Professional Documents

Culture Documents

Excel For Finance

Excel For Finance

Uploaded by

abhishaurya0 ratings0% found this document useful (0 votes)

19 views13 pagesOriginal Title

Excel for Finance

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

19 views13 pagesExcel For Finance

Excel For Finance

Uploaded by

abhishauryaCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 13

Excel for Finance

Problem 1: Buying a Bike on EMI

Prakash wanted to buy a Bajaj

Pulsar 150 CC classic motorcycle.

Its total on road price with taxes

and extra fittings is coming out to

Rs. 1,20,000. He had to pay a down

payment (from his pocket) of Rs.

20,000 and the rest Rs. 100,000 is

financed by Bajaj Finance. The Loan

amount is Rs. 100,000. The interest

rate charged by Bajaj Finance was

12 percent per annum.

Answer the following questions

a) What is the equated monthly instalment (EMI) that Prakash need

to pay for each month for a 12 month loan?

b) Prakash finds the amount he needs to pay is very high? He

requests the tenure to be extended to 24 months. What is the EMI

now?

c) Can we prepare a Loan Amortization table?

d) What is the total interest amount paid in the 12 month loan and

the 24 month loan respectively?

e) What should Prakash do? Take a 12 month loan or 24 Month

Loan? What is the tradeoff?

f) Assignment: Can you use the example to work out the same for

your Education Loan or any other loan?

EMI

We use Excel PMT function to determine how much

each monthly/annual payment should be:

PMT (rate,nper,pv,fv,type)

Fv and type are optional arguments if omitted they are assumed to

be zero.

Rate is the Interest rate per month (12%/12 = 1 %)

Nper is the number of payments (12 M,24 M etc.,)

PV is the Loan Amount (100,000)

Interest Rate

=IPMT (rate, per, nper, pv, [fv], [type])

Per is the payment period of interest

If you want to find out how much Interest is paid

in 1st instalment then per is 1 and so on.

Cumulative Interest Rate

=CUMIPMT (rate, nper, pv, start_period,

end_period, type)

Start_period - First payment in calculation.

end_period - Last payment in calculation.

Problem 2: How to compute Annuity (Equal

Annual Payments)

You take a loan of 100,000 at an interest rate of 12 percent per

year. The bank wants you to make a series of payments

(Annuity) that will pay off the loan and the interest over SIX

years.

We use Excel PMT function to determine how much each

annual payment should be:

PMT (rate,nper,pv,fv,type)

Fv and type are optional arguments if omitted they are

assumed to be zero.

Problem 3: Future Value (FV)

• Suppose you deposit 1000 in an account in

year 0 and forget about it for 10 years. What is

the balance of the amount at the beginning of

year 10.

Problem 4: Future Value Annual Deposits

(FVAD)

Suppose you deposit 1000 in an account in year

0, Now let us assume that to the initial deposit

of 1,000 this year will be followed by similar

deposit at the beginning of years 1,2, … 9. if the

account earns 10% how much will you have in

the account at the start of year 10?

Problem 5: How do you decide to invest or

not in Projects?

Ranjit plans to Invest in a tea stall. He approaches his cousin Manjit

who already runs a dozen tea stalls in a popular road junctions. Manjit

tells him it would require an investment of Rs. 100,000 per tea stall.

Cash inflows after taking into considerations all expenses are around

30,000 per year. Manjit also tells that cost of capital (rate of return that

one needs to earn out of tea stall business) is around 15%. What it

means is that, If you don’t make at least 15% then this business is not

worth it. Ranjit is in a dilemma now. Ranjit wants to run the business

for four years only. Assume that whatever investments Ranjit makes

would be worth less after four years. Should Ranjit invest in the

business ? what is the rate of return that he will earn in this project ?

Compute IRR and NPV !! Excel:

NPV and IRR

The excel definition of NPV (rate, value1, value2,

…) always assumes that the first cash flow

occurs after one period.

The IRR (values,guess) is the compound return of

return paid by the investment.

Problem 6:

Retirement Problem

A is 55 now and plans to retire at age 60, and

want to save X rupees so that after retirement A

can withdraw 30000 each year from the

account. How much should A save in the first

five years if he expects to earn 8% in PPF? A can

plan for any number of years but 8 years nicely

fits into the screen so let us assume that A wants

to plan for only 8 years after retirement and

wants to “DIE BROKE”

Software's and Databases used for learning

• Excel

• SAS

• SPSS

• R

• Python and others

• Databases: CMIE- Prowess, Proquest, EBSCO

Etc.,

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Dictionary of Fashion HistoryDocument567 pagesThe Dictionary of Fashion Historytarnawt100% (6)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Power of Virtual Distance Free Summary by Richard R. Reilly and Karen Sobel LojeskiDocument9 pagesThe Power of Virtual Distance Free Summary by Richard R. Reilly and Karen Sobel Lojeskiyogstr1No ratings yet

- Value Education PDFDocument2 pagesValue Education PDFmonisha vijayanNo ratings yet

- 101-98-Magazine For The Month of March-2022-FinalDocument138 pages101-98-Magazine For The Month of March-2022-FinalPratyush BalNo ratings yet

- Leptos Estates Indicative Price Lists May GreeceDocument12 pagesLeptos Estates Indicative Price Lists May GreeceMansiNo ratings yet

- Member Ethical StandardsDocument9 pagesMember Ethical StandardsEDWIN YEBRAIL BERNAL SANCHEZNo ratings yet

- De Thi Hoc Ki 1 Tieng Anh 10 Friends Global de So 1 1669621904Document17 pagesDe Thi Hoc Ki 1 Tieng Anh 10 Friends Global de So 1 1669621904Minh TrungNo ratings yet

- BESWMC Plan 2023Document2 pagesBESWMC Plan 2023Maynard Agustin Agraan100% (4)

- GR 10 Business SW8Document47 pagesGR 10 Business SW8Olwethu MacikoNo ratings yet

- How To Perfectly Hide IP Address in PC and SmartphoneDocument17 pagesHow To Perfectly Hide IP Address in PC and SmartphoneFulad AfzaliNo ratings yet

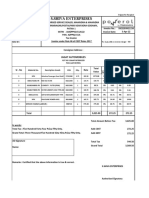

- S.Shiva Enterprises: Jagat AutomobilesDocument2 pagesS.Shiva Enterprises: Jagat AutomobilesS.SHIVA ENTERPRISESNo ratings yet

- WAEC Literature in English SyllabusDocument2 pagesWAEC Literature in English SyllabusLamin Bt SanyangNo ratings yet

- Welch v. Brown - Supreme Court PetitionDocument160 pagesWelch v. Brown - Supreme Court PetitionEquality Case FilesNo ratings yet

- PR1 Covid 19 FinalDocument14 pagesPR1 Covid 19 FinalaaaaaNo ratings yet

- Prudential Bank Vs IAC - G.R. No. 74886. December 8, 1992Document13 pagesPrudential Bank Vs IAC - G.R. No. 74886. December 8, 1992Ebbe DyNo ratings yet

- Thesis Statement On Teenage PregnancyDocument4 pagesThesis Statement On Teenage Pregnancybskb598g100% (2)

- Taruc vs. Bishop Dela Cruz, G.R. No. 144801. March 10, 2005Document1 pageTaruc vs. Bishop Dela Cruz, G.R. No. 144801. March 10, 2005JenNo ratings yet

- The Anatomy of A ChurchDocument6 pagesThe Anatomy of A ChurchAnonymous CabWGmQwNo ratings yet

- Paper 10Document8 pagesPaper 10shikhagrawalNo ratings yet

- NMS COMPLEX EpgDocument12 pagesNMS COMPLEX EpgVishnu KhandareNo ratings yet

- Church Is Citizen of The Year: EventsDocument8 pagesChurch Is Citizen of The Year: EventsDaveNo ratings yet

- Business Intelligence (BI) Frequently Asked Questions (FAQ)Document9 pagesBusiness Intelligence (BI) Frequently Asked Questions (FAQ)Milind ChavareNo ratings yet

- History Coursework PlanDocument8 pagesHistory Coursework Planiuhvgsvcf100% (2)

- Contemp W 1Document26 pagesContemp W 1Mark Jay BongolanNo ratings yet

- The McKinsey 7S ModelDocument14 pagesThe McKinsey 7S ModelLilibeth Amparo100% (1)

- Answer - Tutorial - Record Business TransactionDocument10 pagesAnswer - Tutorial - Record Business TransactiondenixngNo ratings yet

- 1MS Pre-Sequence Days MonthsDocument6 pages1MS Pre-Sequence Days Monthssabrina's worldNo ratings yet

- Nova Scotia Home Finder January 2014Document104 pagesNova Scotia Home Finder January 2014Nancy BainNo ratings yet

- Criminalization of Trafficking VictimsDocument6 pagesCriminalization of Trafficking VictimsBhavika Singh JangraNo ratings yet

- DS Jun Artefacts LRDocument59 pagesDS Jun Artefacts LRmiller999100% (1)