Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

160 viewsL&T and Mindtree

L&T and Mindtree

Uploaded by

Sajid PatelL&T has set aside $1.4 billion to acquire up to 67% of Mindtree through a hostile takeover at $13.5 per share. This would help L&T diversify into the non-core IT industry and reduce risk. However, it raises issues about capital allocation and increases debt. While it provides Mindtree shareholders a good exit, integrating Mindtree comes with risks. The key to success will be developing synergies between the two companies.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- L&T Mindtree Project PresentationDocument8 pagesL&T Mindtree Project PresentationPuneet Agarwal100% (2)

- L&T: Restructuring The Cement BusinessDocument28 pagesL&T: Restructuring The Cement Businessak123umtNo ratings yet

- Ratio Analysis of Tata SteelDocument11 pagesRatio Analysis of Tata SteelUtkarsh GuptaNo ratings yet

- HUL GSK AcquisitionDocument7 pagesHUL GSK AcquisitionTirtha Das100% (1)

- Case Study 2 An Irate Distributor Students Excel SpreadsheetDocument4 pagesCase Study 2 An Irate Distributor Students Excel SpreadsheetPaRas NaSaNo ratings yet

- Group 4 - ITC - Live ProjectDocument31 pagesGroup 4 - ITC - Live ProjectSyama kNo ratings yet

- Mind TreeDocument7 pagesMind TreeJapish MehtaNo ratings yet

- Reckett Benckiser Case AnalysisDocument4 pagesReckett Benckiser Case AnalysisAman kumar JhaNo ratings yet

- The Garden Place - SemifinalDocument4 pagesThe Garden Place - SemifinalKrish Hegde0% (1)

- (EXPLAINED) Larsen & Toubro's Hostile Takeover of Mindtree - Business NewsDocument3 pages(EXPLAINED) Larsen & Toubro's Hostile Takeover of Mindtree - Business NewsSam vermNo ratings yet

- Project On Mindtree Hostile Takeover by L&T: Prepared By:-Bhavin Bagade (20195006)Document11 pagesProject On Mindtree Hostile Takeover by L&T: Prepared By:-Bhavin Bagade (20195006)bagadebhavinNo ratings yet

- Merger of Hul and GSK CH India Hul Presentation Tcm1255 529065 1 enDocument18 pagesMerger of Hul and GSK CH India Hul Presentation Tcm1255 529065 1 ensheetal0% (1)

- Mind TreeDocument27 pagesMind TreeGourav GuhaNo ratings yet

- Performance Management at NIM - Case AnalysisDocument10 pagesPerformance Management at NIM - Case Analysistr07109250% (2)

- Group 4 - From Offer Letter To Resignation LetterDocument7 pagesGroup 4 - From Offer Letter To Resignation LetterGangadhar BituNo ratings yet

- Strategic Management of TCSDocument26 pagesStrategic Management of TCSAmrutha Ammu100% (1)

- Tata Consultancy Services LimitedDocument4 pagesTata Consultancy Services LimitedPRITEENo ratings yet

- All You Need To Know About India'S First It Hostile TakeoverintroductionDocument7 pagesAll You Need To Know About India'S First It Hostile TakeoverintroductionKrishna Kant KumarNo ratings yet

- Green Chillyz Case StudyDocument7 pagesGreen Chillyz Case StudyTanNo ratings yet

- Analysis of L&T's Dividend PolicyDocument39 pagesAnalysis of L&T's Dividend PolicyAmber GuptaNo ratings yet

- Sales and Distribution Channel of ITC SA PDFDocument12 pagesSales and Distribution Channel of ITC SA PDFRomil SailotNo ratings yet

- Fiitjee JD National Head Academic Delivery Strategic Result AssuranceDocument2 pagesFiitjee JD National Head Academic Delivery Strategic Result AssuranceVaishnaviRaviNo ratings yet

- Hero Honda Case StudyDocument3 pagesHero Honda Case StudySameer GopalNo ratings yet

- Finlatics 1Document5 pagesFinlatics 1paras paliwalNo ratings yet

- A5 - Indian ProductsDocument18 pagesA5 - Indian ProductsVignesh nayakNo ratings yet

- D.light DesignDocument5 pagesD.light DesignBOBBY SINHANo ratings yet

- Myjio MMDocument20 pagesMyjio MMSiddhesh Gurjar100% (1)

- Irate Distributor: The Question of Profitability: Group 3Document8 pagesIrate Distributor: The Question of Profitability: Group 3Surbhi SabharwalNo ratings yet

- MindtreeDocument13 pagesMindtreeRuchin DwivediNo ratings yet

- InfoTech CorporationDocument11 pagesInfoTech CorporationSomdipta MaityNo ratings yet

- Internal Analysis of InfosysDocument3 pagesInternal Analysis of InfosysWilliam McconnellNo ratings yet

- Honda or Hero HondaDocument16 pagesHonda or Hero HondaPrince SachdevaNo ratings yet

- L&T Group 3 Rahul SarkarDocument8 pagesL&T Group 3 Rahul SarkarSenthil S. VelNo ratings yet

- 3M India: in India For India: Group MembersDocument7 pages3M India: in India For India: Group MembersHEM BANSALNo ratings yet

- Major Competitors MeeshoDocument2 pagesMajor Competitors MeeshoKartika Bhuvaneswaran NairNo ratings yet

- Larsen & Toubro Infotech's Hostile Bid For Mindtree LTD.: Much Ado About Nothing! A Teaching CaseDocument10 pagesLarsen & Toubro Infotech's Hostile Bid For Mindtree LTD.: Much Ado About Nothing! A Teaching CaseAbhay ShuklaNo ratings yet

- Application of ValuesDocument2 pagesApplication of ValuesAyush SinhaNo ratings yet

- Corporate Governance Failure at SathyamDocument13 pagesCorporate Governance Failure at SathyamKumara RajaNo ratings yet

- Ramesh and Gargi A Case Solution & AnalysisDocument22 pagesRamesh and Gargi A Case Solution & Analysiscikeron503No ratings yet

- Mahindra Holidays - Club MahindraDocument2 pagesMahindra Holidays - Club MahindraCfhunSaatNo ratings yet

- An Irate Distributor: The Question of Profitability: Group 7Document12 pagesAn Irate Distributor: The Question of Profitability: Group 7shNo ratings yet

- TATA Tea's M&A With TetleyDocument16 pagesTATA Tea's M&A With TetleyChandrakant Hingankar100% (1)

- Shiva Tourist DhabaDocument7 pagesShiva Tourist DhabaChaitanya JethaniNo ratings yet

- SDM ProjectDocument14 pagesSDM ProjectGovind N VNo ratings yet

- Esspresso Case WriteupDocument3 pagesEsspresso Case WriteupGautamNo ratings yet

- Ethnic Consumers Consulting Case StudyDocument16 pagesEthnic Consumers Consulting Case StudyRajdeep Roy Chowdhury0% (1)

- Goa Institute of Management SanquelimDocument14 pagesGoa Institute of Management SanquelimShresth Bhatia0% (1)

- Case Study On Convertible Alternative Reference Securities: Xlri-Pgcbm-37Document7 pagesCase Study On Convertible Alternative Reference Securities: Xlri-Pgcbm-37Senthil KumarNo ratings yet

- Marico - Over The WallDocument32 pagesMarico - Over The Wallchintan MehtaNo ratings yet

- OTISLINE PresentationDocument5 pagesOTISLINE PresentationAseem SharmaNo ratings yet

- Sales, Distribution and Retail Management: Final Project On Tata SteelDocument8 pagesSales, Distribution and Retail Management: Final Project On Tata SteelJaatBudhi GaminG0% (1)

- 3rd PresentationDocument25 pages3rd PresentationArpita MehtaNo ratings yet

- Central Equipment CompanyDocument6 pagesCentral Equipment CompanySiddhanth MunjalNo ratings yet

- Aditya Birla GroupDocument7 pagesAditya Birla GroupHerdi SularkoNo ratings yet

- Sip Presentation: Submitted By: Anuj Gupta - JN170021Document20 pagesSip Presentation: Submitted By: Anuj Gupta - JN170021Ajit KumarNo ratings yet

- Northboro Machine Tools CorporationDocument9 pagesNorthboro Machine Tools Corporationsheersha kkNo ratings yet

- Odyssey - The Life and Career of A Senior Consultant: Gyan Prakash Pgp/22/132Document3 pagesOdyssey - The Life and Career of A Senior Consultant: Gyan Prakash Pgp/22/132gyan prakashNo ratings yet

- Tata Corus Case Analysis at GargDocument35 pagesTata Corus Case Analysis at GargNikhil Garg86% (7)

- Tata Consumer Products IC May20Document35 pagesTata Consumer Products IC May20coolabhi77No ratings yet

- Linear Technology Case - Ashmita SrivastavaDocument4 pagesLinear Technology Case - Ashmita SrivastavaAshmita Srivastava0% (1)

- Special Situations Value PortfolioDocument8 pagesSpecial Situations Value PortfolioNarendra ChoudaryNo ratings yet

- Overseas HL Fund and Share AccountDocument2 pagesOverseas HL Fund and Share AccountMaria Evans MayorNo ratings yet

- PDF Accounting Principles 13Th Edition Jerry J Weygandt Ebook Full ChapterDocument53 pagesPDF Accounting Principles 13Th Edition Jerry J Weygandt Ebook Full Chapterivan.stephens123100% (4)

- Auditing Theory 3rd Examination (Answer Key)Document13 pagesAuditing Theory 3rd Examination (Answer Key)KathleenNo ratings yet

- Titan Balance-SheetDocument2 pagesTitan Balance-SheetDt.vijaya ShethNo ratings yet

- Policy Values Follow Up Beneficiary Transaction History Insurance Charges Feedback FormDocument3 pagesPolicy Values Follow Up Beneficiary Transaction History Insurance Charges Feedback FormAgus RahmanNo ratings yet

- Terms Conditions Citi Speed Cash and Citi Balance Conversion Sodexo Promo2 PDFDocument2 pagesTerms Conditions Citi Speed Cash and Citi Balance Conversion Sodexo Promo2 PDFhoneylyncastro948yahoo.comNo ratings yet

- Mac Trading Company Comparative Balance Sheet For The Year Ended December 20CY 20CY 20PYDocument8 pagesMac Trading Company Comparative Balance Sheet For The Year Ended December 20CY 20CY 20PYJoymee BigorniaNo ratings yet

- DBFX MediaFactsheetDocument2 pagesDBFX MediaFactsheetwestlamodsNo ratings yet

- Chapter 2 - Financial RecordingDocument8 pagesChapter 2 - Financial RecordingrtohattonNo ratings yet

- Multiple Choice. Write Your Answer On The Space Provided Before Each NumberDocument12 pagesMultiple Choice. Write Your Answer On The Space Provided Before Each NumberKathleenNo ratings yet

- Contact List 2020Document14 pagesContact List 2020Crawford BoydNo ratings yet

- Mobile Money - Investment Opportunities For SACCOsDocument20 pagesMobile Money - Investment Opportunities For SACCOsKivumbi WilliamNo ratings yet

- Documents ServerDocument2 pagesDocuments Serverﻋﻠﻰﭙﯡﺭﻜﺎ ﺍﯾﻠﻰNo ratings yet

- AccountantsDocument2 pagesAccountantsJoann Saballero HamiliNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument8 pagesMobile Services: Your Account Summary This Month'S ChargesVenkatram PailaNo ratings yet

- Tutorial 7 Solutions FinalDocument5 pagesTutorial 7 Solutions FinalLuz Helena Molina PintoNo ratings yet

- Fixed Assets: Case 25.1: Patel Computers System AssetsDocument2 pagesFixed Assets: Case 25.1: Patel Computers System AssetsMukul KadyanNo ratings yet

- Application Cum Form A2 For LRS Transactions - Revised - 28 - 03 - 2019Document5 pagesApplication Cum Form A2 For LRS Transactions - Revised - 28 - 03 - 2019Prabhu KnNo ratings yet

- DJBBill 098235179545Document3 pagesDJBBill 098235179545Arijit paulNo ratings yet

- Chap9 (Cash & Marketable Securities Management) VanHorne&Brigham, CabreaDocument4 pagesChap9 (Cash & Marketable Securities Management) VanHorne&Brigham, CabreaClaudine DuhapaNo ratings yet

- Sure IpadalaDocument1 pageSure IpadalaChristine LogdatNo ratings yet

- Take-Home Exam 1Document9 pagesTake-Home Exam 1Okuhle MqoboliNo ratings yet

- MudarabaDocument15 pagesMudarabamimiNo ratings yet

- Truist Bank in New Jersey (NJ) - Locations Branches Contact DetailsDocument1 pageTruist Bank in New Jersey (NJ) - Locations Branches Contact Detailselton georgeNo ratings yet

- Report 1-3 - Nabil BankDocument33 pagesReport 1-3 - Nabil BankSalım RaıŋNo ratings yet

- Musembi 2017 Commercial BanksDocument82 pagesMusembi 2017 Commercial Banksvenice paula navarroNo ratings yet

- Ninik Nurhidayah, Indri Kusuma Dewi,: Guest FolioDocument1 pageNinik Nurhidayah, Indri Kusuma Dewi,: Guest FolioNovita SariNo ratings yet

- SMB PM Lead - Check21 - Data TemplateDocument11 pagesSMB PM Lead - Check21 - Data TemplateBankNo ratings yet

- Selected Items:: Receipt Mr. Jian Bin Li Learner ID: X012765Document2 pagesSelected Items:: Receipt Mr. Jian Bin Li Learner ID: X012765Johnson LiNo ratings yet

L&T and Mindtree

L&T and Mindtree

Uploaded by

Sajid Patel0 ratings0% found this document useful (0 votes)

160 views7 pagesL&T has set aside $1.4 billion to acquire up to 67% of Mindtree through a hostile takeover at $13.5 per share. This would help L&T diversify into the non-core IT industry and reduce risk. However, it raises issues about capital allocation and increases debt. While it provides Mindtree shareholders a good exit, integrating Mindtree comes with risks. The key to success will be developing synergies between the two companies.

Original Description:

have fun

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentL&T has set aside $1.4 billion to acquire up to 67% of Mindtree through a hostile takeover at $13.5 per share. This would help L&T diversify into the non-core IT industry and reduce risk. However, it raises issues about capital allocation and increases debt. While it provides Mindtree shareholders a good exit, integrating Mindtree comes with risks. The key to success will be developing synergies between the two companies.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

160 views7 pagesL&T and Mindtree

L&T and Mindtree

Uploaded by

Sajid PatelL&T has set aside $1.4 billion to acquire up to 67% of Mindtree through a hostile takeover at $13.5 per share. This would help L&T diversify into the non-core IT industry and reduce risk. However, it raises issues about capital allocation and increases debt. While it provides Mindtree shareholders a good exit, integrating Mindtree comes with risks. The key to success will be developing synergies between the two companies.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 7

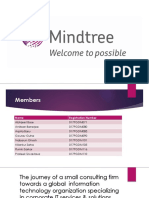

Introduction

• L&T up to an hostile take over of Mindtree as it has set

aside ₹10,700 crore to buy up to 67% in Mindtree in a

hostile takeover. At ₹980 per share, It is a strategy

adopted by L&T to diversify it’s portfolio and invest in non

core business activities as it is in the business of

construction and investment in IT companies will diversify

there portfolio and will reduce the risk .

The strategy

Problems for L&T

• High valuation of Mindtree.

• Increase exposure in non core activites.

• It is also taking a fair amount of risk related to integration

of Mindtree.

• The use its cash for an acquisition in a non-core business

raises pertinent questions about capital allocation as well.

• A slight increases in debt to equity ratio from 1.3 to 1.5

High valuation of Mindtree

Benefits for L&T

• Diversification of portfolio.

• Good use of cash which was ideal in the balance sheet of

L&T.

• Gain from higher scale in some key verticals, which will

give access to some clients and projects, which

subsidiary, L&T Infotech Ltd, couldn’t target on its own.

Benefits to Mindtree

L&T’s entry provides a nice exit opportunity for

Mindtree shareholders at the rate of Rs 980 which have

earned a good return for the investors of Mindtree.

Conclusion

• There was a clear benefit for Mindtree as the company

was highly valued and it earned a good returns for the

investors , but when we talk about the L&T there is a

mixed situation the company has increased its exposure in

non core business activities but it can be set off if it’s

subsidiary is able to pool new clients . The key factor in

the success of this acquisition will be the synergy between

the two companies , If L&T able to develop the synergy

than this acquisition will be a great success.

You might also like

- L&T Mindtree Project PresentationDocument8 pagesL&T Mindtree Project PresentationPuneet Agarwal100% (2)

- L&T: Restructuring The Cement BusinessDocument28 pagesL&T: Restructuring The Cement Businessak123umtNo ratings yet

- Ratio Analysis of Tata SteelDocument11 pagesRatio Analysis of Tata SteelUtkarsh GuptaNo ratings yet

- HUL GSK AcquisitionDocument7 pagesHUL GSK AcquisitionTirtha Das100% (1)

- Case Study 2 An Irate Distributor Students Excel SpreadsheetDocument4 pagesCase Study 2 An Irate Distributor Students Excel SpreadsheetPaRas NaSaNo ratings yet

- Group 4 - ITC - Live ProjectDocument31 pagesGroup 4 - ITC - Live ProjectSyama kNo ratings yet

- Mind TreeDocument7 pagesMind TreeJapish MehtaNo ratings yet

- Reckett Benckiser Case AnalysisDocument4 pagesReckett Benckiser Case AnalysisAman kumar JhaNo ratings yet

- The Garden Place - SemifinalDocument4 pagesThe Garden Place - SemifinalKrish Hegde0% (1)

- (EXPLAINED) Larsen & Toubro's Hostile Takeover of Mindtree - Business NewsDocument3 pages(EXPLAINED) Larsen & Toubro's Hostile Takeover of Mindtree - Business NewsSam vermNo ratings yet

- Project On Mindtree Hostile Takeover by L&T: Prepared By:-Bhavin Bagade (20195006)Document11 pagesProject On Mindtree Hostile Takeover by L&T: Prepared By:-Bhavin Bagade (20195006)bagadebhavinNo ratings yet

- Merger of Hul and GSK CH India Hul Presentation Tcm1255 529065 1 enDocument18 pagesMerger of Hul and GSK CH India Hul Presentation Tcm1255 529065 1 ensheetal0% (1)

- Mind TreeDocument27 pagesMind TreeGourav GuhaNo ratings yet

- Performance Management at NIM - Case AnalysisDocument10 pagesPerformance Management at NIM - Case Analysistr07109250% (2)

- Group 4 - From Offer Letter To Resignation LetterDocument7 pagesGroup 4 - From Offer Letter To Resignation LetterGangadhar BituNo ratings yet

- Strategic Management of TCSDocument26 pagesStrategic Management of TCSAmrutha Ammu100% (1)

- Tata Consultancy Services LimitedDocument4 pagesTata Consultancy Services LimitedPRITEENo ratings yet

- All You Need To Know About India'S First It Hostile TakeoverintroductionDocument7 pagesAll You Need To Know About India'S First It Hostile TakeoverintroductionKrishna Kant KumarNo ratings yet

- Green Chillyz Case StudyDocument7 pagesGreen Chillyz Case StudyTanNo ratings yet

- Analysis of L&T's Dividend PolicyDocument39 pagesAnalysis of L&T's Dividend PolicyAmber GuptaNo ratings yet

- Sales and Distribution Channel of ITC SA PDFDocument12 pagesSales and Distribution Channel of ITC SA PDFRomil SailotNo ratings yet

- Fiitjee JD National Head Academic Delivery Strategic Result AssuranceDocument2 pagesFiitjee JD National Head Academic Delivery Strategic Result AssuranceVaishnaviRaviNo ratings yet

- Hero Honda Case StudyDocument3 pagesHero Honda Case StudySameer GopalNo ratings yet

- Finlatics 1Document5 pagesFinlatics 1paras paliwalNo ratings yet

- A5 - Indian ProductsDocument18 pagesA5 - Indian ProductsVignesh nayakNo ratings yet

- D.light DesignDocument5 pagesD.light DesignBOBBY SINHANo ratings yet

- Myjio MMDocument20 pagesMyjio MMSiddhesh Gurjar100% (1)

- Irate Distributor: The Question of Profitability: Group 3Document8 pagesIrate Distributor: The Question of Profitability: Group 3Surbhi SabharwalNo ratings yet

- MindtreeDocument13 pagesMindtreeRuchin DwivediNo ratings yet

- InfoTech CorporationDocument11 pagesInfoTech CorporationSomdipta MaityNo ratings yet

- Internal Analysis of InfosysDocument3 pagesInternal Analysis of InfosysWilliam McconnellNo ratings yet

- Honda or Hero HondaDocument16 pagesHonda or Hero HondaPrince SachdevaNo ratings yet

- L&T Group 3 Rahul SarkarDocument8 pagesL&T Group 3 Rahul SarkarSenthil S. VelNo ratings yet

- 3M India: in India For India: Group MembersDocument7 pages3M India: in India For India: Group MembersHEM BANSALNo ratings yet

- Major Competitors MeeshoDocument2 pagesMajor Competitors MeeshoKartika Bhuvaneswaran NairNo ratings yet

- Larsen & Toubro Infotech's Hostile Bid For Mindtree LTD.: Much Ado About Nothing! A Teaching CaseDocument10 pagesLarsen & Toubro Infotech's Hostile Bid For Mindtree LTD.: Much Ado About Nothing! A Teaching CaseAbhay ShuklaNo ratings yet

- Application of ValuesDocument2 pagesApplication of ValuesAyush SinhaNo ratings yet

- Corporate Governance Failure at SathyamDocument13 pagesCorporate Governance Failure at SathyamKumara RajaNo ratings yet

- Ramesh and Gargi A Case Solution & AnalysisDocument22 pagesRamesh and Gargi A Case Solution & Analysiscikeron503No ratings yet

- Mahindra Holidays - Club MahindraDocument2 pagesMahindra Holidays - Club MahindraCfhunSaatNo ratings yet

- An Irate Distributor: The Question of Profitability: Group 7Document12 pagesAn Irate Distributor: The Question of Profitability: Group 7shNo ratings yet

- TATA Tea's M&A With TetleyDocument16 pagesTATA Tea's M&A With TetleyChandrakant Hingankar100% (1)

- Shiva Tourist DhabaDocument7 pagesShiva Tourist DhabaChaitanya JethaniNo ratings yet

- SDM ProjectDocument14 pagesSDM ProjectGovind N VNo ratings yet

- Esspresso Case WriteupDocument3 pagesEsspresso Case WriteupGautamNo ratings yet

- Ethnic Consumers Consulting Case StudyDocument16 pagesEthnic Consumers Consulting Case StudyRajdeep Roy Chowdhury0% (1)

- Goa Institute of Management SanquelimDocument14 pagesGoa Institute of Management SanquelimShresth Bhatia0% (1)

- Case Study On Convertible Alternative Reference Securities: Xlri-Pgcbm-37Document7 pagesCase Study On Convertible Alternative Reference Securities: Xlri-Pgcbm-37Senthil KumarNo ratings yet

- Marico - Over The WallDocument32 pagesMarico - Over The Wallchintan MehtaNo ratings yet

- OTISLINE PresentationDocument5 pagesOTISLINE PresentationAseem SharmaNo ratings yet

- Sales, Distribution and Retail Management: Final Project On Tata SteelDocument8 pagesSales, Distribution and Retail Management: Final Project On Tata SteelJaatBudhi GaminG0% (1)

- 3rd PresentationDocument25 pages3rd PresentationArpita MehtaNo ratings yet

- Central Equipment CompanyDocument6 pagesCentral Equipment CompanySiddhanth MunjalNo ratings yet

- Aditya Birla GroupDocument7 pagesAditya Birla GroupHerdi SularkoNo ratings yet

- Sip Presentation: Submitted By: Anuj Gupta - JN170021Document20 pagesSip Presentation: Submitted By: Anuj Gupta - JN170021Ajit KumarNo ratings yet

- Northboro Machine Tools CorporationDocument9 pagesNorthboro Machine Tools Corporationsheersha kkNo ratings yet

- Odyssey - The Life and Career of A Senior Consultant: Gyan Prakash Pgp/22/132Document3 pagesOdyssey - The Life and Career of A Senior Consultant: Gyan Prakash Pgp/22/132gyan prakashNo ratings yet

- Tata Corus Case Analysis at GargDocument35 pagesTata Corus Case Analysis at GargNikhil Garg86% (7)

- Tata Consumer Products IC May20Document35 pagesTata Consumer Products IC May20coolabhi77No ratings yet

- Linear Technology Case - Ashmita SrivastavaDocument4 pagesLinear Technology Case - Ashmita SrivastavaAshmita Srivastava0% (1)

- Special Situations Value PortfolioDocument8 pagesSpecial Situations Value PortfolioNarendra ChoudaryNo ratings yet

- Overseas HL Fund and Share AccountDocument2 pagesOverseas HL Fund and Share AccountMaria Evans MayorNo ratings yet

- PDF Accounting Principles 13Th Edition Jerry J Weygandt Ebook Full ChapterDocument53 pagesPDF Accounting Principles 13Th Edition Jerry J Weygandt Ebook Full Chapterivan.stephens123100% (4)

- Auditing Theory 3rd Examination (Answer Key)Document13 pagesAuditing Theory 3rd Examination (Answer Key)KathleenNo ratings yet

- Titan Balance-SheetDocument2 pagesTitan Balance-SheetDt.vijaya ShethNo ratings yet

- Policy Values Follow Up Beneficiary Transaction History Insurance Charges Feedback FormDocument3 pagesPolicy Values Follow Up Beneficiary Transaction History Insurance Charges Feedback FormAgus RahmanNo ratings yet

- Terms Conditions Citi Speed Cash and Citi Balance Conversion Sodexo Promo2 PDFDocument2 pagesTerms Conditions Citi Speed Cash and Citi Balance Conversion Sodexo Promo2 PDFhoneylyncastro948yahoo.comNo ratings yet

- Mac Trading Company Comparative Balance Sheet For The Year Ended December 20CY 20CY 20PYDocument8 pagesMac Trading Company Comparative Balance Sheet For The Year Ended December 20CY 20CY 20PYJoymee BigorniaNo ratings yet

- DBFX MediaFactsheetDocument2 pagesDBFX MediaFactsheetwestlamodsNo ratings yet

- Chapter 2 - Financial RecordingDocument8 pagesChapter 2 - Financial RecordingrtohattonNo ratings yet

- Multiple Choice. Write Your Answer On The Space Provided Before Each NumberDocument12 pagesMultiple Choice. Write Your Answer On The Space Provided Before Each NumberKathleenNo ratings yet

- Contact List 2020Document14 pagesContact List 2020Crawford BoydNo ratings yet

- Mobile Money - Investment Opportunities For SACCOsDocument20 pagesMobile Money - Investment Opportunities For SACCOsKivumbi WilliamNo ratings yet

- Documents ServerDocument2 pagesDocuments Serverﻋﻠﻰﭙﯡﺭﻜﺎ ﺍﯾﻠﻰNo ratings yet

- AccountantsDocument2 pagesAccountantsJoann Saballero HamiliNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument8 pagesMobile Services: Your Account Summary This Month'S ChargesVenkatram PailaNo ratings yet

- Tutorial 7 Solutions FinalDocument5 pagesTutorial 7 Solutions FinalLuz Helena Molina PintoNo ratings yet

- Fixed Assets: Case 25.1: Patel Computers System AssetsDocument2 pagesFixed Assets: Case 25.1: Patel Computers System AssetsMukul KadyanNo ratings yet

- Application Cum Form A2 For LRS Transactions - Revised - 28 - 03 - 2019Document5 pagesApplication Cum Form A2 For LRS Transactions - Revised - 28 - 03 - 2019Prabhu KnNo ratings yet

- DJBBill 098235179545Document3 pagesDJBBill 098235179545Arijit paulNo ratings yet

- Chap9 (Cash & Marketable Securities Management) VanHorne&Brigham, CabreaDocument4 pagesChap9 (Cash & Marketable Securities Management) VanHorne&Brigham, CabreaClaudine DuhapaNo ratings yet

- Sure IpadalaDocument1 pageSure IpadalaChristine LogdatNo ratings yet

- Take-Home Exam 1Document9 pagesTake-Home Exam 1Okuhle MqoboliNo ratings yet

- MudarabaDocument15 pagesMudarabamimiNo ratings yet

- Truist Bank in New Jersey (NJ) - Locations Branches Contact DetailsDocument1 pageTruist Bank in New Jersey (NJ) - Locations Branches Contact Detailselton georgeNo ratings yet

- Report 1-3 - Nabil BankDocument33 pagesReport 1-3 - Nabil BankSalım RaıŋNo ratings yet

- Musembi 2017 Commercial BanksDocument82 pagesMusembi 2017 Commercial Banksvenice paula navarroNo ratings yet

- Ninik Nurhidayah, Indri Kusuma Dewi,: Guest FolioDocument1 pageNinik Nurhidayah, Indri Kusuma Dewi,: Guest FolioNovita SariNo ratings yet

- SMB PM Lead - Check21 - Data TemplateDocument11 pagesSMB PM Lead - Check21 - Data TemplateBankNo ratings yet

- Selected Items:: Receipt Mr. Jian Bin Li Learner ID: X012765Document2 pagesSelected Items:: Receipt Mr. Jian Bin Li Learner ID: X012765Johnson LiNo ratings yet