Professional Documents

Culture Documents

JK Cement: Key Financial Highlights (2018-19)

JK Cement: Key Financial Highlights (2018-19)

Uploaded by

KpCopyright:

Available Formats

You might also like

- Citibank - Basics of Corporate FinanceDocument417 pagesCitibank - Basics of Corporate Financevikash100% (2)

- Chugging Along: Reliance IndustriesDocument12 pagesChugging Along: Reliance IndustriesAshokNo ratings yet

- Gamuda Berhad: 1HFY07/10 Results To Disappoint - 19/03/2010Document3 pagesGamuda Berhad: 1HFY07/10 Results To Disappoint - 19/03/2010Rhb InvestNo ratings yet

- Viacom Reports Second Quarter Results: Statement From Bob Bakish, President & CeoDocument14 pagesViacom Reports Second Quarter Results: Statement From Bob Bakish, President & CeoNickALiveNo ratings yet

- 2022 Annual Report AccountsDocument73 pages2022 Annual Report AccountsBikash sharmaNo ratings yet

- CCL Products - Initiating Coverage - 09092019 - 11!09!2019 - 08Document29 pagesCCL Products - Initiating Coverage - 09092019 - 11!09!2019 - 08Amit PatelNo ratings yet

- Emkay-Eicher Motors Company Update - Feb 19Document13 pagesEmkay-Eicher Motors Company Update - Feb 19Blue RunnerNo ratings yet

- Available Cars For SaleDocument22 pagesAvailable Cars For SaleNicey RubioNo ratings yet

- Toca Phamy!'s YouTube Stats (Summary Profile) - Social Blade StatsDocument1 pageToca Phamy!'s YouTube Stats (Summary Profile) - Social Blade StatsRohma Fatima Ul Hassan nullNo ratings yet

- Pt. Gs Gold Shine Battery: Nama Karyawa: TRI HANDOKO Jabatan: Director Company Perform - Jan 19Document3 pagesPt. Gs Gold Shine Battery: Nama Karyawa: TRI HANDOKO Jabatan: Director Company Perform - Jan 19Nia TjhoaNo ratings yet

- Mah Sing Group Berhad :getting Stronger-27/08/2010Document4 pagesMah Sing Group Berhad :getting Stronger-27/08/2010Rhb InvestNo ratings yet

- 50 BooksDocument2 pages50 BooksFARMAN SHAIKH SAHABNo ratings yet

- ACFrOgAbumlNAP5GtEPtjWCUV3LJ L4 0m5PqPxMmewrwpxIsxO4LVAQ79UXw3jN6 aMn74UaPmejwvHva5YKv3ImhrzN8TJIsqyBGs90yB3t9eYLteS0pmw4Zdh3NU PDFDocument11 pagesACFrOgAbumlNAP5GtEPtjWCUV3LJ L4 0m5PqPxMmewrwpxIsxO4LVAQ79UXw3jN6 aMn74UaPmejwvHva5YKv3ImhrzN8TJIsqyBGs90yB3t9eYLteS0pmw4Zdh3NU PDFRene BarajasNo ratings yet

- Sheela Foam LTD - Initiaiting Coverage - 18092018 - 19!09!2018 - 08Document32 pagesSheela Foam LTD - Initiaiting Coverage - 18092018 - 19!09!2018 - 08Mansi Raut PatilNo ratings yet

- AI Business Update FY 2018Document34 pagesAI Business Update FY 2018gajah ngupingNo ratings yet

- D089110692 14672067237399333 SchedulescDocument2 pagesD089110692 14672067237399333 SchedulescHeramb SharmaNo ratings yet

- Automotive Axles LTDDocument25 pagesAutomotive Axles LTDLK CoolgirlNo ratings yet

- D081065849 12868951594194930 SchedulescDocument2 pagesD081065849 12868951594194930 SchedulescKarthik PNo ratings yet

- Gaikindo Production Data 'JAN-M AR 2018Document3 pagesGaikindo Production Data 'JAN-M AR 2018gmmojj_23No ratings yet

- Kencana Petroleum Berhad: Termination of Proposed Collaboration With Global Offshore - 20/5/2010Document2 pagesKencana Petroleum Berhad: Termination of Proposed Collaboration With Global Offshore - 20/5/2010Rhb InvestNo ratings yet

- Genting Berhad: Better Years Ahead - 01/03/2010Document5 pagesGenting Berhad: Better Years Ahead - 01/03/2010Rhb InvestNo ratings yet

- Gamuda Berhad: Served A Request For Arbitration Amounting To RM51.5m - 10/03/2010Document3 pagesGamuda Berhad: Served A Request For Arbitration Amounting To RM51.5m - 10/03/2010Rhb InvestNo ratings yet

- Genting Malaysia Berhad: Beating Expectations - 01/03/2010Document5 pagesGenting Malaysia Berhad: Beating Expectations - 01/03/2010Rhb InvestNo ratings yet

- PubCo ValuationDocument12 pagesPubCo ValuationAlan Zhu100% (1)

- Thailand Focus 2023 - Investor Presentation - Distribution - 25 Aug 23Document49 pagesThailand Focus 2023 - Investor Presentation - Distribution - 25 Aug 23鄭翊璇No ratings yet

- Eastern Pacific Industrial Corporation Berhad: No Surprises - 27/04/2010Document3 pagesEastern Pacific Industrial Corporation Berhad: No Surprises - 27/04/2010Rhb InvestNo ratings yet

- The XLRI Student Investment Fund: Equity Research Report August 2018Document3 pagesThe XLRI Student Investment Fund: Equity Research Report August 2018Rohit SinghNo ratings yet

- Hartalega Berhad: No Surprises - 11/08/2010Document3 pagesHartalega Berhad: No Surprises - 11/08/2010Rhb InvestNo ratings yet

- Wah Seong Corp Berhad: Significantly Weaker - 26/08/2010Document3 pagesWah Seong Corp Berhad: Significantly Weaker - 26/08/2010Rhb InvestNo ratings yet

- Ldip 2023 2028Document2 pagesLdip 2023 2028ARCHIE AJIASNo ratings yet

- Prakash S YadavDocument2 pagesPrakash S YadavAnil kadamNo ratings yet

- Dacia Price Guide OctDocument16 pagesDacia Price Guide OctVASILENo ratings yet

- The E-Golf: Product GuideDocument10 pagesThe E-Golf: Product GuidecrocobaurNo ratings yet

- Hyryder PL TN Oct 2022Document1 pageHyryder PL TN Oct 2022CAD MENo ratings yet

- Genting Malaysia Berhad: Holding On To Market Share - 31/5/2010Document5 pagesGenting Malaysia Berhad: Holding On To Market Share - 31/5/2010Rhb InvestNo ratings yet

- GJ16BS2274Document2 pagesGJ16BS2274Sher KhnNo ratings yet

- Kencana Petroleum Berhad: Follow Up - 23/6/2010Document2 pagesKencana Petroleum Berhad: Follow Up - 23/6/2010Rhb InvestNo ratings yet

- Desen Principal Connector RHDocument5 pagesDesen Principal Connector RHMircea100% (1)

- Top Glove Corporation Berhad: 2Q10 Results Within Expectations-18/03/2010Document3 pagesTop Glove Corporation Berhad: 2Q10 Results Within Expectations-18/03/2010Rhb InvestNo ratings yet

- CB Industrial Product Berhad: Look To Better FY10 - 01/03/2010Document3 pagesCB Industrial Product Berhad: Look To Better FY10 - 01/03/2010Rhb InvestNo ratings yet

- WCT Berhad: No Further Provision For Bakun-25/05/2010Document4 pagesWCT Berhad: No Further Provision For Bakun-25/05/2010Rhb InvestNo ratings yet

- SODA 2020 Q1 IR PresentationDocument42 pagesSODA 2020 Q1 IR PresentationprasenjitNo ratings yet

- Tan Chong Motor Berhad: Securing Foothold in Vietnam - 23/09/2010Document3 pagesTan Chong Motor Berhad: Securing Foothold in Vietnam - 23/09/2010Rhb InvestNo ratings yet

- Paris Air Show Boeing 2019Document26 pagesParis Air Show Boeing 2019Sani SanjayaNo ratings yet

- Malaysia Airports Berhad: 1HFY12/10 Hit by Associate Losses - 18/08/2010Document4 pagesMalaysia Airports Berhad: 1HFY12/10 Hit by Associate Losses - 18/08/2010Rhb InvestNo ratings yet

- FOR BID: Refining & NGL Projects Department North RT Refinery & Ju'Aymah NGL Projects DivisionDocument2 pagesFOR BID: Refining & NGL Projects Department North RT Refinery & Ju'Aymah NGL Projects DivisionBilel MahjoubNo ratings yet

- Intp 080318Document3 pagesIntp 080318Cristiano DonzaghiNo ratings yet

- Telekom Malaysia Berhad: No Commitment On Capital Management Yet - 31/5/2010Document5 pagesTelekom Malaysia Berhad: No Commitment On Capital Management Yet - 31/5/2010Rhb InvestNo ratings yet

- Policy Schedule Cum Cer Ficate of Insurance: Premium Computation TableDocument2 pagesPolicy Schedule Cum Cer Ficate of Insurance: Premium Computation Tableriyaz ahmadNo ratings yet

- Sensitivity: LNT Construction Internal UseDocument5 pagesSensitivity: LNT Construction Internal UseAnjum JauherNo ratings yet

- M'sian Airline System: Corporate HighlightsDocument5 pagesM'sian Airline System: Corporate HighlightsRhb InvestNo ratings yet

- Gamuda Berhad: A "Tactical" Construction Play in A News Flow Driven Market - 28/06/2010Document5 pagesGamuda Berhad: A "Tactical" Construction Play in A News Flow Driven Market - 28/06/2010Rhb InvestNo ratings yet

- Icici AltoDocument1 pageIcici AltoSunil KumarNo ratings yet

- Petronas Gas Berhad: No Surprises - 12/5/2010Document3 pagesPetronas Gas Berhad: No Surprises - 12/5/2010Rhb Invest100% (1)

- Margin Concerns Should Take Precedence Over Improved OutlookDocument15 pagesMargin Concerns Should Take Precedence Over Improved Outlookashok yadavNo ratings yet

- Tanjong PLC :awaiting The Next Rerating Catalyst - 13/04/2010Document5 pagesTanjong PLC :awaiting The Next Rerating Catalyst - 13/04/2010Rhb InvestNo ratings yet

- IGPetrochemicals ReportDocument18 pagesIGPetrochemicals ReportP3 AppNo ratings yet

- Axis-Advanced Enzyme Tech (Init Conv) - Sep2016Document43 pagesAxis-Advanced Enzyme Tech (Init Conv) - Sep2016rchawdhry123No ratings yet

- Colorful Chalkboard Classroom Labels and OrganizersFrom EverandColorful Chalkboard Classroom Labels and OrganizersNo ratings yet

- PDFDocument64 pagesPDFAthanasius Kurniawan Prasetyo AdiNo ratings yet

- ThesisDocument72 pagesThesisRaja SekharNo ratings yet

- Financial StatementsDocument27 pagesFinancial StatementsIrish Castillo100% (2)

- FIN 435 - Exam 1 SlidesDocument122 pagesFIN 435 - Exam 1 SlidesshifatNo ratings yet

- Dashboard Template 2 - Complete: Strictly ConfidentialDocument2 pagesDashboard Template 2 - Complete: Strictly ConfidentialKshitize GuptaNo ratings yet

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysiszunaedNo ratings yet

- Chapter 9 PDFDocument29 pagesChapter 9 PDFYhunie Nhita Itha50% (2)

- The Following Information Is Available About The Capital Structure For PDFDocument1 pageThe Following Information Is Available About The Capital Structure For PDFLet's Talk With HassanNo ratings yet

- NHPC 3Document49 pagesNHPC 3Hitesh Mittal100% (1)

- Comfy Home Financials - HW7 For Students - Spring 2022-4Document12 pagesComfy Home Financials - HW7 For Students - Spring 2022-4Sunil SharmaNo ratings yet

- Audit Officer NotesDocument452 pagesAudit Officer NotesEngr Sadam BhuttoNo ratings yet

- Stock Markiet.Document87 pagesStock Markiet.deepti singhalNo ratings yet

- Types of Earnings Management and Manipulation Examples of Earnings ManipulationDocument6 pagesTypes of Earnings Management and Manipulation Examples of Earnings Manipulationkhurram riazNo ratings yet

- Ayala Corporation Statement of Financial Position 2019 2018 in Millions Audited Audited AsssetsDocument11 pagesAyala Corporation Statement of Financial Position 2019 2018 in Millions Audited Audited AsssetsAlgen SabaytonNo ratings yet

- Work+Samples+ +Leads+Sourcing+ +Linkedin+Research+ +Internet+Research+ +Data+ScrapingDocument49 pagesWork+Samples+ +Leads+Sourcing+ +Linkedin+Research+ +Internet+Research+ +Data+Scrapingjoshneves122No ratings yet

- Interim Financial ReportingDocument15 pagesInterim Financial ReportingReetika VaidNo ratings yet

- UntitledDocument6 pagesUntitledomdeviNo ratings yet

- Fina ManDocument20 pagesFina ManhurtlangNo ratings yet

- GAAP AccountingDocument88 pagesGAAP AccountingArshit Mahajan100% (1)

- Comparative Analysis of Sharekhan and Other Stock Broker Companies-Project FinalDocument122 pagesComparative Analysis of Sharekhan and Other Stock Broker Companies-Project FinalSANDEEP SINGH86% (7)

- Fcffsimpleginzu 2014Document54 pagesFcffsimpleginzu 2014Pro Resources100% (1)

- Assignment On Inventory ManagementDocument4 pagesAssignment On Inventory ManagementArif HosenNo ratings yet

- Finals - Financial AccountingDocument6 pagesFinals - Financial AccountingAlyssa QuiambaoNo ratings yet

- CB Niat 2019 Exam SolutionsDocument14 pagesCB Niat 2019 Exam Solutionsdean garciaNo ratings yet

- Lahore School of Economics Financial Management II Working Capital Management - 1 Assignment 9Document2 pagesLahore School of Economics Financial Management II Working Capital Management - 1 Assignment 9AhmedNo ratings yet

- Cash Budget Analysis and Pro Forma FSDocument5 pagesCash Budget Analysis and Pro Forma FSMarijobel L. SanggalangNo ratings yet

- Memo 2023 003 Scope of Qualifying ExamsDocument4 pagesMemo 2023 003 Scope of Qualifying ExamsSara ChanNo ratings yet

- 12.20.10 ENER Dilution Tracker - Dec Debt Swap Boosts Share Out by 5%Document5 pages12.20.10 ENER Dilution Tracker - Dec Debt Swap Boosts Share Out by 5%ac310No ratings yet

- Notes-Unit-3-Final Accounts - (Partial)Document12 pagesNotes-Unit-3-Final Accounts - (Partial)happy lifeNo ratings yet

JK Cement: Key Financial Highlights (2018-19)

JK Cement: Key Financial Highlights (2018-19)

Uploaded by

KpOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JK Cement: Key Financial Highlights (2018-19)

JK Cement: Key Financial Highlights (2018-19)

Uploaded by

KpCopyright:

Available Formats

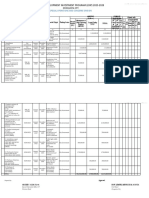

CMP* RESULTS EXPECTED PRICE

JK CEMENT ₹ 1186.95

DATE

17-06-2020

₹

1265.68

*CMP as on

dd/mm/yyyy

EXPECTED

J.K. Cement Limited is engaged in cement business. The Company REVENUE(A)

produces grey cement, white cement and water proof. The Company

manufactures grey cement in two facilities located at Nimbahera and ₹ 5900 Cr

Mangrol in the state of Rajasthan in Northern India. Its cement products

are marketed under the brand names: J.K. Cement and Sarvashaktiman EXPECTED

for OPC products; J.K. Super for PPC products, and J.K. White and PROFIT(A)

Camel for white cement products. During the fiscal year ended March 31,

2012, it produced 3.77 lacs tons of white cement, 5.32 million tons of grey ₹ 507.3 CR

cement

Others SHAREHOLDI

4%

NG PATTERN

Total DII

26%

Promoter

FII/FPI s

12% 58%

KEY FINANCIAL HIGHLIGHTS (2018-19)

₹498 ₹324 13.40 6.50

1.10 2.58 1.07

1 CR CR % %

FIXED ASSET

INTEREST

REVENUE PROFIT EBITDA PAT D/E COVERAGE RATIO

TURNOVER

RATIO

MARGIN MARGIN

KEY FINANCIAL HIGHLIGHTS

0.85

17.96 4.67 16.49 3.14 1.27 24.24

%

ROE ROA P/E P/B PRICE/SALES DIVIDEND INDUSTRY

YIELD P/E

Disclaimer: For educational purposes only, kindly consult your financial adviser before TRADIONS: YOUR

making any investment. PRIVATE ANALYST

ALL-IN-ONE PLAN OF TOP REGISTERED ANALYST | THE MOST AUTHENTIC

Call on 741204770 or mail on care@tradions.com for details

You might also like

- Citibank - Basics of Corporate FinanceDocument417 pagesCitibank - Basics of Corporate Financevikash100% (2)

- Chugging Along: Reliance IndustriesDocument12 pagesChugging Along: Reliance IndustriesAshokNo ratings yet

- Gamuda Berhad: 1HFY07/10 Results To Disappoint - 19/03/2010Document3 pagesGamuda Berhad: 1HFY07/10 Results To Disappoint - 19/03/2010Rhb InvestNo ratings yet

- Viacom Reports Second Quarter Results: Statement From Bob Bakish, President & CeoDocument14 pagesViacom Reports Second Quarter Results: Statement From Bob Bakish, President & CeoNickALiveNo ratings yet

- 2022 Annual Report AccountsDocument73 pages2022 Annual Report AccountsBikash sharmaNo ratings yet

- CCL Products - Initiating Coverage - 09092019 - 11!09!2019 - 08Document29 pagesCCL Products - Initiating Coverage - 09092019 - 11!09!2019 - 08Amit PatelNo ratings yet

- Emkay-Eicher Motors Company Update - Feb 19Document13 pagesEmkay-Eicher Motors Company Update - Feb 19Blue RunnerNo ratings yet

- Available Cars For SaleDocument22 pagesAvailable Cars For SaleNicey RubioNo ratings yet

- Toca Phamy!'s YouTube Stats (Summary Profile) - Social Blade StatsDocument1 pageToca Phamy!'s YouTube Stats (Summary Profile) - Social Blade StatsRohma Fatima Ul Hassan nullNo ratings yet

- Pt. Gs Gold Shine Battery: Nama Karyawa: TRI HANDOKO Jabatan: Director Company Perform - Jan 19Document3 pagesPt. Gs Gold Shine Battery: Nama Karyawa: TRI HANDOKO Jabatan: Director Company Perform - Jan 19Nia TjhoaNo ratings yet

- Mah Sing Group Berhad :getting Stronger-27/08/2010Document4 pagesMah Sing Group Berhad :getting Stronger-27/08/2010Rhb InvestNo ratings yet

- 50 BooksDocument2 pages50 BooksFARMAN SHAIKH SAHABNo ratings yet

- ACFrOgAbumlNAP5GtEPtjWCUV3LJ L4 0m5PqPxMmewrwpxIsxO4LVAQ79UXw3jN6 aMn74UaPmejwvHva5YKv3ImhrzN8TJIsqyBGs90yB3t9eYLteS0pmw4Zdh3NU PDFDocument11 pagesACFrOgAbumlNAP5GtEPtjWCUV3LJ L4 0m5PqPxMmewrwpxIsxO4LVAQ79UXw3jN6 aMn74UaPmejwvHva5YKv3ImhrzN8TJIsqyBGs90yB3t9eYLteS0pmw4Zdh3NU PDFRene BarajasNo ratings yet

- Sheela Foam LTD - Initiaiting Coverage - 18092018 - 19!09!2018 - 08Document32 pagesSheela Foam LTD - Initiaiting Coverage - 18092018 - 19!09!2018 - 08Mansi Raut PatilNo ratings yet

- AI Business Update FY 2018Document34 pagesAI Business Update FY 2018gajah ngupingNo ratings yet

- D089110692 14672067237399333 SchedulescDocument2 pagesD089110692 14672067237399333 SchedulescHeramb SharmaNo ratings yet

- Automotive Axles LTDDocument25 pagesAutomotive Axles LTDLK CoolgirlNo ratings yet

- D081065849 12868951594194930 SchedulescDocument2 pagesD081065849 12868951594194930 SchedulescKarthik PNo ratings yet

- Gaikindo Production Data 'JAN-M AR 2018Document3 pagesGaikindo Production Data 'JAN-M AR 2018gmmojj_23No ratings yet

- Kencana Petroleum Berhad: Termination of Proposed Collaboration With Global Offshore - 20/5/2010Document2 pagesKencana Petroleum Berhad: Termination of Proposed Collaboration With Global Offshore - 20/5/2010Rhb InvestNo ratings yet

- Genting Berhad: Better Years Ahead - 01/03/2010Document5 pagesGenting Berhad: Better Years Ahead - 01/03/2010Rhb InvestNo ratings yet

- Gamuda Berhad: Served A Request For Arbitration Amounting To RM51.5m - 10/03/2010Document3 pagesGamuda Berhad: Served A Request For Arbitration Amounting To RM51.5m - 10/03/2010Rhb InvestNo ratings yet

- Genting Malaysia Berhad: Beating Expectations - 01/03/2010Document5 pagesGenting Malaysia Berhad: Beating Expectations - 01/03/2010Rhb InvestNo ratings yet

- PubCo ValuationDocument12 pagesPubCo ValuationAlan Zhu100% (1)

- Thailand Focus 2023 - Investor Presentation - Distribution - 25 Aug 23Document49 pagesThailand Focus 2023 - Investor Presentation - Distribution - 25 Aug 23鄭翊璇No ratings yet

- Eastern Pacific Industrial Corporation Berhad: No Surprises - 27/04/2010Document3 pagesEastern Pacific Industrial Corporation Berhad: No Surprises - 27/04/2010Rhb InvestNo ratings yet

- The XLRI Student Investment Fund: Equity Research Report August 2018Document3 pagesThe XLRI Student Investment Fund: Equity Research Report August 2018Rohit SinghNo ratings yet

- Hartalega Berhad: No Surprises - 11/08/2010Document3 pagesHartalega Berhad: No Surprises - 11/08/2010Rhb InvestNo ratings yet

- Wah Seong Corp Berhad: Significantly Weaker - 26/08/2010Document3 pagesWah Seong Corp Berhad: Significantly Weaker - 26/08/2010Rhb InvestNo ratings yet

- Ldip 2023 2028Document2 pagesLdip 2023 2028ARCHIE AJIASNo ratings yet

- Prakash S YadavDocument2 pagesPrakash S YadavAnil kadamNo ratings yet

- Dacia Price Guide OctDocument16 pagesDacia Price Guide OctVASILENo ratings yet

- The E-Golf: Product GuideDocument10 pagesThe E-Golf: Product GuidecrocobaurNo ratings yet

- Hyryder PL TN Oct 2022Document1 pageHyryder PL TN Oct 2022CAD MENo ratings yet

- Genting Malaysia Berhad: Holding On To Market Share - 31/5/2010Document5 pagesGenting Malaysia Berhad: Holding On To Market Share - 31/5/2010Rhb InvestNo ratings yet

- GJ16BS2274Document2 pagesGJ16BS2274Sher KhnNo ratings yet

- Kencana Petroleum Berhad: Follow Up - 23/6/2010Document2 pagesKencana Petroleum Berhad: Follow Up - 23/6/2010Rhb InvestNo ratings yet

- Desen Principal Connector RHDocument5 pagesDesen Principal Connector RHMircea100% (1)

- Top Glove Corporation Berhad: 2Q10 Results Within Expectations-18/03/2010Document3 pagesTop Glove Corporation Berhad: 2Q10 Results Within Expectations-18/03/2010Rhb InvestNo ratings yet

- CB Industrial Product Berhad: Look To Better FY10 - 01/03/2010Document3 pagesCB Industrial Product Berhad: Look To Better FY10 - 01/03/2010Rhb InvestNo ratings yet

- WCT Berhad: No Further Provision For Bakun-25/05/2010Document4 pagesWCT Berhad: No Further Provision For Bakun-25/05/2010Rhb InvestNo ratings yet

- SODA 2020 Q1 IR PresentationDocument42 pagesSODA 2020 Q1 IR PresentationprasenjitNo ratings yet

- Tan Chong Motor Berhad: Securing Foothold in Vietnam - 23/09/2010Document3 pagesTan Chong Motor Berhad: Securing Foothold in Vietnam - 23/09/2010Rhb InvestNo ratings yet

- Paris Air Show Boeing 2019Document26 pagesParis Air Show Boeing 2019Sani SanjayaNo ratings yet

- Malaysia Airports Berhad: 1HFY12/10 Hit by Associate Losses - 18/08/2010Document4 pagesMalaysia Airports Berhad: 1HFY12/10 Hit by Associate Losses - 18/08/2010Rhb InvestNo ratings yet

- FOR BID: Refining & NGL Projects Department North RT Refinery & Ju'Aymah NGL Projects DivisionDocument2 pagesFOR BID: Refining & NGL Projects Department North RT Refinery & Ju'Aymah NGL Projects DivisionBilel MahjoubNo ratings yet

- Intp 080318Document3 pagesIntp 080318Cristiano DonzaghiNo ratings yet

- Telekom Malaysia Berhad: No Commitment On Capital Management Yet - 31/5/2010Document5 pagesTelekom Malaysia Berhad: No Commitment On Capital Management Yet - 31/5/2010Rhb InvestNo ratings yet

- Policy Schedule Cum Cer Ficate of Insurance: Premium Computation TableDocument2 pagesPolicy Schedule Cum Cer Ficate of Insurance: Premium Computation Tableriyaz ahmadNo ratings yet

- Sensitivity: LNT Construction Internal UseDocument5 pagesSensitivity: LNT Construction Internal UseAnjum JauherNo ratings yet

- M'sian Airline System: Corporate HighlightsDocument5 pagesM'sian Airline System: Corporate HighlightsRhb InvestNo ratings yet

- Gamuda Berhad: A "Tactical" Construction Play in A News Flow Driven Market - 28/06/2010Document5 pagesGamuda Berhad: A "Tactical" Construction Play in A News Flow Driven Market - 28/06/2010Rhb InvestNo ratings yet

- Icici AltoDocument1 pageIcici AltoSunil KumarNo ratings yet

- Petronas Gas Berhad: No Surprises - 12/5/2010Document3 pagesPetronas Gas Berhad: No Surprises - 12/5/2010Rhb Invest100% (1)

- Margin Concerns Should Take Precedence Over Improved OutlookDocument15 pagesMargin Concerns Should Take Precedence Over Improved Outlookashok yadavNo ratings yet

- Tanjong PLC :awaiting The Next Rerating Catalyst - 13/04/2010Document5 pagesTanjong PLC :awaiting The Next Rerating Catalyst - 13/04/2010Rhb InvestNo ratings yet

- IGPetrochemicals ReportDocument18 pagesIGPetrochemicals ReportP3 AppNo ratings yet

- Axis-Advanced Enzyme Tech (Init Conv) - Sep2016Document43 pagesAxis-Advanced Enzyme Tech (Init Conv) - Sep2016rchawdhry123No ratings yet

- Colorful Chalkboard Classroom Labels and OrganizersFrom EverandColorful Chalkboard Classroom Labels and OrganizersNo ratings yet

- PDFDocument64 pagesPDFAthanasius Kurniawan Prasetyo AdiNo ratings yet

- ThesisDocument72 pagesThesisRaja SekharNo ratings yet

- Financial StatementsDocument27 pagesFinancial StatementsIrish Castillo100% (2)

- FIN 435 - Exam 1 SlidesDocument122 pagesFIN 435 - Exam 1 SlidesshifatNo ratings yet

- Dashboard Template 2 - Complete: Strictly ConfidentialDocument2 pagesDashboard Template 2 - Complete: Strictly ConfidentialKshitize GuptaNo ratings yet

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysiszunaedNo ratings yet

- Chapter 9 PDFDocument29 pagesChapter 9 PDFYhunie Nhita Itha50% (2)

- The Following Information Is Available About The Capital Structure For PDFDocument1 pageThe Following Information Is Available About The Capital Structure For PDFLet's Talk With HassanNo ratings yet

- NHPC 3Document49 pagesNHPC 3Hitesh Mittal100% (1)

- Comfy Home Financials - HW7 For Students - Spring 2022-4Document12 pagesComfy Home Financials - HW7 For Students - Spring 2022-4Sunil SharmaNo ratings yet

- Audit Officer NotesDocument452 pagesAudit Officer NotesEngr Sadam BhuttoNo ratings yet

- Stock Markiet.Document87 pagesStock Markiet.deepti singhalNo ratings yet

- Types of Earnings Management and Manipulation Examples of Earnings ManipulationDocument6 pagesTypes of Earnings Management and Manipulation Examples of Earnings Manipulationkhurram riazNo ratings yet

- Ayala Corporation Statement of Financial Position 2019 2018 in Millions Audited Audited AsssetsDocument11 pagesAyala Corporation Statement of Financial Position 2019 2018 in Millions Audited Audited AsssetsAlgen SabaytonNo ratings yet

- Work+Samples+ +Leads+Sourcing+ +Linkedin+Research+ +Internet+Research+ +Data+ScrapingDocument49 pagesWork+Samples+ +Leads+Sourcing+ +Linkedin+Research+ +Internet+Research+ +Data+Scrapingjoshneves122No ratings yet

- Interim Financial ReportingDocument15 pagesInterim Financial ReportingReetika VaidNo ratings yet

- UntitledDocument6 pagesUntitledomdeviNo ratings yet

- Fina ManDocument20 pagesFina ManhurtlangNo ratings yet

- GAAP AccountingDocument88 pagesGAAP AccountingArshit Mahajan100% (1)

- Comparative Analysis of Sharekhan and Other Stock Broker Companies-Project FinalDocument122 pagesComparative Analysis of Sharekhan and Other Stock Broker Companies-Project FinalSANDEEP SINGH86% (7)

- Fcffsimpleginzu 2014Document54 pagesFcffsimpleginzu 2014Pro Resources100% (1)

- Assignment On Inventory ManagementDocument4 pagesAssignment On Inventory ManagementArif HosenNo ratings yet

- Finals - Financial AccountingDocument6 pagesFinals - Financial AccountingAlyssa QuiambaoNo ratings yet

- CB Niat 2019 Exam SolutionsDocument14 pagesCB Niat 2019 Exam Solutionsdean garciaNo ratings yet

- Lahore School of Economics Financial Management II Working Capital Management - 1 Assignment 9Document2 pagesLahore School of Economics Financial Management II Working Capital Management - 1 Assignment 9AhmedNo ratings yet

- Cash Budget Analysis and Pro Forma FSDocument5 pagesCash Budget Analysis and Pro Forma FSMarijobel L. SanggalangNo ratings yet

- Memo 2023 003 Scope of Qualifying ExamsDocument4 pagesMemo 2023 003 Scope of Qualifying ExamsSara ChanNo ratings yet

- 12.20.10 ENER Dilution Tracker - Dec Debt Swap Boosts Share Out by 5%Document5 pages12.20.10 ENER Dilution Tracker - Dec Debt Swap Boosts Share Out by 5%ac310No ratings yet

- Notes-Unit-3-Final Accounts - (Partial)Document12 pagesNotes-Unit-3-Final Accounts - (Partial)happy lifeNo ratings yet