Professional Documents

Culture Documents

Day 8 - Income From Other Sources

Day 8 - Income From Other Sources

Uploaded by

bibhuti_2110 ratings0% found this document useful (0 votes)

59 views38 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

59 views38 pagesDay 8 - Income From Other Sources

Day 8 - Income From Other Sources

Uploaded by

bibhuti_211Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 38

Income Tax Act - 1961

Session 15 – Income from Other

Sources

Chargeability – Sec 56

As per Sec 56(1), income of every kind,

which is not to be excluded from the total

income under this Act, shall be chargeable

to income tax under the head ‘Income

from Other Sources’ if it is not chargeable

to tax under any of the first four heads.

It is therefore a residuary head of income

Chargeability – Sec 56

Sec 56(2) gives certain specific items which shall be

chargeable to Income tax under this head.

a) Dividends other than dividends referred to in Sec

115-O.

b) Income by way of winnings from lotteries,

crossword puzzles, races including horse race,

card games and other games of any sort,

gambling or betting of any form or nature.

c) Any sum received by the assessee from his

employees as contribution to any provident fund,

or any other welfare fund for the employees

provided it is not taxable under the head Profits

and Gains of Business or Profession

Chargeability – Sec 56

d) Income by way of interest on securities provided

the income is not chargeable to Income tax under

the head Profits and Gains of Business or

Profession.

e) Income from machinery, plant or furniture

belonging to the assessee and let on hire provided

the income is not chargeable to tax under the

head Profits and Gains of Business or Profession.

f) Where the assessee lets on hire, the machinery,

plant or furniture belonging to him and also

Chargeability – Sec 56

buildings and letting of buildings is inseparable

from the letting of the said machinery, plant or

furniture, the income from such letting, if it is not

chargeable to income tax under the head Profits

and Gains of business or profession.

g) Any income received under a Keyman Insurance

Policy, including the sum allocated by way of

bonus on such policy, if such income is not

taxable under the head Salaries or Profits and

Gains of Business or Profession.

Chargeability – Sec 56

h) Any sum of money the aggregate value of which

exceeds Rs.50000 received from any person

without consideration by an individual or HUF,

subject to certain exceptions.

i) The value of any property received without

consideration or for inadequate consideration by

an individual or HUF from any person or persons.

Such properties will include immovable property

being land or building or both, shares and

securities, jewellery, archaeological collections,

Chargeability – Sec 56

drawings, paintings, sculptures or any work of art.

j)Income by way of interest received on

compensation or enhanced compensation referred

to in Sec 145A(b).

(a,b,h,i & j taxable only under this head)

(c,d,e & f taxable under this head if not taxed under

Profits and Gains of Business/ Profession)

(g taxable under this head if not taxed under salaries

or Profits and Gains of Business or Profession)

Dividend

Any amount declared, distributed or paid by

a domestic company by way of dividends

referred to in Sec 115-O (whether interim

or otherwise) whether out of current or

accumulated profits shall not be included

in computing the total income of a

previous year of any person.Hence

dividends are exempt in the hands of the

shareholders (Sec 10(34)).

Dividend

Dividend from a foreign company or deemed

dividend, mentioned under section2(22)(e) shall

however, be taxable under the head ‘Income from

Other Sources’.

Deemed dividend u/s 2(22)(e)

Any payment to the extent of accumulated profits

by a company, not being a company in which

public are substantially interested, of any sum by

way of

i. loan or advance to a shareholder who holds

Dividend

the beneficial ownership of equity shares

carrying not less than 10% of the voting power.

ii. Loan or advance to any concern (HUF, firm, AOP,

BOI or a company) in which such shareholder is

a member or partner holding substantial interest

(20% or more beneficial interest at any time

during the previous year)

iii. Any payment on behalf of or for the individual

benefit of any such shareholder made to any

person.

In pt above, any advance or loan to a shareholder or

a concern in which the shareholder has

Dividend

substantial interest will not be deemed to be

dividend if it has been given during the course of

its business, provided lending of money is a

substantial part of the business of the company.

Deduction of expenses

a) Collection charges – paid to a banker or any other

person for realising the dividend.

b) Interest on money borrowed for purchasing the

shares . This interest can be claimed even if no

income is earned by way if dividend on such

Dividend

shares.

c) Any other expenditure, not being of a

capital nature,expended wholly and

exclusively for earning such income.

Winnings from Lottery etc

Income by way of winnings from any lottery or

crossword puzzle or race including horse race

or card game and other game of any sort or

from gambling or betting of any form shall be

chargeable as income from Other Sources and

shall be chargeable @ 30% u/s 115BB.

These winnings are subject to the following:

1. No expenditure or allowance can be allowed

against such income

2. No deduction under Chapter VIA shall be

allowed.

Winnings from Lottery etc – Sec

115BB

3. No benefit of carry forward and set off of

loss/unabsorbed depreciation allowance is

available against such income.

4. No basic exemption limit is available.

Card game and other game of any sort includes

any game show, an entertainment programme

on television in which people compete to win

prizes or any other similar game.

Income on Securities

Interest on securities may be taxed on receipt basis

or due basis, depending upon the system of

accounting adopted by the assessee.

Deduction for expenses – As in the case of

dividends, collection charges, interest on loan

taken for investment in securities and any other

expenditure (not being of capital nature)

expended wholly for earning such income can be

deducted.

Income from letting of

machinery, plant or furniture

Income from machinery, plant or furniture,

belonging to the assessee and let on hire, is

chargeable to income tax under the head

income from other sources, if not chargeable

under Profits and Gains of Business or

Profession.

(If assets are given on hire as a part of the

assessee’s business activity of as commercial

assets belonging to the assessee, income

derived therefrom will be business income).

Income from composite letting of

machinery, plant or furniture and buildings

Where the assessee lets on hire the machinery,

plant or furniture belonging to him and also

buildings and the letting of the building is

inseparable from the letting of the said

machinery, plant or furniture, income from such

letting,called composite rent, if not chargeable

under Profits and Gains of Business , will be

chargeable as Income from Other Sources.

Letting of machinery, plant or

furniture, with or without building

In case of lease rental on letting of

machinery, plant and furniture, with or

without building, the following shall be

deducted – current repairs, insurance

premium against risk of damage or

destruction, depreciation based upon

block of assets and any other expenditure

(not being of capital nature) expended

wholly for earning such income.

Amount under a Keyman

Insurance Policy

Any sum received under a keyman

insurance policy including bonus is

chargeable under this head when it is

received by any person other than the

employer who took the policy and the

employee in whose name the policy was

taken.

Gift of Money or Property from

unrelated persons

The following 3 kinds of gifts received by an

individual or HUF from an unrelated person shall

be chargeable u/s 56(2)(vii).

i. Gift of money – Where any sum of money is

received by an individual or HUF from any

person or persons without consideration, the

aggregate value of which exceeds Rs.50000,

the whole of the aggregate value of such sum

shall be taxable in the hands of the recipient.

Gift of Money or Property from

unrelated persons

ii. Gift of Immovable Property – Where any immovable

property is received by an individual or HUF from any

person without consideration, the stamp duty value of

which exceeds Rs.50000, the stamp duty value of

such property shall be taxable in the hands of the

recipient.

iii. Gift of Property other than Immovable property

a. Without consideration - Where any property other

than immovable property is received by an individual

or HUF, the aggregate fair market value of which

exceeds Rs.50000, the whole of

Gift of Money or Property from

unrelated persons

the aggregate FMV of such property shall be

taxable in the hands of the recipient.

b. Acquired for inadequate consideration – Where

such property is acquired for a consideration

which is less than the aggregate fair market

value of the property by an amount exceeding

Rs.50000, the aggregate fair market value of

such property as exceeds such consideration

shall be taxable in the hands of the recipient.

Gift of Money or Property from

unrelated persons

Meaning of Property – Property means

i. Immovable property being land or building or both

ii. Shares and securities

iii.Jewellery

iv.Archaeological collections

v. Drawings

vi.Paintings

vii.Sculptures

Gift of Money or Property from

unrelated persons

viii. Any work of art

ix. Bullion

x. Where a firm or a company, not being a

company in which the public are substantially

interested, receives in any P.Y, from any person

or persons (on or after 1/6/2010), any property,

being shares of a company not being a company

in which the public are substantially interested,

a) Without consideration, the aggregate fair

Gift of Money or Property from

unrelated persons

market value of such property

b) For a consideration which is less than the

aggregate fair market value of the property by an

amount exceeding Rs.50000, the aggregate fair

market value of such property as exceeds such

consideration.

However the transactions undertaken for business

reorganisation, amalgamation and demerger

shall be excluded from the application of this

clause.

Gift of Money or Property from

unrelated persons

Circumstances when such gift shall not be

treated as income

Where the sum of money or any property is

received

i) From any relative or

ii) On the occasion of the marriage of the

Gift of Money or Property from

unrelated persons

individual or

iii) Under a Will or by way of inheritance or

iv) In contemplation of death of the payer or

donor as the case may be or

v) From any local authority or

vi) From any fund, foundation, university,

other educational institution, hospital,

medical institution, any trust or institution

referred to in Sec 10(23C) or

Gift of Money or Property from

unrelated persons

vii) From charitable institutions registered u/s

12AA,

the amount so received shall not be

chargeable to income tax.

Definition of relative:

1. Spouse of the individual

2. Brothers or sisters of the individual

3. Brothers or sisters of the spouse of the

individual

Gift of Money or Property from

unrelated persons

4. Brother or sister of either of the parents

of the individual

5. Any lineal ascendant or descendant of

the individual

6. Any lineal ascendant or descendant of

the spouse of the individual

7. Spouse of the person referred to in

clauses 2 to 6 above.

Interest on compensation or

enhanced compensation

Any interest received by an assessee on

compensation or enhanced compensation,

as the case may be, shall be deemed to be

the income of the year in which it is

received.

A deduction of a sum equal to 50% of such

income shall be allowed to the asessee and

no deduction shall be allowed under any

other clause of Section 57.

Family Pension

After the death of the employee, if there is any

family pension received by the legal heirs of

the deceased, it will be deemed to be income

of the legal heir and will be taxable under the

head Income from Other Sources.

On such pension, a standard deduction shall be

allowed to the legal heir @ 33.33% of such

pension or Rs.15000 whichever is less.

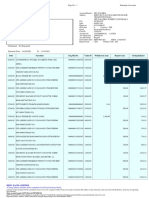

Example

Q.1 - Mr.Ashok received a sum of Rs.500000 as gift during

the financial year 2007-2008, the details of which are

as follows:

a. From relatives on the occasion of birthday Rs.100000

b. From an unregistered charitable institution in

connection with compensation for floods Rs.50000

c. Rs.150000 received from friends on the occasion of

birthday

d. Rs.200000 received from a neighbour who is in death

bed.

Inadmissible Expenses – Sec 58

i) Personal Expenses

ii) Interest and salary payable outside India, if tax

has not been paid or deducted at source.

iii) Income tax/Wealth tax paid

iv) Expenses of the nature specified in Sec 40A

(excessive or unreasonable payments to

certain specified persons) and payments

exceeding Rs.20000 otherwise than by way of

a/c payee cheque or draft.

Inadmissible Expenses – Sec

58

v) No deduction shall be allowed in respect

of winnings from lotteries, crossword

puzzles, card games, races including

horse race, gambling, betting etc.

However expenditure on the activity of

owning and maintaining race horses

shall be allowed as a deduction while

computing the income from this activity.

Deemed Income – Sec 59

Any amount received or benefit derived in

respect of expenditure incurred or loss or

trading liability allowed as deduction shall

be deemed as income in the year in which

the amount is received or the benefit is

accrued.

Interesting Case Laws

1. Amenity charges can be charged under

the head Income from Other sources

only in cases where it is collected

independent of rent from the building. In

case where the composite income is

received towards rent and amenities, the

entire income shall be charged to tax

under the head ‘Income from House

Property’ – SC decision in Shambhu

Investment Pvt Ltd.

Interesting Case Laws

2. When an assessee borrows for the purpose of

investing in securities, interest on loan is

deductible from the income derived from such

investment in the computation of taxable

income. Even if there is no income in a particular

year, the assessee can claim deduction of such

interest, resulting in loss, so long as the purpose

of such expenditure is making or earning income

– CIT vs Rajendra Prasad Moody (SC)

Some examples of income

chargeable under this head

Interest on bank deposits and loans

Income from sub letting

Director’s fee

Agricultural income from outside India

Rent of plot of land

Insurance Commission

Interest on unrecognised provident fund received at the

time of retirement by an employee

Income from private tuition

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- George Santos Vulnerability Report SummaryDocument4 pagesGeorge Santos Vulnerability Report SummaryCBS News PoliticsNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument23 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balanceavnish sharmaNo ratings yet

- The Revision of The Product Liability Directive A Key Piece in The Artificial Intelligence Liability Puzzle-2023Document13 pagesThe Revision of The Product Liability Directive A Key Piece in The Artificial Intelligence Liability Puzzle-2023Huy HoàngNo ratings yet

- Telecommunications of BangladeshDocument61 pagesTelecommunications of BangladeshTaohid KhanNo ratings yet

- Law 22Document6 pagesLaw 22ram RedNo ratings yet

- Google Ads Optimisation Checklist - (Search) Google Ads Optimisation ChecklistDocument2 pagesGoogle Ads Optimisation Checklist - (Search) Google Ads Optimisation ChecklistCamilaNo ratings yet

- Acct Statement XX3571 07112022Document36 pagesAcct Statement XX3571 07112022ashutoshpal21No ratings yet

- A Summer Training Project Report Tushar Raj Bahl 098Document32 pagesA Summer Training Project Report Tushar Raj Bahl 098Chirag BhardwajNo ratings yet

- Raj 2009Document30 pagesRaj 2009Matías ReyesNo ratings yet

- Proforma Invoice: Plot No 4, Sec 4, Industrial Area Near Vithalwadi Station, Hira Compound, Opp Gaodevi TempleDocument1 pageProforma Invoice: Plot No 4, Sec 4, Industrial Area Near Vithalwadi Station, Hira Compound, Opp Gaodevi TempleAbhinav TayadeNo ratings yet

- Instructions For Profit & Loss Distribution and Pool Management For Islamic Banking Institutions (Ibis)Document9 pagesInstructions For Profit & Loss Distribution and Pool Management For Islamic Banking Institutions (Ibis)Alhamd ShariahNo ratings yet

- Chapter IDocument28 pagesChapter IReabels FranciscoNo ratings yet

- HRM 450Document5 pagesHRM 450Fahmid Rahman Siam 1812798630No ratings yet

- Ken - Rate Card (2022)Document2 pagesKen - Rate Card (2022)Jay JayNo ratings yet

- FA5 - Group 1 - Project ProposalDocument33 pagesFA5 - Group 1 - Project ProposalsirdeboyNo ratings yet

- Linc Pen Case StudyDocument13 pagesLinc Pen Case StudySHAHEER THEKKEYILNo ratings yet

- Brief History of Cenvat CreditDocument13 pagesBrief History of Cenvat CreditKirankumar RangdalNo ratings yet

- Agsoba Global: Internal MemoDocument2 pagesAgsoba Global: Internal MemoKunle AkingbadeNo ratings yet

- How Did Economists Get It So Wrong?: by Paul Krugman Published: September 2, 2009Document18 pagesHow Did Economists Get It So Wrong?: by Paul Krugman Published: September 2, 2009jazzskyblueNo ratings yet

- Wew CaseDocument2 pagesWew CaseDonn Eduard GaradoNo ratings yet

- Suchitra Kanuparthi, Member (J) and Chandra Bhan Singh, Member (T)Document17 pagesSuchitra Kanuparthi, Member (J) and Chandra Bhan Singh, Member (T)himeesha dhiliwalNo ratings yet

- Business Plan - Fajardo, AlonaDocument11 pagesBusiness Plan - Fajardo, AlonaAlona FajardoNo ratings yet

- Fayth Ayuste CVDocument1 pageFayth Ayuste CVAb HermosoNo ratings yet

- Social Relevance Project Report - Format - MMSDocument8 pagesSocial Relevance Project Report - Format - MMSSoham BhurkeNo ratings yet

- Hit 7300 Epd PDFDocument44 pagesHit 7300 Epd PDFkupeoNo ratings yet

- Upsc 2023 Classroom Online Courses August Vajiram and Ravi3Document3 pagesUpsc 2023 Classroom Online Courses August Vajiram and Ravi3DCASNo ratings yet

- Korindo ADocument8 pagesKorindo ATeuku Muhammad Iqbal AnwarNo ratings yet

- BUS 510 Assignment 3, An Organizational Change ProjectDocument19 pagesBUS 510 Assignment 3, An Organizational Change ProjectRK JayanaNo ratings yet

- Entrepreneurship Education in Zimbabwe: Research ArticleDocument27 pagesEntrepreneurship Education in Zimbabwe: Research Articlemunaxemimosa8No ratings yet

- Milk Drinking Behaviors in Vietnam Share by WorldLine TechnologyDocument21 pagesMilk Drinking Behaviors in Vietnam Share by WorldLine TechnologyThanh Thâu TrầnNo ratings yet