Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

12 viewsTo Determine The Cost of Capital

To Determine The Cost of Capital

Uploaded by

SO NThe document discusses factors that influence the cost of capital in the future. It separates these factors into those a company can control and those it can't control. Factors a company can control include capital structure policy, dividend policy, and investment policy. Factors outside a company's control are stock and bond market conditions as well as the market risk premium.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- Capital Structure and Dividend PolicyDocument25 pagesCapital Structure and Dividend PolicySarah Mae SudayanNo ratings yet

- Factors Affecting Cost of CapitalDocument11 pagesFactors Affecting Cost of CapitalGairik Deb100% (4)

- Factors Affecting Capital Structure: (A) Internal Factors (B) External Factors (C) General FactorsDocument4 pagesFactors Affecting Capital Structure: (A) Internal Factors (B) External Factors (C) General Factorsshri277No ratings yet

- Capital Structure Decisions - 2 PDFDocument22 pagesCapital Structure Decisions - 2 PDFTashfeen RazzaqNo ratings yet

- FM Sheet 4 (JUHI RAJWANI)Document8 pagesFM Sheet 4 (JUHI RAJWANI)Mukesh SinghNo ratings yet

- FIN2014 Revision-2Document15 pagesFIN2014 Revision-2felicia tanNo ratings yet

- Capital StuctureDocument3 pagesCapital Stucturejiturai5162No ratings yet

- Case of WaccDocument2 pagesCase of WaccSalman RahiNo ratings yet

- Chapter 14Document9 pagesChapter 14Kimberly LimNo ratings yet

- Importance of Capital StructureDocument2 pagesImportance of Capital StructureShruti JoseNo ratings yet

- FIN 319 - Lecture 06Document30 pagesFIN 319 - Lecture 06Trà MyNo ratings yet

- Optimum Capital Structure Maximizes The Market Value of The Firm Determination of The Optimum Capital StructureDocument2 pagesOptimum Capital Structure Maximizes The Market Value of The Firm Determination of The Optimum Capital StructurevaeshnavikanukuntlaNo ratings yet

- An Overview of Financial ManagementDocument46 pagesAn Overview of Financial ManagementKiran IfciNo ratings yet

- Capital Structure PolicyDocument7 pagesCapital Structure PolicymakulitnatupaNo ratings yet

- FNAN 3015 NOTES On Capital Structury Theory 07-09-2020Document2 pagesFNAN 3015 NOTES On Capital Structury Theory 07-09-2020Sonali SharmaNo ratings yet

- Capital Structure Issues: V. VI. V.1 Mergers and Acquisitions Definition and DifferencesDocument26 pagesCapital Structure Issues: V. VI. V.1 Mergers and Acquisitions Definition and Differenceskelvin pogiNo ratings yet

- FIN701 Finance AS1744Document17 pagesFIN701 Finance AS1744anurag soniNo ratings yet

- Leverage: Let's DiscussDocument9 pagesLeverage: Let's DiscussClaudette ManaloNo ratings yet

- Unit 3rd Financial Management BBA 4thDocument18 pagesUnit 3rd Financial Management BBA 4thYashfeen FalakNo ratings yet

- Chapter 6. Capital Structure, Leverage and InterestDocument20 pagesChapter 6. Capital Structure, Leverage and InterestFideliaNo ratings yet

- FM S5 Capitalstructure TheoriesDocument36 pagesFM S5 Capitalstructure TheoriesSunny RajoraNo ratings yet

- Edited Chapter 2-5 FM2Document79 pagesEdited Chapter 2-5 FM2Andualem ZenebeNo ratings yet

- Finance-Basic Concepts: R Srinivasan FCA, FAFD, RV & RPDocument18 pagesFinance-Basic Concepts: R Srinivasan FCA, FAFD, RV & RPusne902No ratings yet

- The AssignmentDocument4 pagesThe AssignmentWalter NwaimoNo ratings yet

- Project AppraisalDocument29 pagesProject AppraisalsaravmbaNo ratings yet

- Capital Structure and LeverageDocument23 pagesCapital Structure and Leveragequeen montanoNo ratings yet

- Topic 3 - Capital StructureDocument17 pagesTopic 3 - Capital StructureSandeepa KaurNo ratings yet

- Chapter OneDocument22 pagesChapter OneFirdows SuleymanNo ratings yet

- FMF T8 DoneDocument10 pagesFMF T8 DoneThongkit ThoNo ratings yet

- Introduction To Financial MGTDocument7 pagesIntroduction To Financial MGTdsena27No ratings yet

- Module Iv Capital Structure÷nd DecisionsDocument37 pagesModule Iv Capital Structure÷nd DecisionsMidhun George VargheseNo ratings yet

- Optimal Capital StructureDocument13 pagesOptimal Capital StructureScarlet SalongaNo ratings yet

- Advance Financial ManagementDocument62 pagesAdvance Financial ManagementKaneNo ratings yet

- MB20202 Corporate Finance Unit IV Study MaterialsDocument21 pagesMB20202 Corporate Finance Unit IV Study MaterialsSarath kumar CNo ratings yet

- Study MaterialDocument17 pagesStudy MaterialRohit KumarNo ratings yet

- FM Mod 4Document12 pagesFM Mod 4Supriya CSNo ratings yet

- Working Capital ManagementDocument59 pagesWorking Capital ManagementYonasNo ratings yet

- Presentation of Capital BudgetingDocument45 pagesPresentation of Capital BudgetingIsmail UmerNo ratings yet

- FM Q-2Document12 pagesFM Q-2anveshvarma365No ratings yet

- Financial Management L2Document17 pagesFinancial Management L2amaniNo ratings yet

- Capital Structure: Definition: Capital Structure Is The Mix of Financial Securities Used To Finance The FirmDocument11 pagesCapital Structure: Definition: Capital Structure Is The Mix of Financial Securities Used To Finance The FirmArun NairNo ratings yet

- Profit and Shareholder MaximizationDocument23 pagesProfit and Shareholder MaximizationDaodu Ladi BusuyiNo ratings yet

- Dark Side of Valuation NotesDocument11 pagesDark Side of Valuation Notesad9292No ratings yet

- Capital Structure TheoryDocument24 pagesCapital Structure TheoryLey Min HookoNo ratings yet

- Corporate Financial Management IntroDocument17 pagesCorporate Financial Management IntroADEYANJU AKEEMNo ratings yet

- CF 04 Lecture NotesDocument16 pagesCF 04 Lecture NotesVealmurugan ThirumalaiNo ratings yet

- CFDocument2 pagesCFGen AbulkhairNo ratings yet

- Chapter OneDocument12 pagesChapter OneSuleyman TesfayeNo ratings yet

- Strategic Finance: 2-Pillars I.E. "Behavioral Finance" & "Strategic Finance"Document7 pagesStrategic Finance: 2-Pillars I.E. "Behavioral Finance" & "Strategic Finance"DK BalochNo ratings yet

- Unit IVDocument48 pagesUnit IVGhar AjaNo ratings yet

- Chapter 2 - AnswerDocument4 pagesChapter 2 - Answerwynellamae80% (5)

- Chapter 15 PDFDocument61 pagesChapter 15 PDFChincel G. ANINo ratings yet

- Project On Impact of Dividends Policy 1Document43 pagesProject On Impact of Dividends Policy 1Soma BanikNo ratings yet

- Capital Structure With Frictions - IIDocument13 pagesCapital Structure With Frictions - IIGeraldiNo ratings yet

- Meaning of Financial ManagementDocument6 pagesMeaning of Financial ManagementMar JinitaNo ratings yet

- Factors Affecting Financial DecisionsDocument4 pagesFactors Affecting Financial Decisionsshubham_cool1996No ratings yet

- MB0029 - P.Srinath - Completely SolvedDocument18 pagesMB0029 - P.Srinath - Completely SolvedSrinathNo ratings yet

- Dividend Investing: Passive Income and Growth Investing for BeginnersFrom EverandDividend Investing: Passive Income and Growth Investing for BeginnersNo ratings yet

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- A Dynamic Model of Customer Complaining Behaviour From The Perspective of Service - Dominant LogicDocument23 pagesA Dynamic Model of Customer Complaining Behaviour From The Perspective of Service - Dominant LogicSO NNo ratings yet

- Navchalno Metodychnyj Pidruchnyk Business CommunacationDocument121 pagesNavchalno Metodychnyj Pidruchnyk Business CommunacationSO NNo ratings yet

- Financial ManagementDocument1 pageFinancial ManagementSO NNo ratings yet

- Econ 101: Principles of Microeconomics Fall 2012: Problem 1: Use The Following Graph To Answer The QuestionsDocument7 pagesEcon 101: Principles of Microeconomics Fall 2012: Problem 1: Use The Following Graph To Answer The QuestionsSO NNo ratings yet

To Determine The Cost of Capital

To Determine The Cost of Capital

Uploaded by

SO N0 ratings0% found this document useful (0 votes)

12 views6 pagesThe document discusses factors that influence the cost of capital in the future. It separates these factors into those a company can control and those it can't control. Factors a company can control include capital structure policy, dividend policy, and investment policy. Factors outside a company's control are stock and bond market conditions as well as the market risk premium.

Original Description:

To determine the Cost of Capital

Original Title

To determine the Cost of Capital

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses factors that influence the cost of capital in the future. It separates these factors into those a company can control and those it can't control. Factors a company can control include capital structure policy, dividend policy, and investment policy. Factors outside a company's control are stock and bond market conditions as well as the market risk premium.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

12 views6 pagesTo Determine The Cost of Capital

To Determine The Cost of Capital

Uploaded by

SO NThe document discusses factors that influence the cost of capital in the future. It separates these factors into those a company can control and those it can't control. Factors a company can control include capital structure policy, dividend policy, and investment policy. Factors outside a company's control are stock and bond market conditions as well as the market risk premium.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 6

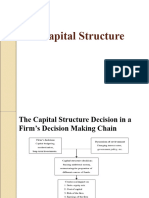

To determine the Cost of Capital in the future,

there are several factors that

influence

The Company The Company

Can Control Can’t Control

Capital Structure Stock and Bond

Policy Markets

Dividend Policy Market Risk Premium

(RPM)

Investment Policy Tax Rates

A. The Company Can Control :

1. Capital Structure Policy

• To determine the Capital Structure

Policy a company must consider the

company's Business Risk (without

debt) and Financial Risk (with debt).

2. Dividend Policy

• Dividend policy is the decision of the

board of directors regarding the amount

of the remaining profits (past or present)

that can be distributed to shareholders in

a company

• Deviden Poliy Optimal when the policy

can create a balance between current

dividends and future growth in order to

maximize the company's stock price

3. Investment Policy

• Investment policy whereby when the company

has new capital and will be invested in assets of

business :

If the company invests in a completely new line

of business the marginal cost of capital must

reflect the risk of the new business.

If the line of business is the same as the core

business the risk can be to assume the

marginal cost of capital with existing assets.

B. The Company Can’t Control :

1. Stock and Bond Markets

• Interest rates are strongly influenced by

inflation. Inflation rises will cause interest

rates to rise.

• if interest rates in the economy rise, the

costs of both debt and equity will

increase.

2. Market Risk Premium (RPM)

• The RPM is the difference between the

expected return on a market portfolio and

the risk-free rate.

• Investors’ aversion to risk determines the

market risk premium. Individual firms have

no control over the RPM, which affects the

cost of equity and thus the WACC.

You might also like

- Capital Structure and Dividend PolicyDocument25 pagesCapital Structure and Dividend PolicySarah Mae SudayanNo ratings yet

- Factors Affecting Cost of CapitalDocument11 pagesFactors Affecting Cost of CapitalGairik Deb100% (4)

- Factors Affecting Capital Structure: (A) Internal Factors (B) External Factors (C) General FactorsDocument4 pagesFactors Affecting Capital Structure: (A) Internal Factors (B) External Factors (C) General Factorsshri277No ratings yet

- Capital Structure Decisions - 2 PDFDocument22 pagesCapital Structure Decisions - 2 PDFTashfeen RazzaqNo ratings yet

- FM Sheet 4 (JUHI RAJWANI)Document8 pagesFM Sheet 4 (JUHI RAJWANI)Mukesh SinghNo ratings yet

- FIN2014 Revision-2Document15 pagesFIN2014 Revision-2felicia tanNo ratings yet

- Capital StuctureDocument3 pagesCapital Stucturejiturai5162No ratings yet

- Case of WaccDocument2 pagesCase of WaccSalman RahiNo ratings yet

- Chapter 14Document9 pagesChapter 14Kimberly LimNo ratings yet

- Importance of Capital StructureDocument2 pagesImportance of Capital StructureShruti JoseNo ratings yet

- FIN 319 - Lecture 06Document30 pagesFIN 319 - Lecture 06Trà MyNo ratings yet

- Optimum Capital Structure Maximizes The Market Value of The Firm Determination of The Optimum Capital StructureDocument2 pagesOptimum Capital Structure Maximizes The Market Value of The Firm Determination of The Optimum Capital StructurevaeshnavikanukuntlaNo ratings yet

- An Overview of Financial ManagementDocument46 pagesAn Overview of Financial ManagementKiran IfciNo ratings yet

- Capital Structure PolicyDocument7 pagesCapital Structure PolicymakulitnatupaNo ratings yet

- FNAN 3015 NOTES On Capital Structury Theory 07-09-2020Document2 pagesFNAN 3015 NOTES On Capital Structury Theory 07-09-2020Sonali SharmaNo ratings yet

- Capital Structure Issues: V. VI. V.1 Mergers and Acquisitions Definition and DifferencesDocument26 pagesCapital Structure Issues: V. VI. V.1 Mergers and Acquisitions Definition and Differenceskelvin pogiNo ratings yet

- FIN701 Finance AS1744Document17 pagesFIN701 Finance AS1744anurag soniNo ratings yet

- Leverage: Let's DiscussDocument9 pagesLeverage: Let's DiscussClaudette ManaloNo ratings yet

- Unit 3rd Financial Management BBA 4thDocument18 pagesUnit 3rd Financial Management BBA 4thYashfeen FalakNo ratings yet

- Chapter 6. Capital Structure, Leverage and InterestDocument20 pagesChapter 6. Capital Structure, Leverage and InterestFideliaNo ratings yet

- FM S5 Capitalstructure TheoriesDocument36 pagesFM S5 Capitalstructure TheoriesSunny RajoraNo ratings yet

- Edited Chapter 2-5 FM2Document79 pagesEdited Chapter 2-5 FM2Andualem ZenebeNo ratings yet

- Finance-Basic Concepts: R Srinivasan FCA, FAFD, RV & RPDocument18 pagesFinance-Basic Concepts: R Srinivasan FCA, FAFD, RV & RPusne902No ratings yet

- The AssignmentDocument4 pagesThe AssignmentWalter NwaimoNo ratings yet

- Project AppraisalDocument29 pagesProject AppraisalsaravmbaNo ratings yet

- Capital Structure and LeverageDocument23 pagesCapital Structure and Leveragequeen montanoNo ratings yet

- Topic 3 - Capital StructureDocument17 pagesTopic 3 - Capital StructureSandeepa KaurNo ratings yet

- Chapter OneDocument22 pagesChapter OneFirdows SuleymanNo ratings yet

- FMF T8 DoneDocument10 pagesFMF T8 DoneThongkit ThoNo ratings yet

- Introduction To Financial MGTDocument7 pagesIntroduction To Financial MGTdsena27No ratings yet

- Module Iv Capital Structure÷nd DecisionsDocument37 pagesModule Iv Capital Structure÷nd DecisionsMidhun George VargheseNo ratings yet

- Optimal Capital StructureDocument13 pagesOptimal Capital StructureScarlet SalongaNo ratings yet

- Advance Financial ManagementDocument62 pagesAdvance Financial ManagementKaneNo ratings yet

- MB20202 Corporate Finance Unit IV Study MaterialsDocument21 pagesMB20202 Corporate Finance Unit IV Study MaterialsSarath kumar CNo ratings yet

- Study MaterialDocument17 pagesStudy MaterialRohit KumarNo ratings yet

- FM Mod 4Document12 pagesFM Mod 4Supriya CSNo ratings yet

- Working Capital ManagementDocument59 pagesWorking Capital ManagementYonasNo ratings yet

- Presentation of Capital BudgetingDocument45 pagesPresentation of Capital BudgetingIsmail UmerNo ratings yet

- FM Q-2Document12 pagesFM Q-2anveshvarma365No ratings yet

- Financial Management L2Document17 pagesFinancial Management L2amaniNo ratings yet

- Capital Structure: Definition: Capital Structure Is The Mix of Financial Securities Used To Finance The FirmDocument11 pagesCapital Structure: Definition: Capital Structure Is The Mix of Financial Securities Used To Finance The FirmArun NairNo ratings yet

- Profit and Shareholder MaximizationDocument23 pagesProfit and Shareholder MaximizationDaodu Ladi BusuyiNo ratings yet

- Dark Side of Valuation NotesDocument11 pagesDark Side of Valuation Notesad9292No ratings yet

- Capital Structure TheoryDocument24 pagesCapital Structure TheoryLey Min HookoNo ratings yet

- Corporate Financial Management IntroDocument17 pagesCorporate Financial Management IntroADEYANJU AKEEMNo ratings yet

- CF 04 Lecture NotesDocument16 pagesCF 04 Lecture NotesVealmurugan ThirumalaiNo ratings yet

- CFDocument2 pagesCFGen AbulkhairNo ratings yet

- Chapter OneDocument12 pagesChapter OneSuleyman TesfayeNo ratings yet

- Strategic Finance: 2-Pillars I.E. "Behavioral Finance" & "Strategic Finance"Document7 pagesStrategic Finance: 2-Pillars I.E. "Behavioral Finance" & "Strategic Finance"DK BalochNo ratings yet

- Unit IVDocument48 pagesUnit IVGhar AjaNo ratings yet

- Chapter 2 - AnswerDocument4 pagesChapter 2 - Answerwynellamae80% (5)

- Chapter 15 PDFDocument61 pagesChapter 15 PDFChincel G. ANINo ratings yet

- Project On Impact of Dividends Policy 1Document43 pagesProject On Impact of Dividends Policy 1Soma BanikNo ratings yet

- Capital Structure With Frictions - IIDocument13 pagesCapital Structure With Frictions - IIGeraldiNo ratings yet

- Meaning of Financial ManagementDocument6 pagesMeaning of Financial ManagementMar JinitaNo ratings yet

- Factors Affecting Financial DecisionsDocument4 pagesFactors Affecting Financial Decisionsshubham_cool1996No ratings yet

- MB0029 - P.Srinath - Completely SolvedDocument18 pagesMB0029 - P.Srinath - Completely SolvedSrinathNo ratings yet

- Dividend Investing: Passive Income and Growth Investing for BeginnersFrom EverandDividend Investing: Passive Income and Growth Investing for BeginnersNo ratings yet

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- A Dynamic Model of Customer Complaining Behaviour From The Perspective of Service - Dominant LogicDocument23 pagesA Dynamic Model of Customer Complaining Behaviour From The Perspective of Service - Dominant LogicSO NNo ratings yet

- Navchalno Metodychnyj Pidruchnyk Business CommunacationDocument121 pagesNavchalno Metodychnyj Pidruchnyk Business CommunacationSO NNo ratings yet

- Financial ManagementDocument1 pageFinancial ManagementSO NNo ratings yet

- Econ 101: Principles of Microeconomics Fall 2012: Problem 1: Use The Following Graph To Answer The QuestionsDocument7 pagesEcon 101: Principles of Microeconomics Fall 2012: Problem 1: Use The Following Graph To Answer The QuestionsSO NNo ratings yet