Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

149 viewsOption Trading: Presented By: Ankit Agarwal MMS - 201

Option Trading: Presented By: Ankit Agarwal MMS - 201

Uploaded by

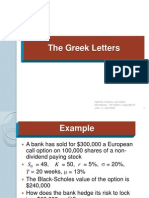

ankit_85The document discusses option Greeks and delta neutral trading. It defines the five main option Greeks - delta, gamma, vega, theta, and rho - which measure an option's sensitivity to changes in the underlying asset price, volatility, time to expiration, and interest rates. Delta measures price sensitivity, gamma measures delta's sensitivity, vega measures volatility sensitivity, theta measures time decay, and rho measures interest rate sensitivity. The document then explains how delta neutral trading can remove small directional risks and potentially profit from volatility by having a near-zero delta position.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- Trading Implied Volatility: Extrinsiq Advanced Options Trading Guides, #4From EverandTrading Implied Volatility: Extrinsiq Advanced Options Trading Guides, #4Rating: 4 out of 5 stars4/5 (1)

- Fule Station 2 (Pas Ful)Document24 pagesFule Station 2 (Pas Ful)Heyder Abdusamad93% (54)

- Wiring OptionsDocument81 pagesWiring Optionsmahaan khatri100% (7)

- Understanding Financial Statements - Making More Authoritative BCDocument6 pagesUnderstanding Financial Statements - Making More Authoritative BCLakshmi Narasimha MoorthyNo ratings yet

- Option Greeks and Management of Market RiskDocument14 pagesOption Greeks and Management of Market RiskSantosh More100% (1)

- 12 - Advanced Option GreeksDocument72 pages12 - Advanced Option Greekssoutik sarkar100% (3)

- Option Greeks for Traders : Part I, Delta, Vega & Theta: Extrinsiq Advanced Options Trading Guides, #5From EverandOption Greeks for Traders : Part I, Delta, Vega & Theta: Extrinsiq Advanced Options Trading Guides, #5No ratings yet

- Financial Ratio Analysis of Bharti AirtelDocument19 pagesFinancial Ratio Analysis of Bharti AirtelDivya Patel50% (2)

- GreeksDocument19 pagesGreeksTafadzwa bee MasumbukoNo ratings yet

- Chapter 6Document45 pagesChapter 6vaman kambleNo ratings yet

- OI - Geeks by ChirraDocument6 pagesOI - Geeks by ChirraQuant R&DNo ratings yet

- Option Pit Boot Camp The Option Pit Method For Trading OptionsDocument55 pagesOption Pit Boot Camp The Option Pit Method For Trading OptionsVineet Vidyavilas PathakNo ratings yet

- Sensitivity AnalysisDocument43 pagesSensitivity AnalysisAsmi KedareNo ratings yet

- Greek OptionDocument9 pagesGreek OptionAbhishek RajNo ratings yet

- Option GreeksDocument24 pagesOption Greeksfreefireguesttwo2No ratings yet

- Why Investors Need To Take The Option Pit Gold CourseDocument38 pagesWhy Investors Need To Take The Option Pit Gold CourseEdmond ThamNo ratings yet

- Option Greeks Part IDocument11 pagesOption Greeks Part Iagt0062No ratings yet

- Ise FX Greeks 121207Document81 pagesIse FX Greeks 121207Satendra KumarNo ratings yet

- Introduction To Derivatives MarketDocument42 pagesIntroduction To Derivatives Marketpriyank2110No ratings yet

- Fintech Chapter 12: OptionsDocument25 pagesFintech Chapter 12: OptionsAllen Uhomist AuNo ratings yet

- Option VolatilityDocument50 pagesOption VolatilityJunedi dNo ratings yet

- Delta Hedging PDFDocument29 pagesDelta Hedging PDFLê AnhNo ratings yet

- Option GreeksDocument135 pagesOption GreeksYugen NamiNo ratings yet

- Overview of Options - An Introduction: October 2004Document82 pagesOverview of Options - An Introduction: October 2004Sharoin SherrifNo ratings yet

- Option GreeksDocument1 pageOption Greeksbiswajit1011aNo ratings yet

- Introduction To GreeksDocument33 pagesIntroduction To GreeksSidharth VarshneyNo ratings yet

- Options Trading For Income Crash Course Day 1Document40 pagesOptions Trading For Income Crash Course Day 1Fernando GallegoNo ratings yet

- Valuation: Equivalent PortfolioDocument24 pagesValuation: Equivalent PortfoliobNo ratings yet

- Option Greeks 4&5Document64 pagesOption Greeks 4&5Saha AmitNo ratings yet

- Option - DerivativesDocument89 pagesOption - DerivativesProf. Suyog ChachadNo ratings yet

- The Greek LettersDocument18 pagesThe Greek LettersSupreet GuptaNo ratings yet

- OptionsDocument49 pagesOptionssacos16074No ratings yet

- Trading EarningsDocument60 pagesTrading EarningsaaaaNo ratings yet

- Trading and Hedging OptionsDocument35 pagesTrading and Hedging Optionsnaimabdullah275% (4)

- Introduction To Derivatives Market: Khader ShaikDocument45 pagesIntroduction To Derivatives Market: Khader Shaikms.AhmedNo ratings yet

- Mba III OptionsDocument67 pagesMba III OptionsRitik MishraNo ratings yet

- Chapter 8 PDFDocument43 pagesChapter 8 PDFCarlosNo ratings yet

- Underlying Determining Parameters, Such As Volatility or The Price of The Underlying AssetDocument2 pagesUnderlying Determining Parameters, Such As Volatility or The Price of The Underlying AssetLeo the BulldogNo ratings yet

- FSD6Document2 pagesFSD6Leo the BulldogNo ratings yet

- 05derivativesmarketarz 100709171035 Phpapp01Document40 pages05derivativesmarketarz 100709171035 Phpapp01leblitzer_0No ratings yet

- Option Writing WebinarDocument46 pagesOption Writing WebinarSwastik TiwariNo ratings yet

- Mid Term Notes-Financial EngineeringDocument32 pagesMid Term Notes-Financial Engineeringgupta tanmayNo ratings yet

- DerivativesDocument29 pagesDerivativessumitbabar0% (1)

- FM - BA - Option Pricing and Market Efficiency Model - ModuleIVDocument37 pagesFM - BA - Option Pricing and Market Efficiency Model - ModuleIVyogesh.jaiyawalaNo ratings yet

- Topic 12 Futures and OptionsDocument19 pagesTopic 12 Futures and OptionsPremah BalasundramNo ratings yet

- Trading With OptionsDocument33 pagesTrading With Optionsartus14No ratings yet

- 05 Derivatives Market ARZ PDFDocument45 pages05 Derivatives Market ARZ PDFDaviNo ratings yet

- Steve Meizinger: Trading Calendar Spreads Using ISE FX OptionsDocument43 pagesSteve Meizinger: Trading Calendar Spreads Using ISE FX OptionsumashankarsNo ratings yet

- MMS Derivatives Lec 4Document64 pagesMMS Derivatives Lec 4AzharNo ratings yet

- Graham3e ppt08Document38 pagesGraham3e ppt08Lim Yu ChengNo ratings yet

- FuturesDocument117 pagesFuturesLekha GuptaNo ratings yet

- Forex Trading - IntroDocument26 pagesForex Trading - IntroKamran MehboobNo ratings yet

- Here's How Traders Can Use Delta and Gamma For Options TradingDocument3 pagesHere's How Traders Can Use Delta and Gamma For Options TradingGagandeep Singh LoteyNo ratings yet

- E Book of OptionsDocument29 pagesE Book of OptionsmohitNo ratings yet

- Module 4Document23 pagesModule 4BABA SIDNo ratings yet

- Derivative ABN AMRODocument22 pagesDerivative ABN AMROtcsdeepanshuNo ratings yet

- Topic Five: (Text Book: Chapter 7)Document35 pagesTopic Five: (Text Book: Chapter 7)Hamdan HassinNo ratings yet

- OFD 10 OptionGreeksDocument19 pagesOFD 10 OptionGreeksANADI NATH MISHRANo ratings yet

- The Greek Letters of An OptionDocument21 pagesThe Greek Letters of An OptionMinh Huỳnh Nguyễn NhậtNo ratings yet

- Summary of Nishant Pant's Mean Reversion TradingFrom EverandSummary of Nishant Pant's Mean Reversion TradingRating: 5 out of 5 stars5/5 (1)

- What About Options?: A Prelude to Profitable Options TradingFrom EverandWhat About Options?: A Prelude to Profitable Options TradingRating: 3 out of 5 stars3/5 (1)

- Analysis of Tax NewsDocument9 pagesAnalysis of Tax Newsankit_85No ratings yet

- Financial Risk Management - The Way ForwardDocument31 pagesFinancial Risk Management - The Way Forwardankit_85No ratings yet

- Financial Risk Management - The Way ForwardDocument31 pagesFinancial Risk Management - The Way Forwardankit_85No ratings yet

- Social Marketing DiabetesDocument22 pagesSocial Marketing Diabetesankit_85No ratings yet

- Freitag Brothers FinalDocument4 pagesFreitag Brothers FinalFAJAR MIRNo ratings yet

- Ramco Cements StandaloneDocument13 pagesRamco Cements StandaloneTao LoheNo ratings yet

- Huzaima Jamal-1Document11 pagesHuzaima Jamal-1Fatima ZehraNo ratings yet

- Kamat Hotels (India) LTD.: Buy Industry: Hotels Price Target: Rs.250Document16 pagesKamat Hotels (India) LTD.: Buy Industry: Hotels Price Target: Rs.250Mga PartsNo ratings yet

- Fundamental AnalysisDocument48 pagesFundamental AnalysisBisma MasoodNo ratings yet

- Management Accounting: Segment Reporting & DecentralizationDocument20 pagesManagement Accounting: Segment Reporting & DecentralizationSamiul AzamNo ratings yet

- Topic 3 5 Ratio AnalysisDocument16 pagesTopic 3 5 Ratio AnalysisEren BarlasNo ratings yet

- Capital StructureDocument10 pagesCapital StructureVivekNo ratings yet

- Pitchbook - Trading Business: BSE LTDDocument34 pagesPitchbook - Trading Business: BSE LTDVenu MadhavNo ratings yet

- Freer On Corporations BarbriDocument38 pagesFreer On Corporations BarbriJEL100% (1)

- A+ Answers To Multiple Choice QuestionsDocument51 pagesA+ Answers To Multiple Choice QuestionsjupiterukNo ratings yet

- Introduction To International Financial Management: Powerpoint® Lecture PresentationDocument34 pagesIntroduction To International Financial Management: Powerpoint® Lecture PresentationRafiqul Islam100% (2)

- Financial Case On Comfort Airlines: by Money Makers'Document14 pagesFinancial Case On Comfort Airlines: by Money Makers'Jubayer Uddin Shamim 1511989647No ratings yet

- FinMan 12 IPO and Hybrid Financing 2015Document50 pagesFinMan 12 IPO and Hybrid Financing 2015panjiNo ratings yet

- A Study On Ratio Analysis of Laxmi BankDocument7 pagesA Study On Ratio Analysis of Laxmi BankAyesha james75% (4)

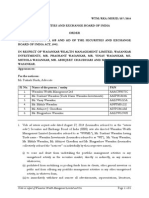

- Order in Respect of Wasankar Wealth Management Limited, Wasankar Investments, Mr. Prashant Wasankar, Mr. Vinay Wasankar, Ms. Mithila, Mr. Abhijeet Chaudhari and Ms. Bhagyashree WasankarDocument6 pagesOrder in Respect of Wasankar Wealth Management Limited, Wasankar Investments, Mr. Prashant Wasankar, Mr. Vinay Wasankar, Ms. Mithila, Mr. Abhijeet Chaudhari and Ms. Bhagyashree WasankarShyam SunderNo ratings yet

- Escrow OfficerDocument4 pagesEscrow Officerapi-121435323No ratings yet

- CorpusDocument162 pagesCorpussiewyukNo ratings yet

- Private Capital Investing: Private Equity - Private DebtDocument20 pagesPrivate Capital Investing: Private Equity - Private Debtw_fibNo ratings yet

- Account Opening ProcessDocument3 pagesAccount Opening Processsaad777No ratings yet

- Advanced Final 2018 2019 2eDocument10 pagesAdvanced Final 2018 2019 2eFlorenzOpingaNo ratings yet

- Cash Flow Statement Literature ReviewDocument6 pagesCash Flow Statement Literature Reviewc5td1cmc100% (1)

- CH 04Document23 pagesCH 04charlie simoNo ratings yet

- Analysis of Capital Structure Stability of Listed Firm in ChinaDocument16 pagesAnalysis of Capital Structure Stability of Listed Firm in ChinaAhmed BakhtNo ratings yet

- 08 - Performance - Task - Risk and Rates of Return PDFDocument1 page08 - Performance - Task - Risk and Rates of Return PDFRhea Mae AbeniaNo ratings yet

- PNL LSB826Document8 pagesPNL LSB826Omkar DesaiNo ratings yet

- Accountancy - XII - QPDocument5 pagesAccountancy - XII - QPKulvirkuljitharmeet singhNo ratings yet

Option Trading: Presented By: Ankit Agarwal MMS - 201

Option Trading: Presented By: Ankit Agarwal MMS - 201

Uploaded by

ankit_850 ratings0% found this document useful (0 votes)

149 views20 pagesThe document discusses option Greeks and delta neutral trading. It defines the five main option Greeks - delta, gamma, vega, theta, and rho - which measure an option's sensitivity to changes in the underlying asset price, volatility, time to expiration, and interest rates. Delta measures price sensitivity, gamma measures delta's sensitivity, vega measures volatility sensitivity, theta measures time decay, and rho measures interest rate sensitivity. The document then explains how delta neutral trading can remove small directional risks and potentially profit from volatility by having a near-zero delta position.

Original Description:

Original Title

Option Trading

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses option Greeks and delta neutral trading. It defines the five main option Greeks - delta, gamma, vega, theta, and rho - which measure an option's sensitivity to changes in the underlying asset price, volatility, time to expiration, and interest rates. Delta measures price sensitivity, gamma measures delta's sensitivity, vega measures volatility sensitivity, theta measures time decay, and rho measures interest rate sensitivity. The document then explains how delta neutral trading can remove small directional risks and potentially profit from volatility by having a near-zero delta position.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

149 views20 pagesOption Trading: Presented By: Ankit Agarwal MMS - 201

Option Trading: Presented By: Ankit Agarwal MMS - 201

Uploaded by

ankit_85The document discusses option Greeks and delta neutral trading. It defines the five main option Greeks - delta, gamma, vega, theta, and rho - which measure an option's sensitivity to changes in the underlying asset price, volatility, time to expiration, and interest rates. Delta measures price sensitivity, gamma measures delta's sensitivity, vega measures volatility sensitivity, theta measures time decay, and rho measures interest rate sensitivity. The document then explains how delta neutral trading can remove small directional risks and potentially profit from volatility by having a near-zero delta position.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 20

Option

Trading Presented By:

Ankit Agarwal

MMS - 201

Options

• Options are derivative instruments, as their fair

price derives from the value of the other asset,

called the underlying.

• Measure the sensitivity of the price of stock

options in relation to 4 different factors:

• Changes in the underlying stock price

• Volatility

• Time decay

• Interest rate

Option Greeks

• The 5 Option Greeks are:

• Delta (Greek Symbol δ)

• Gamma (Greek Symbol γ)

• Vega

• Theta (Greek Symbol θ)

• Rho (Greek Symbol ρ)

Option Greeks - Delta (δ)

• A measure of an option's sensitivity to changes

in the price of the underlying asset

• It approximates the probability that the option

will end up In The Money by expiration

• Factors Affecting Options Delta

• Options Moneyness

• Time to expiration

Option Greeks - Gamma (γ)

• A measure of delta's sensitivity to changes in

the price of the underlying asset

• Important for delta neutral traders.

• As expiration date gets further away, the

gamma value becomes smaller

• Makes stock options with longer expiration

less sensitive to delta changes as the

underlying stock value changes.

Option Greeks – Vega

• A measure of an option's sensitivity to changes in

the volatility of the underlying asset

• Vega is also the greek that most affect option

prices second to Delta.

• Vega is most sensitive when the option is at-the-

money and tapers off either side as the market

trades above/below the strike

• As expiration date gets nearer, the vega value

becomes smaller

Option Greeks - Theta (θ)

• A measure of an option's sensitivity to time decay

• The effect of theta value and time decay is active even

when markets are closed

• Theta behaves differently for ITM/ATM options and

OTM options

• ITM/ATM Options Theta

• Further Expiration : Low Theta

Nearer Expiration : High Theta

• OTM Options Theta

• Further Expiration : High Theta

Nearer Expiration : Low Theta

Option Greeks - Rho (ρ)

• A measure of an option's sensitivity to changes

in the risk free interest rate

• Rho values are usually pretty low and therefore

a percentage increase or decrease in interest

rates don't really make much of a difference to

a stock option.

Delta Neutral Trading (Hedging)

• An option position which is relatively

insensitive to small price movements of the

underlying stock due to having near zero or

zero delta value.

• Delta neutral hedging not only removes small

directional risks but it is also capable of

making a profit on an explosive upside or

downside breakout if a position's gamma

value is kept positive

Delta Neutral Trading (Hedging)

• Delta Neutral Trading - Purpose

• To Make A Profit

• By the bid ask spread of the option - Scalping

• By time delay – Short Straddle

• By Volatility

• By creating volatile option trading strategies –

Long Straddle

• To Protect Position

Delta Neutral Trading (Hedging)

• Delta Neutral Hedging - Step By Step

• Step 1 - Determine the total delta value of your current

position.

• If you are holding 10 contracts of call options with 0.5

delta each, then your total delta value is 0.5 x 1000 = 500

deltas.

• Step 2 - Determine the kind of delta neutral hedge needed.

• If your position is long deltas, then you will need negative

deltas as hedge and if your position is negative deltas,

then you will need long deltas as hedge.

• Step 3 - Determine the total delta value needed to hedge.

THANK YOU

You might also like

- Trading Implied Volatility: Extrinsiq Advanced Options Trading Guides, #4From EverandTrading Implied Volatility: Extrinsiq Advanced Options Trading Guides, #4Rating: 4 out of 5 stars4/5 (1)

- Fule Station 2 (Pas Ful)Document24 pagesFule Station 2 (Pas Ful)Heyder Abdusamad93% (54)

- Wiring OptionsDocument81 pagesWiring Optionsmahaan khatri100% (7)

- Understanding Financial Statements - Making More Authoritative BCDocument6 pagesUnderstanding Financial Statements - Making More Authoritative BCLakshmi Narasimha MoorthyNo ratings yet

- Option Greeks and Management of Market RiskDocument14 pagesOption Greeks and Management of Market RiskSantosh More100% (1)

- 12 - Advanced Option GreeksDocument72 pages12 - Advanced Option Greekssoutik sarkar100% (3)

- Option Greeks for Traders : Part I, Delta, Vega & Theta: Extrinsiq Advanced Options Trading Guides, #5From EverandOption Greeks for Traders : Part I, Delta, Vega & Theta: Extrinsiq Advanced Options Trading Guides, #5No ratings yet

- Financial Ratio Analysis of Bharti AirtelDocument19 pagesFinancial Ratio Analysis of Bharti AirtelDivya Patel50% (2)

- GreeksDocument19 pagesGreeksTafadzwa bee MasumbukoNo ratings yet

- Chapter 6Document45 pagesChapter 6vaman kambleNo ratings yet

- OI - Geeks by ChirraDocument6 pagesOI - Geeks by ChirraQuant R&DNo ratings yet

- Option Pit Boot Camp The Option Pit Method For Trading OptionsDocument55 pagesOption Pit Boot Camp The Option Pit Method For Trading OptionsVineet Vidyavilas PathakNo ratings yet

- Sensitivity AnalysisDocument43 pagesSensitivity AnalysisAsmi KedareNo ratings yet

- Greek OptionDocument9 pagesGreek OptionAbhishek RajNo ratings yet

- Option GreeksDocument24 pagesOption Greeksfreefireguesttwo2No ratings yet

- Why Investors Need To Take The Option Pit Gold CourseDocument38 pagesWhy Investors Need To Take The Option Pit Gold CourseEdmond ThamNo ratings yet

- Option Greeks Part IDocument11 pagesOption Greeks Part Iagt0062No ratings yet

- Ise FX Greeks 121207Document81 pagesIse FX Greeks 121207Satendra KumarNo ratings yet

- Introduction To Derivatives MarketDocument42 pagesIntroduction To Derivatives Marketpriyank2110No ratings yet

- Fintech Chapter 12: OptionsDocument25 pagesFintech Chapter 12: OptionsAllen Uhomist AuNo ratings yet

- Option VolatilityDocument50 pagesOption VolatilityJunedi dNo ratings yet

- Delta Hedging PDFDocument29 pagesDelta Hedging PDFLê AnhNo ratings yet

- Option GreeksDocument135 pagesOption GreeksYugen NamiNo ratings yet

- Overview of Options - An Introduction: October 2004Document82 pagesOverview of Options - An Introduction: October 2004Sharoin SherrifNo ratings yet

- Option GreeksDocument1 pageOption Greeksbiswajit1011aNo ratings yet

- Introduction To GreeksDocument33 pagesIntroduction To GreeksSidharth VarshneyNo ratings yet

- Options Trading For Income Crash Course Day 1Document40 pagesOptions Trading For Income Crash Course Day 1Fernando GallegoNo ratings yet

- Valuation: Equivalent PortfolioDocument24 pagesValuation: Equivalent PortfoliobNo ratings yet

- Option Greeks 4&5Document64 pagesOption Greeks 4&5Saha AmitNo ratings yet

- Option - DerivativesDocument89 pagesOption - DerivativesProf. Suyog ChachadNo ratings yet

- The Greek LettersDocument18 pagesThe Greek LettersSupreet GuptaNo ratings yet

- OptionsDocument49 pagesOptionssacos16074No ratings yet

- Trading EarningsDocument60 pagesTrading EarningsaaaaNo ratings yet

- Trading and Hedging OptionsDocument35 pagesTrading and Hedging Optionsnaimabdullah275% (4)

- Introduction To Derivatives Market: Khader ShaikDocument45 pagesIntroduction To Derivatives Market: Khader Shaikms.AhmedNo ratings yet

- Mba III OptionsDocument67 pagesMba III OptionsRitik MishraNo ratings yet

- Chapter 8 PDFDocument43 pagesChapter 8 PDFCarlosNo ratings yet

- Underlying Determining Parameters, Such As Volatility or The Price of The Underlying AssetDocument2 pagesUnderlying Determining Parameters, Such As Volatility or The Price of The Underlying AssetLeo the BulldogNo ratings yet

- FSD6Document2 pagesFSD6Leo the BulldogNo ratings yet

- 05derivativesmarketarz 100709171035 Phpapp01Document40 pages05derivativesmarketarz 100709171035 Phpapp01leblitzer_0No ratings yet

- Option Writing WebinarDocument46 pagesOption Writing WebinarSwastik TiwariNo ratings yet

- Mid Term Notes-Financial EngineeringDocument32 pagesMid Term Notes-Financial Engineeringgupta tanmayNo ratings yet

- DerivativesDocument29 pagesDerivativessumitbabar0% (1)

- FM - BA - Option Pricing and Market Efficiency Model - ModuleIVDocument37 pagesFM - BA - Option Pricing and Market Efficiency Model - ModuleIVyogesh.jaiyawalaNo ratings yet

- Topic 12 Futures and OptionsDocument19 pagesTopic 12 Futures and OptionsPremah BalasundramNo ratings yet

- Trading With OptionsDocument33 pagesTrading With Optionsartus14No ratings yet

- 05 Derivatives Market ARZ PDFDocument45 pages05 Derivatives Market ARZ PDFDaviNo ratings yet

- Steve Meizinger: Trading Calendar Spreads Using ISE FX OptionsDocument43 pagesSteve Meizinger: Trading Calendar Spreads Using ISE FX OptionsumashankarsNo ratings yet

- MMS Derivatives Lec 4Document64 pagesMMS Derivatives Lec 4AzharNo ratings yet

- Graham3e ppt08Document38 pagesGraham3e ppt08Lim Yu ChengNo ratings yet

- FuturesDocument117 pagesFuturesLekha GuptaNo ratings yet

- Forex Trading - IntroDocument26 pagesForex Trading - IntroKamran MehboobNo ratings yet

- Here's How Traders Can Use Delta and Gamma For Options TradingDocument3 pagesHere's How Traders Can Use Delta and Gamma For Options TradingGagandeep Singh LoteyNo ratings yet

- E Book of OptionsDocument29 pagesE Book of OptionsmohitNo ratings yet

- Module 4Document23 pagesModule 4BABA SIDNo ratings yet

- Derivative ABN AMRODocument22 pagesDerivative ABN AMROtcsdeepanshuNo ratings yet

- Topic Five: (Text Book: Chapter 7)Document35 pagesTopic Five: (Text Book: Chapter 7)Hamdan HassinNo ratings yet

- OFD 10 OptionGreeksDocument19 pagesOFD 10 OptionGreeksANADI NATH MISHRANo ratings yet

- The Greek Letters of An OptionDocument21 pagesThe Greek Letters of An OptionMinh Huỳnh Nguyễn NhậtNo ratings yet

- Summary of Nishant Pant's Mean Reversion TradingFrom EverandSummary of Nishant Pant's Mean Reversion TradingRating: 5 out of 5 stars5/5 (1)

- What About Options?: A Prelude to Profitable Options TradingFrom EverandWhat About Options?: A Prelude to Profitable Options TradingRating: 3 out of 5 stars3/5 (1)

- Analysis of Tax NewsDocument9 pagesAnalysis of Tax Newsankit_85No ratings yet

- Financial Risk Management - The Way ForwardDocument31 pagesFinancial Risk Management - The Way Forwardankit_85No ratings yet

- Financial Risk Management - The Way ForwardDocument31 pagesFinancial Risk Management - The Way Forwardankit_85No ratings yet

- Social Marketing DiabetesDocument22 pagesSocial Marketing Diabetesankit_85No ratings yet

- Freitag Brothers FinalDocument4 pagesFreitag Brothers FinalFAJAR MIRNo ratings yet

- Ramco Cements StandaloneDocument13 pagesRamco Cements StandaloneTao LoheNo ratings yet

- Huzaima Jamal-1Document11 pagesHuzaima Jamal-1Fatima ZehraNo ratings yet

- Kamat Hotels (India) LTD.: Buy Industry: Hotels Price Target: Rs.250Document16 pagesKamat Hotels (India) LTD.: Buy Industry: Hotels Price Target: Rs.250Mga PartsNo ratings yet

- Fundamental AnalysisDocument48 pagesFundamental AnalysisBisma MasoodNo ratings yet

- Management Accounting: Segment Reporting & DecentralizationDocument20 pagesManagement Accounting: Segment Reporting & DecentralizationSamiul AzamNo ratings yet

- Topic 3 5 Ratio AnalysisDocument16 pagesTopic 3 5 Ratio AnalysisEren BarlasNo ratings yet

- Capital StructureDocument10 pagesCapital StructureVivekNo ratings yet

- Pitchbook - Trading Business: BSE LTDDocument34 pagesPitchbook - Trading Business: BSE LTDVenu MadhavNo ratings yet

- Freer On Corporations BarbriDocument38 pagesFreer On Corporations BarbriJEL100% (1)

- A+ Answers To Multiple Choice QuestionsDocument51 pagesA+ Answers To Multiple Choice QuestionsjupiterukNo ratings yet

- Introduction To International Financial Management: Powerpoint® Lecture PresentationDocument34 pagesIntroduction To International Financial Management: Powerpoint® Lecture PresentationRafiqul Islam100% (2)

- Financial Case On Comfort Airlines: by Money Makers'Document14 pagesFinancial Case On Comfort Airlines: by Money Makers'Jubayer Uddin Shamim 1511989647No ratings yet

- FinMan 12 IPO and Hybrid Financing 2015Document50 pagesFinMan 12 IPO and Hybrid Financing 2015panjiNo ratings yet

- A Study On Ratio Analysis of Laxmi BankDocument7 pagesA Study On Ratio Analysis of Laxmi BankAyesha james75% (4)

- Order in Respect of Wasankar Wealth Management Limited, Wasankar Investments, Mr. Prashant Wasankar, Mr. Vinay Wasankar, Ms. Mithila, Mr. Abhijeet Chaudhari and Ms. Bhagyashree WasankarDocument6 pagesOrder in Respect of Wasankar Wealth Management Limited, Wasankar Investments, Mr. Prashant Wasankar, Mr. Vinay Wasankar, Ms. Mithila, Mr. Abhijeet Chaudhari and Ms. Bhagyashree WasankarShyam SunderNo ratings yet

- Escrow OfficerDocument4 pagesEscrow Officerapi-121435323No ratings yet

- CorpusDocument162 pagesCorpussiewyukNo ratings yet

- Private Capital Investing: Private Equity - Private DebtDocument20 pagesPrivate Capital Investing: Private Equity - Private Debtw_fibNo ratings yet

- Account Opening ProcessDocument3 pagesAccount Opening Processsaad777No ratings yet

- Advanced Final 2018 2019 2eDocument10 pagesAdvanced Final 2018 2019 2eFlorenzOpingaNo ratings yet

- Cash Flow Statement Literature ReviewDocument6 pagesCash Flow Statement Literature Reviewc5td1cmc100% (1)

- CH 04Document23 pagesCH 04charlie simoNo ratings yet

- Analysis of Capital Structure Stability of Listed Firm in ChinaDocument16 pagesAnalysis of Capital Structure Stability of Listed Firm in ChinaAhmed BakhtNo ratings yet

- 08 - Performance - Task - Risk and Rates of Return PDFDocument1 page08 - Performance - Task - Risk and Rates of Return PDFRhea Mae AbeniaNo ratings yet

- PNL LSB826Document8 pagesPNL LSB826Omkar DesaiNo ratings yet

- Accountancy - XII - QPDocument5 pagesAccountancy - XII - QPKulvirkuljitharmeet singhNo ratings yet