Professional Documents

Culture Documents

The Financial Plan

The Financial Plan

Uploaded by

amith_reddy0 ratings0% found this document useful (0 votes)

34 views20 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

34 views20 pagesThe Financial Plan

The Financial Plan

Uploaded by

amith_reddyCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 20

The Financial Plan

Financial objectives are both the starting &

finishing point of a good business plan.

The Financial plan seeks to reflect the

financial implications of your marketing,

people and operational plans in the form of

profit-loss accounts, cash flows, and balance

sheets.

Planning Assumptions

Example - SARAVANA BHAVAN

Saravana bhavan will set up and operate a small chain of

south-indian restaurants in UK. These will provide traditional

south-indian food in a relaxed atmosphere offering value-for-

money food in the middle priced NRI market.

The chain of Saravana Bhavan is already a proven concept in

parts of Indian subcontinent, serving south-indian food on a

quick throughput basis but without the fast-food image. Labour

costs are low and with a limited menu, waste is avoided and in

turn makes value for money possible.

One Saravana Bhavan has been in operation for six months in

London, so the following assumptions have been drawn partly

from experience and partly from market research.

Profit & Loss Assumptions

A) Sales

Number of outlets in operation will be :

Year 1 2

Year 2 4

Year 3 7

Year 5 onwards 10

Operating six days a week, meals sales will be :

Year 1 40 per day

Year 2 50 per day

Year 3 onwards 60 per day

Sales value per meal will be :

Food £ 6.50

Drink £ 2.50

B) Cost of sales per meal

Food £ 1.75

Drink £ 1.00

Labour £ 2.70

Total £ 5.45

This equals 61 % of sales.

Profit & Loss Assumptions

C) Wages: each outlet will employ seven staff at a cost of £ 42,600 per

annum (labour costs = 30 % of sales, which compares favorably with a

general restaurant’s 40 percent).

D) Directors: paid £ 15,000 per year, rising to £ 20,000 from year 3.

E) Administrative staff: needed mainly from year 2. Costs will rise from

£ 5,000 to £ 40,000 over seven years.

F) Rent and services : £ 30,000 per outlet per annum

G) Alterations, equipment and decoration : £ 40,000 per outlet.

H) Advertising : £ 2.000 per outlet per annum

I) Inflation: all income and expenditure is stated at current prices.

Cash-Flow assumptions

No debtors – all meals paid in cash

Salaries and wages paid monthly

Purchases paid monthly

Rent paid half-yearly

Rates paid monthly

Loan interest paid quarterly from month 1

Overdraft interest paid quarterly from month 3

Sales spread evenly over each month of year

Balance sheet assumptions

Closing stock : building up to six weeks’ sales

Depreciation of fixed assets: improvements and office, 20

percent per annum; fixtures and fittings, 25 percent per

annum

Creditors: Equivalent to one month’s cost of sales

Once the set of assumptions is made one

has to take care of the following :

Key assumptions

Basis of each Assumption

Confidence in each assumption

What will happen if the assumption proves

incorrect

When contingency action can be taken, when

it should actually be taken

Income Statement or Profit & Loss

Account

A financial statement for companies that indicates

how Revenue (money received from the sale of

products and services before expenses are taken

out, also known as the "top line") is transformed into

net income (the result after all revenues and

expenses have been accounted for, also known as

the "bottom line").

The purpose of the income statement is to show

managers and investors whether the company made

or lost money during the period being reported.

Income Statement or Profit & Loss

Account

Cash-Flow Statement

A financial statement that shows a company's

incoming and outgoing money (sources and

uses of cash) during a time period (often

monthly or quarterly).

The statement shows how changes in

balance sheet and income accounts affected

cash and cash equivalents, and breaks the

analysis down according to operating,

investing, and financing activities.

Balance Sheet

A summary of a persons or organization's

assets, liabilities and Ownership equity on a

specific date, such as the end of its financial

year.

A balance sheet is often described as a

snapshot of a company's financial condition.

Financing a New Venture

Financial assistance to entrepreneurs is

available from institutions such as

Nationalized banks, Small Industries

Development Bank of India, Regional Rural

Banks,etc…. depending upon the project

requirement and promoters background.

Financial assistance has two components :

Loan for Fixed Capital

Loan for Working Capital

Industrial Finance in India

National Level Industrial Development Banks

Industrial Development Bank of India (IDBI)

Industrial Finance Corporation of India (IFCI)

Small Industries Development Bank of India (SIDBI)

Industrial Reconstruction Bank of India (IRBI)

Shipping Credit and Investment Company of India (SCICI)

Specialized Financial Institutions

Technology Development & Information Company of India

Limited (TDICI)

Risk Capital & Technology Finance Corporation Limited

(RCTC)

Tourism Finance Corporation of India (TFCI)

Industrial Finance in India

Investment Institutions

Unit Trust of India (UTI)

General Insurance Corporation of India (GIC)

Life Insurance Corporation of India (LIC)

Other Banks Offering Financial Assistance

Small Industries Development Bank of India (SIDBI)

Industrial Development Bank of India

Industrial Finance Corporation of India

ICICI Bank

National Bank for Agriculture and Rural Development

(NABARD)

State Bank of India

Venture Capital

Venture Capital - Venture capital is a type

of private equity capital typically provided by

professional, outside investors to new, growth

businesses.

Venture capital investments are generally

made as cash in exchange for shares in the

invested company.

Venture Capitalists Generally :

Finance new and rapidly growing companies

Purchase equity securities

Assist in the development of new products or services

Add value to the company through active participation

Take higher risks with the expectation of higher rewards

Have a long-term orientation

Some Venture Capital Organizations

ICICI Venture Funds Management Company Limited

SIDBI Venture Capital Limited (SVCL)

IFCI Venture Capital Funds Ltd. (IVCF)

Gujarat Venture Finance Limited (GVFL)

IL & FS Group Businesses

Venture Capital Financing Process

In general the Venture Capital Financing Process is divided

into 5 different stages:

The SEED Stage – In this stage relatively small amounts of

capital is used to prove concepts & finance feasibility

EARLY- studies.

STAGE The START-UP Stage – In this stage funding is done for

FINANCING product development and initial marketing, but with no

commercial sales yet (basically to get operations started).

The SECOND Stage – In this stage working capital is used

for initial growth phase, but no clear profitability or cash flow

EXPANSION yet.

or The THIRD Stage – In this stage financing is done for major

DEVELOP- expansion for company with rapid sales growth, at break

MENT even or positive profit levels but still private company.

FINANCING

The BRIDGE/PRE-PUBLIC Stage – In this stage Bridge

financing is done so as to prepare the company for public

offering.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Coco Chanel Case StudyDocument5 pagesCoco Chanel Case StudyArun NalamaraNo ratings yet

- Business PlanDocument4 pagesBusiness PlanGwenn PosoNo ratings yet

- 1 - Investment Techniques - An IntroductionDocument33 pages1 - Investment Techniques - An Introductionachu powellNo ratings yet

- CH-6 Business FinancingDocument27 pagesCH-6 Business FinancingNatiphotography01No ratings yet

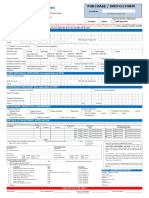

- RHB Switch FormDocument2 pagesRHB Switch FormWei CongNo ratings yet

- Course ManualDocument8 pagesCourse ManualVedantam GuptaNo ratings yet

- The Securities and Exchange Commission, NigeriaDocument5 pagesThe Securities and Exchange Commission, NigeriasiedmubaNo ratings yet

- Venture and Financing StartupDocument22 pagesVenture and Financing StartupJohn DoeNo ratings yet

- Ronty 2Document61 pagesRonty 2Techboy RahulNo ratings yet

- Sample ExamDocument5 pagesSample Exam范明奎No ratings yet

- Strategic Financial Management Cia: Comparison of Venture Capital Schemes OFDocument4 pagesStrategic Financial Management Cia: Comparison of Venture Capital Schemes OFMadhav LuthraNo ratings yet

- Micro Small Med Entpr in India (IIBF) ContentsDocument6 pagesMicro Small Med Entpr in India (IIBF) ContentsPrashant ShindeNo ratings yet

- ComplaintDocument28 pagesComplaintLiberty NationNo ratings yet

- TUTMACDocument63 pagesTUTMACThùy Dương NguyễnNo ratings yet

- FM 1,2,5Document15 pagesFM 1,2,5shaik.712239No ratings yet

- Project Finance Sem 4Document366 pagesProject Finance Sem 4dharaNo ratings yet

- CH 16 - Narrative Report-Short Term Business FinancingDocument13 pagesCH 16 - Narrative Report-Short Term Business Financingjomarybrequillo20No ratings yet

- Org Man - Q2 M7Document31 pagesOrg Man - Q2 M7Irish PradoNo ratings yet

- FinmarDocument67 pagesFinmarGabrielle Anne MagsanocNo ratings yet

- Krishna Grameena BankDocument101 pagesKrishna Grameena BankSuresh Babu ReddyNo ratings yet

- Chap018 Management FinanciarDocument49 pagesChap018 Management FinanciaralkazumNo ratings yet

- Book Published I Field of BusinessDocument189 pagesBook Published I Field of BusinessRikeshNo ratings yet

- Entrepreneurial Finance 6Th Edition by Philip J Adelman Full ChapterDocument41 pagesEntrepreneurial Finance 6Th Edition by Philip J Adelman Full Chapterjennifer.wilson918100% (27)

- GCE Business Business FinanceDocument38 pagesGCE Business Business FinanceSalar CheemaNo ratings yet

- BankFin Midterm Mod 4Document6 pagesBankFin Midterm Mod 4Devon DebarrasNo ratings yet

- Module 1-5 in Financial MarketsDocument55 pagesModule 1-5 in Financial MarketsMixx MineNo ratings yet

- Chapter 2 Working Capital MGT ModularDocument21 pagesChapter 2 Working Capital MGT ModulardeguNo ratings yet

- All Chapters Key Words of Business StudiesDocument15 pagesAll Chapters Key Words of Business StudiesAadi PunjabiNo ratings yet

- 3) 9. Raising CapitalDocument29 pages3) 9. Raising CapitalJhon Ace DuricoNo ratings yet

- Venture Capital Inspiring Financial Inclusion in Latin America (2016-2021)Document20 pagesVenture Capital Inspiring Financial Inclusion in Latin America (2016-2021)Paul YermishNo ratings yet