocument20 pagesCaste and WomenRamjit KumarNo ratings yet

- Macarrubo V MacarruboDocument2 pagesMacarrubo V MacarrubojtjustinNo ratings yet

- Research Paper 2Document10 pagesResearch Paper 2api-519748927No ratings yet

- RP vs. The Honorable Court of Appeals and The Spouses James Anthony Hughes and Lenita Mabunay Hughes, G.R. No. 100835, October 26, 1993Document2 pagesRP vs. The Honorable Court of Appeals and The Spouses James Anthony Hughes and Lenita Mabunay Hughes, G.R. No. 100835, October 26, 1993Edgar Joshua TimbangNo ratings yet

- NepotismDocument9 pagesNepotismopep77No ratings yet

- 3 Emily Isolation Worksheet 19 - AnswersDocument4 pages3 Emily Isolation Worksheet 19 - AnswersPyjamasuniteNo ratings yet

- Search - Birth and Death VerificationDocument1 pageSearch - Birth and Death VerificationMd FerdusNo ratings yet

- Powerpoint For Debate 1Document9 pagesPowerpoint For Debate 1api-253895953No ratings yet

- Case Study GonorrheaDocument19 pagesCase Study GonorrheaErika ThereseNo ratings yet

- ModuleDocument14 pagesModuleapi-312500148No ratings yet

- In Re Edward Raymond Silansky, BK 88-00039-At BK Adver. 88-0116, Debtor. Edward Raymond Silansky v. Brodsky, Greenblatt & Renehan, 897 F.2d 743, 4th Cir. (1990)Document3 pagesIn Re Edward Raymond Silansky, BK 88-00039-At BK Adver. 88-0116, Debtor. Edward Raymond Silansky v. Brodsky, Greenblatt & Renehan, 897 F.2d 743, 4th Cir. (1990)Scribd Government DocsNo ratings yet

- Intestate Estate of Rosales v. Rosales, G.R. No. L-40789, (February 27, 1987), 232 PHIL 73-80)Document6 pagesIntestate Estate of Rosales v. Rosales, G.R. No. L-40789, (February 27, 1987), 232 PHIL 73-80)yasuren2No ratings yet

- CDX Group 2 FinalDocument161 pagesCDX Group 2 Finaljuel_navarro100% (1)

- Petition For Declaration of Nullity of MarriageDocument13 pagesPetition For Declaration of Nullity of MarriageIrene QuimsonNo ratings yet

- Worksheet Hindu & Muslim LawDocument1 pageWorksheet Hindu & Muslim Lawvirat singhNo ratings yet

- Compilation of Case Digests Pafr1Document144 pagesCompilation of Case Digests Pafr1Catherine DimailigNo ratings yet

- (Clarion Herald) Katrina Whereabouts of PriestsDocument1 page(Clarion Herald) Katrina Whereabouts of Priestsapi-3759571No ratings yet

- Lot Tok ImamDocument3 pagesLot Tok ImamHairu NizamNo ratings yet

- Gender Documents 600-1450 (2010)Document25 pagesGender Documents 600-1450 (2010)Brian RobertsNo ratings yet

- ShakespeareDocument44 pagesShakespeareteachenglandNo ratings yet

- Chapter 12 Section 4Document10 pagesChapter 12 Section 4api-206809924No ratings yet

- Euthenics BlendedDocument113 pagesEuthenics BlendedShara GandiaNo ratings yet

- Digital AlbumDocument15 pagesDigital AlbumCHINCHU LNo ratings yet

- IL - 511 Roll No. 33 (Smit Pandya)Document84 pagesIL - 511 Roll No. 33 (Smit Pandya)harshwardhansinghgohil009No ratings yet