Professional Documents

Culture Documents

Strategic Management: Part II: Strategic Actions: Strategy Formulation Chapter 6: Corporate-Level Strategy

Strategic Management: Part II: Strategic Actions: Strategy Formulation Chapter 6: Corporate-Level Strategy

Uploaded by

Nigin G KariattOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Strategic Management: Part II: Strategic Actions: Strategy Formulation Chapter 6: Corporate-Level Strategy

Strategic Management: Part II: Strategic Actions: Strategy Formulation Chapter 6: Corporate-Level Strategy

Uploaded by

Nigin G KariattCopyright:

Available Formats

Strategic Management

Part II: Strategic Actions:

Strategy Formulation

Chapter 6: Corporate-Level Strategy

© 2016 Cengage Learning India Pvt. Ltd. All rights

reserved.

Chapter 6: Corporate-Level Strategy

• Overview: Seven content areas

– Define and discuss corporate-level strategy

– Different levels of diversification

– Three primary reasons firms diversify

– Value creation: related diversification strategy

– Value creation: unrelated diversification strategy

– Incentives and resources encouraging value-neutral

diversification

– Management motives encouraging firm

overdiversification

© 2016 Cengage Learning India Pvt. Ltd. All rights

reserved.

Introduction

• Corporate-level strategy: Specifies actions a firm

takes to gain a competitive advantage by selecting

and managing a group of different businesses

competing in different product markets

– Expected to help firm earn above-average returns

– Value ultimately determined by degree to which “the

businesses in the portfolio are worth more under the

management of the company then they would be under

any other ownership

• Product diversification (PD): primary form of corporate-level

strategy

© 2016 Cengage Learning India Pvt. Ltd. All rights

reserved.

Levels of Diversification

• 1. Low Levels

– Single Business Strategy

• Corporate-level strategy in which the firm generates 95% or

more of its sales revenue from its core business area

– Dominant Business Diversification Strategy

• Corporate-level strategy whereby firm generates 70-95% of

total sales revenue within a single business area

© 2016 Cengage Learning India Pvt. Ltd. All rights

reserved.

Levels of Diversification (Cont’d)

• 2. Moderate to High Levels

– Related Constrained Diversification Strategy

• Less than 70% of revenue comes from the dominant business

• Direct links (i.e., share products, technology and distribution

linkages) between the firm's businesses

– Related Linked Diversification Strategy (Mixed related

and unrelated)

• Less than 70% of revenue comes from the dominant business

• Mixed: Linked firms sharing fewer resources and assets

among their businesses (compared with related constrained,

above), concentrating on the transfer of knowledge and

competencies among the businesses

© 2016 Cengage Learning India Pvt. Ltd. All rights

reserved.

Levels of Diversification

• 3. Very High Levels: Unrelated

• Less than 70% of revenue comes from dominant business

• No relationships between businesses

© 2016 Cengage Learning India Pvt. Ltd. All rights

reserved.

Levels and Types of Diversification

© 2016 Cengage Learning India Pvt. Ltd. All rights

reserved.

Reasons for Diversification

• A number of reasons exist for diversification

including

– Value-creating

• Operational relatedness: sharing activities between

businesses

• Corporate relatedness: transferring core competencies into

business

– Value-neutral

– Value-reducing

© 2016 Cengage Learning India Pvt. Ltd. All rights

reserved.

Value-Creating Diversification Strategies:

Operational and Corporate Relatedness

© 2016 Cengage Learning India Pvt. Ltd. All rights

reserved.

Value-Creating Diversification (VCD): Related

Strategies

• Related diversification wants to develop and

exploit economies of scope between its businesses

– Economies of scope: Cost savings firm creates by

successfully sharing some of its resources and

capabilities or transferring one or more corporate-level

core competencies that were developed in one of its

businesses to another of its businesses

© 2016 Cengage Learning India Pvt. Ltd. All rights

reserved.

Value-Creating Diversification (VCD): Related

Strategies (Cont’d)

• 1. Operational Relatedness: Sharing activities

– Can gain economies of scope

– Share primary or support activities (in value chain)

• Risky as ties create links between outcomes

– Related constrained share activities in order to create

value

– Not easy, often synergies not realized as planned

© 2016 Cengage Learning India Pvt. Ltd. All rights

reserved.

Value-Creating Diversification (VCD): Related

Strategies (Cont’d)

• 2. Corporate Relatedness: Core competency

transfer

– Complex sets of resources and capabilities linking

different businesses through managerial and

technological knowledge, experience and expertise

– Two sources of value creation

• Expense incurred in first business and knowledge transfer

reduces resource allocation for second business

• Intangible resources difficult for competitors to understand

and imitate, so immediate competitive advantage over

competition

– Use related-linked diversification strategy

© 2016 Cengage Learning India Pvt. Ltd. All rights

reserved.

Value-Creating Diversification (VCD):

Unrelated Strategies

• Creates value through two types of financial

economies

– Cost savings realized through improved allocations of

financial resources based on investments inside or

outside firm

• Efficient internal capital market allocation

© 2016 Cengage Learning India Pvt. Ltd. All rights

reserved.

Value-Neutral Diversification:

Incentives and Resources

• Incentives to Diversify

– Antitrust Regulation and Tax Laws

– Low Performance

– Uncertain Future Cash Flows

– Synergy and Firm Risk Reduction

– Resources and Diversification

© 2016 Cengage Learning India Pvt. Ltd. All rights

reserved.

Value-Reducing Diversification:

Managerial Motives to Diversify

• Top-level executives may diversify in order to

diversity their own employment risk, as long as

profitability does not suffer excessively

– Diversification adds benefits to top-level managers but

not shareholders

– This strategy may be held in check by governance

mechanisms or concerns for one’s reputation

© 2016 Cengage Learning India Pvt. Ltd. All rights

reserved.

You might also like

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)From EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Rating: 4.5 out of 5 stars4.5/5 (25)

- ACCA F6 Mock Exam QuestionsDocument22 pagesACCA F6 Mock Exam QuestionsGeo Don100% (1)

- Build Lease and Transfer AgreementDocument8 pagesBuild Lease and Transfer AgreementMunicipal Planning and Development Officer Office0% (1)

- The Pepsi Refresh Project: A Thirst For ChangeDocument10 pagesThe Pepsi Refresh Project: A Thirst For ChangeNigin G KariattNo ratings yet

- Linklaters Schwab ReportDocument81 pagesLinklaters Schwab Reportkiting28No ratings yet

- .Corporate Level StrategyDocument28 pages.Corporate Level StrategyNatani Sai Krishna100% (1)

- Corporate Level StrategyDocument19 pagesCorporate Level StrategyMargaretta LiangNo ratings yet

- Corporate Level StrategyDocument22 pagesCorporate Level StrategyGaurav GopalNo ratings yet

- Chloe Barteau, Erica Cheung, Deanna Shiverick, Devin Sidi, Halle SperegenDocument27 pagesChloe Barteau, Erica Cheung, Deanna Shiverick, Devin Sidi, Halle SperegenNigin G KariattNo ratings yet

- 2013 Ibbotson SBBIDocument43 pages2013 Ibbotson SBBIxjackx100% (1)

- Sony EricssonDocument15 pagesSony EricssonShailesh KumarNo ratings yet

- Business Plan Niel4Document23 pagesBusiness Plan Niel4Niel S. Defensor100% (2)

- Strategic Management: Part II: Strategic Actions: Strategy Formulation Chapter 4: Business-Level StrategyDocument17 pagesStrategic Management: Part II: Strategic Actions: Strategy Formulation Chapter 4: Business-Level StrategyNigin G KariattNo ratings yet

- Strategic Management: Concepts and Cases 9eDocument30 pagesStrategic Management: Concepts and Cases 9egusti sandhiNo ratings yet

- Corporate Level StrategyDocument55 pagesCorporate Level StrategyTeerra100% (1)

- Corporate Strategy: Mod Iii Topic 4Document27 pagesCorporate Strategy: Mod Iii Topic 4Meghna SinghNo ratings yet

- Perencanaan Bisnis StrategiDocument55 pagesPerencanaan Bisnis StrategiSutarjo9No ratings yet

- Chapter Ten: Corporate-Level StrategyDocument31 pagesChapter Ten: Corporate-Level StrategyPulkit SinghalNo ratings yet

- AB3601 - Week 6 - Corporate Level StrategiesDocument49 pagesAB3601 - Week 6 - Corporate Level StrategiesJian XuanNo ratings yet

- Unit-V - Business & Functional Level StrategyDocument70 pagesUnit-V - Business & Functional Level StrategyAmruta PeriNo ratings yet

- MGT 490 Chapter 5Document41 pagesMGT 490 Chapter 5Tamzid Ahmed AnikNo ratings yet

- Chapter 1Document32 pagesChapter 1dero hamidNo ratings yet

- Diversification:: Strategies For Managing A Group of BusinessesDocument20 pagesDiversification:: Strategies For Managing A Group of BusinessesParth ShingalaNo ratings yet

- SHRP01Document19 pagesSHRP01Arju LubnaNo ratings yet

- Lecture - 6 SMDocument42 pagesLecture - 6 SMAnonymous ZRvX6kbXOhNo ratings yet

- SM Unit - IiDocument10 pagesSM Unit - Iirammohan33No ratings yet

- SM Unit - IIIDocument10 pagesSM Unit - IIIrammohan33No ratings yet

- CH07 PowerPointDocument22 pagesCH07 PowerPointHalar AliNo ratings yet

- 4890 CHPT 8, Corporate Strategy, DiversificationDocument45 pages4890 CHPT 8, Corporate Strategy, Diversificationniki399yNo ratings yet

- Corporate Level StrategyDocument23 pagesCorporate Level StrategyNagarjun VsNo ratings yet

- Corporate StrategyDocument15 pagesCorporate StrategySaurabh KhuranaNo ratings yet

- Designing Business Level StrategiesDocument58 pagesDesigning Business Level StrategiesJulie Estopace100% (1)

- Five Generic StrategiesDocument42 pagesFive Generic Strategiesanon_938204859No ratings yet

- SM Ch-6 Corporate Level StrategiesDocument116 pagesSM Ch-6 Corporate Level Strategiesnisar241989No ratings yet

- Level STMDocument23 pagesLevel STMlobna.kamel126No ratings yet

- Chapter 8Document4 pagesChapter 8rakibulislammbstu01No ratings yet

- Valuation of EquityDocument57 pagesValuation of Equityld464121No ratings yet

- Strategic in ActionDocument47 pagesStrategic in ActionIzzy CalangianNo ratings yet

- Corporate Strategy:: Diversification and The Multibusiness CompanyDocument18 pagesCorporate Strategy:: Diversification and The Multibusiness CompanyFarhana MituNo ratings yet

- Planning and Strategic ManagementDocument31 pagesPlanning and Strategic ManagementCharm Mira100% (1)

- Chapter 6Document6 pagesChapter 6Mariya BhavesNo ratings yet

- SM - Ch1Document52 pagesSM - Ch1Mohamed IbrahimNo ratings yet

- Strategy Formulation and ImplementationDocument42 pagesStrategy Formulation and ImplementationAgustinVillarealNo ratings yet

- Levels of Strategic Decision MakingDocument11 pagesLevels of Strategic Decision Makingkareena pooniaNo ratings yet

- Michael Ceasar B. Abarca: BS Business Economics IIDocument14 pagesMichael Ceasar B. Abarca: BS Business Economics IIapi-26604549No ratings yet

- Cis Strategic Management NotesDocument47 pagesCis Strategic Management NotesMandla Dube100% (1)

- Strategic ManagementDocument29 pagesStrategic ManagementN-jay ErnietaNo ratings yet

- Corporatestrpart 2Document20 pagesCorporatestrpart 2api-228377429No ratings yet

- Ch06 SMDocument36 pagesCh06 SMYber LexNo ratings yet

- SHRP01 (Compatibility Mode)Document9 pagesSHRP01 (Compatibility Mode)Stone Forest LtdNo ratings yet

- SS - CH 2Document34 pagesSS - CH 2ena nadiaNo ratings yet

- Corporate StrategyDocument28 pagesCorporate StrategyAnupam SinghNo ratings yet

- Unit 4.3 - Corporate Strategy and DiversificationDocument22 pagesUnit 4.3 - Corporate Strategy and Diversificationjulianne.habito.cthmNo ratings yet

- Eed 413 Note 3Document23 pagesEed 413 Note 3Mujahid UsmanNo ratings yet

- Pasca Strategic Management Week 3-4 Ganjil 2022-2023 PostingDocument23 pagesPasca Strategic Management Week 3-4 Ganjil 2022-2023 PostingADE TIARA FEBRINANo ratings yet

- S MGT Ki - Maa Ki AankhDocument25 pagesS MGT Ki - Maa Ki AankhPrannoy Karekar KalghatkarNo ratings yet

- Competing For Advantage 3rd Edition Hoskisson Solutions ManualDocument30 pagesCompeting For Advantage 3rd Edition Hoskisson Solutions Manualdieulienheipgo100% (34)

- Chapter 4: Planning: Part 2: Stategy Formulation and ImplementationDocument32 pagesChapter 4: Planning: Part 2: Stategy Formulation and ImplementationTuyet ThiNo ratings yet

- PowerPoint Lecture 4Document26 pagesPowerPoint Lecture 4hrleenNo ratings yet

- Startegic Management NotesDocument155 pagesStartegic Management NotesVimal Saxena100% (1)

- Cost LeadershipDocument29 pagesCost Leadershipkamlesh choudharyNo ratings yet

- Competitive Strategy: Lecture 6: Corporate Level StrategyDocument27 pagesCompetitive Strategy: Lecture 6: Corporate Level StrategyhrleenNo ratings yet

- OBS 124 Unit 2 - Manager As Planner and Strategist - Final 2023Document40 pagesOBS 124 Unit 2 - Manager As Planner and Strategist - Final 2023Lungelo Maphumulo100% (1)

- Corporate-Level Strategy:: What Business Are We In?Document5 pagesCorporate-Level Strategy:: What Business Are We In?Chitral PatelNo ratings yet

- Chapter 6 ModuleDocument6 pagesChapter 6 ModuleTRCLNNo ratings yet

- Strategic Management Concepts Competitiveness and Globalization 12Th Edition Hitt Solutions Manual Full Chapter PDFDocument55 pagesStrategic Management Concepts Competitiveness and Globalization 12Th Edition Hitt Solutions Manual Full Chapter PDFdisfleshsipidwcqzs100% (9)

- Strategic Analysis of Internal Environment of a Business OrganisationFrom EverandStrategic Analysis of Internal Environment of a Business OrganisationNo ratings yet

- Snack Food Effect Due To Covid19Document3 pagesSnack Food Effect Due To Covid19Nigin G KariattNo ratings yet

- Literature Review On Adoption of Digital Payment SystemDocument7 pagesLiterature Review On Adoption of Digital Payment SystemNigin G KariattNo ratings yet

- Are Convenience and Rewards Leading To A Digital Flashpoint?Document8 pagesAre Convenience and Rewards Leading To A Digital Flashpoint?Nigin G KariattNo ratings yet

- Comparative Analysis of Payment Method Between Digital Money and Non-Digital Money Towards Customer Purchase DecisionDocument7 pagesComparative Analysis of Payment Method Between Digital Money and Non-Digital Money Towards Customer Purchase DecisionNigin G KariattNo ratings yet

- Currency Exchange Rates How To Convert CurrencyDocument1 pageCurrency Exchange Rates How To Convert CurrencyNigin G KariattNo ratings yet

- Impact of Internet Usage Comfort and Internet Technical Comfort On Online Shopping and Online BankingDocument14 pagesImpact of Internet Usage Comfort and Internet Technical Comfort On Online Shopping and Online BankingNigin G KariattNo ratings yet

- Mobile Money, Towards Understanding How Spending Patterns in Emerging Economy Can Form A Consumer BehaviorDocument3 pagesMobile Money, Towards Understanding How Spending Patterns in Emerging Economy Can Form A Consumer BehaviorNigin G KariattNo ratings yet

- A Massive 5-Step Guide To Successful New Product Launches: Nima TorabiDocument24 pagesA Massive 5-Step Guide To Successful New Product Launches: Nima TorabiNigin G KariattNo ratings yet

- India Economy StatusDocument5 pagesIndia Economy StatusNigin G KariattNo ratings yet

- Strategic Management: Part II: Strategic Actions: Strategy Formulation Chapter 5: Competitive Rivalry and DynamicsDocument22 pagesStrategic Management: Part II: Strategic Actions: Strategy Formulation Chapter 5: Competitive Rivalry and DynamicsNigin G KariattNo ratings yet

- Strategic Management: Part II: Strategic Actions: Strategy Formulation Chapter 8: Global StrategyDocument19 pagesStrategic Management: Part II: Strategic Actions: Strategy Formulation Chapter 8: Global StrategyNigin G KariattNo ratings yet

- Strategic Management: Part II: Strategic Actions: Strategy Formulation Chapter 9: Cooperative Implications For StrategyDocument21 pagesStrategic Management: Part II: Strategic Actions: Strategy Formulation Chapter 9: Cooperative Implications For StrategyNigin G KariattNo ratings yet

- Strategic Management: Part III: Strategic Actions: Strategy Implementation Chapter 10: Corporate Governance and EthicsDocument17 pagesStrategic Management: Part III: Strategic Actions: Strategy Implementation Chapter 10: Corporate Governance and EthicsNigin G KariattNo ratings yet

- Strategic Management: Part II: Strategic Actions: Strategy Formulation Chapter 4: Business-Level StrategyDocument17 pagesStrategic Management: Part II: Strategic Actions: Strategy Formulation Chapter 4: Business-Level StrategyNigin G KariattNo ratings yet

- Strategic ManagementDocument11 pagesStrategic ManagementNigin G KariattNo ratings yet

- Case U MDocument7 pagesCase U MNigin G KariattNo ratings yet

- Performance AssessmentDocument11 pagesPerformance AssessmentNigin G KariattNo ratings yet

- Introduction Objectives Research Design Secondary ResearchDocument103 pagesIntroduction Objectives Research Design Secondary ResearchNigin G KariattNo ratings yet

- Research Challenges and Opportunities in Business Analytics (JBA, 2018)Document12 pagesResearch Challenges and Opportunities in Business Analytics (JBA, 2018)Nigin G KariattNo ratings yet

- Essch 2Document27 pagesEssch 2Ghania KhushnoodNo ratings yet

- The Havaianas Story - Learn How To Paint With Your FeetDocument2 pagesThe Havaianas Story - Learn How To Paint With Your FeetMaarten Schäfer50% (2)

- Week 4 Health Care Facility DesignDocument11 pagesWeek 4 Health Care Facility DesignJessy WairiaNo ratings yet

- Assignment Brief (RQF) : Higher National Certificate/Diploma in BusinessDocument15 pagesAssignment Brief (RQF) : Higher National Certificate/Diploma in BusinessThành Vinh NguyễnNo ratings yet

- FinmarDocument67 pagesFinmarGabrielle Anne MagsanocNo ratings yet

- Article From S.directDocument8 pagesArticle From S.directmustefaNo ratings yet

- Europe 2020: Multi-Level Governance in ActionDocument8 pagesEurope 2020: Multi-Level Governance in ActionAndrei PopescuNo ratings yet

- Sales Letter Agora FinancialDocument10 pagesSales Letter Agora FinancialJapa Tamashiro JrNo ratings yet

- Ranjit HsDocument4 pagesRanjit HsJeeva JaguarNo ratings yet

- G.R. No. L-35726 July 21, 1982 SOCIAL SECURITY SYSTEM, Petitioner, CITY OF BACOLOD and MIGUEL REYNALDO As City Treasurer of Bacolod City, RespondentsDocument2 pagesG.R. No. L-35726 July 21, 1982 SOCIAL SECURITY SYSTEM, Petitioner, CITY OF BACOLOD and MIGUEL REYNALDO As City Treasurer of Bacolod City, RespondentsMary Anne75% (4)

- Cir vs. General Foods Inc.Document2 pagesCir vs. General Foods Inc.Dexter Lee GonzalesNo ratings yet

- MIDTERM EXAMINATION in ENTREPRENEURSHIPDocument3 pagesMIDTERM EXAMINATION in ENTREPRENEURSHIPjafNo ratings yet

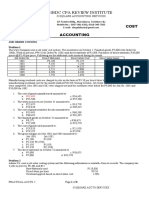

- 1Bdc Cpa Review Institute: Cost AccountingDocument8 pages1Bdc Cpa Review Institute: Cost AccountingJason BautistaNo ratings yet

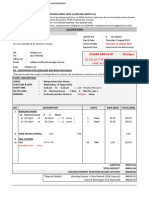

- OU 166 QuoDocument2 pagesOU 166 QuoLincon AsrtraxNo ratings yet

- Bill of Supply For Electricity: BSES Rajdhani Power LimitedDocument2 pagesBill of Supply For Electricity: BSES Rajdhani Power LimitedPriya SharmaNo ratings yet

- BankDocument58 pagesBankalmamunduthm100% (1)

- Survey of Accounting 8th Edition Warren Solutions Manual 1Document39 pagesSurvey of Accounting 8th Edition Warren Solutions Manual 1michael100% (50)

- Management History ModuleDocument32 pagesManagement History ModulevaleriaNo ratings yet

- Chapter 8Document75 pagesChapter 8Nguyen NguyenNo ratings yet

- Answer Key NegotiationDocument2 pagesAnswer Key NegotiationMohamed SaadaouiNo ratings yet

- OBA Overview SlidesDocument9 pagesOBA Overview SlidesWijana NugrahaNo ratings yet

- Business ResearchDocument15 pagesBusiness ResearchJaswanth Singh RajpurohitNo ratings yet

- UAE Vision 2021: Axes of The National AgendaDocument3 pagesUAE Vision 2021: Axes of The National Agendanebhan100% (1)

- Concept+Tree Market+Research KochiDocument4 pagesConcept+Tree Market+Research KochisheizidireesNo ratings yet