Professional Documents

Culture Documents

Pre-Lifend: Zone 3-A Village, Brgy. Caranan, Pasacao, Camarines Sur

Pre-Lifend: Zone 3-A Village, Brgy. Caranan, Pasacao, Camarines Sur

Uploaded by

Ericka Bendong0 ratings0% found this document useful (0 votes)

43 views13 pagesThis document summarizes a pre-need funeral insurance plan. It offers ₱10,000 in life insurance and ₱15,000 in burial cash assistance with a monthly premium of ₱250 over 5 years. The plan covers costs associated with a funeral like memorial services, flowers, and transportation. It has a 30-day grace period for payments and claims are processed within 1-3 months. The full benefits are available immediately if the entire premium is paid upfront, otherwise benefits are paid out gradually over the first few years.

Original Description:

Original Title

Finance Insurance.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes a pre-need funeral insurance plan. It offers ₱10,000 in life insurance and ₱15,000 in burial cash assistance with a monthly premium of ₱250 over 5 years. The plan covers costs associated with a funeral like memorial services, flowers, and transportation. It has a 30-day grace period for payments and claims are processed within 1-3 months. The full benefits are available immediately if the entire premium is paid upfront, otherwise benefits are paid out gradually over the first few years.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

43 views13 pagesPre-Lifend: Zone 3-A Village, Brgy. Caranan, Pasacao, Camarines Sur

Pre-Lifend: Zone 3-A Village, Brgy. Caranan, Pasacao, Camarines Sur

Uploaded by

Ericka BendongThis document summarizes a pre-need funeral insurance plan. It offers ₱10,000 in life insurance and ₱15,000 in burial cash assistance with a monthly premium of ₱250 over 5 years. The plan covers costs associated with a funeral like memorial services, flowers, and transportation. It has a 30-day grace period for payments and claims are processed within 1-3 months. The full benefits are available immediately if the entire premium is paid upfront, otherwise benefits are paid out gradually over the first few years.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 13

PRE-LifEnd

Zone 3-A Village, Brgy. Caranan,

Pasacao, Camarines Sur

09301079717

IT’S

ET T E

B E

O B

R T Y!

R E A D

How this Pre-need Funeral Insurance Works

Burial insurance, also known as funeral insurance or final

expense insurance, is a type of life insurance coverage that pays

the costs that are associated with one’s funeral.

This can include:

• memorial service

• flowers

• transportation

• Other related items such as a casket, a headstone, and burial

plot.

• Technically, there is no such thing as funeral insurance

or burial insurance. There is no policy that will cover

every aspect of a funeral, including the cemetery plot,

headstone, or flowers.

• Generally when someone says they have purchased

funeral insurance, it means that they bought a small life

insurance policy. This is designed to leave money for

your family which covers those expenses after you are

gone.

COVERAGE AND BENEFITS

• Life Insurance ----- Ᵽ10,000.00

• Burial Cash Assistance ----- Ᵽ 15,000.00

• Monthly Premium ----- Ᵽ 250.00 for 5years

• Double amount rule of the minimum

• No age basis

• If arrangements are not in place for paying off obligations, the

loved ones of an individual may end up being responsible for

the payment of remaining debts.

• Lower Cost Funeral, Easy to Qualify, Comfort

PROVISIONS and INFORMATION

• 30-days grace period from due date.

• Period of processing of claim - one (1) to three (3) months

upon submission of complete claims requirements.

• In case coverage lapses, contestability period starts anew.

• Reinstatable only for 2 times due to failure of policyholder to

pay premium.

• Misdeclaration or falsification of information on birthdate,

address, health condition and other data will be ground for

denial of claim.

• Like other whole-life policies, the full cash value isn’t

acquired until you have reached two years. However,

if you pay the entire premium in a single lump sum,

then the benefits will start right away.

• Prior to purchasing, verify all licenses for the

insurance company or funeral home, double check the

price guarantee and policy cancellation rules.

• This is a whole-life insurance. You will purchase it

from the funeral home and not an insurance agent.

• You can select the services you would like for your funeral

and then the policy will cover these expenses.

• When you die, the beneficiary is either the funeral home

itself or a family member, depending upon your state’s

requirements.

• The value of the policy will determine your monthly

premium payments which has the whole minimum of

25,000 less the benefit of 10,000 and will pay under 5

years.

POLICY

• Traditional: This policy provides 100% of the benefits when the policy

is issued. So, if a parent would pass away the day after the policy has

been granted, the full benefits will be covered. Of course, if there is

health issues involved, then a traditional policy may not be issued by

the company.

• The Graded Benefit Policy: In this case the benefits that are provided

come in steps if there are health concerns. A typical graded benefit

policy may have payouts like the following;

First Year: 25%

Second Year: 50%

Third Year: 75%

Fourth Year & Beyond: 100%

REMINDERS:

• Pay premium only to Pre-LifEnd authorized collector who will

issue official receipt.

• Report to our chapter office if collector fails to visit and collect

your premium.

• For inquiries and other concerns, please call us at 09301079717 or

see our nearest chapter or any of our field representatives.

NOTE: In case of lapsation, reinstatement is allowed for two (2)

times only. On third lapsation, coverage expires.

INSURANCE BROKERERS:

Ericka Bendong

Giselle Regaspi

Wendelyn Rampas

Laiza Cedan

Genelyn Mamansag

John Carlo Rosana

John Rey Bobis

TH AN

KY O U

!

You might also like

- 1-2-Notice of Fault in DishonorDocument3 pages1-2-Notice of Fault in DishonorJason Henry88% (8)

- When To Exit GuideDocument24 pagesWhen To Exit GuideGaro OhanogluNo ratings yet

- Story of Demat ScamDocument66 pagesStory of Demat Scamapi-3701467No ratings yet

- Extrajudicial Settlement of EstateDocument2 pagesExtrajudicial Settlement of EstateKaren De LeonNo ratings yet

- Annuity Plus BrochureDocument8 pagesAnnuity Plus BrochureakhilgambhirNo ratings yet

- Barbados Credit Unions Funeral InsuranceDocument12 pagesBarbados Credit Unions Funeral InsuranceKammieNo ratings yet

- Service-Disabled Veterans Insurance RH Information and Premium RatesDocument20 pagesService-Disabled Veterans Insurance RH Information and Premium RatesOmer ErgeanNo ratings yet

- Policy PagesDocument60 pagesPolicy Pagesjaronsnowy1No ratings yet

- AR Term Plan Bro For WebDocument6 pagesAR Term Plan Bro For WebvarunvnNo ratings yet

- ABP 392 General Relief Information Sheet Form - Rev 07-2021Document4 pagesABP 392 General Relief Information Sheet Form - Rev 07-2021Jaun Tew Theory PhuorrNo ratings yet

- My Peace Plan FormDocument2 pagesMy Peace Plan FormStephen PhiriNo ratings yet

- l1098b MedsuppvDocument4 pagesl1098b Medsuppvapi-41207808No ratings yet

- Group Health Insurance - Product BenefitsDocument26 pagesGroup Health Insurance - Product Benefitsgaurav.20230rbNo ratings yet

- Optima Senior Brochure WebDocument8 pagesOptima Senior Brochure WebR SNo ratings yet

- Final Expens Brochure Trans - This OneDocument8 pagesFinal Expens Brochure Trans - This OneaaronNo ratings yet

- Welcome Letter - N-EAP0008408146 - 05022023Document3 pagesWelcome Letter - N-EAP0008408146 - 05022023Aniket GavhankarNo ratings yet

- Aviva Signature 3D Term Plan - 122N148V01 - KFDocument24 pagesAviva Signature 3D Term Plan - 122N148V01 - KFKaushalNo ratings yet

- Life Insurance ClaimsDocument21 pagesLife Insurance ClaimsMahesh Satapathy100% (1)

- Lincoln Moneyguard Reserve Plus: For Life The Lincoln National Life Insurance CompanyDocument12 pagesLincoln Moneyguard Reserve Plus: For Life The Lincoln National Life Insurance CompanyJack KellyNo ratings yet

- New Script (2024)Document7 pagesNew Script (2024)harrismalik.62uNo ratings yet

- Session 5-6Document44 pagesSession 5-6SARA KOSHY RCBSNo ratings yet

- SNAP ApprovalDocument14 pagesSNAP ApprovalLajharus EvansNo ratings yet

- Policy SIS101946046Document3 pagesPolicy SIS101946046An LeNo ratings yet

- New Design MockupDocument4 pagesNew Design MockupbaluNo ratings yet

- AFAS24 034 2024 Agency Segmentation and Benefits Enrolment ProcessDocument7 pagesAFAS24 034 2024 Agency Segmentation and Benefits Enrolment ProcessEya Mina DionNo ratings yet

- EligibilityResultsNotice 5Document7 pagesEligibilityResultsNotice 5Larisa AbrahamyanNo ratings yet

- Accident Claim#002373921 Stephen Forde OCB1 FormDocument32 pagesAccident Claim#002373921 Stephen Forde OCB1 FormTanya GlennNo ratings yet

- Jeevan ArogyaDocument24 pagesJeevan Arogyassvelu5654No ratings yet

- Barbados Co-opLIFE Credit Union Funeral InsuranceDocument11 pagesBarbados Co-opLIFE Credit Union Funeral InsuranceKammie100% (1)

- Closing ScriptDocument7 pagesClosing ScriptAdnan JavedNo ratings yet

- Kasih FamiliDocument26 pagesKasih FamiliBig DaddyCoolNo ratings yet

- Annuity Plus Brochure - BR - New SizeDocument10 pagesAnnuity Plus Brochure - BR - New SizeBharat VyasNo ratings yet

- CA81457 Quick Net BrochureDocument34 pagesCA81457 Quick Net BrochureBradley GreenwoodNo ratings yet

- Chapter 30Document3 pagesChapter 30radislamyNo ratings yet

- 2014-15 Ag-Pro Final New Hire Benefit BookletDocument20 pages2014-15 Ag-Pro Final New Hire Benefit BookletkellifitzgeraldNo ratings yet

- Apollo Easy Health RevisedDocument11 pagesApollo Easy Health Revisedsushantgarg2008No ratings yet

- Saral Pension Brochure English - SBI Life InsuranceDocument8 pagesSaral Pension Brochure English - SBI Life InsuranceBabujee K.NNo ratings yet

- Policy Valuation & Life Settlement Application: Insured's InformationDocument10 pagesPolicy Valuation & Life Settlement Application: Insured's InformationpanopticpermitNo ratings yet

- Optima Restore SlidedeckDocument20 pagesOptima Restore SlidedeckJeedipally Narendar ReddyNo ratings yet

- 5Document10 pages5John C. LewisNo ratings yet

- FAQs About The NYC Medicare Advantage Plus PlanDocument5 pagesFAQs About The NYC Medicare Advantage Plus PlanState Senator Liz KruegerNo ratings yet

- Claim ManagementDocument16 pagesClaim ManagementDhiraj KokareNo ratings yet

- Aviva MyLongTermCare BrochureDocument18 pagesAviva MyLongTermCare BrochureHarmony TeeNo ratings yet

- Care (Health Insurance Product) - BrochureDocument10 pagesCare (Health Insurance Product) - Brochuresanjay4u4allNo ratings yet

- Super Cash PlanDocument4 pagesSuper Cash PlanShivam RustagiNo ratings yet

- Bupa Advantage Care Membership GuideDocument40 pagesBupa Advantage Care Membership GuidePatricia GuzmanNo ratings yet

- Claim FormDocument3 pagesClaim FormInvestor ProtegeNo ratings yet

- Claims Settlement: Fulfilling The PromiseDocument23 pagesClaims Settlement: Fulfilling The PromiseTushar JambukiyaNo ratings yet

- Unit 2Document21 pagesUnit 2nikita2802No ratings yet

- Strategic Alliance PacketDocument4 pagesStrategic Alliance Packetapi-654866166No ratings yet

- Benefit Plan: Manulife Benefits BasicsDocument1 pageBenefit Plan: Manulife Benefits BasicsMuneeb ArshadNo ratings yet

- Canara HSBC Pure Term PlanDocument1 pageCanara HSBC Pure Term PlanSudhakar GanjikuntaNo ratings yet

- Liaison MajesticDocument6 pagesLiaison MajesticJasonNo ratings yet

- Important News About Your Health Benefits: Francisco Gianan 1842 Plaza Del Amo Apt 2 TORRANCE, CA 90501Document13 pagesImportant News About Your Health Benefits: Francisco Gianan 1842 Plaza Del Amo Apt 2 TORRANCE, CA 90501Nina GiananNo ratings yet

- Optima Restore Product DetailsDocument19 pagesOptima Restore Product DetailsRagasNo ratings yet

- Reliance HealthGain Policy-BrochureDocument8 pagesReliance HealthGain Policy-Brochurethakurankit212No ratings yet

- Life InsuranceDocument33 pagesLife InsurancezakkastimepassNo ratings yet

- Eligibility Results NoticeDocument12 pagesEligibility Results NoticeSue GundlachNo ratings yet

- LIC's JEEVAN ANKUR 807 PDFDocument3 pagesLIC's JEEVAN ANKUR 807 PDFgvspavan0% (2)

- The Hidden Value in Your Life Insurance: Funds for Your RetirementFrom EverandThe Hidden Value in Your Life Insurance: Funds for Your RetirementNo ratings yet

- Personal Loans Made Easy, how to borrow money and avoid being blacklisted.From EverandPersonal Loans Made Easy, how to borrow money and avoid being blacklisted.No ratings yet

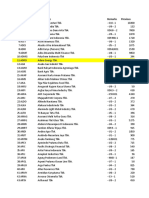

- SBI Amaravati Circle & BranchesDocument318 pagesSBI Amaravati Circle & Branchessrinivasa annamayyaNo ratings yet

- Stock Summary-20190619Document75 pagesStock Summary-20190619Muhammad Firas AndanawarihNo ratings yet

- StatementDocument10 pagesStatementTemidayo EmmanuelNo ratings yet

- Institute of Finance ManagementDocument4 pagesInstitute of Finance Managementchrispin bernadNo ratings yet

- Marketing and Operations of The Banking SectorDocument36 pagesMarketing and Operations of The Banking SectorVineeth MudaliyarNo ratings yet

- Red Bus Ticket ReservationDocument1 pageRed Bus Ticket ReservationSanthosh NayakNo ratings yet

- Impact of The Scam:: Sr. No. Psbs Exposure in INR CroresDocument2 pagesImpact of The Scam:: Sr. No. Psbs Exposure in INR CroressantuNo ratings yet

- Kotak Mahindra Bank PDFDocument8 pagesKotak Mahindra Bank PDFjithendraNo ratings yet

- Bai' Istijrar (Supply Contract)Document12 pagesBai' Istijrar (Supply Contract)Urfi Achyuta0% (1)

- Commweb Virtual Payment Client Integration Guide PDFDocument2 pagesCommweb Virtual Payment Client Integration Guide PDFMelissaNo ratings yet

- Answers To Test Yourunderstanding QuestionsDocument5 pagesAnswers To Test Yourunderstanding QuestionsDean Rodriguez100% (2)

- Allied BANK Project (Word Pad)Document31 pagesAllied BANK Project (Word Pad)plannetsNo ratings yet

- ExercisesDocument7 pagesExercisesMaryjane De GuzmanNo ratings yet

- Yat HarthDocument51 pagesYat HarthAnil BatraNo ratings yet

- How To Form An Event Management CompanyDocument10 pagesHow To Form An Event Management CompanyAnuraag Reyan MahantaNo ratings yet

- Suresh N. Nivatkar: Most Respectfully ShewethDocument18 pagesSuresh N. Nivatkar: Most Respectfully ShewethMahi RaperiaNo ratings yet

- Time Value of Time Value of MoneyDocument57 pagesTime Value of Time Value of MoneymomindkhanNo ratings yet

- Cpa MockexambrochureDocument16 pagesCpa Mockexambrochureqwertypoiuy19No ratings yet

- Exchange Rates ExercisesDocument8 pagesExchange Rates Exercisesarupkalita_aecNo ratings yet

- Mock Test - For Bba - Bca Entrance Exam in The Maharaja Sayajirao University of BarodaDocument10 pagesMock Test - For Bba - Bca Entrance Exam in The Maharaja Sayajirao University of BarodaSocio Fact'sNo ratings yet

- Scotiabank Scene Visa Fees OutlinedDocument2 pagesScotiabank Scene Visa Fees OutlinedsdukhiaNo ratings yet

- Bsc. (Hons) Banking and International Finance: Examinations For 2008 - 2009 Semester 1 / 2008 Semester 2Document4 pagesBsc. (Hons) Banking and International Finance: Examinations For 2008 - 2009 Semester 1 / 2008 Semester 2Mevika MerchantNo ratings yet

- Briana Doyle ResumeDocument1 pageBriana Doyle Resumeapi-312583408No ratings yet

- IIN0341 - Mapeo de Procesos 3Document12 pagesIIN0341 - Mapeo de Procesos 3Cristhian Javier100% (1)

- Rodriguez - Azuero AbogadosDocument11 pagesRodriguez - Azuero AbogadosRodriguez-Azuero AbogadosNo ratings yet

- Spouses Cha Vs CADocument2 pagesSpouses Cha Vs CACarlyn Belle de GuzmanNo ratings yet