Professional Documents

Culture Documents

Basis of Malaysian Income Tax

Basis of Malaysian Income Tax

Uploaded by

Malabaris Malaya Umar Siddiq0 ratings0% found this document useful (0 votes)

559 views19 pages1) The document discusses the basis of Malaysian income tax, including defining taxation as compulsory contributions levied by a government to fund public expenditures.

2) Income tax in Malaysia is governed by the Income Tax Act 1967, which charges tax on two types of income - income accruing in or derived from Malaysia, and income received in Malaysia from foreign sources.

3) The Act classifies income into categories including business gains/profits, employment gains/profits, dividends/interests, rents/royalties, and pensions/annuities. Foreign source income received by most individuals and companies is exempted from tax.

Original Description:

lecturer notes

Original Title

1. Basis of Malaysian Income Tax

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The document discusses the basis of Malaysian income tax, including defining taxation as compulsory contributions levied by a government to fund public expenditures.

2) Income tax in Malaysia is governed by the Income Tax Act 1967, which charges tax on two types of income - income accruing in or derived from Malaysia, and income received in Malaysia from foreign sources.

3) The Act classifies income into categories including business gains/profits, employment gains/profits, dividends/interests, rents/royalties, and pensions/annuities. Foreign source income received by most individuals and companies is exempted from tax.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

559 views19 pagesBasis of Malaysian Income Tax

Basis of Malaysian Income Tax

Uploaded by

Malabaris Malaya Umar Siddiq1) The document discusses the basis of Malaysian income tax, including defining taxation as compulsory contributions levied by a government to fund public expenditures.

2) Income tax in Malaysia is governed by the Income Tax Act 1967, which charges tax on two types of income - income accruing in or derived from Malaysia, and income received in Malaysia from foreign sources.

3) The Act classifies income into categories including business gains/profits, employment gains/profits, dividends/interests, rents/royalties, and pensions/annuities. Foreign source income received by most individuals and companies is exempted from tax.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 19

BASIS OF MALAYSIAN INCOME TAX

BY: NORHIDAYAH ISMAIL

LEARNING OBJECTIVES

At the end of this topic, students are able to

explain:

Definition, objectives and contribution of taxes to the economy

Sources of revenue law

Types of taxes

Classes of income

Charging sections and scope of charge

DEFINITION OF TAXATION

The system of compulsory contributions levied by a government or

other qualified body on people, corporations and property in order

to fund public expenditures.

Raising of money from individuals and organizations by the state in

order to pay for the goods and services its provides.

OBJECTIVES OF TAXATION

To raise revenues for public needs so that persons can live in a

civilized society

An instrument of fiscal policy influences the direction and structure of

money supply, investments, credits, production, interest rate, inflation,

prices and in general, of the national economy

SOURCES OF REVENUE LAW

A tax law is a body of rules passed by the legislature by which the government

acquires a claim on tax payers to convey, transfer and pay to the public authority

- Statute law

- Case law

- IRB

TYPES OF TAXES

Direct :deduction from income

:e.g income tax, RPGT,

stamp duty, petroleum income tax

Indirect :tax on consumption

:e.g sales tax, service tax,

excise duty, entertainment tax

CHARGING SECTION/SCOPE OF CHARGE

In Malaysia, the law governing income taxation is the Income Tax Act

1967 (Act 53/1967).

The transaction must fall within the scope of Section 3 of the Act in

order to be liable to income tax.

If it is not within the ambit of Sec 3 – it is tax free

SECTION 3

“ Subject to and in accordance with this Act, a tax to be known as

income tax shall be charge for each YA upon the income of any

person accruing in or derived from Malaysia or received in

Malaysia from outside Malaysia.”

TWO CIRCUMSTANCES

it sets out two circumstances where income tax liability arises,

namely:

a) The transaction must be ‘income’ in nature and such income is

accruing in or derived from Malaysia

OR

b) The transaction must be ‘income’ in nature and its received in

Malaysia from outside Malaysia( foreign source income).

ACCRUING IN

Accruing in

Means “earned” or “right to received”.

Does not mean “received”.

Income from a particular source can be earned and received in the same period.

CLASSES OF INCOME

The Act does not define the meaning of ‘income’

but merely categorizes the income under section 4

and section 4A

SECTION 4

a) Gains or profits from a business

b) Gains or profits from an employment

c) Dividends, interests or discounts

d) Rents, royalties or premiums

e) Pensions, annuities or other periodical payments

f) Gains or profits not falling under any of the foregoing

paragraphs

SECTION 4A

SPECIAL CLASSES OF INCOME (NON-RESIDENT PERSON)

amounts paid in consideration of services rendered by the person or

his employee in connection with the use of property or rights

belonging to, or the installation or operation of any plant, machinery

or other apparatus purchased from, such person;

amounts paid in consideration of technical advice, assistance or

services rendered in connection with technical management or

administration of any scientific, industrial or commercial undertaking,

venture, project or scheme; or

rent or other payments, made under any aggreement or arrangement

for the use of any moveable property

FOREIGN SOURCE INCOME

With effect from year 2004, foreign source income received by any

person (other than a resident company carrying on the business of

banking, insurance, sea or air transport) will be exempted from

income tax

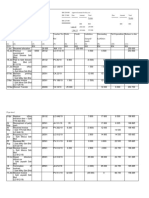

Income Receipts Capital receipts

Chargeable to income tax Not chargeable to income tax

Provision of services personal gift

Sale of goods / trading stock profit from disposal of long

Trading or adventure in the term investment (properties,

nature of trade shares)

Sale of short-term investment speculation, windfall gains

Gambling

Sale of capital assets (motor

vehicles, factory, plant &

machinery)

PERSON

Section 2 of ITA defines ‘person’ to include a company, a body of

persons, a limited partnership and a corporation sole.

Example:

1. Company

2. Individual / natural person

3. Trust

4. Club, trade association

5. Co-operative society

SUMMARY

Malaysian source Foreign income

of income received in

Malaysia

Individuals

• Resident or Non-Resident Taxable Exempted

Companies

• Resident or Non-Resident Taxable Exempted

Companies carrying on business

in banking, insurance, sea and air

transport

• Resident Taxable Taxable

• Non-Resident Taxable Exempted

SCOPE OF CHARGE OF INCOME TAX

Capital Income

Other Income Offshore business

No Tax activity income by

offshore company

Received in M’sia from Accrued in or

outside Malaysia derived from

Malaysia

Resident bank, insurance, Other Persons Not

sea and air transport Chargeable

Taxed

irrespective of

(Sec. 3B)

Exempted from resident status

Taxed Income Tax of person

REFERENCE

Choong Kwai Fatt (2018), Malaysian Taxation: Principles and

Practices, 24th Edition, Malaysia, Inforworld

You might also like

- Due Diligence Checklist For An ASSET PurchaseDocument2 pagesDue Diligence Checklist For An ASSET PurchaseDerek Noble50% (2)

- MFRS133-LECTURE NOTES 1-FAR570 For StudentsDocument20 pagesMFRS133-LECTURE NOTES 1-FAR570 For StudentsJICNo ratings yet

- CRG660 Past Year AnswersDocument85 pagesCRG660 Past Year AnswersMuhammad Zulhisyam100% (3)

- Universiti Teknologi Mara Final Assessment: Confidential 1 AC/JUL 2022/MAF503Document10 pagesUniversiti Teknologi Mara Final Assessment: Confidential 1 AC/JUL 2022/MAF503Alyn AdnanNo ratings yet

- Reconciliation Process FlowchartDocument9 pagesReconciliation Process Flowchartzahoor80No ratings yet

- Chap 1 Basis of Malaysian Income Tax 2022Document7 pagesChap 1 Basis of Malaysian Income Tax 2022Jasne OczyNo ratings yet

- Megan MediaDocument8 pagesMegan Mediarose0% (1)

- FAR 570 Test Mac July 2021 - QQDocument3 pagesFAR 570 Test Mac July 2021 - QQAthira Adriana Bt RemlanNo ratings yet

- Iii. The Sales Presentation Ben Feldman: The Package Concept RevisitedDocument12 pagesIii. The Sales Presentation Ben Feldman: The Package Concept RevisitedCherryber Urdaneta100% (3)

- Final Industrial Training Report SignedDocument66 pagesFinal Industrial Training Report SignedJannah AhmadNo ratings yet

- GROUP 1 TAX INCENTIVES (HOTEL & TOURISM) EditedDocument20 pagesGROUP 1 TAX INCENTIVES (HOTEL & TOURISM) Editedmeera yusufNo ratings yet

- Format - Individual Tax Computation - StudentsDocument2 pagesFormat - Individual Tax Computation - StudentsChandran Pachapan0% (1)

- MFRS 119 Employee BenefitsDocument38 pagesMFRS 119 Employee BenefitsAin YanieNo ratings yet

- Capital Allowance ScheduleDocument4 pagesCapital Allowance ScheduleAmu KrishnanNo ratings yet

- Application For Registration of Company 1Document2 pagesApplication For Registration of Company 1api-536569860No ratings yet

- BSN - SMS Banking GuideDocument1 pageBSN - SMS Banking Guideteam6 reportNo ratings yet

- BF ASN InvestmentDocument1 pageBF ASN InvestmentkeuliseutinNo ratings yet

- Lecture 1 - Introduction of Malaysia TaxationDocument29 pagesLecture 1 - Introduction of Malaysia TaxationkantarubanNo ratings yet

- Malaysian TaxationDocument1 pageMalaysian TaxationHONGCHIPWAINo ratings yet

- Basis PeriodDocument3 pagesBasis Periodafraahmed0No ratings yet

- Test FAR 570 Feb 2021Document2 pagesTest FAR 570 Feb 2021Putri Naajihah 4GNo ratings yet

- Maf 451 - Suggested Solutions: (A) Statement of Equivalent UnitsDocument7 pagesMaf 451 - Suggested Solutions: (A) Statement of Equivalent Unitsanis izzatiNo ratings yet

- Tutorial 6: Jane Lazar and Huang (4 Edition) - Chapter 35-MFRS133Document15 pagesTutorial 6: Jane Lazar and Huang (4 Edition) - Chapter 35-MFRS133HOW BING CHENNo ratings yet

- Fin430 - Dec2019Document6 pagesFin430 - Dec2019nurinsabyhahNo ratings yet

- Strategic Management Samsung ReportDocument30 pagesStrategic Management Samsung ReportAkshay Patel0% (1)

- MIA By-Laws (On Professional Ethics, Conduct and Practice)Document36 pagesMIA By-Laws (On Professional Ethics, Conduct and Practice)Nur IzzahNo ratings yet

- T2 Resident Status 2015Document6 pagesT2 Resident Status 2015Darshini0% (1)

- Assignment Question BAC2634 2110Document11 pagesAssignment Question BAC2634 2110Syamala 29No ratings yet

- Internship Log Book Template LATESTDocument29 pagesInternship Log Book Template LATESTNabila HusnaNo ratings yet

- Inventory Management: Fin658 - Financial Statement AnalysisDocument6 pagesInventory Management: Fin658 - Financial Statement Analysisamirul baharudinNo ratings yet

- PTX - AssignmentDocument15 pagesPTX - AssignmentNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Chapter 2 Corporate TaxDocument50 pagesChapter 2 Corporate TaxNgNo ratings yet

- Tega Payment SystemDocument8 pagesTega Payment Systemzarfarie aron67% (3)

- Capital Allowance 2220Document58 pagesCapital Allowance 2220YanPing AngNo ratings yet

- FAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsDocument5 pagesFAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsAmniNo ratings yet

- Assignment - Eco (1) Dah SiapppDocument11 pagesAssignment - Eco (1) Dah SiapppMUHAMMAD ZIKRY ADAM TAJUL ARAFATNo ratings yet

- Tutorial 3 MFRS 116 QDocument15 pagesTutorial 3 MFRS 116 QN FrzanahNo ratings yet

- Full Assignment Tax RPGTDocument19 pagesFull Assignment Tax RPGTVasant SriudomNo ratings yet

- Far410 Feb2022 Nacab1b 04062023Document15 pagesFar410 Feb2022 Nacab1b 04062023Rabi'atul Addawiyah NoorNo ratings yet

- Written Up AromaDocument3 pagesWritten Up AromaShikin YazidNo ratings yet

- Answer Tax317 Scheme July 2022Document10 pagesAnswer Tax317 Scheme July 2022Kirei RoseNo ratings yet

- Chapter 3 - Agriculture AllowancesDocument3 pagesChapter 3 - Agriculture AllowancesNURKHAIRUNNISA100% (2)

- Acc406 - Feb 2021 - Q - Set 1Document14 pagesAcc406 - Feb 2021 - Q - Set 1NABILA NADHIRAH ROSLANNo ratings yet

- Assignment Report Fin544 Sem 3Document12 pagesAssignment Report Fin544 Sem 3Sharil Afiq bin Turiman100% (1)

- December 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesDecember 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- BAC1634 - Tutorial 5 & 6 QDocument18 pagesBAC1634 - Tutorial 5 & 6 QLee Hau SenNo ratings yet

- UITM Postgraduate Brochure 1Document1 pageUITM Postgraduate Brochure 1Mohamad EzarinNo ratings yet

- Far 2 AssignmentDocument10 pagesFar 2 AssignmentHaripragash ThangaveluNo ratings yet

- Ent530 Social Media PortfolioDocument38 pagesEnt530 Social Media PortfolioNURIN NADHIRAH ABDUL RAHMANNo ratings yet

- Latest Report2Document37 pagesLatest Report2hafizi_nasir100% (1)

- Computation Format For Individual Tax Liability For The Year of Assessment 20XXDocument4 pagesComputation Format For Individual Tax Liability For The Year of Assessment 20XXannastasia luyah100% (1)

- VOTE Book PSADocument4 pagesVOTE Book PSAJulma Jaiiy100% (1)

- LAW485Document23 pagesLAW485Fatiha YusofNo ratings yet

- Nuratiqah Binti Kubak (2020899576) - Individual Assignment 1Document10 pagesNuratiqah Binti Kubak (2020899576) - Individual Assignment 1NuratiqahNo ratings yet

- Soalan Assignment Tax Bab 7 Sem 6Document9 pagesSoalan Assignment Tax Bab 7 Sem 6Vasant SriudomNo ratings yet

- Far270 - Q Test May 2023Document5 pagesFar270 - Q Test May 20232022896776No ratings yet

- FIN658 Degree Session 1 2012Document8 pagesFIN658 Degree Session 1 2012Amirah RahmanNo ratings yet

- Individual Assignment March 2021Document1 pageIndividual Assignment March 2021Muhammad RusydiNo ratings yet

- Fin645 Final AssessmentDocument3 pagesFin645 Final Assessmentmark50% (2)

- Group AssignmentDocument10 pagesGroup AssignmentEli SyahirahNo ratings yet

- Appeal Tax Procedure (Malaysia)Document2 pagesAppeal Tax Procedure (Malaysia)Zati TyNo ratings yet

- RES614 Part A and Part B CFAP225 5B Group 1Document110 pagesRES614 Part A and Part B CFAP225 5B Group 1umairhakim30100% (1)

- Far410 Chapter 2 Conceptual Framework EditedDocument60 pagesFar410 Chapter 2 Conceptual Framework EditedWAN AMIRUL MUHAIMIN WAN ZUKAMALNo ratings yet

- Lect 1 Overview of Taxation 2017Document68 pagesLect 1 Overview of Taxation 2017Devisudha ThanaseelanNo ratings yet

- Chap 1 Intro To TaxationDocument4 pagesChap 1 Intro To TaxationSAIYIDAH AFIQAH BINTI MUHAMAD YUSOFNo ratings yet

- Resident Status For IndividualDocument24 pagesResident Status For IndividualMalabaris Malaya Umar SiddiqNo ratings yet

- Anabolic Hormones and Dietary SupplementsDocument15 pagesAnabolic Hormones and Dietary SupplementsMalabaris Malaya Umar SiddiqNo ratings yet

- Mappila Muslims of MalabarDocument31 pagesMappila Muslims of MalabarMalabaris Malaya Umar Siddiq50% (2)

- Updated Questionnaire NewDocument6 pagesUpdated Questionnaire NewMalabaris Malaya Umar Siddiq100% (1)

- Cover Page InternDocument10 pagesCover Page InternMalabaris Malaya Umar SiddiqNo ratings yet

- Comparative Study of Todim and Topsis MethodsDocument90 pagesComparative Study of Todim and Topsis MethodsMalabaris Malaya Umar SiddiqNo ratings yet

- Mappila Muslims of MalabarDocument31 pagesMappila Muslims of MalabarMalabaris Malaya Umar Siddiq50% (2)

- Cover Page ELCDocument1 pageCover Page ELCMalabaris Malaya Umar SiddiqNo ratings yet

- Chapter 3Document18 pagesChapter 3Malabaris Malaya Umar SiddiqNo ratings yet

- Adm650 Chapter 1 The Nature of SMDocument31 pagesAdm650 Chapter 1 The Nature of SMMalabaris Malaya Umar SiddiqNo ratings yet

- Laboratory Manual Guidelines For Exercise Rehabilitation 1 EditionDocument61 pagesLaboratory Manual Guidelines For Exercise Rehabilitation 1 EditionMalabaris Malaya Umar SiddiqNo ratings yet

- Host Supervisor Assessment Form Ads667 60%Document11 pagesHost Supervisor Assessment Form Ads667 60%Malabaris Malaya Umar SiddiqNo ratings yet

- Proma FulllllDocument43 pagesProma FulllllMalabaris Malaya Umar SiddiqNo ratings yet

- If You CanDocument1 pageIf You CanMalabaris Malaya Umar SiddiqNo ratings yet

- Introduction To Financial ManagementDocument73 pagesIntroduction To Financial ManagementIrish Tamsi100% (1)

- A191 Tutorial 2 - Proposed AnswerDocument13 pagesA191 Tutorial 2 - Proposed AnswerAiden Ying0% (1)

- Financial Statement Analysis FWBLDocument21 pagesFinancial Statement Analysis FWBLAamir Raza100% (2)

- !!!!!!!!!!balance SheetDocument1 page!!!!!!!!!!balance Sheetquickoffice_sqaNo ratings yet

- Keventers Financial EstimationDocument4 pagesKeventers Financial EstimationAnirudhNo ratings yet

- A Practical Experience On PF, Esi, Pension, and GratuityDocument16 pagesA Practical Experience On PF, Esi, Pension, and GratuitySunil Aggarwal83% (12)

- Bank Reconciliation Statement Problems and Solutions I BRS I AK PDFDocument12 pagesBank Reconciliation Statement Problems and Solutions I BRS I AK PDFAdvance Knowledge88% (8)

- Interest Rate DerivativesDocument9 pagesInterest Rate DerivativesPrasad Nayak100% (1)

- Mcdonald'S Financial Analysis: A Presentation by Dhruwan, Meet and PaniyatornDocument9 pagesMcdonald'S Financial Analysis: A Presentation by Dhruwan, Meet and PaniyatornDhruwan ShahNo ratings yet

- Case Analysis - Compania de Telefonos de ChileDocument4 pagesCase Analysis - Compania de Telefonos de ChileSubrata BasakNo ratings yet

- Take Home Test Credit Transactions May 2020Document7 pagesTake Home Test Credit Transactions May 2020Patatas SayoteNo ratings yet

- Calculation of PremiumsDocument4 pagesCalculation of PremiumsSanjyotNo ratings yet

- A Study of Marketing Mix Elements of Reliance Mutual FundDocument22 pagesA Study of Marketing Mix Elements of Reliance Mutual Fundamitagrawal7100% (5)

- List of Ledgers and It's Under Group in TallyDocument5 pagesList of Ledgers and It's Under Group in Tallyrachel Kujur100% (1)

- Northwestern Mutual v2Document9 pagesNorthwestern Mutual v2Shekhar PawarNo ratings yet

- Transfer of Shares From Non Resident To Non Resident in An Indian CompanyDocument13 pagesTransfer of Shares From Non Resident To Non Resident in An Indian CompanyKamal K Arora100% (3)

- GWCDN RosewayDocument3 pagesGWCDN Rosewayapi-26372760No ratings yet

- Problems On Estimation of Cash Flows - 1Document2 pagesProblems On Estimation of Cash Flows - 1Shivu YatiNo ratings yet

- Theory and Practice of Forex and Treasury Management Split PDFDocument205 pagesTheory and Practice of Forex and Treasury Management Split PDFPride Munashe ZhouNo ratings yet

- Opening Case - Dilemma of Vishal JhulkaDocument2 pagesOpening Case - Dilemma of Vishal JhulkaSurbhi SabharwalNo ratings yet

- CIV PRO RULE 8 To 10 CasesDocument73 pagesCIV PRO RULE 8 To 10 CasesAmanda ButtkissNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Santosh IyerNo ratings yet

- Alliance Trust Full Sipp Handbook 2011Document14 pagesAlliance Trust Full Sipp Handbook 2011rohit1000No ratings yet

- Multi-Purpose Loan (MPL) Application Form: (E.g., JR., II) (For Married Women) (Check If Applicable Only)Document2 pagesMulti-Purpose Loan (MPL) Application Form: (E.g., JR., II) (For Married Women) (Check If Applicable Only)AndreRicamaraNo ratings yet

- PPV PPT A3 (Group-2)Document28 pagesPPV PPT A3 (Group-2)sahil patel100% (1)