Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

24 viewsSeatwork-FT and FBT

Seatwork-FT and FBT

Uploaded by

Vergel MartinezCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- Tax ReviewerDocument22 pagesTax ReviewercrestagNo ratings yet

- Topic 5 - Final Income TaxationDocument12 pagesTopic 5 - Final Income TaxationNicol Jay Duriguez100% (3)

- Final Exam Tax - SpecialDocument9 pagesFinal Exam Tax - SpecialKenneth Bryan Tegerero Tegio100% (5)

- COMEX1 TAX REVIEW Canvas-1Document18 pagesCOMEX1 TAX REVIEW Canvas-1LhowellaAquinoNo ratings yet

- 8.1 Assignment - Regular Income TaxDocument3 pages8.1 Assignment - Regular Income TaxCharles Mateo0% (1)

- Tax Summative 2Document14 pagesTax Summative 2Von Andrei MedinaNo ratings yet

- Income Tax On Individuals ContDocument12 pagesIncome Tax On Individuals ContJessa HerreraNo ratings yet

- Assignment No. 2: Part 1: Determination of Income Tax Due/PayableDocument4 pagesAssignment No. 2: Part 1: Determination of Income Tax Due/PayableKenneth Pimentel100% (1)

- COMEX1 TAX REVIEW Canvas-1Document18 pagesCOMEX1 TAX REVIEW Canvas-1Angel RosalesNo ratings yet

- Tax1 Quiz 3 Fringe Benefit TaxDocument17 pagesTax1 Quiz 3 Fringe Benefit TaxJan Mark2No ratings yet

- 2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsDocument2 pages2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsVergel MartinezNo ratings yet

- Certified Accounting Technician Examination Advanced Level Paper T9 (SGP)Document14 pagesCertified Accounting Technician Examination Advanced Level Paper T9 (SGP)springnet2011No ratings yet

- Chapter 8 v2 RevisedDocument13 pagesChapter 8 v2 RevisedSheilamae Sernadilla GregorioNo ratings yet

- QuickBooks For BeginnersDocument9 pagesQuickBooks For BeginnersZain U DdinNo ratings yet

- Name: Santiago II, Cipriano Jeffrey F.: Homework 2 - Tax 1101 - Topic Income Tax - Corporation Part 2Document3 pagesName: Santiago II, Cipriano Jeffrey F.: Homework 2 - Tax 1101 - Topic Income Tax - Corporation Part 2うん こ100% (1)

- Tax Sem OuputDocument43 pagesTax Sem OuputAshlley Nicole VillaranNo ratings yet

- Test 1 TaxDocument16 pagesTest 1 TaxZyrelle Delgado0% (1)

- Chapter 12 v2Document18 pagesChapter 12 v2Sheilamae Sernadilla GregorioNo ratings yet

- A Malaysian Occupying A Managerial Position in An Offshore Banking Unit Located in Taguig Had The Following Data For Taxable Year 2015Document1 pageA Malaysian Occupying A Managerial Position in An Offshore Banking Unit Located in Taguig Had The Following Data For Taxable Year 2015Katrina Dela CruzNo ratings yet

- Allowable Deductions Part 1Document3 pagesAllowable Deductions Part 1John Rich GamasNo ratings yet

- Mock Exam Paper: Time AllowedDocument9 pagesMock Exam Paper: Time AllowedVannak2015No ratings yet

- Acc 3013 - Fwa Revision QuestionsDocument12 pagesAcc 3013 - Fwa Revision Questionsfalnuaimi001No ratings yet

- 06M Midterm Quiz No. 2 Income Tax On CorporationsDocument4 pages06M Midterm Quiz No. 2 Income Tax On CorporationsMarko IllustrisimoNo ratings yet

- Intertemporal Tax M 32Document3 pagesIntertemporal Tax M 32sm munNo ratings yet

- Homework Number 4Document8 pagesHomework Number 4ARISNo ratings yet

- PUP - Assignment No. 3 - Income Taxation - 2nd Sem AY 2020-2021: RequiredDocument12 pagesPUP - Assignment No. 3 - Income Taxation - 2nd Sem AY 2020-2021: RequiredGabrielle Marie RiveraNo ratings yet

- Compute The Tax Due Assuming That - A The Foreign Taxes Are Claimed As Tax Credit: 2 500 2.5 10 250,000 45,000 Answer M+ K M× % +Document6 pagesCompute The Tax Due Assuming That - A The Foreign Taxes Are Claimed As Tax Credit: 2 500 2.5 10 250,000 45,000 Answer M+ K M× % +Lenny Ramos Villafuerte100% (1)

- 0H9SNRYTRDocument16 pages0H9SNRYTRLoey ParkNo ratings yet

- Raid Quiz Saidosd RecitDocument4 pagesRaid Quiz Saidosd RecitKristine Lirose BordeosNo ratings yet

- SW 1Document11 pagesSW 1Charles Justin C. SaldiNo ratings yet

- Tax 1 Problem SolvingDocument4 pagesTax 1 Problem SolvingSheila Mae Araman100% (2)

- Tax Pre TestDocument40 pagesTax Pre TestjohnlerrysilvaNo ratings yet

- Assignment No. 3 Income Taxation 2nd Sem AY 2020 2021Document12 pagesAssignment No. 3 Income Taxation 2nd Sem AY 2020 2021Gabrielle Marie RiveraNo ratings yet

- BAM 031 Income Taxation QuizDocument4 pagesBAM 031 Income Taxation Quizbrmo.amatorio.uiNo ratings yet

- Taxation PreweekDocument25 pagesTaxation Preweekschaffy100% (5)

- Deductions From Gross IncomeDocument2 pagesDeductions From Gross IncomeSetty HakeemaNo ratings yet

- 2023 InTax Contri MTEDocument3 pages2023 InTax Contri MTEgarbenNo ratings yet

- Tax1 DeductionsDocument43 pagesTax1 DeductionsAlliah Mae ArbastoNo ratings yet

- Income Tax ProblemsDocument1 pageIncome Tax ProblemsPam Otic-ReyesNo ratings yet

- Tax1 DeductionsDocument45 pagesTax1 DeductionsjoNo ratings yet

- Income Tax On Individuals ContDocument12 pagesIncome Tax On Individuals ContJessa HerreraNo ratings yet

- SOL QUIZ RIT II and IIIDocument68 pagesSOL QUIZ RIT II and IIIouia iooNo ratings yet

- Chapter 13B - Special Allowable Itemized Deductions and NolcoDocument7 pagesChapter 13B - Special Allowable Itemized Deductions and NolcoprestinejanepanganNo ratings yet

- Fringe Benefit - QuizDocument3 pagesFringe Benefit - QuizArlea AsenciNo ratings yet

- Final Preboard TaxDocument8 pagesFinal Preboard TaxYaj Cruzada100% (1)

- 05M Fringe BenefitDocument4 pages05M Fringe BenefitMarko IllustrisimoNo ratings yet

- Divided by 65%: Fringe Benefit P14,400 Monetary Value P14,400Document4 pagesDivided by 65%: Fringe Benefit P14,400 Monetary Value P14,400Bernardita OpongNo ratings yet

- Tax On Corporations ExercisesDocument3 pagesTax On Corporations ExercisesJacqueline SyNo ratings yet

- Taxation May Board ExamDocument25 pagesTaxation May Board ExamjaysonNo ratings yet

- Corporation Quiz PDFDocument8 pagesCorporation Quiz PDFangelo vasquezNo ratings yet

- Tax Assignment For Mar 7Document3 pagesTax Assignment For Mar 7Marie Loise MarasiganNo ratings yet

- Handouts Gross IncomeDocument7 pagesHandouts Gross IncomebernadethsobritoNo ratings yet

- IncomeTaxation Banggawan2019 Ch13BDocument9 pagesIncomeTaxation Banggawan2019 Ch13BNoreen Ledda0% (2)

- Income Tax - ElaineDocument11 pagesIncome Tax - ElaineSamsung AccountNo ratings yet

- F6uk 2012 Dec QDocument13 pagesF6uk 2012 Dec QSaad HassanNo ratings yet

- Income and TaxationDocument37 pagesIncome and TaxationStephanie Mharie EugenioNo ratings yet

- Theory Type Questions - For Reference OnlyDocument13 pagesTheory Type Questions - For Reference OnlyHaseeb Ahmed ShaikhNo ratings yet

- Quiz-FS AnalysisDocument3 pagesQuiz-FS AnalysisVergel MartinezNo ratings yet

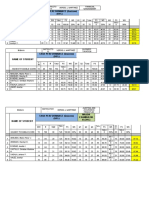

- Name of Student Task Performance (Quizzes) (50%)Document4 pagesName of Student Task Performance (Quizzes) (50%)Vergel MartinezNo ratings yet

- Name of Student TASK PERFORMANCE (Quizzes) (50%) Class Participation (20%) Major Examination (30%)Document10 pagesName of Student TASK PERFORMANCE (Quizzes) (50%) Class Participation (20%) Major Examination (30%)Vergel MartinezNo ratings yet

- Marketable Securities + Receivable: Increase. IncreaseDocument4 pagesMarketable Securities + Receivable: Increase. IncreaseVergel MartinezNo ratings yet

- Final Midterm GradesDocument10 pagesFinal Midterm GradesVergel MartinezNo ratings yet

- Seatwork On Income Taxation NameDocument2 pagesSeatwork On Income Taxation NameVergel MartinezNo ratings yet

- Quiz-Pre Engagement & Audit PlanningDocument5 pagesQuiz-Pre Engagement & Audit PlanningVergel MartinezNo ratings yet

- Time Value of MoneyDocument16 pagesTime Value of MoneyVergel MartinezNo ratings yet

- 2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsDocument2 pages2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsVergel MartinezNo ratings yet

- Quiz-Professional Standards-ARDocument4 pagesQuiz-Professional Standards-ARVergel MartinezNo ratings yet

- BondsDocument8 pagesBondsVergel MartinezNo ratings yet

- Quiz-Pre Engagement & Audit PlanningDocument5 pagesQuiz-Pre Engagement & Audit PlanningVergel MartinezNo ratings yet

- Financial Statements AnalysisDocument9 pagesFinancial Statements AnalysisVergel MartinezNo ratings yet

- Quizzer-Donor's TaxDocument4 pagesQuizzer-Donor's TaxVergel Martinez33% (3)

- 2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsDocument2 pages2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsVergel MartinezNo ratings yet

- Cases) - Retrieved From: References Production ManagementDocument2 pagesCases) - Retrieved From: References Production ManagementVergel MartinezNo ratings yet

- ListDocument5 pagesListVergel MartinezNo ratings yet

- RR 12 QuizDocument2 pagesRR 12 QuizVergel MartinezNo ratings yet

- Course Outline Example For BS AccountancyDocument5 pagesCourse Outline Example For BS AccountancyVergel MartinezNo ratings yet

- Nidec Philippines Corporation Company ProfileDocument35 pagesNidec Philippines Corporation Company ProfileVergel MartinezNo ratings yet

- PILOsDocument2 pagesPILOsVergel MartinezNo ratings yet

- Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument20 pagesRepublic of The Philippines Department of Finance Bureau of Internal RevenueVergel MartinezNo ratings yet

Seatwork-FT and FBT

Seatwork-FT and FBT

Uploaded by

Vergel Martinez0 ratings0% found this document useful (0 votes)

24 views6 pagesOriginal Title

Seatwork-FT and FBT.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

24 views6 pagesSeatwork-FT and FBT

Seatwork-FT and FBT

Uploaded by

Vergel MartinezCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 6

Seatwork

Final Tax and Fringe Benefits Tax

Problem No. 1

• Mr. Juan is a manager of Malayan, Inc. In

2018, his employer rewarded him with a

pre-owned Mitsubishi Lancer purchased

for P408,000 cash registered under Mr.

Juancho’s name. How much is the fringe

benefit tax of the company?

Problem No. 2

Paul, earned the following income for the year 2018:

Interest from an account with Citibank P100,000

Interest from BDO Bank deposit under 300,000

the expanded foreign currency deposit

system

Royalties as musical composer

Royalties from an invention 150,000

Bingo winnings 50,000

Cash dividend from PLDT Corporation 20,000

How much is Paul’s final withholding tax?

Problem No. 3

• Jude, a resident citizen had the following data for the

taxable year 2019:

*Exchange rate (1 dollar=P50)

Interest income from loan receivable P25,000

Interest income on FCDU deposit 1500 (in dollars)

Interest from bank savings deposit 50,000

Royalties from his literary work 270,000

Prize in amateur singing contest 8,000

Lotto winnings 35,000

Sale of a share of stocks (Cost P9,000) 12,000

Problem No. 3-4

3. How much is Jude’s passive income subject to

tax?

4. From the information in the no. 3, the final

tax of Jude is:

Problem No. 5

During 2019, STI College Inc. gave the following fringe benefits to its employees:

• Salaries to teachers-P2,000,000

• Salaries to program heads -800,000

• De minimis benefits to teachers -50,000

• De minimis benefits to program heads-25,000

• Fringe benefits to teachers -100,000

• Fringe benefits to program heads -150,000

How much is the fringe benefit tax?

You might also like

- Tax ReviewerDocument22 pagesTax ReviewercrestagNo ratings yet

- Topic 5 - Final Income TaxationDocument12 pagesTopic 5 - Final Income TaxationNicol Jay Duriguez100% (3)

- Final Exam Tax - SpecialDocument9 pagesFinal Exam Tax - SpecialKenneth Bryan Tegerero Tegio100% (5)

- COMEX1 TAX REVIEW Canvas-1Document18 pagesCOMEX1 TAX REVIEW Canvas-1LhowellaAquinoNo ratings yet

- 8.1 Assignment - Regular Income TaxDocument3 pages8.1 Assignment - Regular Income TaxCharles Mateo0% (1)

- Tax Summative 2Document14 pagesTax Summative 2Von Andrei MedinaNo ratings yet

- Income Tax On Individuals ContDocument12 pagesIncome Tax On Individuals ContJessa HerreraNo ratings yet

- Assignment No. 2: Part 1: Determination of Income Tax Due/PayableDocument4 pagesAssignment No. 2: Part 1: Determination of Income Tax Due/PayableKenneth Pimentel100% (1)

- COMEX1 TAX REVIEW Canvas-1Document18 pagesCOMEX1 TAX REVIEW Canvas-1Angel RosalesNo ratings yet

- Tax1 Quiz 3 Fringe Benefit TaxDocument17 pagesTax1 Quiz 3 Fringe Benefit TaxJan Mark2No ratings yet

- 2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsDocument2 pages2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsVergel MartinezNo ratings yet

- Certified Accounting Technician Examination Advanced Level Paper T9 (SGP)Document14 pagesCertified Accounting Technician Examination Advanced Level Paper T9 (SGP)springnet2011No ratings yet

- Chapter 8 v2 RevisedDocument13 pagesChapter 8 v2 RevisedSheilamae Sernadilla GregorioNo ratings yet

- QuickBooks For BeginnersDocument9 pagesQuickBooks For BeginnersZain U DdinNo ratings yet

- Name: Santiago II, Cipriano Jeffrey F.: Homework 2 - Tax 1101 - Topic Income Tax - Corporation Part 2Document3 pagesName: Santiago II, Cipriano Jeffrey F.: Homework 2 - Tax 1101 - Topic Income Tax - Corporation Part 2うん こ100% (1)

- Tax Sem OuputDocument43 pagesTax Sem OuputAshlley Nicole VillaranNo ratings yet

- Test 1 TaxDocument16 pagesTest 1 TaxZyrelle Delgado0% (1)

- Chapter 12 v2Document18 pagesChapter 12 v2Sheilamae Sernadilla GregorioNo ratings yet

- A Malaysian Occupying A Managerial Position in An Offshore Banking Unit Located in Taguig Had The Following Data For Taxable Year 2015Document1 pageA Malaysian Occupying A Managerial Position in An Offshore Banking Unit Located in Taguig Had The Following Data For Taxable Year 2015Katrina Dela CruzNo ratings yet

- Allowable Deductions Part 1Document3 pagesAllowable Deductions Part 1John Rich GamasNo ratings yet

- Mock Exam Paper: Time AllowedDocument9 pagesMock Exam Paper: Time AllowedVannak2015No ratings yet

- Acc 3013 - Fwa Revision QuestionsDocument12 pagesAcc 3013 - Fwa Revision Questionsfalnuaimi001No ratings yet

- 06M Midterm Quiz No. 2 Income Tax On CorporationsDocument4 pages06M Midterm Quiz No. 2 Income Tax On CorporationsMarko IllustrisimoNo ratings yet

- Intertemporal Tax M 32Document3 pagesIntertemporal Tax M 32sm munNo ratings yet

- Homework Number 4Document8 pagesHomework Number 4ARISNo ratings yet

- PUP - Assignment No. 3 - Income Taxation - 2nd Sem AY 2020-2021: RequiredDocument12 pagesPUP - Assignment No. 3 - Income Taxation - 2nd Sem AY 2020-2021: RequiredGabrielle Marie RiveraNo ratings yet

- Compute The Tax Due Assuming That - A The Foreign Taxes Are Claimed As Tax Credit: 2 500 2.5 10 250,000 45,000 Answer M+ K M× % +Document6 pagesCompute The Tax Due Assuming That - A The Foreign Taxes Are Claimed As Tax Credit: 2 500 2.5 10 250,000 45,000 Answer M+ K M× % +Lenny Ramos Villafuerte100% (1)

- 0H9SNRYTRDocument16 pages0H9SNRYTRLoey ParkNo ratings yet

- Raid Quiz Saidosd RecitDocument4 pagesRaid Quiz Saidosd RecitKristine Lirose BordeosNo ratings yet

- SW 1Document11 pagesSW 1Charles Justin C. SaldiNo ratings yet

- Tax 1 Problem SolvingDocument4 pagesTax 1 Problem SolvingSheila Mae Araman100% (2)

- Tax Pre TestDocument40 pagesTax Pre TestjohnlerrysilvaNo ratings yet

- Assignment No. 3 Income Taxation 2nd Sem AY 2020 2021Document12 pagesAssignment No. 3 Income Taxation 2nd Sem AY 2020 2021Gabrielle Marie RiveraNo ratings yet

- BAM 031 Income Taxation QuizDocument4 pagesBAM 031 Income Taxation Quizbrmo.amatorio.uiNo ratings yet

- Taxation PreweekDocument25 pagesTaxation Preweekschaffy100% (5)

- Deductions From Gross IncomeDocument2 pagesDeductions From Gross IncomeSetty HakeemaNo ratings yet

- 2023 InTax Contri MTEDocument3 pages2023 InTax Contri MTEgarbenNo ratings yet

- Tax1 DeductionsDocument43 pagesTax1 DeductionsAlliah Mae ArbastoNo ratings yet

- Income Tax ProblemsDocument1 pageIncome Tax ProblemsPam Otic-ReyesNo ratings yet

- Tax1 DeductionsDocument45 pagesTax1 DeductionsjoNo ratings yet

- Income Tax On Individuals ContDocument12 pagesIncome Tax On Individuals ContJessa HerreraNo ratings yet

- SOL QUIZ RIT II and IIIDocument68 pagesSOL QUIZ RIT II and IIIouia iooNo ratings yet

- Chapter 13B - Special Allowable Itemized Deductions and NolcoDocument7 pagesChapter 13B - Special Allowable Itemized Deductions and NolcoprestinejanepanganNo ratings yet

- Fringe Benefit - QuizDocument3 pagesFringe Benefit - QuizArlea AsenciNo ratings yet

- Final Preboard TaxDocument8 pagesFinal Preboard TaxYaj Cruzada100% (1)

- 05M Fringe BenefitDocument4 pages05M Fringe BenefitMarko IllustrisimoNo ratings yet

- Divided by 65%: Fringe Benefit P14,400 Monetary Value P14,400Document4 pagesDivided by 65%: Fringe Benefit P14,400 Monetary Value P14,400Bernardita OpongNo ratings yet

- Tax On Corporations ExercisesDocument3 pagesTax On Corporations ExercisesJacqueline SyNo ratings yet

- Taxation May Board ExamDocument25 pagesTaxation May Board ExamjaysonNo ratings yet

- Corporation Quiz PDFDocument8 pagesCorporation Quiz PDFangelo vasquezNo ratings yet

- Tax Assignment For Mar 7Document3 pagesTax Assignment For Mar 7Marie Loise MarasiganNo ratings yet

- Handouts Gross IncomeDocument7 pagesHandouts Gross IncomebernadethsobritoNo ratings yet

- IncomeTaxation Banggawan2019 Ch13BDocument9 pagesIncomeTaxation Banggawan2019 Ch13BNoreen Ledda0% (2)

- Income Tax - ElaineDocument11 pagesIncome Tax - ElaineSamsung AccountNo ratings yet

- F6uk 2012 Dec QDocument13 pagesF6uk 2012 Dec QSaad HassanNo ratings yet

- Income and TaxationDocument37 pagesIncome and TaxationStephanie Mharie EugenioNo ratings yet

- Theory Type Questions - For Reference OnlyDocument13 pagesTheory Type Questions - For Reference OnlyHaseeb Ahmed ShaikhNo ratings yet

- Quiz-FS AnalysisDocument3 pagesQuiz-FS AnalysisVergel MartinezNo ratings yet

- Name of Student Task Performance (Quizzes) (50%)Document4 pagesName of Student Task Performance (Quizzes) (50%)Vergel MartinezNo ratings yet

- Name of Student TASK PERFORMANCE (Quizzes) (50%) Class Participation (20%) Major Examination (30%)Document10 pagesName of Student TASK PERFORMANCE (Quizzes) (50%) Class Participation (20%) Major Examination (30%)Vergel MartinezNo ratings yet

- Marketable Securities + Receivable: Increase. IncreaseDocument4 pagesMarketable Securities + Receivable: Increase. IncreaseVergel MartinezNo ratings yet

- Final Midterm GradesDocument10 pagesFinal Midterm GradesVergel MartinezNo ratings yet

- Seatwork On Income Taxation NameDocument2 pagesSeatwork On Income Taxation NameVergel MartinezNo ratings yet

- Quiz-Pre Engagement & Audit PlanningDocument5 pagesQuiz-Pre Engagement & Audit PlanningVergel MartinezNo ratings yet

- Time Value of MoneyDocument16 pagesTime Value of MoneyVergel MartinezNo ratings yet

- 2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsDocument2 pages2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsVergel MartinezNo ratings yet

- Quiz-Professional Standards-ARDocument4 pagesQuiz-Professional Standards-ARVergel MartinezNo ratings yet

- BondsDocument8 pagesBondsVergel MartinezNo ratings yet

- Quiz-Pre Engagement & Audit PlanningDocument5 pagesQuiz-Pre Engagement & Audit PlanningVergel MartinezNo ratings yet

- Financial Statements AnalysisDocument9 pagesFinancial Statements AnalysisVergel MartinezNo ratings yet

- Quizzer-Donor's TaxDocument4 pagesQuizzer-Donor's TaxVergel Martinez33% (3)

- 2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsDocument2 pages2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsVergel MartinezNo ratings yet

- Cases) - Retrieved From: References Production ManagementDocument2 pagesCases) - Retrieved From: References Production ManagementVergel MartinezNo ratings yet

- ListDocument5 pagesListVergel MartinezNo ratings yet

- RR 12 QuizDocument2 pagesRR 12 QuizVergel MartinezNo ratings yet

- Course Outline Example For BS AccountancyDocument5 pagesCourse Outline Example For BS AccountancyVergel MartinezNo ratings yet

- Nidec Philippines Corporation Company ProfileDocument35 pagesNidec Philippines Corporation Company ProfileVergel MartinezNo ratings yet

- PILOsDocument2 pagesPILOsVergel MartinezNo ratings yet

- Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument20 pagesRepublic of The Philippines Department of Finance Bureau of Internal RevenueVergel MartinezNo ratings yet