Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

8 viewsFundamentals of Taxation: Salary

Fundamentals of Taxation: Salary

Uploaded by

Md.Shadid Ur RahmanCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Test Bank For Personal Finance 12th Edition by KapoorDocument55 pagesTest Bank For Personal Finance 12th Edition by KapoorRobert Allgood100% (40)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tanjung Manis HowDocument7 pagesTanjung Manis Howramen28No ratings yet

- 3.farm Management-I-1 PDFDocument90 pages3.farm Management-I-1 PDFSwapnil AshtankarNo ratings yet

- Lettter of TransmittalDocument1 pageLettter of TransmittalMd.Shadid Ur RahmanNo ratings yet

- Act 322 SagarDocument6 pagesAct 322 SagarMd.Shadid Ur RahmanNo ratings yet

- Act 322 SaddamDocument6 pagesAct 322 SaddamMd.Shadid Ur RahmanNo ratings yet

- MKT202 Term PaperDocument12 pagesMKT202 Term PaperMd.Shadid Ur RahmanNo ratings yet

- John's 1: Suggested AnswersDocument2 pagesJohn's 1: Suggested AnswersMd.Shadid Ur RahmanNo ratings yet

- Presentation On Grameenphone: Prepared byDocument23 pagesPresentation On Grameenphone: Prepared byMd.Shadid Ur RahmanNo ratings yet

- 2012 11 HazardousWorkplaces PDFDocument47 pages2012 11 HazardousWorkplaces PDFMd.Shadid Ur RahmanNo ratings yet

- Akhtar Project ReportDocument22 pagesAkhtar Project ReportMd.Shadid Ur RahmanNo ratings yet

- Problems of Garments Industry in BangladeshDocument21 pagesProblems of Garments Industry in BangladeshMd.Shadid Ur RahmanNo ratings yet

- Fundamentals of Taxation: AssessmentDocument27 pagesFundamentals of Taxation: AssessmentMd.Shadid Ur RahmanNo ratings yet

- Effected Child MaariageDocument3 pagesEffected Child MaariageMd.Shadid Ur RahmanNo ratings yet

- Fundamentals of Taxation: Sec. 22 of The OrdinanceDocument10 pagesFundamentals of Taxation: Sec. 22 of The OrdinanceMd.Shadid Ur RahmanNo ratings yet

- Definition Sec-31: Capital GainsDocument9 pagesDefinition Sec-31: Capital GainsMd.Shadid Ur RahmanNo ratings yet

- Fundamentals of Taxation: Isitpain? Is It Mandatory? Is It Obligatory ?Document24 pagesFundamentals of Taxation: Isitpain? Is It Mandatory? Is It Obligatory ?Md.Shadid Ur RahmanNo ratings yet

- Fundamentals of Taxation: Isitpain? Is It Mandatory? Is It Obligatory ?Document23 pagesFundamentals of Taxation: Isitpain? Is It Mandatory? Is It Obligatory ?Md.Shadid Ur RahmanNo ratings yet

- ch12 - Corporations-Shares, Dividends Retained EarningsDocument61 pagesch12 - Corporations-Shares, Dividends Retained EarningsMd.Shadid Ur RahmanNo ratings yet

- Section 28 & 29: Income From Business or ProfessionDocument5 pagesSection 28 & 29: Income From Business or ProfessionMd.Shadid Ur RahmanNo ratings yet

- ch05 - Accounting For Merchandising OperationsDocument46 pagesch05 - Accounting For Merchandising OperationsMd.Shadid Ur Rahman100% (1)

- ch15 - Financial Statement AnalysisDocument51 pagesch15 - Financial Statement AnalysisMd.Shadid Ur RahmanNo ratings yet

- ECO 100 GUIDES Learn by DoingDocument17 pagesECO 100 GUIDES Learn by Doingveeru53No ratings yet

- RA 10752 LeafletDocument7 pagesRA 10752 LeafletMark Jefferson Cudal RamosNo ratings yet

- Bid Document For Selection of LaboratoryDocument47 pagesBid Document For Selection of Laboratory114912No ratings yet

- Cost Management Periodic Average Costing Setup and Process Flow PDFDocument58 pagesCost Management Periodic Average Costing Setup and Process Flow PDFSmart Diamond0% (2)

- 10 Answer PDFDocument17 pages10 Answer PDFagspurealNo ratings yet

- Analyst PresentationDocument59 pagesAnalyst Presentationsoreng.anupNo ratings yet

- A Guide To Income Tax Benefits For Senior CitizensDocument18 pagesA Guide To Income Tax Benefits For Senior CitizensAshutosh JaiswalNo ratings yet

- Velilla Vs PosadasDocument7 pagesVelilla Vs PosadasKennethQueRaymundoNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sharad PawarNo ratings yet

- IB Economics SL Paper 1 Question Bank - TYCHRDocument25 pagesIB Economics SL Paper 1 Question Bank - TYCHRansirwayneNo ratings yet

- Moc 2Document13 pagesMoc 2pryaparagNo ratings yet

- Bangalore Occupancy Certificate A Complete GuidelineDocument4 pagesBangalore Occupancy Certificate A Complete Guidelinemasta kalandarNo ratings yet

- Sureyan Modern Rice Mill - CMA FinalDocument3 pagesSureyan Modern Rice Mill - CMA FinalJayaElaiya KuamarNo ratings yet

- Draft Settlement AgreementDocument15 pagesDraft Settlement AgreementjvmarronNo ratings yet

- Sentrove 3BR 10DP - 1631441723Document1 pageSentrove 3BR 10DP - 1631441723Ivan Hayes DyNo ratings yet

- Kapil Raj Mandavi 23-24Document1 pageKapil Raj Mandavi 23-24khan khanNo ratings yet

- Elements of Crime Index CardsDocument142 pagesElements of Crime Index CardsJea Co100% (1)

- Acfrogbpqjr3d3qz Ohfamwzegjrbgoqsmr0jtpnp24hyzsopcjalpeciqrq Hhf36iesvlttkbzpk1uro1u-Mt Szhqhzifro0dxbxwamypx1bbgib7oxfsqs4jwuaDocument3 pagesAcfrogbpqjr3d3qz Ohfamwzegjrbgoqsmr0jtpnp24hyzsopcjalpeciqrq Hhf36iesvlttkbzpk1uro1u-Mt Szhqhzifro0dxbxwamypx1bbgib7oxfsqs4jwuaapi-564750164No ratings yet

- Interest Rate On DepositsDocument4 pagesInterest Rate On DepositsPritam PaulNo ratings yet

- Fifth Schedule To The Customs ActDocument66 pagesFifth Schedule To The Customs ActMemona Qasim100% (1)

- Gas Exchanger RetubingDocument15 pagesGas Exchanger Retubinghamal.w757No ratings yet

- Ubs FinalDocument7 pagesUbs FinalJoshua CabreraNo ratings yet

- INVESTOR FAQ - FPC AIF - Sep2022Document16 pagesINVESTOR FAQ - FPC AIF - Sep2022Himanshu MalikNo ratings yet

- Project Report On Convergence of Banking Sector To Housing FinanceDocument4 pagesProject Report On Convergence of Banking Sector To Housing FinanceHari PrasadNo ratings yet

- GG Promoter AgreementDocument9 pagesGG Promoter Agreementapi-290739308No ratings yet

- GO Ms 381 GST 26112018Document4 pagesGO Ms 381 GST 26112018hussainNo ratings yet

- 107-Falguni Gruh UdhyogDocument1 page107-Falguni Gruh UdhyogdeepNo ratings yet

Fundamentals of Taxation: Salary

Fundamentals of Taxation: Salary

Uploaded by

Md.Shadid Ur Rahman0 ratings0% found this document useful (0 votes)

8 views9 pagesOriginal Title

Copy of Taxation-03.ppt

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

8 views9 pagesFundamentals of Taxation: Salary

Fundamentals of Taxation: Salary

Uploaded by

Md.Shadid Ur RahmanCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 9

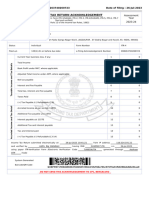

Fundamentals of Taxation

Definition Salary Section 21(1) & 21(2)

Sec. 21(1) of the Ordinance

The following income of an assessee shall be classified and computed under

the head “Salaries” namely

(a). any salary due from an employer to the assessee in the income year,

whether paid or not;

(b). any salary paid or allowed to him in the income year, by or on behalf of

an employer though not due or before it became due to him; and

©. any arrears of salary paid or allowed or alowed to him in the income

year by or on behalf of an employer , if not charged to income tax for

any earlier income year.

Sec. 21(2) of the Ordinance

Where any amount of salary of an assessee is once included in his tota

income of an income year on the basis that it had become due or that it

had been paid in advance in that year , the amount shall not again be

included in his income of any other year.

Fundamentals of Taxation

Definition Salary Section 21(1) & 21(2)

“Salary is the remuneration or compensation for

the services rendered, paid or to be paid to an

employee at regular intervals in terms of such

employment. Such remuneration or compensation

has been specifically stated to include dearness,

gain, compensation or cost of living allowance and

bonus and commission which are payable to an

employee as remuneration or compensation for

services rendered.” (Commissioner of Taxes v.

Telephone Shilpa Sangstha Ltd. 46 DLR 696)

Fundamentals of Taxation

Definition Perquisite Sec. 2(45)

Perquisite means any payment made to an employee by an

employer in the form of cash or in any other form excluding

basic salary, festival bonus, incentive bonus not exceeding

ten percent of the disclosed profit of relevant income year,

arrear salary, advance salary, leave encashment or leave

fare assistance and over time, and

Any benefit, whether convertible into money or not,

provided to an employee by the employer, called by

whatever name, other than contribution to a recognised

provident fund, approved superannuation fund.

Fundamentals of Taxation

Definition Perquisite Sec. 2(45)

Perquisite includes

1. the value of rent free accommodation;

2. the value of any concession in the matter of rent

respecting any accommodation;

3. any sum payable by the employer, whether directly or

indirectly, to effect an insurance on the life of, or to

effect a contract for an annuity for the benefit of, the

assessee or his spouse or any of his dependent child;

4. the value of any benefit provided free of cost or at a

concessionary rate ; and

5. any sum paid by an employer in respect of any

obligation of an employee.

Fundamentals of Taxation

Computation of Income From Salary

Heads Amount Amount of exempted Net taxable

income income

Basic Salary Nil Total amount

received

Special Salary Nil Total amount

received

Dearness Nil Total amount

Allowance received

Conveyance Upto Tk. 30,000.00 per Amount

Allowance year exceeding Tk.

30,000.00

Fundamentals of Taxation

Computation of Income From Salary

Heads Amount Amount of exempted income Net taxable income

House Rent Tk. 20,000.00 per month Amount

Allowance or 50% of monthly basic exceeding the

salary, whichever is less figure so

calculated

Medical Amount received or Amount received

Allowance actual amount of in excess of

expenses incurred, which actual expenses

ever is less

Servant Nil Total amount

Allowance received

Leave Pay Nil Total amount

received

Honorarium/ Nil Total amount

Reward/Fee received

Fundamentals of Taxation

Computation of Income From Salary

Heads Amount Amount of Net taxable

exempted income income

Overtime Nil Total amount

allowance received

Bonus/Ex-gratia Nil Total amount

received

Employer’s Nil Total amount

contribution to received

recognized

provident fund

Interest on Total amount Nil

recognized received

provident fund

Fundamentals of Taxation

Computation of Income From Salary

Heads Amount Amount of exempted Net taxable

income income

Deemed If the assessee is 7.5% of basic

income for provided with a car for salary

transport personal use

facility

Deemed If the assessee is 25% of basic

income for provided with rent free salary

free/subsidized furnished/unfurnished

accommodation accommodation

If the assessee is

provided with Excess of 25%

furnished/unfurnished of basic salary

accommodation at and the

concessional rate amount of

actual rent

which ever is

higher

Fundamentals of Taxation

Computation of Income From Salary

Heads Amount Amount of exempted Net taxable

income income

Others, if any If the assessee is Monetary value

provided with of the services

watchman for so rendered by

residence, gardener, the employer

cook, caretaker,

servant, driver or any

other facilities

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Test Bank For Personal Finance 12th Edition by KapoorDocument55 pagesTest Bank For Personal Finance 12th Edition by KapoorRobert Allgood100% (40)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tanjung Manis HowDocument7 pagesTanjung Manis Howramen28No ratings yet

- 3.farm Management-I-1 PDFDocument90 pages3.farm Management-I-1 PDFSwapnil AshtankarNo ratings yet

- Lettter of TransmittalDocument1 pageLettter of TransmittalMd.Shadid Ur RahmanNo ratings yet

- Act 322 SagarDocument6 pagesAct 322 SagarMd.Shadid Ur RahmanNo ratings yet

- Act 322 SaddamDocument6 pagesAct 322 SaddamMd.Shadid Ur RahmanNo ratings yet

- MKT202 Term PaperDocument12 pagesMKT202 Term PaperMd.Shadid Ur RahmanNo ratings yet

- John's 1: Suggested AnswersDocument2 pagesJohn's 1: Suggested AnswersMd.Shadid Ur RahmanNo ratings yet

- Presentation On Grameenphone: Prepared byDocument23 pagesPresentation On Grameenphone: Prepared byMd.Shadid Ur RahmanNo ratings yet

- 2012 11 HazardousWorkplaces PDFDocument47 pages2012 11 HazardousWorkplaces PDFMd.Shadid Ur RahmanNo ratings yet

- Akhtar Project ReportDocument22 pagesAkhtar Project ReportMd.Shadid Ur RahmanNo ratings yet

- Problems of Garments Industry in BangladeshDocument21 pagesProblems of Garments Industry in BangladeshMd.Shadid Ur RahmanNo ratings yet

- Fundamentals of Taxation: AssessmentDocument27 pagesFundamentals of Taxation: AssessmentMd.Shadid Ur RahmanNo ratings yet

- Effected Child MaariageDocument3 pagesEffected Child MaariageMd.Shadid Ur RahmanNo ratings yet

- Fundamentals of Taxation: Sec. 22 of The OrdinanceDocument10 pagesFundamentals of Taxation: Sec. 22 of The OrdinanceMd.Shadid Ur RahmanNo ratings yet

- Definition Sec-31: Capital GainsDocument9 pagesDefinition Sec-31: Capital GainsMd.Shadid Ur RahmanNo ratings yet

- Fundamentals of Taxation: Isitpain? Is It Mandatory? Is It Obligatory ?Document24 pagesFundamentals of Taxation: Isitpain? Is It Mandatory? Is It Obligatory ?Md.Shadid Ur RahmanNo ratings yet

- Fundamentals of Taxation: Isitpain? Is It Mandatory? Is It Obligatory ?Document23 pagesFundamentals of Taxation: Isitpain? Is It Mandatory? Is It Obligatory ?Md.Shadid Ur RahmanNo ratings yet

- ch12 - Corporations-Shares, Dividends Retained EarningsDocument61 pagesch12 - Corporations-Shares, Dividends Retained EarningsMd.Shadid Ur RahmanNo ratings yet

- Section 28 & 29: Income From Business or ProfessionDocument5 pagesSection 28 & 29: Income From Business or ProfessionMd.Shadid Ur RahmanNo ratings yet

- ch05 - Accounting For Merchandising OperationsDocument46 pagesch05 - Accounting For Merchandising OperationsMd.Shadid Ur Rahman100% (1)

- ch15 - Financial Statement AnalysisDocument51 pagesch15 - Financial Statement AnalysisMd.Shadid Ur RahmanNo ratings yet

- ECO 100 GUIDES Learn by DoingDocument17 pagesECO 100 GUIDES Learn by Doingveeru53No ratings yet

- RA 10752 LeafletDocument7 pagesRA 10752 LeafletMark Jefferson Cudal RamosNo ratings yet

- Bid Document For Selection of LaboratoryDocument47 pagesBid Document For Selection of Laboratory114912No ratings yet

- Cost Management Periodic Average Costing Setup and Process Flow PDFDocument58 pagesCost Management Periodic Average Costing Setup and Process Flow PDFSmart Diamond0% (2)

- 10 Answer PDFDocument17 pages10 Answer PDFagspurealNo ratings yet

- Analyst PresentationDocument59 pagesAnalyst Presentationsoreng.anupNo ratings yet

- A Guide To Income Tax Benefits For Senior CitizensDocument18 pagesA Guide To Income Tax Benefits For Senior CitizensAshutosh JaiswalNo ratings yet

- Velilla Vs PosadasDocument7 pagesVelilla Vs PosadasKennethQueRaymundoNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sharad PawarNo ratings yet

- IB Economics SL Paper 1 Question Bank - TYCHRDocument25 pagesIB Economics SL Paper 1 Question Bank - TYCHRansirwayneNo ratings yet

- Moc 2Document13 pagesMoc 2pryaparagNo ratings yet

- Bangalore Occupancy Certificate A Complete GuidelineDocument4 pagesBangalore Occupancy Certificate A Complete Guidelinemasta kalandarNo ratings yet

- Sureyan Modern Rice Mill - CMA FinalDocument3 pagesSureyan Modern Rice Mill - CMA FinalJayaElaiya KuamarNo ratings yet

- Draft Settlement AgreementDocument15 pagesDraft Settlement AgreementjvmarronNo ratings yet

- Sentrove 3BR 10DP - 1631441723Document1 pageSentrove 3BR 10DP - 1631441723Ivan Hayes DyNo ratings yet

- Kapil Raj Mandavi 23-24Document1 pageKapil Raj Mandavi 23-24khan khanNo ratings yet

- Elements of Crime Index CardsDocument142 pagesElements of Crime Index CardsJea Co100% (1)

- Acfrogbpqjr3d3qz Ohfamwzegjrbgoqsmr0jtpnp24hyzsopcjalpeciqrq Hhf36iesvlttkbzpk1uro1u-Mt Szhqhzifro0dxbxwamypx1bbgib7oxfsqs4jwuaDocument3 pagesAcfrogbpqjr3d3qz Ohfamwzegjrbgoqsmr0jtpnp24hyzsopcjalpeciqrq Hhf36iesvlttkbzpk1uro1u-Mt Szhqhzifro0dxbxwamypx1bbgib7oxfsqs4jwuaapi-564750164No ratings yet

- Interest Rate On DepositsDocument4 pagesInterest Rate On DepositsPritam PaulNo ratings yet

- Fifth Schedule To The Customs ActDocument66 pagesFifth Schedule To The Customs ActMemona Qasim100% (1)

- Gas Exchanger RetubingDocument15 pagesGas Exchanger Retubinghamal.w757No ratings yet

- Ubs FinalDocument7 pagesUbs FinalJoshua CabreraNo ratings yet

- INVESTOR FAQ - FPC AIF - Sep2022Document16 pagesINVESTOR FAQ - FPC AIF - Sep2022Himanshu MalikNo ratings yet

- Project Report On Convergence of Banking Sector To Housing FinanceDocument4 pagesProject Report On Convergence of Banking Sector To Housing FinanceHari PrasadNo ratings yet

- GG Promoter AgreementDocument9 pagesGG Promoter Agreementapi-290739308No ratings yet

- GO Ms 381 GST 26112018Document4 pagesGO Ms 381 GST 26112018hussainNo ratings yet

- 107-Falguni Gruh UdhyogDocument1 page107-Falguni Gruh UdhyogdeepNo ratings yet