Professional Documents

Culture Documents

Oberio Ratio Analysis 2017-18

Oberio Ratio Analysis 2017-18

Uploaded by

Suramya Gambhir0 ratings0% found this document useful (0 votes)

14 views8 pagesThe document contains ratio analysis data for Oberio group for the years 2017 and 2018. It includes current ratio, quick ratio, debt-equity ratio, net profit ratio, total asset to debt ratio, inventory turnover ratio, asset turnover ratio, and return on equity. The ratios show the company's liquidity, leverage, profitability, efficiency and return on shareholders' equity for the two years.

Original Description:

the ratio analysis for the financial year 2017-18

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains ratio analysis data for Oberio group for the years 2017 and 2018. It includes current ratio, quick ratio, debt-equity ratio, net profit ratio, total asset to debt ratio, inventory turnover ratio, asset turnover ratio, and return on equity. The ratios show the company's liquidity, leverage, profitability, efficiency and return on shareholders' equity for the two years.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

14 views8 pagesOberio Ratio Analysis 2017-18

Oberio Ratio Analysis 2017-18

Uploaded by

Suramya GambhirThe document contains ratio analysis data for Oberio group for the years 2017 and 2018. It includes current ratio, quick ratio, debt-equity ratio, net profit ratio, total asset to debt ratio, inventory turnover ratio, asset turnover ratio, and return on equity. The ratios show the company's liquidity, leverage, profitability, efficiency and return on shareholders' equity for the two years.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 8

Oberio group ratio analysis

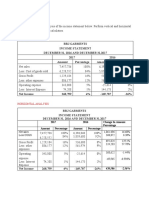

• CURRENT RATIO

YEAR CURRENT ASSESTS CURRENT LAIBILITIES CURRENT RATIO

2017 5361.28 4160.99 1.28:1

2018 5827.08 5770.68 1.09:1

• QUICK RATIO

YEAR CURRENT ASSESTS INVENTORY CURRENT QUICK RATIO

LAIBILITIES

2017 5361.28 495.70 4160.99 1.169

2018 5827.08 510.23 5770.68 0.921

• DEBT-EQUITY RATIO

YEAR DEBT EQUITY DEBT TO EQUITY RATIO

2017 8527.77 28364.33 0.300

2018 11212.45 29529.39 0.379

• NET PROFIT RATIO

YEAR NET PROFIT SALES REVENUE NET PROFIT RATIO

2017 1182.93 15286.49 0.077

2018 1958.06 15988.41 0.122

• TOTAL ASSEST TO DEBT RATIO

YEAR ASSETS DEBT ASSEST TO DEBT RATIO

2017 36892.10 8527.77 4.326

2018 40741.84 11212.45 3.633

• INVENTORY TURNOVER RATIO

YEAR SALES REVENUE INVENTORY INVENTORY TURNOVER

RATIO

2017 15286.49 495.70 30.838

2018 15988.41 510.65 31.309

• ASSEST TURNOVER RATIO

YEAR SALES REVENUE NET ASSETS ASSEST TURNOVER

RATIO

2017 15286.49 36892.10 0.414

2018 15988.41 40741.84 0.392

• RETURN ON EQUITY

YEAR RETURN ON EQUITY

2017

2018

You might also like

- Financial Analysis of TeslaDocument17 pagesFinancial Analysis of TeslaSneha ChawlaNo ratings yet

- Pakistan RefineryDocument9 pagesPakistan RefineryMuhammad MohsinNo ratings yet

- Efficiency Ratios For UNION BANKDocument16 pagesEfficiency Ratios For UNION BANKKazi Sajharul Islam 1410028630No ratings yet

- Efficiency Ratios For UNION BANKDocument16 pagesEfficiency Ratios For UNION BANKKazi Sajharul Islam 1410028630No ratings yet

- Act AHo Excel FileDocument12 pagesAct AHo Excel FileTanbir. Nahid.No ratings yet

- Schedule Showing Changes in Working Capital For The Financial Year 2017-18 (Rs. in Million)Document6 pagesSchedule Showing Changes in Working Capital For The Financial Year 2017-18 (Rs. in Million)Shobhit ShuklaNo ratings yet

- Buget Workshot Presentation 072417Document43 pagesBuget Workshot Presentation 072417Anonymous hTA0wKPm7No ratings yet

- Alk FixedDocument10 pagesAlk FixedIga Meidawati SetyowardaniNo ratings yet

- Analysis NewDocument12 pagesAnalysis NewFairooz AliNo ratings yet

- Ratio Analysis/' ASSIGNMENTDocument15 pagesRatio Analysis/' ASSIGNMENTMr. Harsh Kumar Student, Jaipuria LucknowNo ratings yet

- Book 1Document10 pagesBook 1Gunjan ChoureNo ratings yet

- Year Current RatioDocument13 pagesYear Current Ratiopsana99gmailcomNo ratings yet

- Ratio AnalysisDocument97 pagesRatio Analysissatyansh blackNo ratings yet

- Study On ACC CementDocument9 pagesStudy On ACC CementAashritaNo ratings yet

- 2.5 Ratio Analysis For Lingkaran Trans Kota Holdings Berhad 2.0.1. Current RatioDocument10 pages2.5 Ratio Analysis For Lingkaran Trans Kota Holdings Berhad 2.0.1. Current RatioNurul JannahNo ratings yet

- Draft Financial Performance of Nairobi Stock ExchangeDocument9 pagesDraft Financial Performance of Nairobi Stock ExchangekinduNo ratings yet

- Financial Management ProjectDocument20 pagesFinancial Management ProjectSana ShahidNo ratings yet

- PAPER Ratio Analysis in Muthoot Finance LTD AuradDocument7 pagesPAPER Ratio Analysis in Muthoot Finance LTD AuradDr Bhadrappa HaralayyaNo ratings yet

- Financial Statement AnalysisDocument9 pagesFinancial Statement Analysishashim shahNo ratings yet

- Grafik Price Earnig Ratio: Axis TitleDocument7 pagesGrafik Price Earnig Ratio: Axis Titleعبد الرحمنNo ratings yet

- RatiosDocument3 pagesRatiosAndy KellumNo ratings yet

- A Study On Ratio Analysis at Ultratech CementDocument2 pagesA Study On Ratio Analysis at Ultratech CementSushank AgrawalNo ratings yet

- Ratio Analysis in Muthoot Finance LTD Aurad: March 2022Document8 pagesRatio Analysis in Muthoot Finance LTD Aurad: March 2022Nice NameNo ratings yet

- fm2 Project Phase 1Document7 pagesfm2 Project Phase 1SACHIN THOMAS GEORGE MBA19-21No ratings yet

- Activity Ratio AnalysisDocument4 pagesActivity Ratio AnalysisakhilNo ratings yet

- Internsip Presentation On Financial Performance Analysis of NCC Bank Limited A Study On Madhunaghat BranchDocument19 pagesInternsip Presentation On Financial Performance Analysis of NCC Bank Limited A Study On Madhunaghat BranchShafayet JamilNo ratings yet

- Curret Ratio Acid Test RatioDocument7 pagesCurret Ratio Acid Test RatioNIKHIL MATHEWNo ratings yet

- Feb. 16, 2021 Police Budget PresentationDocument13 pagesFeb. 16, 2021 Police Budget PresentationWVXU NewsNo ratings yet

- Presentation On Financial Analysis of Nestle For FY 2018-2019Document22 pagesPresentation On Financial Analysis of Nestle For FY 2018-2019ARKAJYOTI BASUNo ratings yet

- Balance Sheet at 31st December 2017: Engropower Gen Qaridpur 2017 Financial ReportDocument11 pagesBalance Sheet at 31st December 2017: Engropower Gen Qaridpur 2017 Financial ReportYasir ZafarNo ratings yet

- Kotak Mahindra Bank Limited Consolidated Financials FY18Document60 pagesKotak Mahindra Bank Limited Consolidated Financials FY18Kunal ObhraiNo ratings yet

- Group 2 P&GDocument12 pagesGroup 2 P&GMridul JainNo ratings yet

- Study On Npa OF Indian BanksDocument21 pagesStudy On Npa OF Indian BanksSubham ChoudhuryNo ratings yet

- FinalDocument8 pagesFinalM Fahim RafiNo ratings yet

- JSW Steels: Equity Share CapitalDocument4 pagesJSW Steels: Equity Share CapitalSiddhant RishiNo ratings yet

- Financial Analysis: Reliance Industries LimitedDocument18 pagesFinancial Analysis: Reliance Industries LimitedRohan ChandnaNo ratings yet

- Current Assets Are The Assets That The Firm Expects To Convert Into Cash in The Coming Year and Current Liabilities Represent TheDocument8 pagesCurrent Assets Are The Assets That The Firm Expects To Convert Into Cash in The Coming Year and Current Liabilities Represent TheArlea AsenciNo ratings yet

- Analyze and Benchmark The CompanyDocument31 pagesAnalyze and Benchmark The CompanyCH OMNo ratings yet

- BAFL FinalDocument9 pagesBAFL Finaltalhazaman76No ratings yet

- FS WorkDocument122 pagesFS WorkRodolfo SantosNo ratings yet

- Cement SectorDocument21 pagesCement SectorManahil KhanNo ratings yet

- NAV ComputationDocument130 pagesNAV ComputationamiNo ratings yet

- 7-Eleven AR 2018 - As of 071519 - Optimized PDFDocument44 pages7-Eleven AR 2018 - As of 071519 - Optimized PDFLeviNo ratings yet

- Burberry Annual RepotDocument200 pagesBurberry Annual Repotarun joseNo ratings yet

- Accounting Project FinalDocument152 pagesAccounting Project FinalManahil KhanNo ratings yet

- Comparison Between Two Companies With Ratio AnalysisDocument16 pagesComparison Between Two Companies With Ratio AnalysisSubashNo ratings yet

- Vetical Analysis: V. ProcessDocument1 pageVetical Analysis: V. ProcessJestine AlcantaraNo ratings yet

- Shubham Moon Marketing 4.0 Final Assignment MBA 1Document26 pagesShubham Moon Marketing 4.0 Final Assignment MBA 1shubham moonNo ratings yet

- Juniper Ratios - RatiosDocument1 pageJuniper Ratios - Ratiosapi-463022656No ratings yet

- FM FAT 2 Anjali SinghDocument8 pagesFM FAT 2 Anjali SinghHitesh BhanushaliNo ratings yet

- Request: GLNF9002 Layout: GLNF9002 Scope: DBS Run Date: 9/28/2017Document1 pageRequest: GLNF9002 Layout: GLNF9002 Scope: DBS Run Date: 9/28/2017LamiaNo ratings yet

- DataDocument11 pagesDataA30Yash YellewarNo ratings yet

- BSRM PresentationDocument4 pagesBSRM PresentationMostafa Noman DeepNo ratings yet

- Annual Report 2018Document519 pagesAnnual Report 2018MR RockyNo ratings yet

- Other STRBI Table No 15. Bank Group-Wise Classification of Loan Assets of Scheduled Commercial BanksDocument4 pagesOther STRBI Table No 15. Bank Group-Wise Classification of Loan Assets of Scheduled Commercial BanksAman SinghNo ratings yet

- FM Assignment 22021241198Document14 pagesFM Assignment 22021241198Sanchit GoteNo ratings yet

- Statistics CIA 3 - 2nd SemesterDocument23 pagesStatistics CIA 3 - 2nd SemesterHigi SNo ratings yet

- Current Assets Current LiabilitiesDocument5 pagesCurrent Assets Current LiabilitiessiddheshNo ratings yet

- Annual Report 2018 Bank Mega enDocument478 pagesAnnual Report 2018 Bank Mega enTugas KuliahNo ratings yet