Professional Documents

Culture Documents

SP500 Update 2 Jan 11

SP500 Update 2 Jan 11

Uploaded by

AndysTechnicalsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SP500 Update 2 Jan 11

SP500 Update 2 Jan 11

Uploaded by

AndysTechnicalsCopyright:

Available Formats

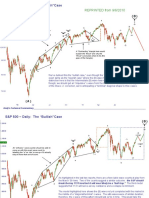

S&P 500 ~ Weekly Non-Log Scale

In wave parlance, we should be at the tail-end of an Intermediate (B) wave within

Primary -C-, right in the middle of Cycle Wave <IV> which began in late 2000. Given the

idea that we’re in a (B) wave, it’s worth remembering these words from Prechter:

-B-

“B waves are phonies. They are sucker plays, bull traps, (Z)

“c”

speculators’ paradise, orgies of odd-lotter mentality or “e”

9/1/2000 “a”

expressions of dumb institutional complacency (or both).

< III > They often involve a focus on a narrow list of stocks, are often

(Y)

“unconfirmed” but other averages, are rarely technically

“c” “b”

strong, and are virtually always doomed to complete

retracement by wave C.”

“d”

INDEED! “b” (B)

“a” (X) “y”

(W) c

“g”

a

“e” “a”

(X) “c” “b”

(X)

“w”

“f”

(W) “x”

“a” “d”

(X) b

“b”

This is a “diametric,” a seven-legged corrective

pattern that takes the shape of either a “bow tie”

or a “diamond.” The “diametric is a probably a (C)

(Z) morphed Orthodox “double zig-zag.”

-C-

(Y) -A- 2012?

“c”

(A)

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Weekly Non-Log Scale

One of the axioms of wave counting is this: “If there is way for a wave to take longer to complete,

assume it will.” This has been especially true of this current (B) Wave. Notice how long it has taken

the S&P 500 to take back the 1255 level from its lows. It took only 24 weeks to drop 590 S&P points

while it has taken 95 weeks to take it back. The point is that both the structure of the move off the

lows and the time it has taken to rally, relative to the previous drop, are all strong clues that this rally

is a corrective (B) wave.

(B)

“y”

c

1313

-5-

Critical Inflection Zone

1255 a

-3-

-1-

-4-

“w”

“x”

-2-

b

alt: (A)

“c”

(A)

Andy’s Technical Commentary__________________________________________________________________________________________________

“y” (B)

S&P 500 ~ Daily with RSI c

-5-

a

-3-

“w” -1- -4-

g

“x”

e

-2-

b

f

c

a This is as sharp of RSI Divergence as we have seen in quite some time. There is only one

d

inescapable conclusion: We’re about to see A LOT of volatility. Because, this sort of

b situation will only be resolved by a severe acceleration higher (which sets a new high on the

RSI) or an imminent puke out.

(A)

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Daily

(B)

I’m expecting this Minuette Wave -5- to conclude within the first several trading days of

2011 as we have now reached equality in time with Wave -1-. “y”

c

-5-

Wave -5- Targets: (b)

a 1261: 61.8% of Wave -3-

1267: 78.6% of Wave -1-

1291: Wave -5- = -1- (d)

[a]

-3-

(5)

(b)

[b]

(3) (c)

(e)

(1) (a) -4-

-1- (4)

-x- (5)

(3) (2)

(1)

(a)

(4)

“x”

(2)

(c)

-w- -2-

-y-

b

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ 180 min with Weekly Support and Resistance

-5-

(5)?

(3)?

(1)?

(4)?

(b)

(2)?

[a]

(d)

-3-

(5)

[b]

(3) (c) (e)

-4-

(1)

(4) (a)

-1-

(5)

(3) (2)

(1)

While I am expecting some sort of peaking action this week, it

continues to be prudent to WAIT for some sort of “sign” from the

(4)

market that it’s “ok” to begin shorting in earnest. A breakdown

below 1233 would constitute that “sign” for me. Alternatively, any

(2)

impulsive move lower on the 60 min. charts will force me into fresh

shorts.

-2-

-y-

b

Andy’s Technical Commentary__________________________________________________________________________________________________

Dow Jones Industrial Average (Monthly Log Scale)

The Dow Jones Industrial Average has become flawed (for wave counting purposes)

over the years as it is an “average,” and not a true index of stocks. It is for this

reason that we don’t model the DJIA. However, the DJIA has a much longer history

than the S&P 500 and is useful in getting our “bearings” on the longer term wave

model. 2000

< III > -B-

-V- -D-

REPRINTED from 9/7/2010

-A-

-C- -E-

< IV >

- III - - IV - 2018-2030

1966

<I> -I- This period looks congestive/correcitve.

-V- -X- The Wave -V- did not start until the

- II - beginning of 1995.

(X)

- III - -Y-

1929

(Y) -W- < II >

<X> (W) - IV - 1982

-I-

-D-

-B-

- II -

-E-

<Y>

-C-

II

The Supercyle Wave II, which began in 1860,

concluded in 1949.

-A-

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Weekly Non-Log Scale

This is my preferred long term model. The “crux” of the count is that the Primary - B - concluded on 12/11/2007, after the “absolute”

high of the same year. It’s “possible” that the -B- even concluded as late as May 2008, when the Transports actually peaked. Because

of the prolonged nature of the -B- wave relative the -A-, the -C- wave MUST last at least as long as (A+B)/2, about 3.5 years.

Therefore, the current Primary -C- wave will not conclude for at least another year.

-B-

2000 (Z)

“c”

“e”

< III > “a”

(Y) REPRINTED from 9/7/2010

This is was a “failed fifth” terminal diagonal “c” “b”

conclusion to the technology bubble.

“d”

( X ) “b”

“a”

(W)

“g”

“a” ( B )?

“e”

(X)

“c” “b” ( B )?

(X)

“f”

(W)

“a” “d”

(X)

“b”

This is a “diametric,” a seven-legged corrective

pattern that takes the shape of either a “bow tie”

or a “diamond.” The “diametric is a probably a

morphed Orthodox “double zig-zag.”

(Z) (C)

(Y) -C-

-A-

2012?

“c”

(A)

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 ~ Daily: The “Bullish”Case

(B)

REPRINTED from 9/7/2010 a “y”

c

-5-

-3-

b

An “orthodox” wave counter should be able to “w” -1-

come up with this exact wave count by “w” g d

labelling the “w” an ‘abc’ move up--it’s actually -4-

g

easy to force that sort of count.

e

“x”

e

c

-2-

a

b

c f

A “Contracting” triangle here would

explain the “thrust” and why the

“thrust” concluded where it did (the

apex of the triangle.)

d

a

b

We’ve dubbed this the “bullish case,” even though the ‘effective’ price action could be the

exact same as the “bearish case” where the (B) wave has already peaked. The important

distinction here is that the Intermediate (B) wave has not yet concluded. In this model,

though, we should get an “impulsive” c-wave from the b-wave low. Because of the depth

of the Wave -2- correction, we’re anticipating a “terminal” diagonal shape to this c-wave.

(A)

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any

kind. This report is technical commentary only. The author is Wave Symbology

NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s "I" or "A" = Grand Supercycle

interpretation of technical analysis. The author may or may not I or A = Supercycle

trade in the markets discussed. The author may hold positions <I>or <A> = Cycle

opposite of what may by inferred by this report. The information -I- or -A- = Primary

contained in this commentary is taken from sources the author (I) or (A) = Intermediate

believes to be reliable, but it is not guaranteed by the author as to "1“ or "a" = Minor

the accuracy or completeness thereof and is sent to you for 1 or a = Minute

information purposes only. Commodity trading involves risk and -1- or -a- = Minuette

is not for everyone. (1) or (a) = Sub-minuette

[1] or [a] = Micro

Here is what the Commodity Futures Trading Commission (CFTC) [.1] or [.a] = Sub-Micro

has said about futures trading: Trading commodity futures and

options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or

options contracts, you should consider your financial experience,

goals and financial resources, and know how much you can afford

to lose above and beyond your initial payment to a broker. You

should understand commodity futures and options contracts and

your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by

thoroughly reviewing the risk disclosure documents your broker is

required to give you.

You might also like

- Unorthodox Corrections & Weird Fractals & SP500 ImplicationsDocument8 pagesUnorthodox Corrections & Weird Fractals & SP500 ImplicationsAndysTechnicals100% (1)

- Market Commentary 1may11Document12 pagesMarket Commentary 1may11AndysTechnicalsNo ratings yet

- Market Update 28 Nov 10Document8 pagesMarket Update 28 Nov 10AndysTechnicalsNo ratings yet

- Market Update 25 July 10Document13 pagesMarket Update 25 July 10AndysTechnicalsNo ratings yet

- S&P 500 Update 23 Jan 10Document7 pagesS&P 500 Update 23 Jan 10AndysTechnicalsNo ratings yet

- Market Update 11 July 10Document13 pagesMarket Update 11 July 10AndysTechnicalsNo ratings yet

- Gold Report 30 May 2010Document7 pagesGold Report 30 May 2010AndysTechnicalsNo ratings yet

- S&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100Document7 pagesS&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100AndysTechnicalsNo ratings yet

- REPRINTED From 9/7/2010:: S&P 500 Daily: The "Bullish"CaseDocument7 pagesREPRINTED From 9/7/2010:: S&P 500 Daily: The "Bullish"CaseAndysTechnicalsNo ratings yet

- S&P 500 Update 9 Nov 09Document6 pagesS&P 500 Update 9 Nov 09AndysTechnicalsNo ratings yet

- Morning View 19 Feb 10Document4 pagesMorning View 19 Feb 10AndysTechnicalsNo ratings yet

- S&P 500 Update 15 Feb 10Document9 pagesS&P 500 Update 15 Feb 10AndysTechnicalsNo ratings yet

- Market Update 29 Aug 10Document13 pagesMarket Update 29 Aug 10AndysTechnicalsNo ratings yet

- Sugar Report Nov 06 2009Document6 pagesSugar Report Nov 06 2009AndysTechnicalsNo ratings yet

- S&P 500 Update 4 Apr 10Document10 pagesS&P 500 Update 4 Apr 10AndysTechnicalsNo ratings yet

- Market Update 18 July 10Document10 pagesMarket Update 18 July 10AndysTechnicalsNo ratings yet

- Dollar Index (180 Minute) "Unorthodox Model"Document6 pagesDollar Index (180 Minute) "Unorthodox Model"AndysTechnicalsNo ratings yet

- Market Commentary 13mar11Document8 pagesMarket Commentary 13mar11AndysTechnicalsNo ratings yet

- Gold Report 12 Sep 2010Document16 pagesGold Report 12 Sep 2010AndysTechnicalsNo ratings yet

- S&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010Document10 pagesS&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010AndysTechnicalsNo ratings yet

- HO - Handout w7Document3 pagesHO - Handout w7Billy JimenezNo ratings yet

- Morning View 17 Feb 10Document10 pagesMorning View 17 Feb 10AndysTechnicalsNo ratings yet

- Gold Report 7 Nov 2010Document8 pagesGold Report 7 Nov 2010AndysTechnicalsNo ratings yet

- Baidu (BIDU) Daily Log Scale: Bullish, Right?Document6 pagesBaidu (BIDU) Daily Log Scale: Bullish, Right?AndysTechnicalsNo ratings yet

- Morning View 12feb2010Document8 pagesMorning View 12feb2010AndysTechnicalsNo ratings yet

- S&P 500 Update 19 Mar 10Document8 pagesS&P 500 Update 19 Mar 10AndysTechnicalsNo ratings yet

- C 9 CH 1-5 Phy Test 2Document4 pagesC 9 CH 1-5 Phy Test 2jugno alikNo ratings yet

- Projection of Solids 2Document15 pagesProjection of Solids 2saketh.s.tandigeNo ratings yet

- Unit 2 CaedDocument13 pagesUnit 2 CaedKevilerNo ratings yet

- Taleem City Institute: Ameenpur, Faisalabad 03126987979Document4 pagesTaleem City Institute: Ameenpur, Faisalabad 03126987979Ahm MalikNo ratings yet

- Daily Test - 78 Hindi PDFDocument2 pagesDaily Test - 78 Hindi PDFankitkumar80843781No ratings yet

- REPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseDocument8 pagesREPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseAndysTechnicalsNo ratings yet

- Smart Test Series: 1-Circle The Correct Answer. (12x1 12)Document4 pagesSmart Test Series: 1-Circle The Correct Answer. (12x1 12)Shaban BukhariNo ratings yet

- Sugar Dec 11 2009Document6 pagesSugar Dec 11 2009AndysTechnicalsNo ratings yet

- S&P 500 Daily: The "Double Top Count"Document7 pagesS&P 500 Daily: The "Double Top Count"AndysTechnicalsNo ratings yet

- Lecture # AnglesDocument6 pagesLecture # AnglesAli AsadNo ratings yet

- 9th Urdu Full Book Tests - NOTESPK - Nauman SadafDocument10 pages9th Urdu Full Book Tests - NOTESPK - Nauman SadafUsama ZahoorNo ratings yet

- TU3ed (E) s1 ch05Document7 pagesTU3ed (E) s1 ch05Jimmy Demetrius Rhys ForgerNo ratings yet

- SP500 Update 22 Aug 10Document7 pagesSP500 Update 22 Aug 10AndysTechnicalsNo ratings yet

- Morning View 27jan2010Document6 pagesMorning View 27jan2010AndysTechnicals100% (1)

- Bt23 AssignmentDocument12 pagesBt23 Assignmentdivyamirchandani.bt23No ratings yet

- Class XI Maths QPDocument5 pagesClass XI Maths QPElectric art TamilNo ratings yet

- Sugar Nov 28 2009Document9 pagesSugar Nov 28 2009AndysTechnicalsNo ratings yet

- Fungi: Colleen Kitchen Colleen Kitchen D (C) B - (A-)Document2 pagesFungi: Colleen Kitchen Colleen Kitchen D (C) B - (A-)ColleenNo ratings yet

- 2011 Wenona T2 SolutionsDocument9 pages2011 Wenona T2 SolutionsShahrazad8No ratings yet

- 242022359-Richard-Laird-Improvising-Jazz-Bass-pdf (Arrastrado) PDFDocument1 page242022359-Richard-Laird-Improvising-Jazz-Bass-pdf (Arrastrado) PDFwisgenerNo ratings yet

- Baidu (BIDU) Daily Linear ScaleDocument6 pagesBaidu (BIDU) Daily Linear ScaleAndysTechnicals100% (1)

- AP Grama Ward Sachivalayam Model Papers 3 Telugu Medium Category 1Document12 pagesAP Grama Ward Sachivalayam Model Papers 3 Telugu Medium Category 1premkumarNo ratings yet

- Adobe Scan 04-May-2023Document1 pageAdobe Scan 04-May-2023Debmalya DattaNo ratings yet

- HT TP: //qpa Pe R.W But .Ac .In: 2012 Fluid Mechanics and Hydraulic MachinesDocument7 pagesHT TP: //qpa Pe R.W But .Ac .In: 2012 Fluid Mechanics and Hydraulic MachinesjeetNo ratings yet

- 64f5c9e85393ec001820ddc4 - ## - Science TestDocument3 pages64f5c9e85393ec001820ddc4 - ## - Science Testrajnishk126No ratings yet

- Sugar Jan 1 2010Document9 pagesSugar Jan 1 2010AndysTechnicalsNo ratings yet

- RS Aggarwal Understanding QuadrilateralsDocument6 pagesRS Aggarwal Understanding QuadrilateralsVanshree PandeNo ratings yet

- Review Unit 8: Graph The Image of The Figure Using The Transformation GivenDocument5 pagesReview Unit 8: Graph The Image of The Figure Using The Transformation GivenFaith Rappe0% (1)

- Adobe Scan 04-May-2023Document1 pageAdobe Scan 04-May-2023Debmalya DattaNo ratings yet

- Morning View 10feb2010Document8 pagesMorning View 10feb2010AndysTechnicalsNo ratings yet

- Maths Lecture 3Document3 pagesMaths Lecture 3Vb June 5No ratings yet

- Smart Test Series: 1-Circle The Correct Answer. (12x1 12)Document4 pagesSmart Test Series: 1-Circle The Correct Answer. (12x1 12)Shaban BukhariNo ratings yet

- Example 1.2: Chapter 1 IntroductionDocument1 pageExample 1.2: Chapter 1 IntroductionCarlos SaavedraNo ratings yet

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- Market Commentary 5aug12Document7 pagesMarket Commentary 5aug12AndysTechnicalsNo ratings yet

- Market Commentary 22JUL12Document6 pagesMarket Commentary 22JUL12AndysTechnicalsNo ratings yet

- Market Commentary 17JUN12Document7 pagesMarket Commentary 17JUN12AndysTechnicalsNo ratings yet

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocument6 pagesS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 25mar12Document8 pagesMarket Commentary 25mar12AndysTechnicalsNo ratings yet

- Market Commentary 10JUN12Document7 pagesMarket Commentary 10JUN12AndysTechnicalsNo ratings yet

- Market Commentary 20NOV11Document7 pagesMarket Commentary 20NOV11AndysTechnicalsNo ratings yet

- Market Commentary 29apr12Document6 pagesMarket Commentary 29apr12AndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- Market Commentary 1apr12Document8 pagesMarket Commentary 1apr12AndysTechnicalsNo ratings yet

- Market Commentary 18mar12Document8 pagesMarket Commentary 18mar12AndysTechnicalsNo ratings yet

- Copper Commentary 11dec11Document6 pagesCopper Commentary 11dec11AndysTechnicalsNo ratings yet

- Dollar Index (DXY) Daily ContinuationDocument6 pagesDollar Index (DXY) Daily ContinuationAndysTechnicalsNo ratings yet

- Market Commentary 19DEC11Document9 pagesMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 16jan12Document7 pagesMarket Commentary 16jan12AndysTechnicalsNo ratings yet

- Market Commentary 27NOV11Document5 pagesMarket Commentary 27NOV11AndysTechnicalsNo ratings yet

- Market Commentary 6NOVT11Document4 pagesMarket Commentary 6NOVT11AndysTechnicalsNo ratings yet

- Sp500 Update 23oct11Document7 pagesSp500 Update 23oct11AndysTechnicalsNo ratings yet

- Sp500 Update 11sep11Document6 pagesSp500 Update 11sep11AndysTechnicalsNo ratings yet

- Market Commentary 30OCT11Document6 pagesMarket Commentary 30OCT11AndysTechnicalsNo ratings yet

- Market Commentary 25SEP11Document8 pagesMarket Commentary 25SEP11AndysTechnicalsNo ratings yet

- Copper Commentary 2OCT11Document8 pagesCopper Commentary 2OCT11AndysTechnicalsNo ratings yet

- Sp500 Update 5sep11Document7 pagesSp500 Update 5sep11AndysTechnicalsNo ratings yet

- W3. Present Worth AnalysisDocument26 pagesW3. Present Worth AnalysisChrisThunder555No ratings yet

- Meghnad Saha - CVDocument9 pagesMeghnad Saha - CVMeghnad sahaNo ratings yet

- 0 Verb QuestionDocument12 pages0 Verb QuestionTrần Thị Thủy TiênNo ratings yet

- Managerial Theories of Firm: Game Theory - II: DR Suneel GuptaDocument23 pagesManagerial Theories of Firm: Game Theory - II: DR Suneel GuptaMahak Gupta Student, Jaipuria LucknowNo ratings yet

- Asian Paints Quotation - 1695434974913Document8 pagesAsian Paints Quotation - 1695434974913tarang333No ratings yet

- Code of EthicsDocument2 pagesCode of EthicsHimani sailabNo ratings yet

- Kawaii Panda Blanket EngDocument14 pagesKawaii Panda Blanket EngkittikoposdiNo ratings yet

- MOS SewerageDocument8 pagesMOS SewerageAhmad Fauzi Bin OmarNo ratings yet

- Kheertee Monetarye 26 SeptDocument2 pagesKheertee Monetarye 26 SeptLovlesh KishunNo ratings yet

- Cost Control & MonitoringDocument18 pagesCost Control & MonitoringAngela Dichoso100% (1)

- Mapua Univeristy: Muralla ST., Intramuros, Manila Department of Civil, Environmental, and Geological EngineeringDocument43 pagesMapua Univeristy: Muralla ST., Intramuros, Manila Department of Civil, Environmental, and Geological EngineeringCha RobinNo ratings yet

- Topic 1 Measuring A Nation's IncomeDocument13 pagesTopic 1 Measuring A Nation's IncomeQuy Nguyen QuangNo ratings yet

- RDO No. 55 - San Pablo City 3Document367 pagesRDO No. 55 - San Pablo City 3Dianne May Cruz100% (3)

- Systems of Track MaintenanceDocument3 pagesSystems of Track MaintenanceShan VelNo ratings yet

- Khyber City by LawsDocument4 pagesKhyber City by LawsMohsin KhanNo ratings yet

- CH 1 EconometricsDocument49 pagesCH 1 EconometricsGenemo FitalaNo ratings yet

- Entrepreneurship: (BCAS401)Document6 pagesEntrepreneurship: (BCAS401)Akash HalsanaNo ratings yet

- Inv and PMT TRK@SPDFVDocument4 pagesInv and PMT TRK@SPDFVANAND MADHABAVINo ratings yet

- Intermediate Financial Management 11th Edition Brigham Solutions ManualDocument26 pagesIntermediate Financial Management 11th Edition Brigham Solutions ManualSabrinaFloresmxzie100% (51)

- Pre-Test Tve Carpentry 7Document3 pagesPre-Test Tve Carpentry 7Maria Theresa Dejesa100% (1)

- ABSTRACT 16-17 (English)Document707 pagesABSTRACT 16-17 (English)DeepakNo ratings yet

- Evaluating Mutual Fund Investment Information: Source Source Source Criteria Evaluation 1 2 3Document2 pagesEvaluating Mutual Fund Investment Information: Source Source Source Criteria Evaluation 1 2 3Joel Christian MascariñaNo ratings yet

- Introduction To Econometrics, 5 Edition: Chapter 3: Multiple Regression AnalysisDocument28 pagesIntroduction To Econometrics, 5 Edition: Chapter 3: Multiple Regression AnalysisRamarcha KumarNo ratings yet

- Fakultas Rekayasa Industri: Pengantar Ilmu Ekonomi (Iei2C2)Document32 pagesFakultas Rekayasa Industri: Pengantar Ilmu Ekonomi (Iei2C2)aliffian alifNo ratings yet

- BM Assignment 1 SolDocument3 pagesBM Assignment 1 SolPrateek MaggonNo ratings yet

- Diagnostic Test 1st TLEDocument2 pagesDiagnostic Test 1st TLEMilagross FabregasNo ratings yet

- MR Palutla Subba Rao Your Policy Details: Tata AIG General Insurance Company LimitedDocument3 pagesMR Palutla Subba Rao Your Policy Details: Tata AIG General Insurance Company LimitedParshu NagNo ratings yet

- Sample Business Contract: 1. The Contract Is BetweenDocument3 pagesSample Business Contract: 1. The Contract Is BetweenJunaid KhanNo ratings yet

- Vessel and Conveyors - VPDDocument4 pagesVessel and Conveyors - VPDAntonio Mizraim Magallon SantanaNo ratings yet

- Subject:: Payment of Education StipendDocument12 pagesSubject:: Payment of Education StipendShahaan ZulfiqarNo ratings yet