Professional Documents

Culture Documents

Recording Business Transactions: 2-1 © 2015 Pearson Education, Limited

Recording Business Transactions: 2-1 © 2015 Pearson Education, Limited

Uploaded by

Ralph TahtouhCopyright:

Available Formats

You might also like

- College Accounting A Career Approach 13th Edition Scott Solutions ManualDocument35 pagesCollege Accounting A Career Approach 13th Edition Scott Solutions ManualCalvinMataazscm100% (17)

- Horngrens Accounting 12th Edition Nobles Solutions ManualDocument109 pagesHorngrens Accounting 12th Edition Nobles Solutions ManualAnnGregoryDDSytidk100% (16)

- Syndicated Leveraged Loans During and After The CrisisDocument25 pagesSyndicated Leveraged Loans During and After The Crisisresat gürNo ratings yet

- Fintech Business ModelsDocument8 pagesFintech Business ModelsSarthak0% (1)

- NFO SBI Balanced Advantage Fund PresentationDocument25 pagesNFO SBI Balanced Advantage Fund PresentationJohnTP100% (1)

- Basic Accounting For Non-AccountantsDocument34 pagesBasic Accounting For Non-Accountantsekta100% (1)

- Accounting TransactionsDocument28 pagesAccounting TransactionsPaolo100% (1)

- Nobles Acctg10 PPT 02Document39 pagesNobles Acctg10 PPT 02Tayar ElieNo ratings yet

- Recording Business TransactionsDocument39 pagesRecording Business TransactionsNajwa Al-khateebNo ratings yet

- Chapter 2Document25 pagesChapter 2Jose Carlos SouzaNo ratings yet

- 2-Accounting Equation & Journal Entries, Posting To LedgersDocument12 pages2-Accounting Equation & Journal Entries, Posting To LedgershattarvapeNo ratings yet

- Fa PPT CH 2 - 7eDocument59 pagesFa PPT CH 2 - 7eMaria GomezNo ratings yet

- Topic 2 Financial Statements, Taxes and CashflowsDocument22 pagesTopic 2 Financial Statements, Taxes and CashflowsQianyiiNo ratings yet

- Learning Outcome and Programme Learning Objectives (Plos)Document64 pagesLearning Outcome and Programme Learning Objectives (Plos)ANGEL ROBIN RCBSNo ratings yet

- 3-ACC 1101 Topic 3Document51 pages3-ACC 1101 Topic 3Abd AL Rahman Shah Bin Azlan ShahNo ratings yet

- Financial Statements - Basis of AnalysisDocument44 pagesFinancial Statements - Basis of AnalysisJasmine ActaNo ratings yet

- 10 Examples of Double Entry Accounting 1683305482Document33 pages10 Examples of Double Entry Accounting 1683305482co1g4xqxNo ratings yet

- Accounting Pre Q1 Mid-Term Review 11thDocument36 pagesAccounting Pre Q1 Mid-Term Review 11thOscar Armando Villeda AlvaradoNo ratings yet

- AFM CH 2Document58 pagesAFM CH 2Birhanu MengisteNo ratings yet

- Recording Business Transactions: © 2016 Pearson Education, LTDDocument53 pagesRecording Business Transactions: © 2016 Pearson Education, LTDEce BarlasNo ratings yet

- Financial Accounting, 4eDocument49 pagesFinancial Accounting, 4eZulfiqarNo ratings yet

- Accounting Concepts & PrinciplesDocument26 pagesAccounting Concepts & PrinciplesThy Ngoc100% (1)

- Accounting Basics Using Quickbooks: Presented by Mike KimutaiDocument17 pagesAccounting Basics Using Quickbooks: Presented by Mike KimutaiMike Kimutai 'Sonko'No ratings yet

- CH 2 - FudDocument16 pagesCH 2 - FudbavanthinilNo ratings yet

- Chapter 11 Bookkeeping EntrepDocument37 pagesChapter 11 Bookkeeping EntrepJacel GadonNo ratings yet

- Module 6: Accounting Equation, T-Account, Rules of Debit and Credit and Normal BalancesDocument10 pagesModule 6: Accounting Equation, T-Account, Rules of Debit and Credit and Normal BalancesDarwin AniarNo ratings yet

- PPT 2 - Business TransactionDocument29 pagesPPT 2 - Business Transactionthinkaboutbe14No ratings yet

- The Income Statement and Adjusting Entries: Financial Accounting - Lecture 2Document28 pagesThe Income Statement and Adjusting Entries: Financial Accounting - Lecture 2minghuiNo ratings yet

- Introduction To AccountingDocument39 pagesIntroduction To AccountingVikash HurrydossNo ratings yet

- BBAW2103 - Tutorial 1Document69 pagesBBAW2103 - Tutorial 1M THREE THOUSAND RESOURCESNo ratings yet

- Project On Final Accounts: Vishal Jadhav Nilesh Wadhwa Pankaj Kathayat Ravi Gera MBA 2010Document23 pagesProject On Final Accounts: Vishal Jadhav Nilesh Wadhwa Pankaj Kathayat Ravi Gera MBA 2010Ravi GeraNo ratings yet

- Senior High School Department: Quarter 3 - Module 4: Debit and Credit-The Double - Entry SystemDocument13 pagesSenior High School Department: Quarter 3 - Module 4: Debit and Credit-The Double - Entry SystemJaye Ruanto100% (1)

- Basics of Accounting in VEDocument25 pagesBasics of Accounting in VEIpang NoyoNo ratings yet

- JPIA 1st Tutorial Basic AccountingDocument6 pagesJPIA 1st Tutorial Basic AccountingZee SantisasNo ratings yet

- MAF CH 2 NEWDocument58 pagesMAF CH 2 NEWAsegid H/meskelNo ratings yet

- Basics of Accounting in VEDocument25 pagesBasics of Accounting in VEIpang NoyoNo ratings yet

- Module 4 - Double Entry Bookkeeping System and The Accounting EquationDocument9 pagesModule 4 - Double Entry Bookkeeping System and The Accounting EquationMark Christian BrlNo ratings yet

- Week 9: Introductory Accounting and The Balance Sheet: Public Health Accounting and Budgeting Lili Elkins-ThompsonDocument64 pagesWeek 9: Introductory Accounting and The Balance Sheet: Public Health Accounting and Budgeting Lili Elkins-Thompsons430230No ratings yet

- Slides Review - Final - Exam Prof. EnacheDocument126 pagesSlides Review - Final - Exam Prof. EnachesarahodettemartinezNo ratings yet

- Basic AccountingDocument48 pagesBasic Accounting3122No ratings yet

- To Financial Statement AnalysisDocument23 pagesTo Financial Statement AnalysisKa Hou ChgNo ratings yet

- BOOKKEEPINGDocument102 pagesBOOKKEEPINGAtty. Rheneir MoraNo ratings yet

- Financial AccountingDocument124 pagesFinancial AccountingShashi Ranjan100% (1)

- Dwnload Full College Accounting A Career Approach 13th Edition Scott Solutions Manual PDFDocument20 pagesDwnload Full College Accounting A Career Approach 13th Edition Scott Solutions Manual PDFraisable.maugerg07jpg100% (16)

- Accounting 101 Chapter 1Document39 pagesAccounting 101 Chapter 1Md. Riyad Mahmud 183-15-11991No ratings yet

- Financial Accounting - MGT101 Power Point Slides Lecture 02Document15 pagesFinancial Accounting - MGT101 Power Point Slides Lecture 02Advance KnowledgeNo ratings yet

- Recording Transactions: Powerpoint Presentation by Phil Johnson ©2015 John Wiley & Sons Australia LTDDocument34 pagesRecording Transactions: Powerpoint Presentation by Phil Johnson ©2015 John Wiley & Sons Australia LTDShiTheng Love UNo ratings yet

- Topic 3 - Recording Transactions (STU)Document60 pagesTopic 3 - Recording Transactions (STU)thiennnannn45No ratings yet

- ABM 1 COURSE PACK - WITH EXCEL DISCUSSION Lesson 3Document27 pagesABM 1 COURSE PACK - WITH EXCEL DISCUSSION Lesson 3May AnneNo ratings yet

- CH 1 Part 1Document41 pagesCH 1 Part 1hstptr8wdwNo ratings yet

- Lesson 1Document9 pagesLesson 1Bervette HansNo ratings yet

- The Income Statement and Adjusting Entries: Financial Accounting - Lecture 2Document21 pagesThe Income Statement and Adjusting Entries: Financial Accounting - Lecture 2Peter Shang100% (1)

- CHAPTER 1 - PPT Intro To AccountingDocument14 pagesCHAPTER 1 - PPT Intro To AccountingAmrinNo ratings yet

- School Od Business and Management Institut Teknologi BandungDocument53 pagesSchool Od Business and Management Institut Teknologi BandungadamobirkNo ratings yet

- Accounting Principles: Second Canadian EditionDocument39 pagesAccounting Principles: Second Canadian EditionGizachew ZelekeNo ratings yet

- Part B: Computerised AccountingDocument6 pagesPart B: Computerised AccountingSonakshi JainNo ratings yet

- Financial Analysis - IMIDocument9 pagesFinancial Analysis - IMIrangoli maheshwariNo ratings yet

- Pertemuan 5: Profitability ActivitiesDocument21 pagesPertemuan 5: Profitability ActivitiesSofyan AliNo ratings yet

- 12ENTREP Q2 Module 8 Terminal Report of Business OperationsDocument10 pages12ENTREP Q2 Module 8 Terminal Report of Business OperationsJM Almaden AbadNo ratings yet

- SOB - Financial Accounting and Reporting 1Document87 pagesSOB - Financial Accounting and Reporting 1Miccccch50% (2)

- Lecture01-Introduction To AccountingDocument26 pagesLecture01-Introduction To Accounting錢永健No ratings yet

- Introduction To Accounting and FinanceDocument39 pagesIntroduction To Accounting and FinanceEngr Muhammad RohanNo ratings yet

- The Institutes' Waiver Request Form: For Approval, Please SubmitDocument2 pagesThe Institutes' Waiver Request Form: For Approval, Please SubmitShanmuganathan RamanathanNo ratings yet

- Islamic Banking and Finance Insight On Possibilities For EuropeDocument100 pagesIslamic Banking and Finance Insight On Possibilities For EuropeZulejha IsmihanNo ratings yet

- Unit 3 Financial Services: An Introduction: ObjectivesDocument19 pagesUnit 3 Financial Services: An Introduction: ObjectivesKashif UddinNo ratings yet

- Study Notes With Case Studes HSC Business Studies 2021 VersionDocument71 pagesStudy Notes With Case Studes HSC Business Studies 2021 VersionZoeNo ratings yet

- New MCQS On FM 4 - Managing Banks & Financial InstitutionsDocument7 pagesNew MCQS On FM 4 - Managing Banks & Financial InstitutionsSakshi DongreNo ratings yet

- XII ACCOUNTANCY SET-2 Marking Scheme Ist Pre Board 2023-24-1Document9 pagesXII ACCOUNTANCY SET-2 Marking Scheme Ist Pre Board 2023-24-1Riddhima Murarka50% (2)

- MBA Accounting Managers 1styear Notes 1Document286 pagesMBA Accounting Managers 1styear Notes 1gibNo ratings yet

- 7-21 (Objectives 7-3, 7-4) : Chapter 7 & 8Document8 pages7-21 (Objectives 7-3, 7-4) : Chapter 7 & 8GuinevereNo ratings yet

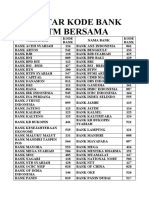

- DAFTAR KODE BANK ScibdDocument2 pagesDAFTAR KODE BANK ScibdKuroi ShinigamiNo ratings yet

- AIS Midterm NotesDocument30 pagesAIS Midterm NotesArielle CabritoNo ratings yet

- ACCT1101 Wk6 Tutorial 5 SolutionsDocument7 pagesACCT1101 Wk6 Tutorial 5 SolutionskyleNo ratings yet

- Kyc Aml CFTDocument201 pagesKyc Aml CFTkunal tyagi100% (2)

- 03 Ch3 Money Market - Practice SheetDocument17 pages03 Ch3 Money Market - Practice SheetDhruvi VachhaniNo ratings yet

- 8int 2011 Jun ADocument9 pages8int 2011 Jun ADawn CaldeiraNo ratings yet

- Corporate Finance Group Assigment - Case Study 2Document24 pagesCorporate Finance Group Assigment - Case Study 2PK LNo ratings yet

- Multiple Choice Questions of TYBBI Auditing (Sem 5)Document15 pagesMultiple Choice Questions of TYBBI Auditing (Sem 5)jai shree krishnaNo ratings yet

- Credo CompanyDocument2 pagesCredo CompanyYan TagleNo ratings yet

- Tool 7 Template Materiality Assessment PaperDocument4 pagesTool 7 Template Materiality Assessment PaperMargenete CasianoNo ratings yet

- Fundamental Analysis ModuleDocument2 pagesFundamental Analysis ModuleJayesh ShahNo ratings yet

- Note Topic 2Document4 pagesNote Topic 2ModraNo ratings yet

- ISB535 Individual AssingmentDocument11 pagesISB535 Individual AssingmentnazrysllNo ratings yet

- Customer Perception Towards Plastic MoneyDocument65 pagesCustomer Perception Towards Plastic Moneyfrnds4everz71% (7)

- Intermediate Acctg 3 Finals With Answers PDFDocument6 pagesIntermediate Acctg 3 Finals With Answers PDFPrincesNo ratings yet

- QUESTIONAIREDocument3 pagesQUESTIONAIREsunny12101986No ratings yet

- New Issue Market in IndiaDocument3 pagesNew Issue Market in IndiaAbhi SinhaNo ratings yet

- GFMP - Debt Markets - Money MarketDocument16 pagesGFMP - Debt Markets - Money MarketrudypatilNo ratings yet

- Partnership AgreementDocument1 pagePartnership AgreementCAMILLE CRIS B. MONASTERIALNo ratings yet

Recording Business Transactions: 2-1 © 2015 Pearson Education, Limited

Recording Business Transactions: 2-1 © 2015 Pearson Education, Limited

Uploaded by

Ralph TahtouhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Recording Business Transactions: 2-1 © 2015 Pearson Education, Limited

Recording Business Transactions: 2-1 © 2015 Pearson Education, Limited

Uploaded by

Ralph TahtouhCopyright:

Available Formats

Recording

Business

Transactions

Chapter 2

© 2015 Pearson Education, Limited. 2-1

Learning Objectives

1. Explain accounts as they relate

to the accounting equation and

describe common accounts

2. Define debits, credits, and

normal account balances using

double-entry accounting and T-

accounts

3. Record transactions in a journal

and post journal entries to the

ledger

© 2015 Pearson Education, Limited. 2-2

Learning Objectives

4. Prepare the trial balance and

illustrate how to use the trial

balance to prepare financial

statements

5. Use the debt ratio to evaluate

business performance

© 2015 Pearson Education, Limited. 2-3

Learning Objective 1

Explain accounts as

they relate to the

accounting equation

and describe common

accounts

© 2015 Pearson Education, Limited. 2-4

What Is an Account?

Assets = Liabilities + Equity

• Each element of the Accounting Equation

contains smaller elements called accounts.

• Account—the

Account detailed record of all increases

and decreases that have occurred in an

individual asset, liability, equity, revenue or

expense during a specified period.

© 2015 Pearson Education, Limited. 2-5

Chart of Accounts

• Companies typically

maintain a listing of all of Large companies can

the accounts that they have thousands of

use in their accounting different accounts that

system, called the Chart are used in their

of Accounts.

Accounts accounting system.

• Often accounts are

numbered. It is easier to reference

– The numbers will usually a specific account if

be grouped by account there is a number

type. assigned to it.

© 2015 Pearson Education, Limited. 2-6

Chart of Accounts

Exhibit 2-4 Chart of Accounts—Smart Touch Learning

Balance Sheet Accounts

Assets Liabilities Equity

101 Cash 201 Accounts Payable 301 Bright, Capital

111 Accounts Receivable 211 Salaries Payable 311 Bright, Withdrawals

121 Notes Receivable 221 Interest Payable

141 Offi ce Supplies 231 Unearned Revenue

151 Furniture 241 Notes Payable

171 Building

191 Land

Income Statement Accounts (Part of Equity)

Revenues Expenses

401 Service Revenue 501 Rent Expense

411 Interest Revenue 511 Salaries Expense

521 Utilities Expense

531 Advertising Expense

© 2015 Pearson Education, Limited. 2-7

Learning Objective 2

Define debits, credits,

and normal account

balances using double-

entry accounting and

T-accounts

© 2015 Pearson Education, Limited. 2-8

What Is Double-Entry Accounting?

• Transactions always have two impacts on

the accounting equation.

– When Smart Touch

bought land, the

Land account

increased, but the

Cash account

decreased by the same amount.

– These “double” entries help keep the

accounting equation in balance.

© 2015 Pearson Education, Limited. 2-9

What Is a T-Account?

• A T-account is a shortened visual form of

the more formal general ledger account

format.

Account Name

• Increases are shown

+/- +/-

on one side of the

T-account and decreases

on the other side.

• The T-account is balanced at the end of

each period.

© 2015 Pearson Education, Limited. 2-10

What Are Debits and Credits?

• Debits and Credits are used to record the

increases and decreases in T-accounts.

– Debit means “left”

Account Name

– Credit means “right”

Debit (DR) Credit (CR)

• Any time we put a debit

in one account, we have

to put an equal credit in

another account.

© 2015 Pearson Education, Limited. 2-11

What Are Debits and Credits?

• An account with more debits than credits

will have a “debit” balance.

• An account with more

Account Name

credits than debits will Debit (DR) Credit (CR)

have a “credit” balance.

• Some accounts will be

increased with debits, and

some accounts will be increased with

credits.

© 2015 Pearson Education, Limited. 2-12

What Are Debits and Credits?

• We can explain the balancing impact of

transactions using T-accounts and debits

and credits.

© 2015 Pearson Education, Limited. 2-13

What Are Debits and Credits?

• When Smart Touch purchases land, we

use debits to increase the Land account,

and credits to decrease the Cash account.

Land Cash

20,000 20,000

© 2015 Pearson Education, Limited. 2-14

What Are Debits and Credits?

Increases in owner’s

Owner's Capital contributions or owner’s

Debit for Credit for withdrawals will be reflected

in the changing owner’s

Decreases Increases

capital balance.

Withdrawals

Debit for

Increases

© 2015 Pearson Education, Limited. 2-15

What Are Debits and Credits?

When revenues exceed

Owner's Capital expenses, net income

Debit for Credit for increases Owner’s

Decreases Increases Capital.

Revenues Expenses

Credit for Debit for

Increases Increases

© 2015 Pearson Education, Limited. 2-16

Learning Objective3

Record transactions in

a journal and post

journal entries to the

ledger

© 2015 Pearson Education, Limited. 2-17

How Do You Record Transactions?

The next step in the process is to formally

record the transaction in the General Journal.

© 2015 Pearson Education, Limited. 2-18

How Do You Record Transactions?

• Transactions are first recorded using a

“journal entry."

• The account to be debited is usually

written first.

© 2015 Pearson Education, Limited. 2-19

How Do You Record Transactions?

• In Transaction #1, Bright contributed

$30,000 to Smart Touch.

• Cash should be debited for $30,000 and

Bright, Capital should be credited for

$30,000.

© 2015 Pearson Education, Limited. 2-20

How Do You Record Transactions?

• In Transaction #1, Bright contributed

$30,000 to Smart Touch.

• Cash should be debited for $30,000 and

Bright, Capital should be credited for

$30,000.

© 2015 Pearson Education, Limited. 2-21

How Do You Record Transactions?

• Next, each amount should be “posted”

to the appropriate T-account.

• Without this step, the trial balance will

NOT balance.

© 2015 Pearson Education, Limited. 2-22

How Do You Record Transactions?

Cash Bright, Capital

30,000 30,000

© 2015 Pearson Education, Limited. 2-23

How Do You Record Transactions?

• In Transaction #2, Smart Touch

purchased Land for $20,000 cash.

• Land should be debited for $20,000 and

Cash should be credited for $20,000.

© 2015 Pearson Education, Limited. 2-24

How Do You Record Transactions?

• In Transaction #2, Smart Touch

purchased Land for $20,000 cash.

• Land should be debited for $20,000 and

Cash should be credited for $20,000.

© 2015 Pearson Education, Limited. 2-25

How Do You Record Transactions?

• Next, each amount should be “posted”

to the appropriate T-account.

• Without this step, the trial balance will

NOT balance.

© 2015 Pearson Education, Limited. 2-26

How Do You Record Transactions?

Land Cash

20,000 30,000 20,000

© 2015 Pearson Education, Limited. 2-27

How Do You Record Transactions?

• In Transaction #3, Smart Touch purchased

Office Supplies on account for $500 cash.

• Office Supplies should be debited for $500

and Accounts Payable should be credited

for $500.

© 2015 Pearson Education, Limited. 2-28

How Do You Record Transactions?

• In Transaction #3, Smart Touch purchased

Office Supplies on account for $500 cash.

• Office Supplies should be debited for $500

and Accounts Payable should be credited

for $500.

© 2015 Pearson Education, Limited. 2-29

How Do You Record Transactions?

• Next, each amount should be “posted”

to the appropriate T-account.

• Without this step, the trial balance will

NOT balance.

© 2015 Pearson Education, Limited. 2-30

How Do You Record Transactions?

Office Supplies Accounts Payable

500 500

© 2015 Pearson Education, Limited. 2-31

Learning Objective 4

Prepare the trial

balance and illustrate

how to use the trial

balance to prepare

financial statements

© 2015 Pearson Education, Limited. 2-32

Trial Balance

The primary purpose of

the trial balance is to

prove the mathematical

equality of debits and

credits after posting.

The amounts come

from the individual

account balances in the

General Ledger.

© 2015 Pearson Education, Limited. 2-33

First, we prepare the

Income Statement.

SMART

SMARTTT OUCH

OUCHLEARNING

LEARNING

Income Statement

Income Statement

TTwo

wo MonthsEnded

Months EndedDecember

December31,

31,2014

2014

Revenues

Revenues

Service

ServiceRevenue

Revenue $$ 16,500

16,500

Expenses

Expenses

Salaries

SalariesExpense

Expense $$ 3,600

3,600

Rent

Rentexpense

expense 2,000

2,000

Utilities Expense

Utilities Expense 100

100

Total expenses

Total expenses 5,700

5,700

Net income

Net income $ 10,800

$ 10,800

© 2015 Pearson Education, Limited. 2-34

SMART

SMARTTT OUCH

OUCHLEARNING

LEARNING The information for

Income Statement

TTwo Months

Income Statement

wo MonthsEnded

EndedDecember

December31,

31,2014

2014

the Statement of

Revenues

Revenues

Service

ServiceRevenue

Revenue $$ 16,500

16,500

Owner’s Equity comes

Expenses

Expenses

Salaries

from the trial balance

SalariesExpense

Expense $$ 3,600

3,600

Rent expense

Rent expense

Utilities Expense

2,000

2,000

100

AND from the Income

Utilities Expense 100

Total expenses

Total expenses 5,700

5,700 Statement.

Net income

Net income $ 10,800

$ 10,800

SMART

SMARTTT OUCH

OUCHLEARNING

LEARNING

Statement

Statement of Owner'sEquity

of Owner's Equity

TT

wo

wo Months Ended December31,

Months Ended December 31,2014

2014

Bright,

Bright,Capital,

Capital,11/1/14

11/1/14 $$ --

Owner

OwnerContribution

Contribution 48,000

48,000

Net Income for 2 Months

Net Income for 2 Months 10,800

10,800

58,800

58,800

Owner Withdrawal

Owner Withdrawal (5,000)

(5,000)

Bright, Capital, 12/31/14

Bright, Capital, 12/31/14 $ 53,800

$ 53,800

© 2015 Pearson Education, Limited. 2-35

Smart

SmartTT

ouch

ouchLearning

Learning

The information for

Balance Sheet

Balance Sheet

31-Dec-14

31-Dec-14

Assets

Assetsthe Statement of

Cash

Cash $$ 12,200

12,200

Owner’s

Accounts Equity comes

Receivable

Accounts Receivable 1,000

1,000

Office Supplies 500

from

Prepaid

PrepaidRent

the

Office Supplies

Rent

trial balance 500

3,000

3,000

AND

Furniture from the Income

Furniture

Building

Building

18,000

18,000

60,000

60,000

Land

Land

Total Assets

Statement. 20,000

20,000

$ 114,700

Total Assets $ 114,700

Liabilities

Liabilities

Accounts

AccountsPayable

Payable $$ 200

200

Utilities Payable

Utilities Payable 100

100

Unearned

UnearnedRevenue

Revenue 600

600

Notes Payable

Notes Payable 60,000

60,000

Total

TotalLiabilities

Liabilities 60,900

60,900

Owner's

Owner'sEquity

Equity

Bright

Bright Capital,12/31/14

Capital, 12/31/14 53,800

53,800

Total

TotalLiabilities

Liabilities&&Owner's

Owner'sEquity

Equity $$ 114,700

114,700

© 2015 Pearson Education, Limited. 2-36

Learning Objective 5

Use the debt ratio to

evaluate business

performance

© 2015 Pearson Education, Limited. 2-37

The Debt Ratio

• The debt ratio shows the proportion of

assets financed with debt.

• It can be used to evaluate a business’s

ability to pay its debts and to determine if

the company has too much debt to be

considered financially “healthy.”

© 2015 Pearson Education, Limited. 2-38

End of Chapter 2

© 2015 Pearson Education, Limited. 2-39

You might also like

- College Accounting A Career Approach 13th Edition Scott Solutions ManualDocument35 pagesCollege Accounting A Career Approach 13th Edition Scott Solutions ManualCalvinMataazscm100% (17)

- Horngrens Accounting 12th Edition Nobles Solutions ManualDocument109 pagesHorngrens Accounting 12th Edition Nobles Solutions ManualAnnGregoryDDSytidk100% (16)

- Syndicated Leveraged Loans During and After The CrisisDocument25 pagesSyndicated Leveraged Loans During and After The Crisisresat gürNo ratings yet

- Fintech Business ModelsDocument8 pagesFintech Business ModelsSarthak0% (1)

- NFO SBI Balanced Advantage Fund PresentationDocument25 pagesNFO SBI Balanced Advantage Fund PresentationJohnTP100% (1)

- Basic Accounting For Non-AccountantsDocument34 pagesBasic Accounting For Non-Accountantsekta100% (1)

- Accounting TransactionsDocument28 pagesAccounting TransactionsPaolo100% (1)

- Nobles Acctg10 PPT 02Document39 pagesNobles Acctg10 PPT 02Tayar ElieNo ratings yet

- Recording Business TransactionsDocument39 pagesRecording Business TransactionsNajwa Al-khateebNo ratings yet

- Chapter 2Document25 pagesChapter 2Jose Carlos SouzaNo ratings yet

- 2-Accounting Equation & Journal Entries, Posting To LedgersDocument12 pages2-Accounting Equation & Journal Entries, Posting To LedgershattarvapeNo ratings yet

- Fa PPT CH 2 - 7eDocument59 pagesFa PPT CH 2 - 7eMaria GomezNo ratings yet

- Topic 2 Financial Statements, Taxes and CashflowsDocument22 pagesTopic 2 Financial Statements, Taxes and CashflowsQianyiiNo ratings yet

- Learning Outcome and Programme Learning Objectives (Plos)Document64 pagesLearning Outcome and Programme Learning Objectives (Plos)ANGEL ROBIN RCBSNo ratings yet

- 3-ACC 1101 Topic 3Document51 pages3-ACC 1101 Topic 3Abd AL Rahman Shah Bin Azlan ShahNo ratings yet

- Financial Statements - Basis of AnalysisDocument44 pagesFinancial Statements - Basis of AnalysisJasmine ActaNo ratings yet

- 10 Examples of Double Entry Accounting 1683305482Document33 pages10 Examples of Double Entry Accounting 1683305482co1g4xqxNo ratings yet

- Accounting Pre Q1 Mid-Term Review 11thDocument36 pagesAccounting Pre Q1 Mid-Term Review 11thOscar Armando Villeda AlvaradoNo ratings yet

- AFM CH 2Document58 pagesAFM CH 2Birhanu MengisteNo ratings yet

- Recording Business Transactions: © 2016 Pearson Education, LTDDocument53 pagesRecording Business Transactions: © 2016 Pearson Education, LTDEce BarlasNo ratings yet

- Financial Accounting, 4eDocument49 pagesFinancial Accounting, 4eZulfiqarNo ratings yet

- Accounting Concepts & PrinciplesDocument26 pagesAccounting Concepts & PrinciplesThy Ngoc100% (1)

- Accounting Basics Using Quickbooks: Presented by Mike KimutaiDocument17 pagesAccounting Basics Using Quickbooks: Presented by Mike KimutaiMike Kimutai 'Sonko'No ratings yet

- CH 2 - FudDocument16 pagesCH 2 - FudbavanthinilNo ratings yet

- Chapter 11 Bookkeeping EntrepDocument37 pagesChapter 11 Bookkeeping EntrepJacel GadonNo ratings yet

- Module 6: Accounting Equation, T-Account, Rules of Debit and Credit and Normal BalancesDocument10 pagesModule 6: Accounting Equation, T-Account, Rules of Debit and Credit and Normal BalancesDarwin AniarNo ratings yet

- PPT 2 - Business TransactionDocument29 pagesPPT 2 - Business Transactionthinkaboutbe14No ratings yet

- The Income Statement and Adjusting Entries: Financial Accounting - Lecture 2Document28 pagesThe Income Statement and Adjusting Entries: Financial Accounting - Lecture 2minghuiNo ratings yet

- Introduction To AccountingDocument39 pagesIntroduction To AccountingVikash HurrydossNo ratings yet

- BBAW2103 - Tutorial 1Document69 pagesBBAW2103 - Tutorial 1M THREE THOUSAND RESOURCESNo ratings yet

- Project On Final Accounts: Vishal Jadhav Nilesh Wadhwa Pankaj Kathayat Ravi Gera MBA 2010Document23 pagesProject On Final Accounts: Vishal Jadhav Nilesh Wadhwa Pankaj Kathayat Ravi Gera MBA 2010Ravi GeraNo ratings yet

- Senior High School Department: Quarter 3 - Module 4: Debit and Credit-The Double - Entry SystemDocument13 pagesSenior High School Department: Quarter 3 - Module 4: Debit and Credit-The Double - Entry SystemJaye Ruanto100% (1)

- Basics of Accounting in VEDocument25 pagesBasics of Accounting in VEIpang NoyoNo ratings yet

- JPIA 1st Tutorial Basic AccountingDocument6 pagesJPIA 1st Tutorial Basic AccountingZee SantisasNo ratings yet

- MAF CH 2 NEWDocument58 pagesMAF CH 2 NEWAsegid H/meskelNo ratings yet

- Basics of Accounting in VEDocument25 pagesBasics of Accounting in VEIpang NoyoNo ratings yet

- Module 4 - Double Entry Bookkeeping System and The Accounting EquationDocument9 pagesModule 4 - Double Entry Bookkeeping System and The Accounting EquationMark Christian BrlNo ratings yet

- Week 9: Introductory Accounting and The Balance Sheet: Public Health Accounting and Budgeting Lili Elkins-ThompsonDocument64 pagesWeek 9: Introductory Accounting and The Balance Sheet: Public Health Accounting and Budgeting Lili Elkins-Thompsons430230No ratings yet

- Slides Review - Final - Exam Prof. EnacheDocument126 pagesSlides Review - Final - Exam Prof. EnachesarahodettemartinezNo ratings yet

- Basic AccountingDocument48 pagesBasic Accounting3122No ratings yet

- To Financial Statement AnalysisDocument23 pagesTo Financial Statement AnalysisKa Hou ChgNo ratings yet

- BOOKKEEPINGDocument102 pagesBOOKKEEPINGAtty. Rheneir MoraNo ratings yet

- Financial AccountingDocument124 pagesFinancial AccountingShashi Ranjan100% (1)

- Dwnload Full College Accounting A Career Approach 13th Edition Scott Solutions Manual PDFDocument20 pagesDwnload Full College Accounting A Career Approach 13th Edition Scott Solutions Manual PDFraisable.maugerg07jpg100% (16)

- Accounting 101 Chapter 1Document39 pagesAccounting 101 Chapter 1Md. Riyad Mahmud 183-15-11991No ratings yet

- Financial Accounting - MGT101 Power Point Slides Lecture 02Document15 pagesFinancial Accounting - MGT101 Power Point Slides Lecture 02Advance KnowledgeNo ratings yet

- Recording Transactions: Powerpoint Presentation by Phil Johnson ©2015 John Wiley & Sons Australia LTDDocument34 pagesRecording Transactions: Powerpoint Presentation by Phil Johnson ©2015 John Wiley & Sons Australia LTDShiTheng Love UNo ratings yet

- Topic 3 - Recording Transactions (STU)Document60 pagesTopic 3 - Recording Transactions (STU)thiennnannn45No ratings yet

- ABM 1 COURSE PACK - WITH EXCEL DISCUSSION Lesson 3Document27 pagesABM 1 COURSE PACK - WITH EXCEL DISCUSSION Lesson 3May AnneNo ratings yet

- CH 1 Part 1Document41 pagesCH 1 Part 1hstptr8wdwNo ratings yet

- Lesson 1Document9 pagesLesson 1Bervette HansNo ratings yet

- The Income Statement and Adjusting Entries: Financial Accounting - Lecture 2Document21 pagesThe Income Statement and Adjusting Entries: Financial Accounting - Lecture 2Peter Shang100% (1)

- CHAPTER 1 - PPT Intro To AccountingDocument14 pagesCHAPTER 1 - PPT Intro To AccountingAmrinNo ratings yet

- School Od Business and Management Institut Teknologi BandungDocument53 pagesSchool Od Business and Management Institut Teknologi BandungadamobirkNo ratings yet

- Accounting Principles: Second Canadian EditionDocument39 pagesAccounting Principles: Second Canadian EditionGizachew ZelekeNo ratings yet

- Part B: Computerised AccountingDocument6 pagesPart B: Computerised AccountingSonakshi JainNo ratings yet

- Financial Analysis - IMIDocument9 pagesFinancial Analysis - IMIrangoli maheshwariNo ratings yet

- Pertemuan 5: Profitability ActivitiesDocument21 pagesPertemuan 5: Profitability ActivitiesSofyan AliNo ratings yet

- 12ENTREP Q2 Module 8 Terminal Report of Business OperationsDocument10 pages12ENTREP Q2 Module 8 Terminal Report of Business OperationsJM Almaden AbadNo ratings yet

- SOB - Financial Accounting and Reporting 1Document87 pagesSOB - Financial Accounting and Reporting 1Miccccch50% (2)

- Lecture01-Introduction To AccountingDocument26 pagesLecture01-Introduction To Accounting錢永健No ratings yet

- Introduction To Accounting and FinanceDocument39 pagesIntroduction To Accounting and FinanceEngr Muhammad RohanNo ratings yet

- The Institutes' Waiver Request Form: For Approval, Please SubmitDocument2 pagesThe Institutes' Waiver Request Form: For Approval, Please SubmitShanmuganathan RamanathanNo ratings yet

- Islamic Banking and Finance Insight On Possibilities For EuropeDocument100 pagesIslamic Banking and Finance Insight On Possibilities For EuropeZulejha IsmihanNo ratings yet

- Unit 3 Financial Services: An Introduction: ObjectivesDocument19 pagesUnit 3 Financial Services: An Introduction: ObjectivesKashif UddinNo ratings yet

- Study Notes With Case Studes HSC Business Studies 2021 VersionDocument71 pagesStudy Notes With Case Studes HSC Business Studies 2021 VersionZoeNo ratings yet

- New MCQS On FM 4 - Managing Banks & Financial InstitutionsDocument7 pagesNew MCQS On FM 4 - Managing Banks & Financial InstitutionsSakshi DongreNo ratings yet

- XII ACCOUNTANCY SET-2 Marking Scheme Ist Pre Board 2023-24-1Document9 pagesXII ACCOUNTANCY SET-2 Marking Scheme Ist Pre Board 2023-24-1Riddhima Murarka50% (2)

- MBA Accounting Managers 1styear Notes 1Document286 pagesMBA Accounting Managers 1styear Notes 1gibNo ratings yet

- 7-21 (Objectives 7-3, 7-4) : Chapter 7 & 8Document8 pages7-21 (Objectives 7-3, 7-4) : Chapter 7 & 8GuinevereNo ratings yet

- DAFTAR KODE BANK ScibdDocument2 pagesDAFTAR KODE BANK ScibdKuroi ShinigamiNo ratings yet

- AIS Midterm NotesDocument30 pagesAIS Midterm NotesArielle CabritoNo ratings yet

- ACCT1101 Wk6 Tutorial 5 SolutionsDocument7 pagesACCT1101 Wk6 Tutorial 5 SolutionskyleNo ratings yet

- Kyc Aml CFTDocument201 pagesKyc Aml CFTkunal tyagi100% (2)

- 03 Ch3 Money Market - Practice SheetDocument17 pages03 Ch3 Money Market - Practice SheetDhruvi VachhaniNo ratings yet

- 8int 2011 Jun ADocument9 pages8int 2011 Jun ADawn CaldeiraNo ratings yet

- Corporate Finance Group Assigment - Case Study 2Document24 pagesCorporate Finance Group Assigment - Case Study 2PK LNo ratings yet

- Multiple Choice Questions of TYBBI Auditing (Sem 5)Document15 pagesMultiple Choice Questions of TYBBI Auditing (Sem 5)jai shree krishnaNo ratings yet

- Credo CompanyDocument2 pagesCredo CompanyYan TagleNo ratings yet

- Tool 7 Template Materiality Assessment PaperDocument4 pagesTool 7 Template Materiality Assessment PaperMargenete CasianoNo ratings yet

- Fundamental Analysis ModuleDocument2 pagesFundamental Analysis ModuleJayesh ShahNo ratings yet

- Note Topic 2Document4 pagesNote Topic 2ModraNo ratings yet

- ISB535 Individual AssingmentDocument11 pagesISB535 Individual AssingmentnazrysllNo ratings yet

- Customer Perception Towards Plastic MoneyDocument65 pagesCustomer Perception Towards Plastic Moneyfrnds4everz71% (7)

- Intermediate Acctg 3 Finals With Answers PDFDocument6 pagesIntermediate Acctg 3 Finals With Answers PDFPrincesNo ratings yet

- QUESTIONAIREDocument3 pagesQUESTIONAIREsunny12101986No ratings yet

- New Issue Market in IndiaDocument3 pagesNew Issue Market in IndiaAbhi SinhaNo ratings yet

- GFMP - Debt Markets - Money MarketDocument16 pagesGFMP - Debt Markets - Money MarketrudypatilNo ratings yet

- Partnership AgreementDocument1 pagePartnership AgreementCAMILLE CRIS B. MONASTERIALNo ratings yet