Professional Documents

Culture Documents

Rick's English Hut (Slides)

Rick's English Hut (Slides)

Uploaded by

Saswat Kumar Dey0 ratings0% found this document useful (0 votes)

23 views8 pagesRick's English Hut is facing sustainability issues with its current operations and regulations requiring at least 50% of sales from food. The document evaluates three options: 1) Buying a liquor license, which merely adds to fixed costs without increasing sales. 2) Closing early and losing profitable liquor sales, reducing overall revenue. 3) Selling brunch at a loss, which paradoxically provides the best financial outcomes despite an initial loss. The takeaways are on the importance of analyzing at the firm level when fixed costs are joint and on ensuring the underlying problem is correctly identified.

Original Description:

Original Title

1562027044_rick’s_english_hut_(slides).pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRick's English Hut is facing sustainability issues with its current operations and regulations requiring at least 50% of sales from food. The document evaluates three options: 1) Buying a liquor license, which merely adds to fixed costs without increasing sales. 2) Closing early and losing profitable liquor sales, reducing overall revenue. 3) Selling brunch at a loss, which paradoxically provides the best financial outcomes despite an initial loss. The takeaways are on the importance of analyzing at the firm level when fixed costs are joint and on ensuring the underlying problem is correctly identified.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

23 views8 pagesRick's English Hut (Slides)

Rick's English Hut (Slides)

Uploaded by

Saswat Kumar DeyRick's English Hut is facing sustainability issues with its current operations and regulations requiring at least 50% of sales from food. The document evaluates three options: 1) Buying a liquor license, which merely adds to fixed costs without increasing sales. 2) Closing early and losing profitable liquor sales, reducing overall revenue. 3) Selling brunch at a loss, which paradoxically provides the best financial outcomes despite an initial loss. The takeaways are on the importance of analyzing at the firm level when fixed costs are joint and on ensuring the underlying problem is correctly identified.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 8

Rick’s English Hut

Multi-product CVP Analysis

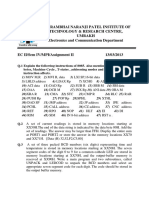

Problem Statement

Current • Current operations are not

Sales (Food) in $ $ 27,000 sustainable

Sales (liquor) in $ 33,000

Total sales $ 60,000 • Regulation that food sales

be at least 50%

CMR (Food) in % 20%

CMR (liquor) in % 50%

Current fixed cost ($) $ 10,950 • Which of the three options

considered is the best?

Evaluation: Current state

CMR (food = 45%) 20%

• Liquor has much higher

CMR (liquor = 55%) 50%

CMR than food

Weighted CMR 36.5% • Fixed costs are joint

• No sense in allocating to

Breakeven revenue $30,000 individual products

Current profit $10,950

Operating Leverage 200.0% • The firm is doing well

Margin of safety 50.0%

Evaluation: Buy license for $1,168

CMR (food) 20% • Option merely adds to fixed

CMR (liquor) 50% costs. Sales still at 33K for

liquor and 27K for food.

Weighted CMR 36.5%

• Bad outcomes

• Increases break even volume

• Decreases margin of safety

Old Fixed cost $10,950

• Increase operating leverage

Additional fixed cost 1,168

Total fixed cost $12,118

• In general, adding fixed

Breakeven revenue $33,200

costs is not profit

maximizing

Profit 9,782 • Need to have off-setting

Operating Leverage 223.9% incremental revenue

Margin of safety 44.7%

Evaluation: Close early & lose liquor sales

CMR (food; 50% share) 20% • Option reduces revenue of

more profitable product! Sales

CMR (liquor; 50% share) 50% of $27K each for liquor and for

food

Weighted CMR 35.0%

• Bad outcomes

• No change in break even

volume (FC and CMR offset)

Old Fixed cost $10,950 • Decreases margin of safety

• Increase operating leverage

Additional fixed cost (450)

Total fixed cost $10,500

• In general, getting rid of

revenue is not good unless we

can get rid of fixed costs as

Breakeven revenue $30,000 well

• Need to offset $3,000 (CM from

Profit 8,400 lost sales of $6,000 in liquor) for

Operating Leverage 225.0% same profit

Margin of safety 44.4%

Evaluation: Sell brunch for a loss

CMR (food; 40.91% share) 20% • Option adds a “loss leader”

CMR (liquor; 50% share) 50% • Brunch adds $6K to current

sales

CMR (brunch; 9.09% share) -2%

• Selling for less than variable

cost!

Weighted CMR 33.0%

• Best outcome

Old Fixed cost $10,950 • Breakeven goes up a bit

• OL is a bit higher

Additional fixed cost 105

• MOS is a bit lower

Total fixed cost $11,055

• How can this be?

• Adding small fixed cost

Breakeven revenue $33,500

• Loss per $ in brunch in small

Profit 10,725 • Sales of brunch are also low

Operating Leverage 201.9%

Margin of safety 49.5%

Take away points

• Role for regulation

• Effect of loss leader

• It is not proper to analyze each product separately when the

fixed costs are joint

• Generally, we even add “traceable” fixed costs to obtain one total

fixed costs

• Analysis is at the firm level

• Might be OK to do individual product level analysis IF

common fixed costs are “small” and the traceable fixed cost

is “large”

Larger issues

• Is Rick solving the right problem?

• The choice is one of strategy – what business does Rick want

to run?

• If Bar – Get license & max out on liquor sales

• If Restaurant – we have to find ways to increase food sales

• Brunch may add a lot to the workload & impinge on life style issues

• Is additional fixed cost only $105? What about OC of his time?

• Create new options: Increase liquor prices and lower food prices?

You might also like

- Honest Tea Case StudyDocument28 pagesHonest Tea Case StudySusana GarciaNo ratings yet

- Chapter 10 Relevant Information For Decision MakingDocument19 pagesChapter 10 Relevant Information For Decision MakingHannah Pamela LegaspiNo ratings yet

- Group 4 Team 6: Area of Benchmarking Kpi Mcdonald'S KFCDocument1 pageGroup 4 Team 6: Area of Benchmarking Kpi Mcdonald'S KFCbala pandian0% (1)

- Worksheet 240357970 Case Analysis Soren ChemicalsDocument8 pagesWorksheet 240357970 Case Analysis Soren Chemicalsmahesh.mohandas3181No ratings yet

- Google Ads Budget CalculatorDocument2 pagesGoogle Ads Budget CalculatorAyaz HaniffaNo ratings yet

- HEB "Own Brand" or Private Labels in RetailDocument49 pagesHEB "Own Brand" or Private Labels in RetailPreethi MendonNo ratings yet

- Reference Asnwer 2Document3 pagesReference Asnwer 2Kyle Lee UyNo ratings yet

- Marico BangladeshDocument21 pagesMarico BangladeshSaswat Kumar DeyNo ratings yet

- 20170519021234part 1 ProjectDocument12 pages20170519021234part 1 ProjectEkkala NarutteyNo ratings yet

- The Costs of ProductionDocument40 pagesThe Costs of Productionabdul moeedNo ratings yet

- Cost-Volume-Profit (CVP) AnalysisDocument42 pagesCost-Volume-Profit (CVP) AnalysisYu-Han KaoNo ratings yet

- Leverage: Return, Whereas Decreases in Leverage Result in Decreases inDocument17 pagesLeverage: Return, Whereas Decreases in Leverage Result in Decreases inRajan sharmaNo ratings yet

- Evaluating Risk in Cost StructureDocument28 pagesEvaluating Risk in Cost StructureYu-Han KaoNo ratings yet

- Marketing Metrics As of 090219Document32 pagesMarketing Metrics As of 090219joyceabellaNo ratings yet

- Session 3Document20 pagesSession 3Talha JavedNo ratings yet

- Produk & Biaya BersamaDocument20 pagesProduk & Biaya BersamaNovi AndryNo ratings yet

- Managerial Accounting: Tools For Business Decision-MakingDocument69 pagesManagerial Accounting: Tools For Business Decision-MakingdavidNo ratings yet

- 8 Costs Production 2022Document40 pages8 Costs Production 2022Pletea GeorgeNo ratings yet

- CMA ExamDocument34 pagesCMA Examtimmy457No ratings yet

- Chapter 16 PPTs StudentDocument26 pagesChapter 16 PPTs StudentSarah SomaniNo ratings yet

- Cost Volume Profit AnalysisDocument16 pagesCost Volume Profit AnalysisAMITS1014No ratings yet

- Session 4 Break Even Operating and Financial LeverageDocument29 pagesSession 4 Break Even Operating and Financial LeverageMargaretta LiangNo ratings yet

- Joint Costs and AllocationDocument20 pagesJoint Costs and AllocationhyasNo ratings yet

- Baldwin Bicycle CompanyDocument19 pagesBaldwin Bicycle CompanyMannu83No ratings yet

- Kpi Strategy // Kpi Strategy // Kpi Strategy // Kpi Strategy // Kpi Strategy // Kpi Strategy // Kpi Strategy // Kpi Strategy // Kpi STDocument1 pageKpi Strategy // Kpi Strategy // Kpi Strategy // Kpi Strategy // Kpi Strategy // Kpi Strategy // Kpi Strategy // Kpi Strategy // Kpi STVlad RăducuNo ratings yet

- AccountingManagers 12Document11 pagesAccountingManagers 12Alenne FelizardoNo ratings yet

- CVP and Income Taxes: OI X (1-Tax Rate) NIDocument8 pagesCVP and Income Taxes: OI X (1-Tax Rate) NIajeng.saraswatiNo ratings yet

- Financial LeverageDocument16 pagesFinancial LeverageEvan MiñozaNo ratings yet

- Session - 7 - 8 - 9 - 10 - Theory of Cost and ProductionDocument51 pagesSession - 7 - 8 - 9 - 10 - Theory of Cost and ProductionYogita ChoudharyNo ratings yet

- Financing Decisions 10-12Document48 pagesFinancing Decisions 10-12Rajat ShrinetNo ratings yet

- Ch09 Break-Even Point and Cost-Volume Profit AnalysisDocument19 pagesCh09 Break-Even Point and Cost-Volume Profit AnalysisZaira PangesfanNo ratings yet

- Cost Volume Profit AnalysisDocument15 pagesCost Volume Profit AnalysisxxpinkywitchxxNo ratings yet

- SFM Wrigley JR Case Solution HBRDocument17 pagesSFM Wrigley JR Case Solution HBRHayat Omer Malik100% (1)

- Pricing IntricaciesDocument35 pagesPricing IntricaciesRadhaNo ratings yet

- Unit Economics - Mike Lingle For FI - 2021Document28 pagesUnit Economics - Mike Lingle For FI - 2021Founder Institute100% (1)

- Lecture 6Document18 pagesLecture 6marwanfathy002No ratings yet

- Revised ModelDocument27 pagesRevised ModelAnonymous 0CbF7xaNo ratings yet

- Decisions Making: Management AccountingDocument11 pagesDecisions Making: Management Accountingsyeda hifzaNo ratings yet

- CH 13 The Costs of ProductionDocument33 pagesCH 13 The Costs of ProductionSakibNo ratings yet

- Money Matter$ Pricing For ProfitDocument22 pagesMoney Matter$ Pricing For Profityen yenNo ratings yet

- Financial AnalysisDocument24 pagesFinancial AnalysisMahsheed AfshanNo ratings yet

- Determinants of Beta: FormallyDocument13 pagesDeterminants of Beta: FormallyvinagoyaNo ratings yet

- Baldwin Bicycle CaseDocument10 pagesBaldwin Bicycle CaseDhurjati Majumdar100% (1)

- Production and Cost - Cotd.Document17 pagesProduction and Cost - Cotd.Emon ChowdhuryNo ratings yet

- Ratio Analysis Case StudyDocument18 pagesRatio Analysis Case StudyAarti JNo ratings yet

- Sslides - Vatel - Lslides - Review of Chap 2Document14 pagesSslides - Vatel - Lslides - Review of Chap 2uyenthanhtran2312No ratings yet

- Chapter 26Document15 pagesChapter 26Sanh NguyệtNo ratings yet

- Google Ads Budget Calculator Updated Aug 2020 1Document2 pagesGoogle Ads Budget Calculator Updated Aug 2020 1vider39605No ratings yet

- Cee3 - CH - 03 (Cost Concepts and Behaviors)Document28 pagesCee3 - CH - 03 (Cost Concepts and Behaviors)VismoNo ratings yet

- FACh 17 SDocument18 pagesFACh 17 S1763Farjana RahmanNo ratings yet

- Accob3 HW6Document7 pagesAccob3 HW6Reshawn Kimi SantosNo ratings yet

- Project Cost Elements and Income Tax Rate To Be UsedDocument14 pagesProject Cost Elements and Income Tax Rate To Be UsedNivika TiffanyNo ratings yet

- SIMON FINAL VERSION Cash Flow Analysis V3Document25 pagesSIMON FINAL VERSION Cash Flow Analysis V3Suoi HoaNo ratings yet

- MSFT LNKD Deal ValuationDocument8 pagesMSFT LNKD Deal ValuationDaniel MooneyNo ratings yet

- Capstone Engineering Services: Refining Gasoline Blending OptimizationDocument21 pagesCapstone Engineering Services: Refining Gasoline Blending OptimizationSatyanarayna EjjurotuNo ratings yet

- Incremental AnalysisDocument34 pagesIncremental AnalysisSomesh SiddharthNo ratings yet

- CH 07Document49 pagesCH 07ChristyNo ratings yet

- CH 05Document28 pagesCH 05Xinjie MaNo ratings yet

- Service Orient or Be Doomed!: How Service Orientation Will Change Your BusinessFrom EverandService Orient or Be Doomed!: How Service Orientation Will Change Your BusinessRating: 4.5 out of 5 stars4.5/5 (1)

- The Food Service Professional Guide to Controlling Liquor, Wine & Beverage CostsFrom EverandThe Food Service Professional Guide to Controlling Liquor, Wine & Beverage CostsNo ratings yet

- M.A Assignment - Group 24 - Case 1 & 2Document7 pagesM.A Assignment - Group 24 - Case 1 & 2Saswat Kumar DeyNo ratings yet

- Case 2Document4 pagesCase 2Saswat Kumar DeyNo ratings yet

- London Jets - Section1 - Group17Document2 pagesLondon Jets - Section1 - Group17Saswat Kumar DeyNo ratings yet

- CRM Section2 Group12 MahindraDocument10 pagesCRM Section2 Group12 MahindraSaswat Kumar DeyNo ratings yet

- CRM Section2 Group12 XiameterDocument10 pagesCRM Section2 Group12 XiameterSaswat Kumar DeyNo ratings yet

- Hangover HelpersDocument17 pagesHangover HelpersSaswat Kumar DeyNo ratings yet

- ECO7 WorksheetDocument9 pagesECO7 WorksheetSaswat Kumar DeyNo ratings yet

- SOPDocument4 pagesSOPSaswat Kumar DeyNo ratings yet

- Worksheet in Campaign Performance Analysis & Budget AllocationDocument102 pagesWorksheet in Campaign Performance Analysis & Budget AllocationSaswat Kumar DeyNo ratings yet

- Seating Chart - Management Information Systems - Dr. Sriram Rajagopalan (End Term)Document9 pagesSeating Chart - Management Information Systems - Dr. Sriram Rajagopalan (End Term)Saswat Kumar DeyNo ratings yet

- Know The IIM Admission Criteria 2015-17 PDFDocument41 pagesKnow The IIM Admission Criteria 2015-17 PDFSaswat Kumar DeyNo ratings yet

- Mock 6Document81 pagesMock 6Saswat Kumar DeyNo ratings yet

- Starcraft - (1999) Hybrid - Chris Metzen PDFDocument10 pagesStarcraft - (1999) Hybrid - Chris Metzen PDFHawk RangerNo ratings yet

- Application of Negative Stiffness Devices For Seismic Protection of Bridge StructuresDocument10 pagesApplication of Negative Stiffness Devices For Seismic Protection of Bridge StructuresganeshNo ratings yet

- Mistibushi Servo Drive PDFDocument350 pagesMistibushi Servo Drive PDFnitin hadkeNo ratings yet

- Vascular and Non-Vascular PlantsDocument3 pagesVascular and Non-Vascular PlantsLeonardo PigaNo ratings yet

- Rasgas Company Limited: Cranes and Lifting Gear Integrity ManualDocument2 pagesRasgas Company Limited: Cranes and Lifting Gear Integrity ManualReda Elawady100% (1)

- Bandas PDFDocument3 pagesBandas PDFClaudia DiazNo ratings yet

- Profitability and Marketability of The Top 55 U.S. Commercial BanksDocument19 pagesProfitability and Marketability of The Top 55 U.S. Commercial BanksSasa LuNo ratings yet

- Costing Breif CaseDocument2 pagesCosting Breif Casehema varshiniNo ratings yet

- The 10 Commandments (MonkeyDM)Document45 pagesThe 10 Commandments (MonkeyDM)Claudio GonzalezNo ratings yet

- Faculty - Accountancy - 2022 - Session 2 - Diploma - Maf251Document7 pagesFaculty - Accountancy - 2022 - Session 2 - Diploma - Maf251NUR FARISHA MOHD AZHARNo ratings yet

- "Praktikum Lab Scanning" (Enumeration Modul CEH V10)Document39 pages"Praktikum Lab Scanning" (Enumeration Modul CEH V10)Yanada Sari SitumorangNo ratings yet

- Company Profile PDFDocument9 pagesCompany Profile PDFSamir WalunjNo ratings yet

- SF - SafeFlame Data Sheet UVIRDocument2 pagesSF - SafeFlame Data Sheet UVIRVincent GabrielNo ratings yet

- Fussion3000 MackieDocument8 pagesFussion3000 MackieMarco BruceNo ratings yet

- Full Download Test Bank For Workshop Statistics Discovery With Data 4th Edition Allan J Rossman Beth L Chance PDF Full ChapterDocument36 pagesFull Download Test Bank For Workshop Statistics Discovery With Data 4th Edition Allan J Rossman Beth L Chance PDF Full Chapterpithsomeknockingsawv100% (24)

- Development On Plot No. Donyo Sabuk/Komarock BLOCK 1/25878 Client: Lilian Lutta MalobaDocument12 pagesDevelopment On Plot No. Donyo Sabuk/Komarock BLOCK 1/25878 Client: Lilian Lutta MalobaAustin AnindoNo ratings yet

- Notes Receivable and Loan ReceivableDocument21 pagesNotes Receivable and Loan ReceivableLady BelleNo ratings yet

- Submarine Magmatic-Hydrothermal Systems at The Monowai Volcanic Center, Kermadec ArcDocument26 pagesSubmarine Magmatic-Hydrothermal Systems at The Monowai Volcanic Center, Kermadec ArcberthingNo ratings yet

- Dealroom Embedded Finance v2Document32 pagesDealroom Embedded Finance v2Sushma KazaNo ratings yet

- Pe Lesson Plan 2 16 17Document7 pagesPe Lesson Plan 2 16 17api-350775200No ratings yet

- Cityscope Sports and LeisureDocument7 pagesCityscope Sports and LeisurePD HoàngNo ratings yet

- DS2 - Unit 2-DC MachinesDocument57 pagesDS2 - Unit 2-DC MachinesTommba TommyNo ratings yet

- Sitarambhai Naranji Patel Institute of Technology & Research Centre, Umrakh Electronics and Communication DepartmentDocument3 pagesSitarambhai Naranji Patel Institute of Technology & Research Centre, Umrakh Electronics and Communication DepartmentMitali TakawalaNo ratings yet

- A8Ponetics: Series SystemsDocument86 pagesA8Ponetics: Series SystemsdmitroivanenkoNo ratings yet

- Neyhns: Eticket ItineraryDocument3 pagesNeyhns: Eticket Itineraryadi saputraNo ratings yet

- Chemistry 10th Edition Whitten Test BankDocument12 pagesChemistry 10th Edition Whitten Test BankEdwinMyersbnztx100% (64)

- Basic Rate AnalysisDocument33 pagesBasic Rate AnalysisSudip GhimireNo ratings yet

- Salesforce Pages Developers GuideDocument810 pagesSalesforce Pages Developers GuideanynameNo ratings yet

- Urban HierarchyDocument12 pagesUrban HierarchyNafisa Irina100% (1)

- Bannari Amman Institute of Technology Department of Information TechnologyDocument7 pagesBannari Amman Institute of Technology Department of Information Technologyinvincible_shalin6954No ratings yet