Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

40 viewsChapter 1

Chapter 1

Uploaded by

Ayesha GuptaThis chapter discusses financial services. It defines financial services according to Indian law and outlines the key features of financial services. The chapter also describes the types of challenges faced by the financial services industry and categorizes financial services into two main types: fund-based services which involve financial institutions' funds, and non-fund based services where fees are paid for services but funds are not involved. Common examples of each type of service are provided.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- Input: Frozen Foods Products: Cost of CapitalDocument12 pagesInput: Frozen Foods Products: Cost of CapitalSurya G.C.No ratings yet

- Chapter 1. Introduction To FIMDocument55 pagesChapter 1. Introduction To FIMHiếu Nhi TrịnhNo ratings yet

- Financial Services-MBA-BMDocument12 pagesFinancial Services-MBA-BMAyesha GuptaNo ratings yet

- Investment Banking OverviewDocument77 pagesInvestment Banking OverviewEmerson De Mello100% (26)

- Lecture 6 - Coleman Case SolutionDocument3 pagesLecture 6 - Coleman Case SolutionMs ShoaibNo ratings yet

- Unit 1 - Indian Financial SystemDocument31 pagesUnit 1 - Indian Financial SystemPrasad IngoleNo ratings yet

- IFS Notes 1Document43 pagesIFS Notes 1Tejas NagulwarNo ratings yet

- FINANCIAL SERVICES IN INDIA Sahil TybmsDocument5 pagesFINANCIAL SERVICES IN INDIA Sahil TybmsOmkar AyareNo ratings yet

- CHP 1 Intro To FS TextbkDocument31 pagesCHP 1 Intro To FS TextbkVenom BhaiyaNo ratings yet

- Financial ServicesDocument86 pagesFinancial ServicesSahana Sameer Kulkarni100% (1)

- Unit 3 Financial Services: An Introduction: ObjectivesDocument19 pagesUnit 3 Financial Services: An Introduction: ObjectivesKashif UddinNo ratings yet

- Financial ServicesDocument9 pagesFinancial Servicesamitmali.armNo ratings yet

- Financial Services Notes - Jeganraj - 2020Document23 pagesFinancial Services Notes - Jeganraj - 2020jeganrajraj100% (1)

- Unit 1Document12 pagesUnit 1Manav MundraNo ratings yet

- Marketing of Financial ServicesDocument11 pagesMarketing of Financial ServicesSurya NavikNo ratings yet

- Financial Services PDFDocument47 pagesFinancial Services PDFPrachi ChaurasiaNo ratings yet

- Lecture - 1 Merchant BankingDocument31 pagesLecture - 1 Merchant Bankingram pNo ratings yet

- 1.1 Meaning and DefinitionDocument36 pages1.1 Meaning and DefinitionShoumi MahapatraNo ratings yet

- Financial ServiceDocument7 pagesFinancial ServiceValarmathi MbaNo ratings yet

- Financial ServicesDocument392 pagesFinancial ServicesCLAUDINE MUGABEKAZINo ratings yet

- Financial ServicesDocument24 pagesFinancial ServicesPrashant GamanagattiNo ratings yet

- Bfs - Unit IV Short NotesDocument16 pagesBfs - Unit IV Short NotesvelmuruganbNo ratings yet

- Acct L-2 TVET BestDocument91 pagesAcct L-2 TVET BestFelekePhiliphosNo ratings yet

- MB18FM02 Managing Banks and Financial InstitutionsDocument29 pagesMB18FM02 Managing Banks and Financial Institutionsdaniel rajkumarNo ratings yet

- Raj EmfsDocument9 pagesRaj EmfsbcbiNo ratings yet

- Study MaterialDocument46 pagesStudy MaterialSRISHTINo ratings yet

- Unit - I Learning ObjectivesDocument277 pagesUnit - I Learning Objectiveskashyap00No ratings yet

- Financial Services MbaDocument251 pagesFinancial Services MbaMohammed Imran50% (2)

- Financial ServicesDocument85 pagesFinancial ServicesPankaj KumarNo ratings yet

- Chapter 6 FmsDocument29 pagesChapter 6 FmsTHRISHA JINKALANo ratings yet

- Nature, Type, Scope, Fund Based, Non Fund BasedDocument15 pagesNature, Type, Scope, Fund Based, Non Fund BasedSaurabhNo ratings yet

- Marketing of Financial ServicesDocument20 pagesMarketing of Financial ServicesVirendra Choudhry100% (2)

- Financial Services and Merchant BankingDocument54 pagesFinancial Services and Merchant Bankingananya_nagrajNo ratings yet

- Financial Service Review - IcfaiDocument7 pagesFinancial Service Review - IcfaiS.Kumar0% (1)

- Chapter 6Document16 pagesChapter 6Ayesha GuptaNo ratings yet

- SYBCom - Financial Services and Production Management - Module 2Document26 pagesSYBCom - Financial Services and Production Management - Module 2Yash SuranaNo ratings yet

- Personal Finance WordDocument5 pagesPersonal Finance WordJahsmen NavarroNo ratings yet

- Intro To Traditional Financial ServicesDocument10 pagesIntro To Traditional Financial Servicesmoinavrang123No ratings yet

- Financial ServiceDocument2 pagesFinancial ServiceGARCIA RAMIREZ CAROLINANo ratings yet

- Meaning of Financial ServicesDocument4 pagesMeaning of Financial Servicesmarvels fanNo ratings yet

- FM III - Unit 1Document25 pagesFM III - Unit 1Sharada KadurNo ratings yet

- IMChap 1Document10 pagesIMChap 1babar zahoor100% (1)

- 1.1 Financial ServicesDocument60 pages1.1 Financial ServicesPrachi AsawaNo ratings yet

- A Marketing of Innovative E-Financial Services With Reference To SBI and ICICI BankDocument11 pagesA Marketing of Innovative E-Financial Services With Reference To SBI and ICICI BankInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Intro Mon Pol - Oct 19 ABRDocument150 pagesIntro Mon Pol - Oct 19 ABRSoumya JainNo ratings yet

- MBFS Financial SystemDocument40 pagesMBFS Financial SystemNagendra Basetti100% (1)

- 387 P16mba4ef6 2020051606081212 PDFDocument257 pages387 P16mba4ef6 2020051606081212 PDFParivel ParivelNo ratings yet

- Indian Financial SystemDocument5 pagesIndian Financial Systemshibashish PandaNo ratings yet

- Day1, Discuss The Evolution of IFS Post GFCDocument3 pagesDay1, Discuss The Evolution of IFS Post GFCjatinNo ratings yet

- Financial Services - Unit - 1Document19 pagesFinancial Services - Unit - 1rajesh337masssNo ratings yet

- Unit 2 EDocument50 pagesUnit 2 EDhamma DahiwaleNo ratings yet

- Module-3 Types of Financial ServicesDocument141 pagesModule-3 Types of Financial Serviceskarthik karthikNo ratings yet

- Financial Services Refer To The Range of Services Provided by The Financial IndustryDocument2 pagesFinancial Services Refer To The Range of Services Provided by The Financial Industrykhageswarsingh865No ratings yet

- 8 NBFCDocument110 pages8 NBFCrohit sharmaNo ratings yet

- Course OutlineDocument4 pagesCourse Outlinefbicia218No ratings yet

- Financial ServicesDocument7 pagesFinancial ServicesRaman KumarNo ratings yet

- Bank Management and Financial Services 9th Edition Rose Solutions ManualDocument17 pagesBank Management and Financial Services 9th Edition Rose Solutions Manualdubitateswanmarkm4nvo100% (26)

- Final Nancy121Document66 pagesFinal Nancy121Sahil SethiNo ratings yet

- MfI Chapter 1Document32 pagesMfI Chapter 1Jiru AlemayehuNo ratings yet

- Notes On Introduction To Financial ServicesDocument18 pagesNotes On Introduction To Financial ServicesKirti Giyamalani100% (1)

- Kami Export - MFS (Unit 1-4) Combine NotesDocument81 pagesKami Export - MFS (Unit 1-4) Combine Notesamangt9988No ratings yet

- Soft Copy of Project... 2Document21 pagesSoft Copy of Project... 2Jahid KhanNo ratings yet

- Marketing of Consumer Financial Products: Insights From Service MarketingFrom EverandMarketing of Consumer Financial Products: Insights From Service MarketingNo ratings yet

- Private Money Brokering Demystified: A Step-by-Step Guide for the Novice Real Estate InvestorFrom EverandPrivate Money Brokering Demystified: A Step-by-Step Guide for the Novice Real Estate InvestorNo ratings yet

- Unlocking Rental Wealth: Strategies for Successful Property Investment and ManagementFrom EverandUnlocking Rental Wealth: Strategies for Successful Property Investment and ManagementNo ratings yet

- FinanceDocument81 pagesFinanceAyesha GuptaNo ratings yet

- Chapter 6Document16 pagesChapter 6Ayesha GuptaNo ratings yet

- MarketingDocument5 pagesMarketingAyesha GuptaNo ratings yet

- Ch02 Organ Buying BehaviorDocument28 pagesCh02 Organ Buying BehaviorAyesha GuptaNo ratings yet

- Ch03 Cust Relationship MGMTDocument23 pagesCh03 Cust Relationship MGMTAyesha GuptaNo ratings yet

- 9588 - Handouts Session 1Document9 pages9588 - Handouts Session 1Ayesha GuptaNo ratings yet

- Understanding Leadership Styles and Competencies: DR - Kalpana SahooDocument25 pagesUnderstanding Leadership Styles and Competencies: DR - Kalpana SahooAyesha GuptaNo ratings yet

- FinanceDocument7 pagesFinanceAyesha GuptaNo ratings yet

- Biomedical PPT FinalDocument37 pagesBiomedical PPT FinalAyesha GuptaNo ratings yet

- 9599 - Mutual Fund AssignmentDocument4 pages9599 - Mutual Fund AssignmentAyesha GuptaNo ratings yet

- 1 A Indian Contract Act 1872Document36 pages1 A Indian Contract Act 1872Ayesha GuptaNo ratings yet

- SRM Final PPT - GRP7Document11 pagesSRM Final PPT - GRP7Ayesha GuptaNo ratings yet

- Decision MakingDocument31 pagesDecision MakingAyesha GuptaNo ratings yet

- Session 4 Introduction To ProbabilityDocument37 pagesSession 4 Introduction To ProbabilityAyesha GuptaNo ratings yet

- Session 3-Bivariate RepresentationDocument15 pagesSession 3-Bivariate RepresentationAyesha GuptaNo ratings yet

- 2 Consideration and Legality of ObjectsDocument38 pages2 Consideration and Legality of ObjectsAyesha GuptaNo ratings yet

- Comm PUMADocument12 pagesComm PUMAAyesha GuptaNo ratings yet

- Initial Public Offerings (Ipos) : Regulations & ProcessDocument54 pagesInitial Public Offerings (Ipos) : Regulations & ProcessAyesha GuptaNo ratings yet

- Operational Amplifiers: Basic Building Block Black BoxDocument27 pagesOperational Amplifiers: Basic Building Block Black BoxAyesha GuptaNo ratings yet

- Frequency Response of Two Stage RC Coupled AmplifierDocument38 pagesFrequency Response of Two Stage RC Coupled AmplifierAyesha Gupta100% (2)

- East Coast YachtsDocument6 pagesEast Coast YachtsMuhamad FudolahNo ratings yet

- CH 14 MC AlgoDocument27 pagesCH 14 MC AlgoLancelotNo ratings yet

- CourseHero FSDocument4 pagesCourseHero FSPraise BuenaflorNo ratings yet

- Accounting Quations IIDocument27 pagesAccounting Quations IIyoftahe habtamuNo ratings yet

- Annual Report of Honda AtlasDocument1 pageAnnual Report of Honda AtlaskEBAYNo ratings yet

- Save and Learn Money Market Fund ProspectusDocument43 pagesSave and Learn Money Market Fund ProspectusEunice QueNo ratings yet

- Capital Market - Types of Bonds Iasmania - Civil Services Preparation Online ! UPSC & IAS Study MaterialDocument5 pagesCapital Market - Types of Bonds Iasmania - Civil Services Preparation Online ! UPSC & IAS Study MaterialSundar MechNo ratings yet

- R21 Currency Exchange Rates IFT NotesDocument35 pagesR21 Currency Exchange Rates IFT NotesMohammad Jubayer AhmedNo ratings yet

- Financial Accounting and Reporting Test Bank 80102016 - 3: - Investment in AssociateDocument10 pagesFinancial Accounting and Reporting Test Bank 80102016 - 3: - Investment in AssociateFery AnnNo ratings yet

- Acca f7 FlashcardsDocument5 pagesAcca f7 FlashcardsAna CristescuNo ratings yet

- Sales and Marketing Plan Introduction and Fundamentals - Original FileDocument22 pagesSales and Marketing Plan Introduction and Fundamentals - Original FileShah XiaoNo ratings yet

- Havells India 3QF14 Result Review 30-01-14Document8 pagesHavells India 3QF14 Result Review 30-01-14GaneshNo ratings yet

- Working Capital Management NotesDocument5 pagesWorking Capital Management NotesAmbika Bm100% (1)

- Factors Affect Factors Affecting Working Capitaling Working CapitalDocument24 pagesFactors Affect Factors Affecting Working Capitaling Working Capitalranjita kelageriNo ratings yet

- Cashflow AnalysisDocument19 pagesCashflow Analysisgl101No ratings yet

- Acctg-Prelim ExamDocument5 pagesAcctg-Prelim Examrodelyn waclinNo ratings yet

- Finance 2midterm 2010 - SolutionsDocument5 pagesFinance 2midterm 2010 - SolutionsKelvin FuNo ratings yet

- Bus PlanDocument4 pagesBus PlanMohamed BanounNo ratings yet

- 1.the Branding of Club Atletico de Madrid .Document5 pages1.the Branding of Club Atletico de Madrid .kunalNo ratings yet

- Financial and Managerial Accounting 4th Edition Wild Test BankDocument23 pagesFinancial and Managerial Accounting 4th Edition Wild Test Bankmatildaamelinda25o3100% (26)

- CA Inter Paper 6Document1 pageCA Inter Paper 6ap.quatrroNo ratings yet

- Module 10Document4 pagesModule 10PaupauNo ratings yet

- Basics On Stock Market IndexDocument4 pagesBasics On Stock Market Indexben kookNo ratings yet

- This Study Resource Was Shared ViaDocument5 pagesThis Study Resource Was Shared ViaSophia Varias CruzNo ratings yet

- Alpha LTD: (A) Capital Reduction and Reorganisation AccountDocument2 pagesAlpha LTD: (A) Capital Reduction and Reorganisation AccountpatrickNo ratings yet

- Economics: Regulatory Arbitrage Regulation Used To Exploit Differences in EconomicDocument28 pagesEconomics: Regulatory Arbitrage Regulation Used To Exploit Differences in EconomicAniket JainNo ratings yet

Chapter 1

Chapter 1

Uploaded by

Ayesha Gupta0 ratings0% found this document useful (0 votes)

40 views11 pagesThis chapter discusses financial services. It defines financial services according to Indian law and outlines the key features of financial services. The chapter also describes the types of challenges faced by the financial services industry and categorizes financial services into two main types: fund-based services which involve financial institutions' funds, and non-fund based services where fees are paid for services but funds are not involved. Common examples of each type of service are provided.

Original Description:

FINANCE

Original Title

Chapter 1 Ppt

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis chapter discusses financial services. It defines financial services according to Indian law and outlines the key features of financial services. The chapter also describes the types of challenges faced by the financial services industry and categorizes financial services into two main types: fund-based services which involve financial institutions' funds, and non-fund based services where fees are paid for services but funds are not involved. Common examples of each type of service are provided.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

40 views11 pagesChapter 1

Chapter 1

Uploaded by

Ayesha GuptaThis chapter discusses financial services. It defines financial services according to Indian law and outlines the key features of financial services. The chapter also describes the types of challenges faced by the financial services industry and categorizes financial services into two main types: fund-based services which involve financial institutions' funds, and non-fund based services where fees are paid for services but funds are not involved. Common examples of each type of service are provided.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 11

Financial Services by Renuka

Sharma and Kiran Mehta 1

This chapter will help the readers to:

◦ Define the Meaning of Financial Services

◦ Understand the Features of Financial Services

◦ Learn about the Challenges Faced by the Financial

Service Industry

◦ Illustrate the Types of Financial Services

Financial Services by Renuka

Sharma and Kiran Mehta 2

Because of innovation in finance, the financial

products and services have become one of

the significant contributors to economic

development.

Financial Services by Renuka

Sharma and Kiran Mehta 3

A precise definition of financial services is given

in section 65(10) of the Finance Act 1994. As per

the act, if a banking company or a financial

institution or a non-banking financial company

(NBFC) provides the following services, then

these services are financial services.

◦ Leasing and hire purchase

◦ Credit card services

◦ Asset management services (mutual funds, etc.)

◦ FOREX broking

◦ Portfolio management

◦ Venture capital and so on…

Financial Services by Renuka

Sharma and Kiran Mehta 4

Intangible

Short Life

Indivisibility

Importance of Information

Dynamic

Financial Services by Renuka

Sharma and Kiran Mehta 5

Lack of awareness

Lack of qualified personnel for financial

service industry

Specialized Services. vs diversified services

Lack of research skills and non-availability of

data

Financial Services by Renuka

Sharma and Kiran Mehta 6

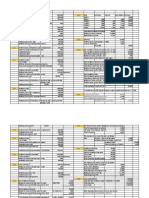

Financial Services by Renuka

Sharma and Kiran Mehta 7

Fund-based services involves funds of financial institutions.

Under this category, the following types of financial services are

included:

a. Lease financing

b. Hire-purchase

c. Factoring

d. Forfaiting

e. Venture capital

f. Consumer credit

g. Insurance services

h. Housing finance

i. Mutual funds

j. Participating in money market

k. Underwriting

l. Bills discounting

Financial Services by Renuka

Sharma and Kiran Mehta 8

In such types of financial services, funds of

financial institutions are not involved, but some

fees/commission is paid on receiving such

services. Financial service providers receive

fees/commission for providing such services.

Under this category, the following types of financial

services are included:

a. Credit rating

b. Securitization

c. Loan syndication

d. Merger and acquisition

e. Merchant banking and issue management

f. Advisory/consultancy services

g. Loan syndication

h. Portfolio management

Financial Services by Renuka

Sharma and Kiran Mehta 9

The efficiency of financial service providers directly affects

the channelization of savings and investments in the country.

Majority of the financial institutions can be categorized into

banking and non-banking financial companies.

Financial services are known for their features like intangible,

short life, importance of information, and dynamic.

Most of the financial services are divided into fund based and

non-fund based services. The fund based services may

include, lease financing, hire-purchase, factoring, forfaiting,

venture capital, consumer credit, and insurance services, etc.

And non-fund based services may include, credit rating,

securitization, loan syndication, merger and acquisition and

other advisory and consultancy services.

Financial Services by Renuka

Sharma and Kiran Mehta 10

Financial Services by Renuka

Sharma and Kiran Mehta 11

You might also like

- Input: Frozen Foods Products: Cost of CapitalDocument12 pagesInput: Frozen Foods Products: Cost of CapitalSurya G.C.No ratings yet

- Chapter 1. Introduction To FIMDocument55 pagesChapter 1. Introduction To FIMHiếu Nhi TrịnhNo ratings yet

- Financial Services-MBA-BMDocument12 pagesFinancial Services-MBA-BMAyesha GuptaNo ratings yet

- Investment Banking OverviewDocument77 pagesInvestment Banking OverviewEmerson De Mello100% (26)

- Lecture 6 - Coleman Case SolutionDocument3 pagesLecture 6 - Coleman Case SolutionMs ShoaibNo ratings yet

- Unit 1 - Indian Financial SystemDocument31 pagesUnit 1 - Indian Financial SystemPrasad IngoleNo ratings yet

- IFS Notes 1Document43 pagesIFS Notes 1Tejas NagulwarNo ratings yet

- FINANCIAL SERVICES IN INDIA Sahil TybmsDocument5 pagesFINANCIAL SERVICES IN INDIA Sahil TybmsOmkar AyareNo ratings yet

- CHP 1 Intro To FS TextbkDocument31 pagesCHP 1 Intro To FS TextbkVenom BhaiyaNo ratings yet

- Financial ServicesDocument86 pagesFinancial ServicesSahana Sameer Kulkarni100% (1)

- Unit 3 Financial Services: An Introduction: ObjectivesDocument19 pagesUnit 3 Financial Services: An Introduction: ObjectivesKashif UddinNo ratings yet

- Financial ServicesDocument9 pagesFinancial Servicesamitmali.armNo ratings yet

- Financial Services Notes - Jeganraj - 2020Document23 pagesFinancial Services Notes - Jeganraj - 2020jeganrajraj100% (1)

- Unit 1Document12 pagesUnit 1Manav MundraNo ratings yet

- Marketing of Financial ServicesDocument11 pagesMarketing of Financial ServicesSurya NavikNo ratings yet

- Financial Services PDFDocument47 pagesFinancial Services PDFPrachi ChaurasiaNo ratings yet

- Lecture - 1 Merchant BankingDocument31 pagesLecture - 1 Merchant Bankingram pNo ratings yet

- 1.1 Meaning and DefinitionDocument36 pages1.1 Meaning and DefinitionShoumi MahapatraNo ratings yet

- Financial ServiceDocument7 pagesFinancial ServiceValarmathi MbaNo ratings yet

- Financial ServicesDocument392 pagesFinancial ServicesCLAUDINE MUGABEKAZINo ratings yet

- Financial ServicesDocument24 pagesFinancial ServicesPrashant GamanagattiNo ratings yet

- Bfs - Unit IV Short NotesDocument16 pagesBfs - Unit IV Short NotesvelmuruganbNo ratings yet

- Acct L-2 TVET BestDocument91 pagesAcct L-2 TVET BestFelekePhiliphosNo ratings yet

- MB18FM02 Managing Banks and Financial InstitutionsDocument29 pagesMB18FM02 Managing Banks and Financial Institutionsdaniel rajkumarNo ratings yet

- Raj EmfsDocument9 pagesRaj EmfsbcbiNo ratings yet

- Study MaterialDocument46 pagesStudy MaterialSRISHTINo ratings yet

- Unit - I Learning ObjectivesDocument277 pagesUnit - I Learning Objectiveskashyap00No ratings yet

- Financial Services MbaDocument251 pagesFinancial Services MbaMohammed Imran50% (2)

- Financial ServicesDocument85 pagesFinancial ServicesPankaj KumarNo ratings yet

- Chapter 6 FmsDocument29 pagesChapter 6 FmsTHRISHA JINKALANo ratings yet

- Nature, Type, Scope, Fund Based, Non Fund BasedDocument15 pagesNature, Type, Scope, Fund Based, Non Fund BasedSaurabhNo ratings yet

- Marketing of Financial ServicesDocument20 pagesMarketing of Financial ServicesVirendra Choudhry100% (2)

- Financial Services and Merchant BankingDocument54 pagesFinancial Services and Merchant Bankingananya_nagrajNo ratings yet

- Financial Service Review - IcfaiDocument7 pagesFinancial Service Review - IcfaiS.Kumar0% (1)

- Chapter 6Document16 pagesChapter 6Ayesha GuptaNo ratings yet

- SYBCom - Financial Services and Production Management - Module 2Document26 pagesSYBCom - Financial Services and Production Management - Module 2Yash SuranaNo ratings yet

- Personal Finance WordDocument5 pagesPersonal Finance WordJahsmen NavarroNo ratings yet

- Intro To Traditional Financial ServicesDocument10 pagesIntro To Traditional Financial Servicesmoinavrang123No ratings yet

- Financial ServiceDocument2 pagesFinancial ServiceGARCIA RAMIREZ CAROLINANo ratings yet

- Meaning of Financial ServicesDocument4 pagesMeaning of Financial Servicesmarvels fanNo ratings yet

- FM III - Unit 1Document25 pagesFM III - Unit 1Sharada KadurNo ratings yet

- IMChap 1Document10 pagesIMChap 1babar zahoor100% (1)

- 1.1 Financial ServicesDocument60 pages1.1 Financial ServicesPrachi AsawaNo ratings yet

- A Marketing of Innovative E-Financial Services With Reference To SBI and ICICI BankDocument11 pagesA Marketing of Innovative E-Financial Services With Reference To SBI and ICICI BankInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Intro Mon Pol - Oct 19 ABRDocument150 pagesIntro Mon Pol - Oct 19 ABRSoumya JainNo ratings yet

- MBFS Financial SystemDocument40 pagesMBFS Financial SystemNagendra Basetti100% (1)

- 387 P16mba4ef6 2020051606081212 PDFDocument257 pages387 P16mba4ef6 2020051606081212 PDFParivel ParivelNo ratings yet

- Indian Financial SystemDocument5 pagesIndian Financial Systemshibashish PandaNo ratings yet

- Day1, Discuss The Evolution of IFS Post GFCDocument3 pagesDay1, Discuss The Evolution of IFS Post GFCjatinNo ratings yet

- Financial Services - Unit - 1Document19 pagesFinancial Services - Unit - 1rajesh337masssNo ratings yet

- Unit 2 EDocument50 pagesUnit 2 EDhamma DahiwaleNo ratings yet

- Module-3 Types of Financial ServicesDocument141 pagesModule-3 Types of Financial Serviceskarthik karthikNo ratings yet

- Financial Services Refer To The Range of Services Provided by The Financial IndustryDocument2 pagesFinancial Services Refer To The Range of Services Provided by The Financial Industrykhageswarsingh865No ratings yet

- 8 NBFCDocument110 pages8 NBFCrohit sharmaNo ratings yet

- Course OutlineDocument4 pagesCourse Outlinefbicia218No ratings yet

- Financial ServicesDocument7 pagesFinancial ServicesRaman KumarNo ratings yet

- Bank Management and Financial Services 9th Edition Rose Solutions ManualDocument17 pagesBank Management and Financial Services 9th Edition Rose Solutions Manualdubitateswanmarkm4nvo100% (26)

- Final Nancy121Document66 pagesFinal Nancy121Sahil SethiNo ratings yet

- MfI Chapter 1Document32 pagesMfI Chapter 1Jiru AlemayehuNo ratings yet

- Notes On Introduction To Financial ServicesDocument18 pagesNotes On Introduction To Financial ServicesKirti Giyamalani100% (1)

- Kami Export - MFS (Unit 1-4) Combine NotesDocument81 pagesKami Export - MFS (Unit 1-4) Combine Notesamangt9988No ratings yet

- Soft Copy of Project... 2Document21 pagesSoft Copy of Project... 2Jahid KhanNo ratings yet

- Marketing of Consumer Financial Products: Insights From Service MarketingFrom EverandMarketing of Consumer Financial Products: Insights From Service MarketingNo ratings yet

- Private Money Brokering Demystified: A Step-by-Step Guide for the Novice Real Estate InvestorFrom EverandPrivate Money Brokering Demystified: A Step-by-Step Guide for the Novice Real Estate InvestorNo ratings yet

- Unlocking Rental Wealth: Strategies for Successful Property Investment and ManagementFrom EverandUnlocking Rental Wealth: Strategies for Successful Property Investment and ManagementNo ratings yet

- FinanceDocument81 pagesFinanceAyesha GuptaNo ratings yet

- Chapter 6Document16 pagesChapter 6Ayesha GuptaNo ratings yet

- MarketingDocument5 pagesMarketingAyesha GuptaNo ratings yet

- Ch02 Organ Buying BehaviorDocument28 pagesCh02 Organ Buying BehaviorAyesha GuptaNo ratings yet

- Ch03 Cust Relationship MGMTDocument23 pagesCh03 Cust Relationship MGMTAyesha GuptaNo ratings yet

- 9588 - Handouts Session 1Document9 pages9588 - Handouts Session 1Ayesha GuptaNo ratings yet

- Understanding Leadership Styles and Competencies: DR - Kalpana SahooDocument25 pagesUnderstanding Leadership Styles and Competencies: DR - Kalpana SahooAyesha GuptaNo ratings yet

- FinanceDocument7 pagesFinanceAyesha GuptaNo ratings yet

- Biomedical PPT FinalDocument37 pagesBiomedical PPT FinalAyesha GuptaNo ratings yet

- 9599 - Mutual Fund AssignmentDocument4 pages9599 - Mutual Fund AssignmentAyesha GuptaNo ratings yet

- 1 A Indian Contract Act 1872Document36 pages1 A Indian Contract Act 1872Ayesha GuptaNo ratings yet

- SRM Final PPT - GRP7Document11 pagesSRM Final PPT - GRP7Ayesha GuptaNo ratings yet

- Decision MakingDocument31 pagesDecision MakingAyesha GuptaNo ratings yet

- Session 4 Introduction To ProbabilityDocument37 pagesSession 4 Introduction To ProbabilityAyesha GuptaNo ratings yet

- Session 3-Bivariate RepresentationDocument15 pagesSession 3-Bivariate RepresentationAyesha GuptaNo ratings yet

- 2 Consideration and Legality of ObjectsDocument38 pages2 Consideration and Legality of ObjectsAyesha GuptaNo ratings yet

- Comm PUMADocument12 pagesComm PUMAAyesha GuptaNo ratings yet

- Initial Public Offerings (Ipos) : Regulations & ProcessDocument54 pagesInitial Public Offerings (Ipos) : Regulations & ProcessAyesha GuptaNo ratings yet

- Operational Amplifiers: Basic Building Block Black BoxDocument27 pagesOperational Amplifiers: Basic Building Block Black BoxAyesha GuptaNo ratings yet

- Frequency Response of Two Stage RC Coupled AmplifierDocument38 pagesFrequency Response of Two Stage RC Coupled AmplifierAyesha Gupta100% (2)

- East Coast YachtsDocument6 pagesEast Coast YachtsMuhamad FudolahNo ratings yet

- CH 14 MC AlgoDocument27 pagesCH 14 MC AlgoLancelotNo ratings yet

- CourseHero FSDocument4 pagesCourseHero FSPraise BuenaflorNo ratings yet

- Accounting Quations IIDocument27 pagesAccounting Quations IIyoftahe habtamuNo ratings yet

- Annual Report of Honda AtlasDocument1 pageAnnual Report of Honda AtlaskEBAYNo ratings yet

- Save and Learn Money Market Fund ProspectusDocument43 pagesSave and Learn Money Market Fund ProspectusEunice QueNo ratings yet

- Capital Market - Types of Bonds Iasmania - Civil Services Preparation Online ! UPSC & IAS Study MaterialDocument5 pagesCapital Market - Types of Bonds Iasmania - Civil Services Preparation Online ! UPSC & IAS Study MaterialSundar MechNo ratings yet

- R21 Currency Exchange Rates IFT NotesDocument35 pagesR21 Currency Exchange Rates IFT NotesMohammad Jubayer AhmedNo ratings yet

- Financial Accounting and Reporting Test Bank 80102016 - 3: - Investment in AssociateDocument10 pagesFinancial Accounting and Reporting Test Bank 80102016 - 3: - Investment in AssociateFery AnnNo ratings yet

- Acca f7 FlashcardsDocument5 pagesAcca f7 FlashcardsAna CristescuNo ratings yet

- Sales and Marketing Plan Introduction and Fundamentals - Original FileDocument22 pagesSales and Marketing Plan Introduction and Fundamentals - Original FileShah XiaoNo ratings yet

- Havells India 3QF14 Result Review 30-01-14Document8 pagesHavells India 3QF14 Result Review 30-01-14GaneshNo ratings yet

- Working Capital Management NotesDocument5 pagesWorking Capital Management NotesAmbika Bm100% (1)

- Factors Affect Factors Affecting Working Capitaling Working CapitalDocument24 pagesFactors Affect Factors Affecting Working Capitaling Working Capitalranjita kelageriNo ratings yet

- Cashflow AnalysisDocument19 pagesCashflow Analysisgl101No ratings yet

- Acctg-Prelim ExamDocument5 pagesAcctg-Prelim Examrodelyn waclinNo ratings yet

- Finance 2midterm 2010 - SolutionsDocument5 pagesFinance 2midterm 2010 - SolutionsKelvin FuNo ratings yet

- Bus PlanDocument4 pagesBus PlanMohamed BanounNo ratings yet

- 1.the Branding of Club Atletico de Madrid .Document5 pages1.the Branding of Club Atletico de Madrid .kunalNo ratings yet

- Financial and Managerial Accounting 4th Edition Wild Test BankDocument23 pagesFinancial and Managerial Accounting 4th Edition Wild Test Bankmatildaamelinda25o3100% (26)

- CA Inter Paper 6Document1 pageCA Inter Paper 6ap.quatrroNo ratings yet

- Module 10Document4 pagesModule 10PaupauNo ratings yet

- Basics On Stock Market IndexDocument4 pagesBasics On Stock Market Indexben kookNo ratings yet

- This Study Resource Was Shared ViaDocument5 pagesThis Study Resource Was Shared ViaSophia Varias CruzNo ratings yet

- Alpha LTD: (A) Capital Reduction and Reorganisation AccountDocument2 pagesAlpha LTD: (A) Capital Reduction and Reorganisation AccountpatrickNo ratings yet

- Economics: Regulatory Arbitrage Regulation Used To Exploit Differences in EconomicDocument28 pagesEconomics: Regulatory Arbitrage Regulation Used To Exploit Differences in EconomicAniket JainNo ratings yet