Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

15 viewsIAS 1,33 and IFRS 1 CONCEPT MAP

IAS 1,33 and IFRS 1 CONCEPT MAP

Uploaded by

Jenne LeeCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- Ind As Summary Charts PDFDocument47 pagesInd As Summary Charts PDFVinayak67% (3)

- Cortez Practice Set JanuaryDocument5 pagesCortez Practice Set JanuaryChristian LapidNo ratings yet

- Business Cup Level 1 Quiz BeeDocument28 pagesBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareNo ratings yet

- Ind AS Summary Charts PDFDocument52 pagesInd AS Summary Charts PDFNitin P. Dhole100% (1)

- Business Letter Writing: TestsDocument18 pagesBusiness Letter Writing: TestsAirynn IrinaNo ratings yet

- SAP Profit Center AccountingDocument62 pagesSAP Profit Center Accountingrohitmandhania100% (7)

- ANSWER: X 2.544: PORTFOLIO BETA: Suppose You Are A Manager of A Mutual Fund and Hold A $10Document1 pageANSWER: X 2.544: PORTFOLIO BETA: Suppose You Are A Manager of A Mutual Fund and Hold A $10MiconNo ratings yet

- Chapter 16 Dissolution and Liquidation of PartnershipDocument14 pagesChapter 16 Dissolution and Liquidation of Partnershipkp_popinjNo ratings yet

- Retained Earnings - ModuleDocument12 pagesRetained Earnings - ModuleFiverr RallNo ratings yet

- Shareholders' Equity - Contributed Capital: Part A: The Nature of Shareholders' Equity I. Sources of Shareholders' EquityDocument12 pagesShareholders' Equity - Contributed Capital: Part A: The Nature of Shareholders' Equity I. Sources of Shareholders' Equitycriszel4sobejanaNo ratings yet

- Current Liabilities: Topic OutlineDocument8 pagesCurrent Liabilities: Topic OutlineJulie Mae Caling MalitNo ratings yet

- 4 2 Endless Company PDFDocument3 pages4 2 Endless Company PDFJulius Mark Carinhay TolitolNo ratings yet

- Accou NT No. Account Name Trial Balance Adjustment Income Statement Debit Credit Debit Credit DebitDocument40 pagesAccou NT No. Account Name Trial Balance Adjustment Income Statement Debit Credit Debit Credit DebitJam SurdivillaNo ratings yet

- 1, Title XVII, of This Book. (N)Document4 pages1, Title XVII, of This Book. (N)Bernalyn Manaog100% (1)

- FAR 0 Merged Handouts and ReviewersDocument31 pagesFAR 0 Merged Handouts and ReviewersKin LeeNo ratings yet

- W4 - SW1 - Statement of Financial PositionDocument2 pagesW4 - SW1 - Statement of Financial PositionJere Mae MarananNo ratings yet

- Partnership Dissolution ProblemsDocument22 pagesPartnership Dissolution ProblemsMikhaella ZamoraNo ratings yet

- IA2 CH15A PROBLEMS (Vhinson)Document5 pagesIA2 CH15A PROBLEMS (Vhinson)sophomorefilesNo ratings yet

- IAII FINAL EXAM Maual SET ADocument9 pagesIAII FINAL EXAM Maual SET ALovely Anne Dela CruzNo ratings yet

- Warranty Liability: Start of DiscussionDocument2 pagesWarranty Liability: Start of DiscussionclarizaNo ratings yet

- Chapt 4 Partnership Dissolution - Asset Revaluation & BonusDocument8 pagesChapt 4 Partnership Dissolution - Asset Revaluation & BonusDaenaNo ratings yet

- 2.0.1 Seatwork - Cost Behavior - Belle and Shinly - AnswersDocument3 pages2.0.1 Seatwork - Cost Behavior - Belle and Shinly - AnswersRoselyn LumbaoNo ratings yet

- Lobrigas Unit5 Topic5 AssessmentDocument6 pagesLobrigas Unit5 Topic5 AssessmentClaudine LobrigasNo ratings yet

- Illustration 5Document2 pagesIllustration 5Bea Nicole BaltazarNo ratings yet

- CH 32 - Noncurrent Asset Held For SaleDocument3 pagesCH 32 - Noncurrent Asset Held For SaleJm SevallaNo ratings yet

- Problem 3 Page 41Document8 pagesProblem 3 Page 41MAG MAGNo ratings yet

- Taxation of Partnerships, Estates and Trusts Classification of Partnerships 1. General Professional PartnershipDocument11 pagesTaxation of Partnerships, Estates and Trusts Classification of Partnerships 1. General Professional PartnershipErika DioquinoNo ratings yet

- PRELIM Chapter 9 10 11Document37 pagesPRELIM Chapter 9 10 11Bisag AsaNo ratings yet

- Chapter 2Document12 pagesChapter 2Cassandra KarolinaNo ratings yet

- Property, Plant and EquipmentDocument40 pagesProperty, Plant and EquipmentNatalie SerranoNo ratings yet

- Byproduct AccountingDocument13 pagesByproduct AccountingAbu NaserNo ratings yet

- FAR REVIEWER Part 1Document7 pagesFAR REVIEWER Part 1jessamae gundanNo ratings yet

- Quiz LeasesDocument2 pagesQuiz LeasesCyra de LemosNo ratings yet

- Intacc 3 Leases FinalsDocument9 pagesIntacc 3 Leases FinalsDarryl AgustinNo ratings yet

- Par Cor Quizzes Soln Pca 2019Document27 pagesPar Cor Quizzes Soln Pca 2019mariellec907No ratings yet

- Finalchapter 20Document11 pagesFinalchapter 20Jud Rossette ArcebesNo ratings yet

- Valuation B and S - Q & ADocument3 pagesValuation B and S - Q & Aaaaaa aaaaaNo ratings yet

- Lease 2. Incremental Borrowing Rate of The Lessee Is Used in The Absence of Implicit InterestDocument4 pagesLease 2. Incremental Borrowing Rate of The Lessee Is Used in The Absence of Implicit InterestQueen Valle100% (2)

- Chapter 4Document16 pagesChapter 4April Noreen Riego PizarraNo ratings yet

- Business Combination1Document5 pagesBusiness Combination1Mae Ciarie YangcoNo ratings yet

- Requirement: A New Set of Books Will Be Opened by The Partnership Roces' Books Sales' BooksDocument7 pagesRequirement: A New Set of Books Will Be Opened by The Partnership Roces' Books Sales' BooksJunzen Ralph YapNo ratings yet

- October To September Sales Report Movies by GenreDocument3 pagesOctober To September Sales Report Movies by GenreAngelica Austria-MantalNo ratings yet

- Chapter 20 Ia2Document24 pagesChapter 20 Ia2JM Valonda Villena, CPA, MBANo ratings yet

- A Summary of IFRS 5Document2 pagesA Summary of IFRS 5Asma AliNo ratings yet

- Appendix A Worksheet 1 Name: Kimberly T. Gallaron Date: February 4, 2021 Program & Year: BSA-2 PurcommDocument2 pagesAppendix A Worksheet 1 Name: Kimberly T. Gallaron Date: February 4, 2021 Program & Year: BSA-2 PurcommKimberly GallaronNo ratings yet

- Oblicon ReviewerDocument110 pagesOblicon ReviewerThe ApprenticeNo ratings yet

- Prelim Exam - Intermediate Accounting Part 1Document13 pagesPrelim Exam - Intermediate Accounting Part 1Vincent AbellaNo ratings yet

- Law and Joint Obligations ModifiedDocument34 pagesLaw and Joint Obligations ModifiedAllanah AncotNo ratings yet

- Multiple Choice Answers and Solutions: PAR Boogie BirdieDocument19 pagesMultiple Choice Answers and Solutions: PAR Boogie BirdieNelia Mae S. VillenaNo ratings yet

- 401 Chap13 Flashcards - QuizletDocument8 pages401 Chap13 Flashcards - QuizletJaceNo ratings yet

- Far Qualifying ExaminationDocument30 pagesFar Qualifying ExaminationAlvin BaternaNo ratings yet

- Chapter6 Matematika BusinessDocument17 pagesChapter6 Matematika BusinessKarlina DewiNo ratings yet

- MODULE 5-Part 1Document5 pagesMODULE 5-Part 1trixie maeNo ratings yet

- Midterm Exam Parcor 2020Document1 pageMidterm Exam Parcor 2020John Alfred CastinoNo ratings yet

- Investment in Equity SecuritiesDocument12 pagesInvestment in Equity Securitieslois martinNo ratings yet

- Bonds Payable Related Standards: Pfrs 9 - Financial InstrumentsDocument4 pagesBonds Payable Related Standards: Pfrs 9 - Financial InstrumentsJulie Mae Caling MalitNo ratings yet

- 01 Taskperformance 1Document6 pages01 Taskperformance 1nathaniel xtraNo ratings yet

- AFAR.01 Partnership AccountingDocument13 pagesAFAR.01 Partnership AccountingCristine Joy BenitezNo ratings yet

- Intacc 3Document26 pagesIntacc 3Maria DubloisNo ratings yet

- Accounting: Quantitative Information Primarily Financial inDocument19 pagesAccounting: Quantitative Information Primarily Financial inleeeydoNo ratings yet

- FS Reviewer CH1Document10 pagesFS Reviewer CH1karen perrerasNo ratings yet

- Understanding Financial Statements For Non-AccountantsDocument5 pagesUnderstanding Financial Statements For Non-AccountantsAngella RiveraNo ratings yet

- Chapter 6 Audit Responsibilities and ObjectivesDocument22 pagesChapter 6 Audit Responsibilities and ObjectivesJenne LeeNo ratings yet

- Pag IbigDocument2 pagesPag IbigJenne LeeNo ratings yet

- Modes of Extinguishment of AgencyDocument7 pagesModes of Extinguishment of AgencyJenne LeeNo ratings yet

- Philippine Seven Corporation Corporate InformationDocument5 pagesPhilippine Seven Corporation Corporate InformationJenne LeeNo ratings yet

- Ias 16: Poperty, Plant, and Equipment Objective:: Measurement at RecognitionDocument1 pageIas 16: Poperty, Plant, and Equipment Objective:: Measurement at RecognitionJenne LeeNo ratings yet

- Ias 1 Concept MapDocument3 pagesIas 1 Concept MapJenne Lee100% (1)

- Edm Dignity of LifeDocument1 pageEdm Dignity of LifeJenne LeeNo ratings yet

- Modified Midterm Exam 2020Document8 pagesModified Midterm Exam 2020Jenne LeeNo ratings yet

- Interim Financial Reporting: International Accounting Standard 34Document12 pagesInterim Financial Reporting: International Accounting Standard 34Jenne LeeNo ratings yet

- Pfrs 1Document8 pagesPfrs 1Jenne LeeNo ratings yet

- Chapter 2: The Total Environment of The FirmDocument4 pagesChapter 2: The Total Environment of The FirmSeokjin KimNo ratings yet

- Behavioural FinanceDocument25 pagesBehavioural Financeuglyface007100% (1)

- Coco Levy Senate Hearing - TranscriptDocument103 pagesCoco Levy Senate Hearing - TranscriptCocoLevyNo ratings yet

- Basic Monte Carlo TechniquesDocument10 pagesBasic Monte Carlo TechniquesMobeen AhmadNo ratings yet

- EAPP Accounting Outline Jargon OpinionDocument4 pagesEAPP Accounting Outline Jargon OpinionArthur AquinoNo ratings yet

- Strategy Formulation of Biman Bangladesh Airlines Ltd. SIM: 501 (Fundamentals of Strategic Management)Document14 pagesStrategy Formulation of Biman Bangladesh Airlines Ltd. SIM: 501 (Fundamentals of Strategic Management)Shahidul Rassel100% (2)

- FABPro Specialities, Bangladesh 30th Sep, 2018Document52 pagesFABPro Specialities, Bangladesh 30th Sep, 2018ramsiva354No ratings yet

- DBS China Dairy Industry Jun110217Document9 pagesDBS China Dairy Industry Jun110217Tony LeongNo ratings yet

- Growth Matrix - Ansoff Growth MatrixDocument5 pagesGrowth Matrix - Ansoff Growth MatrixOng SooShin100% (1)

- Analyse The Economic Consequences of Liberalisation in India.Document14 pagesAnalyse The Economic Consequences of Liberalisation in India.Maya ParteNo ratings yet

- Consolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Document5 pagesConsolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Basit Ali ChaudhryNo ratings yet

- Industry Profile: Vega Auto Accessories Private LTDDocument57 pagesIndustry Profile: Vega Auto Accessories Private LTDSanjay SmartNo ratings yet

- Mutual Funds: An Overview Shaleen PrakashDocument41 pagesMutual Funds: An Overview Shaleen PrakashSudham SandeepNo ratings yet

- Reliance Industries in ChinaDocument24 pagesReliance Industries in ChinaSanddeepTirukoveleNo ratings yet

- Theory Questions 1 FMDocument3 pagesTheory Questions 1 FMQuestionscastle Friend100% (1)

- Sales Tracker - SeptDocument33 pagesSales Tracker - SeptNikhilNo ratings yet

- Introduction To Economics and FinanceDocument10 pagesIntroduction To Economics and FinanceShanti Prakhar AwasthiNo ratings yet

- LOVISA V PANDORA FINANCIAL ANALYSIS RATIODocument30 pagesLOVISA V PANDORA FINANCIAL ANALYSIS RATIOpipahNo ratings yet

- Basra Oil&Gas Brochure TNRDocument8 pagesBasra Oil&Gas Brochure TNRcoskunmertNo ratings yet

- 004 - Project File OCRDocument30 pages004 - Project File OCRPREM BHAI VERMANo ratings yet

- Problems Related To Capital Structure and Leverage PDFDocument9 pagesProblems Related To Capital Structure and Leverage PDFrameessalam852569No ratings yet

- Challenges of Indian Aviation Industry in Chaotic Phase: Rajesh U. KantheDocument3 pagesChallenges of Indian Aviation Industry in Chaotic Phase: Rajesh U. KanthePratham MittalNo ratings yet

- TestGenie Santander Numerical Reasoning Test PracticeDocument24 pagesTestGenie Santander Numerical Reasoning Test PracticeYomi Tejumola100% (3)

- 10 Steps To Building A Winning Trading Plan PDFDocument8 pages10 Steps To Building A Winning Trading Plan PDFscreen1 record100% (1)

- Efficiency at Height: Tower CranesDocument16 pagesEfficiency at Height: Tower Cranesmd.amer mohiuddinNo ratings yet

- College of Accountancy: Midterm Examination in Financial Accounting and ReportingDocument6 pagesCollege of Accountancy: Midterm Examination in Financial Accounting and ReportingALMA MORENANo ratings yet

- Pre-Tax Post-Tax Ke DDocument3 pagesPre-Tax Post-Tax Ke DAtif RehmanNo ratings yet

- Corporate Finance I Module 1 5excmn8wfmDocument23 pagesCorporate Finance I Module 1 5excmn8wfmApramit RayNo ratings yet

IAS 1,33 and IFRS 1 CONCEPT MAP

IAS 1,33 and IFRS 1 CONCEPT MAP

Uploaded by

Jenne Lee0 ratings0% found this document useful (0 votes)

15 views3 pagesOriginal Title

IAS 1,33 and IFRS 1 CONCEPT MAP.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

15 views3 pagesIAS 1,33 and IFRS 1 CONCEPT MAP

IAS 1,33 and IFRS 1 CONCEPT MAP

Uploaded by

Jenne LeeCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 3

IAS 1: PRESENTATION OF FINANCIAL

FINANCIAL STATEMENTS STATEMENTS STRUCUTURE AND CONTENT

PURPOSE: GENERAL FEATURES:

to provide information about the financial position, financial performance and 1. True and fair view-requires the faithful representation of the effects of

cash flows of an entity that is useful to users in making economic decisions. transactions.

2. Going concern-management shall make an assessment of an entity’s

COMPLETE SET OF FINANCIAL STATEMENTS: ability to continue as a going concern.

a. a statement of financial position as at the end of the period; 3. Accrual-financial statements, except for cash flow information, are

b. a statement of profit or loss and other comprehensive income for prepared using accrual basis.

the period; 4. Materiality and Aggregation-present separately each material class of

c. a statement of changes in equity for the period; similar items.

d. a statement of cash flows for the period; 5. Offsetting-entity shall not offset asset and liability or income and

e. notes, comprising significant accounting policies and other expense.

explanatory information; 6. Frequency-present a complete set of financial statements at least

f. a statement of financial position as at the beginning of the annually.

preceding periodc 7. Comparatives-present comparative information in respect of the

preceding period for all amounts reported in the current period.

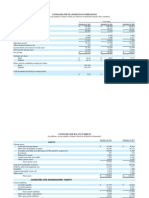

STATEMENT OF FINANCIAL POSITION 8. Consistency-retain the presentation and classification of items in the

financial statements from one period to the next.

ASSET= LIABILTY- EQUITY

EQUITY is the residual interest in the assets of the entity after deducting all of its

liabilities. NOTES TO FINANCIAL STATEMENTS

CURRENT ASSET/LIABILITY: Used to report information that does not fit into the body of the financial

NON-CURRENT ASSET/LIABILITY: statement in order to enhance the understandability of the financial

no more than twelve months more than twelve months statements.

after the reporting period, after the reporting period.

Two forms of statement of financial position

STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME REPORT FORM ACCOUNT FORM

a) PROFIT OR LOSS- total income less expenses, excluding the components Assets are shown on the left

This form sets forth the three

of other comprehensive income. side and liabilities and equity

major section in a downward

b) OTHER COMPREHENSIVE INCOME- comprises items of income and on the right side of the

sequence of asset, liabilities,

expense including reclassification adjustments that are not recognized in statement of the financial

and equity.

profit or loss. position.

IAS 33: EARNINGS PER SHARE

Is the amount attributable to every ordinary share outstanding

during the period. Thus, earning per share information pertains

only to ordinary share.

USES OF EARNINGS PER SHARE PRESENTATION

a) Determinant of the market price of An entity shall present on the face of the income

ordinary share. RETROSPECTIVE ADJUSTMENTS statement basic and diluted earnings per share for

Involves altering past financial income or loss from continuing operations. An entity

b) Measure of performance of

information according to a new that reports discontinued operation shall disclose the

management in conducting basic amount per share for the discontinued

operations. accounting principle, as if that operation either on the face of the income statement

c) Basis of dividend policy of an entity. principle had always been applied. or in the notes to the statements.

DILUTED EARNINGS PER SHARE

Dilution arises when the inclusion of the potential ordinary shares

BASIC EARNINGS PER SHARE decreases the basic earnings per share or increases the basic loss per

Basic EPS= Net income/ Ordinary shares outstanding share. The computation of the diluted earnings per share is based on the

An entity shall calculate basic earnings per share amounts “as if” scenario;

for profit or loss attributable to ordinary equity holders of a) Convertible bonds payable- assumes that the bond payable is

converted into ordinary share. Thus, adjustments shall be made to

the parent entity and, if presented, profit or loss from net income and to the number of ordinary shares outstanding.

continuing operations attributable to those equity holders. b) Convertible preference share- assumes that the preference share is

Where share dividends or share splits create a change in converted into ordinary share. Net income is not reduced anymore by

the capital structure, the increase or decrease in the the amount of preference dividend.

number of shares shall be recognized retroactively. c) Options and warrants- are dilutive if the exercise price or option price

is less than the average market price of the ordinary share. These are

included in the EPS computation through the treasury share method.

IFRS 1: First‑time Adoption of International

Financial Reporting Standards

An entity is considered first time adopter when for the first time such entity

makes an explicit and unreserved statement that its general purpose financial

statements comply with International Financial Reporting Standards.

DATE OF TRANSITION TO IFRS

FIRST PFRS FINANCIAL STATEMENTS The date of transition to PFRS depends on two factors, namely:

Financial statements presented by an entity in the a) Date of adoption to IFRS

current year would qualify as first financial b) Number of years of comparative information that an entity decides to present

statements under the following condition. together with the financial statements in the year of adoption.

1. When an entity presented its most recent

previous financial statements: OPENING PFRS STATEMENT OF FIRST PFRS FINANCIAL

a) Under national GAAP inconsistent with IFRS in FINANCIAL POSITION STATEMENTS

all aspect.

b) In conformity with PFRS in all respect but this It is the starting point for It includes:

statements did not contain an explicit and accounting in accordance with 1. Three statements of financial position

unreserved statement that they complied with at the end of current year, at the end

IFRS. Entity is required to;

IFRSs; of prior year and at the date of

c) containing an explicit statement of compliance 1. Recognize all assets and transition to IFRS.

with some, but not all, IFRSs; liabilities required by IFRS. 2. Two statements of comprehensive

d) Under national GAAP with a reconciliation of 2. Derecognize assets and income for the current year and prior

selected figures to amounts determined under

IFRS. liabilities not permitted by year.

2. When an entity prepared financial statements in IFRS. 3. Two separate income statement for

accordance with IFRS for internal use only. 3. Reclassify items that is current year and prior year.

3. When an entity prepared financial statements in 4. Teo statement of changes in equity for

recognized under previous

accordance with IFRS for consolidated purposes the current year and prior year

GAAP 5. Two statements of cash flow for the

without a complete set of financial statements.

4. Measure all recognized assets current year and prior year

4. When an entity did not present financial

statements in the previous period. and liabilities in compliance 6. Notes to financial statements including

with IFRS. comparative information

You might also like

- Ind As Summary Charts PDFDocument47 pagesInd As Summary Charts PDFVinayak67% (3)

- Cortez Practice Set JanuaryDocument5 pagesCortez Practice Set JanuaryChristian LapidNo ratings yet

- Business Cup Level 1 Quiz BeeDocument28 pagesBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareNo ratings yet

- Ind AS Summary Charts PDFDocument52 pagesInd AS Summary Charts PDFNitin P. Dhole100% (1)

- Business Letter Writing: TestsDocument18 pagesBusiness Letter Writing: TestsAirynn IrinaNo ratings yet

- SAP Profit Center AccountingDocument62 pagesSAP Profit Center Accountingrohitmandhania100% (7)

- ANSWER: X 2.544: PORTFOLIO BETA: Suppose You Are A Manager of A Mutual Fund and Hold A $10Document1 pageANSWER: X 2.544: PORTFOLIO BETA: Suppose You Are A Manager of A Mutual Fund and Hold A $10MiconNo ratings yet

- Chapter 16 Dissolution and Liquidation of PartnershipDocument14 pagesChapter 16 Dissolution and Liquidation of Partnershipkp_popinjNo ratings yet

- Retained Earnings - ModuleDocument12 pagesRetained Earnings - ModuleFiverr RallNo ratings yet

- Shareholders' Equity - Contributed Capital: Part A: The Nature of Shareholders' Equity I. Sources of Shareholders' EquityDocument12 pagesShareholders' Equity - Contributed Capital: Part A: The Nature of Shareholders' Equity I. Sources of Shareholders' Equitycriszel4sobejanaNo ratings yet

- Current Liabilities: Topic OutlineDocument8 pagesCurrent Liabilities: Topic OutlineJulie Mae Caling MalitNo ratings yet

- 4 2 Endless Company PDFDocument3 pages4 2 Endless Company PDFJulius Mark Carinhay TolitolNo ratings yet

- Accou NT No. Account Name Trial Balance Adjustment Income Statement Debit Credit Debit Credit DebitDocument40 pagesAccou NT No. Account Name Trial Balance Adjustment Income Statement Debit Credit Debit Credit DebitJam SurdivillaNo ratings yet

- 1, Title XVII, of This Book. (N)Document4 pages1, Title XVII, of This Book. (N)Bernalyn Manaog100% (1)

- FAR 0 Merged Handouts and ReviewersDocument31 pagesFAR 0 Merged Handouts and ReviewersKin LeeNo ratings yet

- W4 - SW1 - Statement of Financial PositionDocument2 pagesW4 - SW1 - Statement of Financial PositionJere Mae MarananNo ratings yet

- Partnership Dissolution ProblemsDocument22 pagesPartnership Dissolution ProblemsMikhaella ZamoraNo ratings yet

- IA2 CH15A PROBLEMS (Vhinson)Document5 pagesIA2 CH15A PROBLEMS (Vhinson)sophomorefilesNo ratings yet

- IAII FINAL EXAM Maual SET ADocument9 pagesIAII FINAL EXAM Maual SET ALovely Anne Dela CruzNo ratings yet

- Warranty Liability: Start of DiscussionDocument2 pagesWarranty Liability: Start of DiscussionclarizaNo ratings yet

- Chapt 4 Partnership Dissolution - Asset Revaluation & BonusDocument8 pagesChapt 4 Partnership Dissolution - Asset Revaluation & BonusDaenaNo ratings yet

- 2.0.1 Seatwork - Cost Behavior - Belle and Shinly - AnswersDocument3 pages2.0.1 Seatwork - Cost Behavior - Belle and Shinly - AnswersRoselyn LumbaoNo ratings yet

- Lobrigas Unit5 Topic5 AssessmentDocument6 pagesLobrigas Unit5 Topic5 AssessmentClaudine LobrigasNo ratings yet

- Illustration 5Document2 pagesIllustration 5Bea Nicole BaltazarNo ratings yet

- CH 32 - Noncurrent Asset Held For SaleDocument3 pagesCH 32 - Noncurrent Asset Held For SaleJm SevallaNo ratings yet

- Problem 3 Page 41Document8 pagesProblem 3 Page 41MAG MAGNo ratings yet

- Taxation of Partnerships, Estates and Trusts Classification of Partnerships 1. General Professional PartnershipDocument11 pagesTaxation of Partnerships, Estates and Trusts Classification of Partnerships 1. General Professional PartnershipErika DioquinoNo ratings yet

- PRELIM Chapter 9 10 11Document37 pagesPRELIM Chapter 9 10 11Bisag AsaNo ratings yet

- Chapter 2Document12 pagesChapter 2Cassandra KarolinaNo ratings yet

- Property, Plant and EquipmentDocument40 pagesProperty, Plant and EquipmentNatalie SerranoNo ratings yet

- Byproduct AccountingDocument13 pagesByproduct AccountingAbu NaserNo ratings yet

- FAR REVIEWER Part 1Document7 pagesFAR REVIEWER Part 1jessamae gundanNo ratings yet

- Quiz LeasesDocument2 pagesQuiz LeasesCyra de LemosNo ratings yet

- Intacc 3 Leases FinalsDocument9 pagesIntacc 3 Leases FinalsDarryl AgustinNo ratings yet

- Par Cor Quizzes Soln Pca 2019Document27 pagesPar Cor Quizzes Soln Pca 2019mariellec907No ratings yet

- Finalchapter 20Document11 pagesFinalchapter 20Jud Rossette ArcebesNo ratings yet

- Valuation B and S - Q & ADocument3 pagesValuation B and S - Q & Aaaaaa aaaaaNo ratings yet

- Lease 2. Incremental Borrowing Rate of The Lessee Is Used in The Absence of Implicit InterestDocument4 pagesLease 2. Incremental Borrowing Rate of The Lessee Is Used in The Absence of Implicit InterestQueen Valle100% (2)

- Chapter 4Document16 pagesChapter 4April Noreen Riego PizarraNo ratings yet

- Business Combination1Document5 pagesBusiness Combination1Mae Ciarie YangcoNo ratings yet

- Requirement: A New Set of Books Will Be Opened by The Partnership Roces' Books Sales' BooksDocument7 pagesRequirement: A New Set of Books Will Be Opened by The Partnership Roces' Books Sales' BooksJunzen Ralph YapNo ratings yet

- October To September Sales Report Movies by GenreDocument3 pagesOctober To September Sales Report Movies by GenreAngelica Austria-MantalNo ratings yet

- Chapter 20 Ia2Document24 pagesChapter 20 Ia2JM Valonda Villena, CPA, MBANo ratings yet

- A Summary of IFRS 5Document2 pagesA Summary of IFRS 5Asma AliNo ratings yet

- Appendix A Worksheet 1 Name: Kimberly T. Gallaron Date: February 4, 2021 Program & Year: BSA-2 PurcommDocument2 pagesAppendix A Worksheet 1 Name: Kimberly T. Gallaron Date: February 4, 2021 Program & Year: BSA-2 PurcommKimberly GallaronNo ratings yet

- Oblicon ReviewerDocument110 pagesOblicon ReviewerThe ApprenticeNo ratings yet

- Prelim Exam - Intermediate Accounting Part 1Document13 pagesPrelim Exam - Intermediate Accounting Part 1Vincent AbellaNo ratings yet

- Law and Joint Obligations ModifiedDocument34 pagesLaw and Joint Obligations ModifiedAllanah AncotNo ratings yet

- Multiple Choice Answers and Solutions: PAR Boogie BirdieDocument19 pagesMultiple Choice Answers and Solutions: PAR Boogie BirdieNelia Mae S. VillenaNo ratings yet

- 401 Chap13 Flashcards - QuizletDocument8 pages401 Chap13 Flashcards - QuizletJaceNo ratings yet

- Far Qualifying ExaminationDocument30 pagesFar Qualifying ExaminationAlvin BaternaNo ratings yet

- Chapter6 Matematika BusinessDocument17 pagesChapter6 Matematika BusinessKarlina DewiNo ratings yet

- MODULE 5-Part 1Document5 pagesMODULE 5-Part 1trixie maeNo ratings yet

- Midterm Exam Parcor 2020Document1 pageMidterm Exam Parcor 2020John Alfred CastinoNo ratings yet

- Investment in Equity SecuritiesDocument12 pagesInvestment in Equity Securitieslois martinNo ratings yet

- Bonds Payable Related Standards: Pfrs 9 - Financial InstrumentsDocument4 pagesBonds Payable Related Standards: Pfrs 9 - Financial InstrumentsJulie Mae Caling MalitNo ratings yet

- 01 Taskperformance 1Document6 pages01 Taskperformance 1nathaniel xtraNo ratings yet

- AFAR.01 Partnership AccountingDocument13 pagesAFAR.01 Partnership AccountingCristine Joy BenitezNo ratings yet

- Intacc 3Document26 pagesIntacc 3Maria DubloisNo ratings yet

- Accounting: Quantitative Information Primarily Financial inDocument19 pagesAccounting: Quantitative Information Primarily Financial inleeeydoNo ratings yet

- FS Reviewer CH1Document10 pagesFS Reviewer CH1karen perrerasNo ratings yet

- Understanding Financial Statements For Non-AccountantsDocument5 pagesUnderstanding Financial Statements For Non-AccountantsAngella RiveraNo ratings yet

- Chapter 6 Audit Responsibilities and ObjectivesDocument22 pagesChapter 6 Audit Responsibilities and ObjectivesJenne LeeNo ratings yet

- Pag IbigDocument2 pagesPag IbigJenne LeeNo ratings yet

- Modes of Extinguishment of AgencyDocument7 pagesModes of Extinguishment of AgencyJenne LeeNo ratings yet

- Philippine Seven Corporation Corporate InformationDocument5 pagesPhilippine Seven Corporation Corporate InformationJenne LeeNo ratings yet

- Ias 16: Poperty, Plant, and Equipment Objective:: Measurement at RecognitionDocument1 pageIas 16: Poperty, Plant, and Equipment Objective:: Measurement at RecognitionJenne LeeNo ratings yet

- Ias 1 Concept MapDocument3 pagesIas 1 Concept MapJenne Lee100% (1)

- Edm Dignity of LifeDocument1 pageEdm Dignity of LifeJenne LeeNo ratings yet

- Modified Midterm Exam 2020Document8 pagesModified Midterm Exam 2020Jenne LeeNo ratings yet

- Interim Financial Reporting: International Accounting Standard 34Document12 pagesInterim Financial Reporting: International Accounting Standard 34Jenne LeeNo ratings yet

- Pfrs 1Document8 pagesPfrs 1Jenne LeeNo ratings yet

- Chapter 2: The Total Environment of The FirmDocument4 pagesChapter 2: The Total Environment of The FirmSeokjin KimNo ratings yet

- Behavioural FinanceDocument25 pagesBehavioural Financeuglyface007100% (1)

- Coco Levy Senate Hearing - TranscriptDocument103 pagesCoco Levy Senate Hearing - TranscriptCocoLevyNo ratings yet

- Basic Monte Carlo TechniquesDocument10 pagesBasic Monte Carlo TechniquesMobeen AhmadNo ratings yet

- EAPP Accounting Outline Jargon OpinionDocument4 pagesEAPP Accounting Outline Jargon OpinionArthur AquinoNo ratings yet

- Strategy Formulation of Biman Bangladesh Airlines Ltd. SIM: 501 (Fundamentals of Strategic Management)Document14 pagesStrategy Formulation of Biman Bangladesh Airlines Ltd. SIM: 501 (Fundamentals of Strategic Management)Shahidul Rassel100% (2)

- FABPro Specialities, Bangladesh 30th Sep, 2018Document52 pagesFABPro Specialities, Bangladesh 30th Sep, 2018ramsiva354No ratings yet

- DBS China Dairy Industry Jun110217Document9 pagesDBS China Dairy Industry Jun110217Tony LeongNo ratings yet

- Growth Matrix - Ansoff Growth MatrixDocument5 pagesGrowth Matrix - Ansoff Growth MatrixOng SooShin100% (1)

- Analyse The Economic Consequences of Liberalisation in India.Document14 pagesAnalyse The Economic Consequences of Liberalisation in India.Maya ParteNo ratings yet

- Consolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Document5 pagesConsolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Basit Ali ChaudhryNo ratings yet

- Industry Profile: Vega Auto Accessories Private LTDDocument57 pagesIndustry Profile: Vega Auto Accessories Private LTDSanjay SmartNo ratings yet

- Mutual Funds: An Overview Shaleen PrakashDocument41 pagesMutual Funds: An Overview Shaleen PrakashSudham SandeepNo ratings yet

- Reliance Industries in ChinaDocument24 pagesReliance Industries in ChinaSanddeepTirukoveleNo ratings yet

- Theory Questions 1 FMDocument3 pagesTheory Questions 1 FMQuestionscastle Friend100% (1)

- Sales Tracker - SeptDocument33 pagesSales Tracker - SeptNikhilNo ratings yet

- Introduction To Economics and FinanceDocument10 pagesIntroduction To Economics and FinanceShanti Prakhar AwasthiNo ratings yet

- LOVISA V PANDORA FINANCIAL ANALYSIS RATIODocument30 pagesLOVISA V PANDORA FINANCIAL ANALYSIS RATIOpipahNo ratings yet

- Basra Oil&Gas Brochure TNRDocument8 pagesBasra Oil&Gas Brochure TNRcoskunmertNo ratings yet

- 004 - Project File OCRDocument30 pages004 - Project File OCRPREM BHAI VERMANo ratings yet

- Problems Related To Capital Structure and Leverage PDFDocument9 pagesProblems Related To Capital Structure and Leverage PDFrameessalam852569No ratings yet

- Challenges of Indian Aviation Industry in Chaotic Phase: Rajesh U. KantheDocument3 pagesChallenges of Indian Aviation Industry in Chaotic Phase: Rajesh U. KanthePratham MittalNo ratings yet

- TestGenie Santander Numerical Reasoning Test PracticeDocument24 pagesTestGenie Santander Numerical Reasoning Test PracticeYomi Tejumola100% (3)

- 10 Steps To Building A Winning Trading Plan PDFDocument8 pages10 Steps To Building A Winning Trading Plan PDFscreen1 record100% (1)

- Efficiency at Height: Tower CranesDocument16 pagesEfficiency at Height: Tower Cranesmd.amer mohiuddinNo ratings yet

- College of Accountancy: Midterm Examination in Financial Accounting and ReportingDocument6 pagesCollege of Accountancy: Midterm Examination in Financial Accounting and ReportingALMA MORENANo ratings yet

- Pre-Tax Post-Tax Ke DDocument3 pagesPre-Tax Post-Tax Ke DAtif RehmanNo ratings yet

- Corporate Finance I Module 1 5excmn8wfmDocument23 pagesCorporate Finance I Module 1 5excmn8wfmApramit RayNo ratings yet