Professional Documents

Culture Documents

Strategic Planning Cases: Instructor: Moataz Darwish

Strategic Planning Cases: Instructor: Moataz Darwish

Uploaded by

Baher WilliamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Strategic Planning Cases: Instructor: Moataz Darwish

Strategic Planning Cases: Instructor: Moataz Darwish

Uploaded by

Baher WilliamCopyright:

Available Formats

Edinburgh Business School MBA

AUC Academic Partner

Strategic Planning

Cases

Instructor: Moataz Darwish, MBA

Introduction

The strategist has to think more widely and deeply than

the individual functional specialists.

This is an extremely difficult game to play and it goes without saying that

unless you practice you will never get into the top right hand box

of Strategic thinking.

Introduction – Moataz Darwish 2

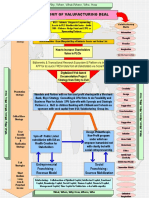

The SP Model

• 4 rows

• 5 eggs

• 12 boxes

Introduction – Moataz Darwish 3

The Augmented Process Model

Introduction – Moataz Darwish 4

Augmented Model - summary

Who Decides To Do What Analysis And Diagnoses Analysis And Diagnoses Choice Implementation

OBJECTIVES THE GENERAL INTERNAL FACTORS GENERIC STRATEGY RESOURCES AND

Business Definition ENVIRONMENT Value chain ALTERNATIVES STRUCTURE

Mission Macroeconomic analysis: Shareholder value analysis Corporate and business Divisional, functional, matrix

Shareholder wealth unemployment, inflation, Competence (resources/routines strategy Managerial style

Gap analysis interest rate, exchange rate matrix) Stability, expansion, Critical success factors

Means and ends Forecasting Architecture Retrenchment, Combination Incentives

Ethics Competitive advantage of Experience curve Cost leadership, Differentiation, Resource allocation

Profit maximisation nations Economies of scale Focus Opportunity cost

Environmental scanning Economies of scope Segmentation Marginal analysis

Growth vector (Ansoff)

Stakeholder map PEST Innovation Strategy variations Optimisation

Scenarios Synergy Diversification: related and Budgets

Credible, quantifiable,

The industry and international Joint production Unrelated (Fam Matrix) Critical success factors

disaggregated, economic,

financial environment Opportunity cost Vertical integration Evaluation and control

Demand and supply, price Marginal analysis Mergers and acquisitions Performance measures

STRATEGISTS

determination, elasticity Ratios Joint ventures and alliances Ratios

Prospector, analyzer, defender,

reactor Barriers to entry Gearing Pricing: leadership, limit, Degree of Planning and type

Principal agent Forms of competition: perfect, Cash flow predatory of Control

Risk aversion imperfect, oligopoly, Benchmarking Strategy choice Monitoring systems

Team composition monopoly Human resource management Risk analysis

Segmentation Managerial perceptions

Group dynamics Culture: power, role, task, FEEDBACK

Differentiation Net present value

Corporate Governance personal

Quality Competitive position Familiarity Communication

Strategic groups Product life cycle Scenarios Management style

Market share Break even Adaptability

Portfolio analysis (BCG) Payback Learning organisation

Perceived differentiation Sensitivity

Strategic groups SWOT

Competitive reaction Game theory

First mover

Five forces

Elements of competitive adv

ETOPS

Strategic advantage profile (SAP)

Introduction – Moataz Darwish

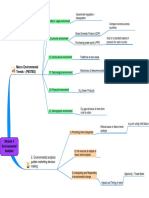

Objective –> Strategy -> Recommendations

Environmental/Industry/Internal Scanning ETOP

SWOT

SAP

Introduction – Moataz Darwish

SWOT to Strategy

ETOP Short term Corporate Ex. Cost/mkt share/efficiency

SWOT SBU

SAP Long Term

Corporate Ex. Move along Ansoff matrix

SBU

In strategic terms the distinction is between actions that are intended to deal with immediate issues (short term),

such as reducing cost to avoid bankruptcy, rather than those that deal with the basis on which the company

competes, such as building competences, developing a portfolio and adjusting market position to generate

competitive advantage (Long term). There is often a conflict between the need to deal with the immediate

imperatives and building long term competitive advantage; this can be a permanent feature of companies in a

volatile environment in which there is a continual need to make trade offs.

Introduction – Moataz Darwish

SP Exam

• Question 1: Data Based Case (1/3 of the exam grade)

• Question 2: Real Life Case (1/3 of the exam grade)

1. Identify what the story is about - success/failure/new venture…etc

2. Identify reasons/causes (ex. for the failure…)

• Question 3: Essay (1/3 of the exam grade)

• Present a balanced argument (for and against)

• Arrive to conclusion backed w/ argument

• Plenty of opportunities to incorporates ideas

Introduction – Moataz Darwish 8

Exam Tips

• No right and wrong

• Read the question first

• Put things in order (STUCTURE) - note taking (closet organizer),

(Case Model Tools->Analyses->conclusion)

• Don’t simply mention the tool/concept…APPLY IT

• Explain WHY you’re applying a certain tool/concept

• Make use of ALL data…it’s there for a purpose

• Leave space after every case and sub-sections of the model to revisit if possible

• Have a go at ALL Questions and ALL PARTS of Questions

• Watch out for comparisons in the single case (between 2 periods, 2 companies…),

that would entail duplicating the model structure of both.

• Do not panic because you have not completely filled in the answer book; we are

looking for good quality applications and reasoned arguments.

Introduction – Moataz Darwish 9

Exam Tips

Examination grading

• Each of the three questions in the examination carries equal weighting.

• Usually each question consists of more than one part, but marks are not

specifically awarded to each individual part.

• This is because there is often a degree of overlap among different parts and the

examiner takes an overall view of how the question was answered.

• Obviously if part of a question is not tackled, the mark will be downgraded.

• Finally, the examination paper as a whole is evaluated in terms of its analytical

content, the application of strategic concepts, any insights and the quality of the

arguments; in marginal cases, the decision is made on the basis of overall content

rather than simply taking the sum of the marks on the three questions.

• Long vs. short term (see notes below)

EBS MBA / AUC Introduction – Moataz Darwish 10

Case Study Analyses

Put things in order – note taking – closet organizer

Case

Relate to Break down to Deduct

Paragraphs Tools

Model Matrices Analyses

Key (Buzz) Concepts

words

Introduction – Moataz Darwish 11

‘Focus on Nestlé’ Case

Question 2, Jun 07 Exam

Required:

1. What changes to the strategic process in Nestlé did Mr Brabeck introduce after taking over from

Mr Maucher?

2. There is some doubt on future strategic moves. Set up a SWOT analysis and advise Mr

Brabeck on a course of action.

Introduction – Moataz Darwish 12

Active-Reading Methodology - Nestlé’ Case

Objective->Name+what industry?

1. By 2004 Nestlé, a Swiss food and drink group,

Implementation->org str

2. was by far the biggest in its sector.

Industry/Internal->Mkt share

3. For twenty years, Nestlé had been growing through

Past objective -> growth

4. a series of acquisitions and new market entries,

Past Strategy->expansion-> >Acq+mkt entry->Ansoff?

5. but its CEO, Mr Brabeck, still had plans to

Strategist->Defender?

6. maintain or even increase its rate of growth.

Objective->profitability?

Strategy->stabilization?

7. In order to do so he recognized that he would

8. have to transform Nestlé from being a group of

9. Unrelated businesses into an efficient and Strategy->from unrelated diversification to

coordinated operation. internal efficiency through change mgt

-> from expansion to stabilization?

Introduction – Moataz Darwish 13

Exercise

• Please practice the active-reading methodology for the rest of the

case and solve the case accordingly.

Introduction – Moataz Darwish

Nestlé’ Case

1. A major difference between Mr Brabeck and His competitors is the approach to growth.

2. While Nestlé was expanding, most of the other big companies in the sector either shrank or

remained stable. For example, between 2000 and

3. 2004, Unilever cut its workforce by 14%, closed 100 factories, and reduced its brands from 1600

4. to 400. In 2003, Cadbury announced the closure of 25 factories and a 10% reduction in the

5. workforce. Yet while Nestlé kept growing, its profit margins lagged behind those of its major

6. competitors. It has been argued that Nestlé should have returned cash to shareholders rather

7. than using it to fund growth but, on the other hand, between 1975 and 2004, Nestlé’s share

8. price rose by about three times the S&P index.

9. The growth trail

10. Nestlé’s current growth trajectory began under Mr Brabeck’s predecessor, Mr Maucher, who took

11. over in 1981 after Nestlé had made a misguided expansion into hotels and restaurants. Mr

12. Maucher sold off the unprofitable businesses and decided that Nestlé would focus on mineral

13. water,ice cream, pet food and confectionery. In 1988, Mr Maucher bought Rowntree, famous for

14. Kit Kat and Smarties, and in 1992 Perrier; he also purchased the market dominant ice cream

15. makers in Spain, Australia and Canada. When he took over in 1997, Mr Brabeck continued

16. buying, culminating in 2001 with the purchase of Ralston Purina, a US pet food company, for $10

17. billion; this made Nestlé one of the two biggest pet food makers in the world.

Introduction – Moataz Darwish 15

Nestlé’ Case

1. Mr Brabeck versus Mr Maucher

2. The two CEOs initially appeared to have a similar approach and issued a circular setting out what

3. would not change under Mr Brabeck. There were two ‘unique’ features they wished to preserve:

4. first, IT would not be important in the day to day running of Nestlé because the focus was on its

5. people, products and brands; second, the commitment to decentralisation would remain to

6. cater to local tastes and maintain emotional links with distant clients.

7. But within two years Mr Brabeck recognised that these ‘unique’ features were not contributing to

8. competitive advantage. Decentralisation was abandoned with the establishment of SBUs

9. dealing with similar products. But this was resisted by many managers who did not want to

10. lose their independence; the result was a management shake-out. But Mr Brabeck was now

11. faced with a conundrum. Companies such as Danone, which focused only on water, diary

12. products and biscuits, were doing better than Nestlé. So the question had to be faced whether

13. focus was necessary in the food industry. At the same time, the attempt to transform Nestlé into a

14. global business ran the risk of losing the ability to adapt to local conditions. For example, there are

15. 200 varieties of Nescafé, the instant coffee brand. Mr Brabeck turned his attention to cost cutting

16. and efficiency and closed 150 under-performing factories; he also aimed to reduce administrative

17. costs by 1% by 2006. In 2000, Mr Brabeck June 2007launched the ‘Global Business Excellence’ project

18. with SAP, a German software company, to develop a company wide resource planning

19. system which will be based on one technology platform providing more accurate information on

20. raw materials and stock levels. This standardisation is necessary because different

21. versions of software are in use because of the legacy from acquisitions. There was no

22. coordination in purchasing, resulting in Nestlé paying 20 different prices for vanilla to the same

23. supplier. In some regions, such as the US and Asia, steps have already been taken to

24. standardise systems with considerable success. But whether this can be made to work at a global

25. level remains to be seen. It had not taken Mr Brabeck long to dispense with

26. the two ‘unique’ features. But some analysts claim to have been puzzled that Mr Brabeck

27. signed up to those in the first place, and that he was now acting in the same way as other CEOs of

28. big complex companies.

Introduction – Moataz Darwish 16

Nestlé’ Case

1. Some lurking issues

2. There is some doubt as to how long it will take to make the new resource planning system fully functional. The initial

3. prediction was for 2006, revised to 2007, and some analysts doubt whether it will be running before 2010. This will

4. inevitably delay the full transformation of Nestlé that Mr Brabeck needs to compete effectively. Nestlé is so well known that

5. it is exposed to a high level of reputational risk. In the 1970s, Nestlé was involved in a scandal that it has never

6. shaken off over sales of baby-milk formulae in poor countries. In 2002, Nestlé made a blunder by trying to extract payments

7. from Ethiopia, which at the time was impoverished. Continuing efforts are directed at maintaining Nestl é’s reputation which

8. is essential for a food company; the consumer complaints hotlines follow up every complaint; also, every year some products

9. are withdrawn. The obesity epidemic has forced Nestlé to reconsider its image and Mr Brabeck is attempting to reposition

10. Nestlé as a ‘food, nutrition, health and wellness’ company. A new Nutrition division has been created that produces

11. clinical nutrition, performance nutrition and baby food. Nestlé is now selling a ‘new nutritional message’ that food provides

12. health benefits rather than making people fat. By 2004, Nestlé had introduced 600 new or reformulated products in 50

13. countries by adding minerals and vitamins to products such as yogurt and ice cream. But there is no guarantee of success

14. even in the new health conscious climate. For example, the new line of yogurts, LC1, that is meant to improve the

15. immune system and digestion, failed in several European countries in the face of competition

16. from a similar product Actimel, produced by Danone. The push into new markets is continuing, and

17. Nestlé is willing to enter countries such as Iraq and Iran so long as there is a free market, a large

18. enough population, and a welcome for foreign investors. The result was that organic growth

19. (excluding acquisitions) from 1999 to 2003 was 5.7% compared with 2.7% for Unilever; but there

20. are significant risks associated with entering new and untried markets.

21. Any attempt to grow further by acquisition is likely to cause problems with antitrust laws.

22. There is also the problem that existing portfolios do not often fit; for example, if Nestl é went

23. ahead with a potential acquisition of General Mills it would probably have to sell off about half the

24. business. Nestlé still has some non-core businesses. It has major ownership of Alcon, an ophthalmological equipment maker,

25. and L’Oréal, the French cosmetics company. It has been rumoured that Nestlé is considering acquiring total ownership of

26. L’Oréal and producing innovative nutritional cosmetic products. The big issue is whether Mr Brabeck will make any further

acquisitions before Nestlé transforms itself into an effective global company with strong controls and a low cost base.

Introduction – Moataz Darwish 17

Case 3 - June 2008

• Question 3

• The CEO of a large multinational diversified company was

concerned that profitability had been falling for the previous two

years and that the company had not been exploiting

opportunities effectively. He employed two famous management

consultants to provide independent remedies and they provided two

completely different sets of recommendations. One focused on the

need to reduce the management structure (delayering) and

improve internal communications; the other criticised product

positioning and the composition of the product portfolio. Each

was supported by highly convincing arguments. The CEO asked you

to help choose between them. Your response was that there was no

scientific basis for choosing between them and, depending on their

impact on the strategic process, it may be advisable to apply both.

• Why is it impossible to produce scientifically acceptable evidence

that either of the approaches is correct?

• Demonstrate the potential impact of the two sets of

recommendations on the strategic process. Is it advisable to apply

both?

Introduction – Moataz Darwish

Case 3 - Dec 2007

• Question 3

• A major multinational had announced losses for the first time

ever, primarily due to poor performance in 7 out of 15

Divisions. The non-executive Board members had met to decide

on the fate of the CEO. The Chairman said that as he saw it the

problem was due to the CEO’s lack of control both in financial

terms and in the strategic direction of the company; he felt that

this shortcoming should have been spotted before. The Deputy

Chairman disagreed saying that the CEO had consciously adopted

the emergent rather than the planning approach to strategy.

The Chairman found it difficult to accept that the difference was

one of managerial approach rather than efficiency.

• Your job is to explain to him the differences in the two

approaches, their benefits and drawbacks and how they

would impact on the strategy process.

Introduction – Moataz Darwish

Case 3 - June 2007

Question 3

AcmeRadios has developed from its home base producing high performance

radios to a leading multinational electronics conglomerate producing

and selling a portfolio of 14 products in 23 countries. The portfolio now

includes transmitters, telephone components, laser direction finders and

electronic gun sights. It had been pointed out to the CEO that AcmeRadios

was facing increasing competition in all of its markets and that overall

profitability had decreased steadily for the past three years. He made,

therefore, the following announcement. If we are going to maintain our

market position, we need to set ourselves high level objectives. There is

no point to resting on our laurels; even excellent performance can be

improved on. So let’s stretch ourselves: here’s what we are going to do

Establish AcmeRadios as a leading high quality low cost brand in all

markets Increase return on sales for every product by 5%

1. Are managers likely to regard these ‘stretch’ objectives as credible?

2. What does the CEO not understand about setting objectives?

Introduction – Moataz Darwish

Case 3 - June 2006

• Question 3

• The Fairline cosmetics company prided itself on its structured approach

to management. The launch of its new shampoo colouring product was a

model of clarity and financial analysis. Projections of future market

growth and market shares were carried out, cash flow estimates were

derived, probabilities were worked out and the resulting weighted cash

flow profile easily met the company hurdle rate. The only problem was

that three years later the shampoo was a complete flop. The CEO was

surprised when he learned about this and retained a strategist to find out

what had caused the disaster, given that in his words, ‘We had done

everything right.’

• What are the important issues that the company could have got wrong?

Introduction – Moataz Darwish

Case 3 - Dec 2006

Question 3

AcmeService had been operating a successful mobile car service business for over

twenty years. Customers could have their car serviced at home, at work or any

other location; the depot held component packs for the range of cars dealt with and

a fully equipped truck with two highly trained personnel could service up to 5 cars

in a day. When the CEO heard that CompuServe was going bankrupt he acted

swiftly and acquired the company and its assets. CompuServe also ran a mobile

service company but this was for computers in small businesses. The CEO argued

that AcmeService’s core competence lay in providing mobile services and that

acquiring CompuServe was a product extension. He felt that the control centre

could easily cope with the additional demands and that there was a significant

economy of scope.

Three years later, the CEO was desperately looking for a buyer who would take

CompuServe off his hands. Not only were the computer operations still losing

money, but the car service business had also suffered a major reduction in

profits.

• The CEO had been very positive about the acquisition, but as a cynical strategist

what do you think went wrong?

Introduction – Moataz Darwish

Dec 05

• A long established international diversified company started to make

losses three years ago and had been unable to improve significantly on

the situation. The CEO, who had been in office for twenty years, asked

his top management team for an explanation. The production director said

that more control over operations was required and project

management techniques should be more widely used. The marketing

manager said he would be able to increase market share with a larger

marketing budget. The finance director said that no one understood the

need for financial stringency and recommended all SBUs should be

instructed to reduce costs by 4%. The personnel manager said that

working conditions had deteriorated and were leading to a high

turnover. The CEO was rather pleased. He reckoned that these

observations provided the basis for tackling the problem of poor profit

performance. Then the strategic planner spoke up. She stated that

tackling individual issues was not going to resolve the basic problem,

which was a weak strategic process.

• The CEO was not accustomed to being challenged. He said ‘You had better

explain yourself, otherwise it seems to me that your role in this company

is not looking very bright.’

• How should the strategic planner reply?

Introduction – Moataz Darwish

Jun 05

• Question 3The finance director was concerned about

the way the senior management team was allocating

its time. In order to rationalise this, he carried out a

shareholder value analysis. This involved identifying

the cost and revenue streams associated with the six

product lines and discounting the net revenues. He

found that there was a mismatch between his

calculation of how value was created and how his

colleagues spent their time. But when he presented

his findings, his recommendation that the senior

team should change its behaviour met with

considerable resistance.

• Required:

1. Why did the mismatch occur?

2. Why was there resistance to change?

Introduction – Moataz Darwish

Dec 04

• A large multinational diversified company was faced with declining

market share and profit margins in all of its markets. The company

strategist stated that this was due to increased competitive

pressures. However, the Board decided to give SBU CEOs a clear set

of objectives and incentives to stop the decline in market shares and

profits. The following four objectives were communicated to the

SBUs.

1. Achieve a minimum of 20% return on sales

2. Reduce direct unit cost by 3% per annum

3. Achieve at least third place in terms of market share in all 10

international markets

4. Develop a reputation for product quality and top class after sales

service

• As an incentive, each SBU CEO would be rewarded for every 1%

increase in return on sales above 20% and would be penalised for

each 1% below the 3% cost reduction target

• Required:

1. Do you think that these objectives are all likely to be achievable?

2. Is the proposed incentive scheme likely to lead to achieving the

objectives?

3. If not, what kind of incentive scheme would you suggest?

Introduction – Moataz Darwish

Jun 04

• A major company was concerned about its exposure to

strategic risk and hired a risk specialist to rationalise its

approach. At the briefing session, the Finance Director said

that this was a major step forward and that once the risk

profile of the company had been determined appropriate

action could be taken. However, the risk specialist replied that

it was not so simple as that and posed a couple of questions:

• What do you think is the difference between risk and

uncertainty?

• What is your attitude to risk?

• The risk specialist claimed that his proposals would depend on

the answers to these questions as much as identifying where

risks actually lay.

• Required:

1. How might risk and uncertainty be incorporated into strategy

making by a risk averse company compared with a high risk

taking company.

2. What do you think are the main strategic benefits and

drawbacks in each case.

Introduction – Moataz Darwish

Dec 03

• Question 3A large company appointed a new Finance

Director who was previously a Professor of Finance at a

major University. At the first Board meeting a new

product was given approval despite the fact that the

net present value was negative. The Finance Director

was aghast and argued that since the appraisal had not

taken into account projected cash flows and objective

measures of risk the decision was seriously in error.

Afterwards the CEO persuaded him that in fact the

decision was quite justifiable because there is a

difference between a financial analysis and the process

which leads to a strategic decision.

• Required:

• Set out the arguments you would have used as CEO to

persuade the Finance Director; you would also have to

reassure the Finance Director that financial analysis is

valuable and that his contribution was taken into

account.

Introduction – Moataz Darwish

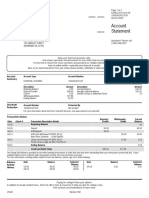

• Price earnings ratio

• I am confused by the answer in the text of Case Study 8.1.

The answer in the appendix states P/E is share price divided

by dividend per share. I thought it was earnings per share?

• Also, where did the figure of 100 come from, by which 28 is

divided to get a 4% return. Sorry, but I am having trouble

following how the estimates were made from the P/E of 28

given in the text, since we are not told the share price,

number of shares outstanding, or the actual earnings per

share figure.

• This is an application of Finance ideas: I used the approach in

Finance section 2.5 in which it is assumed that earnings per

share and dividends are the same thing.

• So think about what the P/E ratio is telling you: if the price

were 10 times the earnings this implies 10% rate of return,

i.e. the rate of return is the converse of the P/E ratio. So with

a P/E ratio of 25 the implied rate of return is 4%; I said that a

P/E ratio of 28 comes to less than 4%. The important point

here is that the very high P/E ratio implies a low rate of

return.

Introduction – Moataz Darwish

Introduction – Moataz Darwish

You might also like

- Assignment Financial Decision MakingDocument10 pagesAssignment Financial Decision Makingchopheltshering67No ratings yet

- Assignment Task: Read The Following Scenario, and Prepare A Report With The Guidelines ProvidedDocument4 pagesAssignment Task: Read The Following Scenario, and Prepare A Report With The Guidelines ProvidedSuraj Apex0% (3)

- Busi97318 Corporate Finance Tutorial 7: MSC Finance and AccountingDocument48 pagesBusi97318 Corporate Finance Tutorial 7: MSC Finance and AccountingSamir IsmailNo ratings yet

- Revenue (Sales) XXX (-) Variable Costs XXXDocument10 pagesRevenue (Sales) XXX (-) Variable Costs XXXNageshwar SinghNo ratings yet

- ANATOMY OF Valufacturing Deal .Document26 pagesANATOMY OF Valufacturing Deal .BabarNo ratings yet

- 7 - The Stock MarketDocument20 pages7 - The Stock MarketcihtanbioNo ratings yet

- Tutorial 5Document66 pagesTutorial 5yitong zhang100% (1)

- Finc361 - Lecture - 05 - Stock Valuation - Continued PDFDocument38 pagesFinc361 - Lecture - 05 - Stock Valuation - Continued PDFLondonFencer2012No ratings yet

- ED 101 OR EDG 1 THE COURSE STUDY COMMUNICATION SKILLS ASSIGNMENTS 1 2 FOR THE YEAR 2017 at THE ZAMBIAN OPEN UNIVERSITY DATE 19 DECEMBER 2016 A MONDAYDocument2 pagesED 101 OR EDG 1 THE COURSE STUDY COMMUNICATION SKILLS ASSIGNMENTS 1 2 FOR THE YEAR 2017 at THE ZAMBIAN OPEN UNIVERSITY DATE 19 DECEMBER 2016 A MONDAYTapiwa Namwila NalungweNo ratings yet

- Case StudyDocument29 pagesCase Studysherif_awadNo ratings yet

- (HRM-DH45ISB-1) Nguyễn Minh Thảo - Mindmap Session 1 - 31191022307Document1 page(HRM-DH45ISB-1) Nguyễn Minh Thảo - Mindmap Session 1 - 31191022307Ng. Minh ThảoNo ratings yet

- Part I - Investing in StocksDocument97 pagesPart I - Investing in StocksPJ DavisNo ratings yet

- Morgan Stanley On Indian Economy Building Stronger Recovery WeDocument23 pagesMorgan Stanley On Indian Economy Building Stronger Recovery Wemanitjainm21No ratings yet

- Daily Stock Market Report SampleDocument2 pagesDaily Stock Market Report SampleVikash GoelNo ratings yet

- Lesson 2 - The Financial MarketDocument32 pagesLesson 2 - The Financial MarketJames Adam VecinoNo ratings yet

- BTC Options: Dissecting Volatility TrendsDocument38 pagesBTC Options: Dissecting Volatility TrendsVishvendra SinghNo ratings yet

- Job Design MindmapDocument1 pageJob Design MindmapabuadamNo ratings yet

- Valuation of Stressed Assets: The Institute of Cost Accountants of IndiaDocument43 pagesValuation of Stressed Assets: The Institute of Cost Accountants of IndiaAny YnaNo ratings yet

- International Finance Lecture SlidesDocument27 pagesInternational Finance Lecture Slidesmaryam ashfaqNo ratings yet

- AQA A Level Business Studies Unit 8.2Document20 pagesAQA A Level Business Studies Unit 8.2malcewanNo ratings yet

- Tutorial 06 AnsDocument3 pagesTutorial 06 Anscharlie simo100% (2)

- Advanced Management AccountingDocument10 pagesAdvanced Management AccountingKhalid AhmedNo ratings yet

- Chapter 3.2 Futures HedgingDocument19 pagesChapter 3.2 Futures HedginglelouchNo ratings yet

- International Finance Assignment - SolutionDocument5 pagesInternational Finance Assignment - SolutionFagbola Oluwatobi OmolajaNo ratings yet

- Group 9 IndicatorsDocument20 pagesGroup 9 IndicatorsJhay Dela TorreNo ratings yet

- Chapter 17 Solutions BKM Investments 9eDocument11 pagesChapter 17 Solutions BKM Investments 9enpiper29100% (1)

- Nanyang Business School AB1201 Financial Management Tutorial 5: Risk and Rates of Return (Common Questions)Document3 pagesNanyang Business School AB1201 Financial Management Tutorial 5: Risk and Rates of Return (Common Questions)asdsadsaNo ratings yet

- CH 13Document28 pagesCH 13ReneeNo ratings yet

- KTML Annual 2011Document364 pagesKTML Annual 2011Mian Asif BashirNo ratings yet

- Basel 3Document32 pagesBasel 3Venkat SaiNo ratings yet

- Process of Fundamental Analysis PDFDocument8 pagesProcess of Fundamental Analysis PDFajay.1k7625100% (1)

- Technical Analysis: Expo-Nential Moving AverageDocument89 pagesTechnical Analysis: Expo-Nential Moving Averageman_oj26No ratings yet

- 7.2.8 Percentage-Of-Sales Method Worksheet and DiscussionDocument3 pages7.2.8 Percentage-Of-Sales Method Worksheet and DiscussionMikie AbrigoNo ratings yet

- Day2 1Document111 pagesDay2 1Antariksh ShahwalNo ratings yet

- Business Valuation and Analysis Using Financial StatementsDocument20 pagesBusiness Valuation and Analysis Using Financial Statementsrovvy85No ratings yet

- Risk ManagementDocument22 pagesRisk Managementkirang gandhiNo ratings yet

- SAPM Portfolio RevisionDocument9 pagesSAPM Portfolio RevisionSpUnky RohitNo ratings yet

- Stock Market Investing and Fundamental Analysis For Equity InvestmentsDocument53 pagesStock Market Investing and Fundamental Analysis For Equity InvestmentsChanz CatlyNo ratings yet

- Zomato DamodaranDocument64 pagesZomato DamodaranCuriousMan87No ratings yet

- Polymedicure TIADocument28 pagesPolymedicure TIAProton CongoNo ratings yet

- Iso 14001 Syllabus PDFDocument4 pagesIso 14001 Syllabus PDFSeni OkeNo ratings yet

- Corporate Financing Decisions and Efficient Capital Markets: Mcgraw-Hill/IrwinDocument36 pagesCorporate Financing Decisions and Efficient Capital Markets: Mcgraw-Hill/IrwinILHAM BOCIL100% (1)

- WyckoffSetups March15,+2018 Actual PDFDocument5 pagesWyckoffSetups March15,+2018 Actual PDFacernam4849No ratings yet

- Top 10 Finance Certifications 1Document2 pagesTop 10 Finance Certifications 1Ghaouti ZidaniNo ratings yet

- Chapter 7Document53 pagesChapter 7Baby KhorNo ratings yet

- 2011 08 05 Migbank Daily Technical Analysis Report+Document15 pages2011 08 05 Migbank Daily Technical Analysis Report+migbankNo ratings yet

- Investment Management Technical AnalysisDocument29 pagesInvestment Management Technical AnalysisckapasiNo ratings yet

- FRT - HM Research-Report V.finalDocument47 pagesFRT - HM Research-Report V.finalANH PHAM QUYNHNo ratings yet

- Fundamental AnalysisDocument28 pagesFundamental AnalysisUjjawal Raj -57No ratings yet

- Stock Market 101Document15 pagesStock Market 101Ezekiel CruzNo ratings yet

- Business Valuations PDFDocument5 pagesBusiness Valuations PDFAyan NoorNo ratings yet

- CdosDocument53 pagesCdosapi-3742111No ratings yet

- Expolanka Holdings Ltd-IpoDocument6 pagesExpolanka Holdings Ltd-IpoNipuna SanjeewaNo ratings yet

- Lecture 4-Hedging With FuturesDocument36 pagesLecture 4-Hedging With FuturesNIAZ ALI KHANNo ratings yet

- Lecture 3 Ratio AnalysisDocument59 pagesLecture 3 Ratio AnalysisJiun Herng LeeNo ratings yet

- Problem Unit 4Document7 pagesProblem Unit 4meenasaratha100% (1)

- Break Even Analysis: Presented byDocument16 pagesBreak Even Analysis: Presented byGaurav Kumar100% (1)

- 5021 Solutions 7Document7 pages5021 Solutions 7karsten_fdsNo ratings yet

- SM 8 Decision GoalsDocument29 pagesSM 8 Decision GoalsCGM MechanicalNo ratings yet

- Jean-Baptiste de La Salle: Background StoryDocument3 pagesJean-Baptiste de La Salle: Background StoryBaher WilliamNo ratings yet

- GMAT First Reading and SolutionDocument6 pagesGMAT First Reading and SolutionBaher WilliamNo ratings yet

- ScheduleDocument1 pageScheduleBaher WilliamNo ratings yet

- CV TemplateDocument2 pagesCV TemplateBaher WilliamNo ratings yet

- Technology and ScienceDocument4 pagesTechnology and ScienceBaher WilliamNo ratings yet

- Function S 1 .1: (Math Level 1)Document5 pagesFunction S 1 .1: (Math Level 1)Baher WilliamNo ratings yet

- Module 12k PDFDocument1 pageModule 12k PDFBaher WilliamNo ratings yet

- Module 4 PDFDocument1 pageModule 4 PDFBaher WilliamNo ratings yet

- Module 2k PDFDocument1 pageModule 2k PDFBaher WilliamNo ratings yet

- Math Tests Part 2 Math Tests Part 1Document1 pageMath Tests Part 2 Math Tests Part 1Baher WilliamNo ratings yet

- The Customer 6 Categories of Industrial Goods and Services: Understanding Organisational Markets and Buying BehaviourDocument1 pageThe Customer 6 Categories of Industrial Goods and Services: Understanding Organisational Markets and Buying BehaviourBaher WilliamNo ratings yet

- Macro Environmental Trends - (PESTED) : 2. Environmental Analyisis Guides Marketing Decison MakingDocument1 pageMacro Environmental Trends - (PESTED) : 2. Environmental Analyisis Guides Marketing Decison MakingBaher WilliamNo ratings yet

- Module 3 - 6 - Capital Budgeting - CF From Acs - APV - Leasing - EAC - International ProjectsDocument15 pagesModule 3 - 6 - Capital Budgeting - CF From Acs - APV - Leasing - EAC - International ProjectsBaher WilliamNo ratings yet

- Revision Exercise 2 - Int Rates + Capl Budgeting - SolutionsDocument25 pagesRevision Exercise 2 - Int Rates + Capl Budgeting - SolutionsBaher WilliamNo ratings yet

- Module 12 - Option Pricing - Binomial - Black Scholes - How To Do It - UPDATEDDocument20 pagesModule 12 - Option Pricing - Binomial - Black Scholes - How To Do It - UPDATEDBaher WilliamNo ratings yet

- Crenshaw/LAX Line Contract ReportDocument28 pagesCrenshaw/LAX Line Contract ReportMetro Los AngelesNo ratings yet

- Application of Information and Technology in Supply Chain Management of Fruits and Vegetables - A Brief OverviewDocument7 pagesApplication of Information and Technology in Supply Chain Management of Fruits and Vegetables - A Brief OverviewInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Sri Lankan Bank Account ComparisonDocument18 pagesSri Lankan Bank Account ComparisonVaruni_Gunawardana100% (1)

- Chapter 4 Cost of CapitalDocument70 pagesChapter 4 Cost of CapitalYến NhiNo ratings yet

- CGDocument23 pagesCGTeuku Rifqy RatzarsyahNo ratings yet

- Dotdigital Benchmark ReportDocument22 pagesDotdigital Benchmark Reportmusicman2763No ratings yet

- Catalent - PractusDocument3 pagesCatalent - PractusLaal GuhbbaraNo ratings yet

- B0175 Dsday2 Atlstmts - Linex.dsstmts - 4408 - Ddastmts 04212020Document1 pageB0175 Dsday2 Atlstmts - Linex.dsstmts - 4408 - Ddastmts 04212020Coughman MattNo ratings yet

- Letter of InstructionsDocument1 pageLetter of InstructionsHAN SOLONo ratings yet

- Slope Protection Inspection SheetDocument11 pagesSlope Protection Inspection SheetArchie Joseph LlanaNo ratings yet

- TUGAS 1 Bahasa InggrisDocument1 pageTUGAS 1 Bahasa InggrisEfrilia TanziaNo ratings yet

- Deepanshu CV October 2021 - 1655808176031 - Deepanshu KatariaDocument3 pagesDeepanshu CV October 2021 - 1655808176031 - Deepanshu KatariaSatish SinghNo ratings yet

- A Slowing Malaysian Economy: The Circular Flow of IncomeDocument7 pagesA Slowing Malaysian Economy: The Circular Flow of IncomeMuhammad FaizanNo ratings yet

- Course Notes Handbook RSGDocument26 pagesCourse Notes Handbook RSGjaeNo ratings yet

- Summer Internship Project (Pharma)Document8 pagesSummer Internship Project (Pharma)Sadiya ZaveriNo ratings yet

- Customer Grievance Redressal Policy - 2018Document14 pagesCustomer Grievance Redressal Policy - 2018oliver senNo ratings yet

- COTIZACION PILOTAJE BOTERO INGS (Ingles)Document10 pagesCOTIZACION PILOTAJE BOTERO INGS (Ingles)German BaccaNo ratings yet

- Aicpa Aud Moderate2015Document25 pagesAicpa Aud Moderate2015King MercadoNo ratings yet

- Dhaka Ashulia Pre Feasibility ReportDocument332 pagesDhaka Ashulia Pre Feasibility ReportAdeev El AzizNo ratings yet

- Lecture 6 - Interest Rates and Bond ValuationDocument56 pagesLecture 6 - Interest Rates and Bond Valuationabubaker janiNo ratings yet

- What Is A Market System?: Direct Market Players Such As Producers, Buyers, and Consumers Who DriveDocument3 pagesWhat Is A Market System?: Direct Market Players Such As Producers, Buyers, and Consumers Who DriveRonald James DiazNo ratings yet

- Assessment of Office Property Development in AkureDocument55 pagesAssessment of Office Property Development in AkureDaniel ObasiNo ratings yet

- KYC Form - Entity (EN) For ClientDocument3 pagesKYC Form - Entity (EN) For ClientUsmän MïrżäNo ratings yet

- Introduction To Business EconomicsDocument14 pagesIntroduction To Business EconomicsMujahid AmjidNo ratings yet

- Diageo PLC Fundamental Company Report Including Financial, SWOT, Competitors and Industry AnalysisDocument15 pagesDiageo PLC Fundamental Company Report Including Financial, SWOT, Competitors and Industry Analysisvicky thapliyalNo ratings yet

- Sec Quarter Entrep ReviewerDocument14 pagesSec Quarter Entrep ReviewerSherie Hazzell BasaNo ratings yet

- VDA 6.3 2016 Process Audit ChecklistDocument48 pagesVDA 6.3 2016 Process Audit ChecklistAlma RosalesNo ratings yet

- Kapalan Gb513 Business Analytics Unit 1 AssignmentDocument3 pagesKapalan Gb513 Business Analytics Unit 1 AssignmentDoreenNo ratings yet

- Coa Gar 42-40Document1 pageCoa Gar 42-40UMKM OKENo ratings yet