Professional Documents

Culture Documents

Financial Institution: Muhammad Talha Akhtar

Financial Institution: Muhammad Talha Akhtar

Uploaded by

Talha Akhtar0 ratings0% found this document useful (0 votes)

46 views17 pagesOriginal Title

Financial Institution

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

46 views17 pagesFinancial Institution: Muhammad Talha Akhtar

Financial Institution: Muhammad Talha Akhtar

Uploaded by

Talha AkhtarCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 17

Financial Institution

Muhammad Talha Akhtar

Types of Financial Institutions

• Depository institutions: Financial institutions

that accept deposits

from individuals and provide loans

– Commercial banks: financial institutions that

accept deposits and use the funds to provide

commercial and personal loans

• Deposits insured by Federal Deposit Insurance

Corporation (FDIC) up to $100,000 per depositor

Copyright ©2004 Pearson Education, Inc.

5-2

All rights reserved.

Types of Financial Institutions

– Savings institutions (or thrift institutions): financial

institutions that accept deposits and provide

mortgage and personal loans to individuals

– Credit unions: nonprofit depository

institutions that serve members who have a

common affiliation

Copyright ©2004 Pearson Education, Inc.

5-3

All rights reserved.

Types of Financial Institutions

• Focus on Ethics: Special Rates on Deposits

– Check the fine print before making any deposit

– Ask important questions

• How long is an advertised rate good for?

• What will it be lowered to?

• How long must your maintain the deposit?

Copyright ©2004 Pearson Education, Inc.

5-4

All rights reserved.

Types of Financial Institutions

• Nondepository institutions: financial

institutions that do not offer federally insured

deposit accounts, but provide various other

financial services

– Finance companies: nondepository institutions

that specialize in providing personal loans

Copyright ©2004 Pearson Education, Inc.

5-5

All rights reserved.

Types of Financial Institutions

– Securities firms: nondepository institutions that

facilitate the purchase or sale of securities by

providing investment banking and brokerage

services

– Insurance companies: nondepository institutions

that provide insurance to protect individuals or

firms against possible

adverse events

Copyright ©2004 Pearson Education, Inc.

5-6

All rights reserved.

Types of Financial Institutions

– Investment companies: nondepository institutions

that sell shares to individuals

and use the proceeds to invest in securities

to create mutual funds

• Financial conglomerates: financial institutions

that offer a diverse set of financial services to

individuals or firms

– Examples include Bank of America, Merrill Lynch,

and Citigroup

Copyright ©2004 Pearson Education, Inc.

5-7

All rights reserved.

Types of Financial Institutions

Copyright ©2004 Pearson Education, Inc.

5-8

All rights reserved.

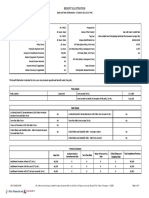

Banking Services Offered by Financial

Institutions

• Checking services

– Checking accounts allow you to draw on funds by

writing checks

– Monitor your account balance by recording checks

as you write them

• Banks charge fees for bounced checks

– You should reconcile your account balance with

your monthly statement

Copyright ©2004 Pearson Education, Inc.

5-9

All rights reserved.

Banking Services Offered by Financial

Institutions

Copyright ©2004 Pearson Education, Inc.

5-10

All rights reserved.

Banking Services Offered by

Financial Institutions

• You can often access your account balance by

calling an automated phone service or online

• Electronic checking reduces fraud by clearing

checks immediately

Copyright ©2004 Pearson Education, Inc.

5-11

All rights reserved.

Banking Services Offered by

Financial Institutions

• Credit card financing such as Visa

and Mastercard

• Debit card: a card that is used to make

purchases that are charged against an existing

checking account

• Safety deposit box: a box at a financial

institution where a customer stores valuables

such as documents or jewelry

Copyright ©2004 Pearson Education, Inc.

5-12

All rights reserved.

Additional Services

Financial Institutions Offer

• Automated teller machines (ATMs): machines

where individuals can deposit

and withdraw funds any time of the day

• Money order: a check that is written

on behalf of a person and will be charged

against a nonfinancial institution’s account

Copyright ©2004 Pearson Education, Inc.

5-13

All rights reserved.

Additional Services

Financial Institutions Offer

• Traveler’s check: a check that is written

on behalf of an individual and will be charged against

a large well-known financial institution or credit card

sponsor’s account

• Cashier’s check: a check that is written on behalf of a

person to a specific payee and will be charged against

a financial institution’s account

Copyright ©2004 Pearson Education, Inc.

5-14

All rights reserved.

Selecting a Financial Institution

• Convenience

– Close to where you live or work, convenient ATM

locations, Internet banking

• Deposit rates and insurance

– Comparison shop for best interest rates

• Fees

– Comparison shop for best fees on the services you

need

Copyright ©2004 Pearson Education, Inc.

5-15

All rights reserved.

Financial Planning Online:

Internet Banking

• Go to: http://www.chicagofed.org

• Click on: Project Money $mart, then “What

You Should Know About Internet Banking”

• This Web site provides information that can

help you decide whether an Internet bank

suits your needs.

Copyright ©2004 Pearson Education, Inc.

5-16

All rights reserved.

Financial Planning Online: Financial

Institutions That Can Serve Your Needs

• Go to:

http://dir.yahoo.com/business_and_economy/

finance_and_investment/banking/

• This Web site provides information about

individual financial institutions such as the

services they offer and the interest rates they

pay on deposits or charge on loans.

Copyright ©2004 Pearson Education, Inc.

5-17

All rights reserved.

You might also like

- Personal Finance 5th Edition Jeff Madura Solutions Manual 1Document8 pagesPersonal Finance 5th Edition Jeff Madura Solutions Manual 1kurt100% (51)

- TAX 2202E TBS01 02.solutionDocument2 pagesTAX 2202E TBS01 02.solutionZhitong LuNo ratings yet

- Discharge of Surety's Liability by AbhishekDocument9 pagesDischarge of Surety's Liability by AbhishekAbhishek Kamat100% (1)

- Chapter 3, Basic Elements of Financial SystemDocument27 pagesChapter 3, Basic Elements of Financial Systemmiracle123No ratings yet

- 2020 NCAA Financial Report-South CarolinaDocument80 pages2020 NCAA Financial Report-South CarolinaMatt BrownNo ratings yet

- Chapter 5. Banking and Interest RatesDocument40 pagesChapter 5. Banking and Interest RatesNguyen Dac ThichNo ratings yet

- L7 Financial ManagementDocument42 pagesL7 Financial Managementfairylucas708No ratings yet

- Chapter 12Document65 pagesChapter 12Francisca Rojas CameronNo ratings yet

- Lecture Week 3&4 - BFDocument28 pagesLecture Week 3&4 - BFMuhammad HasnainNo ratings yet

- Financial Institutions, Functions and Importance.: Prepared By: Dr. Albert C. RocesDocument12 pagesFinancial Institutions, Functions and Importance.: Prepared By: Dr. Albert C. RocesAMNo ratings yet

- Chapter Five: Management of Monetary AssetsDocument30 pagesChapter Five: Management of Monetary AssetsSwati PorwalNo ratings yet

- Corporate FinancingDocument25 pagesCorporate FinancingHoai ThuongNo ratings yet

- Managing Your Cash and SavingsDocument48 pagesManaging Your Cash and SavingsAbigail ConstantinoNo ratings yet

- AFN 221 W04 Savings vF2021Document19 pagesAFN 221 W04 Savings vF2021Dina SboulNo ratings yet

- Module 1.1 Financial MarketsDocument60 pagesModule 1.1 Financial MarketssateeshjorliNo ratings yet

- Msme Week 7 - Finance and Small BusinessFile-1Document55 pagesMsme Week 7 - Finance and Small BusinessFile-1Rahiana AminNo ratings yet

- Presentation (6) Business FinanceDocument17 pagesPresentation (6) Business FinancecycygajatorNo ratings yet

- Chapter Six: Risk Management in Financial InstitutionsDocument22 pagesChapter Six: Risk Management in Financial InstitutionsMikias DegwaleNo ratings yet

- Personal Finance 4 - 1Document47 pagesPersonal Finance 4 - 1Taeyeon KimNo ratings yet

- Polytechnic University of The Philippines: Financing CompaniesDocument48 pagesPolytechnic University of The Philippines: Financing CompaniesMomo MontefalcoNo ratings yet

- Chapter - 10 - Fixed Income Securities - GitmanDocument39 pagesChapter - 10 - Fixed Income Securities - GitmanJessica Charoline PangkeyNo ratings yet

- Money and Banking & Managing FinanceDocument29 pagesMoney and Banking & Managing FinancebanghazimNo ratings yet

- Access To Capital Forum 2015Document136 pagesAccess To Capital Forum 2015Bronwen Elizabeth MaddenNo ratings yet

- FMI REPORTING Group 1Document18 pagesFMI REPORTING Group 1Stephanie DesembranaNo ratings yet

- Chapter 1aDocument33 pagesChapter 1aVasunNo ratings yet

- Finacial Institutions and Its Role: Entrepreneurship ProjectDocument17 pagesFinacial Institutions and Its Role: Entrepreneurship ProjectAyush GiriNo ratings yet

- 5-Non-Banking Financial InstitutionsDocument19 pages5-Non-Banking Financial InstitutionsSharleen Joy TuguinayNo ratings yet

- Personal Finance 5th Edition Jeff Madura Solutions Manual 1Document36 pagesPersonal Finance 5th Edition Jeff Madura Solutions Manual 1karenhalesondbatxme100% (33)

- PPCH 08 ADocument55 pagesPPCH 08 AumaNo ratings yet

- Rift Valley: UnversityDocument11 pagesRift Valley: Unversitybirook lemaNo ratings yet

- Unit IV. Non Banking Financial InstitutionsDocument19 pagesUnit IV. Non Banking Financial InstitutionsclatowedNo ratings yet

- Oct 17 WS 1 Understanding Credit and How To Improve Your Credit ScoreDocument19 pagesOct 17 WS 1 Understanding Credit and How To Improve Your Credit ScorePîslaru NicoletaNo ratings yet

- Personal Finance 6th Edition Madura Solutions Manual 1Document36 pagesPersonal Finance 6th Edition Madura Solutions Manual 1karenhalesondbatxme100% (25)

- Financial Economics Chapter ThreeDocument21 pagesFinancial Economics Chapter ThreeGenemo FitalaNo ratings yet

- Financialservices: Kanika BhasinDocument14 pagesFinancialservices: Kanika BhasinkanikaNo ratings yet

- Bank of Maharashtra ProjectDocument67 pagesBank of Maharashtra ProjectDilip JainNo ratings yet

- Chap I Introduction To Financial InstitutionsDocument57 pagesChap I Introduction To Financial InstitutionsGing freexNo ratings yet

- Sources of Business FinanceDocument12 pagesSources of Business Financepriyanshu ahujaNo ratings yet

- Financial Institutions: 1. Life Insurance Companies, Which Sell Life Insurance, Annuities and PensionsDocument7 pagesFinancial Institutions: 1. Life Insurance Companies, Which Sell Life Insurance, Annuities and PensionssamouNo ratings yet

- Sources of Finance: Neeta Asnani Alpana Garg Pratibha Arora Kalpana TewaniDocument23 pagesSources of Finance: Neeta Asnani Alpana Garg Pratibha Arora Kalpana TewaniMahima LounganiNo ratings yet

- Ae18-004-The Philippine Financial SystemDocument30 pagesAe18-004-The Philippine Financial SystemLaezelie PalajeNo ratings yet

- Financial Services-Basics: LT P. Abdul Azees Farook College IndiaDocument18 pagesFinancial Services-Basics: LT P. Abdul Azees Farook College IndiaVivek SharmaNo ratings yet

- BCH FE NotesDocument25 pagesBCH FE NotesDownload MovieNo ratings yet

- Corporate BankingDocument21 pagesCorporate BankingPadma NarayananNo ratings yet

- Chapter ThreeDocument25 pagesChapter Threeshraddha amatyaNo ratings yet

- Financial Markets and InstitutionsDocument11 pagesFinancial Markets and InstitutionsEarl Daniel RemorozaNo ratings yet

- Kuratko 8 e CH 08Document35 pagesKuratko 8 e CH 08waqasNo ratings yet

- MODULE 3 SVV Banking StudentDocument6 pagesMODULE 3 SVV Banking StudentJessica RosalesNo ratings yet

- Presentation On Financial InstitutionDocument20 pagesPresentation On Financial InstitutionBushra KashafNo ratings yet

- Entrepreneur CH 6Document37 pagesEntrepreneur CH 6Getahun AbebawNo ratings yet

- CH 6Document19 pagesCH 6george manNo ratings yet

- MN2615 T5 Session 2 - Small Business FinanceDocument59 pagesMN2615 T5 Session 2 - Small Business FinanceHaseeb DarNo ratings yet

- Banks and Other Financial Intermediaries: By: John Paulo H. PobleteDocument12 pagesBanks and Other Financial Intermediaries: By: John Paulo H. PobleteMary Elleonice Franchette QuiambaoNo ratings yet

- Part - I: Introduction: Chapter 2: Overview of The Financial SystemDocument25 pagesPart - I: Introduction: Chapter 2: Overview of The Financial SystemAKSHIT JAINNo ratings yet

- Debt and Equity Markets As Source of LT FinanceDocument23 pagesDebt and Equity Markets As Source of LT FinanceAbhishekNo ratings yet

- Indian Financial SystemDocument23 pagesIndian Financial SystemAkash YadavNo ratings yet

- B.AEco (Hon) - Macro - 4th Sem - Lesson 9Document15 pagesB.AEco (Hon) - Macro - 4th Sem - Lesson 9Sharad RanjanNo ratings yet

- BF Week 9 Short and Long Term FundsDocument29 pagesBF Week 9 Short and Long Term FundsNathasha Mitch FontanaresNo ratings yet

- Financial Management: 12 Abm-Jonah Mr. Raffy Rey DomasianDocument24 pagesFinancial Management: 12 Abm-Jonah Mr. Raffy Rey DomasianDioselin Pegoria SoloNo ratings yet

- UNIT 1 Core Banking Vs Allied Banking Activities AKG-1Document21 pagesUNIT 1 Core Banking Vs Allied Banking Activities AKG-1A Walk To InfinityNo ratings yet

- Module 4 - Non-Bank Financial InstitutionsDocument19 pagesModule 4 - Non-Bank Financial InstitutionsMICHELLE MILANANo ratings yet

- Chapter 7 Source of Finance PDFDocument30 pagesChapter 7 Source of Finance PDFtharinduNo ratings yet

- Exam LTAM: You Have What It Takes To PassDocument12 pagesExam LTAM: You Have What It Takes To Passderianfg100% (1)

- Smart Scholar: Best Investment Plan For Children's EducationDocument1 pageSmart Scholar: Best Investment Plan For Children's EducationTricolor C ANo ratings yet

- G.R. No. L-18452Document6 pagesG.R. No. L-18452Hanifa D. Al-ObinayNo ratings yet

- Krishna ProjectDocument32 pagesKrishna Projectprashant mhatreNo ratings yet

- Lic CaseDocument3 pagesLic CaseDhriti DhingraNo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 2Document4 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 2Onn InternationalNo ratings yet

- Internship Program at IDL IMFDocument2 pagesInternship Program at IDL IMFsakshi srivastavaNo ratings yet

- It FileDocument16 pagesIt Filedishu kumarNo ratings yet

- Mint Article Unclaimed 13 July 2023Document9 pagesMint Article Unclaimed 13 July 2023cosoxal118No ratings yet

- All You Need To Know About Angelique KantengwaDocument2 pagesAll You Need To Know About Angelique KantengwaAngelique KantengwaNo ratings yet

- Introducing Acko HealthDocument12 pagesIntroducing Acko HealthtamaldNo ratings yet

- Job Ad - CSODocument1 pageJob Ad - CSOMuhammad AdnanNo ratings yet

- Platinum Trio Hmo 0-25 Offex m0033963 01-24 SBCDocument9 pagesPlatinum Trio Hmo 0-25 Offex m0033963 01-24 SBCapi-531507901No ratings yet

- What If I Die Without A Business PartnerDocument2 pagesWhat If I Die Without A Business PartnerDave SeemsNo ratings yet

- Car Auto Repair Research QuestionsDocument5 pagesCar Auto Repair Research QuestionsFatima SethiNo ratings yet

- Great Pacific Life-vs-CADocument2 pagesGreat Pacific Life-vs-CAmario navalezNo ratings yet

- Smart Income LeafletDocument2 pagesSmart Income Leafletsspublicationservices indiaNo ratings yet

- Construction Law Senet Fall 2020Document64 pagesConstruction Law Senet Fall 2020Rhyzan CroomesNo ratings yet

- Insurance Case Digest Batch 2Document4 pagesInsurance Case Digest Batch 2Di CanNo ratings yet

- Your Guide To Disability BenefitsDocument11 pagesYour Guide To Disability BenefitsStephenFitchNo ratings yet

- SIP FileDocument62 pagesSIP FileswetaNo ratings yet

- Quiz 1 Tax - AnswerDocument9 pagesQuiz 1 Tax - AnswerHannahNo ratings yet

- Axis Bank PrintDocument41 pagesAxis Bank PrintRudrasish BeheraNo ratings yet

- Finance e PN 2016 17Document69 pagesFinance e PN 2016 17Ancy RajNo ratings yet

- Lapse Study: Date: August 13, 2012 By: Albert Li, Simon HirstDocument33 pagesLapse Study: Date: August 13, 2012 By: Albert Li, Simon Hirstmatematikawan muslimNo ratings yet

- Northwestern State University of Louisiana Certification of Financial Responsibility InstructionsDocument2 pagesNorthwestern State University of Louisiana Certification of Financial Responsibility InstructionsOlawale DawoduNo ratings yet

- Computation of Taxable Income Under Various HeadsDocument155 pagesComputation of Taxable Income Under Various Headsdajit1100% (6)