Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

11 viewsCoronavirus: The World Economy at Risk: 4 Charts Show The Coronavirus Impact On The Global Economy and Markets So Far

Coronavirus: The World Economy at Risk: 4 Charts Show The Coronavirus Impact On The Global Economy and Markets So Far

Uploaded by

DODGEThe coronavirus outbreak has become a major threat to the global economy. It has infected over 110,000 people across 110 countries so far, with over 4,000 deaths. China, where the majority of cases are, has implemented strict containment measures that will significantly slow its economy and impact the global economy. As the virus spreads across other major economies like Italy, Iran, and South Korea, it is further weakening global manufacturing and international trade. Analysts expect this will reduce global economic growth in 2020.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- International Economics Theory and Policy Krugman 10th Edition Solutions ManualDocument4 pagesInternational Economics Theory and Policy Krugman 10th Edition Solutions ManualJessicaJohnsonqfzm100% (41)

- Coronavirus: The World Economy at Risk: 4 Charts Show The Coronavirus Impact On The Global Economy and Markets So FarDocument6 pagesCoronavirus: The World Economy at Risk: 4 Charts Show The Coronavirus Impact On The Global Economy and Markets So FarwalidNo ratings yet

- Coronavirus: The World Economy at Risk: 4 Charts Show The Coronavirus Impact On The Global Economy and Markets So FarDocument6 pagesCoronavirus: The World Economy at Risk: 4 Charts Show The Coronavirus Impact On The Global Economy and Markets So FarwalidNo ratings yet

- Coronavirus: The World Economy at Risk: 4 Charts Show The Coronavirus Impact On The Global Economy and Markets So FarDocument6 pagesCoronavirus: The World Economy at Risk: 4 Charts Show The Coronavirus Impact On The Global Economy and Markets So FarDODGENo ratings yet

- Effect of Coronavirus On Global EconomyDocument3 pagesEffect of Coronavirus On Global EconomyNatalia PatnaikNo ratings yet

- Assignment: Ghazi University D G KhanDocument8 pagesAssignment: Ghazi University D G KhanBirmani BirmaniNo ratings yet

- Impact of Corona Virus On Global EconomyDocument10 pagesImpact of Corona Virus On Global EconomyAsif Sadat 1815274060No ratings yet

- International Business International Business: Neha Singh Neha SinghDocument10 pagesInternational Business International Business: Neha Singh Neha SinghNeha SinghNo ratings yet

- Project: TOPIC: Socio Cultural and Economic Impact On EpidemicDocument21 pagesProject: TOPIC: Socio Cultural and Economic Impact On Epidemicmaryam100% (1)

- Covid-19 Effects On IBT - LINSODocument2 pagesCovid-19 Effects On IBT - LINSOHazraphine LinsoNo ratings yet

- Socio Cultural and Economic Impact On EpidemicDocument28 pagesSocio Cultural and Economic Impact On EpidemicNikitaNo ratings yet

- Questions and Answer (Short Assingment) : Q1: What The Economical Impact of The Covid-19 Pandemic? AnsDocument6 pagesQuestions and Answer (Short Assingment) : Q1: What The Economical Impact of The Covid-19 Pandemic? AnsTabi SabahNo ratings yet

- Coronavirus RSTVDocument4 pagesCoronavirus RSTVVikram GuptaNo ratings yet

- COVID-19 and Its Impact On The International EconomyDocument17 pagesCOVID-19 and Its Impact On The International EconomyGeetika Khandelwal100% (7)

- IntroductionDocument6 pagesIntroductionArnab SenNo ratings yet

- Coronavirus and The Global EconomyDocument5 pagesCoronavirus and The Global EconomyАнастасия ТерентьеваNo ratings yet

- The Impact of COVID19 On Global EconomyDocument9 pagesThe Impact of COVID19 On Global Economyمحمود عليمىNo ratings yet

- Maryam Ka CoronaDocument2 pagesMaryam Ka CoronaMariam SiddiquiNo ratings yet

- Global Impact On Economy During Covid-19Document18 pagesGlobal Impact On Economy During Covid-19Shivam NirwanaNo ratings yet

- A Covid-19.01Document6 pagesA Covid-19.01Nida AbbasNo ratings yet

- T&Cs Found HereDocument4 pagesT&Cs Found HereRuben PangalilaNo ratings yet

- Corona VirusDocument11 pagesCorona VirusDeepti TiwariNo ratings yet

- The Impact of The Coronavirus Pandemic On The Global EconomyDocument8 pagesThe Impact of The Coronavirus Pandemic On The Global Economymd tarequl islamNo ratings yet

- Covid 19 Impacts On Politics Economy IntDocument8 pagesCovid 19 Impacts On Politics Economy Intvicky sam ka keiNo ratings yet

- Assignment On: The Effect of Corona Virus Pandemic On International TradeDocument13 pagesAssignment On: The Effect of Corona Virus Pandemic On International Trademenhajur rahamanNo ratings yet

- Effect of Covid-19 On World Economy: AssignmentDocument3 pagesEffect of Covid-19 On World Economy: AssignmentShubham PandeyNo ratings yet

- Ccas Coronavirus ChnecoDocument10 pagesCcas Coronavirus ChnecoMein HunNo ratings yet

- Impact of Corona Virus On The Global Economy: February 2020Document3 pagesImpact of Corona Virus On The Global Economy: February 2020Uzzal AhmedNo ratings yet

- IFM Termpaper PDFDocument13 pagesIFM Termpaper PDFmenhajur rahamanNo ratings yet

- Impact of Diseases On The Global EconomyDocument7 pagesImpact of Diseases On The Global EconomyGraciela MendezNo ratings yet

- Infect-Philippine-Economy: Increasingly Worried Aren't So WorriedDocument4 pagesInfect-Philippine-Economy: Increasingly Worried Aren't So Worriedphoebus ramirezNo ratings yet

- Ramirez PSC31 ASEAN China Trade Relations The Impact of China's Zero COVID Policy On The Economic Performance of ASEAN Member StatesDocument10 pagesRamirez PSC31 ASEAN China Trade Relations The Impact of China's Zero COVID Policy On The Economic Performance of ASEAN Member StatesJoshua RamirezNo ratings yet

- FL 20Document15 pagesFL 20TOÀN NGUYỄN TRẦN PHƯỚCNo ratings yet

- Article 1: (Sept 16 2020) US Broke Rules by Imposing Tariffs On ChinaDocument9 pagesArticle 1: (Sept 16 2020) US Broke Rules by Imposing Tariffs On ChinaPranave NellikattilNo ratings yet

- Covid 19Document10 pagesCovid 19Manas gupta100% (1)

- Coronavirus (Covid-19) and Its Effects On The World and Indian EconomyDocument11 pagesCoronavirus (Covid-19) and Its Effects On The World and Indian EconomyDarpanNo ratings yet

- Challenges To The World Economy in 2020Document6 pagesChallenges To The World Economy in 2020PLABAN PANDANo ratings yet

- Name: Rohit Purohit Submitted To: DR - Sumedh Lokhande. Subject: Political Science Assignment: Research Paper Om Covid-19 and It's EffectsDocument4 pagesName: Rohit Purohit Submitted To: DR - Sumedh Lokhande. Subject: Political Science Assignment: Research Paper Om Covid-19 and It's EffectsmarshmelloNo ratings yet

- Impact of Corona Virus On The Global Economy: February 2020Document3 pagesImpact of Corona Virus On The Global Economy: February 2020Ihsaan Gulzar AwanNo ratings yet

- China Imports, Exports Plunge in December: Customs: Facebook Twitter Linkedin ViberDocument3 pagesChina Imports, Exports Plunge in December: Customs: Facebook Twitter Linkedin ViberMark Allen PascualNo ratings yet

- Impact of COVID-19 Outbreak On Financial ReportingDocument18 pagesImpact of COVID-19 Outbreak On Financial Reportingsafa haddadNo ratings yet

- Impactof Corona Virusonthe Global Economy SAKIBMAHMUDDocument3 pagesImpactof Corona Virusonthe Global Economy SAKIBMAHMUDBorhan NidamiNo ratings yet

- The Coronomics and World Economy: Impacts On PakistanDocument12 pagesThe Coronomics and World Economy: Impacts On PakistanKhuleedShaikhNo ratings yet

- Economics in The Time of COVID HAFIDZ ASH SHALIHDocument9 pagesEconomics in The Time of COVID HAFIDZ ASH SHALIHErlangga Wisnu0% (1)

- COVID-19: Social and Global Impacts: Birla Institute of TechnologyDocument11 pagesCOVID-19: Social and Global Impacts: Birla Institute of TechnologyManas guptaNo ratings yet

- Parcor ResearchDocument9 pagesParcor ResearchJessa MontonNo ratings yet

- What Is A Coronavirus?: Keywords: Economic Crisis Recession Coronavirus COVID-19 Financial CrisisDocument7 pagesWhat Is A Coronavirus?: Keywords: Economic Crisis Recession Coronavirus COVID-19 Financial CrisisNayan NathNo ratings yet

- Assingment On Impact of CovidDocument20 pagesAssingment On Impact of Covidprerna100% (1)

- Impact of The Whole WorldDocument4 pagesImpact of The Whole Worldوسيم أكرمNo ratings yet

- The World Economy The Peril and The Promise: Special ReportDocument5 pagesThe World Economy The Peril and The Promise: Special ReportViruu DiazNo ratings yet

- Army Institute of Business Administration: AssignmentDocument6 pagesArmy Institute of Business Administration: AssignmentFarhan TanvirNo ratings yet

- Corona Virus & The Global EconomyDocument1 pageCorona Virus & The Global EconomyIsmail EmonNo ratings yet

- Compiled COVIDDocument49 pagesCompiled COVIDLaarnie Linggayo100% (1)

- COVID-19: Its Impact On The Philippines - Parts I, II and III of VDocument27 pagesCOVID-19: Its Impact On The Philippines - Parts I, II and III of VLaarnie Linggayo100% (3)

- Economic Impact of Covid-19 Pandemic: July 2020Document20 pagesEconomic Impact of Covid-19 Pandemic: July 2020Rhem Rick CorpuzNo ratings yet

- 23-11-22 Article of The DayDocument8 pages23-11-22 Article of The DayZaid SattarNo ratings yet

- East West University: AssignmentDocument4 pagesEast West University: AssignmentmuhammadvaqasNo ratings yet

- The Economic Impact of COVID-19 Research University of OxfordDocument1 pageThe Economic Impact of COVID-19 Research University of OxfordDiscendo DiscimusNo ratings yet

- Cwe 12349Document25 pagesCwe 12349Karen Faith ALABOTNo ratings yet

- Canuto, Kimberly Anne V. Iv-BmaDocument2 pagesCanuto, Kimberly Anne V. Iv-BmaLayca Clarice Germino BrimbuelaNo ratings yet

- Stocks Only Go Up: What role did apps like Robinhood, influencers like David Portnoy and government stimulus checks play in the emergence of Millennials in the stock market?From EverandStocks Only Go Up: What role did apps like Robinhood, influencers like David Portnoy and government stimulus checks play in the emergence of Millennials in the stock market?No ratings yet

- Test Bank For International Accounting 4Th Edition Doupnik Perera 0077862201 9780077862206 Full Chapter PDFDocument36 pagesTest Bank For International Accounting 4Th Edition Doupnik Perera 0077862201 9780077862206 Full Chapter PDFryan.boyd506100% (20)

- Solved in Figure 20 1 Which Compares Money Growth and Inflation OverDocument1 pageSolved in Figure 20 1 Which Compares Money Growth and Inflation OverM Bilal SaleemNo ratings yet

- Class 10th Development BoardPrep SolutionDocument10 pagesClass 10th Development BoardPrep SolutionABISHUA HANOK LALNo ratings yet

- 0455 Economics: MARK SCHEME For The May/June 2009 Question Paper For The Guidance of TeachersDocument4 pages0455 Economics: MARK SCHEME For The May/June 2009 Question Paper For The Guidance of TeachersAhmedNo ratings yet

- Thomson Reuters Equal Weight Commodity Total Return Index: Refinitiv IndicesDocument2 pagesThomson Reuters Equal Weight Commodity Total Return Index: Refinitiv IndicespatluNo ratings yet

- (Ebook PDF) (Ebook PDF) CoreMacroeconomics Third Edition by Eric Chiang All ChapterDocument43 pages(Ebook PDF) (Ebook PDF) CoreMacroeconomics Third Edition by Eric Chiang All Chaptertjgkroi6100% (7)

- Financing Agreement: Grant Number D763-RyDocument35 pagesFinancing Agreement: Grant Number D763-RyRonanNo ratings yet

- Men 5Document14 pagesMen 5Agile InvestmentsNo ratings yet

- Expenditure MehodDocument13 pagesExpenditure MehodAshishNo ratings yet

- Billionaire Sam Zell Talks Trump, SPACs, and Interest Rates in Forbes Q+A - 12-2020Document6 pagesBillionaire Sam Zell Talks Trump, SPACs, and Interest Rates in Forbes Q+A - 12-2020Peter KaiserNo ratings yet

- KORME Atyrau 2023Document1 pageKORME Atyrau 202364y27f4wwtNo ratings yet

- SAMPLE: Application To Be An IntervenorDocument2 pagesSAMPLE: Application To Be An Intervenorhefflinger0% (1)

- Module 3 Global Finance With e BankingDocument4 pagesModule 3 Global Finance With e BankingPatrick BarrogaNo ratings yet

- Questions Isc AccDocument52 pagesQuestions Isc Accrajc080805No ratings yet

- 10Document48 pages10RB STNo ratings yet

- Simple Rules To Trade Using 5 EMA (LOW-HIGH)Document9 pagesSimple Rules To Trade Using 5 EMA (LOW-HIGH)JoTraderNo ratings yet

- EnterpriseDocument17 pagesEnterprisethinklegal2212No ratings yet

- Chess School 1a Manual of Chess Combinations IvashchenkoDocument146 pagesChess School 1a Manual of Chess Combinations IvashchenkoBence CsizmadiaNo ratings yet

- Foreign Exchange Risk ManagementDocument10 pagesForeign Exchange Risk ManagementThomas nyadeNo ratings yet

- Infrastructure Sector & Infrastructure Policy: Is There A Big Boost?Document18 pagesInfrastructure Sector & Infrastructure Policy: Is There A Big Boost?Sameer RajaNo ratings yet

- GE CaseDocument20 pagesGE CaseMeenal MalhotraNo ratings yet

- UntitledDocument32 pagesUntitledAswinNo ratings yet

- IFSCA Grade A Officer 2022 Phase 1 Paper 2 Previous Year PaperDocument20 pagesIFSCA Grade A Officer 2022 Phase 1 Paper 2 Previous Year PaperSwayamNo ratings yet

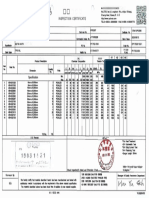

- Inspection Certificate: SpecificationDocument1 pageInspection Certificate: SpecificationMohamed RaafatNo ratings yet

- Inventory - Management - Vedanta, Tech MahindraDocument9 pagesInventory - Management - Vedanta, Tech MahindraBinodini SenNo ratings yet

- Economic Environment Course Outline 2021-22 - PGP - 25Document4 pagesEconomic Environment Course Outline 2021-22 - PGP - 25Swati PorwalNo ratings yet

- Financial Institutions J Market and Services CIA 3Document18 pagesFinancial Institutions J Market and Services CIA 3Mansehaj SinghNo ratings yet

- Bizgate - Company ProfileDocument6 pagesBizgate - Company ProfileROLTAMAX PORTEKNo ratings yet

- IOC Schedule 2019Document3 pagesIOC Schedule 2019Soumil KuraniNo ratings yet

Coronavirus: The World Economy at Risk: 4 Charts Show The Coronavirus Impact On The Global Economy and Markets So Far

Coronavirus: The World Economy at Risk: 4 Charts Show The Coronavirus Impact On The Global Economy and Markets So Far

Uploaded by

DODGE0 ratings0% found this document useful (0 votes)

11 views6 pagesThe coronavirus outbreak has become a major threat to the global economy. It has infected over 110,000 people across 110 countries so far, with over 4,000 deaths. China, where the majority of cases are, has implemented strict containment measures that will significantly slow its economy and impact the global economy. As the virus spreads across other major economies like Italy, Iran, and South Korea, it is further weakening global manufacturing and international trade. Analysts expect this will reduce global economic growth in 2020.

Original Description:

Original Title

Coronavirus eco.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe coronavirus outbreak has become a major threat to the global economy. It has infected over 110,000 people across 110 countries so far, with over 4,000 deaths. China, where the majority of cases are, has implemented strict containment measures that will significantly slow its economy and impact the global economy. As the virus spreads across other major economies like Italy, Iran, and South Korea, it is further weakening global manufacturing and international trade. Analysts expect this will reduce global economic growth in 2020.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

11 views6 pagesCoronavirus: The World Economy at Risk: 4 Charts Show The Coronavirus Impact On The Global Economy and Markets So Far

Coronavirus: The World Economy at Risk: 4 Charts Show The Coronavirus Impact On The Global Economy and Markets So Far

Uploaded by

DODGEThe coronavirus outbreak has become a major threat to the global economy. It has infected over 110,000 people across 110 countries so far, with over 4,000 deaths. China, where the majority of cases are, has implemented strict containment measures that will significantly slow its economy and impact the global economy. As the virus spreads across other major economies like Italy, Iran, and South Korea, it is further weakening global manufacturing and international trade. Analysts expect this will reduce global economic growth in 2020.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 6

Coronavirus:

The world economy

at risk

4 charts show the coronavirus impact on the

global economy and markets so far

• The ongoing spread of the new coronavirus has become one of the

biggest threats to the global economy and financial markets.

• The virus, first detected in the Chinese city of Wuhan last December,

has infected more than 110,000 people in at least 110 countries and

territories globally, according to the World Health Organization. Of

those infected, more than 4,000 people have died, according to WHO

data.

• China is where majority of the confirmed cases are — more than

80,000 infections have been reported in the mainland so far. To

contain the COVID-19 outbreak, Chinese authorities locked down

cities, restricted movements of millions and suspended business

operations — moves that will slow down the world’s second-largest

economy and drag down the global economy along the way.

• To make things worse, the disease is spreading rapidly around the

world, with countries like Italy, Iran and South Korea reporting more

than 7,000 cases each. Other European countries like France,

China’s gross domestic product growth saw the largest downgrade

in terms of magnitude, according to the report. The Asian economic

giant is expected to grow by 4.9% this year, slower than the earlier

forecast of 5.7%, said OECD.

Meanwhile, the global economy is expected to grow by 2.4% in

2020 — down from the 2.9% projected earlier, said the report.

Such a slowdown in Chinese manufacturing has hurt countries with close

economic links to Pacific economies China, many of which are Asia such

as Vietnam, Singapore and South Korea.

Factories in China are taking longer than expected to resume operations,

several analysts said. That, along with a rapid spread of COVID-19

outside China, means that global manufacturing activity could remain

subdued for longer, economists said.

China is not the only country where the services sector has weakened. The services sector in the U.S., the

world’s largest consumer market, also contracted in February, according to IHS Markit, which compiles the

monthly PMI data.

One reason behind the U.S. services contraction was a reduction in “new business from abroad as customers

held back from placing orders amid global economic uncertainty and the coronavirus outbreak,” said IHS Markit.

China, the epicenter of the coronavirus outbreak, is the world’s largest crude

oil importer.

“The spread of the virus in Italy and other parts of Europe is particularly

worrying and will likely dampen demand in OECD countries as well,” the DBS

analysts wrote in a report.

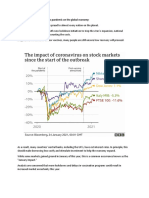

Stock market rout

Fear surrounding the impact of COVID-19 on the global economy has hurt

investor sentiment and brought down stock prices in major markets.

You might also like

- International Economics Theory and Policy Krugman 10th Edition Solutions ManualDocument4 pagesInternational Economics Theory and Policy Krugman 10th Edition Solutions ManualJessicaJohnsonqfzm100% (41)

- Coronavirus: The World Economy at Risk: 4 Charts Show The Coronavirus Impact On The Global Economy and Markets So FarDocument6 pagesCoronavirus: The World Economy at Risk: 4 Charts Show The Coronavirus Impact On The Global Economy and Markets So FarwalidNo ratings yet

- Coronavirus: The World Economy at Risk: 4 Charts Show The Coronavirus Impact On The Global Economy and Markets So FarDocument6 pagesCoronavirus: The World Economy at Risk: 4 Charts Show The Coronavirus Impact On The Global Economy and Markets So FarwalidNo ratings yet

- Coronavirus: The World Economy at Risk: 4 Charts Show The Coronavirus Impact On The Global Economy and Markets So FarDocument6 pagesCoronavirus: The World Economy at Risk: 4 Charts Show The Coronavirus Impact On The Global Economy and Markets So FarDODGENo ratings yet

- Effect of Coronavirus On Global EconomyDocument3 pagesEffect of Coronavirus On Global EconomyNatalia PatnaikNo ratings yet

- Assignment: Ghazi University D G KhanDocument8 pagesAssignment: Ghazi University D G KhanBirmani BirmaniNo ratings yet

- Impact of Corona Virus On Global EconomyDocument10 pagesImpact of Corona Virus On Global EconomyAsif Sadat 1815274060No ratings yet

- International Business International Business: Neha Singh Neha SinghDocument10 pagesInternational Business International Business: Neha Singh Neha SinghNeha SinghNo ratings yet

- Project: TOPIC: Socio Cultural and Economic Impact On EpidemicDocument21 pagesProject: TOPIC: Socio Cultural and Economic Impact On Epidemicmaryam100% (1)

- Covid-19 Effects On IBT - LINSODocument2 pagesCovid-19 Effects On IBT - LINSOHazraphine LinsoNo ratings yet

- Socio Cultural and Economic Impact On EpidemicDocument28 pagesSocio Cultural and Economic Impact On EpidemicNikitaNo ratings yet

- Questions and Answer (Short Assingment) : Q1: What The Economical Impact of The Covid-19 Pandemic? AnsDocument6 pagesQuestions and Answer (Short Assingment) : Q1: What The Economical Impact of The Covid-19 Pandemic? AnsTabi SabahNo ratings yet

- Coronavirus RSTVDocument4 pagesCoronavirus RSTVVikram GuptaNo ratings yet

- COVID-19 and Its Impact On The International EconomyDocument17 pagesCOVID-19 and Its Impact On The International EconomyGeetika Khandelwal100% (7)

- IntroductionDocument6 pagesIntroductionArnab SenNo ratings yet

- Coronavirus and The Global EconomyDocument5 pagesCoronavirus and The Global EconomyАнастасия ТерентьеваNo ratings yet

- The Impact of COVID19 On Global EconomyDocument9 pagesThe Impact of COVID19 On Global Economyمحمود عليمىNo ratings yet

- Maryam Ka CoronaDocument2 pagesMaryam Ka CoronaMariam SiddiquiNo ratings yet

- Global Impact On Economy During Covid-19Document18 pagesGlobal Impact On Economy During Covid-19Shivam NirwanaNo ratings yet

- A Covid-19.01Document6 pagesA Covid-19.01Nida AbbasNo ratings yet

- T&Cs Found HereDocument4 pagesT&Cs Found HereRuben PangalilaNo ratings yet

- Corona VirusDocument11 pagesCorona VirusDeepti TiwariNo ratings yet

- The Impact of The Coronavirus Pandemic On The Global EconomyDocument8 pagesThe Impact of The Coronavirus Pandemic On The Global Economymd tarequl islamNo ratings yet

- Covid 19 Impacts On Politics Economy IntDocument8 pagesCovid 19 Impacts On Politics Economy Intvicky sam ka keiNo ratings yet

- Assignment On: The Effect of Corona Virus Pandemic On International TradeDocument13 pagesAssignment On: The Effect of Corona Virus Pandemic On International Trademenhajur rahamanNo ratings yet

- Effect of Covid-19 On World Economy: AssignmentDocument3 pagesEffect of Covid-19 On World Economy: AssignmentShubham PandeyNo ratings yet

- Ccas Coronavirus ChnecoDocument10 pagesCcas Coronavirus ChnecoMein HunNo ratings yet

- Impact of Corona Virus On The Global Economy: February 2020Document3 pagesImpact of Corona Virus On The Global Economy: February 2020Uzzal AhmedNo ratings yet

- IFM Termpaper PDFDocument13 pagesIFM Termpaper PDFmenhajur rahamanNo ratings yet

- Impact of Diseases On The Global EconomyDocument7 pagesImpact of Diseases On The Global EconomyGraciela MendezNo ratings yet

- Infect-Philippine-Economy: Increasingly Worried Aren't So WorriedDocument4 pagesInfect-Philippine-Economy: Increasingly Worried Aren't So Worriedphoebus ramirezNo ratings yet

- Ramirez PSC31 ASEAN China Trade Relations The Impact of China's Zero COVID Policy On The Economic Performance of ASEAN Member StatesDocument10 pagesRamirez PSC31 ASEAN China Trade Relations The Impact of China's Zero COVID Policy On The Economic Performance of ASEAN Member StatesJoshua RamirezNo ratings yet

- FL 20Document15 pagesFL 20TOÀN NGUYỄN TRẦN PHƯỚCNo ratings yet

- Article 1: (Sept 16 2020) US Broke Rules by Imposing Tariffs On ChinaDocument9 pagesArticle 1: (Sept 16 2020) US Broke Rules by Imposing Tariffs On ChinaPranave NellikattilNo ratings yet

- Covid 19Document10 pagesCovid 19Manas gupta100% (1)

- Coronavirus (Covid-19) and Its Effects On The World and Indian EconomyDocument11 pagesCoronavirus (Covid-19) and Its Effects On The World and Indian EconomyDarpanNo ratings yet

- Challenges To The World Economy in 2020Document6 pagesChallenges To The World Economy in 2020PLABAN PANDANo ratings yet

- Name: Rohit Purohit Submitted To: DR - Sumedh Lokhande. Subject: Political Science Assignment: Research Paper Om Covid-19 and It's EffectsDocument4 pagesName: Rohit Purohit Submitted To: DR - Sumedh Lokhande. Subject: Political Science Assignment: Research Paper Om Covid-19 and It's EffectsmarshmelloNo ratings yet

- Impact of Corona Virus On The Global Economy: February 2020Document3 pagesImpact of Corona Virus On The Global Economy: February 2020Ihsaan Gulzar AwanNo ratings yet

- China Imports, Exports Plunge in December: Customs: Facebook Twitter Linkedin ViberDocument3 pagesChina Imports, Exports Plunge in December: Customs: Facebook Twitter Linkedin ViberMark Allen PascualNo ratings yet

- Impact of COVID-19 Outbreak On Financial ReportingDocument18 pagesImpact of COVID-19 Outbreak On Financial Reportingsafa haddadNo ratings yet

- Impactof Corona Virusonthe Global Economy SAKIBMAHMUDDocument3 pagesImpactof Corona Virusonthe Global Economy SAKIBMAHMUDBorhan NidamiNo ratings yet

- The Coronomics and World Economy: Impacts On PakistanDocument12 pagesThe Coronomics and World Economy: Impacts On PakistanKhuleedShaikhNo ratings yet

- Economics in The Time of COVID HAFIDZ ASH SHALIHDocument9 pagesEconomics in The Time of COVID HAFIDZ ASH SHALIHErlangga Wisnu0% (1)

- COVID-19: Social and Global Impacts: Birla Institute of TechnologyDocument11 pagesCOVID-19: Social and Global Impacts: Birla Institute of TechnologyManas guptaNo ratings yet

- Parcor ResearchDocument9 pagesParcor ResearchJessa MontonNo ratings yet

- What Is A Coronavirus?: Keywords: Economic Crisis Recession Coronavirus COVID-19 Financial CrisisDocument7 pagesWhat Is A Coronavirus?: Keywords: Economic Crisis Recession Coronavirus COVID-19 Financial CrisisNayan NathNo ratings yet

- Assingment On Impact of CovidDocument20 pagesAssingment On Impact of Covidprerna100% (1)

- Impact of The Whole WorldDocument4 pagesImpact of The Whole Worldوسيم أكرمNo ratings yet

- The World Economy The Peril and The Promise: Special ReportDocument5 pagesThe World Economy The Peril and The Promise: Special ReportViruu DiazNo ratings yet

- Army Institute of Business Administration: AssignmentDocument6 pagesArmy Institute of Business Administration: AssignmentFarhan TanvirNo ratings yet

- Corona Virus & The Global EconomyDocument1 pageCorona Virus & The Global EconomyIsmail EmonNo ratings yet

- Compiled COVIDDocument49 pagesCompiled COVIDLaarnie Linggayo100% (1)

- COVID-19: Its Impact On The Philippines - Parts I, II and III of VDocument27 pagesCOVID-19: Its Impact On The Philippines - Parts I, II and III of VLaarnie Linggayo100% (3)

- Economic Impact of Covid-19 Pandemic: July 2020Document20 pagesEconomic Impact of Covid-19 Pandemic: July 2020Rhem Rick CorpuzNo ratings yet

- 23-11-22 Article of The DayDocument8 pages23-11-22 Article of The DayZaid SattarNo ratings yet

- East West University: AssignmentDocument4 pagesEast West University: AssignmentmuhammadvaqasNo ratings yet

- The Economic Impact of COVID-19 Research University of OxfordDocument1 pageThe Economic Impact of COVID-19 Research University of OxfordDiscendo DiscimusNo ratings yet

- Cwe 12349Document25 pagesCwe 12349Karen Faith ALABOTNo ratings yet

- Canuto, Kimberly Anne V. Iv-BmaDocument2 pagesCanuto, Kimberly Anne V. Iv-BmaLayca Clarice Germino BrimbuelaNo ratings yet

- Stocks Only Go Up: What role did apps like Robinhood, influencers like David Portnoy and government stimulus checks play in the emergence of Millennials in the stock market?From EverandStocks Only Go Up: What role did apps like Robinhood, influencers like David Portnoy and government stimulus checks play in the emergence of Millennials in the stock market?No ratings yet

- Test Bank For International Accounting 4Th Edition Doupnik Perera 0077862201 9780077862206 Full Chapter PDFDocument36 pagesTest Bank For International Accounting 4Th Edition Doupnik Perera 0077862201 9780077862206 Full Chapter PDFryan.boyd506100% (20)

- Solved in Figure 20 1 Which Compares Money Growth and Inflation OverDocument1 pageSolved in Figure 20 1 Which Compares Money Growth and Inflation OverM Bilal SaleemNo ratings yet

- Class 10th Development BoardPrep SolutionDocument10 pagesClass 10th Development BoardPrep SolutionABISHUA HANOK LALNo ratings yet

- 0455 Economics: MARK SCHEME For The May/June 2009 Question Paper For The Guidance of TeachersDocument4 pages0455 Economics: MARK SCHEME For The May/June 2009 Question Paper For The Guidance of TeachersAhmedNo ratings yet

- Thomson Reuters Equal Weight Commodity Total Return Index: Refinitiv IndicesDocument2 pagesThomson Reuters Equal Weight Commodity Total Return Index: Refinitiv IndicespatluNo ratings yet

- (Ebook PDF) (Ebook PDF) CoreMacroeconomics Third Edition by Eric Chiang All ChapterDocument43 pages(Ebook PDF) (Ebook PDF) CoreMacroeconomics Third Edition by Eric Chiang All Chaptertjgkroi6100% (7)

- Financing Agreement: Grant Number D763-RyDocument35 pagesFinancing Agreement: Grant Number D763-RyRonanNo ratings yet

- Men 5Document14 pagesMen 5Agile InvestmentsNo ratings yet

- Expenditure MehodDocument13 pagesExpenditure MehodAshishNo ratings yet

- Billionaire Sam Zell Talks Trump, SPACs, and Interest Rates in Forbes Q+A - 12-2020Document6 pagesBillionaire Sam Zell Talks Trump, SPACs, and Interest Rates in Forbes Q+A - 12-2020Peter KaiserNo ratings yet

- KORME Atyrau 2023Document1 pageKORME Atyrau 202364y27f4wwtNo ratings yet

- SAMPLE: Application To Be An IntervenorDocument2 pagesSAMPLE: Application To Be An Intervenorhefflinger0% (1)

- Module 3 Global Finance With e BankingDocument4 pagesModule 3 Global Finance With e BankingPatrick BarrogaNo ratings yet

- Questions Isc AccDocument52 pagesQuestions Isc Accrajc080805No ratings yet

- 10Document48 pages10RB STNo ratings yet

- Simple Rules To Trade Using 5 EMA (LOW-HIGH)Document9 pagesSimple Rules To Trade Using 5 EMA (LOW-HIGH)JoTraderNo ratings yet

- EnterpriseDocument17 pagesEnterprisethinklegal2212No ratings yet

- Chess School 1a Manual of Chess Combinations IvashchenkoDocument146 pagesChess School 1a Manual of Chess Combinations IvashchenkoBence CsizmadiaNo ratings yet

- Foreign Exchange Risk ManagementDocument10 pagesForeign Exchange Risk ManagementThomas nyadeNo ratings yet

- Infrastructure Sector & Infrastructure Policy: Is There A Big Boost?Document18 pagesInfrastructure Sector & Infrastructure Policy: Is There A Big Boost?Sameer RajaNo ratings yet

- GE CaseDocument20 pagesGE CaseMeenal MalhotraNo ratings yet

- UntitledDocument32 pagesUntitledAswinNo ratings yet

- IFSCA Grade A Officer 2022 Phase 1 Paper 2 Previous Year PaperDocument20 pagesIFSCA Grade A Officer 2022 Phase 1 Paper 2 Previous Year PaperSwayamNo ratings yet

- Inspection Certificate: SpecificationDocument1 pageInspection Certificate: SpecificationMohamed RaafatNo ratings yet

- Inventory - Management - Vedanta, Tech MahindraDocument9 pagesInventory - Management - Vedanta, Tech MahindraBinodini SenNo ratings yet

- Economic Environment Course Outline 2021-22 - PGP - 25Document4 pagesEconomic Environment Course Outline 2021-22 - PGP - 25Swati PorwalNo ratings yet

- Financial Institutions J Market and Services CIA 3Document18 pagesFinancial Institutions J Market and Services CIA 3Mansehaj SinghNo ratings yet

- Bizgate - Company ProfileDocument6 pagesBizgate - Company ProfileROLTAMAX PORTEKNo ratings yet

- IOC Schedule 2019Document3 pagesIOC Schedule 2019Soumil KuraniNo ratings yet