Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

74 viewsIRCTC

IRCTC

Uploaded by

YashIRCTC is an Indian government-owned enterprise and a major ticketing, catering and tourism arm of Indian Railways. It handles around 5.5-6 million online ticket bookings per day, making it the world's second busiest rail ticketing website. Some key financial metrics for IRCTC include a market capitalization of Rs. 31,960 crore and consistent growth in revenue, earnings and cash flows over the past 5 years, with annual earnings growth between 16.5-23.4% during this period.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You might also like

- KSA Retail OverviewDocument21 pagesKSA Retail OverviewPrashant Pratap SinghNo ratings yet

- Case Solutions Chapter - 08Document2 pagesCase Solutions Chapter - 08chadtandon67% (6)

- Thoma Pharmaceutical Company-Capital Budgeting and Estimating Cash Flows-Part V-Chapter 12Document3 pagesThoma Pharmaceutical Company-Capital Budgeting and Estimating Cash Flows-Part V-Chapter 12Rajib Dahal78% (9)

- (IN CR.) : Risk Return AnalysisDocument1 page(IN CR.) : Risk Return AnalysisYashNo ratings yet

- CH CFDocument10 pagesCH CFSyed OsamaNo ratings yet

- Financial Model of Infosys: Revenue Ebitda Net IncomeDocument32 pagesFinancial Model of Infosys: Revenue Ebitda Net IncomePrabhdeep Dadyal100% (1)

- Investor Release For December 31, 2016 (Company Update)Document10 pagesInvestor Release For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Advanced PortfolioDocument8 pagesAdvanced PortfolioRaiyanNo ratings yet

- ITC Limited: One of India's Most Admired and Valuable CompaniesDocument65 pagesITC Limited: One of India's Most Admired and Valuable Companieshelloamit1991No ratings yet

- Elevance Health: (Former Anthem Inc)Document5 pagesElevance Health: (Former Anthem Inc)Hans WeirlNo ratings yet

- DupontDocument8 pagesDupontAnonymous 5m1uMUPaHNo ratings yet

- Larsen & Toubro: On TrackDocument9 pagesLarsen & Toubro: On TrackalparathiNo ratings yet

- Capital Budgeting-2Document48 pagesCapital Budgeting-2Adarsh Singh RathoreNo ratings yet

- Cipla Financial ModelDocument15 pagesCipla Financial ModelAryan HateNo ratings yet

- 1Q20 Core Earnings in Line With Forecast: Metro Pacific Investments CorporationDocument8 pages1Q20 Core Earnings in Line With Forecast: Metro Pacific Investments CorporationJNo ratings yet

- Presentation Fy 2020Document9 pagesPresentation Fy 2020hammalbaloch5656No ratings yet

- Performance Analysis of Central Pharmaceuticals LTDDocument21 pagesPerformance Analysis of Central Pharmaceuticals LTDFahim RahmanNo ratings yet

- Financial Modelling ReportDocument15 pagesFinancial Modelling ReportakshaynamsaniNo ratings yet

- Cost ModellingDocument10 pagesCost ModellingRESMITA DASNo ratings yet

- Financial Modeling: NSE: TCS - BSE: 532540 Shaik OmerDocument20 pagesFinancial Modeling: NSE: TCS - BSE: 532540 Shaik Omergoku sonNo ratings yet

- Care Ratings - Q4FY19 - Call Closure - 13062019 - 14-06-2019 - 09Document4 pagesCare Ratings - Q4FY19 - Call Closure - 13062019 - 14-06-2019 - 09Jai SinghNo ratings yet

- TSX Mty or Us Otc Mtyff - Passive WatchDocument8 pagesTSX Mty or Us Otc Mtyff - Passive WatchwmthomsonNo ratings yet

- Ratios 123Document40 pagesRatios 123Mahesh G VNo ratings yet

- Project Telehealth - Health at Home: Equipment InformationDocument1 pageProject Telehealth - Health at Home: Equipment InformationSenapati Prabhupada DasNo ratings yet

- Purchase Price 10000 Life 6 Years Salvage/Liquidation Value 4000 Book Value at 5 1666.667 0 - 10000 Capital Gains 2333.333 1 Tax 700 2 After Tax Cash Flow On Asset Sale 3300 3 4 5 4000Document6 pagesPurchase Price 10000 Life 6 Years Salvage/Liquidation Value 4000 Book Value at 5 1666.667 0 - 10000 Capital Gains 2333.333 1 Tax 700 2 After Tax Cash Flow On Asset Sale 3300 3 4 5 4000Sneha DasNo ratings yet

- Mutual Fund Screener: For The Quarter Ended Jun - 18Document27 pagesMutual Fund Screener: For The Quarter Ended Jun - 18BHAVESH KHOMNENo ratings yet

- Laketran FoloDocument1 pageLaketran Fololkessel5622No ratings yet

- Investment DecisionDocument11 pagesInvestment DecisionTahir IqbalNo ratings yet

- Free Cash Flow Estimate (In INR CRS)Document2 pagesFree Cash Flow Estimate (In INR CRS)SaiVamsiNo ratings yet

- Our TopicDocument17 pagesOur Topicadil siddiqyuiNo ratings yet

- Problem 6-26: Contribution Format Income StatementDocument2 pagesProblem 6-26: Contribution Format Income StatementHira Mustafa ShahNo ratings yet

- Case StudyDocument5 pagesCase Studyphượng nguyễn thị minhNo ratings yet

- AXIS_BANK_Ltd_1719518460Document16 pagesAXIS_BANK_Ltd_1719518460Sudheer Reddy TenaliNo ratings yet

- Mahindra Limited ModelDocument15 pagesMahindra Limited Modelamishi.jain2012No ratings yet

- SafariDocument49 pagesSafariwafaNo ratings yet

- Project RequirementDocument4 pagesProject RequirementAlina Binte EjazNo ratings yet

- Accounting Quality MeasuresDocument19 pagesAccounting Quality MeasuresAmit RanjanNo ratings yet

- TitanDocument7 pagesTitan869jshh52hNo ratings yet

- THGL - Proposal - Summary - 16thaug19 - SlidesDocument10 pagesTHGL - Proposal - Summary - 16thaug19 - Slidessaheb167No ratings yet

- TCS - 1QFY20 - HDFC Sec-201907100816499656445Document15 pagesTCS - 1QFY20 - HDFC Sec-201907100816499656445Sandip HaseNo ratings yet

- Tata Consultancy Services: Lacks Acceleration Trigger Downgrade To HOLDDocument8 pagesTata Consultancy Services: Lacks Acceleration Trigger Downgrade To HOLDAshokNo ratings yet

- FADM Project: Alkem PharmaDocument63 pagesFADM Project: Alkem PharmaAYUSH KHANDELWALNo ratings yet

- Strategic Analysis of VistaraDocument12 pagesStrategic Analysis of Vistarax76qfz5np4No ratings yet

- Itc Clsa Oct2020Document100 pagesItc Clsa Oct2020ksatishbabuNo ratings yet

- Case 1: Market PriceDocument6 pagesCase 1: Market PriceNoor ul HudaNo ratings yet

- 3-Statement Model (Complete)Document16 pages3-Statement Model (Complete)James BondNo ratings yet

- CA Inter FM ECO Suggested Answer Nov 2022Document27 pagesCA Inter FM ECO Suggested Answer Nov 2022Abhishant KapahiNo ratings yet

- AnalystPresentn 2010Document25 pagesAnalystPresentn 2010Abhishek SinhaNo ratings yet

- 3-Statement Model (Complete)Document16 pages3-Statement Model (Complete)Philip SembiringNo ratings yet

- Ahorra March 2003 IndraDocument31 pagesAhorra March 2003 Indra7kvvm8tsk6No ratings yet

- Adani PortDocument6 pagesAdani PortAdarsh ChavelNo ratings yet

- Market Update 25th October 2017Document1 pageMarket Update 25th October 2017Anonymous iFZbkNwNo ratings yet

- PWF Tax Compliance1Document1 pagePWF Tax Compliance1SaraNo ratings yet

- Zainab Ki Word File (Complete)Document14 pagesZainab Ki Word File (Complete)alinacheema16No ratings yet

- Sustained Leadership in Life Insurance: October 2010Document39 pagesSustained Leadership in Life Insurance: October 2010VarunSoodNo ratings yet

- K10 SFMDocument6 pagesK10 SFMSrijan AgarwalNo ratings yet

- Improving Mobility in SuratDocument33 pagesImproving Mobility in SuratDr. Rajesh Pandya SVNITNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

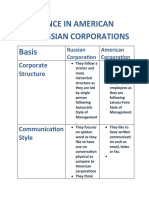

- Difference in American and Russian Corporations Basis: Corporate StructureDocument4 pagesDifference in American and Russian Corporations Basis: Corporate StructureYashNo ratings yet

- Khush Khunteta InvestmentDocument2 pagesKhush Khunteta InvestmentYashNo ratings yet

- (IN CR.) : Risk Return AnalysisDocument1 page(IN CR.) : Risk Return AnalysisYashNo ratings yet

- Irctc InvestmentDocument6 pagesIrctc InvestmentYashNo ratings yet

- Month Key Activities Key AchievementsDocument1 pageMonth Key Activities Key AchievementsYashNo ratings yet

IRCTC

IRCTC

Uploaded by

Yash0 ratings0% found this document useful (0 votes)

74 views1 pageIRCTC is an Indian government-owned enterprise and a major ticketing, catering and tourism arm of Indian Railways. It handles around 5.5-6 million online ticket bookings per day, making it the world's second busiest rail ticketing website. Some key financial metrics for IRCTC include a market capitalization of Rs. 31,960 crore and consistent growth in revenue, earnings and cash flows over the past 5 years, with annual earnings growth between 16.5-23.4% during this period.

Original Description:

Original Title

IRCTC PPT

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIRCTC is an Indian government-owned enterprise and a major ticketing, catering and tourism arm of Indian Railways. It handles around 5.5-6 million online ticket bookings per day, making it the world's second busiest rail ticketing website. Some key financial metrics for IRCTC include a market capitalization of Rs. 31,960 crore and consistent growth in revenue, earnings and cash flows over the past 5 years, with annual earnings growth between 16.5-23.4% during this period.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

74 views1 pageIRCTC

IRCTC

Uploaded by

YashIRCTC is an Indian government-owned enterprise and a major ticketing, catering and tourism arm of Indian Railways. It handles around 5.5-6 million online ticket bookings per day, making it the world's second busiest rail ticketing website. Some key financial metrics for IRCTC include a market capitalization of Rs. 31,960 crore and consistent growth in revenue, earnings and cash flows over the past 5 years, with annual earnings growth between 16.5-23.4% during this period.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 1

IRCTC

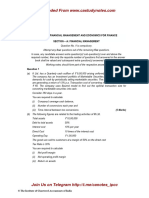

COMPANY OVERVIEW Market Cap (Rs Market Lot 1

IT handles the catering, 311960 Industry P/E

tourism and online ticketing P/E 66.56

operations of the latter, with 73.22 EPS (TTM)

Book Value (Rs) 26.62

around 5,50,000 to 6,00,000

65.18 P/C

bookings everyday.

Dividend (%) 68.6

It is the world's second

298.50

busiest and highest of 15 to 16

Lakhs tickets every day.[2]

RATIOS 2019 2018 2017

DEBT –EQUITY RATIO 0.00 0.00 0.00

INTEREST COVERAGE RATIO 128.21 116.60 136.52

RETURN ON CAPITAL 40.24 36.26 44.81

EMPLOYED (%)

RETURN ON NET WORTH (%) 27.30 25.34 34.48

NET PROFIT MARGIN (%) 14.59 15.00 14.92

PBIT MARGIN (%) 24.67 24.78 23.17

(IN CR.)

20000

15000 RISK RETURN ANALYSIS

STANDARD DEVIAION 0%

10000

BETA 0%

5000

0

2017 2018 2019

REVENUE EARNINGS

CASH FLOWS

Past 5 Years Annual Earnings

Growth

Past 5 Years Annual Earnings Growth

23.40%

16.50% 16.90%

COMPANY INDUSTRY MARKET

You might also like

- KSA Retail OverviewDocument21 pagesKSA Retail OverviewPrashant Pratap SinghNo ratings yet

- Case Solutions Chapter - 08Document2 pagesCase Solutions Chapter - 08chadtandon67% (6)

- Thoma Pharmaceutical Company-Capital Budgeting and Estimating Cash Flows-Part V-Chapter 12Document3 pagesThoma Pharmaceutical Company-Capital Budgeting and Estimating Cash Flows-Part V-Chapter 12Rajib Dahal78% (9)

- (IN CR.) : Risk Return AnalysisDocument1 page(IN CR.) : Risk Return AnalysisYashNo ratings yet

- CH CFDocument10 pagesCH CFSyed OsamaNo ratings yet

- Financial Model of Infosys: Revenue Ebitda Net IncomeDocument32 pagesFinancial Model of Infosys: Revenue Ebitda Net IncomePrabhdeep Dadyal100% (1)

- Investor Release For December 31, 2016 (Company Update)Document10 pagesInvestor Release For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Advanced PortfolioDocument8 pagesAdvanced PortfolioRaiyanNo ratings yet

- ITC Limited: One of India's Most Admired and Valuable CompaniesDocument65 pagesITC Limited: One of India's Most Admired and Valuable Companieshelloamit1991No ratings yet

- Elevance Health: (Former Anthem Inc)Document5 pagesElevance Health: (Former Anthem Inc)Hans WeirlNo ratings yet

- DupontDocument8 pagesDupontAnonymous 5m1uMUPaHNo ratings yet

- Larsen & Toubro: On TrackDocument9 pagesLarsen & Toubro: On TrackalparathiNo ratings yet

- Capital Budgeting-2Document48 pagesCapital Budgeting-2Adarsh Singh RathoreNo ratings yet

- Cipla Financial ModelDocument15 pagesCipla Financial ModelAryan HateNo ratings yet

- 1Q20 Core Earnings in Line With Forecast: Metro Pacific Investments CorporationDocument8 pages1Q20 Core Earnings in Line With Forecast: Metro Pacific Investments CorporationJNo ratings yet

- Presentation Fy 2020Document9 pagesPresentation Fy 2020hammalbaloch5656No ratings yet

- Performance Analysis of Central Pharmaceuticals LTDDocument21 pagesPerformance Analysis of Central Pharmaceuticals LTDFahim RahmanNo ratings yet

- Financial Modelling ReportDocument15 pagesFinancial Modelling ReportakshaynamsaniNo ratings yet

- Cost ModellingDocument10 pagesCost ModellingRESMITA DASNo ratings yet

- Financial Modeling: NSE: TCS - BSE: 532540 Shaik OmerDocument20 pagesFinancial Modeling: NSE: TCS - BSE: 532540 Shaik Omergoku sonNo ratings yet

- Care Ratings - Q4FY19 - Call Closure - 13062019 - 14-06-2019 - 09Document4 pagesCare Ratings - Q4FY19 - Call Closure - 13062019 - 14-06-2019 - 09Jai SinghNo ratings yet

- TSX Mty or Us Otc Mtyff - Passive WatchDocument8 pagesTSX Mty or Us Otc Mtyff - Passive WatchwmthomsonNo ratings yet

- Ratios 123Document40 pagesRatios 123Mahesh G VNo ratings yet

- Project Telehealth - Health at Home: Equipment InformationDocument1 pageProject Telehealth - Health at Home: Equipment InformationSenapati Prabhupada DasNo ratings yet

- Purchase Price 10000 Life 6 Years Salvage/Liquidation Value 4000 Book Value at 5 1666.667 0 - 10000 Capital Gains 2333.333 1 Tax 700 2 After Tax Cash Flow On Asset Sale 3300 3 4 5 4000Document6 pagesPurchase Price 10000 Life 6 Years Salvage/Liquidation Value 4000 Book Value at 5 1666.667 0 - 10000 Capital Gains 2333.333 1 Tax 700 2 After Tax Cash Flow On Asset Sale 3300 3 4 5 4000Sneha DasNo ratings yet

- Mutual Fund Screener: For The Quarter Ended Jun - 18Document27 pagesMutual Fund Screener: For The Quarter Ended Jun - 18BHAVESH KHOMNENo ratings yet

- Laketran FoloDocument1 pageLaketran Fololkessel5622No ratings yet

- Investment DecisionDocument11 pagesInvestment DecisionTahir IqbalNo ratings yet

- Free Cash Flow Estimate (In INR CRS)Document2 pagesFree Cash Flow Estimate (In INR CRS)SaiVamsiNo ratings yet

- Our TopicDocument17 pagesOur Topicadil siddiqyuiNo ratings yet

- Problem 6-26: Contribution Format Income StatementDocument2 pagesProblem 6-26: Contribution Format Income StatementHira Mustafa ShahNo ratings yet

- Case StudyDocument5 pagesCase Studyphượng nguyễn thị minhNo ratings yet

- AXIS_BANK_Ltd_1719518460Document16 pagesAXIS_BANK_Ltd_1719518460Sudheer Reddy TenaliNo ratings yet

- Mahindra Limited ModelDocument15 pagesMahindra Limited Modelamishi.jain2012No ratings yet

- SafariDocument49 pagesSafariwafaNo ratings yet

- Project RequirementDocument4 pagesProject RequirementAlina Binte EjazNo ratings yet

- Accounting Quality MeasuresDocument19 pagesAccounting Quality MeasuresAmit RanjanNo ratings yet

- TitanDocument7 pagesTitan869jshh52hNo ratings yet

- THGL - Proposal - Summary - 16thaug19 - SlidesDocument10 pagesTHGL - Proposal - Summary - 16thaug19 - Slidessaheb167No ratings yet

- TCS - 1QFY20 - HDFC Sec-201907100816499656445Document15 pagesTCS - 1QFY20 - HDFC Sec-201907100816499656445Sandip HaseNo ratings yet

- Tata Consultancy Services: Lacks Acceleration Trigger Downgrade To HOLDDocument8 pagesTata Consultancy Services: Lacks Acceleration Trigger Downgrade To HOLDAshokNo ratings yet

- FADM Project: Alkem PharmaDocument63 pagesFADM Project: Alkem PharmaAYUSH KHANDELWALNo ratings yet

- Strategic Analysis of VistaraDocument12 pagesStrategic Analysis of Vistarax76qfz5np4No ratings yet

- Itc Clsa Oct2020Document100 pagesItc Clsa Oct2020ksatishbabuNo ratings yet

- Case 1: Market PriceDocument6 pagesCase 1: Market PriceNoor ul HudaNo ratings yet

- 3-Statement Model (Complete)Document16 pages3-Statement Model (Complete)James BondNo ratings yet

- CA Inter FM ECO Suggested Answer Nov 2022Document27 pagesCA Inter FM ECO Suggested Answer Nov 2022Abhishant KapahiNo ratings yet

- AnalystPresentn 2010Document25 pagesAnalystPresentn 2010Abhishek SinhaNo ratings yet

- 3-Statement Model (Complete)Document16 pages3-Statement Model (Complete)Philip SembiringNo ratings yet

- Ahorra March 2003 IndraDocument31 pagesAhorra March 2003 Indra7kvvm8tsk6No ratings yet

- Adani PortDocument6 pagesAdani PortAdarsh ChavelNo ratings yet

- Market Update 25th October 2017Document1 pageMarket Update 25th October 2017Anonymous iFZbkNwNo ratings yet

- PWF Tax Compliance1Document1 pagePWF Tax Compliance1SaraNo ratings yet

- Zainab Ki Word File (Complete)Document14 pagesZainab Ki Word File (Complete)alinacheema16No ratings yet

- Sustained Leadership in Life Insurance: October 2010Document39 pagesSustained Leadership in Life Insurance: October 2010VarunSoodNo ratings yet

- K10 SFMDocument6 pagesK10 SFMSrijan AgarwalNo ratings yet

- Improving Mobility in SuratDocument33 pagesImproving Mobility in SuratDr. Rajesh Pandya SVNITNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Difference in American and Russian Corporations Basis: Corporate StructureDocument4 pagesDifference in American and Russian Corporations Basis: Corporate StructureYashNo ratings yet

- Khush Khunteta InvestmentDocument2 pagesKhush Khunteta InvestmentYashNo ratings yet

- (IN CR.) : Risk Return AnalysisDocument1 page(IN CR.) : Risk Return AnalysisYashNo ratings yet

- Irctc InvestmentDocument6 pagesIrctc InvestmentYashNo ratings yet

- Month Key Activities Key AchievementsDocument1 pageMonth Key Activities Key AchievementsYashNo ratings yet