Professional Documents

Culture Documents

Understanding The Sector Impact of COVID-19: Mining & Metals

Understanding The Sector Impact of COVID-19: Mining & Metals

Uploaded by

Rashi VajaniCopyright:

Available Formats

You might also like

- Test Bank For Macroeconomics 15th Canadian Edition Christopher T S RaganDocument36 pagesTest Bank For Macroeconomics 15th Canadian Edition Christopher T S Ragangaoleryis.cj8rly100% (44)

- Deloitte SWOTDocument11 pagesDeloitte SWOTamrit_P50% (4)

- Lloyds Banking Group PLCDocument20 pagesLloyds Banking Group PLCImran HussainNo ratings yet

- Environmental Factors Affecting Success of A New BusinessDocument13 pagesEnvironmental Factors Affecting Success of A New BusinessGurmeet singh86% (7)

- Business Environment Assignment Titan IndustriesDocument8 pagesBusiness Environment Assignment Titan IndustriesAnuj Singh50% (2)

- UK Deloitte PlatformsDocument212 pagesUK Deloitte PlatformsNaisscentNo ratings yet

- Group 8: - Dilan Gowda - Chandreyee Dutta - Ishan Mudgalkar - Abhay Singh - Aishwarya Tirthgirikar - Garima VaishDocument8 pagesGroup 8: - Dilan Gowda - Chandreyee Dutta - Ishan Mudgalkar - Abhay Singh - Aishwarya Tirthgirikar - Garima VaishRashi VajaniNo ratings yet

- Market Research Plan Sports BarDocument17 pagesMarket Research Plan Sports BarRashi VajaniNo ratings yet

- Understanding The Sector Impact of COVID-19: Oil, Gas & ChemicalsDocument2 pagesUnderstanding The Sector Impact of COVID-19: Oil, Gas & ChemicalsperelapelNo ratings yet

- GX Impact Engineering Construction SectorDocument2 pagesGX Impact Engineering Construction SectorperelapelNo ratings yet

- Understanding The Sector Impact of COVID-19: Banking & Capital MarketsDocument2 pagesUnderstanding The Sector Impact of COVID-19: Banking & Capital MarketsGlenn CNo ratings yet

- Understanding The Sector Impact of COVID-19: Transport OrganizationsDocument2 pagesUnderstanding The Sector Impact of COVID-19: Transport OrganizationsNurul Ain Mohd FaisalNo ratings yet

- Accelerating-The US-Securities-Settlement-Cycle-to-T1-December-1-2021Document45 pagesAccelerating-The US-Securities-Settlement-Cycle-to-T1-December-1-2021soju.suresh28No ratings yet

- Nashrah Alam FMA Assignment 1Document9 pagesNashrah Alam FMA Assignment 1Nashrah AlamNo ratings yet

- Understanding The Sector Impact of COVID-19: Media & EntertainmentDocument2 pagesUnderstanding The Sector Impact of COVID-19: Media & Entertainmentram179No ratings yet

- Understanding The Sector Impact of COVID-19: Oil and GasDocument3 pagesUnderstanding The Sector Impact of COVID-19: Oil and GasPrakharNo ratings yet

- Risk Assessment and Treatment - AssignmentDocument9 pagesRisk Assessment and Treatment - AssignmentHarshNo ratings yet

- Opportunities:: Types of ServicesDocument10 pagesOpportunities:: Types of ServiceskajalNo ratings yet

- COVID-19 Impact Towards Different IndustriesDocument48 pagesCOVID-19 Impact Towards Different IndustriesAnuruddha Rajasuriya100% (1)

- What Is InsuranceDocument9 pagesWhat Is InsuranceVarun Jain100% (1)

- Blythe Pandp Chapter 2 The Marketing EnvironmentDocument30 pagesBlythe Pandp Chapter 2 The Marketing EnvironmentFith LaaNo ratings yet

- COVID 19 Implications For Law FirmsDocument8 pagesCOVID 19 Implications For Law Firmsraf12259873No ratings yet

- Unit 1 - Chapter 2 - Business Structure 2023Document13 pagesUnit 1 - Chapter 2 - Business Structure 2023Blanny MacgawNo ratings yet

- International Tax and Business Guide: MexicoDocument16 pagesInternational Tax and Business Guide: MexicoChristian PerezNo ratings yet

- 1.) What Is Business Environment?Document16 pages1.) What Is Business Environment?Ashwin ShettyNo ratings yet

- OTC Derivatives ClearingDocument18 pagesOTC Derivatives ClearingStephen HurstNo ratings yet

- Business Environment As Such Are Classified Into The Following Three Major Categories, They AreDocument10 pagesBusiness Environment As Such Are Classified Into The Following Three Major Categories, They AresanritaNo ratings yet

- Lectura McQuivey (2021) The Future of Work Starts NowDocument11 pagesLectura McQuivey (2021) The Future of Work Starts NowCarol Viviana Zanetti DuranNo ratings yet

- Reporting Alert: COVID-19: MD&A Disclosures in Volatile and Uncertain TimesDocument6 pagesReporting Alert: COVID-19: MD&A Disclosures in Volatile and Uncertain TimesAchmad AndruNo ratings yet

- Addressing The Impact of COVID-19: Crisis Management and Resilience PlanningDocument2 pagesAddressing The Impact of COVID-19: Crisis Management and Resilience PlanningImran JavedNo ratings yet

- Business and Global Economy - Exam Roll Number - GM21CM043Document7 pagesBusiness and Global Economy - Exam Roll Number - GM21CM043Ravi ParekhNo ratings yet

- M&a PDFDocument6 pagesM&a PDFHarshita SethiyaNo ratings yet

- RESPOND BUS CONT Implement Cash Tax Strategies Leverage GovernmentDocument2 pagesRESPOND BUS CONT Implement Cash Tax Strategies Leverage GovernmentImran JavedNo ratings yet

- An Assessment of Business Environment & New Vistas For Small, Medium & Tiny Entrepreneurs in India (Yr.2011)Document10 pagesAn Assessment of Business Environment & New Vistas For Small, Medium & Tiny Entrepreneurs in India (Yr.2011)Amit BhushanNo ratings yet

- Sector In-Depth - Corporates-Global - 16mar20 PDFDocument5 pagesSector In-Depth - Corporates-Global - 16mar20 PDFCarlos RuizNo ratings yet

- Liberalization Privatization Globalization Development Private SectorDocument7 pagesLiberalization Privatization Globalization Development Private SectorEzeal EzealNo ratings yet

- "Introduction To Administrative Studies": ADMS1000Document16 pages"Introduction To Administrative Studies": ADMS1000xxDantasticxxNo ratings yet

- Eco AssignmentDocument5 pagesEco AssignmentArman KhanNo ratings yet

- Zale Industry Analysis EditedDocument10 pagesZale Industry Analysis EditedJaveria RandhawaNo ratings yet

- Relianc DigitalDocument12 pagesRelianc DigitalAaditya Reborn Zeus100% (1)

- By Khine Maung YiDocument23 pagesBy Khine Maung Yisoe sanNo ratings yet

- B20-G20 Anti-corruptionToolkit For SMEs 2015.1Document82 pagesB20-G20 Anti-corruptionToolkit For SMEs 2015.1ErwanNo ratings yet

- Business Management PDFDocument5 pagesBusiness Management PDFmr unbelivable perfectNo ratings yet

- Indian Business Environment'Document48 pagesIndian Business Environment'shashaank SharmaNo ratings yet

- General Business Environment - myLPUDocument18 pagesGeneral Business Environment - myLPUAngel Madelene BernardoNo ratings yet

- Business Environment-1Document8 pagesBusiness Environment-1lakshmiananad577No ratings yet

- Engineering, Business and SocietyDocument35 pagesEngineering, Business and SocietyMatthew LiNo ratings yet

- By Kyaw ThuraDocument23 pagesBy Kyaw Thurasoe sanNo ratings yet

- Risk in International BusinessDocument37 pagesRisk in International BusinessNeetu Kumari 1 8 3 1 8No ratings yet

- Ch3 - Business Environment 2022-23Document3 pagesCh3 - Business Environment 2022-23Abhishek DhillonNo ratings yet

- Discussion Note 3-Private Sector Creditors - Hle FFD Covid-5-25-20Document5 pagesDiscussion Note 3-Private Sector Creditors - Hle FFD Covid-5-25-20Vladimir Soria FreireNo ratings yet

- Business Environment MBA 105Document68 pagesBusiness Environment MBA 105rachitNo ratings yet

- Cia 1a CLDocument9 pagesCia 1a CLAryan PandeyNo ratings yet

- Retail Market Conduct Task Force Report Initial Findings and Observations About The Impact of COVID-19 On Retail Market ConductDocument30 pagesRetail Market Conduct Task Force Report Initial Findings and Observations About The Impact of COVID-19 On Retail Market ConductTarbNo ratings yet

- Deloitte Touche Tohmatsu - Company ProfileDocument23 pagesDeloitte Touche Tohmatsu - Company ProfiletitnaNo ratings yet

- Acct3708 Major AssignmentDocument10 pagesAcct3708 Major AssignmenthereisgoneNo ratings yet

- Ethical Issues in Mergers and AcquisitionsDocument5 pagesEthical Issues in Mergers and Acquisitionsrichamishra14100% (1)

- DoingBusinessCIV2012 CDocument102 pagesDoingBusinessCIV2012 Cperico1962No ratings yet

- Business EthicsDocument31 pagesBusiness EthicsFahim HossainNo ratings yet

- International Business Is A Term Used To Collectively Describe All Commercial TransactionsDocument24 pagesInternational Business Is A Term Used To Collectively Describe All Commercial TransactionsMohit MakkerNo ratings yet

- Economic Proof Your Digital Business: A Solopreneur's Guide to Thriving in Turbulent TimesFrom EverandEconomic Proof Your Digital Business: A Solopreneur's Guide to Thriving in Turbulent TimesNo ratings yet

- The What, The Why, The How: Mergers and AcquisitionsFrom EverandThe What, The Why, The How: Mergers and AcquisitionsRating: 2 out of 5 stars2/5 (1)

- Inventory Management in Supply ChainDocument43 pagesInventory Management in Supply ChainRashi VajaniNo ratings yet

- Classification and Regression TreesDocument37 pagesClassification and Regression TreesRashi VajaniNo ratings yet

- ContractsDocument13 pagesContractsRashi VajaniNo ratings yet

- DRW Technologies BCA ReportDocument8 pagesDRW Technologies BCA ReportRashi VajaniNo ratings yet

- 27 Harvey Balls Powerpoint TemplateDocument3 pages27 Harvey Balls Powerpoint TemplateRashi VajaniNo ratings yet

- TFC Case StudyDocument1 pageTFC Case StudyRashi VajaniNo ratings yet

- Striders: Running Away or Towards The Growth (Group 8)Document1 pageStriders: Running Away or Towards The Growth (Group 8)Rashi VajaniNo ratings yet

- Group 2 Aditya Jindal Aditya Jha Antra Chawla Rashi Vaani Rajat SurveDocument8 pagesGroup 2 Aditya Jindal Aditya Jha Antra Chawla Rashi Vaani Rajat SurveRashi VajaniNo ratings yet

- Click To Edit Master Title Style: Year East West Latin America FederalDocument2 pagesClick To Edit Master Title Style: Year East West Latin America FederalRashi VajaniNo ratings yet

- Airtel TargetsandEvaluationDocument2 pagesAirtel TargetsandEvaluationRashi VajaniNo ratings yet

- Vdna LabDocument1 pageVdna Labnaveen kumarNo ratings yet

- 21yo83 2023-24Document1 page21yo83 2023-24Raghu NayakNo ratings yet

- Presantation On Special Economic Zone (Sez) by Rahul Jagtap PGDM 1stsemDocument27 pagesPresantation On Special Economic Zone (Sez) by Rahul Jagtap PGDM 1stsemcimr33No ratings yet

- Z.A. Sea Foods1Document1 pageZ.A. Sea Foods1Richard GaurabNo ratings yet

- IJRHS 2013 Vol01 Issue 07 06Document5 pagesIJRHS 2013 Vol01 Issue 07 06Kalyani ThakurNo ratings yet

- Rural MarketingDocument6 pagesRural MarketingAshik M Kaleekal100% (2)

- 67597225eco 24 AlokDocument3 pages67597225eco 24 AlokAlok GoswamiNo ratings yet

- Final Module in Ss 13Document13 pagesFinal Module in Ss 13marvsNo ratings yet

- Punch Price List PDFDocument1 pagePunch Price List PDFAvinash KNo ratings yet

- The HistoricalEvolutionofCentral BankingDocument25 pagesThe HistoricalEvolutionofCentral Bankingmansavi bihaniNo ratings yet

- GHGGVG Data UploadedDocument3 pagesGHGGVG Data Uploadedshriya shettiwarNo ratings yet

- Instant Download PDF Applied Calculus Brief 6th Edition Berresford Test Bank Full ChapterDocument59 pagesInstant Download PDF Applied Calculus Brief 6th Edition Berresford Test Bank Full Chapteraxtonzieba8100% (5)

- AFE5008-B Financial Accounting: The Following Information Is Also RelevantDocument2 pagesAFE5008-B Financial Accounting: The Following Information Is Also RelevantDiana TuckerNo ratings yet

- TP 31 FP 68 F FromDocument1 pageTP 31 FP 68 F FromBhavdeep ShahNo ratings yet

- All LeadsDocument44 pagesAll Leadskomal LPSNo ratings yet

- Portfolio ReconstructionDocument2 pagesPortfolio ReconstructionOsmaan GóÑÍNo ratings yet

- U3A2 - Recording Transactions in A Journal - TemplateDocument3 pagesU3A2 - Recording Transactions in A Journal - TemplateJay PatelNo ratings yet

- Vietnam Economic GrowthDocument17 pagesVietnam Economic GrowthHuong Tra LeNo ratings yet

- Concession/ Deviation FormatDocument3 pagesConcession/ Deviation FormatMoorthy NaveenNo ratings yet

- Certificate of Travel Insurance: Policy DetailsDocument2 pagesCertificate of Travel Insurance: Policy DetailsLusi FebriantiNo ratings yet

- Successive Increase/ Decrease: PercentageDocument2 pagesSuccessive Increase/ Decrease: PercentageMadhu Sudhan NayakaNo ratings yet

- Working Capital ManagementDocument65 pagesWorking Capital ManagementPranav PasteNo ratings yet

- 4q22 Investor Presentaion February 2023Document34 pages4q22 Investor Presentaion February 2023mukeshindpatiNo ratings yet

- Fundamentals of ABMDocument4 pagesFundamentals of ABMMadriñan Wency M.No ratings yet

- Circular No. 449 - Modified Guidelines On The Pag-IBIG Fund Calamity Loan ProgramDocument8 pagesCircular No. 449 - Modified Guidelines On The Pag-IBIG Fund Calamity Loan ProgramJaybie SabadoNo ratings yet

- DividendDocument36 pagesDividendPooja SinghNo ratings yet

- Assignment 1 - Digital CurrencyDocument10 pagesAssignment 1 - Digital CurrencyAina SaffiyahNo ratings yet

- Rapport Annuel 2020 - enDocument79 pagesRapport Annuel 2020 - enDavid GatesNo ratings yet

- Specific Borrowing, P2, Number 5, Page 295Document2 pagesSpecific Borrowing, P2, Number 5, Page 295Jxrriz Cyrxl EhxllaNo ratings yet

Understanding The Sector Impact of COVID-19: Mining & Metals

Understanding The Sector Impact of COVID-19: Mining & Metals

Uploaded by

Rashi VajaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Understanding The Sector Impact of COVID-19: Mining & Metals

Understanding The Sector Impact of COVID-19: Mining & Metals

Uploaded by

Rashi VajaniCopyright:

Available Formats

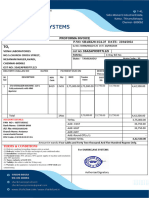

April 1, 2020

Understanding the Sector Impact of

COVID-19

Mining & Metals

The commodity markets have been affected by the COVID-19 crisis in a variety of ways. Company

operations themselves have been affected through isolated outbreaks and government-mandated

shutdowns in markets like South Africa and Peru. Demand for many commodities like copper, iron ore

and zinc remain low as markets anticipate a lower near-term demand outlook for these commodities.

One of the key exceptions to this trend has been gold, which typically benefits from higher levels of

uncertainty. As China emerges from the COVID-19 crisis, we are seeing Chinese manufacturing, mining

and metals companies back online, but a wider increase in commodity demand prices are likely to

remain low for a few quarters. One silver lining for the mining industry has been lower energy prices.

With energy typically constituting 20-25 percent of direct operating costs, companies with unhedged

positions in energy are able to benefit from this new pricing regime.

Potential long-term impact on mining and metals companies

If we see a protracted recession or several waves of COVID-19 outbreaks, this could have some longer

term implications for the sector:

• Companies with balance sheet strength now may take advantage of M&A opportunities driving

further consolidation in key sectors.

• Prior to the crisis, liquidity was tight in the junior end of the market; this is likely to be further

exacerbated.

• Mining companies may see benefit in IROCs (Integrated Operations Centers) long term as well as

opportunities for automation of critical roles and functions.

• Companies pre-crisis were expected to provide value beyond compliance to communities and host

governments. This is likely to accelerate, particularly as health care infrastructure in developing

markets become strained.

Key questions executives and boards should be asking

• How do we maintain the safety of own people first?

• As the crisis evolves, how exposed is our supply chain across different geographies?

• Through any cost-takeout, how do we prevent that cost coming back in 12-18 months?

• Are our current risk systems adequate across our organization?

Practical next steps

Mining and metals leaders will be defined by what they do along the three dimensions of managing a

crisis: Respond, Recover, and Thrive. Some key next steps include:

• Determine how to maintain critical services while ensuring the safety of employees through a number

of possible scenarios.

• Focus efforts on understanding your financial and legal exposure and formulating plans to release

cash and maintain financial viability through uncertainty.

• Consider if the crisis can be used as a catalyst to rethink how and where work is done, improve

the ability to collaborate remotely, and accelerate adoption of automation and digital capabilities.

For additional steps that companies should consider taking, visit

www.deloitte.com/covid19-resilient- leadership

Contact:

Andrew Swart

Global Leader - Mining & Metals

+1 416 813 2335

aswart@deloitte.ca

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as

“Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL

member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more.

Deloitte is a leading global provider of audit and assurance, consulting, financial advisory, risk advisory, tax and related services. Our global network of member firms and related entities in more than 150

countries and territories (collectively, the “Deloitte organization”) serves four out of five Fortune Global 500® companies. Learn how Deloitte’s approximately 312,000 people make an impact that matters

at www.deloitte.com.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities (collectively, the “Deloitte

organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should

consult a qualified professional adviser. No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and

none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on

this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities.

© 2020. For information, contact Deloitte Touche Tohmatsu Limited.

You might also like

- Test Bank For Macroeconomics 15th Canadian Edition Christopher T S RaganDocument36 pagesTest Bank For Macroeconomics 15th Canadian Edition Christopher T S Ragangaoleryis.cj8rly100% (44)

- Deloitte SWOTDocument11 pagesDeloitte SWOTamrit_P50% (4)

- Lloyds Banking Group PLCDocument20 pagesLloyds Banking Group PLCImran HussainNo ratings yet

- Environmental Factors Affecting Success of A New BusinessDocument13 pagesEnvironmental Factors Affecting Success of A New BusinessGurmeet singh86% (7)

- Business Environment Assignment Titan IndustriesDocument8 pagesBusiness Environment Assignment Titan IndustriesAnuj Singh50% (2)

- UK Deloitte PlatformsDocument212 pagesUK Deloitte PlatformsNaisscentNo ratings yet

- Group 8: - Dilan Gowda - Chandreyee Dutta - Ishan Mudgalkar - Abhay Singh - Aishwarya Tirthgirikar - Garima VaishDocument8 pagesGroup 8: - Dilan Gowda - Chandreyee Dutta - Ishan Mudgalkar - Abhay Singh - Aishwarya Tirthgirikar - Garima VaishRashi VajaniNo ratings yet

- Market Research Plan Sports BarDocument17 pagesMarket Research Plan Sports BarRashi VajaniNo ratings yet

- Understanding The Sector Impact of COVID-19: Oil, Gas & ChemicalsDocument2 pagesUnderstanding The Sector Impact of COVID-19: Oil, Gas & ChemicalsperelapelNo ratings yet

- GX Impact Engineering Construction SectorDocument2 pagesGX Impact Engineering Construction SectorperelapelNo ratings yet

- Understanding The Sector Impact of COVID-19: Banking & Capital MarketsDocument2 pagesUnderstanding The Sector Impact of COVID-19: Banking & Capital MarketsGlenn CNo ratings yet

- Understanding The Sector Impact of COVID-19: Transport OrganizationsDocument2 pagesUnderstanding The Sector Impact of COVID-19: Transport OrganizationsNurul Ain Mohd FaisalNo ratings yet

- Accelerating-The US-Securities-Settlement-Cycle-to-T1-December-1-2021Document45 pagesAccelerating-The US-Securities-Settlement-Cycle-to-T1-December-1-2021soju.suresh28No ratings yet

- Nashrah Alam FMA Assignment 1Document9 pagesNashrah Alam FMA Assignment 1Nashrah AlamNo ratings yet

- Understanding The Sector Impact of COVID-19: Media & EntertainmentDocument2 pagesUnderstanding The Sector Impact of COVID-19: Media & Entertainmentram179No ratings yet

- Understanding The Sector Impact of COVID-19: Oil and GasDocument3 pagesUnderstanding The Sector Impact of COVID-19: Oil and GasPrakharNo ratings yet

- Risk Assessment and Treatment - AssignmentDocument9 pagesRisk Assessment and Treatment - AssignmentHarshNo ratings yet

- Opportunities:: Types of ServicesDocument10 pagesOpportunities:: Types of ServiceskajalNo ratings yet

- COVID-19 Impact Towards Different IndustriesDocument48 pagesCOVID-19 Impact Towards Different IndustriesAnuruddha Rajasuriya100% (1)

- What Is InsuranceDocument9 pagesWhat Is InsuranceVarun Jain100% (1)

- Blythe Pandp Chapter 2 The Marketing EnvironmentDocument30 pagesBlythe Pandp Chapter 2 The Marketing EnvironmentFith LaaNo ratings yet

- COVID 19 Implications For Law FirmsDocument8 pagesCOVID 19 Implications For Law Firmsraf12259873No ratings yet

- Unit 1 - Chapter 2 - Business Structure 2023Document13 pagesUnit 1 - Chapter 2 - Business Structure 2023Blanny MacgawNo ratings yet

- International Tax and Business Guide: MexicoDocument16 pagesInternational Tax and Business Guide: MexicoChristian PerezNo ratings yet

- 1.) What Is Business Environment?Document16 pages1.) What Is Business Environment?Ashwin ShettyNo ratings yet

- OTC Derivatives ClearingDocument18 pagesOTC Derivatives ClearingStephen HurstNo ratings yet

- Business Environment As Such Are Classified Into The Following Three Major Categories, They AreDocument10 pagesBusiness Environment As Such Are Classified Into The Following Three Major Categories, They AresanritaNo ratings yet

- Lectura McQuivey (2021) The Future of Work Starts NowDocument11 pagesLectura McQuivey (2021) The Future of Work Starts NowCarol Viviana Zanetti DuranNo ratings yet

- Reporting Alert: COVID-19: MD&A Disclosures in Volatile and Uncertain TimesDocument6 pagesReporting Alert: COVID-19: MD&A Disclosures in Volatile and Uncertain TimesAchmad AndruNo ratings yet

- Addressing The Impact of COVID-19: Crisis Management and Resilience PlanningDocument2 pagesAddressing The Impact of COVID-19: Crisis Management and Resilience PlanningImran JavedNo ratings yet

- Business and Global Economy - Exam Roll Number - GM21CM043Document7 pagesBusiness and Global Economy - Exam Roll Number - GM21CM043Ravi ParekhNo ratings yet

- M&a PDFDocument6 pagesM&a PDFHarshita SethiyaNo ratings yet

- RESPOND BUS CONT Implement Cash Tax Strategies Leverage GovernmentDocument2 pagesRESPOND BUS CONT Implement Cash Tax Strategies Leverage GovernmentImran JavedNo ratings yet

- An Assessment of Business Environment & New Vistas For Small, Medium & Tiny Entrepreneurs in India (Yr.2011)Document10 pagesAn Assessment of Business Environment & New Vistas For Small, Medium & Tiny Entrepreneurs in India (Yr.2011)Amit BhushanNo ratings yet

- Sector In-Depth - Corporates-Global - 16mar20 PDFDocument5 pagesSector In-Depth - Corporates-Global - 16mar20 PDFCarlos RuizNo ratings yet

- Liberalization Privatization Globalization Development Private SectorDocument7 pagesLiberalization Privatization Globalization Development Private SectorEzeal EzealNo ratings yet

- "Introduction To Administrative Studies": ADMS1000Document16 pages"Introduction To Administrative Studies": ADMS1000xxDantasticxxNo ratings yet

- Eco AssignmentDocument5 pagesEco AssignmentArman KhanNo ratings yet

- Zale Industry Analysis EditedDocument10 pagesZale Industry Analysis EditedJaveria RandhawaNo ratings yet

- Relianc DigitalDocument12 pagesRelianc DigitalAaditya Reborn Zeus100% (1)

- By Khine Maung YiDocument23 pagesBy Khine Maung Yisoe sanNo ratings yet

- B20-G20 Anti-corruptionToolkit For SMEs 2015.1Document82 pagesB20-G20 Anti-corruptionToolkit For SMEs 2015.1ErwanNo ratings yet

- Business Management PDFDocument5 pagesBusiness Management PDFmr unbelivable perfectNo ratings yet

- Indian Business Environment'Document48 pagesIndian Business Environment'shashaank SharmaNo ratings yet

- General Business Environment - myLPUDocument18 pagesGeneral Business Environment - myLPUAngel Madelene BernardoNo ratings yet

- Business Environment-1Document8 pagesBusiness Environment-1lakshmiananad577No ratings yet

- Engineering, Business and SocietyDocument35 pagesEngineering, Business and SocietyMatthew LiNo ratings yet

- By Kyaw ThuraDocument23 pagesBy Kyaw Thurasoe sanNo ratings yet

- Risk in International BusinessDocument37 pagesRisk in International BusinessNeetu Kumari 1 8 3 1 8No ratings yet

- Ch3 - Business Environment 2022-23Document3 pagesCh3 - Business Environment 2022-23Abhishek DhillonNo ratings yet

- Discussion Note 3-Private Sector Creditors - Hle FFD Covid-5-25-20Document5 pagesDiscussion Note 3-Private Sector Creditors - Hle FFD Covid-5-25-20Vladimir Soria FreireNo ratings yet

- Business Environment MBA 105Document68 pagesBusiness Environment MBA 105rachitNo ratings yet

- Cia 1a CLDocument9 pagesCia 1a CLAryan PandeyNo ratings yet

- Retail Market Conduct Task Force Report Initial Findings and Observations About The Impact of COVID-19 On Retail Market ConductDocument30 pagesRetail Market Conduct Task Force Report Initial Findings and Observations About The Impact of COVID-19 On Retail Market ConductTarbNo ratings yet

- Deloitte Touche Tohmatsu - Company ProfileDocument23 pagesDeloitte Touche Tohmatsu - Company ProfiletitnaNo ratings yet

- Acct3708 Major AssignmentDocument10 pagesAcct3708 Major AssignmenthereisgoneNo ratings yet

- Ethical Issues in Mergers and AcquisitionsDocument5 pagesEthical Issues in Mergers and Acquisitionsrichamishra14100% (1)

- DoingBusinessCIV2012 CDocument102 pagesDoingBusinessCIV2012 Cperico1962No ratings yet

- Business EthicsDocument31 pagesBusiness EthicsFahim HossainNo ratings yet

- International Business Is A Term Used To Collectively Describe All Commercial TransactionsDocument24 pagesInternational Business Is A Term Used To Collectively Describe All Commercial TransactionsMohit MakkerNo ratings yet

- Economic Proof Your Digital Business: A Solopreneur's Guide to Thriving in Turbulent TimesFrom EverandEconomic Proof Your Digital Business: A Solopreneur's Guide to Thriving in Turbulent TimesNo ratings yet

- The What, The Why, The How: Mergers and AcquisitionsFrom EverandThe What, The Why, The How: Mergers and AcquisitionsRating: 2 out of 5 stars2/5 (1)

- Inventory Management in Supply ChainDocument43 pagesInventory Management in Supply ChainRashi VajaniNo ratings yet

- Classification and Regression TreesDocument37 pagesClassification and Regression TreesRashi VajaniNo ratings yet

- ContractsDocument13 pagesContractsRashi VajaniNo ratings yet

- DRW Technologies BCA ReportDocument8 pagesDRW Technologies BCA ReportRashi VajaniNo ratings yet

- 27 Harvey Balls Powerpoint TemplateDocument3 pages27 Harvey Balls Powerpoint TemplateRashi VajaniNo ratings yet

- TFC Case StudyDocument1 pageTFC Case StudyRashi VajaniNo ratings yet

- Striders: Running Away or Towards The Growth (Group 8)Document1 pageStriders: Running Away or Towards The Growth (Group 8)Rashi VajaniNo ratings yet

- Group 2 Aditya Jindal Aditya Jha Antra Chawla Rashi Vaani Rajat SurveDocument8 pagesGroup 2 Aditya Jindal Aditya Jha Antra Chawla Rashi Vaani Rajat SurveRashi VajaniNo ratings yet

- Click To Edit Master Title Style: Year East West Latin America FederalDocument2 pagesClick To Edit Master Title Style: Year East West Latin America FederalRashi VajaniNo ratings yet

- Airtel TargetsandEvaluationDocument2 pagesAirtel TargetsandEvaluationRashi VajaniNo ratings yet

- Vdna LabDocument1 pageVdna Labnaveen kumarNo ratings yet

- 21yo83 2023-24Document1 page21yo83 2023-24Raghu NayakNo ratings yet

- Presantation On Special Economic Zone (Sez) by Rahul Jagtap PGDM 1stsemDocument27 pagesPresantation On Special Economic Zone (Sez) by Rahul Jagtap PGDM 1stsemcimr33No ratings yet

- Z.A. Sea Foods1Document1 pageZ.A. Sea Foods1Richard GaurabNo ratings yet

- IJRHS 2013 Vol01 Issue 07 06Document5 pagesIJRHS 2013 Vol01 Issue 07 06Kalyani ThakurNo ratings yet

- Rural MarketingDocument6 pagesRural MarketingAshik M Kaleekal100% (2)

- 67597225eco 24 AlokDocument3 pages67597225eco 24 AlokAlok GoswamiNo ratings yet

- Final Module in Ss 13Document13 pagesFinal Module in Ss 13marvsNo ratings yet

- Punch Price List PDFDocument1 pagePunch Price List PDFAvinash KNo ratings yet

- The HistoricalEvolutionofCentral BankingDocument25 pagesThe HistoricalEvolutionofCentral Bankingmansavi bihaniNo ratings yet

- GHGGVG Data UploadedDocument3 pagesGHGGVG Data Uploadedshriya shettiwarNo ratings yet

- Instant Download PDF Applied Calculus Brief 6th Edition Berresford Test Bank Full ChapterDocument59 pagesInstant Download PDF Applied Calculus Brief 6th Edition Berresford Test Bank Full Chapteraxtonzieba8100% (5)

- AFE5008-B Financial Accounting: The Following Information Is Also RelevantDocument2 pagesAFE5008-B Financial Accounting: The Following Information Is Also RelevantDiana TuckerNo ratings yet

- TP 31 FP 68 F FromDocument1 pageTP 31 FP 68 F FromBhavdeep ShahNo ratings yet

- All LeadsDocument44 pagesAll Leadskomal LPSNo ratings yet

- Portfolio ReconstructionDocument2 pagesPortfolio ReconstructionOsmaan GóÑÍNo ratings yet

- U3A2 - Recording Transactions in A Journal - TemplateDocument3 pagesU3A2 - Recording Transactions in A Journal - TemplateJay PatelNo ratings yet

- Vietnam Economic GrowthDocument17 pagesVietnam Economic GrowthHuong Tra LeNo ratings yet

- Concession/ Deviation FormatDocument3 pagesConcession/ Deviation FormatMoorthy NaveenNo ratings yet

- Certificate of Travel Insurance: Policy DetailsDocument2 pagesCertificate of Travel Insurance: Policy DetailsLusi FebriantiNo ratings yet

- Successive Increase/ Decrease: PercentageDocument2 pagesSuccessive Increase/ Decrease: PercentageMadhu Sudhan NayakaNo ratings yet

- Working Capital ManagementDocument65 pagesWorking Capital ManagementPranav PasteNo ratings yet

- 4q22 Investor Presentaion February 2023Document34 pages4q22 Investor Presentaion February 2023mukeshindpatiNo ratings yet

- Fundamentals of ABMDocument4 pagesFundamentals of ABMMadriñan Wency M.No ratings yet

- Circular No. 449 - Modified Guidelines On The Pag-IBIG Fund Calamity Loan ProgramDocument8 pagesCircular No. 449 - Modified Guidelines On The Pag-IBIG Fund Calamity Loan ProgramJaybie SabadoNo ratings yet

- DividendDocument36 pagesDividendPooja SinghNo ratings yet

- Assignment 1 - Digital CurrencyDocument10 pagesAssignment 1 - Digital CurrencyAina SaffiyahNo ratings yet

- Rapport Annuel 2020 - enDocument79 pagesRapport Annuel 2020 - enDavid GatesNo ratings yet

- Specific Borrowing, P2, Number 5, Page 295Document2 pagesSpecific Borrowing, P2, Number 5, Page 295Jxrriz Cyrxl EhxllaNo ratings yet