Professional Documents

Culture Documents

It New Slab

It New Slab

Uploaded by

sushil kumarCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5824)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

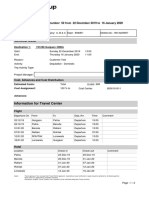

- Trip No. 568, B1 City, 5B-Grade WBS With AdvanceDocument5 pagesTrip No. 568, B1 City, 5B-Grade WBS With Advancesushil kumarNo ratings yet

- Step-Wise Leave EncashmentDocument7 pagesStep-Wise Leave Encashmentsushil kumarNo ratings yet

- Trip No. 567 PR03 Status After 1st ApprovalDocument3 pagesTrip No. 567 PR03 Status After 1st Approvalsushil kumarNo ratings yet

- Time Recording: - Recording of Clock in or Clock Out or Number of WorkingDocument2 pagesTime Recording: - Recording of Clock in or Clock Out or Number of Workingsushil kumarNo ratings yet

- LSMW TemplateDocument9 pagesLSMW Templatesushil kumarNo ratings yet

- Advantages of Time Management: Quota Driven AbsencesDocument6 pagesAdvantages of Time Management: Quota Driven Absencessushil kumarNo ratings yet

- A.Holiday Calendars and Work Schedules: Feature SCHKZDocument5 pagesA.Holiday Calendars and Work Schedules: Feature SCHKZsushil kumarNo ratings yet

- HR Configuration Steps:: First Goto SAP Logon Screen You Come To The SAP Initial ScreenDocument4 pagesHR Configuration Steps:: First Goto SAP Logon Screen You Come To The SAP Initial Screensushil kumarNo ratings yet

- DFGHJKLDFGHJMDocument1 pageDFGHJKLDFGHJMsushil kumarNo ratings yet

- TM - Absence - Absence Catalog - Define Absence Type - New EntryDocument3 pagesTM - Absence - Absence Catalog - Define Absence Type - New Entrysushil kumarNo ratings yet

- Travel Request: General DataDocument2 pagesTravel Request: General Datasushil kumarNo ratings yet

- New Microsoft Word DocumentMMMKHBXHDocument1 pageNew Microsoft Word DocumentMMMKHBXHsushil kumarNo ratings yet

- Payroll Schemas and Personnel Calculation Rules (PCR'S) : Skip To End of Metadata Go To Start of MetadataDocument22 pagesPayroll Schemas and Personnel Calculation Rules (PCR'S) : Skip To End of Metadata Go To Start of Metadatasushil kumarNo ratings yet

It New Slab

It New Slab

Uploaded by

sushil kumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

It New Slab

It New Slab

Uploaded by

sushil kumarCopyright:

Available Formats

Income Tax Slab Tax Rate

Up to Rs.2.5 lakh Nil

From Rs.2,50,001 to Rs.5,00,000 5% of the total income that is more than Rs.2.5 lakh + 4% cess

From Rs.5,00,001 to Rs.7,50,000 10% of the total income that is more than Rs.5 lakh + 4% cess

From Rs.7,50,001 to Rs.10,00,000 15% of the total income that is more than Rs.7.5 lakh + 4% cess

From Rs.10,00,001 to Rs.12,50,000 20% of the total income that is more than Rs.10 lakh + 4% cess

From Rs.12,50,001 to Rs.15,00,000 25% of the total income that is more than Rs.12.5 lakh + 4% cess

Income above Rs.15,00,001 30% of the total income that is more than Rs.15 lakh + 4% cess

The important tax breaks that will not be available under the new tax regime include Section 80C (Investments in PF, NPS, Life insurance premium, home loan

principal repayment etc.), Section 80D (medical insurance premium), tax breaks on HRA (House Rent Allowance) and on interest paid on housing loan. Tax breaks for

the disabled and for charitable donations will also go. Therefore, it is not clear as to whether the new personal tax regime will really bring substantial tax savings for

most.

A. The deduction claimed for medical insurance premium under section 80D will also not be claimable.

B. Tax benefits for disability under sections 80DD and 80DDB will not be claimable

C. Tax break on interest paid on education loan will not be claimable-section 80E

D. Tax break on donations to charitable institutions available under section 80G will not be available

E. Deduction of Rs 15000 allowed from family pension under clause (iia) of section 57

F. House rent allowance normally paid to salaried individuals as part of salary. This could be claimed as tax exempt upto certain specified limits if the individual

was staying in rented accommodation.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5824)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Trip No. 568, B1 City, 5B-Grade WBS With AdvanceDocument5 pagesTrip No. 568, B1 City, 5B-Grade WBS With Advancesushil kumarNo ratings yet

- Step-Wise Leave EncashmentDocument7 pagesStep-Wise Leave Encashmentsushil kumarNo ratings yet

- Trip No. 567 PR03 Status After 1st ApprovalDocument3 pagesTrip No. 567 PR03 Status After 1st Approvalsushil kumarNo ratings yet

- Time Recording: - Recording of Clock in or Clock Out or Number of WorkingDocument2 pagesTime Recording: - Recording of Clock in or Clock Out or Number of Workingsushil kumarNo ratings yet

- LSMW TemplateDocument9 pagesLSMW Templatesushil kumarNo ratings yet

- Advantages of Time Management: Quota Driven AbsencesDocument6 pagesAdvantages of Time Management: Quota Driven Absencessushil kumarNo ratings yet

- A.Holiday Calendars and Work Schedules: Feature SCHKZDocument5 pagesA.Holiday Calendars and Work Schedules: Feature SCHKZsushil kumarNo ratings yet

- HR Configuration Steps:: First Goto SAP Logon Screen You Come To The SAP Initial ScreenDocument4 pagesHR Configuration Steps:: First Goto SAP Logon Screen You Come To The SAP Initial Screensushil kumarNo ratings yet

- DFGHJKLDFGHJMDocument1 pageDFGHJKLDFGHJMsushil kumarNo ratings yet

- TM - Absence - Absence Catalog - Define Absence Type - New EntryDocument3 pagesTM - Absence - Absence Catalog - Define Absence Type - New Entrysushil kumarNo ratings yet

- Travel Request: General DataDocument2 pagesTravel Request: General Datasushil kumarNo ratings yet

- New Microsoft Word DocumentMMMKHBXHDocument1 pageNew Microsoft Word DocumentMMMKHBXHsushil kumarNo ratings yet

- Payroll Schemas and Personnel Calculation Rules (PCR'S) : Skip To End of Metadata Go To Start of MetadataDocument22 pagesPayroll Schemas and Personnel Calculation Rules (PCR'S) : Skip To End of Metadata Go To Start of Metadatasushil kumarNo ratings yet