Professional Documents

Culture Documents

MDIGurgaon - Muskurate Mandevians Final

MDIGurgaon - Muskurate Mandevians Final

Uploaded by

yashi mittalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MDIGurgaon - Muskurate Mandevians Final

MDIGurgaon - Muskurate Mandevians Final

Uploaded by

yashi mittalCopyright:

Available Formats

Big Idea: Transforming Palmolive into a universal brand which caters to premium customers extending beyond it’s general

positioning of a brand only for females

Current situation Idea Objective Impact

Palmolive perceived as a solely female centric brand leading to low • Line extension into natural • Maximise untapped brand • Change in perception from a

brand recall among males products specifically for men potential and catch up on the female centric brand to a

Low brand awareness amongst target group due to unclear and • Reposition Palmolive as a trend by aggressively foraying universal one

dissatisfactory brand communication universal brand for premium into the men personal care • Plethora of opportunities by

Other brands have successful online channels which is not the case and aspirational customers space which has huge way of introduction to new

with Palmolive

• Over time, expand further in opportunities and high income customer

Customer insights – Primary & Secondary Research face & hair cleansing space segments

Men Spend More: Men spend an average of around Rs.300-350 while Sales and marketing strategy

women spend around Rs.200-250 monthly on bathing essentials

• Subscription based model • Digital media campaigns

Gender specific products preferred: Both men and women have high • Bundled Products as per variants

sensitivity towards gender specific products • Portray it as a brand that a successful man adopts

• Highlight the absence of artificial ingredients along • Perfect fir for everyone in all spheres of life be

Perception of Premium: 80% men perceive natural ingredients and

freshness whereas 75% women perceive natural ingredients & fragrance with the presence of natural ones it while going to the gym, office, parties.

Channel Preference: 78% consumers prefer Supermarkets and Business Model Canvas

online channels for buying their bathing essentials

Subscription Model: ¾ Customers are conducive to a subscription Value propositions Key activities Key partners

based model for purchasing their personal care products

• A natural bathing experience • New product development • E-Tailers

Gaps identified • Brand communication through

that destresses and freshens • Premium hotels and spas and

Very few natural products in the bathing space specifically for men • Premium experience for a aggressive media campaigns salons (wellness industry)

which makes the current market scattered and untapped select few • Revamping online distribution

No company offering subscriptions for bathing products • Free from artificial ingredients channels and official website

• Strategic Alliances and

Channels

• Soft tube based packaging

Proof of concept instead of plastic bottles for a Investments to acquire new • Foray in the online space with

premium and seamless competencies both third party vendors and

Highly successful men premium bathing start-ups coming up both in

the Indian and International market experience exclusive channels

Customer relationships

Subscription based model replicated by companies in the foreign • Selective offline channels like

market like Art Of Sport, Man Cave Customer segments • Specialised Trained Executives Shoppers Stop, Lifestyle, etc

at Kiosks in select cities • Exclusive Pop Up Stores in

• Millennials • Personalised and customised Premium Spaces

• Gen X and Gen Y with high recommendations both online • Exclusive spaces in multi

disposable income and offline brand stores – Kiosk Mode

Team Name: Muskurate Mandevians (MDI Gurgaon)

ROADMAP FOR NEXT 5 YEARS

2020 2021 2022 2023 2024

Launch a new product line to Partner with select offline Expand into newer Partner with Spas and With sufficient time gone by

expand in men’s category channels like Shoppers Stop, categories with more Hotels so as to foray in after repositioning, review

Lifestyle, etc. variants so as to capture the wellness industry and build upon stronger

Foray into online space by new audiences variants while discarding or

rebranding official website Come up with exclusive pop- Bring out specific improving weak ones

and partnering with major up stores via Kiosk Model in Launch a select few facial and exclusive ranges for

e-tailers premium spaces cleansing products the wellness industry Capture newer segments

herein untapped by way of

Aggressively advertise With increasing sales and Advertise this heavily with

Keep a few products limited launching ayurvedic variants

Palmolive as brand for highly brand awareness launch a select targeting of the

to exclusive channels to

aspirational & successful men subscription based model right customer segments Projected Revenue: 168 Crores

ensure the premium feel

through digital advertising

To acquire better and newer Projected Revenue: 93 Crores Projected Revenue: 105 Crores

Projected Revenue: 129 Crores

competencies look at

strategic alliances with Key Assumptions Projected revenues by product categories (crores)

upcoming start-ups

Palmolive’s current size: 80 crores CAGR for body wash and shower 2020 2021 2022 2023 2024

Projected Revenue: 86 Crores Palmolive’s overall share in the gel has been assumed 3 times

Bar soap 63 64 64 65 66

Indian bath and shower market is that of industry since major idea

Roadmap at a Glance 0.3% (as per Euromonitor report). caters to that category Body wash/shower 12 16 22 30 41

The same market size has been Since the new product for hair gel

Begin by foraying in the men’s

assumed for all product categories cleansing launches in 2022, CAGR Face cleansing 11 13 18 26 39

category with limited variants

The overall projected CAGR for all initially assumed same as industry

Specific emphasis given to Hair cleansing NA NA NA 8 23

the product categories has been and 3 times for the last 3 years

digital advertising and

taken from the Euromonitor report Hair cleansing revenue assumed Total revenue 86 93 105 129 168

channels to establish brand

and the CAGR for Palmolive has as negligible for now due to

identity and awareness Estimated cost of social media campaigns: Approx. 3 crores

been assumed accordingly absence of Indian products by

Expand to new products

Since our idea doesn’t cater to bar Palmolive in this space. Assuming Financials and calculations in the excel attached:

further down the line with

soaps, CAGR has been assumed captured market share of 0.3 and

established brand awareness

same as overall 0.5% in the last two years Team Name: Muskurate Mandevians (MDI Gurgaon)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- MG 472 Global Strategy, Management and Information Systems Port Aventura Case StudyDocument2 pagesMG 472 Global Strategy, Management and Information Systems Port Aventura Case Studyyashi mittalNo ratings yet

- Clyde Work Pant: Print at Home Pattern Assembly GuideDocument31 pagesClyde Work Pant: Print at Home Pattern Assembly Guidebrechjeb100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- CH 06 SMDocument94 pagesCH 06 SMapi-234680678No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- White Dog Café: Service Marketing (Macewan University)Document8 pagesWhite Dog Café: Service Marketing (Macewan University)yashi mittalNo ratings yet

- Problems Faced by Bakery Owners in KeralaDocument57 pagesProblems Faced by Bakery Owners in Keralanaveen.kurian75% (16)

- (Name of Campus) (Name of Team) (Team Members)Document6 pages(Name of Campus) (Name of Team) (Team Members)yashi mittalNo ratings yet

- Cyworld: Creating and Capturing Value in A Social Network: Group 4Document11 pagesCyworld: Creating and Capturing Value in A Social Network: Group 4yashi mittalNo ratings yet

- Dalda & Amitabh-Culture, Context and Category: Dr. Kanwal KapilDocument5 pagesDalda & Amitabh-Culture, Context and Category: Dr. Kanwal Kapilyashi mittalNo ratings yet

- Market Entry Games: by Group-16Document15 pagesMarket Entry Games: by Group-16yashi mittalNo ratings yet

- Data For Hub and Spoke MapsDocument2 pagesData For Hub and Spoke Mapsyashi mittalNo ratings yet

- Agtb 2020 - Endterm1 - PGPMDocument2 pagesAgtb 2020 - Endterm1 - PGPMyashi mittalNo ratings yet

- Organization of SalesforceDocument21 pagesOrganization of Salesforceyashi mittalNo ratings yet

- Community and Public Toilet OM In-India PDFDocument2 pagesCommunity and Public Toilet OM In-India PDFyashi mittalNo ratings yet

- BRM - Group 6Document15 pagesBRM - Group 6yashi mittal100% (1)

- Brand Image: Is Now PerceivedDocument11 pagesBrand Image: Is Now Perceivedyashi mittalNo ratings yet

- HabermanDocument1 pageHabermanyashi mittalNo ratings yet

- MDIGurgaon - Muskurate Mandevians FinalDocument2 pagesMDIGurgaon - Muskurate Mandevians Finalyashi mittalNo ratings yet

- Bijou HeadbandDocument6 pagesBijou HeadbandThilakamNo ratings yet

- Achi MasalaDocument11 pagesAchi Masalasathya kNo ratings yet

- Unit 5: Money: Ngô Hải Phương Nguyễn Thùy Trang Lê Thu Hiền Dương Hoàng LongDocument12 pagesUnit 5: Money: Ngô Hải Phương Nguyễn Thùy Trang Lê Thu Hiền Dương Hoàng LongLê Thu HiềnNo ratings yet

- Technology and Livelihood Education Agri Crop ProductionDocument21 pagesTechnology and Livelihood Education Agri Crop ProductionMaricris Pamulaklakin Almendras100% (2)

- FFFDocument26 pagesFFFChirag Shah100% (1)

- Imports (BOP) CommoditiesDocument37 pagesImports (BOP) Commoditiesfarhaj_11No ratings yet

- Unidades Didacticas InglesDocument11 pagesUnidades Didacticas InglesJessii giblazNo ratings yet

- Assignment On Quantitative Techniques Inventory Model in Retail ChainDocument18 pagesAssignment On Quantitative Techniques Inventory Model in Retail ChainShobhit DixitNo ratings yet

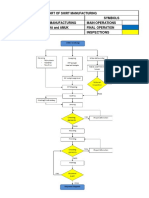

- Process Flow Chart of Shirt ManufacturingDocument8 pagesProcess Flow Chart of Shirt ManufacturingAASTHA KUMARINo ratings yet

- Ilocos Sur Festival - Manpower and MaterialsDocument3 pagesIlocos Sur Festival - Manpower and MaterialsZYRA JADE FABIANNo ratings yet

- Felt DollDocument11 pagesFelt Dollmely753100% (2)

- Lovely Professional University Department of Management: IN Distt. - Sri Ganganagar and Hanumangarah (Rajasthan)Document28 pagesLovely Professional University Department of Management: IN Distt. - Sri Ganganagar and Hanumangarah (Rajasthan)rijhwaninaveenNo ratings yet

- Learning How To Sew For The FamilyDocument17 pagesLearning How To Sew For The FamilySaraya Erica Olayon0% (1)

- AK Textile CollectionDocument42 pagesAK Textile CollectionNiyazi GurNo ratings yet

- Brand Loyalty Comparison Between Safeguard and Lifebuoy SoapDocument34 pagesBrand Loyalty Comparison Between Safeguard and Lifebuoy SoapNazish Sohail100% (2)

- Marketing Channels DiscussionDocument4 pagesMarketing Channels DiscussionjemimaNo ratings yet

- Supervisor MechanicalDocument3 pagesSupervisor MechanicalAsif AmeerNo ratings yet

- Production Planning in The Clothing Industry:: Failing To Plan Is Planning To FailDocument5 pagesProduction Planning in The Clothing Industry:: Failing To Plan Is Planning To Failjatinder.kaler100% (2)

- BA 105 First ExamDocument11 pagesBA 105 First ExamJessica BodoNo ratings yet

- Singer Dressform DF520/251 Accessory Instruction ManualDocument6 pagesSinger Dressform DF520/251 Accessory Instruction ManualiliiexpugnansNo ratings yet

- Marketing Midterm With AnswersDocument3 pagesMarketing Midterm With AnswersKarina Leakes100% (1)

- The Cheesemakers AppretinceDocument177 pagesThe Cheesemakers Appretincedescarao100% (6)

- Urban LifestyleDocument27 pagesUrban LifestyleNindy AslindaNo ratings yet

- NDONI by Keabetswe MahlabaDocument1,020 pagesNDONI by Keabetswe Mahlabasilungelwe3100% (3)

- E Com ReportDocument82 pagesE Com ReportSajal AroraNo ratings yet

- SAP SD DeterminationsDocument4 pagesSAP SD DeterminationsJanardhanNo ratings yet

- Summit Pack 2016Document39 pagesSummit Pack 2016RominaSauraPalmaNo ratings yet