Professional Documents

Culture Documents

Annexure A-ECB - Quick Reference Card

Annexure A-ECB - Quick Reference Card

Uploaded by

Pankaj Kumar SaoCopyright:

Available Formats

You might also like

- SR Insights Non Convertible Debentures Entry Routes For Foreign InvestorsDocument8 pagesSR Insights Non Convertible Debentures Entry Routes For Foreign InvestorsHimashu DhakedNo ratings yet

- Fema - Ecb and Compounding - Final PDFDocument44 pagesFema - Ecb and Compounding - Final PDFRavi Sankar ELTNo ratings yet

- IB History Guide: Causes of The Great DepressionDocument2 pagesIB History Guide: Causes of The Great DepressionKatelyn CooperNo ratings yet

- Presentation by Cs R V Seckar Mobile No - 79047 19295 Email IdDocument21 pagesPresentation by Cs R V Seckar Mobile No - 79047 19295 Email IdShweta Prathamesh BadgujarNo ratings yet

- ECBDocument19 pagesECBSACHIDANAND KANDLOORNo ratings yet

- What Is Ecb?Document25 pagesWhat Is Ecb?Abhishek PanigrahiNo ratings yet

- PWC News Alert 19 January 2019 Changes To The Ecb FrameworkDocument4 pagesPWC News Alert 19 January 2019 Changes To The Ecb FrameworkShweta AgarwalNo ratings yet

- External Commercial BorrowingsDocument37 pagesExternal Commercial BorrowingsTrisha Agarwala100% (1)

- External Commercial 003Document23 pagesExternal Commercial 003mukeshloves17No ratings yet

- External Commercial Borrowings - IndiaDocument4 pagesExternal Commercial Borrowings - IndiaPPPnewsNo ratings yet

- ECB - RBI Guidelines: Prasanna Krishnan SBI Capital Markets Limited Revised: February/03/2010Document30 pagesECB - RBI Guidelines: Prasanna Krishnan SBI Capital Markets Limited Revised: February/03/2010lutfiali205No ratings yet

- RBI ECB GuidelinesDocument19 pagesRBI ECB GuidelinesnareshkapoorsNo ratings yet

- Benefits To Borrower:: Automatic RouteDocument4 pagesBenefits To Borrower:: Automatic RoutehemantsrNo ratings yet

- ECBDocument48 pagesECBArjit AgrawalNo ratings yet

- External Commercial Borrowings (Ecbs)Document5 pagesExternal Commercial Borrowings (Ecbs)Prateek MallNo ratings yet

- External Commercial Borrowings: Master DirectionDocument18 pagesExternal Commercial Borrowings: Master DirectionRajendra KumarNo ratings yet

- RBI DocDocument36 pagesRBI DocPritesh RoyNo ratings yet

- Funding Options: External Commercial BorrowingsDocument12 pagesFunding Options: External Commercial BorrowingsBhargav Tej PNo ratings yet

- Funding Options: External Commercial BorrowingsDocument12 pagesFunding Options: External Commercial BorrowingsKannu KhuranaNo ratings yet

- Structure OF External Commercial BorrowingDocument15 pagesStructure OF External Commercial BorrowingNitesh TanwarNo ratings yet

- External Commercial Borrowings (Ecb) : Release of Foreign Exchange by Authorised DealersDocument10 pagesExternal Commercial Borrowings (Ecb) : Release of Foreign Exchange by Authorised DealersAnonymous rkZNo8No ratings yet

- External Commercial Borrowing & Import Trade CreditDocument42 pagesExternal Commercial Borrowing & Import Trade CreditNikhil VarshneyNo ratings yet

- International Trade FinanceDocument19 pagesInternational Trade FinanceEknath BirariNo ratings yet

- External Commercial BorrowingDocument10 pagesExternal Commercial BorrowingKunal TapreNo ratings yet

- Ecb and Trade CreditDocument8 pagesEcb and Trade CreditSatyanag VenishettyNo ratings yet

- External Commercial BorrowingDocument8 pagesExternal Commercial BorrowingRatna HubliNo ratings yet

- External Commercial BorrowingsDocument17 pagesExternal Commercial BorrowingsRam PujariNo ratings yet

- Group 6 - FEMADocument31 pagesGroup 6 - FEMAYousha KhanNo ratings yet

- Xternal Ommercial Orrowings: Chinmay@sbhandari - inDocument176 pagesXternal Ommercial Orrowings: Chinmay@sbhandari - incachinmayNo ratings yet

- Loan Checklist - List of Compliances For A Loan TransactionDocument6 pagesLoan Checklist - List of Compliances For A Loan TransactionDinesh GadkariNo ratings yet

- External Commercial BorrowingDocument27 pagesExternal Commercial BorrowingNUPUR SAININo ratings yet

- Major FunctionsDocument3 pagesMajor Functionspooja_chowkseyNo ratings yet

- Master Direction - ECBDocument27 pagesMaster Direction - ECBAadya BansalNo ratings yet

- External Commercial Borrowings (Ecb)Document11 pagesExternal Commercial Borrowings (Ecb)Soumik ChatterjeeNo ratings yet

- Master Circular On External Commercial Borrowings and Trade CreditsDocument43 pagesMaster Circular On External Commercial Borrowings and Trade Creditsway2iimaNo ratings yet

- Presentatio N On:: ECB & FCCBDocument41 pagesPresentatio N On:: ECB & FCCBMilan PateliyaNo ratings yet

- Merge Rs & Acqui Siti OnsDocument68 pagesMerge Rs & Acqui Siti OnsVisakan KandaswamyNo ratings yet

- E C B PresntationDocument32 pagesE C B PresntationJayveer VoraNo ratings yet

- Economy - MEGA Question Bank For Prelims 2024 Sleepy Classes IASDocument131 pagesEconomy - MEGA Question Bank For Prelims 2024 Sleepy Classes IAShemanthhrsu9No ratings yet

- Submitted To: Mr. K.K.Jindal Submitted By: Disha Sogani (09RBA) Ritu Rani (38A) Romi (03RBA) Saurabh Gupta (41B) Shakun Bishnoi (42A) Sweta (7RBA)Document42 pagesSubmitted To: Mr. K.K.Jindal Submitted By: Disha Sogani (09RBA) Ritu Rani (38A) Romi (03RBA) Saurabh Gupta (41B) Shakun Bishnoi (42A) Sweta (7RBA)shakun bishnoiNo ratings yet

- Join Caiib With Ashok On Youtube & App: BFM Module - ADocument34 pagesJoin Caiib With Ashok On Youtube & App: BFM Module - ASamir BuddheNo ratings yet

- Regulatory Provisions Under EcbDocument6 pagesRegulatory Provisions Under EcbAllwyn FlowNo ratings yet

- External Commercial Borrowing: Team:-InnovatorsDocument24 pagesExternal Commercial Borrowing: Team:-Innovatorsravish419No ratings yet

- External Commercial BorrowingsDocument34 pagesExternal Commercial BorrowingsVishal MadlaniNo ratings yet

- Foreign FundingDocument24 pagesForeign FundingharshNo ratings yet

- UFCE RBI REGULATION Jan 23Document12 pagesUFCE RBI REGULATION Jan 23renu.balaNo ratings yet

- External Commercial BorrowingDocument23 pagesExternal Commercial BorrowingAnshika SharmaNo ratings yet

- FED Master Direction No. 5 External Commercial Borrowings, Trade Credit Dec 2021Document27 pagesFED Master Direction No. 5 External Commercial Borrowings, Trade Credit Dec 2021Prabhat SinghNo ratings yet

- Project Finance - Regulatory FrameworkDocument11 pagesProject Finance - Regulatory FrameworkHimanshu MukimNo ratings yet

- External Commercial BorrowingDocument9 pagesExternal Commercial Borrowingapi-3822396100% (3)

- Presentation On ECBDocument37 pagesPresentation On ECBD Attitude KidNo ratings yet

- External Commercial Borrowings (ECB)Document6 pagesExternal Commercial Borrowings (ECB)manthan1312No ratings yet

- ECB Trade CreditDocument27 pagesECB Trade CreditSachin DakahaNo ratings yet

- Ecb and Trade CreditsDocument10 pagesEcb and Trade CreditsVarun JainNo ratings yet

- External Commercial Borrowings PDFDocument26 pagesExternal Commercial Borrowings PDFAmit SinghNo ratings yet

- FEMABudgetannoucements 06 03Document4 pagesFEMABudgetannoucements 06 03Pawan KvsNo ratings yet

- Contingent Convertible Bonds, Corporate Hybrid Securities and Preferred Shares: Instruments, Regulation, ManagementFrom EverandContingent Convertible Bonds, Corporate Hybrid Securities and Preferred Shares: Instruments, Regulation, ManagementNo ratings yet

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportFrom EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportNo ratings yet

- Credit Derivatives and Structured Credit: A Guide for InvestorsFrom EverandCredit Derivatives and Structured Credit: A Guide for InvestorsNo ratings yet

- Financial Digitalization and Its Implications for ASEAN+3 Regional Financial StabilityFrom EverandFinancial Digitalization and Its Implications for ASEAN+3 Regional Financial StabilityNo ratings yet

- 14 Ashok Kumar GuptaDocument12 pages14 Ashok Kumar GuptaPankaj Kumar SaoNo ratings yet

- 36 Raja ReddyDocument12 pages36 Raja ReddyPankaj Kumar SaoNo ratings yet

- 8 Usha BhatnagarDocument12 pages8 Usha BhatnagarPankaj Kumar SaoNo ratings yet

- Process Fee FormDocument67 pagesProcess Fee FormPankaj Kumar SaoNo ratings yet

- Reporting of Loan Agreement Details Under Foreign Exchange Management Act, 1999Document7 pagesReporting of Loan Agreement Details Under Foreign Exchange Management Act, 1999Pankaj Kumar SaoNo ratings yet

- Samala vs. Valencia 512 SCRA 1 A.C. No. 5439 January 22 2007Document11 pagesSamala vs. Valencia 512 SCRA 1 A.C. No. 5439 January 22 2007Angelie FloresNo ratings yet

- A LoRa 868MHz Collinear Antenna - Projects by KeptenkurkDocument8 pagesA LoRa 868MHz Collinear Antenna - Projects by Keptenkurkjax almarNo ratings yet

- Accounting ProblemsDocument31 pagesAccounting ProblemsJanna Gunio100% (1)

- 3 Gimp Size Color Contrast Crop RedeyeDocument2 pages3 Gimp Size Color Contrast Crop Redeyeapi-370628488No ratings yet

- ForestDocument30 pagesForestZarjaan ShahidNo ratings yet

- Coupled Level-Set and Volume of Fluid (CLSVOF) Solver ForDocument18 pagesCoupled Level-Set and Volume of Fluid (CLSVOF) Solver ForBharath kumarNo ratings yet

- Diploma in MarineDocument18 pagesDiploma in MarineKaung Min MoNo ratings yet

- A4064-2 Datasheet en - 201003Document1 pageA4064-2 Datasheet en - 201003Khalid ElfiqyNo ratings yet

- 2193-Article Text-2779-1-10-20171231Document11 pages2193-Article Text-2779-1-10-20171231Roisya marzuqiNo ratings yet

- ICFO Slides Part 2Document33 pagesICFO Slides Part 2Bhavesh ChauhanNo ratings yet

- Assessment of Capital Budgeting Technique in Evaluating The Profitability of Manufacturing Firm With Reference To SME in RajasthanDocument5 pagesAssessment of Capital Budgeting Technique in Evaluating The Profitability of Manufacturing Firm With Reference To SME in RajasthanSunita MishraNo ratings yet

- Personal Project Handbook 2023-2024Document32 pagesPersonal Project Handbook 2023-2024Gayatri AroraNo ratings yet

- Event ManagementDocument3 pagesEvent ManagementAirene Abear PascualNo ratings yet

- LOCKv101 - Mode 8Document18 pagesLOCKv101 - Mode 8Nurul KanGen DyaNo ratings yet

- Trans World Airlines vs. CA G.R. No. 78656Document2 pagesTrans World Airlines vs. CA G.R. No. 78656Rhea CalabinesNo ratings yet

- WRAP Food Grade HDPE Recycling Process: Commercial Feasibility StudyDocument45 pagesWRAP Food Grade HDPE Recycling Process: Commercial Feasibility StudyHACHALU FAYENo ratings yet

- EX2600 LD Lip Assembly OfferingDocument1 pageEX2600 LD Lip Assembly Offeringr.brekenNo ratings yet

- Gas Velocity CalculatorDocument5 pagesGas Velocity CalculatoresutjiadiNo ratings yet

- Holiday Homework: FUN INDocument25 pagesHoliday Homework: FUN INSunita palNo ratings yet

- Carey MTD OrderDocument17 pagesCarey MTD OrderTHROnlineNo ratings yet

- Manejadora - Cba25uh - 018 Al 060 - Lennox - Ficha Tecnica - I LennoxDocument16 pagesManejadora - Cba25uh - 018 Al 060 - Lennox - Ficha Tecnica - I LennoxWalter BernalNo ratings yet

- Motorola Gp338 Users Manual 272276Document4 pagesMotorola Gp338 Users Manual 272276Uta GobelNo ratings yet

- WB 36Document21 pagesWB 36Nitin BajpaiNo ratings yet

- Unofficial Manual For Sknote Disto: Normal Stereo ModeDocument4 pagesUnofficial Manual For Sknote Disto: Normal Stereo ModedbiscuitsNo ratings yet

- Irs Wtc2020Document73 pagesIrs Wtc2020Himanshu SinghNo ratings yet

- Leon Cooperman's Letter To President To ObamaDocument3 pagesLeon Cooperman's Letter To President To ObamaLuis AhumadaNo ratings yet

- Passive Active Ve Reactive. Flow ControlpdfDocument441 pagesPassive Active Ve Reactive. Flow Controlpdfayabozgoren100% (1)

- MelEye - CatalogDocument4 pagesMelEye - CatalogChinmay GhoshNo ratings yet

- Tender Document - Haryana Data CentreDocument58 pagesTender Document - Haryana Data CentreBullzeye StrategyNo ratings yet

Annexure A-ECB - Quick Reference Card

Annexure A-ECB - Quick Reference Card

Uploaded by

Pankaj Kumar SaoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annexure A-ECB - Quick Reference Card

Annexure A-ECB - Quick Reference Card

Uploaded by

Pankaj Kumar SaoCopyright:

Available Formats

1

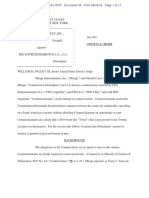

Quick referencer for the revised

ECB framework

Revised ECB framework- ready referencer 2

Requirement Track I Track II Track III

Medium term ECB denominated in foreign currency Long term ECB denominated in Medium term ECB denominated in INR

foreign currency

Minimum Average Maturity 3 years for ECB up to USD 5 mn & 5 years for ECB beyond that More than 10 years 3 years for ECB upto USD 5 mn & 5 years for

('MAM') ECB beyond that

Currency denomniation Foreign currency Foreign currency INR

Eligible borrower Companies in manufacturing, software development, shipping and All the Companies given in track 1 Companies in track I plus NBFCs, Section 8

companies airlines sector for any MAM within 10 years companies, societies, trust and cooperatives and

(refer notes 1) NGOs engaged in micro finance activities

Companies in infrastructure sector, NBFC-IFCs, NBFC-AFCs Holding

companies and CIC with MAM of 5 years and max of 10 years

subject to100 % hedging

Eligible lenders Foreign equity holders & Foreign equity holders & Foreign equity holders; and in case of section 8

(refer note 1 & 2) other specified financial institutions other specified financial institutions companies & NGOs, ECB can also be availed

from overseas organizations and individuals

satisfying certain conditions

Permitted end use Capital expenditures which inter alia includes overseas investment in For all purposes except-real estate, For all purposes except-real estate, investment in

JV/WOS and refinancing of existing ECB. Further, ECB can also be investment in capital market, domestic capital market, domestic equity investment,

availed for general corporate purpose (including working capital), equity investment, purchase of land and purchase of land and lending to entities with the

however, only from foreign direct/indirect equity holder or from a lending to entities with the said objects said objects.

group company for MAM of 5 years Exception-

Exceptions: NBFCs may raise ECBs for on-lending for any

- NBFC-IFCs, NBFC-AFCs can raise ECB only for financing activities including infrastructure as permitted by

infrastructure the concerned regulatory department of RBI.

- Holding Companies and CICs shall use ECB proceeds only for on-

lending to infrastructure Special Purpose Vehicles (SPVs).

Limits(for automatic Companies in infrastructure sector/Holding Companies/CIC/NBFC-IFCs, NBFC-AFCs - USD 750 mn

route) companies in software development sector- USD 200 mn

Entities in micro finanace - USD 100 mn

Other entities- USD 500 mn

Notes:

1 Only key extracts from the revised ECB framework which have been summarized here.

2 The term foreign equity holder for the purpose of ECB means: (a) direct foreign equity holder with minimum 25% direct equity holding by the lender in the borrowing entity, (b) indirect

equity holder with minimum indirect equity holding of 51%, and (c) group company with common overseas parent.

3 Only those NBFCs which comes under the regulatory purview of RBI could raise ECBs

4 RBI has delegated substantial powers to AD Banks to deal with ECB cases. These powers have been specified in this revised ECB framework.

You might also like

- SR Insights Non Convertible Debentures Entry Routes For Foreign InvestorsDocument8 pagesSR Insights Non Convertible Debentures Entry Routes For Foreign InvestorsHimashu DhakedNo ratings yet

- Fema - Ecb and Compounding - Final PDFDocument44 pagesFema - Ecb and Compounding - Final PDFRavi Sankar ELTNo ratings yet

- IB History Guide: Causes of The Great DepressionDocument2 pagesIB History Guide: Causes of The Great DepressionKatelyn CooperNo ratings yet

- Presentation by Cs R V Seckar Mobile No - 79047 19295 Email IdDocument21 pagesPresentation by Cs R V Seckar Mobile No - 79047 19295 Email IdShweta Prathamesh BadgujarNo ratings yet

- ECBDocument19 pagesECBSACHIDANAND KANDLOORNo ratings yet

- What Is Ecb?Document25 pagesWhat Is Ecb?Abhishek PanigrahiNo ratings yet

- PWC News Alert 19 January 2019 Changes To The Ecb FrameworkDocument4 pagesPWC News Alert 19 January 2019 Changes To The Ecb FrameworkShweta AgarwalNo ratings yet

- External Commercial BorrowingsDocument37 pagesExternal Commercial BorrowingsTrisha Agarwala100% (1)

- External Commercial 003Document23 pagesExternal Commercial 003mukeshloves17No ratings yet

- External Commercial Borrowings - IndiaDocument4 pagesExternal Commercial Borrowings - IndiaPPPnewsNo ratings yet

- ECB - RBI Guidelines: Prasanna Krishnan SBI Capital Markets Limited Revised: February/03/2010Document30 pagesECB - RBI Guidelines: Prasanna Krishnan SBI Capital Markets Limited Revised: February/03/2010lutfiali205No ratings yet

- RBI ECB GuidelinesDocument19 pagesRBI ECB GuidelinesnareshkapoorsNo ratings yet

- Benefits To Borrower:: Automatic RouteDocument4 pagesBenefits To Borrower:: Automatic RoutehemantsrNo ratings yet

- ECBDocument48 pagesECBArjit AgrawalNo ratings yet

- External Commercial Borrowings (Ecbs)Document5 pagesExternal Commercial Borrowings (Ecbs)Prateek MallNo ratings yet

- External Commercial Borrowings: Master DirectionDocument18 pagesExternal Commercial Borrowings: Master DirectionRajendra KumarNo ratings yet

- RBI DocDocument36 pagesRBI DocPritesh RoyNo ratings yet

- Funding Options: External Commercial BorrowingsDocument12 pagesFunding Options: External Commercial BorrowingsBhargav Tej PNo ratings yet

- Funding Options: External Commercial BorrowingsDocument12 pagesFunding Options: External Commercial BorrowingsKannu KhuranaNo ratings yet

- Structure OF External Commercial BorrowingDocument15 pagesStructure OF External Commercial BorrowingNitesh TanwarNo ratings yet

- External Commercial Borrowings (Ecb) : Release of Foreign Exchange by Authorised DealersDocument10 pagesExternal Commercial Borrowings (Ecb) : Release of Foreign Exchange by Authorised DealersAnonymous rkZNo8No ratings yet

- External Commercial Borrowing & Import Trade CreditDocument42 pagesExternal Commercial Borrowing & Import Trade CreditNikhil VarshneyNo ratings yet

- International Trade FinanceDocument19 pagesInternational Trade FinanceEknath BirariNo ratings yet

- External Commercial BorrowingDocument10 pagesExternal Commercial BorrowingKunal TapreNo ratings yet

- Ecb and Trade CreditDocument8 pagesEcb and Trade CreditSatyanag VenishettyNo ratings yet

- External Commercial BorrowingDocument8 pagesExternal Commercial BorrowingRatna HubliNo ratings yet

- External Commercial BorrowingsDocument17 pagesExternal Commercial BorrowingsRam PujariNo ratings yet

- Group 6 - FEMADocument31 pagesGroup 6 - FEMAYousha KhanNo ratings yet

- Xternal Ommercial Orrowings: Chinmay@sbhandari - inDocument176 pagesXternal Ommercial Orrowings: Chinmay@sbhandari - incachinmayNo ratings yet

- Loan Checklist - List of Compliances For A Loan TransactionDocument6 pagesLoan Checklist - List of Compliances For A Loan TransactionDinesh GadkariNo ratings yet

- External Commercial BorrowingDocument27 pagesExternal Commercial BorrowingNUPUR SAININo ratings yet

- Major FunctionsDocument3 pagesMajor Functionspooja_chowkseyNo ratings yet

- Master Direction - ECBDocument27 pagesMaster Direction - ECBAadya BansalNo ratings yet

- External Commercial Borrowings (Ecb)Document11 pagesExternal Commercial Borrowings (Ecb)Soumik ChatterjeeNo ratings yet

- Master Circular On External Commercial Borrowings and Trade CreditsDocument43 pagesMaster Circular On External Commercial Borrowings and Trade Creditsway2iimaNo ratings yet

- Presentatio N On:: ECB & FCCBDocument41 pagesPresentatio N On:: ECB & FCCBMilan PateliyaNo ratings yet

- Merge Rs & Acqui Siti OnsDocument68 pagesMerge Rs & Acqui Siti OnsVisakan KandaswamyNo ratings yet

- E C B PresntationDocument32 pagesE C B PresntationJayveer VoraNo ratings yet

- Economy - MEGA Question Bank For Prelims 2024 Sleepy Classes IASDocument131 pagesEconomy - MEGA Question Bank For Prelims 2024 Sleepy Classes IAShemanthhrsu9No ratings yet

- Submitted To: Mr. K.K.Jindal Submitted By: Disha Sogani (09RBA) Ritu Rani (38A) Romi (03RBA) Saurabh Gupta (41B) Shakun Bishnoi (42A) Sweta (7RBA)Document42 pagesSubmitted To: Mr. K.K.Jindal Submitted By: Disha Sogani (09RBA) Ritu Rani (38A) Romi (03RBA) Saurabh Gupta (41B) Shakun Bishnoi (42A) Sweta (7RBA)shakun bishnoiNo ratings yet

- Join Caiib With Ashok On Youtube & App: BFM Module - ADocument34 pagesJoin Caiib With Ashok On Youtube & App: BFM Module - ASamir BuddheNo ratings yet

- Regulatory Provisions Under EcbDocument6 pagesRegulatory Provisions Under EcbAllwyn FlowNo ratings yet

- External Commercial Borrowing: Team:-InnovatorsDocument24 pagesExternal Commercial Borrowing: Team:-Innovatorsravish419No ratings yet

- External Commercial BorrowingsDocument34 pagesExternal Commercial BorrowingsVishal MadlaniNo ratings yet

- Foreign FundingDocument24 pagesForeign FundingharshNo ratings yet

- UFCE RBI REGULATION Jan 23Document12 pagesUFCE RBI REGULATION Jan 23renu.balaNo ratings yet

- External Commercial BorrowingDocument23 pagesExternal Commercial BorrowingAnshika SharmaNo ratings yet

- FED Master Direction No. 5 External Commercial Borrowings, Trade Credit Dec 2021Document27 pagesFED Master Direction No. 5 External Commercial Borrowings, Trade Credit Dec 2021Prabhat SinghNo ratings yet

- Project Finance - Regulatory FrameworkDocument11 pagesProject Finance - Regulatory FrameworkHimanshu MukimNo ratings yet

- External Commercial BorrowingDocument9 pagesExternal Commercial Borrowingapi-3822396100% (3)

- Presentation On ECBDocument37 pagesPresentation On ECBD Attitude KidNo ratings yet

- External Commercial Borrowings (ECB)Document6 pagesExternal Commercial Borrowings (ECB)manthan1312No ratings yet

- ECB Trade CreditDocument27 pagesECB Trade CreditSachin DakahaNo ratings yet

- Ecb and Trade CreditsDocument10 pagesEcb and Trade CreditsVarun JainNo ratings yet

- External Commercial Borrowings PDFDocument26 pagesExternal Commercial Borrowings PDFAmit SinghNo ratings yet

- FEMABudgetannoucements 06 03Document4 pagesFEMABudgetannoucements 06 03Pawan KvsNo ratings yet

- Contingent Convertible Bonds, Corporate Hybrid Securities and Preferred Shares: Instruments, Regulation, ManagementFrom EverandContingent Convertible Bonds, Corporate Hybrid Securities and Preferred Shares: Instruments, Regulation, ManagementNo ratings yet

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportFrom EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportNo ratings yet

- Credit Derivatives and Structured Credit: A Guide for InvestorsFrom EverandCredit Derivatives and Structured Credit: A Guide for InvestorsNo ratings yet

- Financial Digitalization and Its Implications for ASEAN+3 Regional Financial StabilityFrom EverandFinancial Digitalization and Its Implications for ASEAN+3 Regional Financial StabilityNo ratings yet

- 14 Ashok Kumar GuptaDocument12 pages14 Ashok Kumar GuptaPankaj Kumar SaoNo ratings yet

- 36 Raja ReddyDocument12 pages36 Raja ReddyPankaj Kumar SaoNo ratings yet

- 8 Usha BhatnagarDocument12 pages8 Usha BhatnagarPankaj Kumar SaoNo ratings yet

- Process Fee FormDocument67 pagesProcess Fee FormPankaj Kumar SaoNo ratings yet

- Reporting of Loan Agreement Details Under Foreign Exchange Management Act, 1999Document7 pagesReporting of Loan Agreement Details Under Foreign Exchange Management Act, 1999Pankaj Kumar SaoNo ratings yet

- Samala vs. Valencia 512 SCRA 1 A.C. No. 5439 January 22 2007Document11 pagesSamala vs. Valencia 512 SCRA 1 A.C. No. 5439 January 22 2007Angelie FloresNo ratings yet

- A LoRa 868MHz Collinear Antenna - Projects by KeptenkurkDocument8 pagesA LoRa 868MHz Collinear Antenna - Projects by Keptenkurkjax almarNo ratings yet

- Accounting ProblemsDocument31 pagesAccounting ProblemsJanna Gunio100% (1)

- 3 Gimp Size Color Contrast Crop RedeyeDocument2 pages3 Gimp Size Color Contrast Crop Redeyeapi-370628488No ratings yet

- ForestDocument30 pagesForestZarjaan ShahidNo ratings yet

- Coupled Level-Set and Volume of Fluid (CLSVOF) Solver ForDocument18 pagesCoupled Level-Set and Volume of Fluid (CLSVOF) Solver ForBharath kumarNo ratings yet

- Diploma in MarineDocument18 pagesDiploma in MarineKaung Min MoNo ratings yet

- A4064-2 Datasheet en - 201003Document1 pageA4064-2 Datasheet en - 201003Khalid ElfiqyNo ratings yet

- 2193-Article Text-2779-1-10-20171231Document11 pages2193-Article Text-2779-1-10-20171231Roisya marzuqiNo ratings yet

- ICFO Slides Part 2Document33 pagesICFO Slides Part 2Bhavesh ChauhanNo ratings yet

- Assessment of Capital Budgeting Technique in Evaluating The Profitability of Manufacturing Firm With Reference To SME in RajasthanDocument5 pagesAssessment of Capital Budgeting Technique in Evaluating The Profitability of Manufacturing Firm With Reference To SME in RajasthanSunita MishraNo ratings yet

- Personal Project Handbook 2023-2024Document32 pagesPersonal Project Handbook 2023-2024Gayatri AroraNo ratings yet

- Event ManagementDocument3 pagesEvent ManagementAirene Abear PascualNo ratings yet

- LOCKv101 - Mode 8Document18 pagesLOCKv101 - Mode 8Nurul KanGen DyaNo ratings yet

- Trans World Airlines vs. CA G.R. No. 78656Document2 pagesTrans World Airlines vs. CA G.R. No. 78656Rhea CalabinesNo ratings yet

- WRAP Food Grade HDPE Recycling Process: Commercial Feasibility StudyDocument45 pagesWRAP Food Grade HDPE Recycling Process: Commercial Feasibility StudyHACHALU FAYENo ratings yet

- EX2600 LD Lip Assembly OfferingDocument1 pageEX2600 LD Lip Assembly Offeringr.brekenNo ratings yet

- Gas Velocity CalculatorDocument5 pagesGas Velocity CalculatoresutjiadiNo ratings yet

- Holiday Homework: FUN INDocument25 pagesHoliday Homework: FUN INSunita palNo ratings yet

- Carey MTD OrderDocument17 pagesCarey MTD OrderTHROnlineNo ratings yet

- Manejadora - Cba25uh - 018 Al 060 - Lennox - Ficha Tecnica - I LennoxDocument16 pagesManejadora - Cba25uh - 018 Al 060 - Lennox - Ficha Tecnica - I LennoxWalter BernalNo ratings yet

- Motorola Gp338 Users Manual 272276Document4 pagesMotorola Gp338 Users Manual 272276Uta GobelNo ratings yet

- WB 36Document21 pagesWB 36Nitin BajpaiNo ratings yet

- Unofficial Manual For Sknote Disto: Normal Stereo ModeDocument4 pagesUnofficial Manual For Sknote Disto: Normal Stereo ModedbiscuitsNo ratings yet

- Irs Wtc2020Document73 pagesIrs Wtc2020Himanshu SinghNo ratings yet

- Leon Cooperman's Letter To President To ObamaDocument3 pagesLeon Cooperman's Letter To President To ObamaLuis AhumadaNo ratings yet

- Passive Active Ve Reactive. Flow ControlpdfDocument441 pagesPassive Active Ve Reactive. Flow Controlpdfayabozgoren100% (1)

- MelEye - CatalogDocument4 pagesMelEye - CatalogChinmay GhoshNo ratings yet

- Tender Document - Haryana Data CentreDocument58 pagesTender Document - Haryana Data CentreBullzeye StrategyNo ratings yet