Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

47 viewsChapter # 2: Organizing Financial Assets

Chapter # 2: Organizing Financial Assets

Uploaded by

Tabish KhanThis document discusses organizing financial assets and different types of financial assets. It describes three main ways for an investor to invest - in non-marketable assets, directly in markets, or indirectly through investment companies. It provides details on types of non-marketable assets like savings accounts, certificates of deposit, money market accounts, and government bonds. It also outlines various money market securities available for direct investment such as treasury bills, commercial paper, repurchase agreements, and bankers acceptances.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- This Chapter Addresses Several Reasons Why Marketing Is An Important Area of Study. Should Marketing Be Required For All College Students, No Matter Their Major? Why or Why Not?Document2 pagesThis Chapter Addresses Several Reasons Why Marketing Is An Important Area of Study. Should Marketing Be Required For All College Students, No Matter Their Major? Why or Why Not?Tabish Khan100% (1)

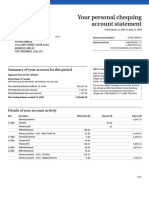

- Estatement PDFDocument1 pageEstatement PDFRudy AlconcherNo ratings yet

- Submitted To Dr. Khurram Shahzad Submitted by Muhammad Ibrahim Shafei SUBMITTED ON 08-11-2021 Sap Id 27912Document11 pagesSubmitted To Dr. Khurram Shahzad Submitted by Muhammad Ibrahim Shafei SUBMITTED ON 08-11-2021 Sap Id 27912Tabish KhanNo ratings yet

- The Alchemist Summray (Own Words)Document2 pagesThe Alchemist Summray (Own Words)Tabish KhanNo ratings yet

- Investment and Portfolio ManagementDocument46 pagesInvestment and Portfolio Managementaamer shahzad wattu100% (1)

- Indicate How and Why Each of These Factors Is Important To The Successful Operation of A SupermarketDocument1 pageIndicate How and Why Each of These Factors Is Important To The Successful Operation of A SupermarketTabish Khan100% (3)

- Maf 630 Chapter 4Document2 pagesMaf 630 Chapter 4Pablo EkskobaNo ratings yet

- Chapter 3 Financial InstrumentsDocument4 pagesChapter 3 Financial InstrumentsshaneNo ratings yet

- Investment AlternativesDocument32 pagesInvestment AlternativesMadihaBhattiNo ratings yet

- Module 1 FMODocument6 pagesModule 1 FMOba8477273No ratings yet

- Investement CHAPTER ONEDocument13 pagesInvestement CHAPTER ONEBeamlakNo ratings yet

- Chapter One Introduction To InvestmentDocument10 pagesChapter One Introduction To InvestmentMIKIYAS BERHENo ratings yet

- Money Market: TREASURY BILLS. Treasury Bills (T-Bills) Are Short-Term Notes Issued by The U.SDocument9 pagesMoney Market: TREASURY BILLS. Treasury Bills (T-Bills) Are Short-Term Notes Issued by The U.SArslan AkramNo ratings yet

- Non Marketable Financial Assets & Money Market SecuritiesDocument3 pagesNon Marketable Financial Assets & Money Market Securities020Elisya MufadilahNo ratings yet

- Instruments of Money MarketDocument17 pagesInstruments of Money MarketTanvir Hasan SohanNo ratings yet

- Chapter 4 FMIDocument13 pagesChapter 4 FMItame kibruNo ratings yet

- International Financial Market Instruments: Presented ByDocument45 pagesInternational Financial Market Instruments: Presented BygeetshijNo ratings yet

- Securities and MarketsDocument51 pagesSecurities and MarketsBilal JavedNo ratings yet

- Chapter One Introduction To InvestmentDocument13 pagesChapter One Introduction To InvestmentAdugna KeneaNo ratings yet

- Chapter One Introduction To InvestmentDocument15 pagesChapter One Introduction To InvestmentHaileNo ratings yet

- Capital-markets-Midterm With ExplanationDocument9 pagesCapital-markets-Midterm With ExplanationfroelanangusatiNo ratings yet

- The Role of The Financial MarketsDocument6 pagesThe Role of The Financial Marketsrosalyn mauricioNo ratings yet

- Importance of Money Market SecuritiesDocument2 pagesImportance of Money Market SecuritiesZainab SheraziNo ratings yet

- Purple Gradient 3D Bold Modern Investing Tips PresentationDocument47 pagesPurple Gradient 3D Bold Modern Investing Tips PresentationJana Beni Carolyn R. SabadoNo ratings yet

- Instruments of Finance in International Money MarketsDocument32 pagesInstruments of Finance in International Money Marketsapi-372709093% (15)

- CHAPTER 3 - Questions - EditedDocument9 pagesCHAPTER 3 - Questions - EditedEsraa TarekNo ratings yet

- Security Analysis and Portfolio Management: UNIT-1Document51 pagesSecurity Analysis and Portfolio Management: UNIT-1Sudha PanneerselvamNo ratings yet

- International Financial Market Instruments: Neenu T. Hari Shiji PremDocument20 pagesInternational Financial Market Instruments: Neenu T. Hari Shiji PremNeenu T HariNo ratings yet

- Banking II Chap 2 Money MarketDocument33 pagesBanking II Chap 2 Money Market2023643626No ratings yet

- Collateral: Bill PurchasingDocument4 pagesCollateral: Bill PurchasingFiza kamranNo ratings yet

- Chapter 4 - The Money Market NEWDocument12 pagesChapter 4 - The Money Market NEWNUR FAZERA AHMADNo ratings yet

- Money Market and Its InstrumentsDocument18 pagesMoney Market and Its InstrumentsSandip KarNo ratings yet

- Money Market - A BriefDocument6 pagesMoney Market - A BriefasfaarsafiNo ratings yet

- Investment CH 1Document13 pagesInvestment CH 1Binyam TayeNo ratings yet

- Kazungu's Assignment 2Document4 pagesKazungu's Assignment 2stam GNo ratings yet

- IFMDocument18 pagesIFMJayana ModiNo ratings yet

- FMI CH 4 Financial Markets in The Financial SystemDocument25 pagesFMI CH 4 Financial Markets in The Financial SystemYared GirmaNo ratings yet

- CCCCC CC CC: $%C C CC CDocument1 pageCCCCC CC CC: $%C C CC CSakkarai ManiNo ratings yet

- Capital Market and Money MarketDocument17 pagesCapital Market and Money MarketSwastika Singh100% (1)

- Financial System and MarketsDocument17 pagesFinancial System and MarketsDipesh GautamNo ratings yet

- Treasury 4Document22 pagesTreasury 4MpNo ratings yet

- FINVA100 Module1 Part2 OnlineDocument21 pagesFINVA100 Module1 Part2 OnlineLOUIE MAR RIVERANo ratings yet

- Lawrence Brian R. Labasan CBE InstructorDocument37 pagesLawrence Brian R. Labasan CBE InstructorCastor DamasoNo ratings yet

- Topic 1 Intro InvestDocument12 pagesTopic 1 Intro InvestIjok KarkunNo ratings yet

- Chapter 3 Financial InstrumentsDocument64 pagesChapter 3 Financial InstrumentsCyryll PayumoNo ratings yet

- Chapter 4Document3 pagesChapter 4meseleNo ratings yet

- Money Market Instruments-1Document11 pagesMoney Market Instruments-1Faiz KamranNo ratings yet

- Q5. What Do You Mean by Money Market and Money Market Instruments?Document2 pagesQ5. What Do You Mean by Money Market and Money Market Instruments?Jay PatelNo ratings yet

- Markets & InstrumentsDocument12 pagesMarkets & InstrumentsMerwan EbtedaiNo ratings yet

- Part One: Money and Capital Market: Chapter Four Financial Markets in The Financial SystemDocument22 pagesPart One: Money and Capital Market: Chapter Four Financial Markets in The Financial SystemSeid KassawNo ratings yet

- Chapter Four FinalDocument18 pagesChapter Four FinalSeid KassawNo ratings yet

- Investment and Security Analysis by Charles P Jones Chapter 2 - Tabish Khan From KohatDocument5 pagesInvestment and Security Analysis by Charles P Jones Chapter 2 - Tabish Khan From KohatTabish KhanNo ratings yet

- Government Securities MarketDocument26 pagesGovernment Securities MarketRaghav ThakurNo ratings yet

- Ibo 6 em PDFDocument6 pagesIbo 6 em PDFFirdosh Khan100% (7)

- Money Markets and Capital MarketsDocument4 pagesMoney Markets and Capital MarketsEmmanuelle RojasNo ratings yet

- Money Market Instrument SalvsDocument9 pagesMoney Market Instrument SalvsRenz DoctorNo ratings yet

- Financial Markets Treasury Bills Commercial Paper Bankers' Acceptances Mortgage-Asset-Backed Securities Liquidity Global Financial SystemDocument6 pagesFinancial Markets Treasury Bills Commercial Paper Bankers' Acceptances Mortgage-Asset-Backed Securities Liquidity Global Financial Systemujj1No ratings yet

- Muhammad Abdullah (6772) Capital & Money MarketDocument5 pagesMuhammad Abdullah (6772) Capital & Money MarketMuhammad AbdullahNo ratings yet

- Sources of FundsDocument22 pagesSources of FundsImtiaz RashidNo ratings yet

- Money MarketsDocument11 pagesMoney MarketsRonah Abigail BejocNo ratings yet

- Gen Math Stocks and BondsDocument41 pagesGen Math Stocks and BondsDaniel VillahermosaNo ratings yet

- Money Market Securities - : Certificates of Deposit (CDS)Document4 pagesMoney Market Securities - : Certificates of Deposit (CDS)Crisha-mae JavillonarNo ratings yet

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2From EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2No ratings yet

- Failures of D-8Document14 pagesFailures of D-8Tabish KhanNo ratings yet

- Brief IntroductionDocument4 pagesBrief IntroductionTabish KhanNo ratings yet

- Common WealthDocument5 pagesCommon WealthTabish KhanNo ratings yet

- Internship Tasks: Tabish KhanDocument12 pagesInternship Tasks: Tabish KhanTabish KhanNo ratings yet

- NTS - National Testing ServiceDocument3 pagesNTS - National Testing ServiceTabish KhanNo ratings yet

- Question 1 Answer: 1. Figurehead Role of ManagerDocument8 pagesQuestion 1 Answer: 1. Figurehead Role of ManagerTabish KhanNo ratings yet

- Fee Details Fee Details Fee Details: (/Apply/Applicantsummary)Document2 pagesFee Details Fee Details Fee Details: (/Apply/Applicantsummary)Tabish KhanNo ratings yet

- Freelancing Excercise 4Document3 pagesFreelancing Excercise 4Tabish KhanNo ratings yet

- MS Proposal of Tabish KhanDocument6 pagesMS Proposal of Tabish KhanTabish KhanNo ratings yet

- AssignmentDocument7 pagesAssignmentTabish KhanNo ratings yet

- Submitted To Dr. Muhammad Kaleem Submitted by Ghazal Shahab Registration No MS320201001 Semester 3 Program Ms. MarketingDocument5 pagesSubmitted To Dr. Muhammad Kaleem Submitted by Ghazal Shahab Registration No MS320201001 Semester 3 Program Ms. MarketingTabish KhanNo ratings yet

- Graphic Designing Exercise 2Document2 pagesGraphic Designing Exercise 2Tabish KhanNo ratings yet

- Question 1 AnswerDocument3 pagesQuestion 1 AnswerTabish KhanNo ratings yet

- Tabish Khan Freelancing Exercise 2Document5 pagesTabish Khan Freelancing Exercise 2Tabish KhanNo ratings yet

- Question 1 Answer: Marketing ConceptDocument7 pagesQuestion 1 Answer: Marketing ConceptTabish KhanNo ratings yet

- IMFI 2022 02 ZulfikarDocument11 pagesIMFI 2022 02 ZulfikarZulfikar ZulfikarNo ratings yet

- The Origin of The Tourism in The PhilippinesDocument18 pagesThe Origin of The Tourism in The PhilippinesLove Joy Espinueva100% (1)

- Russian Were Purchasing Exclusively From India at Much Higher Price Than What Available in World Market. (Reason Political)Document3 pagesRussian Were Purchasing Exclusively From India at Much Higher Price Than What Available in World Market. (Reason Political)RahulKumarNo ratings yet

- Jawahar Vidya Mandir: OfficeDocument2 pagesJawahar Vidya Mandir: OfficeRavindra SahuNo ratings yet

- 2022 S1 2nd Sem Bookkeeping and Accounts Final ExamDocument18 pages2022 S1 2nd Sem Bookkeeping and Accounts Final ExamXuen Khun TanNo ratings yet

- IELTS Writing Task 2 - 2nd HomeworkDocument3 pagesIELTS Writing Task 2 - 2nd HomeworkYusufhartomiNo ratings yet

- TN26689Document1 pageTN26689Kiran KumarNo ratings yet

- Economic History of The PhilippinesDocument4 pagesEconomic History of The PhilippinesClint Agustin M. RoblesNo ratings yet

- Retainer Agreement FormatDocument6 pagesRetainer Agreement FormatDamilare OdusanyaNo ratings yet

- Income Tax II Illustration Clubbing of Incomes PDFDocument1 pageIncome Tax II Illustration Clubbing of Incomes PDFSubramanian SenthilNo ratings yet

- Conveyor Roller Chain - Conveyor Chains - USA Roller ChainDocument10 pagesConveyor Roller Chain - Conveyor Chains - USA Roller Chainarvin john cabralNo ratings yet

- AX Computer ShopDocument1 pageAX Computer ShopCherry Jana RobianesNo ratings yet

- Old Currency of OmanDocument8 pagesOld Currency of OmanMohammed Al khamisiNo ratings yet

- Notice No 4Document1 pageNotice No 4nitish JhaNo ratings yet

- Vivid Money SA Retail Fees and Withdrawal RightsDocument4 pagesVivid Money SA Retail Fees and Withdrawal RightsdavidoffsmiNo ratings yet

- Negotiable Instruments ActDocument8 pagesNegotiable Instruments ActKarthik ImperiousNo ratings yet

- Answers: FRM Part 1: Mock Exam - SolutionsDocument18 pagesAnswers: FRM Part 1: Mock Exam - SolutionsipeeterNo ratings yet

- ch005 1Document6 pagesch005 1Mr CutsforthNo ratings yet

- 2316 2021 Provi Newly HiredDocument99 pages2316 2021 Provi Newly HiredDelio Amante Jr.No ratings yet

- Globalize or Customize: Finding The Right Balance: Global Steel 2015-2016Document32 pagesGlobalize or Customize: Finding The Right Balance: Global Steel 2015-2016Aswin Lorenzo GultomNo ratings yet

- A - Deed of Absolute SaleDocument3 pagesA - Deed of Absolute SalenorieNo ratings yet

- Rural Management BookDocument3 pagesRural Management BookKomal Singh50% (2)

- ADMAS UNIVERSITY FINAL ThesisDocument52 pagesADMAS UNIVERSITY FINAL ThesisWeldu GebruNo ratings yet

- ZARTSA ZODLAP Integration GuideDocument10 pagesZARTSA ZODLAP Integration Guideyussuf rajabNo ratings yet

- PT Cahaya Xii Akl SMK KartiniDocument40 pagesPT Cahaya Xii Akl SMK Kartiniwahyudi yudiNo ratings yet

- C2Document17 pagesC2Joseph Lee100% (1)

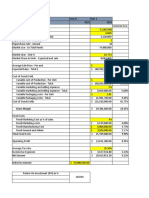

- Gross MarginDocument2 pagesGross MarginEDxColdBloodedNo ratings yet

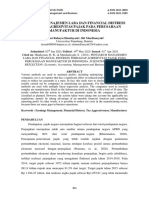

- Pengaruh Manajemen Laba Dan Financial Distress Terhadap Agresivitas Pajak Pada Perusahaan Manufaktur Di IndonesiaDocument10 pagesPengaruh Manajemen Laba Dan Financial Distress Terhadap Agresivitas Pajak Pada Perusahaan Manufaktur Di Indonesiakelas cNo ratings yet

- Joint ArrangementsDocument7 pagesJoint ArrangementsMarinel Mae ChicaNo ratings yet

Chapter # 2: Organizing Financial Assets

Chapter # 2: Organizing Financial Assets

Uploaded by

Tabish Khan0 ratings0% found this document useful (0 votes)

47 views14 pagesThis document discusses organizing financial assets and different types of financial assets. It describes three main ways for an investor to invest - in non-marketable assets, directly in markets, or indirectly through investment companies. It provides details on types of non-marketable assets like savings accounts, certificates of deposit, money market accounts, and government bonds. It also outlines various money market securities available for direct investment such as treasury bills, commercial paper, repurchase agreements, and bankers acceptances.

Original Description:

Original Title

Organizing fin assets.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses organizing financial assets and different types of financial assets. It describes three main ways for an investor to invest - in non-marketable assets, directly in markets, or indirectly through investment companies. It provides details on types of non-marketable assets like savings accounts, certificates of deposit, money market accounts, and government bonds. It also outlines various money market securities available for direct investment such as treasury bills, commercial paper, repurchase agreements, and bankers acceptances.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

47 views14 pagesChapter # 2: Organizing Financial Assets

Chapter # 2: Organizing Financial Assets

Uploaded by

Tabish KhanThis document discusses organizing financial assets and different types of financial assets. It describes three main ways for an investor to invest - in non-marketable assets, directly in markets, or indirectly through investment companies. It provides details on types of non-marketable assets like savings accounts, certificates of deposit, money market accounts, and government bonds. It also outlines various money market securities available for direct investment such as treasury bills, commercial paper, repurchase agreements, and bankers acceptances.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 14

CHAPTER # 2

ORGANIZING FINANCIAL ASSETS

Financial Assets

Financial assets are financial claims on the

issuer of the securities like govt or

corporations.

An investor can invest in three different ways

1. Investing in non marketable assets

2. Investing directly

3. Investing indirectly

EXHIBIT2-1

Major types of financial assets

DIRECT INVESTING

Nonmarketable Savings deposits

Certificates of deposit

Money market deposit accounts

U.S. savings bonds

Money market Treasury bills

Negotiable certificates of deposit

Commercial paper

Eurodollars

Repurchase agreements

Banker’s acceptances

Capital market Fixed income

Treasuries

Agencies

Municipals

Corporates

Equities

Preferred stock

Common stock

Derivatives market Options

Future contracts

INDIRECT INVESTING

Investment companies Unit investment trust

Open end

Money market mutual fund

Stock, bond, and income funds

Closed end

Exchange-traded funds

Non Marketable Financial

Assets

Personal transaction between the owner and

the issuer

Safe and very liquid investments

Types of non marketable financial assets

1. Savings accounts

Opened in commercial banks and other

financial institutions

Very safe and provide regular return

Interest rate is determined by govt

2.Non negotiable certifcates of

deposits

Offered by commercial banks and other

financial institutions.

They are infact saving certificates known as

CoD

Have different maturities

Return depends on maturity

Often issued at their own terms

Penalty charged for early withdrawals

3.Money market deposit

accounts

Offered by financial insttutions

Terms on these instruments are very relaxed

Can be opened with minimum deposit

Offer competitive rates and are insured

There is no limit on no. of deposits and

withdrawals

4. US Govt bonds/ Govt bonds

These are non marketable instruments issued

by govt

Non transferable, non negotiable and cannot be

used for collateral

Purchased from treasury through fin.

Institutions

Issued in different denominations

Money market securities

Market for short term, highly liquid and low

risk assets

They are debt instruments issued by govt,

financial institutions, and banks

Maturity is of one day to one year and mostly

less then 90 days

Some are negotiable while others are non

negotiable

Investors can invest in them directly or

indirectly

Types of Money market

securities

1. Treasury Bills

Short term, risk free money market instrument

They are fully gauranteed

Issued at discount

The actual yield on a bond can be calculated as:

Investment yield=FV-PP/PP*3/Maturity in days

Outstanding bonds can be further bought and

sold in secondary market

Negotiable certificates of

deposit

These certificates are issued by financial

institutions when an investor makes deposit

Represent marketable deposit liability of issuer

They are considered negotiable because they

can be traded in market before maturity

The deposit is maintained in banks until

maturity, at which the depositor receives

deposited amount +interest

3. Commercial Paper

A short term unsecured promissory note issued by large

financially strong corporations

Issued at discount directly or indirectly

Secondary market for commercial papers is weak

4. Eurodollars:

Deposits in dollars held in foreign banks

This type of market originated in Europe

Eurodollar deposits consist of both time deposit and

CDs

Maturities are short term most often less than six

months

5. Repurchase agreement

An agreement between borrower and lender to sell

and repurchase govt securities

The borrower is a financial institution and lender

an investor

Borrower sells repurchase agreement to investor

and agrees to repurchase it back in short time, often

overnight

The difference between sale price and purchase

price is interest of investor

A tool used by central banks to control money

suuply

6. Banker’s acceptance

A time draft drawn on a bank by a customer,in

which bank agrees to pay a particular amount

at some future date.

They are negotiable and can be sold at discount

Used in international trade

Maturity ranges from 30 to 180 days

You might also like

- This Chapter Addresses Several Reasons Why Marketing Is An Important Area of Study. Should Marketing Be Required For All College Students, No Matter Their Major? Why or Why Not?Document2 pagesThis Chapter Addresses Several Reasons Why Marketing Is An Important Area of Study. Should Marketing Be Required For All College Students, No Matter Their Major? Why or Why Not?Tabish Khan100% (1)

- Estatement PDFDocument1 pageEstatement PDFRudy AlconcherNo ratings yet

- Submitted To Dr. Khurram Shahzad Submitted by Muhammad Ibrahim Shafei SUBMITTED ON 08-11-2021 Sap Id 27912Document11 pagesSubmitted To Dr. Khurram Shahzad Submitted by Muhammad Ibrahim Shafei SUBMITTED ON 08-11-2021 Sap Id 27912Tabish KhanNo ratings yet

- The Alchemist Summray (Own Words)Document2 pagesThe Alchemist Summray (Own Words)Tabish KhanNo ratings yet

- Investment and Portfolio ManagementDocument46 pagesInvestment and Portfolio Managementaamer shahzad wattu100% (1)

- Indicate How and Why Each of These Factors Is Important To The Successful Operation of A SupermarketDocument1 pageIndicate How and Why Each of These Factors Is Important To The Successful Operation of A SupermarketTabish Khan100% (3)

- Maf 630 Chapter 4Document2 pagesMaf 630 Chapter 4Pablo EkskobaNo ratings yet

- Chapter 3 Financial InstrumentsDocument4 pagesChapter 3 Financial InstrumentsshaneNo ratings yet

- Investment AlternativesDocument32 pagesInvestment AlternativesMadihaBhattiNo ratings yet

- Module 1 FMODocument6 pagesModule 1 FMOba8477273No ratings yet

- Investement CHAPTER ONEDocument13 pagesInvestement CHAPTER ONEBeamlakNo ratings yet

- Chapter One Introduction To InvestmentDocument10 pagesChapter One Introduction To InvestmentMIKIYAS BERHENo ratings yet

- Money Market: TREASURY BILLS. Treasury Bills (T-Bills) Are Short-Term Notes Issued by The U.SDocument9 pagesMoney Market: TREASURY BILLS. Treasury Bills (T-Bills) Are Short-Term Notes Issued by The U.SArslan AkramNo ratings yet

- Non Marketable Financial Assets & Money Market SecuritiesDocument3 pagesNon Marketable Financial Assets & Money Market Securities020Elisya MufadilahNo ratings yet

- Instruments of Money MarketDocument17 pagesInstruments of Money MarketTanvir Hasan SohanNo ratings yet

- Chapter 4 FMIDocument13 pagesChapter 4 FMItame kibruNo ratings yet

- International Financial Market Instruments: Presented ByDocument45 pagesInternational Financial Market Instruments: Presented BygeetshijNo ratings yet

- Securities and MarketsDocument51 pagesSecurities and MarketsBilal JavedNo ratings yet

- Chapter One Introduction To InvestmentDocument13 pagesChapter One Introduction To InvestmentAdugna KeneaNo ratings yet

- Chapter One Introduction To InvestmentDocument15 pagesChapter One Introduction To InvestmentHaileNo ratings yet

- Capital-markets-Midterm With ExplanationDocument9 pagesCapital-markets-Midterm With ExplanationfroelanangusatiNo ratings yet

- The Role of The Financial MarketsDocument6 pagesThe Role of The Financial Marketsrosalyn mauricioNo ratings yet

- Importance of Money Market SecuritiesDocument2 pagesImportance of Money Market SecuritiesZainab SheraziNo ratings yet

- Purple Gradient 3D Bold Modern Investing Tips PresentationDocument47 pagesPurple Gradient 3D Bold Modern Investing Tips PresentationJana Beni Carolyn R. SabadoNo ratings yet

- Instruments of Finance in International Money MarketsDocument32 pagesInstruments of Finance in International Money Marketsapi-372709093% (15)

- CHAPTER 3 - Questions - EditedDocument9 pagesCHAPTER 3 - Questions - EditedEsraa TarekNo ratings yet

- Security Analysis and Portfolio Management: UNIT-1Document51 pagesSecurity Analysis and Portfolio Management: UNIT-1Sudha PanneerselvamNo ratings yet

- International Financial Market Instruments: Neenu T. Hari Shiji PremDocument20 pagesInternational Financial Market Instruments: Neenu T. Hari Shiji PremNeenu T HariNo ratings yet

- Banking II Chap 2 Money MarketDocument33 pagesBanking II Chap 2 Money Market2023643626No ratings yet

- Collateral: Bill PurchasingDocument4 pagesCollateral: Bill PurchasingFiza kamranNo ratings yet

- Chapter 4 - The Money Market NEWDocument12 pagesChapter 4 - The Money Market NEWNUR FAZERA AHMADNo ratings yet

- Money Market and Its InstrumentsDocument18 pagesMoney Market and Its InstrumentsSandip KarNo ratings yet

- Money Market - A BriefDocument6 pagesMoney Market - A BriefasfaarsafiNo ratings yet

- Investment CH 1Document13 pagesInvestment CH 1Binyam TayeNo ratings yet

- Kazungu's Assignment 2Document4 pagesKazungu's Assignment 2stam GNo ratings yet

- IFMDocument18 pagesIFMJayana ModiNo ratings yet

- FMI CH 4 Financial Markets in The Financial SystemDocument25 pagesFMI CH 4 Financial Markets in The Financial SystemYared GirmaNo ratings yet

- CCCCC CC CC: $%C C CC CDocument1 pageCCCCC CC CC: $%C C CC CSakkarai ManiNo ratings yet

- Capital Market and Money MarketDocument17 pagesCapital Market and Money MarketSwastika Singh100% (1)

- Financial System and MarketsDocument17 pagesFinancial System and MarketsDipesh GautamNo ratings yet

- Treasury 4Document22 pagesTreasury 4MpNo ratings yet

- FINVA100 Module1 Part2 OnlineDocument21 pagesFINVA100 Module1 Part2 OnlineLOUIE MAR RIVERANo ratings yet

- Lawrence Brian R. Labasan CBE InstructorDocument37 pagesLawrence Brian R. Labasan CBE InstructorCastor DamasoNo ratings yet

- Topic 1 Intro InvestDocument12 pagesTopic 1 Intro InvestIjok KarkunNo ratings yet

- Chapter 3 Financial InstrumentsDocument64 pagesChapter 3 Financial InstrumentsCyryll PayumoNo ratings yet

- Chapter 4Document3 pagesChapter 4meseleNo ratings yet

- Money Market Instruments-1Document11 pagesMoney Market Instruments-1Faiz KamranNo ratings yet

- Q5. What Do You Mean by Money Market and Money Market Instruments?Document2 pagesQ5. What Do You Mean by Money Market and Money Market Instruments?Jay PatelNo ratings yet

- Markets & InstrumentsDocument12 pagesMarkets & InstrumentsMerwan EbtedaiNo ratings yet

- Part One: Money and Capital Market: Chapter Four Financial Markets in The Financial SystemDocument22 pagesPart One: Money and Capital Market: Chapter Four Financial Markets in The Financial SystemSeid KassawNo ratings yet

- Chapter Four FinalDocument18 pagesChapter Four FinalSeid KassawNo ratings yet

- Investment and Security Analysis by Charles P Jones Chapter 2 - Tabish Khan From KohatDocument5 pagesInvestment and Security Analysis by Charles P Jones Chapter 2 - Tabish Khan From KohatTabish KhanNo ratings yet

- Government Securities MarketDocument26 pagesGovernment Securities MarketRaghav ThakurNo ratings yet

- Ibo 6 em PDFDocument6 pagesIbo 6 em PDFFirdosh Khan100% (7)

- Money Markets and Capital MarketsDocument4 pagesMoney Markets and Capital MarketsEmmanuelle RojasNo ratings yet

- Money Market Instrument SalvsDocument9 pagesMoney Market Instrument SalvsRenz DoctorNo ratings yet

- Financial Markets Treasury Bills Commercial Paper Bankers' Acceptances Mortgage-Asset-Backed Securities Liquidity Global Financial SystemDocument6 pagesFinancial Markets Treasury Bills Commercial Paper Bankers' Acceptances Mortgage-Asset-Backed Securities Liquidity Global Financial Systemujj1No ratings yet

- Muhammad Abdullah (6772) Capital & Money MarketDocument5 pagesMuhammad Abdullah (6772) Capital & Money MarketMuhammad AbdullahNo ratings yet

- Sources of FundsDocument22 pagesSources of FundsImtiaz RashidNo ratings yet

- Money MarketsDocument11 pagesMoney MarketsRonah Abigail BejocNo ratings yet

- Gen Math Stocks and BondsDocument41 pagesGen Math Stocks and BondsDaniel VillahermosaNo ratings yet

- Money Market Securities - : Certificates of Deposit (CDS)Document4 pagesMoney Market Securities - : Certificates of Deposit (CDS)Crisha-mae JavillonarNo ratings yet

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2From EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2No ratings yet

- Failures of D-8Document14 pagesFailures of D-8Tabish KhanNo ratings yet

- Brief IntroductionDocument4 pagesBrief IntroductionTabish KhanNo ratings yet

- Common WealthDocument5 pagesCommon WealthTabish KhanNo ratings yet

- Internship Tasks: Tabish KhanDocument12 pagesInternship Tasks: Tabish KhanTabish KhanNo ratings yet

- NTS - National Testing ServiceDocument3 pagesNTS - National Testing ServiceTabish KhanNo ratings yet

- Question 1 Answer: 1. Figurehead Role of ManagerDocument8 pagesQuestion 1 Answer: 1. Figurehead Role of ManagerTabish KhanNo ratings yet

- Fee Details Fee Details Fee Details: (/Apply/Applicantsummary)Document2 pagesFee Details Fee Details Fee Details: (/Apply/Applicantsummary)Tabish KhanNo ratings yet

- Freelancing Excercise 4Document3 pagesFreelancing Excercise 4Tabish KhanNo ratings yet

- MS Proposal of Tabish KhanDocument6 pagesMS Proposal of Tabish KhanTabish KhanNo ratings yet

- AssignmentDocument7 pagesAssignmentTabish KhanNo ratings yet

- Submitted To Dr. Muhammad Kaleem Submitted by Ghazal Shahab Registration No MS320201001 Semester 3 Program Ms. MarketingDocument5 pagesSubmitted To Dr. Muhammad Kaleem Submitted by Ghazal Shahab Registration No MS320201001 Semester 3 Program Ms. MarketingTabish KhanNo ratings yet

- Graphic Designing Exercise 2Document2 pagesGraphic Designing Exercise 2Tabish KhanNo ratings yet

- Question 1 AnswerDocument3 pagesQuestion 1 AnswerTabish KhanNo ratings yet

- Tabish Khan Freelancing Exercise 2Document5 pagesTabish Khan Freelancing Exercise 2Tabish KhanNo ratings yet

- Question 1 Answer: Marketing ConceptDocument7 pagesQuestion 1 Answer: Marketing ConceptTabish KhanNo ratings yet

- IMFI 2022 02 ZulfikarDocument11 pagesIMFI 2022 02 ZulfikarZulfikar ZulfikarNo ratings yet

- The Origin of The Tourism in The PhilippinesDocument18 pagesThe Origin of The Tourism in The PhilippinesLove Joy Espinueva100% (1)

- Russian Were Purchasing Exclusively From India at Much Higher Price Than What Available in World Market. (Reason Political)Document3 pagesRussian Were Purchasing Exclusively From India at Much Higher Price Than What Available in World Market. (Reason Political)RahulKumarNo ratings yet

- Jawahar Vidya Mandir: OfficeDocument2 pagesJawahar Vidya Mandir: OfficeRavindra SahuNo ratings yet

- 2022 S1 2nd Sem Bookkeeping and Accounts Final ExamDocument18 pages2022 S1 2nd Sem Bookkeeping and Accounts Final ExamXuen Khun TanNo ratings yet

- IELTS Writing Task 2 - 2nd HomeworkDocument3 pagesIELTS Writing Task 2 - 2nd HomeworkYusufhartomiNo ratings yet

- TN26689Document1 pageTN26689Kiran KumarNo ratings yet

- Economic History of The PhilippinesDocument4 pagesEconomic History of The PhilippinesClint Agustin M. RoblesNo ratings yet

- Retainer Agreement FormatDocument6 pagesRetainer Agreement FormatDamilare OdusanyaNo ratings yet

- Income Tax II Illustration Clubbing of Incomes PDFDocument1 pageIncome Tax II Illustration Clubbing of Incomes PDFSubramanian SenthilNo ratings yet

- Conveyor Roller Chain - Conveyor Chains - USA Roller ChainDocument10 pagesConveyor Roller Chain - Conveyor Chains - USA Roller Chainarvin john cabralNo ratings yet

- AX Computer ShopDocument1 pageAX Computer ShopCherry Jana RobianesNo ratings yet

- Old Currency of OmanDocument8 pagesOld Currency of OmanMohammed Al khamisiNo ratings yet

- Notice No 4Document1 pageNotice No 4nitish JhaNo ratings yet

- Vivid Money SA Retail Fees and Withdrawal RightsDocument4 pagesVivid Money SA Retail Fees and Withdrawal RightsdavidoffsmiNo ratings yet

- Negotiable Instruments ActDocument8 pagesNegotiable Instruments ActKarthik ImperiousNo ratings yet

- Answers: FRM Part 1: Mock Exam - SolutionsDocument18 pagesAnswers: FRM Part 1: Mock Exam - SolutionsipeeterNo ratings yet

- ch005 1Document6 pagesch005 1Mr CutsforthNo ratings yet

- 2316 2021 Provi Newly HiredDocument99 pages2316 2021 Provi Newly HiredDelio Amante Jr.No ratings yet

- Globalize or Customize: Finding The Right Balance: Global Steel 2015-2016Document32 pagesGlobalize or Customize: Finding The Right Balance: Global Steel 2015-2016Aswin Lorenzo GultomNo ratings yet

- A - Deed of Absolute SaleDocument3 pagesA - Deed of Absolute SalenorieNo ratings yet

- Rural Management BookDocument3 pagesRural Management BookKomal Singh50% (2)

- ADMAS UNIVERSITY FINAL ThesisDocument52 pagesADMAS UNIVERSITY FINAL ThesisWeldu GebruNo ratings yet

- ZARTSA ZODLAP Integration GuideDocument10 pagesZARTSA ZODLAP Integration Guideyussuf rajabNo ratings yet

- PT Cahaya Xii Akl SMK KartiniDocument40 pagesPT Cahaya Xii Akl SMK Kartiniwahyudi yudiNo ratings yet

- C2Document17 pagesC2Joseph Lee100% (1)

- Gross MarginDocument2 pagesGross MarginEDxColdBloodedNo ratings yet

- Pengaruh Manajemen Laba Dan Financial Distress Terhadap Agresivitas Pajak Pada Perusahaan Manufaktur Di IndonesiaDocument10 pagesPengaruh Manajemen Laba Dan Financial Distress Terhadap Agresivitas Pajak Pada Perusahaan Manufaktur Di Indonesiakelas cNo ratings yet

- Joint ArrangementsDocument7 pagesJoint ArrangementsMarinel Mae ChicaNo ratings yet