Professional Documents

Culture Documents

Neat System: (National Exchange For Automated Trading)

Neat System: (National Exchange For Automated Trading)

Uploaded by

neetika0%(1)0% found this document useful (1 vote)

1K views7 pagesThe NEAT system is NSE's online trading system that allows for placing buy and sell orders, modifying existing orders, and monitoring market movements. It uses satellite communication and stores all trading information in an in-memory database to provide minimal response times and maximum system availability. The NEAT system has three types of markets - a normal market for regular lot sizes, an odd lot market for non-standard lot sizes, and an auction market initiated by the exchange.

Original Description:

Original Title

NEAT SYSTEM.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe NEAT system is NSE's online trading system that allows for placing buy and sell orders, modifying existing orders, and monitoring market movements. It uses satellite communication and stores all trading information in an in-memory database to provide minimal response times and maximum system availability. The NEAT system has three types of markets - a normal market for regular lot sizes, an odd lot market for non-standard lot sizes, and an auction market initiated by the exchange.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0%(1)0% found this document useful (1 vote)

1K views7 pagesNeat System: (National Exchange For Automated Trading)

Neat System: (National Exchange For Automated Trading)

Uploaded by

neetikaThe NEAT system is NSE's online trading system that allows for placing buy and sell orders, modifying existing orders, and monitoring market movements. It uses satellite communication and stores all trading information in an in-memory database to provide minimal response times and maximum system availability. The NEAT system has three types of markets - a normal market for regular lot sizes, an odd lot market for non-standard lot sizes, and an auction market initiated by the exchange.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 7

NEAT SYSTEM

(NATIONAL EXCHANGE FOR

AUTOMATED TRADING)

Presented To : Mr. Manpreet

Presented By : Neetika Saini

Program : B.B.A 6th

Roll No. : GU-2016-0044

ONLINE TRADING SYSTEM

Both NSE and BSE have switched over to

computerized Online Trading system from open

outcry trading system.

BSE has BOLT (BSE Online Trading) and NSE has

NEAT (National Exchange Automated Trading).

With these highly efficient online trading systems

efficiency and transparency of BSE and NSE have

increased dramatically.

NEAT SYSTEM

NSE is the first exchange in the world to use satellite communication

technology for trading. Its trading system, called National Exchange for

Automated Trading (NEAT), is a client server based application.

The NEAT screen consists of various functions to make trading a

pleasant experience. These functions help us in performing various

tasks like

• placing a buy order

• placing a sell order

• modifying the orders already placed

• keeping a watch on the market movement

Continue…

At the server end all trading information is stored in an in-memory

database to achieve:-

• minimum response time and

• maximum system availability for users.

For all trades entered into NEAT system, there is uniform

response time of less than one second.

On logging into the system the

following screen appears:

The NEAT system has three types of

market. They are:

1. Normal Market:-All orders which are of regular lot size or multiples

are traded in the Normal Market. Normal market consists of various book types

wherein orders are segregated as Regular lot orders, Special Term orders,

Negotiated Trade Orders and Stop Loss orders depending on their order

attributes.

2. Odd Lot Market:-All orders whose order size is less than the regular

lot size are traded in the odd-lot market. These orders do not have any special

terms attributes attached to them. In an odd-lot market, both the price and

quantity of both the orders (buy and sell) should exactly match for the trade to

take place.

3. Auction Market:-In the Auction Market, auctions are initiated by the

Exchange on behalf of trading members for settlement related reasons. There

are 3 participants in this market.

1.Initiator - the party who initiates the auction process is called an initiator

2.Competitor - the party who enters orders on the same side as of the initiator

3.Solicitor - the party who enters orders on the opposite side as of the initiator

You might also like

- EyeEm Property Release enDocument1 pageEyeEm Property Release endesa benculukNo ratings yet

- This Study Resource Was: LG415 Case Study: The Elevator DilemmaDocument1 pageThis Study Resource Was: LG415 Case Study: The Elevator DilemmaAdrianBrionesGallardoNo ratings yet

- Indian Financial SystemDocument16 pagesIndian Financial Systemshankarinadar100% (1)

- NeatDocument20 pagesNeatAbhi PujaraNo ratings yet

- BSC Online Trading SystemDocument19 pagesBSC Online Trading SystemAaryendr100% (1)

- (Funds Settlement) : NSE - Valuation Debit, Valuation Price, Bad and Short Delivery, AuctionDocument2 pages(Funds Settlement) : NSE - Valuation Debit, Valuation Price, Bad and Short Delivery, AuctionHRish BhimberNo ratings yet

- Stock Exchange Project - PDF - Stocks - Stock ExchangeDocument25 pagesStock Exchange Project - PDF - Stocks - Stock ExchangeAkshat SinghalNo ratings yet

- Role of SEBI in Investor ProtectionDocument21 pagesRole of SEBI in Investor Protectionkusum kalani100% (1)

- History and Evolution of Stock Exchange in IndiaDocument6 pagesHistory and Evolution of Stock Exchange in IndiaAmudha Mony50% (4)

- BST Project 1Document26 pagesBST Project 1Kashish AgrawalNo ratings yet

- Project On National IncomeDocument13 pagesProject On National IncomesanjamNo ratings yet

- Listing of SecuritiesDocument7 pagesListing of SecuritiesNeha Mishra100% (1)

- Industrial Securities MarketDocument16 pagesIndustrial Securities MarketNaga Mani Merugu100% (3)

- Nse Project WorkDocument25 pagesNse Project WorkArif Khan100% (1)

- Project On Finalization of Partnership FirmDocument38 pagesProject On Finalization of Partnership Firmvenkynaidu67% (3)

- National IncomeDocument25 pagesNational Incomeshivamset576100% (2)

- Concepts of Demonetisation and GST (Prepared From NCERT Books)Document1 pageConcepts of Demonetisation and GST (Prepared From NCERT Books)Krishna BhattacharyaNo ratings yet

- Ch-3 of Indian Economy NotesDocument6 pagesCh-3 of Indian Economy NotesAyush LohiyaNo ratings yet

- Tax PlanDocument2 pagesTax PlanMrigendra MishraNo ratings yet

- Brief History of RBI: Hilton Young CommissionDocument24 pagesBrief History of RBI: Hilton Young CommissionharishNo ratings yet

- Guru Nanak International Public School: Conomics Project OnDocument42 pagesGuru Nanak International Public School: Conomics Project OnRohit Nagar100% (1)

- Agencies That Facilitate International FlowsDocument10 pagesAgencies That Facilitate International FlowsKamlesh Choudhary100% (1)

- Ad Mad Rules 1Document1 pageAd Mad Rules 1Richi RichNo ratings yet

- BCom 6th Sem - AuditingDocument46 pagesBCom 6th Sem - AuditingJibin Samuel100% (1)

- Economics ProjectDocument27 pagesEconomics ProjectKashish AgrawalNo ratings yet

- A STUDY ON INDIAN STOCK MARKET - IiflDocument10 pagesA STUDY ON INDIAN STOCK MARKET - IiflkizieNo ratings yet

- Project Report On Stock ExchangeDocument11 pagesProject Report On Stock Exchangebhawna33% (3)

- Company Regulatory Legislations in IndiaDocument57 pagesCompany Regulatory Legislations in IndiaAmit verma100% (1)

- Depository ServicesDocument7 pagesDepository ServicesakhilNo ratings yet

- Main Market FormsDocument9 pagesMain Market FormsP Janaki Raman50% (2)

- Formation of CompanyDocument7 pagesFormation of CompanyPragya SinghNo ratings yet

- A Detailed Project On Secondary Market.Document40 pagesA Detailed Project On Secondary Market.Jatin Anand100% (3)

- BST CH2 AssiDocument4 pagesBST CH2 AssiKhushi Kumari100% (1)

- Studies - (Chapter - 3) Environment, BST Class 12Document23 pagesStudies - (Chapter - 3) Environment, BST Class 12Manish NagdevNo ratings yet

- Bse and NseDocument15 pagesBse and NseChinmay P Kalelkar50% (2)

- BST PROJECT On E-BusinessDocument12 pagesBST PROJECT On E-BusinessSOURAV KHARKIA100% (1)

- Balance of Payments ProjectDocument21 pagesBalance of Payments Projectmanoj100% (2)

- Price Determination Under Perfect Competition: Unit 9Document11 pagesPrice Determination Under Perfect Competition: Unit 9Gayl Ignacio Tolentino0% (1)

- Impact of GST On GDPDocument9 pagesImpact of GST On GDPAnshaj GuptaNo ratings yet

- CBSE Class 12 Case Studies in Business Studies - Financial ManagementDocument46 pagesCBSE Class 12 Case Studies in Business Studies - Financial Managementgv4t47gx7dNo ratings yet

- Economics ProjectDocument28 pagesEconomics ProjectANANYA100% (2)

- Some Basic Concepts of MacroeconomicsDocument16 pagesSome Basic Concepts of MacroeconomicsAnvi RaiNo ratings yet

- NseDocument18 pagesNseishan chughNo ratings yet

- Causes and Measures of DisequilibriumDocument28 pagesCauses and Measures of DisequilibriumPankaj Chetry100% (1)

- New Issue MarketDocument18 pagesNew Issue Marketoureducation.inNo ratings yet

- Project On Stock Exchange Financial Management Class 12 CbseDocument21 pagesProject On Stock Exchange Financial Management Class 12 CbseBhavya DayalNo ratings yet

- Investor Protection Measures by SebiDocument3 pagesInvestor Protection Measures by SebiMitu Rana100% (1)

- Issue of SharesDocument16 pagesIssue of SharesAdan HoodaNo ratings yet

- Functional Report of SEBIDocument9 pagesFunctional Report of SEBIAMIT K SINGH100% (1)

- Unit 10 Merits and Demerits of Fixed and Flexible Foreign Exchange Rates. Merits of Fixed Exchange RateDocument2 pagesUnit 10 Merits and Demerits of Fixed and Flexible Foreign Exchange Rates. Merits of Fixed Exchange RateSenthil Kumar GanesanNo ratings yet

- Small Scale IndustriesDocument17 pagesSmall Scale IndustriesPradeep Biradar100% (1)

- OTCEI: Concept and Advantages - India - Financial ManagementDocument9 pagesOTCEI: Concept and Advantages - India - Financial Managementjobin josephNo ratings yet

- 12 Economics - Liberalisation, Privatisation and Globalisation An Appraisal - Notes and Video LinkDocument14 pages12 Economics - Liberalisation, Privatisation and Globalisation An Appraisal - Notes and Video Linksayooj tvNo ratings yet

- CH 3 Private, Public and Global EnterprisesDocument7 pagesCH 3 Private, Public and Global EnterprisesHarsha Billore0% (1)

- New Issue MarketDocument13 pagesNew Issue MarketKanivarasi Hercule100% (2)

- CLASS XI ACCOUNTANCY NOTES Chapter 2 - Theory Base of AccountingDocument26 pagesCLASS XI ACCOUNTANCY NOTES Chapter 2 - Theory Base of AccountingPradyumna Choudhary100% (1)

- 12 Economics Notes Macro Ch02 Money and BankingDocument6 pages12 Economics Notes Macro Ch02 Money and BankingRitika50% (2)

- Integration of Indian Financial Market With Global MarketDocument20 pagesIntegration of Indian Financial Market With Global Marketab29cd83% (6)

- Forms of MarketDocument32 pagesForms of MarketDhrampal Gupta100% (1)

- Foreign Exchange Market PDFDocument17 pagesForeign Exchange Market PDFHemanth KumarNo ratings yet

- NEAT Chapter 1Document6 pagesNEAT Chapter 1Vivek KansalNo ratings yet

- BMC Base Minimum CapitalDocument21 pagesBMC Base Minimum Capitalsairajesh1984No ratings yet

- S105465GC10 Mod17 PDFDocument41 pagesS105465GC10 Mod17 PDFHsie HsuanNo ratings yet

- Analyzing The Effectiveness of Confluence of Price Action Disciplines in Forex MarketDocument17 pagesAnalyzing The Effectiveness of Confluence of Price Action Disciplines in Forex MarketTinasheNo ratings yet

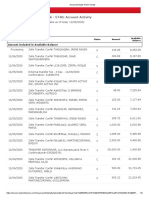

- Business Fundamentals CHK - 5740: Account Activity: All TransactionsDocument3 pagesBusiness Fundamentals CHK - 5740: Account Activity: All TransactionsAnnaly Carolina Bravo CastilloNo ratings yet

- Format - Rent AgreementDocument2 pagesFormat - Rent AgreementMritunjai SinghNo ratings yet

- Laying Grounds For InternationalizationDocument2 pagesLaying Grounds For Internationalizationkristine contrerasNo ratings yet

- New Trasdata (Jtag/Bdm/Boot) Ecu Application List: Cpu Supported (Groups and Families)Document11 pagesNew Trasdata (Jtag/Bdm/Boot) Ecu Application List: Cpu Supported (Groups and Families)Jérémie Royer-Audet0% (1)

- 3rd Term Lesson Note For Ss2 On EconomicsDocument24 pages3rd Term Lesson Note For Ss2 On Economicslukajoy082No ratings yet

- REVIEWER - BUSLAW Law On SalesDocument8 pagesREVIEWER - BUSLAW Law On SalesJinnie TannieNo ratings yet

- MC 99 NotesDocument3 pagesMC 99 NotesVloudy Mia Serrano PangilinanNo ratings yet

- Midterm 2010 DanielandreiinfoDocument11 pagesMidterm 2010 DanielandreiinfoCindy MaNo ratings yet

- Las LS3 Work SampleDocument9 pagesLas LS3 Work SampleZaibell Jane TareNo ratings yet

- Theo Chocolate: Ethical Supply Chains: Daniels Fund Ethics Initiative University of New MexicoDocument4 pagesTheo Chocolate: Ethical Supply Chains: Daniels Fund Ethics Initiative University of New MexicoJewel CabigonNo ratings yet

- Project ManagementDocument187 pagesProject Managementshashi puriNo ratings yet

- Topic 3 - Magna Carta For Disabled PersonsDocument38 pagesTopic 3 - Magna Carta For Disabled PersonsNddejNo ratings yet

- Assaignment Int MKT (Azmol 193046067)Document16 pagesAssaignment Int MKT (Azmol 193046067)Azmol bdNo ratings yet

- 8 - Batch 1 - Eastern Condiments CaseDocument9 pages8 - Batch 1 - Eastern Condiments CaseAman SaxenaNo ratings yet

- Apparel Production Supervisory Training-CustomizedDocument185 pagesApparel Production Supervisory Training-CustomizedEsubalew gebrieNo ratings yet

- Proofpoint Indirect Partner Program DocumentsDocument22 pagesProofpoint Indirect Partner Program DocumentsForense OrlandoNo ratings yet

- DIGEST - CIR v. Cebu Toyo CorporationDocument4 pagesDIGEST - CIR v. Cebu Toyo CorporationAgatha ApolinarioNo ratings yet

- Creating A Process MapDocument7 pagesCreating A Process MapHarrison NchoeNo ratings yet

- Challenges For Sustainable Development Strategies in Oil and Gas IndustriesDocument13 pagesChallenges For Sustainable Development Strategies in Oil and Gas IndustriesAkshay Solanki100% (1)

- Iban Registry: Registration Authority For ISO 13616Document86 pagesIban Registry: Registration Authority For ISO 13616Ferjani RiahiNo ratings yet

- Rohan Sharma - CV 2023Document1 pageRohan Sharma - CV 2023Nishant AhujaNo ratings yet

- Aldar Brand Guidelines Nov 2022Document45 pagesAldar Brand Guidelines Nov 2022emanabdk98No ratings yet

- Test Bank For Essential Statistics For Public Managers and Policy Analysts 4th Edition Evan Berman Xiaohu WangDocument28 pagesTest Bank For Essential Statistics For Public Managers and Policy Analysts 4th Edition Evan Berman Xiaohu Wangglaivefang2a8v67100% (19)

- Unit-6 SWOT AnalysisDocument12 pagesUnit-6 SWOT Analysisvg_mrtNo ratings yet

- WSP Reporting and Investigation PolicyDocument9 pagesWSP Reporting and Investigation PolicyroshanrajasNo ratings yet

- 7p, S of Green Marketing FinalDocument11 pages7p, S of Green Marketing FinalSangeeta JainNo ratings yet