Professional Documents

Culture Documents

deeganAFA 7e ch28 Reduced

deeganAFA 7e ch28 Reduced

Uploaded by

mail2manshaa0 ratings0% found this document useful (0 votes)

39 views19 pagesOriginal Title

deeganAFA_7e_ch28_reduced.ppt

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

39 views19 pagesdeeganAFA 7e ch28 Reduced

deeganAFA 7e ch28 Reduced

Uploaded by

mail2manshaaCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 19

Chapter 28

Further consolidation

issues I: Accounting for

intragroup transactions

Copyright © 2012 McGraw-Hill Australia Pty Ltd

PPTs to accompany Deegan, Australian Financial Accounting 7e

16-1

Objectives of this lecture

• Understand the nature of intragroup transactions

• Understand how and why to eliminate intragroup

dividends on consolidation

• Understand how to account for intragroup sales of

inventory inclusive of the related tax expense effects

• Understand how to account for intragroup sales of

non-current assets inclusive of the related tax

expense effects

Copyright © 2012 McGraw-Hill Australia Pty Ltd

PPTs to accompany Deegan, Australian Financial Accounting 7e

16-2

Introduction to accounting for

intragroup transactions

Overview

• During a financial period it is common for separate legal entities

within an economic entity to transact with each other

• In preparing consolidated financial statements, the effects of all

transactions between entities within the economic entity are

eliminated in full, even where the parent entity holds only a

fraction of the issued equity.

• Examples of intragroup transactions

• Consolidation adjustments for intragroup transactions:

– Typically eliminate these transactions by reversing the original accounting

entries

– Such eliminations can also introduce temporary tax differences into the

consolidated financial statements

Copyright © 2012 McGraw-Hill Australia Pty Ltd

PPTs to accompany Deegan, Australian Financial Accounting 7e

16-3

Dividend payments from pre- and

post-acquisition earnings

Dividend payments

• In the consolidation process it is necessary to eliminate:

– all dividends paid/payable to other entities within the group

– all dividends received/receivable from other entities within

the group

• Only dividends paid externally should be shown in the

consolidated financial statements

AASB 10 requires that:

• on consolidation of intragroup balances, transactions, income

and expenses are all to be eliminated in full

Refer to Worked Example 28.1 on pp. 922–924—Dividend payments to a

subsidiary out of post-acquisition earnings

Copyright © 2012 McGraw-Hill Australia Pty Ltd

PPTs to accompany Deegan, Australian Financial Accounting 7e

16-4

Dividend payments out of pre- and

post-acquisition earnings (cont.)

Dividends out of pre-acquisition profits

• If an entity pays dividends out of profits earned before

acquisition, it is effectively returning part of the net assets

originally acquired (return of part of investment in

subsidiary)

• In 2008 the above treatment was changed and now

dividends paid by a subsidiary are to be recorded as

dividend revenue in the parent entity’s accounts

AASB 127 Separate Financial Statements now states:

An entity shall recognise a dividend from a subsidiary, jointly

controlled entity or associate in profit or loss in its separate

financial statements when its right to receive the dividend is

established

Copyright © 2012 McGraw-Hill Australia Pty Ltd

PPTs to accompany Deegan, Australian Financial Accounting 7e

16-5

Dividends paid from pre-acquisition

earnings of the investee

• If a dividend payment is made out of pre-acquisition profits of

the subsidiary then this in itself may have implications for the

value of the parent’s investment in the subsidiary.

• The dividend payment will have the effect of reducing the net

assets of the subsidiary. This in turn might provide an indication

that the parent entity’s investment in the subsidiary may

thereafter have a value that may be below the original cost of

the investment.

• If an impairment loss is recognised in the accounts of the parent

entity then that impairment loss would be reversed as a

consolidation adjustment prior to the consolidation entry that

eliminates the parent’s investment in a subsidiary....

Copyright © 2012 McGraw-Hill Australia Pty Ltd

PPTs to accompany Deegan, Australian Financial Accounting 7e

16-6

Intragroup sale of inventory

• From the group’s perspective, revenue should not be

recognised until inventory is sold to parties outside the group

• We will need to eliminate any unrealised profits from the

consolidated financial statements

• Unrealised profits result from inventory, which is sold within

the group for a profit, remaining on hand within the group at

the end of the reporting period

As we know, AASB 10 requires:

Consolidated financial statements eliminate in full intragroup assets

and liabilities, equity, income, expenses and cash flows relating to

transactions between entities of the group (profits or losses

resulting from intragroup transactions that are recognised in assets,

such as inventory and fixed assets, are eliminated in full).

Copyright © 2012 McGraw-Hill Australia Pty Ltd

PPTs to accompany Deegan, Australian Financial Accounting 7e

16-7

Copyright © 2012 McGraw-Hill Australia Pty Ltd

PPTs to accompany Deegan, Australian Financial Accounting 7e

16-8

Intragroup sale of inventory (cont.)

• Each member of a group is typically taxed individually

on its income, not the group collectively

• If tax has been paid by one member of the group, from

the group’s perspective this represents a prepayment of

tax (deferred tax asset) to the extent that the inventory

remains within the group (meaning that the related profit

is unrealised from the perspective of the economic

entity)

• This income will not be earned by the economic

entity until the inventory is sold outside the group

Copyright © 2012 McGraw-Hill Australia Pty Ltd

PPTs to accompany Deegan, Australian Financial Accounting 7e

16-9

Intragroup sale of inventory (cont.)

Journal entry to eliminate inter-company sales

• To eliminate total intragroup sales as no sales

have occurred from perspective of group

Dr Sales x

Cr Cost of goods sold (perpetual) or x

purchases (periodic)

Copyright © 2012 McGraw-Hill Australia Pty Ltd

PPTs to accompany Deegan, Australian Financial Accounting 7e

16-10

Intragroup sale of inventory (cont.)

Journal entry to eliminate unrealised profit in closing stock

Accounting Standards require that inventory must be valued

at the lower of cost and net realisable value. Therefore, on

consolidation we must reduce the value of closing inventory to

its cost to the economic entity.

Dr Cost of goods sold (perpetual) or x

closing inventory—(periodic)

Cr Inventory x

Copyright © 2012 McGraw-Hill Australia Pty Ltd

PPTs to accompany Deegan, Australian Financial Accounting 7e

16-11

Intragroup sale of inventory (cont.)

Consideration of tax paid on intragroup sale of inventory

Any tax paid by members of the group related to intragroup

sales where full amount of revenue has not been earned from

the group’s perspective, effectively represents a prepayment

of tax. The adjusting consolidation entry would be:

Dr Deferred tax asset x

Cr Income tax expense x

Refer to Worked Example 28.3 on p. 930—Unrealised profit

in closing inventory

Copyright © 2012 McGraw-Hill Australia Pty Ltd

PPTs to accompany Deegan, Australian Financial Accounting 7e

16-12

Intragroup sale of inventory (cont.)

Unrealised profit in opening inventory

• If there have been intragroup sales in the

previous period, and some of the inventory is still

on hand at the previous year end, then the cost

of opening inventory held by one of the entities

within the group will be overstated from the

group’s perspective

• In the consolidation journal entries we need to

shift income from the previous period, in which

inventory was still on hand, to the period in which

the inventory is ultimately sold to external parties

Copyright © 2012 McGraw-Hill Australia Pty Ltd

PPTs to accompany Deegan, Australian Financial Accounting 7e

16-13

Intragroup sale of inventory (cont.)

Unrealised profit in opening inventory (cont.)

Consolidation entries: Unrealised profits in opening inventory

Reducing opening inventory reduces cost of goods sold

Dr Opening retained earnings x

Cr Cost of goods sold x

Higher profits lead to higher tax expense—and remember from

an accounting perspective, tax expense is based on accounting

profit

Dr Income tax expense x

Cr Opening retained earnings x

Consider Worked Example 28.4 (pp. 936–38)—Unrealised profit in

opening inventory

Copyright © 2012 McGraw-Hill Australia Pty Ltd

PPTs to accompany Deegan, Australian Financial Accounting 7e

16-14

Sale of non-current assets within

the group

• Assets of the group need to be valued as if the

intragroup sale had not occurred

• Need to reinstate the non-current asset to the

original cost or revalued amount

– Eliminate any unrealised profits on sale

– Adjust depreciation

– There may be tax on profit of sale, which will represent a

temporary difference in the consolidated financial

statements

Copyright © 2012 McGraw-Hill Australia Pty Ltd

PPTs to accompany Deegan, Australian Financial Accounting 7e

16-15

Sale of non-current assets within the

group (cont.)

Consolidation journal entries to eliminate sale of non-

current asset

Reversing gain and reinstating accumulated depreciation

Dr Gain on sale x

Dr Asset x

Cr Accumulated depreciation x

Recognising deferred tax asset

Dr Deferred tax asset x

Cr Income tax expense x

Copyright © 2012 McGraw-Hill Australia Pty Ltd

PPTs to accompany Deegan, Australian Financial Accounting 7e

16-16

Sale of non-current assets within the

group (cont.)

Consolidation journal entries to eliminate sale of non-

current asset (cont.)

Adjusting depreciation to reflect correct amount

Dr Accumulated depreciation x

Cr Depreciation expense x

Partially reversing deferred tax asset to reflect depreciation

adjustment

Dr Income tax expense x

Cr Deferred tax asset x

Refer to Worked Example 28.5 on pp. 939–42—Intragroup sale

of a non-current asset

Copyright © 2012 McGraw-Hill Australia Pty Ltd

PPTs to accompany Deegan, Australian Financial Accounting 7e

16-17

Summary

• The lecture considered the consolidation process and,

in particular, how to account for intragroup transactions

• Only dividends paid externally should be shown in the

consolidated financial statements—intragroup dividends

paid by one entity within the group are to be offset

against the dividend revenue recorded in other entity

• Within the consolidation worksheet, the liability

associated with dividends payable is to be offset

against dividend receivable

• Where intragroup sales of inventory have taken place

and inventory remains on hand at year end,

consolidation adjustments are required to reduce the

consolidated balance of closing inventory

Copyright © 2012 McGraw-Hill Australia Pty Ltd

PPTs to accompany Deegan, Australian Financial Accounting 7e

16-18

Summary (cont.)

• Where there is sale of non-current assets within

the group, consolidation adjustments are required

to eliminate any intragroup profit on sale and to

adjust the cost of the asset to reflect the cost of the

asset to the economic entity—this may also require

adjustments to depreciation expense

• If there are non-controlling interests, the effect of

intragroup transactions will be still eliminated in full

even though the parent entity might hold only a

proportion of the capital of the respective

subsidiaries

Copyright © 2012 McGraw-Hill Australia Pty Ltd

PPTs to accompany Deegan, Australian Financial Accounting 7e

16-19

You might also like

- Financial Management Theory and Practice 13th Edition Brigham Solutions ManualDocument35 pagesFinancial Management Theory and Practice 13th Edition Brigham Solutions Manualrappelpotherueo100% (21)

- Solution Manual For Foundations of Financial Management Block Hirt Danielsen 15th EditionDocument37 pagesSolution Manual For Foundations of Financial Management Block Hirt Danielsen 15th Editionabatisretroactl5z6100% (30)

- DLP-COT-festival DanceDocument2 pagesDLP-COT-festival DanceJelly Mae Getalla70% (10)

- Solution Manual For Corporate Finance A Focused Approach 6th EditionDocument37 pagesSolution Manual For Corporate Finance A Focused Approach 6th Editionjanetgriffintizze100% (17)

- Solution Manual For Financial Management Theory and Practice 14th Edition by Brigham and Ehrhardt ISBN 1111972214 9781111972219Document36 pagesSolution Manual For Financial Management Theory and Practice 14th Edition by Brigham and Ehrhardt ISBN 1111972214 9781111972219caseywestfmjcgodkzr100% (26)

- Solution Manual For Corporate Finance A Focused Approach 5th Edition by Ehrhardt Brigham ISBN 1133947530 9781133947530Document36 pagesSolution Manual For Corporate Finance A Focused Approach 5th Edition by Ehrhardt Brigham ISBN 1133947530 9781133947530heathernashdnjbczemra100% (28)

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- 3 Group Accounts and Business Combinations Lecture NotesDocument47 pages3 Group Accounts and Business Combinations Lecture NotesAKINYEMI ADISA KAMORU100% (4)

- Leave Application Form: Employee's DetailsDocument1 pageLeave Application Form: Employee's Detailsmail2manshaa100% (1)

- Sargasso Construction & Development Corp., Et Al., vs. PPADocument3 pagesSargasso Construction & Development Corp., Et Al., vs. PPAClaire SilvestreNo ratings yet

- Further Consolidation Issues II: Accounting For Non-Controlling InterestsDocument32 pagesFurther Consolidation Issues II: Accounting For Non-Controlling InterestsJesa SinghbalNo ratings yet

- Financial&managerial Accounting - 15e Williamshakabettner Chap 12Document16 pagesFinancial&managerial Accounting - 15e Williamshakabettner Chap 12mzqaceNo ratings yet

- Session 2Document13 pagesSession 2officialwork684No ratings yet

- XH-H 3e PPT Chap05Document69 pagesXH-H 3e PPT Chap05An NhiênNo ratings yet

- Analyzing Investing Activities Chapter 5Document29 pagesAnalyzing Investing Activities Chapter 5Agathos Kurapaq0% (1)

- Accounting For Group Structures: Ppts To Accompany Deegan, Australian Financial Accounting 7EDocument43 pagesAccounting For Group Structures: Ppts To Accompany Deegan, Australian Financial Accounting 7EChelsea Anne VidalloNo ratings yet

- Lecture 2C The Income StatementDocument12 pagesLecture 2C The Income StatementParadoxicalNo ratings yet

- EDHEC - MSC Fin - FAA - Overview of The Income StatementDocument27 pagesEDHEC - MSC Fin - FAA - Overview of The Income StatementGabriele GabrieliNo ratings yet

- Further Consolidation Issues II: Accounting For Indirect Interests and Changes in Degree of Ownership of A SubsidiaryDocument24 pagesFurther Consolidation Issues II: Accounting For Indirect Interests and Changes in Degree of Ownership of A SubsidiaryDanish JamaliNo ratings yet

- Cooking The Book: Tên Thành Viên: - Đ Hà ThànhDocument16 pagesCooking The Book: Tên Thành Viên: - Đ Hà ThànhThu Võ ThịNo ratings yet

- The Corporate Income Statement and The Statement of Stockholders' EquityDocument46 pagesThe Corporate Income Statement and The Statement of Stockholders' EquitySumiya KaleemNo ratings yet

- FR5 - Consolidated Is (Stud)Document15 pagesFR5 - Consolidated Is (Stud)duong duongNo ratings yet

- Solution Manual For Corporate Finance A Focused Approach 6th Edition by Ehrhard Brigham ISBN 1305637100 9781305637108Document36 pagesSolution Manual For Corporate Finance A Focused Approach 6th Edition by Ehrhard Brigham ISBN 1305637100 9781305637108stephanievargasogimkdbxwn100% (28)

- CIEM5160 - Ch3 - IS & SREDocument30 pagesCIEM5160 - Ch3 - IS & SREMatthew LiNo ratings yet

- Dwnload Full Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions Manual PDFDocument36 pagesDwnload Full Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions Manual PDFmiltongoodwin2490i100% (18)

- Full Download Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions ManualDocument36 pagesFull Download Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions Manualkisslingcicelypro100% (37)

- 0 Share: Meaning and Need For Corporate RestructuringDocument11 pages0 Share: Meaning and Need For Corporate Restructuringdeepti_gaddamNo ratings yet

- Module 7Document5 pagesModule 7lilian.doan98No ratings yet

- ACC2001 Lecture 10 Interco TransactionsDocument42 pagesACC2001 Lecture 10 Interco Transactionsmichael krueseiNo ratings yet

- CIMA F3 - FS - Chapter - 9Document52 pagesCIMA F3 - FS - Chapter - 9MichelaRosignoliNo ratings yet

- ACC ASSIGNMENT - Abhilash ChaudharyDocument17 pagesACC ASSIGNMENT - Abhilash ChaudharyAbhilash ChaudharyNo ratings yet

- Hoyle 14e Ch003 AccessibleDocument67 pagesHoyle 14e Ch003 Accessibleabdullah.h.aloibiNo ratings yet

- Assignment 13 - Section A - Group 9Document3 pagesAssignment 13 - Section A - Group 9Calypso StarsNo ratings yet

- Grade 12 Acc Lesson PlanDocument57 pagesGrade 12 Acc Lesson PlansiphephelosihlerhNo ratings yet

- Chapter Four AdvDocument23 pagesChapter Four AdvMisganu AyanaNo ratings yet

- Analyzing Investing Activities:: Special TopicsDocument40 pagesAnalyzing Investing Activities:: Special TopicsAbhishek PandaNo ratings yet

- Planning Sales For Distributable Profits: F F M MDocument3 pagesPlanning Sales For Distributable Profits: F F M MmeetwithsanjayNo ratings yet

- South Western Federal Taxation 2017 Corporations Partnerships Estates and Trusts 40Th Edition Hoffman Solutions Manual Full Chapter PDFDocument41 pagesSouth Western Federal Taxation 2017 Corporations Partnerships Estates and Trusts 40Th Edition Hoffman Solutions Manual Full Chapter PDFSarahSweeneyjpox100% (12)

- ATX-SD21 AnsDocument13 pagesATX-SD21 AnsKAM JIA LINGNo ratings yet

- Byrd PPT Ch14Document38 pagesByrd PPT Ch14Muhammad ImranNo ratings yet

- Acc 2021 T1 Week 1 CO Accounts ENGDocument9 pagesAcc 2021 T1 Week 1 CO Accounts ENGRyno de BeerNo ratings yet

- Chapter 10 - Responsibility AcctgDocument40 pagesChapter 10 - Responsibility AcctgAdrian MontemayorNo ratings yet

- Segment Reporting, Decentralization, and The Balanced ScorecardDocument36 pagesSegment Reporting, Decentralization, and The Balanced ScorecardiamnumberfourNo ratings yet

- Analyzing Investing Activities: Intercorporate InvestmentsDocument38 pagesAnalyzing Investing Activities: Intercorporate Investmentsshldhy100% (1)

- Hoyle 14e ch005 Accessible PPTDocument56 pagesHoyle 14e ch005 Accessible PPTabdullah.h.aloibiNo ratings yet

- Measuring and Controlling Assets EmployedDocument30 pagesMeasuring and Controlling Assets EmployedRhaymond MonterdeNo ratings yet

- Consolidation of AccountsDocument12 pagesConsolidation of AccountsrootningNo ratings yet

- Solution Manual: (Updated Through November 11, 2013)Document55 pagesSolution Manual: (Updated Through November 11, 2013)Jay BrockNo ratings yet

- SM Hoyle AdvAcc11e Ch07Document43 pagesSM Hoyle AdvAcc11e Ch07Anton VitaliNo ratings yet

- Changes in A PartnershipDocument18 pagesChanges in A PartnershipHadi HarizNo ratings yet

- The Basic Financial Statement FinalDocument69 pagesThe Basic Financial Statement FinalKaren Annica Astrero MedinaNo ratings yet

- Advanced Accounting 13th Edition Hoyle Solutions Manual Full Chapter PDFDocument60 pagesAdvanced Accounting 13th Edition Hoyle Solutions Manual Full Chapter PDFanwalteru32x100% (15)

- Advanced Accounting 13th Edition Hoyle Solutions ManualDocument38 pagesAdvanced Accounting 13th Edition Hoyle Solutions Manualpottpotlacew8mf1t100% (17)

- Profitability AnalysisDocument12 pagesProfitability AnalysisJudyeast AstillaNo ratings yet

- Group Reporting IV: Consolidation Under Ifrs 10Document84 pagesGroup Reporting IV: Consolidation Under Ifrs 10فهد التويجريNo ratings yet

- CHAPTER 26 - AnswerDocument21 pagesCHAPTER 26 - Answernash67% (3)

- Chapter 11 GA Consolidated BSDocument50 pagesChapter 11 GA Consolidated BSswarna dasNo ratings yet

- Chap 013Document49 pagesChap 013palak32100% (1)

- Income STDocument23 pagesIncome STKholoud LabadyNo ratings yet

- Gross Compensation IncomeDocument4 pagesGross Compensation IncomeAngeline LicuanNo ratings yet

- AFA 3e PPT Chap05Document85 pagesAFA 3e PPT Chap05Quỳnh NguyễnNo ratings yet

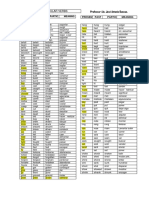

- Year Import Price Index Year Export Price IndexDocument1 pageYear Import Price Index Year Export Price Indexmail2manshaaNo ratings yet

- deeganAFA 7e ch28 ReducedDocument19 pagesdeeganAFA 7e ch28 Reducedmail2manshaaNo ratings yet

- Week 1 - Time Value of Money - MCQDocument10 pagesWeek 1 - Time Value of Money - MCQmail2manshaa100% (1)

- 3 - Economy of TourismDocument2 pages3 - Economy of Tourismmail2manshaaNo ratings yet

- Topic - Week 2 Valuation of Bonds MCQDocument6 pagesTopic - Week 2 Valuation of Bonds MCQmail2manshaaNo ratings yet

- Numerical Methods: 1. Trapezoidal RuleDocument11 pagesNumerical Methods: 1. Trapezoidal Rulemail2manshaaNo ratings yet

- Manual of Mathematics Ii For Bca Second SemesterDocument1 pageManual of Mathematics Ii For Bca Second Semestermail2manshaaNo ratings yet

- General Power of Attorney FormDocument2 pagesGeneral Power of Attorney Formmail2manshaaNo ratings yet

- College Lecturer Experience LetterDocument6 pagesCollege Lecturer Experience Lettermail2manshaaNo ratings yet

- Rganization: Presented by Sristi JoshiDocument6 pagesRganization: Presented by Sristi Joshimail2manshaaNo ratings yet

- Trade Union ActDocument1 pageTrade Union Actmail2manshaaNo ratings yet

- CystitisDocument16 pagesCystitismail2manshaaNo ratings yet

- K - J) Z KQ X/FPSF Jolqmx?Sf) Dagwdf: HRD KoreaDocument1 pageK - J) Z KQ X/FPSF Jolqmx?Sf) Dagwdf: HRD Koreamail2manshaaNo ratings yet

- Change The Verbs To Adverbs AidDocument2 pagesChange The Verbs To Adverbs Aidarnel0% (1)

- Human Eye and The Colourful World Previous Years QuestionsDocument2 pagesHuman Eye and The Colourful World Previous Years Questionssinghmrinalini1305No ratings yet

- How To Play The Harmonized Half Whole Diminished Scale PDFDocument4 pagesHow To Play The Harmonized Half Whole Diminished Scale PDFAnonymous TBwEsioWNo ratings yet

- The Physical Life of Woman:Advice To The Maiden, Wife and Mother by Napheys, George H. (George Henry), 1842-1876Document192 pagesThe Physical Life of Woman:Advice To The Maiden, Wife and Mother by Napheys, George H. (George Henry), 1842-1876Gutenberg.orgNo ratings yet

- 2021 Feb EMTEK Door Hardware Price Book WebDocument228 pages2021 Feb EMTEK Door Hardware Price Book WebAlejandro LópezNo ratings yet

- ADR TopicsDocument14 pagesADR TopicsSathvik ReddyNo ratings yet

- Irregular Verbs Nueva Lista DuncanDocument2 pagesIrregular Verbs Nueva Lista DuncanAndrey Vargas MoralesNo ratings yet

- At 01 - Introduction To Assurance and Related Services (Incl. Intro To Audit) - QuizzerDocument6 pagesAt 01 - Introduction To Assurance and Related Services (Incl. Intro To Audit) - QuizzerRei-Anne Rea100% (1)

- Naivas CP & SP Description Cost Price Selling Price %margins C.P S.P %marginsDocument12 pagesNaivas CP & SP Description Cost Price Selling Price %margins C.P S.P %marginsBonnie Maguathi MwauraNo ratings yet

- Uae Essential Network List July 2016Document75 pagesUae Essential Network List July 2016ubyisismayilNo ratings yet

- The Food Industry in Nigeria Development and QualiDocument6 pagesThe Food Industry in Nigeria Development and Qualimercy luwaNo ratings yet

- LUN Provisioning FormDocument4 pagesLUN Provisioning FormluckysrvstvNo ratings yet

- Service Operation Management: Session 8Document59 pagesService Operation Management: Session 8mukul3087_305865623No ratings yet

- All 16 Strategies in A NutshellDocument1 pageAll 16 Strategies in A NutshellLakshay SharmaNo ratings yet

- 01 Diabetes Mellitus Type2Document39 pages01 Diabetes Mellitus Type2Che HaniffNo ratings yet

- Metaphysics of AristotleDocument60 pagesMetaphysics of AristotleJaimon Thadathil100% (4)

- Cooling Tower FundamentalDocument64 pagesCooling Tower FundamentaltienNo ratings yet

- Fudge Brownies - King Arthur FlourDocument2 pagesFudge Brownies - King Arthur FlourJengNo ratings yet

- ShapeFuture Brochure2022 EnglishDocument36 pagesShapeFuture Brochure2022 EnglishJenifer Yajaira Rodríguez ChamorroNo ratings yet

- Legal Metrology Act: Analysis: Dhruv Sharma, 01319103516 BBALLB 9Document4 pagesLegal Metrology Act: Analysis: Dhruv Sharma, 01319103516 BBALLB 9dhruv sharmaNo ratings yet

- Chapter 8 Bonding Powerpoint AP ChemDocument68 pagesChapter 8 Bonding Powerpoint AP ChemAbdul jan sultaniNo ratings yet

- Julie Tozer Aldrich ResumeDocument2 pagesJulie Tozer Aldrich ResumeJulie Tozer AldrichNo ratings yet

- Neuropsychological Assessment in Illiterates: II. Language and Praxic AbilitiesDocument16 pagesNeuropsychological Assessment in Illiterates: II. Language and Praxic AbilitiesroxanaNo ratings yet

- Case Study 6: Maternal and Child NursingDocument18 pagesCase Study 6: Maternal and Child NursingJayson Ray AbellarNo ratings yet

- Automation Testing 2 Years Exp 2Document3 pagesAutomation Testing 2 Years Exp 2Swapnil FulariNo ratings yet

- Diagnostic Test Untuk Siswa Baru Kelas ViiDocument2 pagesDiagnostic Test Untuk Siswa Baru Kelas ViiZendy PradiktaNo ratings yet

- Fce Gap Filling PDFDocument30 pagesFce Gap Filling PDFRodica Ioana BândilăNo ratings yet

- Book Decade SDocument555 pagesBook Decade STrey MaklerNo ratings yet