Professional Documents

Culture Documents

INFLATION - Presentation

INFLATION - Presentation

Uploaded by

Naga Bhushan0 ratings0% found this document useful (0 votes)

26 views40 pagesInflation Presentation

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInflation Presentation

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

26 views40 pagesINFLATION - Presentation

INFLATION - Presentation

Uploaded by

Naga BhushanInflation Presentation

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 40

Inflation

Inflation is the rising price of goods and services

over time. It's an economics term that means

you have to spend more to fill your gas tank, buy

a gallon of milk or get a haircut. Inflation

increases your cost of living.

Effect of Interest rate on Inflation

DEFLATION

Objectives of Monetary Policy

• Economic growth

• Increase in employment

• Price stability and inflation control

• Exchange rate stability

• Balance of payments equilibrium

• Reducing income inequality

Demonetization pulls down India GDP growth

rate to 6.1% in Q4 2016-17

Instruments of Monetary Policy

All the categories of monetary policy can be

categorized under two categories

Quantitative Measure: Bank rate, Repo rate,

Reverse Repo rate, CRR, SLR, Open market

Structure

Qualitative Measure: Credit Rationing, change

in margin requirements, direct controls.

(As per RBI’s Fifth bi-monthly Monetary Policy Statement for

2017-18 announced on 6th December, 2017)

Repo Rate 6.00%

Reverse Repo Rate 5.75%

Bank Rate 6.25%

Marginal Standing Facility (MSF) Rate 6.25%

Cash Reserve Ratio (CRR) 4.00%

Statutory Liquidity Ratio (SLR) 19.50%

REPO RATE

Repo rate is the rate at which the RBI lends to

short-term money to the banks against

securities. When the Repo rate increasing

borrowing from RBI becomes more expensive.

Open Market Operations

• Buying and selling government securities by

the RBI in the open market is called open

market operations.

• When RBI buys government securities the

money supply increases.

• When RBI sells government securities the

money supply decreases.

Qualitative Measures

• It is also called as the selective credit controls since

these policies affect only certain aspects

• Credit rationing is controlling the amount of credit

available for certain industrial sectors in order to

ensure that all sectors get adequate amount of

credit.

• Change in margin requirement affects the minimum

amount of money that an individual is required to

use from his own resources when he borrows money

form bank

Fiscal Policy

Fiscal policy is the part of government

policy which is concerned with raising revenue

through taxation and other means and deciding

on the level pattern of expenditure with a view

to correct the situations of excess demand or

deficit demand in the economy.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ipo Fact SheetDocument18 pagesIpo Fact SheetManali ShahNo ratings yet

- Private Equity Holding AGDocument68 pagesPrivate Equity Holding AGArvinLedesmaChiongNo ratings yet

- NY Business Law Journal - Atty. Wallshein Article On Advanced Standing Issues in Securitized MortgagesDocument8 pagesNY Business Law Journal - Atty. Wallshein Article On Advanced Standing Issues in Securitized Mortgages83jjmackNo ratings yet

- Bachelor of Commerce: Bcoc - 137: Corporate AccountingDocument23 pagesBachelor of Commerce: Bcoc - 137: Corporate Accountingsubhaa DasNo ratings yet

- Pag IBIG Housing Loan Application Form PDFDocument2 pagesPag IBIG Housing Loan Application Form PDFBon Vincent Chua100% (1)

- Chapter 7: Intercompany Profit Transactions - Bonds: Advanced AccountingDocument14 pagesChapter 7: Intercompany Profit Transactions - Bonds: Advanced AccountingDivya rezkyNo ratings yet

- Module 2 Conceptual FrameworkDocument8 pagesModule 2 Conceptual FrameworkEloisa Joy MoredoNo ratings yet

- Pandey 2021Document10 pagesPandey 2021abhinavatripathiNo ratings yet

- MAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingDocument12 pagesMAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingSadia AbidNo ratings yet

- Menagement of ReceiveableDocument5 pagesMenagement of ReceiveableMuhammad Furqan AkramNo ratings yet

- NRE Lecture 1Document8 pagesNRE Lecture 1yaregalNo ratings yet

- Day 3 Class Work SPCCDocument6 pagesDay 3 Class Work SPCCkawaljeetsingh121666No ratings yet

- 大萧条:历史与经验Document54 pages大萧条:历史与经验吴宙航No ratings yet

- Memo 2023 003 Scope of Qualifying ExamsDocument4 pagesMemo 2023 003 Scope of Qualifying ExamsSara ChanNo ratings yet

- CaiaDocument5 pagesCaiaRohan Haldankar0% (1)

- Concept of Capital and Revenue TransactionsDocument5 pagesConcept of Capital and Revenue TransactionsYakkstar 21No ratings yet

- Acc106 Assignment 2 Tie Beauty Enterprise FinalDocument15 pagesAcc106 Assignment 2 Tie Beauty Enterprise Finalnur anisNo ratings yet

- Chapter2 - Organization and Functioning of Securities MarketsDocument74 pagesChapter2 - Organization and Functioning of Securities MarketsBerhanu ShankoNo ratings yet

- Chapter 4 The Time Value of MoneyDocument39 pagesChapter 4 The Time Value of MoneyQuỳnh NguyễnNo ratings yet

- StatementDocument9 pagesStatementEduard-Dumitru HogasNo ratings yet

- Dokumen - Tips - MCQ Working Capital Management Cpar 1 84Document18 pagesDokumen - Tips - MCQ Working Capital Management Cpar 1 84Sabahat JavedNo ratings yet

- Transaction Dispute FormDocument1 pageTransaction Dispute FormashokjpNo ratings yet

- Notes - Money MarketDocument7 pagesNotes - Money MarketShivshankar KhemnarNo ratings yet

- Survey ChecklistDocument4 pagesSurvey ChecklistAngela Miles DizonNo ratings yet

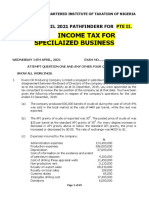

- April 2021 Pathfinder For PTE 2 LevelDocument65 pagesApril 2021 Pathfinder For PTE 2 LevelAdedotun OmonijoNo ratings yet

- Addl - Charge Allowance of D.A.ODocument4 pagesAddl - Charge Allowance of D.A.Oapi-3710215No ratings yet

- East India CompanyDocument27 pagesEast India CompanyShubho BoseNo ratings yet

- 1560788338706Document4 pages1560788338706Digaant AroraNo ratings yet

- ATMDocument38 pagesATMseid negashNo ratings yet

- TorenttDocument2 pagesTorenttpriyapatelfreeNo ratings yet