Professional Documents

Culture Documents

RISK Theory

RISK Theory

Uploaded by

aswanysankar0 ratings0% found this document useful (0 votes)

10 views30 pagesRisk

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRisk

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

10 views30 pagesRISK Theory

RISK Theory

Uploaded by

aswanysankarRisk

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 30

TYPES OF RISK

• SYSTAMATIC RISK/ MARKET RISK/ NON-

DIVERSIFIABLE RISK.

THE VARIABILITY IN A SECURITY’S TOTAL

RETURN THAT IS DIRECTLY ASSOCIATED WITH

THE OVERALL MOVEMENT IN THE GENERAL

MARKET OR ECONOMY IS CALLED SYSTAMATIC

RISK

UNSYSTAMATIC RISK

• NON MARKET RISK OR

• DIVERSIFIABLE RISK.

MARKET RISK

• RISK OF A SECURITY OR ITS SENSITIVITY TO

THE MOVEMENTS IN THE MARKET.

• BETA INDICATES THE EXTEND TO WHICH THE

RISK OF A GIVEN ASSET IS NON-

DIVERSIFIABLE.

INTEREST RATE RISK

• THE VARIASBILITY IN RETURN ON SECURITY

DUE TO CHANGES IN THE LEVEL OF MARKET

INTEREST RATES, OR IT IS THE LOSS OF

PRINCIPAL OF A FIXED- RETURN SECURITY DUE

TO AN INCREASE IN THE GENERAL LEVEL OF

INTEREST RATES.

• WHEN INTEREST RATES RISE, THE VALUE OR

MARKET PRICE OF THE SECURITY DROPS, AND

VICECERSA.

INTEREST RATE RISK

• TWO TYPES

• 1) PRICE RISK

• INVERSE RELATIOSHIP BETWEEN THE

SECURITY PRICE AND INTEREST RATES.

• 2)REINVESTMENT RISK.

• UNCERTAINTY ABOUT THE INTEREST RATE AT

WHICH THE FUTURE COUPON INCOME.

INFLATION RISK/PURCHASING POWER

RISK

• NOMINAL RETURN

• REAL RETURN

EXCHANGE RATE / CURRENCY RISK

• FIXED EXCHANGE RATE SYSTEM- NO RISK

• FREE FLOATING

BUSINESS RISK

• INTERNAL

• EXTERNAL

• MEASURED THROUGH EBIT.

FINANCIAL RISK

• USE OF DEBT FINANCING

• MEASURED BY DEBT/EQUITY RATIO

• HIGHER THE RATIO HIGHER THE RISK.

DEFAULT RISK

• COMPLETE FAILURE OR DELAY IN PAYMENT.

• CAPITAL RISK

• INCOME RISK

LIQUIDITY RISK

• BOUGHT AND SOLD QUICKLY WITHOUT PRICE

CONCESSION.

• LIQUIDITY RISK OF BANKS

MATURITY RISK

• TERM OF MATURITY OF THE SECURITY

• THE LOMGER THE TERM TO MATURITY, THE

GREATER IS THE RISK.

CALL RISK

• CORPORATE BONDS(CALL PROVISION)

• GIVING UP HIGH COUPON RATE.

RISK RETURN TRADE OFF

FACTORS AFFECTING INVESTMENT

• ?

• MODULE –II

• MONEY MARKET

CALL MONEY MARKET

• THE DAY TO DAY SURPLUS FUNDS, MOSTLY OF

BANKS ARE TRADED.

• HELPS THE BANK TO BORROW WITHOUT

COLLATERAL FROM OTHER BANKS TO

MAINTAIN CRR.

• ONE DAY TO A FORTNIGHT.

• REPAYABLE ON DD OR AT THE OPTION OF OF

EITHER THE LENDER OR BORROWER.

• LIQUID AFTER CASH.

PARTICIPANTS IN THE CMM

• SCHEDULED COMMERCIAL BANKS

• NON SCHEDULED COMMERCIAL BANKS

• FOREIGN BANKS

• STATE , DISTRICT AND URBAN, COOPERATIVE

BANKS

• DISCOUNT AND FINANCE HOUSE OF INDIA(DFHI)

• SECURITIES TRADING CORPORATION OF

INDIA(STCI)

• CALL MONEY MARKET – OVERNIGHT BASIS

• NOTICE MONE MARKET – 2 TO 14 DAYS

• TERM MONEY MARKET – 15 DAYS TO 1 YEAR.

Call Rate:

• Call Rate is the rate of interest that is paid on

Call Money Loans. It is highly volatile because

the changes in demand and supply of Call

Loans are instantly reflected in Call Rates. Call

Rate also helps the RBI access the liquidity

situation in the economy.

• There are two Call Rates in India:

1) Inter-bank Call Rate

2) Lending rate of DFHI

• The eligible participants are free to decide Call

Rates in the Call Money Market. Interest

payable on Call Money is based on the

methodology given by the Fixed Income

Money Market and Derivatives Association of

India (FIMMDA), which is a voluntary

association of Commercial Banks, Financial

Institutions and Primary Dealers.

FUNCTION

• Call Loans are availed through auctions or

negotiations on Call Rates. The highest bidder

gets the loan. Electronic trading platform

called Negotiated Trading System (NDS),

deals with Call Money. The Call Money

Market is known as the most sensitive segment

of the financial system.

REPO MARKET

• A repurchase agreement (repo) is a form of short-term

borrowing for dealers in government securities. In the

case of a repo, a dealer sells government securities

to investors, usually on an overnight basis, and buys

them back the following day.

• For the party selling the security and agreeing to

repurchase it in the future, it is a repo; for the party on

the other end of the transaction, buying the security

and agreeing to sell in the future, it is a reverse

repurchase agreement.

• Repos are typically used to raise short-term capital.

CBLO

• A collateralized borrowing and lending

obligation (CBLO) is a money market

instrument that represents an obligation

between a borrower and a lender as to the

terms and conditions of a loan. Collateralized

borrowing and lending obligations allow those

restricted from using the interbank call money

market in India to participate in the short-

term money markets.

• Collateralized borrowing and lending

obligations (CBLOs) is operated by the Clearing

Corporation of India Ltd. (CCIL) and Reserve

Bank of India (RBI). CBLOs allow short-term

loans to be secured by financial institutions,

helping cover their transactions. To access

these funds, the institution must provide

eligible securities as collateral—such

as Treasury Bills that are at least six months

from maturity.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Kingdom of Thailand: Cross Cultural Management Project WorkDocument51 pagesKingdom of Thailand: Cross Cultural Management Project WorkaswanysankarNo ratings yet

- Thai Dining EtiquetteDocument13 pagesThai Dining EtiquetteaswanysankarNo ratings yet

- CertificateDocument20 pagesCertificateaswanysankarNo ratings yet

- Chapter 1Document7 pagesChapter 1aswanysankarNo ratings yet

- Aswnny2 PDFDocument21 pagesAswnny2 PDFaswanysankarNo ratings yet

- Intrinsic PDFDocument10 pagesIntrinsic PDFaswanysankarNo ratings yet

- Aswny 3 PDFDocument17 pagesAswny 3 PDFaswanysankarNo ratings yet

- SAFTA: Few Observations: Shahid Ahmed, PH.D Associate Professor, Department of Economics, Jamia Millia Islamia New DelhiDocument11 pagesSAFTA: Few Observations: Shahid Ahmed, PH.D Associate Professor, Department of Economics, Jamia Millia Islamia New DelhiaswanysankarNo ratings yet

- EffectsDocument28 pagesEffectsaswanysankarNo ratings yet

- Case Study: Jack Welch's Creative Revolutionary Transformation of General Electric and The Thermidorean Reaction (1981-2004)Document11 pagesCase Study: Jack Welch's Creative Revolutionary Transformation of General Electric and The Thermidorean Reaction (1981-2004)aswanysankarNo ratings yet

- English RevisionDocument3 pagesEnglish RevisionKhanssaa AboutayabNo ratings yet

- hw4 SolDocument3 pageshw4 SoladvifulNo ratings yet

- STD 5 Unit 7 Simple Machines Study MaterialDocument6 pagesSTD 5 Unit 7 Simple Machines Study MaterialCool WritzNo ratings yet

- Ba 6238Document8 pagesBa 6238Antony BurgersNo ratings yet

- Persia and The Persian Question Volume IDocument275 pagesPersia and The Persian Question Volume IhbatesNo ratings yet

- CURVESDocument30 pagesCURVESPHULARAM PEGUNo ratings yet

- EQ 5D 5L Index Value Calculator V1.1Document146 pagesEQ 5D 5L Index Value Calculator V1.1mmmaw mmNo ratings yet

- RDDocument6 pagesRDViệt HùngNo ratings yet

- Lab Manual Load - Test - On - DC - Shunt - Motor PDFDocument8 pagesLab Manual Load - Test - On - DC - Shunt - Motor PDFfongNo ratings yet

- 13 Week Military TrainingDocument5 pages13 Week Military TrainingJ. Fernandez100% (1)

- Data Compression (RCS 087)Document51 pagesData Compression (RCS 087)sakshi mishraNo ratings yet

- SM-Personal Finance-Unit1to3Document176 pagesSM-Personal Finance-Unit1to3Priyanshu BhattNo ratings yet

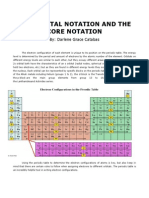

- Catabas Darlene - Orbital Core NotationDocument9 pagesCatabas Darlene - Orbital Core Notationapi-233267698No ratings yet

- Grade 8 Integrated Science Week 2 Lesson 2Document5 pagesGrade 8 Integrated Science Week 2 Lesson 2Balram HaroldNo ratings yet

- Legislative Counsel's Digest: Section 1 of This Bill Authorizes A Person Who Is Not Under Arrest or in TheDocument9 pagesLegislative Counsel's Digest: Section 1 of This Bill Authorizes A Person Who Is Not Under Arrest or in TheFOX5 VegasNo ratings yet

- Velocity String Installation and Performance ReviewDocument13 pagesVelocity String Installation and Performance ReviewSilicon Density100% (1)

- Typical Details of Switchyard RequirementDocument364 pagesTypical Details of Switchyard RequirementEspro100% (1)

- 2009-11-05Document20 pages2009-11-05The University Daily KansanNo ratings yet

- Philippines RegionsDocument5 pagesPhilippines RegionsKristine MercadoNo ratings yet

- TED 30 Bài Phát Biểu Song Ngữ Anh TrungDocument249 pagesTED 30 Bài Phát Biểu Song Ngữ Anh Trungttkimoanh.workNo ratings yet

- Physics Education Thesis TopicsDocument4 pagesPhysics Education Thesis TopicsPaperWriterServicesCanada100% (2)

- Wissman Stroke Center PDFDocument2 pagesWissman Stroke Center PDFyasinNo ratings yet

- Fruit Juice IndustryDocument11 pagesFruit Juice IndustryArlene GutierrezNo ratings yet

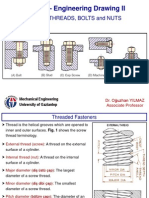

- SCREW THREADS, BOLTS and NUTS PDFDocument10 pagesSCREW THREADS, BOLTS and NUTS PDFhrhgk50% (2)

- Murphybed dn1117Document17 pagesMurphybed dn1117mcvelli40100% (2)

- BT08 PDFDocument4 pagesBT08 PDFAfdhalNo ratings yet

- Chapter 3Document10 pagesChapter 3Adrian LohNo ratings yet

- Sea Food DishesDocument60 pagesSea Food DishesOliver FabonNo ratings yet

- Straight Line Equation of A Straight Line 3x - 4y 7: Answer All Questions. For Examiner' S UseDocument22 pagesStraight Line Equation of A Straight Line 3x - 4y 7: Answer All Questions. For Examiner' S UseDavinAvalaniNo ratings yet

- Media Richness TheoryDocument10 pagesMedia Richness Theoryestefania sofea zahara100% (2)