Professional Documents

Culture Documents

GST - Input Tax Credit - Puneet Agrawal - 10 08 16 - NIRC of ICAI

GST - Input Tax Credit - Puneet Agrawal - 10 08 16 - NIRC of ICAI

Uploaded by

kOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GST - Input Tax Credit - Puneet Agrawal - 10 08 16 - NIRC of ICAI

GST - Input Tax Credit - Puneet Agrawal - 10 08 16 - NIRC of ICAI

Uploaded by

kCopyright:

Available Formats

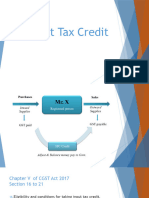

Input Tax Credit

By:- Puneet Agrawal

B. Com (H), CA, LLB

Partner

Athena Law Associates

Dell - Internal Use - Confidential

CONTENTS

This presentation covers-

Concept of Input Tax

Conditions and Restrictions for claiming input tax

Apportionment of credit

Transfer of credit

Reversal of credit

Manner of taking credit

Utilization of credit

Dell - Internal Use - Confidential

CONCEPT OF INPUT TAX

Dell - Internal Use - Confidential

Input Tax

• “Input tax” is defined in Section 2(57)

• Input tax in relation to a taxable person, means

– the {IGST and CGST}/{IGST and SGST}

– charged on

– any supply of goods and/or services to him

– which are used, or are intended to be used, in the course or furtherance

of his business and

– includes the tax payable under sub-section (3) of section 7 (tax paid on

reverse charge basis)

• “Input tax credit” means credit of ‘input tax’ as defined in section 2(56)

• It seems that there is some error in the definition of input tax credit. In the

said definition, “input tax” is referred as defined in Section 2(56) whereas it

is defined in Section 2(57).

Dell - Internal Use - Confidential

Athena Comments

• In the current scenario [as present in Cenvat Credit Rules, 2004 (CCR)], credit is available only in

respect of:

– input,

– input services, and

– capital goods.

• Thus, to avail CENVAT credit in respect of any goods/ services, it is essential that they must be

covered within the definitions of input/capital goods/input services, as the case maybe.

• However, in the GST scenario, the definition of input tax is very wide –

– any GST

– charged on

– supply of goods or services

– which are used (or to be used) in the course of furtherance of business

• Thus, there is no need to fit goods/ services within four corners of definition of input/capital

goods/input service

• Further as per the definition of “input tax”, there is no need for creating a relationship between the

goods or services availed and the output of a taxable person the only requirement is that such goods

should be used in the furtherance of business

Dell - Internal Use - Confidential

Athena Comments

• In the past, the definition of “input service” allowed credit in respect of “activities

relating to business”. Such provision has been subject matter of interpretation by

our courts in the context of CENVAT credit.

• In the landmark case of Coca Cola India Private Limited 2009-TIOL-449-HC-

MUM-ST this phrase (Activities relating to business) was analyzed by the Hon’ble

High Court in detail. High Court observed :

“27. ... that all and any activity relating to business falls within the definition of

input service provided there is a relation between the manufacturer of concentrate

and the activity. Therefore, the phrase “activities relating to business” are words of

wide import.”

• In the present context, the expression “in the course or furtherance of business”

would cover all activities related to the functioning of a business. For example in

relation to a manufacturer, business cannot be restricted only to the activity of

manufacturing the final products; rather it would comprise of all the integrated

activities comprising of whole of the business operations of the taxable person.

Dell - Internal Use - Confidential

Athena Comments

• Lets examine whether in terms of the definition of “input tax”, credit can be

made available on following goods/ services

– Gardening services used in factory

– Security services used for office of manufacturing unit

– Transport services provided to the office staff for commuting between

office and home

– Hiring a company for undertaking corporate social responsibility on

their behalf

Dell - Internal Use - Confidential

Input and Input Service

• “input” is defined in Section 2(54)

• Input means any goods other than capital goods, subject to exceptions as

may be provided under this Act or the rules made thereunder, used or

intended to be used by a supplier for making an outward supply in the

course or furtherance of business

• “input service” is defined in Section 2(55)

• Input Service means any service, subject to exceptions as may be provided

under this Act or the rules made thereunder, used or intended to be used by

a supplier for making an outward supply in the course or furtherance of

business

Dell - Internal Use - Confidential

Athena Comments

• Although “input” and “input service” are defined in the GST Act, but in GST

scenario these definitions have very limited use.

• It is pertinent to note that “input” and “input services” are defined in restrictive

sense (used by a supplier for making an outward supply) in comparison to the

definition of “input tax”; and thus, it creates an anomaly.

Dell - Internal Use - Confidential

Input Tax Credit (ITC) to Registered

Taxable Person

• Every registered taxable person shall

– subject to such conditions and restrictions as may be prescribed and within the time and

manner specified in section 35

– be entitled to take credit of input tax admissible to him.

• Such amount shall be credited to the electronic credit ledger of such person.

Continued..

Dell - Internal Use - Confidential

Newly Registered Person Voluntary Registration Dealer ceases to be a

composition dealer

A person who has applied for A person who has applied Where any registered taxable

registration within 30 days for voluntary registration person ceases to pay tax

from the date on which he (under section 19 (3)) shall under section 8, he shall be

becomes liable to registration, be entitled to take ITC in entitled to take

and has ultimately been granted respect of inputs which are credit of input tax in respect

such registration, shall also be - of inputs which are-

entitled to take ITC in respect o held in stock, and o held in stock, and

of inputs which are – o contained in semi- o inputs contained in

o held in stock, and finished or finished semi-finished or

o contained in semi- goods held in stock finished goods held

finished or finished … on the day immediately in stock

goods held in stock preceding the date of …..on the day immediately

… on the day immediately registration preceding the date from

preceding the date from which which he becomes liable to

he becomes liable to pay tax pay tax under section 7

In above three cases, a taxable person shall not be entitled to take input tax credit in respect

of any supply of goods and / or services to him after the expiry of 1 year from the date of

issue of tax invoice relating to such supply

Dell - Internal Use - Confidential

Athena Comments

• Availability of credit is linked with registration i.e. only registered taxable

persons are allowed credit.

• However, as per CCR, registration is not required for availing Cenvat credit and

this position has also been affirmed by various courts.

• In the case of any new business with a high initial investment and long gestation

period to earn any revenue from such investment (for example, research and

development for a pharmaceutical company), it would be difficult to claim input tax

credit in respect of the expenses made during investment stage

• In such cases, business would be liable to be registered at a later stage when it

generates revenue (for example, when the pharmaceutical sales begin in the market)

• For newly registered person, ITC is allowed in respect of inputs held in stock on

the day preceding the date from which the person becomes liable to pay tax.

• It does not specify as to what shall happen in respect of goods and services

received during the interval from the date on which he becomes liable to pay the

tax and the date which he is actually granted the registration.

Dell - Internal Use - Confidential

Negative List: Input Tax Credit not

available

• Input tax credit will not be available in respect of the

following:

A. MOTOR VEHICLES

However credit in respect of motor vehicles would be available in the

following cases:

– when supplied in usual course of business – for example, a Trader in

motor vehicles purchases motor vehicles and supplies them in usual

course of his business. He shall be eligible to claim credit of GST paid

on purchase of vehicles.

– Motor vehicles used for providing the following taxable services:

• transportation of passengers,

• transportation of goods, or

• imparting training on motor driving skills

Dell - Internal Use - Confidential

Athena comments

• If motor vehicles used for:

– Courier agency [transporting documents]

– Outdoor catering

– Pandal and shamiana

– Tour operator [may be said that they transport passengers –

but revenue may say that they transport tourists]

Dell - Internal Use - Confidential

No Input tax allowed

B. Goods and services provided in relation to:

o food and beverages

o outdoor catering

o beauty treatment

o health services

o cosmetic and plastic surgery

o membership of a club

o health and fitness centre

o life insurance

o health insurance

o travel benefits extended to employees on vacation such as leave or home

travel concession

… when such goods and services are used primarily for personal

use or consumption of any employee

Dell - Internal Use - Confidential

Athena Comments

This exclusion is a re-iteration of current exclusions.

If use of such goods and services can be shown to be more than just for personal use or

consumption of the employees, input tax credit would be available.

For example,

a modelling agency hiring services of beauticians for its model employees would be

eligible to claim credit of GST charged by the beauticians.

This is so because even though the models are employees, the services of beauty

treatment are not for mere personal use or consumption of the models; it is rather for the

provision of output services by the modelling agency itself.

FOOD FOR THOUGHT No. 1 -

If any goods and services are to be purchased by a company as per mandatory legal

requirement for benefit of employees, will ITC be available for these??

For example, a factory buys health insurance for all employees as per requirements

defined by Factories Act; will ITC be available even though such insurance is for

personal benefit of employees while being a requirement for furtherance of business also

??

Dell - Internal Use - Confidential

Athena Comments

FOOD FOR THOUGHT No. 2

Whether ITC be available in respect of an outdoor catering services where a

company hires such outdoor catering for a training event of employees;

It should be noted that this catering provides food for personal consumption of

employees; but such catering is a part of a larger goal of training the employees

for furtherance of business.

Dell - Internal Use - Confidential

No Input Tax Allowed (Cont.)

C. Works Contracts

– Goods and services

– acquired by the principal

– in the execution of works contract

– when such contract results in construction of immovable property,

other than plant and machinery

• This covers cases where:

– The person gives works contract to another contractor

Dell - Internal Use - Confidential

Athena Comments

If the result of works contract is plant and machinery, then credit remains

available.

Plant and machinery is not defined anywhere under the act.

These expressions have been interpreted to be very wide under other fiscal statutes.

This exclusion is guided from the predecessor laws where credit was generally not

allowed in respect of activities resulting in immovable property.

There is no sound logic to denying the credit of tax paid on goods and services used

in integral activities for furtherance of business; for example, construction of factory

or office building.

When the very philosophy of GST is to tax only the value additions, then denying

the credit on this integral activity relating to business seems to be guided by the past

rather than any sound logic.

Dell - Internal Use - Confidential

No Input Tax Allowed (Cont.)

D. Goods purchased for use in the construction

– Goods acquired by the principal

– which are used in the construction of immovable property, other than plant

and machinery, and

– which are not transferred by him to any other person.

• This covers cases where:

– The person purchase goods and uses them in construction of immovable

property for his own use

Dell - Internal Use - Confidential

No Input Tax Allowed (Cont.)

E. Goods and services on which tax has been paid under the

composition levy under section 8.

F. Goods and services used for private or personal

consumption to the extent they are so consumed.

Dell - Internal Use - Confidential

Athena comments

• Goods and services used for private / personal

consumption – deemed as supply

• No logic of denying credit

Dell - Internal Use - Confidential

CONDITIONS AND RESTRICTIONS

FOR CLAIMING INPUT TAX

Dell - Internal Use - Confidential

Conditions for claiming Credit

• No taxable person shall be entitled to the credit of any input tax unless following

four conditions are satisfied:

– he is in possession of a tax invoice, debit note, supplementary invoice or such other

taxpaying document as prescribed, issued by registered supplier

– he has received the goods or services

• it shall be deemed that the taxable person has received the goods where the goods

are delivered by the supplier to a recipient or any other person on the direction of

such taxable person, whether acting as an agent or otherwise, before or during

movement of goods, either by way of transfer of documents of title to goods or

otherwise.

– the tax is charged in respect of such supply has been actually paid to the credit of the

appropriate government, either in cash or utilization of input tax credit admissible in

respect of the said supply

– he has furnished the return under section 27

• A return furnished under sub-section (1) by a registered taxable person without

payment of full tax due as per such return shall not be treated as a valid return for

allowing input tax credit in respect of supplies made by such person.

Dell - Internal Use - Confidential

Athena Comments

• The third condition as per the list above is a severe provision.

• When the buyer of goods and services has already paid tax to the supplier, he

should be allowed to claim credit of such tax.

• Buyer has no resources to track that such tax has been deposited by supplier in

government treasury.

• Further, the buyer who has followed all legal provisions should not be penalized

due to the fault of supplier who has not deposited tax on time to the government

treasury.

• This provision is defeating the very purpose of GST i.e. to ensure availability of

credit of tax paid in a easy and convenient manner to taxpayers.

• Such provision is not present in CCR, however, such provision is there in certain

state VAT acts.

– Gheru Lal case (P&H HC)

– Mahalaxmi Cotton case (Bombay HC)

– Suvasini case (Delhi HC) – issue pending

Dell - Internal Use - Confidential

Conditions for claiming Credit

• It has further been stated that where the goods against an invoice are received in

lots or installments, the registered taxable person shall be entitled to the credit upon

receipt of the last lot or installment.

Dell - Internal Use - Confidential

Restrictions for claiming Credit

• Time Limit for claiming Credit

A taxable person shall not be entitled to take input tax credit in respect of

any supply after the earlier of following two events

1. filing of return under section 27 for the month of September following

the end of financial year to with such invoice pertains; or

2. filing of the relevant annual return

• Where the registered taxable person has claimed depreciation on the tax

component of the cost of capital goods under the provisions of the Income

Tax Act 1961, the input tax credit shall not be allowed on the said tax

component.

Dell - Internal Use - Confidential

Athena Comments

• Time limit for claiming credit of tax is present even in CCR. Currently, the time

limit is 1 year from date of invoice. Thus, presently in respect of all the invoices

taxable person can claim credit any time within 1 year from the date of invoice. In

GST scenario, in respect of invoices for the month of Jan – March tax payer would

be available with a little time for availing credit. Due to this, the taxpayer has to be

vigilant to ensure that all invoices have been booked on time and GST has been

claimed.

• This provision may discourage timely filing of annual return by taxpayers since

they would be at an advantage (get more time to claim credit) if they delay the

annual filing for financial year to the month of November.

• The table below illustrates the time limit of claiming credit under different

scenarios of filing of annual return by taxpayer for the same month of invoice:

Month of Time Limit 1 - Month Time Limit 2 – Month of filing for return Applicable Time Time limit

Invoice of filing annual return u/s 27 for month of September limit available to

for FY of invoice following end of FY of invoice claim credit

20 Mar’15 20 July’15 20 Nov’15 20 July’15 4 months

20 Mar’15 20 Dec’15 20 Nov’15 20 Nov’15 8 months

Dell - Internal Use - Confidential

APPORTIONMENT OF CREDIT

Dell - Internal Use - Confidential

Apportionment of credit in certain cases

• Where the goods and services are used by the registered taxable person

partly for the purpose of any business and partly for other purposes, the

amount of credit shall be restricted to so much of the input tax as

attributable to the purposes of his business.

• where the goods and services are used by the registered taxable person

partly for effecting taxable supplies and partly for effecting non-taxable

supplies, including exempt supplies but excluding zero-rated supplies, the

amount of credit shall be restricted to so much of the input tax as is

attributable to the taxable supplies including zero-rated supplies.

• The appropriate government may, by notification, prescribe the manner in

which the credit referred above may be attributed.

Dell - Internal Use - Confidential

TRANSFER OF CREDIT

Dell - Internal Use - Confidential

Transfer of credit

• where there is a change in the constitution of a registered taxable person on

account of

– sale,

– merger,

– demerger,

– amalgamation,

– lease or

– transfer of the business

• with the specific provision for transfer of liabilities,

• the said registered taxable person shall be allowed to transfer the input tax

credit that remains unutilized in its books of accounts to such sold, merged,

demerged, amalgamated, leased or transferred business in the manner

prescribed.

Dell - Internal Use - Confidential

REVERSAL OF CREDIT

Dell - Internal Use - Confidential

Reversal of credit in certain cases

• Where

– a registered taxable person switches to composition levy scheme (under section 8)

or where the goods; or

– services supplied by him become exempt absolutely under section 10,

…he shall pay an amount equal and to the credit of input tax in respect of

– imports held in stock; and

– inputs contained in semi finished or finished goods held in stock

……on the day immediately preceding the date of such switchover or the date of such

exemption.

• If after payment of such amount, any balance remains in input tax credit the

same shall be lapsed.

Dell - Internal Use - Confidential

Reversal of credit in certain cases (contd.)

• In case the taxable person supplies capital goods on which input tax credit

has been taken, he shall pay an amount equal to

– input tax credit taken on said capital goods reduced by the percentage points as may be

specified in this behalf; or

– the tax on transaction value such goods,

– whichever is higher

Dell - Internal Use - Confidential

MANNER OF TAKING CREDIT

Dell - Internal Use - Confidential

Claim of ITC on provision basis

Step 1 for taking ITC

• As per Section 28, every taxable person shall be entitled to take credit of

input tax,

– as self assessed, in his return and

– such amount shall be credited, on a provisional basis,to his electronic

credit ledger to be maintained in the manner as may be prescribed

• Provided that a taxable person who has not furnished a valid return under

section 27 of the Act shall not be allowed to utilize such credit till he

discharges his self-assessed tax liability

Dell - Internal Use - Confidential

Finalization of Claim of ITC

Step 2 for taking ITC (Section 29)

Matching of claim of ITC

• The details of inward supply furnished by taxable person (“recipient”) for a

tax period be matched-

– With the corresponding details of outward supply furnished by the

corresponding taxable person (“Supplier”) in his valid return for the same tax

period or any preceding tax period

– With the additional duty of customs paid under Section 3 of the Customs Tariff

Act, 1975

• The claim of input tax credit be finally accepted and shall be communicated

to the recipient where-

– Invoices and/ or debit notes relating to inward supply matches with the details

of corresponding outward supply or with the additional duty of customs paid

Dell - Internal Use - Confidential

Finalization of Claim of ITC

• Where ITC claimed by recipient in respect of inward supply is

in excess of tax declared by the supplier for the same supply or

the outward supply is not declared by supplier in his valid

return then:

– The discrepancy shall be communicated to both i.e. the recipient and the

supplier

– If such discrepancy is not rectified by the supplier in his valid return for the

month in which discrepancy is communicated then the amount of

discrepancy shall be added to the output tax liability of the recipient for the

month succeeding the month in which discrepancy is communicated

– The recipient is also required to pay interest on said addition of output

liability at the rate specified under Section 36(1)

Dell - Internal Use - Confidential

Finalization of Claim of ITC

Excess of ITC on account of duplication of claim

• The duplication of claim of ITC shall be communicated to the

recipient

• The amount of claim of ITC that is found to be in excess on

account of duplication of claim shall be added to the output tax

liability of the recipient - for the month in which duplication

is communicated

• In such case recipient is also required to pay interest at the rate

specified in Section 36(1)

Dell - Internal Use - Confidential

UTILIZATION OF CREDIT

Dell - Internal Use - Confidential

Utilizing ITC

• The ITC as self assessed (Section 28) in the return of the

taxable person shall be credited to his electronic credit ledger

• The amount available in electronic credit ledger may be used

for making any payment towards tax payable under the act-

– In such manner

– Subject to such conditions; and

– Within such time as may be prescribed

Dell - Internal Use - Confidential

Order of Preference for using ITC relating

to different taxes i.e. IGST/ SGST/ CGST

• The taxable person may have ITC on account of various taxes

such as IGST/ CGST/ SGST – following is the table that

summaries the order of preference for using the credit

available on account of different taxes

Type of First Second Third Comments

credit preference preference preference

IGST IGST CGST SGST

CGST CGST IGST - Credit pertaining to CGST

cannot be used for payment of

SGST

SGST SGST IGST - Credit pertaining to SGST

cannot be used for payment of

CGST

Dell - Internal Use - Confidential

Questions??

Dell - Internal Use - Confidential

THANK YOU

Contact us:

Puneet Agrawal

Partner

Athena Law Associates

puneet@athenalawassociates.com

+91-9891-898911

Website: athena.org.in

Blog: gstlawindia.com

Dell - Internal Use - Confidential

You might also like

- Exercise 19-27 Return On Investment Residual Income EVA® (LO 19-1, 19-2, 19-3)Document2 pagesExercise 19-27 Return On Investment Residual Income EVA® (LO 19-1, 19-2, 19-3)Chryshelle LontokNo ratings yet

- (Indian Economy - 2) UNIT - 2 POLICIES AND PERFORMANCE IN INDUSTRYDocument16 pages(Indian Economy - 2) UNIT - 2 POLICIES AND PERFORMANCE IN INDUSTRYAndroid Boy100% (2)

- Financial System, Markets and ServicesDocument65 pagesFinancial System, Markets and Servicessatya123b8101100% (1)

- Derivatives Disaster SumitomoDocument3 pagesDerivatives Disaster SumitomopoojaNo ratings yet

- Entrepreneurship Project On Gaming Zone in UniversityDocument50 pagesEntrepreneurship Project On Gaming Zone in UniversityArslan Ali Butt89% (19)

- 6.case Study On Input Tax Credit Under GSTDocument17 pages6.case Study On Input Tax Credit Under GSTSUNIL PUJARINo ratings yet

- Goods and Services Tax (GST) in India: Input Tax Credit (ITC)Document24 pagesGoods and Services Tax (GST) in India: Input Tax Credit (ITC)Noman AreebNo ratings yet

- IDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesDocument27 pagesIDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesRonita DuttaNo ratings yet

- Session 3 & 4 - Input Tax Credit and Cross Utilisation of Taxes FinalDocument42 pagesSession 3 & 4 - Input Tax Credit and Cross Utilisation of Taxes FinalaskNo ratings yet

- Input Tax CreditDocument16 pagesInput Tax CreditPreeti SapkalNo ratings yet

- Presentation 1Document23 pagesPresentation 1Adiba maazNo ratings yet

- Input Tax Credit: Speaker: Sudhir V SDocument31 pagesInput Tax Credit: Speaker: Sudhir V Smahi_kunkuNo ratings yet

- 66519bos53752 cp6Document100 pages66519bos53752 cp6Aditya ThesiaNo ratings yet

- Overview of Input Tax Credit: CMA Arindam GoswamiDocument4 pagesOverview of Input Tax Credit: CMA Arindam Goswamiharshadaphandge165No ratings yet

- 6 ItcDocument114 pages6 ItcRAUNAQ SHARMANo ratings yet

- Input Tax credit-GSTDocument17 pagesInput Tax credit-GSTSandhya DangiNo ratings yet

- Kjaefncl (Complete)Document42 pagesKjaefncl (Complete)Kenzo RodisNo ratings yet

- G.R. No. 153866. February 11, 2005Document3 pagesG.R. No. 153866. February 11, 2005samaral bentesinkoNo ratings yet

- GST Overview Rachana 1Document31 pagesGST Overview Rachana 1Path A Way AheadNo ratings yet

- Highlights of Budgetary Changes 2022 - VATDocument22 pagesHighlights of Budgetary Changes 2022 - VATRoyNo ratings yet

- Standardised PPT On Revised Model GST Law (Nov 2016)Document234 pagesStandardised PPT On Revised Model GST Law (Nov 2016)bharigopan8360No ratings yet

- 62329bos50452 cp8Document186 pages62329bos50452 cp8Pabitra Kumar PrustyNo ratings yet

- 67767bos54359 cp8 PDFDocument193 pages67767bos54359 cp8 PDFvenuNo ratings yet

- 012 Terms and Phrases You Must Know Under GST - Part IDocument3 pages012 Terms and Phrases You Must Know Under GST - Part I0amrevkapeed0No ratings yet

- Input Tax Credit-Cp8Document118 pagesInput Tax Credit-Cp8Shipra SonaliNo ratings yet

- Comparative Analysis Under GST RegimeDocument5 pagesComparative Analysis Under GST RegimeAmita SinwarNo ratings yet

- Profits and Gains of Business - JBIMSDocument85 pagesProfits and Gains of Business - JBIMSSwapnil ManeNo ratings yet

- 76220bos61590 cp7Document208 pages76220bos61590 cp7Sunil KumarNo ratings yet

- Tax Glimpses 2012Document92 pagesTax Glimpses 2012CharuJagwaniNo ratings yet

- Imports Under Gst02june2017Document2 pagesImports Under Gst02june2017shahruchirNo ratings yet

- 07) CIR V Seagate Tech PhilsDocument3 pages07) CIR V Seagate Tech PhilsAlfonso Miguel LopezNo ratings yet

- Itc FinalDocument47 pagesItc FinalarshiaNo ratings yet

- Cs Executive Idt Marathon NotesDocument239 pagesCs Executive Idt Marathon NotesChayank lohchabNo ratings yet

- PGBP Complete TheoryDocument21 pagesPGBP Complete TheoryNirbheek Doyal100% (4)

- 2) Income From Business (Head of Income) : Hamza Hashmi Advocate Hight CourtDocument19 pages2) Income From Business (Head of Income) : Hamza Hashmi Advocate Hight CourtArham SheikhNo ratings yet

- Itc GSTDocument22 pagesItc GST311812922nishanthininkNo ratings yet

- Gstrajkagrawal InputtaxcreditDocument6 pagesGstrajkagrawal InputtaxcreditPrince Of no oneNo ratings yet

- G. CIR vs. Seagate Technology, GR No. 153866, 11 Feb 2005Document32 pagesG. CIR vs. Seagate Technology, GR No. 153866, 11 Feb 2005WAYNENo ratings yet

- Newdelhi) / (2014) 362 Itr 134 (Aar - Newdelhi) / (2014) 265 CTR 449 (Aar - Newdelhi)Document4 pagesNewdelhi) / (2014) 362 Itr 134 (Aar - Newdelhi) / (2014) 265 CTR 449 (Aar - Newdelhi)Karsin ManochaNo ratings yet

- 4th Session - ISD and Cross Charge - by CA Samir Kapadia SirDocument42 pages4th Session - ISD and Cross Charge - by CA Samir Kapadia Sirvaishaliak2008No ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument36 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaManjunathreddy SeshadriNo ratings yet

- "Isolated Activity": Sybbi / Sybaf PGBP Direct Taxation-II Chapter 5:-Profits & Gains of Business or ProfessionDocument5 pages"Isolated Activity": Sybbi / Sybaf PGBP Direct Taxation-II Chapter 5:-Profits & Gains of Business or Professionas2207530No ratings yet

- New Microsoft Word DocumentDocument5 pagesNew Microsoft Word Documentparth.sharma0029No ratings yet

- Input Tax Credit Mechanism in GSTDocument9 pagesInput Tax Credit Mechanism in GSThanumanthaiahgowdaNo ratings yet

- Important GST Amendments in Budget 2023 - Taxguru - in PDFDocument10 pagesImportant GST Amendments in Budget 2023 - Taxguru - in PDFPawan AswaniNo ratings yet

- Section 165Document10 pagesSection 165aindri.sahaNo ratings yet

- Instructions For Form 8810: Corporate Passive Activity Loss and Credit LimitationsDocument12 pagesInstructions For Form 8810: Corporate Passive Activity Loss and Credit LimitationsIRSNo ratings yet

- Idt 2Document10 pagesIdt 2manan agrawalNo ratings yet

- Economic Update 17th May-1Document2 pagesEconomic Update 17th May-1mNo ratings yet

- Goods and Services Tax: Basic ConceptsDocument11 pagesGoods and Services Tax: Basic ConceptsVenkatraman NatarajanNo ratings yet

- S. 16: Eligibility & Conditions: Receipt of Document Forward Charge Cases (FCM)Document3 pagesS. 16: Eligibility & Conditions: Receipt of Document Forward Charge Cases (FCM)MANU SHANKARNo ratings yet

- Itc FormsDocument5 pagesItc FormssaranistudyNo ratings yet

- NR Tds 195 (1) CA Kapil GoelDocument63 pagesNR Tds 195 (1) CA Kapil GoelSridharRaoNo ratings yet

- Input Tax CreditDocument8 pagesInput Tax CreditPranjal AgrawalNo ratings yet

- Export and ImportDocument13 pagesExport and ImportkingslinNo ratings yet

- Tax Planning and Financial Management Decisions: CA Aarti PatkiDocument50 pagesTax Planning and Financial Management Decisions: CA Aarti PatkiRahul SinghNo ratings yet

- GST - Part 1Document81 pagesGST - Part 1Robin LiuNo ratings yet

- Unit 4 - GST Liability & Input Tax CreditDocument13 pagesUnit 4 - GST Liability & Input Tax CreditPrathik PsNo ratings yet

- Article On Composition Scheme With Case StudyDocument12 pagesArticle On Composition Scheme With Case StudySejal GuptaNo ratings yet

- B4 Nov MSDocument13 pagesB4 Nov MSCerealis FelicianNo ratings yet

- Input Tax Credit Under GSTDocument4 pagesInput Tax Credit Under GSTharshadaphandge165No ratings yet

- Guide AppDocument43 pagesGuide AppjonbelzaNo ratings yet

- Budget - 2012 - HighlightsDocument16 pagesBudget - 2012 - Highlightskris_neelNo ratings yet

- October 12,: Vat Zero-Rated Sale of Service (Labor Aspect)Document6 pagesOctober 12,: Vat Zero-Rated Sale of Service (Labor Aspect)LaBron JamesNo ratings yet

- OFAC Blocked Property GuidanceDocument3 pagesOFAC Blocked Property GuidanceRonald WederfoortNo ratings yet

- Renatus Bulletin 1.22.12Document4 pagesRenatus Bulletin 1.22.12Donyetta JenkinsNo ratings yet

- B95) of Insurance ContractDocument2 pagesB95) of Insurance Contractkarina gayosNo ratings yet

- Chapter 3 - Task and Macro Environments of ManagementDocument43 pagesChapter 3 - Task and Macro Environments of ManagementNeel PeswaniNo ratings yet

- MPA Brochure 2018Document20 pagesMPA Brochure 2018Masfadhlul KarmiNo ratings yet

- 01 Merger and Acquisition QADocument5 pages01 Merger and Acquisition QApijiyo78No ratings yet

- Financial Statement Analysis: MGT-537 Dr. Hafiz Muhammad Ishaq 32Document77 pagesFinancial Statement Analysis: MGT-537 Dr. Hafiz Muhammad Ishaq 32gazmeerNo ratings yet

- Shipra SrishtiDocument8 pagesShipra SrishtiGreen Realtech Projects Pvt LtdNo ratings yet

- WEF Scenarios SouthCaucasusCentralAsia Report 2014Document48 pagesWEF Scenarios SouthCaucasusCentralAsia Report 2014Daniel ZaretskyNo ratings yet

- Cepde MasterDocument244 pagesCepde MasterDivyamNo ratings yet

- Online Portfolio SelectionDocument227 pagesOnline Portfolio SelectionChua Yong Sheng DarrenNo ratings yet

- Global Value How To Spot Bubbles, Avoid Market Crashes, and Earn Big Returns in The Stock Market (PDFDrive)Document88 pagesGlobal Value How To Spot Bubbles, Avoid Market Crashes, and Earn Big Returns in The Stock Market (PDFDrive)Mihaela Milea0% (1)

- SuplementsDocument6 pagesSuplementsRenalyn OlasimanNo ratings yet

- BWD Aar Cy 2010 Notes To Fs Dec 5Document8 pagesBWD Aar Cy 2010 Notes To Fs Dec 5melanie81No ratings yet

- Second Year Mba Syllabus (Only Electives) Third Semester Functional Area: MarketingDocument21 pagesSecond Year Mba Syllabus (Only Electives) Third Semester Functional Area: MarketingSatya ReddyNo ratings yet

- AMORTIZATIONDocument10 pagesAMORTIZATIONManuella RyanNo ratings yet

- Real Estate Finance and Investments 13Th Edition Brueggeman Test Bank Full Chapter PDFDocument35 pagesReal Estate Finance and Investments 13Th Edition Brueggeman Test Bank Full Chapter PDFMichaelHughesafdmb100% (9)

- Winingtrades in A RowDocument106 pagesWiningtrades in A RowtingNo ratings yet

- November 2013Document64 pagesNovember 2013Eric SantiagoNo ratings yet

- Frs1, Cash Flow Statements: The Scope and Authority of FrssDocument11 pagesFrs1, Cash Flow Statements: The Scope and Authority of FrssKavee JhugrooNo ratings yet

- Airline Disclosure Guide Aircraft AcquisitionDocument20 pagesAirline Disclosure Guide Aircraft AcquisitionSlamet SupriyadiNo ratings yet

- Market Share - PPMDocument13 pagesMarket Share - PPMyounginvNo ratings yet

- Topic 4Document17 pagesTopic 4andy033003No ratings yet

- Assignment CHPT 12Document3 pagesAssignment CHPT 12Sultan LimitNo ratings yet

- Overview of Credit RatingsDocument13 pagesOverview of Credit RatingsFragancias Europeas CTNo ratings yet