Professional Documents

Culture Documents

Market Discussion 5 Dec 10

Market Discussion 5 Dec 10

Uploaded by

AndysTechnicalsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Discussion 5 Dec 10

Market Discussion 5 Dec 10

Uploaded by

AndysTechnicalsCopyright:

Available Formats

S&P 500 ~ Daily w/RSI One of the struggles has been determining where Minute b-wave (B)

concluded. Last week, we showed the case where b-wave

concluded at 1040 in a triangle. The next two slides will lay out

the wave count trajectory using both of those b-wave conclusions. “y”

a c?

1220

“x”

Whatever the count is, the next new high

on the S&P 500 will trigger some very

1040 clear and sharp RSI Divergence.

b

1011

b

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Daily Bullish Count (B)

“y”

c

This is the general wave count we had been discussing and thinking -5-

about for several weeks now. This model calls for several more weeks

of price action higher/sideways that should get the S&P 500 to 1265.

That target comes from the idea that fifth waves in a “Terminal” should (b)*

be 62% of third waves, when the third is the extended wave, as was the

case here.

(d)

-3-

(c) (e)

-4-

(a)

-1-

* A b-wave in a triangle cannot exceed 261.8% of the a-wave.

This (b) wave comes in just short of that figure.

-2-

1011

b

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Daily Bearish Terminal Count (B)

This would be the wave count for a “Terminal” c-wave pattern off the “y”

1040 lows. In this pattern, the various waves break down into c

“corrective” legs which is what it looks like. Under this model, there isn’t -3- -5-

much more room for Wave -5-, which CANNOT exceed 1240, otherwise (c)

it will be larger than Wave -3- (impossible).

(a)

(x)

(b)

-4-

-1-

(y) (y)

-2-

(w)

(w)

(x)

1040

b

Andy’s Technical Commentary__________________________________________________________________________________________________

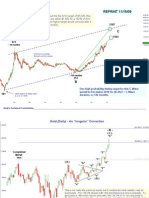

S&P 500 ~ 60 min: Weekly Support and Resistance

The market remained comfortably within our first levels of support and resistance during the

holiday shortened week. Presented here are updated (and relatively tight)

support/resistance points for the week ahead. The action over the last several days is taking

the shape of a bearish triangle/congestion. I want to add to my core short position (currently

40% of a Max short) but will use 1199 and 1207 as my stop losses on the new shorts.

[.2]

REPRINTED from 11/28/2010

[.4]

[.1]

[.3]

The move down from the high is NOT a five

wave impulse lower, but there is an

“impulse” present within the progression.

Perhaps the previous wave ended a little

later? It’s still too earlier to tell what might

be happening here, but this picture looks

short term bearish.

[.5]

Andy’s Technical Commentary__________________________________________________________________________________________________

Last week’s resistance levels become this week’s support. We were stopped out of all fresh shorts last week, which is

why “stop loss” strategies are the most important aspects of trading! This was a very explosive move out of what

appears to have been a triangle development from the 1227 high. The medium/longer term technical picture remains

bearish, but it makes no sense to initiate any new shorts until this market shows some sort of “peaking action.” For

instance, if it were to “breakout” above 1227, drawing in new length, and then reversed back below 1227, creating a “bear

trap,” then that would be peaking action. Until then, the best posture is to be on the sidelines.

S&P 500 ~ 60 min: Weekly Support and Resistance

(b)

(d)

(e)

(a) (c)

Andy’s Technical Commentary__________________________________________________________________________________________________

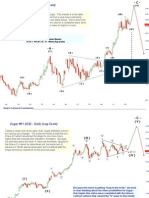

Gold 180 min. (Dec Futures) with Weekly Support and Resistance Levels

Head?

REPRINTED from 11/28/2010

Left Right

Shoulder? Shoulder?

The Gold market did a good job of carving out a possible right shoulder last week. This picture

looks short/medium term bearish as the bounce we’re witnessing looks very much “corrective” in

nature. $1,388 seems like a nice level of resistance for new shorts to consider as a “stop”--it

lines up with the proposed left shoulder and is also the 61.8% retracement of the down move. A

break of the blue dashed line would look very bearish.

Andy’s Technical Commentary__________________________________________________________________________________________________

Gold 180 min. (Dec Futures) with Weekly Support and Resistance Levels

The yellow metal blew out short-sellers once again last week. Thoughts of a bearish Head and Shoulder top are now on the

back-burner. If there is an H&S forming, it might a “double headed” one. Similar to the S&P suggestion, there is no point in

initiating any fresh shorts here until it “shows us something.” This is a very frothy and over-extended market, but they can stay

that way longer then you think. 1417.50-1424 is a fairly tight zone of resistance just above. 1399 and 1383 look like very clear

levels of support that might guide “stop-loss” strategies for those with gold length.

Andy’s Technical Commentary__________________________________________________________________________________________________

DXY 180 min. (Dec Futures) with Weekly Support and Resistance Levels

Here’s the reason for the “risk on” trading. The DXY broke down below trend support and looks destined to probe the 78-76.71 zone.

This is not a good picture for DXY bulls, with the move off the lows looking more corrective than anything else--and, not the

beginning of some kind of stronger move higher.

y

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any

kind. This report is technical commentary only. The author is Wave Symbology

NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s "I" or "A" = Grand Supercycle

interpretation of technical analysis. The author may or may not I or A = Supercycle

trade in the markets discussed. The author may hold positions <I>or <A> = Cycle

opposite of what may by inferred by this report. The information -I- or -A- = Primary

contained in this commentary is taken from sources the author (I) or (A) = Intermediate

believes to be reliable, but it is not guaranteed by the author as to "1“ or "a" = Minor

the accuracy or completeness thereof and is sent to you for 1 or a = Minute

information purposes only. Commodity trading involves risk and -1- or -a- = Minuette

is not for everyone. (1) or (a) = Sub-minuette

[1] or [a] = Micro

Here is what the Commodity Futures Trading Commission (CFTC) [.1] or [.a] = Sub-Micro

has said about futures trading: Trading commodity futures and

options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or

options contracts, you should consider your financial experience,

goals and financial resources, and know how much you can afford

to lose above and beyond your initial payment to a broker. You

should understand commodity futures and options contracts and

your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by

thoroughly reviewing the risk disclosure documents your broker is

required to give you.

You might also like

- Test Bank For Introduction To Derivatives and Risk Management, 10th Edition - Don M. ChanceDocument4 pagesTest Bank For Introduction To Derivatives and Risk Management, 10th Edition - Don M. ChancefdvdfvNo ratings yet

- Sales Trading StructuringDocument19 pagesSales Trading StructuringKonstantinos ReniosNo ratings yet

- Hedging Against Rising Coal Prices Using Coal FuturesDocument38 pagesHedging Against Rising Coal Prices Using Coal FuturesSunil ToshniwalNo ratings yet

- OFOD7 e Test Bank CH 03Document2 pagesOFOD7 e Test Bank CH 03Danny NgNo ratings yet

- Market Discussion 19 Dec 10Document6 pagesMarket Discussion 19 Dec 10AndysTechnicalsNo ratings yet

- Market Update 21 Nov 10Document10 pagesMarket Update 21 Nov 10AndysTechnicalsNo ratings yet

- Wednesday Update 10 March 2010Document6 pagesWednesday Update 10 March 2010AndysTechnicalsNo ratings yet

- Market Discussion 12 Dec 10Document9 pagesMarket Discussion 12 Dec 10AndysTechnicalsNo ratings yet

- Morning View 10feb2010Document8 pagesMorning View 10feb2010AndysTechnicalsNo ratings yet

- Market Commentary 21feb11Document10 pagesMarket Commentary 21feb11AndysTechnicalsNo ratings yet

- Morning View 27jan2010Document6 pagesMorning View 27jan2010AndysTechnicals100% (1)

- S&P 500 Update 2 Jan 10Document8 pagesS&P 500 Update 2 Jan 10AndysTechnicalsNo ratings yet

- S&P 500 Update 20 Dec 09Document10 pagesS&P 500 Update 20 Dec 09AndysTechnicalsNo ratings yet

- Crude Oil 31 October 2010Document8 pagesCrude Oil 31 October 2010AndysTechnicalsNo ratings yet

- Market Update 18 July 10Document10 pagesMarket Update 18 July 10AndysTechnicalsNo ratings yet

- REPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartDocument8 pagesREPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartAndysTechnicalsNo ratings yet

- S&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100Document7 pagesS&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100AndysTechnicalsNo ratings yet

- Gold Report 29 Nov 2009Document11 pagesGold Report 29 Nov 2009AndysTechnicalsNo ratings yet

- Market Commentary 13mar11Document8 pagesMarket Commentary 13mar11AndysTechnicalsNo ratings yet

- Market Update 28 Nov 10Document8 pagesMarket Update 28 Nov 10AndysTechnicalsNo ratings yet

- S&P 500 (Daily) - Sniffed Out Some Support .Document4 pagesS&P 500 (Daily) - Sniffed Out Some Support .AndysTechnicalsNo ratings yet

- Morning View 26jan2010Document8 pagesMorning View 26jan2010AndysTechnicalsNo ratings yet

- SP500 Update 24 Oct 09Document7 pagesSP500 Update 24 Oct 09AndysTechnicalsNo ratings yet

- S&P 500 Update 23 Jan 10Document7 pagesS&P 500 Update 23 Jan 10AndysTechnicalsNo ratings yet

- Morning Update 2 Mar 10Document4 pagesMorning Update 2 Mar 10AndysTechnicalsNo ratings yet

- Morning View 24 Feb 10Document4 pagesMorning View 24 Feb 10AndysTechnicalsNo ratings yet

- S&P 500 Update 1 Nov 09Document7 pagesS&P 500 Update 1 Nov 09AndysTechnicalsNo ratings yet

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- Morning View 12feb2010Document8 pagesMorning View 12feb2010AndysTechnicalsNo ratings yet

- Sugar Report Nov 06 2009Document6 pagesSugar Report Nov 06 2009AndysTechnicalsNo ratings yet

- Market Discussion 23 Jan 11Document10 pagesMarket Discussion 23 Jan 11AndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- Hacker 3 RCDocument290 pagesHacker 3 RCjennyphuong0802No ratings yet

- Market Commentary 27mar11Document10 pagesMarket Commentary 27mar11AndysTechnicalsNo ratings yet

- Morning View 21jan2010Document6 pagesMorning View 21jan2010AndysTechnicalsNo ratings yet

- Morning View 23 Feb 10Document6 pagesMorning View 23 Feb 10AndysTechnicalsNo ratings yet

- 202002-SW02L2 Y10 Transformations Practice WorksheetDocument8 pages202002-SW02L2 Y10 Transformations Practice WorksheetSarah TseungNo ratings yet

- Dollar Index (180 Minute) "Unorthodox Model"Document6 pagesDollar Index (180 Minute) "Unorthodox Model"AndysTechnicalsNo ratings yet

- S&P 500 Update 4 Apr 10Document10 pagesS&P 500 Update 4 Apr 10AndysTechnicalsNo ratings yet

- Morning View 17 Feb 10Document10 pagesMorning View 17 Feb 10AndysTechnicalsNo ratings yet

- 2.5E Underpurlins Exercise 1 - MGP10 - S124Document5 pages2.5E Underpurlins Exercise 1 - MGP10 - S124jackblack6550No ratings yet

- Morning View 29jan2010Document5 pagesMorning View 29jan2010AndysTechnicalsNo ratings yet

- Morning View 20jan2010Document8 pagesMorning View 20jan2010AndysTechnicalsNo ratings yet

- S&P 500 Update 9 Nov 09Document6 pagesS&P 500 Update 9 Nov 09AndysTechnicalsNo ratings yet

- Section-A: L-21T - 2/CEDocument20 pagesSection-A: L-21T - 2/CEﱞﱞﱞﱞﱞﱞﱞﱞﱞﱞﱞﱞﱞﱞﱞﱞﱞﱞﱞﱞﱞﱞﱞﱞNo ratings yet

- Rebar Tension Development and Splice Lengths LRFD 8th EditionDocument12 pagesRebar Tension Development and Splice Lengths LRFD 8th EditionScottNo ratings yet

- Fnce100 PS3Document18 pagesFnce100 PS3Denisa KollcinakuNo ratings yet

- L-1ff-2/ARCH Date: 10/04/2019: Section - A Four ThreeDocument7 pagesL-1ff-2/ARCH Date: 10/04/2019: Section - A Four Threertgersergtgr trghgrwthtrtehNo ratings yet

- L 2rr-IINAME Date:31/12/2012 - : - Section-A FourDocument14 pagesL 2rr-IINAME Date:31/12/2012 - : - Section-A Fourpartho RoyNo ratings yet

- Morning View 28jan2010Document7 pagesMorning View 28jan2010AndysTechnicalsNo ratings yet

- Gold Report 12 Sep 2010Document16 pagesGold Report 12 Sep 2010AndysTechnicalsNo ratings yet

- W17 (CH26) (9Q)Document6 pagesW17 (CH26) (9Q)Mohammed NajihNo ratings yet

- Morning View 5mar2010Document7 pagesMorning View 5mar2010AndysTechnicalsNo ratings yet

- Morning View 19 Feb 10Document4 pagesMorning View 19 Feb 10AndysTechnicalsNo ratings yet

- Morning Update 3 Mar 10Document5 pagesMorning Update 3 Mar 10AndysTechnicalsNo ratings yet

- TCP2101 Algorithm Design and Analysis Lab05 - GraphsDocument5 pagesTCP2101 Algorithm Design and Analysis Lab05 - Graphshusnazk.workNo ratings yet

- Set P3 20Document16 pagesSet P3 20krishna jkanaNo ratings yet

- Gold Report 15 Nov 2009Document11 pagesGold Report 15 Nov 2009AndysTechnicalsNo ratings yet

- Copper Report 31 Jan 2010Document8 pagesCopper Report 31 Jan 2010AndysTechnicalsNo ratings yet

- S&P 500 Update 15 Feb 10Document9 pagesS&P 500 Update 15 Feb 10AndysTechnicalsNo ratings yet

- SP500 Update 31 May 10Document13 pagesSP500 Update 31 May 10AndysTechnicalsNo ratings yet

- S&P Futures 3 March 10 EveningDocument2 pagesS&P Futures 3 March 10 EveningAndysTechnicalsNo ratings yet

- Design of BridgesDocument2 pagesDesign of Bridgesabhi98mnNo ratings yet

- A Hierarchy of Turing Degrees: A Transfinite Hierarchy of Lowness Notions in the Computably Enumerable Degrees, Unifying Classes, and Natural Definability (AMS-206)From EverandA Hierarchy of Turing Degrees: A Transfinite Hierarchy of Lowness Notions in the Computably Enumerable Degrees, Unifying Classes, and Natural Definability (AMS-206)No ratings yet

- Market Commentary 5aug12Document7 pagesMarket Commentary 5aug12AndysTechnicalsNo ratings yet

- Market Commentary 22JUL12Document6 pagesMarket Commentary 22JUL12AndysTechnicalsNo ratings yet

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- Market Commentary 10JUN12Document7 pagesMarket Commentary 10JUN12AndysTechnicalsNo ratings yet

- Market Commentary 17JUN12Document7 pagesMarket Commentary 17JUN12AndysTechnicalsNo ratings yet

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocument6 pagesS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 25mar12Document8 pagesMarket Commentary 25mar12AndysTechnicalsNo ratings yet

- Market Commentary 20NOV11Document7 pagesMarket Commentary 20NOV11AndysTechnicalsNo ratings yet

- Market Commentary 29apr12Document6 pagesMarket Commentary 29apr12AndysTechnicalsNo ratings yet

- Dollar Index (DXY) Daily ContinuationDocument6 pagesDollar Index (DXY) Daily ContinuationAndysTechnicalsNo ratings yet

- Market Commentary 19DEC11Document9 pagesMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 1apr12Document8 pagesMarket Commentary 1apr12AndysTechnicalsNo ratings yet

- Market Commentary 18mar12Document8 pagesMarket Commentary 18mar12AndysTechnicalsNo ratings yet

- Copper Commentary 11dec11Document6 pagesCopper Commentary 11dec11AndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- Market Commentary 16jan12Document7 pagesMarket Commentary 16jan12AndysTechnicalsNo ratings yet

- Market Commentary 30OCT11Document6 pagesMarket Commentary 30OCT11AndysTechnicalsNo ratings yet

- Market Commentary 27NOV11Document5 pagesMarket Commentary 27NOV11AndysTechnicalsNo ratings yet

- Market Commentary 6NOVT11Document4 pagesMarket Commentary 6NOVT11AndysTechnicalsNo ratings yet

- Sp500 Update 23oct11Document7 pagesSp500 Update 23oct11AndysTechnicalsNo ratings yet

- Market Commentary 25SEP11Document8 pagesMarket Commentary 25SEP11AndysTechnicalsNo ratings yet

- Copper Commentary 2OCT11Document8 pagesCopper Commentary 2OCT11AndysTechnicalsNo ratings yet

- Sp500 Update 11sep11Document6 pagesSp500 Update 11sep11AndysTechnicalsNo ratings yet

- Sp500 Update 5sep11Document7 pagesSp500 Update 5sep11AndysTechnicalsNo ratings yet

- Options and Corporate Finance: Mcgraw-Hill/IrwinDocument76 pagesOptions and Corporate Finance: Mcgraw-Hill/IrwinPedro CamargoNo ratings yet

- 4 FI Derivatives - Forward, FRA, IRSDocument25 pages4 FI Derivatives - Forward, FRA, IRSyveziviNo ratings yet

- More On Models and Numerical ProceduresDocument42 pagesMore On Models and Numerical ProceduresUtkarsh GoelNo ratings yet

- Bfw2751 s1 2022 Lecture Week 1Document30 pagesBfw2751 s1 2022 Lecture Week 1Ki KiNo ratings yet

- A&J Questions Bank For SOA Exam MFE/ CAS Exam 3FDocument24 pagesA&J Questions Bank For SOA Exam MFE/ CAS Exam 3Fanjstudymanual100% (1)

- Chapter 10 DerivativesDocument8 pagesChapter 10 DerivativesClaire VensueloNo ratings yet

- Option Trading Staretegy PDFDocument73 pagesOption Trading Staretegy PDFAtul JainNo ratings yet

- Chap 016Document59 pagesChap 016anilmeherNo ratings yet

- JoshiDocument22 pagesJoshiwaterloo1815No ratings yet

- Practice Question Hull RMFI, Chapter 17 Regulation of The OTC Derivatives MarketDocument6 pagesPractice Question Hull RMFI, Chapter 17 Regulation of The OTC Derivatives MarketBlack MambaNo ratings yet

- 10 Trading Secrets To Trade Like A Pro PDFDocument13 pages10 Trading Secrets To Trade Like A Pro PDFJoe DNo ratings yet

- Chapter 5 - Currency Derivatives (FX Management Tools)Document7 pagesChapter 5 - Currency Derivatives (FX Management Tools)jamilkhannNo ratings yet

- Future & Options FinalDocument8 pagesFuture & Options Finalabhiraj_bangeraNo ratings yet

- CH 17 Hull Fundamentals 8 The DDocument32 pagesCH 17 Hull Fundamentals 8 The DjlosamNo ratings yet

- Chapter 8Document29 pagesChapter 8jgau0017No ratings yet

- 9-The Option Greeks (Delta) Part 1Document6 pages9-The Option Greeks (Delta) Part 1Zahid GolandazNo ratings yet

- Options Open Interest Analysis SimplifiedDocument17 pagesOptions Open Interest Analysis SimplifiedMOBILE FRIENDNo ratings yet

- The Greek Letters: Option Portfolio Value and GreeksDocument16 pagesThe Greek Letters: Option Portfolio Value and Greeksmiku hrshNo ratings yet

- Options Open Interest Analysis SimplifiedDocument17 pagesOptions Open Interest Analysis SimplifiedNaveenNo ratings yet

- Order Desk Updates: During Periods of High Volatility, Please Visit For Current Margin LevelsDocument3 pagesOrder Desk Updates: During Periods of High Volatility, Please Visit For Current Margin LevelsAurel Florent DOSSANo ratings yet

- Call & Put OptionsDocument76 pagesCall & Put OptionsKrishna KanthNo ratings yet

- Mathematics of Options, Futures and Derivatives SecuritiesDocument29 pagesMathematics of Options, Futures and Derivatives SecuritiesLinh DangNo ratings yet

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocument31 pagesInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownyousufalkaiumNo ratings yet

- Basics of Derivatives - Forward, Futures and SwapDocument18 pagesBasics of Derivatives - Forward, Futures and SwapRewant MehraNo ratings yet

- AKUZAWA NewApproachVolatilitySkewDocument38 pagesAKUZAWA NewApproachVolatilitySkewfloqfloNo ratings yet

- Dwnload Full Options Futures and Other Derivatives 8th Edition Hull Test Bank PDFDocument35 pagesDwnload Full Options Futures and Other Derivatives 8th Edition Hull Test Bank PDFwhalemanfrauleinshlwvz100% (13)