Professional Documents

Culture Documents

Process Costing

Process Costing

Uploaded by

Qurat Saboor0 ratings0% found this document useful (0 votes)

12 views38 pagesOriginal Title

5300106.ppt

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

12 views38 pagesProcess Costing

Process Costing

Uploaded by

Qurat SaboorCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 38

Process Costing

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

1. Identify the situation in which process-

costing systems are appropriate

2. Understand the basic concepts of process-

costing and compute average unit costs

3. Describe the five steps in process costing

and calculate equivalent units

4. Use the weighted-average method and

first-in, first-out (FIFO) method of process

costing

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-2

5. Apply process-costing methods to situations

with transferred-in costs

6. Understand the need for hybrid-costing

systems such as operation-costing

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-3

Job-Costing Systems Process-Costing

Systems

Distinct, identifiable

units of a product Masses of identical

or service or similar units of a

product or service

Examples:

Custom-made Examples:

machines, Food,

houses chemical processing

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-4

Process costing is a system where the unit cost

of a product or service is obtained by assigning

total costs to many identical or similar units of

output.

Unit costs are computed by dividing total costs

incurred by the number of units of output from

the production process.

Each unit receives the same or similar amounts

of direct materials costs, direct labor costs, and

manufacturing overhead.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-5

In a job-costing system, individual jobs use

different quantities of resources, so it would

be incorrect to cost each job at the same

average production cost.

In contrast, when identical or similar units of

products or services are mass-produced,

process costing is used to calculate an

average production cost for all units

produced.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-6

Process-costing systems separate costs into

cost categories according to when costs are

introduced into the process.

1. Direct materials are usually added at the

beginning of the production process, or at

the start of work in a subsequent department

down the assembly line.

2. Conversion costs are generally added

equally along the production process.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-7

Let’s look at the process-costing process three

ways:

1.No beginning or ending work-in-process

inventories.

2.No beginning work-in-process inventory and

some ending work-in-process inventory.

3.Both beginning and ending work-in-process

inventories are present.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-8

When using process costing without any

beginning or ending work-in-process inventory,

all costs that were introduced to the process

during the period will be assigned to the

finished units leaving work-in-process

inventory at the end of the period.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-9

1. Summarize the flow of physical units of

output.

2. Compute output in terms of equivalent

units.

3. Summarize total costs to account for.

4. Compute cost per equivalent unit.

5. Assign total costs to units completed and

to units in ending work-in-process.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-10

A derived amount of output units that:

1. Takes the quantity of each input in units

completed and in unfinished units of work in

process and

2. Converts the quantity of input into the

amount of completed output units that could

be produced with that quantity of input.

Are calculated separately for each input.

(direct materials and conversion cost)

When calculating equivalent units in step

2, focus on quantities and disregard dollar

amounts until after the equivalent units

are computed.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-11

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-12

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-13

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-14

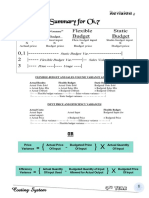

Process costing can be accomplished using

the weighted-average method or the FIFO

method. We’ll look first at weighted-

average.

Calculates cost per equivalent unit of all

work done to date. (regardless of the

accounting period in which it was done)

Assigns this cost to equivalent units

completed and transferred out of the

process, and to equivalent units in ending

work-in-process inventory.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-15

The Weighted-average cost is the total of all

costs entering the work-in-process account

divided by the total equivalent units of work

done to date.

The beginning balance of the work-in-process

account (work done in a prior period) is

blended in with current period costs.

Let’s look at Case 3 (with both beginning and

ending work-in-process inventory using the

Weighted Average method.)

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-16

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-17

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-18

Two critical figures arise out of step 5 of

the cost allocation process:

1. The amount of the journal entry transferring

the allocated cost of units completed and

sent from work-in-process inventory to

finished goods inventory

2. The ending balance of the work-in-process

inventory account that will appear on the

balance sheet.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-19

Assigns the cost of the previous accounting

period’s equivalent units in beginning work-

in-process inventory to the first units

completed and transferred out of the

process.

Assigns the cost of equivalent units worked

on during the current period first to

complete beginning inventory, next to

started and completed new units, and

finally to units in ending work-in-process

inventory.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-20

A distinctive feature of FIFO process-costing

method is that work done on beginning

inventory is kept separate from work done in

the current period.

There is no blending of costs as we saw with

the weighted-average method.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-21

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-22

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-23

Two critical figures arise out of step 5 of

the cost-allocation process:

1. The amount of the journal entry transferring

the allocated cost of units completed and

sent from work-in-process inventory to

finished goods inventory.

2. The ending balance of the work-in-process

inventory account that will appear on the

balance sheet.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-24

FIFO assumes that all the higher-cost units

(from our example) from the previous period

in beginning wip are the first to be

completed and transferred out and that

ending wip consists of only the lower-cost

current-period units.

The weighted-average method smooths out

the cost per equivalent unit by assuming that

more lower-cost units are transferred out

and some higher-cost remain in ending wip.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-25

Managers use information from process-

costing systems to make pricing and product-

mix decisions and understand how well a

firm’s processes are performing.

FIFO provides managers with information

about changes in the costs per unit from one

period to the next.

In a period of rising prices, the weighted-

average method will decrease taxes because

cost of goods sold will be higher and

operating income lower.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-26

Are costs incurred in previous departments

that are carried forward as the product’s

cost when it moves to a subsequent process

in the production cycle.

Are also called previous department costs.

Journal entries are made to mirror the

progress in production from department to

department.

Transferred-in costs are treated as if they

are a separate type of direct material

added at the beginning of the process.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-27

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-28

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-29

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-30

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-31

1. Be sure to include the transferred-in costs

from previous departments in your

calculations.

2. When calculating the costs to be transferred

using the FIFO method, do not overlook costs

that were in beginning wip which may now be

part of the units transferred.

3. Unit costs may fluctuate between periods so

transferred units may contain batches

accumulated at different costs (using FIFO).

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-32

4. Those unit costs discussed in item #3 on the

prior slide will be transferred to the next

department at ONE AVERAGE UNIT cost.

5. Units may be measured in different

denominations in different departments

(feet in one department and yards in

another or kilos vs. liters). In this case,

measurements must be converted to the

correct measure.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-33

Product-costing systems do not always fall

neatly into either job-costing or process-

costing categories.

A Hybrid-costing system blends

characteristics from both job-costing and

process-costing systems.

Many actual production systems are in fact

hybrids.

Examples include manufacturers of

televisions, dishwashers, and washing

machines, and shoes who tend to use hybrid-

costing systems.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-34

The hybrid-costing systems use process

costing to account for the conversion costs

and job costing for the material and

customizable components.

One specific type of hybrid-costing system is

known as the Operation-Costing System

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-35

An operation is a standardized method or

technique that is performed repetitively

resulting in different finished goods.

An operation-costing system is a hybrid-costing

system applied to batches of similar, but not

identical, products.

Within each operation, all product units are

treated exactly alike, using identical amounts of

the operation’s resources.

Managers find operation costing useful in cost

management because operation costing focuses

on control of physical processes or operations of

a given production system.

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-36

TERMS TO LEARN PAGE NUMBER REFERENCE

Equivalent units Page 668

First-in, first-out (FIFO) process- Page 676

costing method

Hybrid-costing system Page 685

Operation Page 686

Operation-costing system Page 686

Previous-department costs Page 681

Transferred-in costs Page 681

Weighted-average process- Page 673

costing method

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

17-37

Copyright © 2015 Pearson Education, Inc. All Rights Reserved.

38

You might also like

- Assignment 4 Capital Budgeting and COCDocument3 pagesAssignment 4 Capital Budgeting and COCQurat Saboor100% (1)

- 20221218145704D6181 - Datar - 17e - Accessible - Fullppt - 18 - Process Costing WeightedDocument27 pages20221218145704D6181 - Datar - 17e - Accessible - Fullppt - 18 - Process Costing WeightedMateus AriatamaNo ratings yet

- Victoria Chemicals PLC (B) - The Merseyside and Rotterdam Projects (SPREADSHEET) F-1544XDocument4 pagesVictoria Chemicals PLC (B) - The Merseyside and Rotterdam Projects (SPREADSHEET) F-1544XPaco ColínNo ratings yet

- Process Costing and Operation Costing: Answers To QuestionsDocument45 pagesProcess Costing and Operation Costing: Answers To Questionschanlego123No ratings yet

- Chapter 4 Solution..Document53 pagesChapter 4 Solution..HanaSuhanaNo ratings yet

- GE Hca15 PPT ch17Document38 pagesGE Hca15 PPT ch17Tita NurvitaNo ratings yet

- Chapter 16 Cost InformationDocument37 pagesChapter 16 Cost InformationvalerieNo ratings yet

- Cost Accounting 2 Fourth Year Second Semester 2020-2021 Chapter (17) Part (Dr. Badr Nabeeh) (1&2)Document17 pagesCost Accounting 2 Fourth Year Second Semester 2020-2021 Chapter (17) Part (Dr. Badr Nabeeh) (1&2)محمود احمدNo ratings yet

- Chapter 17 Final + Class Problems - pdf-1Document43 pagesChapter 17 Final + Class Problems - pdf-1محمود احمدNo ratings yet

- Ch17 Solution PDFDocument53 pagesCh17 Solution PDFmaria dezarie brioso100% (1)

- Hongren CH 17Document68 pagesHongren CH 17Sindymhn100% (1)

- Ch. 4 Job-Order CostingDocument39 pagesCh. 4 Job-Order CostingdhfbbbbbbbbbbbbbbbbbhNo ratings yet

- PDF Solution Manual For Horngrens Accounting The Managerial Chapters 12Th Edition 12Th Edition Online Ebook Full ChapterDocument120 pagesPDF Solution Manual For Horngrens Accounting The Managerial Chapters 12Th Edition 12Th Edition Online Ebook Full Chapterdorothea.cornell941100% (7)

- ASSIGNEMENT OF COST WubeDocument9 pagesASSIGNEMENT OF COST Wubewebeshet bekeleNo ratings yet

- Process CostingDocument36 pagesProcess CostingyusofayranNo ratings yet

- 6-Mac 1Document16 pages6-Mac 1nachofr2704No ratings yet

- CH 17Document15 pagesCH 17emmyindraNo ratings yet

- Chapter 2 Costing SystemsDocument26 pagesChapter 2 Costing SystemsfekadeNo ratings yet

- SM Horngren Cost Accounting 14e Ch17Document48 pagesSM Horngren Cost Accounting 14e Ch17Shrouk__Anas100% (2)

- Langfield-Smith7e IRM Ch05Document71 pagesLangfield-Smith7e IRM Ch05Rujun Wu100% (1)

- Process Costing: © 2009 Pearson Prentice Hall. All Rights ReservedDocument30 pagesProcess Costing: © 2009 Pearson Prentice Hall. All Rights ReservedAnonymous d1eylzUpNo ratings yet

- Process Costing: © 2012 Pearson Prentice Hall. All Rights ReservedDocument26 pagesProcess Costing: © 2012 Pearson Prentice Hall. All Rights ReservedayyazmNo ratings yet

- Process Costing: © 2009 Pearson Prentice Hall. All Rights ReservedDocument33 pagesProcess Costing: © 2009 Pearson Prentice Hall. All Rights ReservedGesaNo ratings yet

- Process Costing FIFO CRDocument21 pagesProcess Costing FIFO CRMiyangNo ratings yet

- Process Costing and Hybrid Product-Costing Systems: Answers To Review QuestionsDocument60 pagesProcess Costing and Hybrid Product-Costing Systems: Answers To Review QuestionsMISRET 2018 IEI JSCNo ratings yet

- 1Document3 pages1cruellaNo ratings yet

- COSACC Assignment 3Document2 pagesCOSACC Assignment 3Kenneth Jim HipolitoNo ratings yet

- Process Costing ActivityDocument3 pagesProcess Costing ActivityCassandra CeñidoNo ratings yet

- Cost Accounting Foundations and Evolutions 9th Edition Kinney Solutions Manual 1Document36 pagesCost Accounting Foundations and Evolutions 9th Edition Kinney Solutions Manual 1brandonmcdonaldewtqsgonkc100% (34)

- HorngrenCostAcc7ce PPT ch17Document29 pagesHorngrenCostAcc7ce PPT ch17Marj AgustinNo ratings yet

- Chap 004Document56 pagesChap 004palak32100% (5)

- Process CostingDocument4 pagesProcess CostingVidia ProjNo ratings yet

- Managerial Acc 3Document52 pagesManagerial Acc 3emadhamdy2002No ratings yet

- Process CostingDocument3 pagesProcess Costingmasof007No ratings yet

- GE Hca15 PPT ch02Document35 pagesGE Hca15 PPT ch02kkNo ratings yet

- Process CostinggDocument22 pagesProcess CostinggKurt Del RosarioNo ratings yet

- Chap 004Document52 pagesChap 004sunflower12345100% (2)

- Cost17EChapter18 SolutionsDocument57 pagesCost17EChapter18 SolutionsRon Matthew VillaruelNo ratings yet

- Process Costing vs. Job CostingDocument11 pagesProcess Costing vs. Job CostingRhea Royce CabuhatNo ratings yet

- Hmcost3e SM Ch06Document53 pagesHmcost3e SM Ch06omarshazakiNo ratings yet

- Chap 011Document47 pagesChap 011AakashSinghNo ratings yet

- Chapter 8 Assigment Manual CompleteDocument85 pagesChapter 8 Assigment Manual CompleteGio BurburanNo ratings yet

- Chap4 (E)Document47 pagesChap4 (E)Kiên Lê TrungNo ratings yet

- POMA Chapter 4 Process CostingDocument17 pagesPOMA Chapter 4 Process CostingzainabmossadiqNo ratings yet

- Process Costing QuestionsDocument4 pagesProcess Costing QuestionsAshley Ibe GuevarraNo ratings yet

- Managerial Accounting Hilton 6e Chapter 4 Solution PDFDocument68 pagesManagerial Accounting Hilton 6e Chapter 4 Solution PDFNoor QamarNo ratings yet

- Session 10-14 PGDM 2020-21Document44 pagesSession 10-14 PGDM 2020-21Krishnapriya NairNo ratings yet

- Chapter 3Document27 pagesChapter 3kenaNo ratings yet

- Process CostingDocument1 pageProcess CostingRocio EversNo ratings yet

- Management AccountingDocument246 pagesManagement AccountingsaraNo ratings yet

- Hilton7e SM CH4Document51 pagesHilton7e SM CH4VivekRaptor100% (1)

- تكاليف Ch17Document14 pagesتكاليف Ch17alsaqarhamzaNo ratings yet

- Pertemuan 2 - Cost Term and PurposesDocument32 pagesPertemuan 2 - Cost Term and PurposesGhinasaussanNo ratings yet

- Process Costing: ReadingsDocument52 pagesProcess Costing: Readingsمحمود احمدNo ratings yet

- Key Points or Learnings..Document3 pagesKey Points or Learnings..sakura harunoNo ratings yet

- Cost Accounting: Army Institute of Business Administration, SylhetDocument3 pagesCost Accounting: Army Institute of Business Administration, SylhetJafa AbnNo ratings yet

- Chapter 18 PPTs StudentDocument28 pagesChapter 18 PPTs StudentSarah SomaniNo ratings yet

- Ch04accessible 200101211933 PDFDocument61 pagesCh04accessible 200101211933 PDFMostakNo ratings yet

- Class - 6Document35 pagesClass - 6harsheen kaurNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Chapter 5 Cost Behavior Analysis and UseDocument2 pagesChapter 5 Cost Behavior Analysis and UseQurat SaboorNo ratings yet

- Week 8 and 9 CostofcapitalandinvestmenttheoryDocument35 pagesWeek 8 and 9 CostofcapitalandinvestmenttheoryQurat SaboorNo ratings yet

- Chapter 2 Cost Terms, Concepts, and ClassificationsDocument4 pagesChapter 2 Cost Terms, Concepts, and ClassificationsQurat SaboorNo ratings yet

- Chapter 3 Systems Design Job Order CostingDocument3 pagesChapter 3 Systems Design Job Order CostingQurat SaboorNo ratings yet

- Chapter 4 Systems Design Process CostingDocument3 pagesChapter 4 Systems Design Process CostingQurat SaboorNo ratings yet

- Week 10 Basics-Of-Capital-BudgetingDocument26 pagesWeek 10 Basics-Of-Capital-BudgetingQurat SaboorNo ratings yet

- W11-12 Cost-Volume-Profit RelationshipsDocument82 pagesW11-12 Cost-Volume-Profit RelationshipsQurat SaboorNo ratings yet

- Materials PlanningDocument2 pagesMaterials PlanningQurat SaboorNo ratings yet

- Bonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskDocument33 pagesBonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskQurat SaboorNo ratings yet

- Duration of Bonds Appendix A Sheet 1: Excel Yield (For Comparison) 0.644% 0.859% 2.042%Document10 pagesDuration of Bonds Appendix A Sheet 1: Excel Yield (For Comparison) 0.644% 0.859% 2.042%Qurat SaboorNo ratings yet

- Time Value of Money Fundamentals of Valuation With Financial CalculatorsDocument16 pagesTime Value of Money Fundamentals of Valuation With Financial CalculatorsQurat SaboorNo ratings yet

- Assignment 5 Investment AppraisalDocument3 pagesAssignment 5 Investment AppraisalQurat SaboorNo ratings yet

- Assignment 3 Risk and ReturnDocument2 pagesAssignment 3 Risk and ReturnQurat SaboorNo ratings yet

- Pha Foundation: Membership Registration Form of Pha Residencia PeshawarDocument1 pagePha Foundation: Membership Registration Form of Pha Residencia PeshawarQurat SaboorNo ratings yet

- Pha Foundation: Membership Registration Form of Pha Residencia PeshawarDocument1 pagePha Foundation: Membership Registration Form of Pha Residencia PeshawarQurat SaboorNo ratings yet

- Pha Foundation: Membership Registration Form of Pha Residencia PeshawarDocument1 pagePha Foundation: Membership Registration Form of Pha Residencia PeshawarQurat SaboorNo ratings yet

- Pha Foundation: Membership Registration Form of Pha Residencia PeshawarDocument1 pagePha Foundation: Membership Registration Form of Pha Residencia PeshawarQurat SaboorNo ratings yet

- Pha Foundation: Membership Registration Form of Pha Residencia PeshawarDocument1 pagePha Foundation: Membership Registration Form of Pha Residencia PeshawarQurat SaboorNo ratings yet

- Chapter 10 - The Cost of CapitalDocument13 pagesChapter 10 - The Cost of CapitalQurat SaboorNo ratings yet

- Managerial AccountingDocument39 pagesManagerial AccountingQurat SaboorNo ratings yet

- Highlowmethod 170125131453 PDFDocument11 pagesHighlowmethod 170125131453 PDFQurat SaboorNo ratings yet

- Application of Supply and DemandDocument22 pagesApplication of Supply and DemandSven Te Eng FoNo ratings yet

- NEW Netflix Inspired Powerpoint Design Template (By GEMO EDITS)Document20 pagesNEW Netflix Inspired Powerpoint Design Template (By GEMO EDITS)Heleniya RenukaNo ratings yet

- MACRO XII Subhash Dey All Chapters PPTs (Teaching Made Easier)Document2,231 pagesMACRO XII Subhash Dey All Chapters PPTs (Teaching Made Easier)Vatsal HarkarNo ratings yet

- Paper 5 Cost and Management Accounting PDFDocument685 pagesPaper 5 Cost and Management Accounting PDFExcel Champ50% (2)

- Hum 277Document4 pagesHum 277Mir Noushad HussainNo ratings yet

- DAV Question BankDocument79 pagesDAV Question BankSantosh SrivastavaNo ratings yet

- Industrial Management NotesDocument301 pagesIndustrial Management NotesVidhya Ds75% (4)

- MCQs - Answer KeyDocument7 pagesMCQs - Answer KeyNikhil AdhavanNo ratings yet

- CH 4 The Theory of Production and CostDocument30 pagesCH 4 The Theory of Production and Costserway bookNo ratings yet

- International Economics II - CH 3Document35 pagesInternational Economics II - CH 3Ermias AtalayNo ratings yet

- MAS 3 - Standard Costing For UploadDocument9 pagesMAS 3 - Standard Costing For UploadJD SolañaNo ratings yet

- Revision-Ch.7 Cost 3Document12 pagesRevision-Ch.7 Cost 3Ahmed TahaNo ratings yet

- What Is National IncomeDocument3 pagesWhat Is National IncomeRayad AliNo ratings yet

- National Income StasticsDocument18 pagesNational Income StasticsKudzanai KudziNo ratings yet

- Economic Effects of An AppreciationDocument11 pagesEconomic Effects of An AppreciationIndeevari SenanayakeNo ratings yet

- Innovation and Firm PerformanceDocument67 pagesInnovation and Firm PerformanceSaad Salih HusseinNo ratings yet

- Food Processing - Module4-EditedDocument16 pagesFood Processing - Module4-EditedDonna Marie ArcangelNo ratings yet

- Principles of Macroeconomics - FullDocument375 pagesPrinciples of Macroeconomics - FullHafsa YusifNo ratings yet

- Acctg201 StandardCostingLectureNotes (FINALS)Document19 pagesAcctg201 StandardCostingLectureNotes (FINALS)Sophia Marie Eredia FerolinoNo ratings yet

- Instructional Material FOR ECON 30023 Macroeconomics: Polytechnic University of The PhilippinesDocument19 pagesInstructional Material FOR ECON 30023 Macroeconomics: Polytechnic University of The PhilippinesTrisha QuiranteNo ratings yet

- Macroeconomics 9th Edition Boyes Solutions Manual 1Document36 pagesMacroeconomics 9th Edition Boyes Solutions Manual 1todddoughertygswzfbjaon100% (33)

- Economic Text BookDocument92 pagesEconomic Text Bookharshal fakeNo ratings yet

- Economic Development (Bba)Document9 pagesEconomic Development (Bba)amitsinghbdn0% (1)

- Efficiency, Effectiveness and Performance of Public SectorDocument16 pagesEfficiency, Effectiveness and Performance of Public Sectorfreya4u100% (1)

- Cost Concepts in EconomicsDocument18 pagesCost Concepts in EconomicsHimaani ShahNo ratings yet

- ABC Theory PDFDocument63 pagesABC Theory PDFSmriti MohtaNo ratings yet

- True False and MCQ On Consumers ChoiceDocument3 pagesTrue False and MCQ On Consumers ChoiceEudochia Hustiuc100% (4)

- Productivity DefinitionDocument14 pagesProductivity DefinitionRashmi KanungoNo ratings yet

- CH 17Document15 pagesCH 17emmyindraNo ratings yet